- Home

- »

- Automotive & Transportation

- »

-

Electric Vehicle Charger Operations & Maintenance Services MarketGVR Report cover

![Electric Vehicle Charger Operations And Maintenance Services Market Size, Share & Trends Report]()

Electric Vehicle Charger Operations And Maintenance Services Market Size, Share & Trends Analysis Report By Installation (Public, Private), By End-use (Retail, Logistics), By Application, By Charger Type, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-089-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global electric vehicle charger operations and maintenance services market size was valued at USD 277.55 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 26.3% from 2023 to 2030. The rapid adoption of Electric Vehicles (EVs) worldwide is expected to drive the market growth. As the number of EVson the roads continues to increase, the demand for charging infrastructure and maintenance services also rises. This trend is fueled by government incentives and initiatives to promote electric mobility and reduce Greenhouse Gas (GHG) emissions. Moreover, advancements in charging technology are driving the market forward.

Innovations, such as fast charging, wireless charging, and smart charging solutions, are enhancing the convenience and efficiency of charging EVs. These technological advancements are attracting consumers and encouraging the expansion of charging networks, leading to an increased demand for operations and maintenance services. Furthermore, the market is driven by the need for reliable and efficient charging infrastructure. EV owners rely on charging stations for their daily commuting and long-distance travel, and they expect a seamless charging experience. Therefore, the maintenance and upkeep of charging stations are crucial to ensure their proper functioning and availability.

Service providers play a vital role in ensuring that charging infrastructure is well-maintained, minimizing downtime, and maximizing customer satisfaction. In addition, the focus on sustainability and environmental consciousness is propelling the growth market. Governments, organizations, and individuals are increasingly embracing clean energy solutions, including EVs, as part of their efforts to reduce carbon footprints. As a result, there is a growing emphasis on maintaining and expanding charging infrastructure to support the widespread adoption of EVs and promote sustainable transportation.

The increasing complexity of charging infrastructure is also driving the demand for specialized operations and maintenance services. EV charging networks are becoming more intricate, incorporating multiple charging standards, payment systems, and data management platforms. Service providers with expertise in managing and maintaining such complex networks are essential to ensure seamless operations and optimize the charging experience for EV users. In addition, these specialized operations and maintenance services contribute to the overall growth and sustainability of the EV industry by promoting reliability, efficiency, and customer satisfaction.

However, the market is restrained by the lack of standardized charging infrastructure. The industry currently lacks uniformity in terms of charging standards, connectors, and protocols, which can create challenges for service providers and users alike. This lack of standardization poses barriers to interoperability and hinders the seamless operation and maintenance of charging stations. To overcome this challenge, industry stakeholders, including governments, manufacturers, and service providers, need to work collaboratively to establish protocols and common standards for charging infrastructure. Developing standardized solutions will enhance compatibility, reduce costs, and enable efficient operations and maintenance services across different charging networks.

COVID-19 Impact Analysis

The COVID-19 pandemic has positively impacted the market. One of the key factors driving this impact is the increased adoption of EVs during the pandemic. As people became more conscious of health and environmental concerns, there has been a surge in demand for EVs as a cleaner and more sustainable mode of transportation. This increased adoption has led to a corresponding rise in the need for reliable and efficient charging infrastructure. As a result, the market has witnessed significant growth as companies and governments have focused on expanding and enhancing the charging network to meet the growing demand.

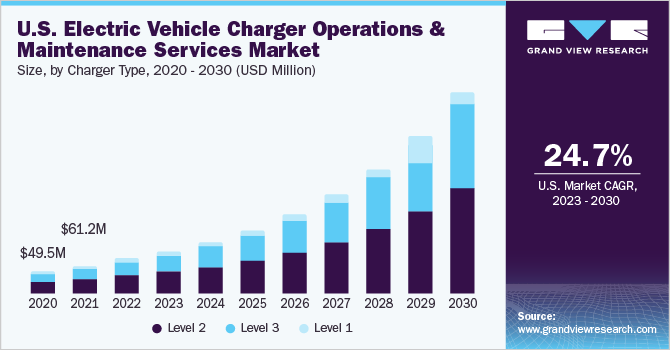

Charger Type Insights

The level 2 segment dominated the market in 2022 and accounted for a revenue share of more than 52.0%. Level 2 chargers offer a balance between charging speed and affordability, making them a popular choice for both residential and commercial applications. They provide a significant improvement over standard Level 1 chargers in terms of charging time, allowing for faster and more convenient charging of electric vehicles. Moreover, Level 2 chargers are versatile and compatible with a wide range of EVs, making them suitable for widespread adoption.

The level 3 segment is anticipated to register significant growth over the forecast period. Level 3 chargers, also known as DC fast chargers, offer significantly faster charging times compared to Level 2 chargers. They can provide a substantial amount of power to EVs, enabling them to charge at a much higher rate. This feature particularly appeals to EV owners who require quick and convenient charging options, such as those on long road trips or in busy urban areas.

Installation Insights

The private installation segment dominated the market in 2022 and accounted for a revenue share of more than 69.0%. Private installations cater to the charging needs of individual EV owners, residential complexes, commercial establishments, and private parking facilities. These private installations offer the convenience and accessibility of charging at home or within private premises, eliminating the need for owners to rely solely on public charging infrastructure. Moreover, private installations provide more control and flexibility over charging operations, allowing users to customize their charging experience according to their specific requirements.

The public segment is anticipated to register significant growth over the forecast period. The increasing adoption of EVs has led to a growing demand for public charging infrastructure to cater to the charging needs of EV owners who do not have access to private installations. Public installations provide a convenient and accessible charging solution for owners away from home or in public areas, such as shopping malls, parking lots, and roadside stations. Moreover, the expansion of public charging networks by government authorities, utility companies, and other stakeholders plays a crucial role in driving the growth of the public segment.

Application Insights

The commercial segment dominated the market in 2022 and accounted for a revenue share of over 90.0%. Businesses and organizations are increasingly adopting EVs for their fleet operations as part of their sustainability initiatives and to reduce carbon emissions. This has led to a surge in demand for charging infrastructure in commercial settings, such as office complexes, parking lots, and logistics centers. Furthermore, commercial establishments often require more charging stations to accommodate the charging needs of their EV fleet or their employees' vehicles. As a result, installing and maintaining EV chargers in commercial settings have become crucial to ensure uninterrupted charging services and efficient fleet management.

The residential segment is anticipated to register significant growth. The increasing adoption of EVs among homeowners drives the demand for residential charging infrastructure. As more individuals choose to own electric vehicles, they require convenient and accessible home charging solutions. This has led to a surge in the installation of residential charging stations, allowing EV owners to conveniently charge their vehicles overnight or during periods of low electricity demand. Moreover, government incentives and policies promoting the installation of residential charging infrastructure have further accelerated the growth of this segment.

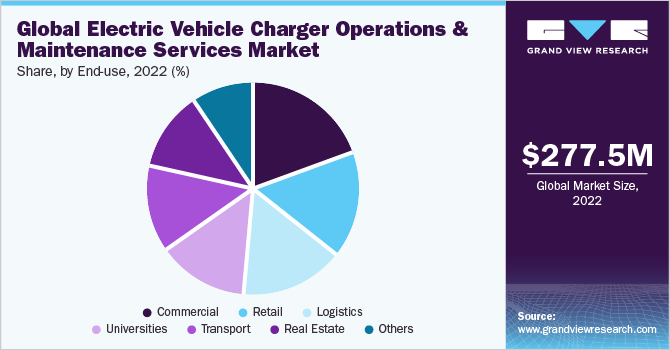

End-use Insights

The commercial segment dominated the market in 2022 and accounted for a global revenue share of more than 19.0%. Commercial entities often have a larger number of vehicles than individual consumers, making it essential for them to have efficient and reliable charging solutions to meet their operational needs. Moreover, the commercial segment benefits from economies of scale, as multiple EVs can be charged simultaneously, making it a cost-effective solution for businesses. This scalability and efficiency contribute to the dominance of the commercial segment in the market.

The retail segment is anticipated to register significant growth over the forecast period. The retail industry is increasingly recognizing the importance of providing convenient charging solutions for customers who own EVs. Retail establishments, such as shopping malls, supermarkets, and convenience stores strategically install charging stations in their parking lots to attract and retain customers. These charging facilities offer convenience to EV owners and serve as an additional service that enhances the overall customer experience.

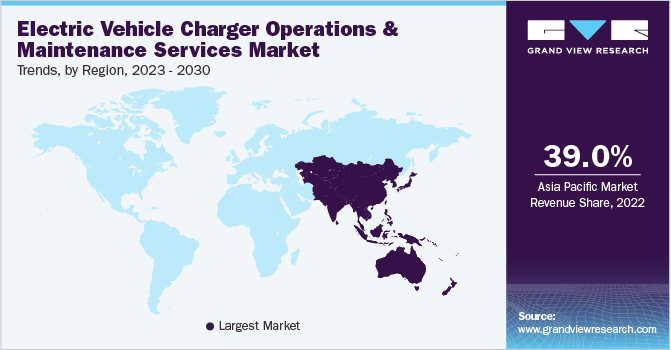

Regional Insights

Asia Pacific dominated the market in 2022 and accounted for a share of more than 39.0% of the overall revenue. The Asia Pacific region is experiencing rapid growth in EV adoption, driven by supportive government policies, incentives, and a strong commitment to reducing carbon emissions. Countries like China, Japan, and South Korea have invested significantly in EV charging infrastructure, creating a robust ecosystem for EV owners. This widespread adoption has created a high demand for charger operations and maintenance services in the region.The North America regional market is anticipated to emerge at a significant CAGR from 2023 to 2030.

North America has seen a substantial increase in the adoption of EVs, driven by government initiatives, environmental regulations, and consumer demand for sustainable transportation options. This surge in EV ownership has created a need for robust charging infrastructure and reliable maintenance services, fueling regional market growth. In addition, North America’s supportive regulatory framework and incentives have encouraged the development of charging infrastructure, making it more accessible for EV owners. This favorable environment has attracted investments and spurred the expansion of charger operations & maintenance services in the region.

Key Companies & Market Share Insights

The key players are committed to continuous innovation and improvement through investments in research and development. By allocating resources to R&D activities, these companies aim to enhance their existing product portfolios and develop new solutions that align with the evolving needs of the market and customers. This proactive approach allows them to stay ahead of the competition and maintain market leadership. In addition to R&D investments, these companies actively seek collaborations, acquisitions, and partnerships to expand their market reach and strengthen their position in the industry.

For instance, in January 2023, Voltera, a comprehensive EV charging solutions provider, formed a strategic alliance with Amerit Fleet Solutions, an EV fleet maintenance provider. This partnership aims to deliver on-site mobile fleet maintenance services at EV charging sites developed by Voltera for its clients in the U.S. By joining forces, Voltera and Amerit Fleet Solutions can offer a holistic solution that encompasses both EV charging infrastructure and fleet maintenance, providing clients with a seamless and efficient experience. Some of the prominent players in the global electric vehicle charger operations and maintenance services market include:

-

ChargePoint, Inc.

-

ABB

-

bp pulse

-

EVA Global

-

SEAM Group

-

Chargerhelp!

-

BTC Power

-

eFaraday

-

Pearce Renewables

-

Vital EV Solutions

Electric Vehicle Charger Operations And Maintenance Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 339.50 million

Revenue forecast in 2030

USD 1,744.72 million

Growth rate

CAGR of 26.3% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Charger type, installation, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Netherlands; Norway; China; India; Japan; South Korea; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

ChargerPoint, Inc.; ABB; bp pulse; EVA Global; SEAM Group; Chargerhelp!; BTC Power; eFaraday; Pearce Renewables; Vital EV Solutions

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Vehicle Charger Operations And Maintenance Services Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the electric vehicle charger operations and maintenance services market based on charger type, installation, application, end-use, and region:

-

Charger Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Level 1

-

Level 2

-

Level 3

-

-

Installation Outlook (Revenue, USD Million, 2017 - 2030)

-

Public

-

Private

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial

-

Destination Charging Stations

-

Highway Charging Stations

-

Bus Charging Stations

-

Fleet Charging Stations

-

-

Residential

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Logistics

-

Retail

-

Universities

-

Commercial

-

Transport

-

Real Estate

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

The Netherlands

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric vehicle charger operations and maintenance services market size was estimated at USD 277.55 million in 2022 and is expected to reach USD 339.50 million in 2023.

b. The global electric vehicle charger operations and maintenance services market is expected to grow at a compound annual growth rate of 26.3% from 2023 to 2030 to reach USD 1,744.72 million by 2030.

b. Asia Pacific dominated the electric vehicle charger operations and maintenance services market with a share of 39.95% in 2022. The Asia Pacific region is experiencing rapid growth in electric vehicle adoption, driven by supportive government policies, incentives, and a strong commitment to reducing carbon emissions.

b. Some key players operating in the electric vehicle charger operations and maintenance services market include ChargerPoint, Inc.; ABB; bp pulse; EVA Global; SEAM Group; Chargerhelp!; BTC Power; eFaraday; Pearce Renewables; Vital EV Solutions

b. Key factors that are driving the market growth include the expansion of electric vehicles and the charging infrastructure market, the need for electric vehicle charger maintenance services, and government funding and initiatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."