- Home

- »

- Automotive & Transportation

- »

-

Electric Transporters Market Size And Share Report, 2030GVR Report cover

![Electric Transporters Market Size, Share & Trends Report]()

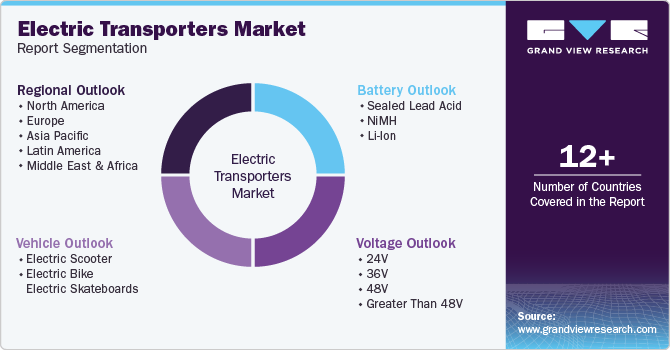

Electric Transporters Market (2024 - 2030) Size, Share & Trends Analysis Report By Vehicle, By Battery (Sealed Lead Acid, NiMH, Li-Ion), By Voltage (24V, 36V, 48V, Greater Than 48V), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-767-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Transporters Market Size & Trends

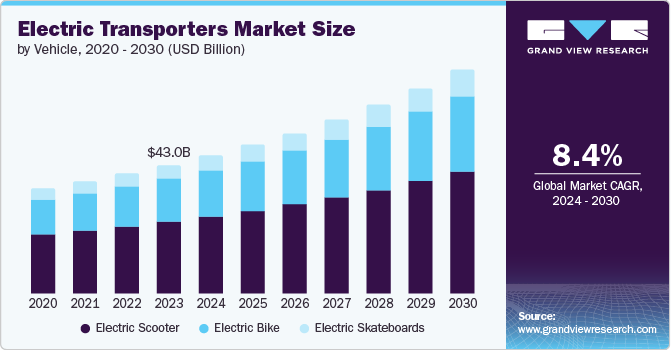

The global electric transporters market size was valued at USD 43.03 billion in 2023 and is projected to grow at a CAGR of 8.4% from 2024 to 2030. Key factors driving the global electric transporters market growth include improvements in battery technology, reduced costs, and support from government policies. The cost of manufacturing electric transporters has decreased due to the lower production costs of lithium-ion batteries, a key raw material in their construction. Increasing fuel costs are another significant factor driving the need for electric transportation.

Economically, electric transporters provide a cost-effective alternative to conventional transportation methods. The rising fuel cost and the high maintenance expenses associated with internal combustion engines make electric scooters, bikes, and skateboards suitable options for daily commutes and short-distance travel. The lower operating costs of electric vehicles, due to their minimal maintenance requirements and the decreasing cost of electricity relative to gasoline, contribute to their growing popularity. Additionally, the initial investment in electric transporters has become more accessible due to advancements in battery technology and economies of scale in production, making these vehicles more affordable for a broader range of consumers.

Significant improvements in battery technology have led to enhanced performance, longer ranges, and shorter charging times, addressing some of the primary concerns previously associated with electric vehicles. Innovations in design and engineering have also resulted in more reliable and user-friendly products, making them suitable for various applications, from urban commuting to leisure activities. Furthermore, integrating smart features, such as connectivity with mobile apps for real-time tracking and diagnostics, enhances the user experience and adds to the appeal of electric transporters.

Urbanization and changing lifestyle preferences are also key factors driving the adoption of electric transporters. The need for efficient, compact, and convenient modes of transportation is critical in densely populated urban areas. Electric scooters, bikes, and skateboards offer practical solutions for navigating congested streets and limited parking spaces. They cater to the increasing demand for flexible and personal mobility solutions that integrate easily with public transportation systems. As cities expand and the global population becomes more urbanized, the demand for such agile and adaptable transportation options is expected to grow correspondingly.

Vehicle Insights

The electric scooter segment held the largest market revenue share of 55.9% in 2023. Electric scooters provide a convenient and effective way to travel short distances within urban areas. They are created to be easy to use, are lightweight, and can be folded for convenient portability. Electric scooters are equipped with rechargeable batteries and have controls on the handlebars for speed and acceleration. They are seamless for riding through busy city streets and narrow pathways, making them a convenient option for transportation.

The electric skateboard segment is projected to grow with the fastest CAGR of 9.6% over the forecast period. Electric skateboards offer a compact, portable, and cost-effective solution for short-distance commuting, suitable for city dwellers. Additionally, advancements in battery technology and motor efficiency have significantly improved the performance and range of these skateboards. The growing interest in sustainable living and adopting electric personal transporters as a lifestyle choice also contributes to their rising popularity. Furthermore, the influence of social media and a trend toward innovative, high-tech gadgets have boosted their visibility and desirability among younger demographics.

Battery Insights

The Li-Ion segment held the largest market revenue share in 2023. Li-Ion batteries offer a superior energy density, which allows electric vehicles (EVs) to achieve longer ranges on a single charge, addressing one of the primary concerns of potential EV buyers. Additionally, Li-Ion batteries have a longer lifespan and better efficiency than traditional battery types, reducing the overall cost of ownership. Technological advancements and economies of scale have also contributed to the declining cost of Li-Ion batteries, making EVs more affordable and accessible. Furthermore, the growing focus on environmental sustainability and the global push to reduce carbon emissions have led to supportive government policies and incentives for EV adoption, further bolstering the demand for Li-Ion batteries.

The NiMH segment is projected to grow at a significant CAGR over the forecast period.NiMH batteries are known for their relatively high energy density, long cycle life, and robustness, which are crucial for the demanding requirements of electric transporters. NiMH batteries do not suffer from the "memory effect" seen in older battery technologies, which enhances their reliability and efficiency over time. Environmental concerns and regulatory pressures are also driving the shift towards NiMH batteries, as they are less toxic and more environmentally friendly compared to other battery chemistries. Moreover, advancements in NiMH technology have led to improvements in energy storage capacity and charging times, further boosting their appeal in the electric transporter market.

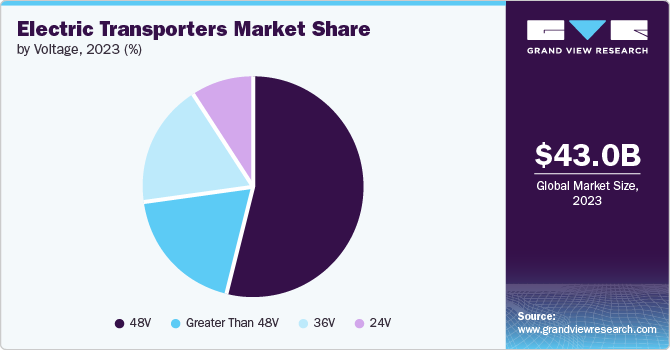

Voltage Insights

48V segment held the largest market revenue share in 2023. The demand for the 48V segment in the electric transporter market is increasing due to its optimal balance between performance, efficiency, and cost. This voltage level is particularly suitable for light electric vehicles, such as electric scooters, bicycles, and low-speed electric cars, which require sufficient power without the complexity and expense associated with higher voltage systems. The 48V systems provide enhanced energy efficiency, improved battery life, and greater safety features compared to traditional 12V or 24V systems.

The greater than 24V segment is projected to grow at the fastest CAGR over the forecast period. The demand for the 24V segment in the electric transporter market is rising due to its optimal balance between power and efficiency, making it ideal for a wide range of applications. This voltage level is particularly well-suited for personal electric vehicles, such as e-bikes and scooters, where it offers sufficient power to handle various terrains while maintaining manageable battery sizes and costs. Additionally, the 24V systems tend to have lower energy losses compared to higher voltage alternatives, enhancing overall efficiency and battery life.

Regional Insights

North America is anticipated to grow significantly in the coming years. The region’s developed EV industry is one of the key driving factors for the market expansion. Rising awareness about environment conservation among North American consumers drives the demand for electric transport. Countries, including the U.S, Canada, and Mexico, are witnessing significant advancement in the electric transporter industry.

U.S. Electric Transporters Market Insights

The U.S. dominated the regional market in 2023. Heightened environmental awareness has driven consumers to seek eco-friendly transportation options, leading to increased adoption of electric vehicles (EVs). Government incentives, such as tax credits and rebates, have made EVs more financially attractive, further boosting their appeal. Additionally, advancements in battery technology have extended the range of electric transporters, alleviating range anxiety and making them more practical for everyday use.

Europe Electric Transporters Market Insights

Europe electric transporters market was witnessed as lucrative in this industry. The growth of the region’s market is attributed to increasing demand for high-voltage batteries to enhance performance and range for electric bikes, scooters, and skateboards. Increasing environmental awareness and the need for eco-friendly transportation contribute to adopting electric transporters. Rapidly growing urbanization and traffic congestion prompt consumers to opt for electric alternatives to transportation.

The UK electric transporters market is anticipated to witness prominent growth in the forecast period. The UK government is continuously working on improving essential infrastructure to facilitate the widespread adoption of electric vehicles. This involves significant funding for charging infrastructure nationwide to expand the number of rapid-charging stations. In addition, rising awareness among consumers regarding environment conservation is driving the demand for electric transporters in the country.

Asia Pacific Electric Transporters Market Insights

Asia Pacific held the largest market revenue share of 43.2% in 2023. Governments across the region are implementing stringent emission regulations and offering incentives to promote cleaner transportation alternatives, addressing the urgent need to combat air pollution and reduce greenhouse gas emissions. Additionally, the rapid urbanization and growing middle class in countries such as China, India, and Japan are driving the adoption of electric vehicles (EVs) as consumers seek more efficient and cost-effective transportation options.

China's electric transporters market is witnessing significant growth in this industry. China's government has implemented stringent environmental regulations and offered substantial incentives to promote the adoption of electric vehicles (EVs) as part of its commitment to reducing carbon emissions and combating severe air pollution. Urbanization and the growth of megacities have intensified traffic congestion, prompting a shift towards more efficient and sustainable modes of transportation.

Latin America Electric Transporters Market Insights

Latin America electric transporters market is expected to grow at the fastest CAGR over the forecast period. Many countries in the region, such as Brazil, Mexico, and Chile, are increasingly focusing on reducing their carbon footprints and improving air quality, leading to greater governmental and public support for electric vehicles (EVs). Additionally, the rising cost of fossil fuels has made electric transporters a more cost-effective alternative for consumers and businesses.

Key Electric Transporters Company Insights

Some of the key companies in the Electric Transporters market include Hyundai Motor Company; Kia Motors; Ford Motor Company; Renault Group; and others.

-

AllCell Technologies LLC is a player in the energy storage and electric transport markets. The company specializes in designing and manufacturing advanced lithium-ion battery packs that integrate its proprietary phase change material (PCM) technology, which enhances safety, longevity, and performance by efficiently managing heat. AllCell's product offerings cater to various electric transport applications, including electric bikes, scooters, motorcycles, and other light electric vehicles.

Key Electric Transporters Companies:

The following are the leading companies in the electric transporters market. These companies collectively hold the largest market share and dictate industry trends.

- AllCell Technologies LLC

- BMW Motorrad International

- BOXX Corporation

- Kiwano

- Ninebot Inc.

- Razor USA LLC

- Hama GmbH & Co KG

- Honda Motor Co. Ltd.

- Jiangsu Xinri E-Vehicle Co., Ltd.

- Airwheel Holding Ltd.

Electric Transporters Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 46.21 billion

Revenue forecast in 2030

USD 75.13 billion

Growth Rate

CAGR of 8.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle, battery, voltage, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE.

Key companies profiled

AllCell Technologies LLC, BMW Motorrad International, BOXX Corporation, Kiwano, Ninebot Inc., Razor USA LLC, Hama GmbH & Co KG, Honda Motor Co. Ltd., Jiangsu Xinri E-Vehicle Co., Ltd., Airwheel Holding Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Transporters Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the electric transporters market report based on vehicle, battery, voltage, and region.

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Electric Scooter

-

Retro

-

Standing/Self-Balancing

-

Folding

-

-

Electric Bike

-

Electric Skateboards

-

-

Battery Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sealed Lead Acid

-

NiMH

-

Li-Ion

-

-

Voltage Outlook (Revenue, USD Billion, 2018 - 2030)

-

24V

-

36V

-

48V

-

Greater Than 48V

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.