- Home

- »

- Petrochemicals

- »

-

Electric Vehicle Battery Coolant Market Size Report, 2030GVR Report cover

![Electric Vehicle Battery Coolant Market Size, Share & Trends Report]()

Electric Vehicle Battery Coolant Market (2024 - 2030) Size, Share & Trends Analysis Report By Vehicle Type (Battery Electric Vehicles, Hybrid Electric Vehicles), By Battery Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-468-2

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Vehicle Battery Coolant Market Summary

The global electric vehicle battery coolant market size was estimated at USD 2,027.64 million in 2023 and is projected to reach USD 2,612.23 million by 2030, growing at a CAGR of 3.8% from 2024 to 2030. The growing concern over environmental pollution and the shift towards sustainable modes of transportation are significantly boosting the demand for electric vehicles.

Key Market Trends & Insights

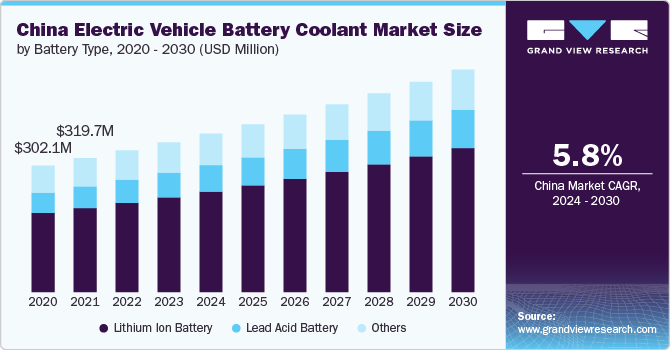

- Asia Pacific dominated the electric vehicle battery coolant market with the largest revenue share of 45.60% in 2023.

- The electric vehicle battery coolant market in Europe is anticipated to grow at the fastest CAGR during the forecast period.

- Based on battery type, the lithium ion battery segment led the market with the largest revenue share of 60.6% in 2023.

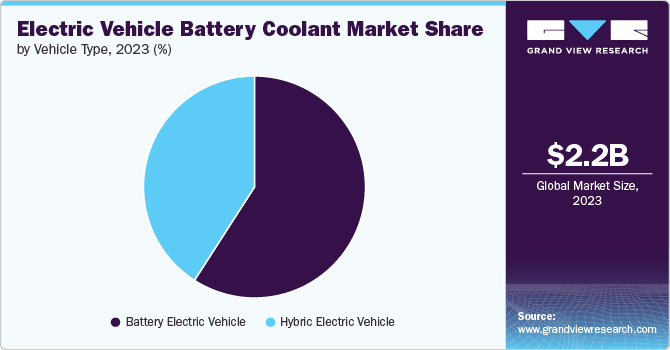

- Based on vehicle type, the battery electric vehicles segment led the market with the largest revenue share of 59.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2,027.64 Million

- 2030 Projected Market Size: USD 2,612.23 Million

- CAGR (2024-2030): 3.8%

- Asia Pacific: Largest market in 2023

- Europe: Fastest growing market

This surge in EV adoption directly impacts the demand for effective battery cooling systems to ensure vehicle efficiency and battery longevity. As battery technology evolves, there is a continuous effort to increase energy density, reduce charging time, and enhance overall battery performance. These advancements necessitate more efficient cooling solutions to manage the heat generated during operation and charging, thereby driving the need for advanced battery coolants. Governments around the world are implementing stricter regulations regarding vehicle emissions and fuel efficiency. These regulations are pushing automakers to invest in electric vehicle technology, including advanced cooling systems to optimize battery performance and comply with regulatory standards.

The integration of renewable energy sources with electric vehicle charging infrastructure is growing. This trend encourages the use of electric vehicles, as it reduces the carbon footprint associated with EV charging. Consequently, the demand for sophisticated battery cooling systems that can handle rapid charging and discharging cycles is on the rise.

Consumers are increasingly demanding electric vehicles that offer longer range and improved performance. Efficient battery cooling is critical to achieving these objectives, as it helps maintain optimal battery operation temperatures, thereby extending battery life and vehicle range. Major automotive manufacturers are expanding their EV lineups and increasing production capacities. This expansion is directly linked to a higher demand for EV battery coolants, as manufacturers seek to incorporate cooling technologies that enhance battery safety, performance, and durability.

The market is driven by the cumulative effect of increased EV adoption, technological advancements in battery and cooling systems, stringent regulatory requirements, and a collective push towards improved vehicle performance and sustainability.

Battery Type Insights

Based on battery type, the lithium ion battery segment led the market with the largest revenue share of 60.6% in 2023. Lithium-ion batteries, which power the majority of electric vehicles (EVs), require effective cooling systems to maintain optimal performance and safety. The role of coolants in these systems is crucial because lithium-ion batteries generate heat during operation and charging. If this heat is not properly managed, it can lead to reduced efficiency, shorter battery life, and in extreme cases, thermal runaway. Coolants in EVs serve to absorb and dissipate the heat generated by the battery cells, keeping the temperature within a safe and efficient operating range. This is vital for preserving the battery's energy density, charging speed, and overall lifespan. Several types of cooling systems are used in electric vehicles, including air cooling, liquid cooling, and phase change material cooling, with liquid cooling being the most effective for high-performance and high-capacity lithium-ion battery packs.

Lead-acid batteries have been a staple power source for various applications, including traditional internal combustion engine vehicles, for many decades. Lead-acid batteries, similar to other battery types, generate heat during charging and discharging cycles. In applications where lead-acid batteries are used in EVs, cooling is often achieved through simpler, passive means. This can include strategic placement within the vehicle to ensure adequate air flow, the use of thermal insulators to protect against external temperature variations, and ensuring that the battery compartment is vented to allow heat to escape and to manage the gases that lead-acid batteries can emit during operation.

Vehicle Type Insights

Based on vehicle type, the battery electric vehicles segment led the market with the largest revenue share of 59.1% in 2023. Battery coolants are essential in managing the efficiency, safety, and longevity of batteries in electric battery vehicles. These coolants are crucial because they help maintain the battery's temperature within an optimal range, ensuring that the vehicle can perform effectively and safely. In electric battery vehicles, where the battery is a key component for propulsion, the performance of the battery directly influences the vehicle's overall performance and range.

Effective cooling systems are particularly important for hybrid vehicles, which use a combination of an electric powertrain and a conventional internal combustion engine. These vehicles often depend on their battery system for short bursts of power and for enhancing fuel efficiency, leading to rapid temperature changes. A well-designed battery cooling system can help manage these fluctuations, improving the battery's performance and extending its lifespan.

Regional Insights

The electric vehicle battery coolant market in North America is expected to grow at the fastest CAGR during the forecast period. The use of effective battery coolants is an essential aspect of ensuring the performance, safety, and longevity of EV batteries. As the demand for EVs continues to grow, the development and application of advanced cooling systems have become increasingly important. These systems are designed to manage the heat generated by the battery cells during operation, which can significantly impact the overall efficiency and lifespan of the battery. The market in North America is also influenced by stringent regulations regarding the use of eco-friendly and low-VOC (volatile organic compounds) products. This has led to the adoption of advanced electric vehicle battery coolant that meets environmental standards.

U.S. Electric Vehicle Battery Coolant Market Trends

The electric vehicle battery coolant market in U.S. is anticipated to grow at a significant CAGR during the forecast period. In the U.S., the majority of modern electric vehicles use lithium-ion batteries, which have a higher energy density but also generate more heat than older battery technologies, such as lead-acid batteries. To manage this, EV manufacturers have developed advanced cooling systems. The coolant used in these systems is typically a mixture of water and glycol or a proprietary blend designed to optimize heat absorption and transfer. The specific composition of the coolant can vary between manufacturers and is often a closely guarded secret due to its importance in the overall performance of the EV.

Asia Pacific Electric Vehicle Battery Coolant Market Trends

Asia Pacific dominated the electric vehicle battery coolant market with the largest revenue share of 45.60% in 2023. The region is witnessing a significant surge in the electric vehicle (EV) market, which in turn is driving a focused attention toward the components critical for the optimal performance of these vehicles, particularly the battery coolant system.

This burgeoning focus on developing and refining coolant technologies is crucial for the Asia Pacific's fast-growing EV market. The choice of coolant system-whether liquid-based, which involves the circulation of coolant fluid through channels in the battery pack to absorb and dissipate heat, or air-based, which uses fans to blow ambient air through the battery pack-has significant implications not only for the vehicle's performance but also for its market competitiveness.

Europe Electric Vehicle Battery Coolant Market Trends

The electric vehicle battery coolant market in Europe is anticipated to grow at the fastest CAGR during the forecast period. In Europe, where the adoption of electric vehicles is rapidly increasing, advancements in battery technology, including efficient cooling solutions, are of paramount importance. The climate varies significantly across Europe, from the cold Arctic conditions in the north to the warmer Mediterranean climate in the south, making the development of versatile and efficient battery cooling systems essential for the wide adoption of EVs. European automakers and battery manufacturers are at the forefront of researching and implementing innovative cooling techniques, such as liquid cooling systems, which are more effective and compact compared to air-cooled systems

Key Electric Vehicle Battery Coolant Company Insights

The market is a competitive sector with several major players dominating, including BASF SE, Valvoline Inc., Exxon Mobil Corporation, Shell Group, BP Plc, TotalEnergies, and GS Caltex, among others. These key companies are actively expanding their global footprint by enhancing their manufacturing capabilities and diversifying their product offerings. This strategic expansion is expected to significantly contribute to the market growth over the forecast period.

-

BASF has developed coolants and other materials that support battery thermal management systems. Their portfolio includes products designed for high performance and safety.

-

Shell offers a range of fluids suitable for battery cooling, including E-fluids specifically designed for electric vehicles. These products aim to enhance battery efficiency and lifespan.

Key Electric Vehicle Battery Coolant Companies:

The following are the leading companies in the electric vehicle battery coolant market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Valvoline Inc.

- Exxon Mobil Corporation

- Shell Group

- GS Caltexa

Recent Developments

-

On February 2024, the chemical manufacturer claims its DuPont AmberLite EV2X resin - a high-performing glycol-purification solution - can help extend the lifetime of EV coolant, while reducing glycol maintenance requirements. This is achieved by offering enhanced thermal stability and excellent operating characteristics compared to standard ion exchange resins currently on the market

-

On24 October 2023, the Chinese National Ministry of Transport has the intention issuing a new standard for water glycol-based coolants, which will require the use of a safety coolant in battery cooling loops. Tests conducted by its affiliated "Research Institute On Highway" ("RIOH") point to the added value of coolants with much reduced, yet non-zero, electrical conductivity

Electric Vehicle Battery Coolant Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,088.47 million

Revenue forecast in 2030

USD 2,612.23 million

Growth rate

CAGR of 3.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, battery type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

BASF SE; Valvoline Inc.; Exxon Mobil Corporation; Shell Group; GS Caltex

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Vehicle Battery Coolant Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric vehicle battery coolant market report based on vehicle type, battery type, and region:

-

Vehicle Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Battery Electric Vehicles

-

Hybrid Electric Vehicles

-

-

Battery Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Lead Acid Battery

-

Lithium Ion Battery

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric vehicle battery coolant market was valued at USD 2,027.64 million in 2023 and is projected to reach USD 2,088.47 million in 2024

b. The global electric vehicle battery coolant market is anticipated to grow at a CAGR of 3.8% from 2024 to 2030 to reach USD 2,612.23 million by 2030.

b. Lithium Ion Battery dominated the market with a revenue share of 60.6% in 2023. Lithium-ion batteries, which power the majority of electric vehicles (EVs), require effective cooling systems to maintain optimal performance and safety.

b. The electric vehicle battery coolant market is a competitive sector with several major players dominating, including BASF SE, Valvoline Inc., Exxon Mobil Corporation, Shell Group, BP Plc, TotalEnergies, and GS Caltex, among others

b. The growing concern over environmental pollution and the shift towards sustainable modes of transportation are significantly boosting the demand for electric vehicles. This surge in EV adoption directly impacts the demand for effective battery cooling systems to ensure vehicle efficiency and battery longevity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.