- Home

- »

- Next Generation Technologies

- »

-

Electric Motor Market Size & Share, Industry Report, 2033GVR Report cover

![Electric Motor Market Size, Share & Trends Report]()

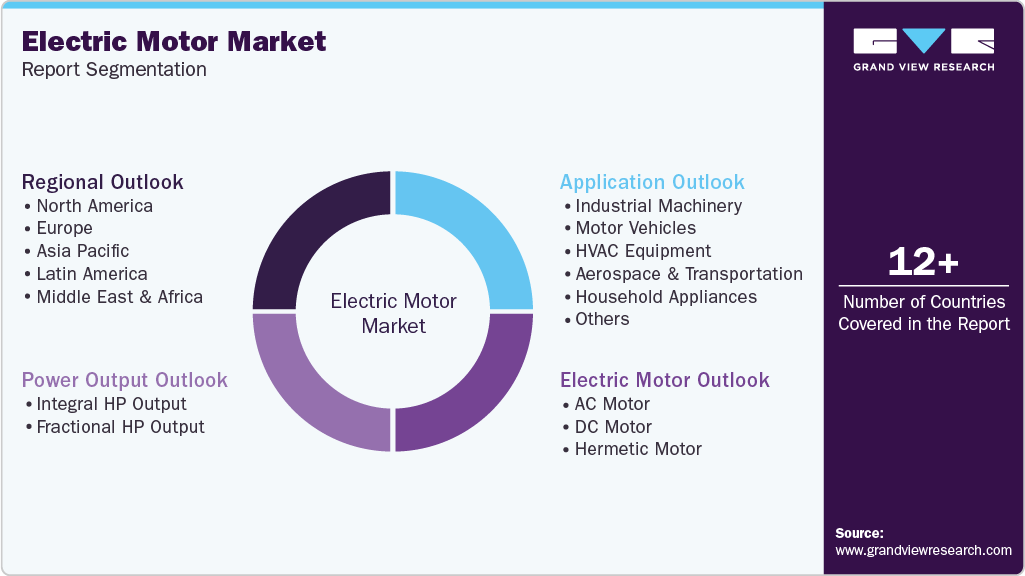

Electric Motor Market (2026 - 2033) Size, Share & Trends Analysis Report By Motor (AC, DC, Hermetic), By Power Output (Integral HP Output, Fractional HP Output), By Application (Industrial Machinery, Motor Vehicles, HVAC Equipment), By Region, And Segment Forecasts

- Report ID: 978-1-68038-662-2

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Motor Market Summary

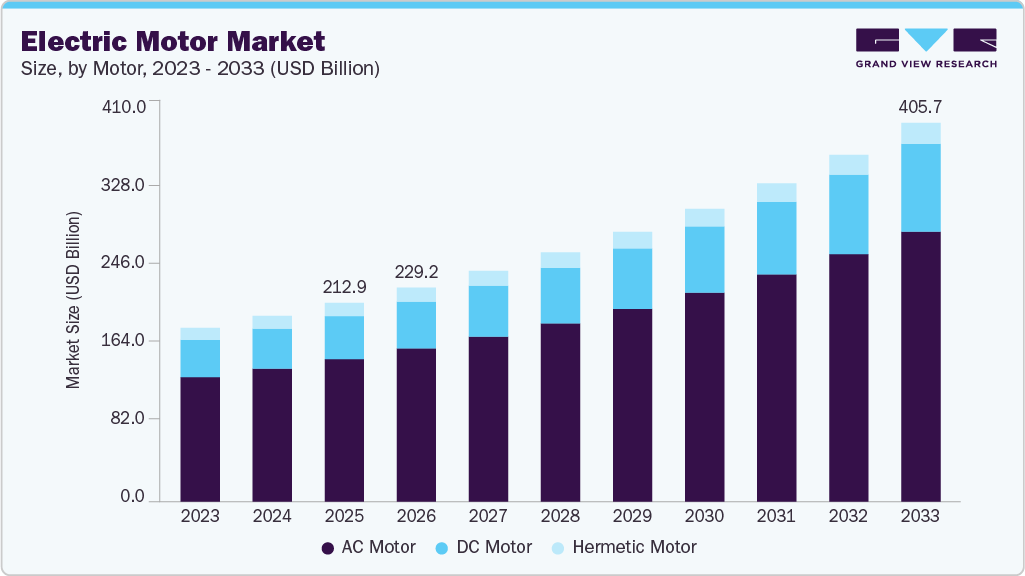

The global electric motor market size was estimated at USD 212.96 billion in 2025 and is projected to reach USD 405.67 billion by 2033, growing at a CAGR of 8.5% from 2026 to 2033. This market expansion is primarily driven by the growing adoption of electric vehicles, increasing automation across industrial manufacturing, rising demand for energy-efficient motors in HVAC and appliances, and expanding investments in renewable energy and infrastructure projects.

Key Market Trends & Insights

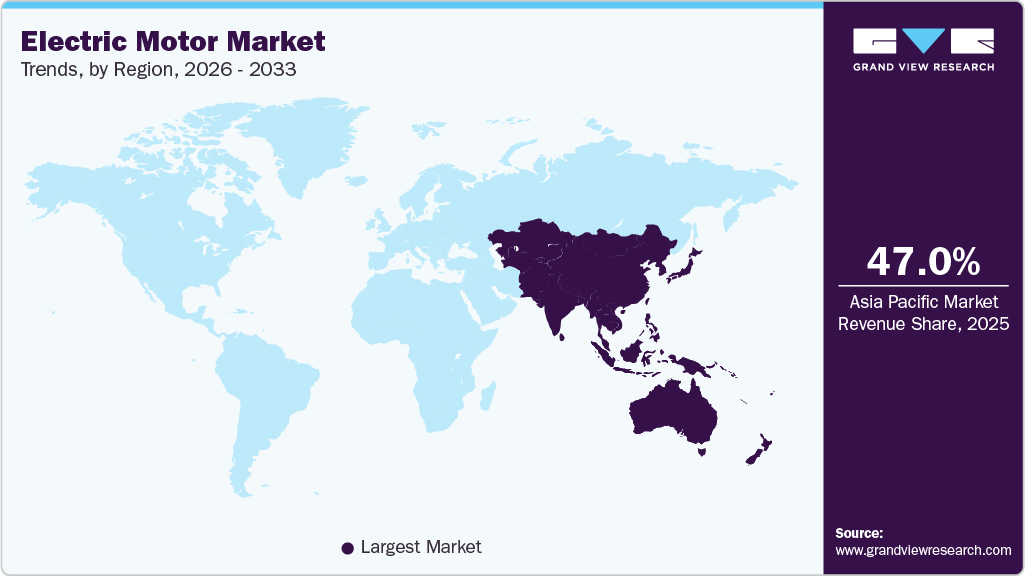

- Asia Pacific dominated the global electric motor industry with the largest revenue share of over 47% in 2025.

- The electric motor industry in China led the Asia Pacific market and held the largest revenue share in 2025.

- By motor, the AC motors segment led the market and held the largest revenue share of over 71% in 2025.

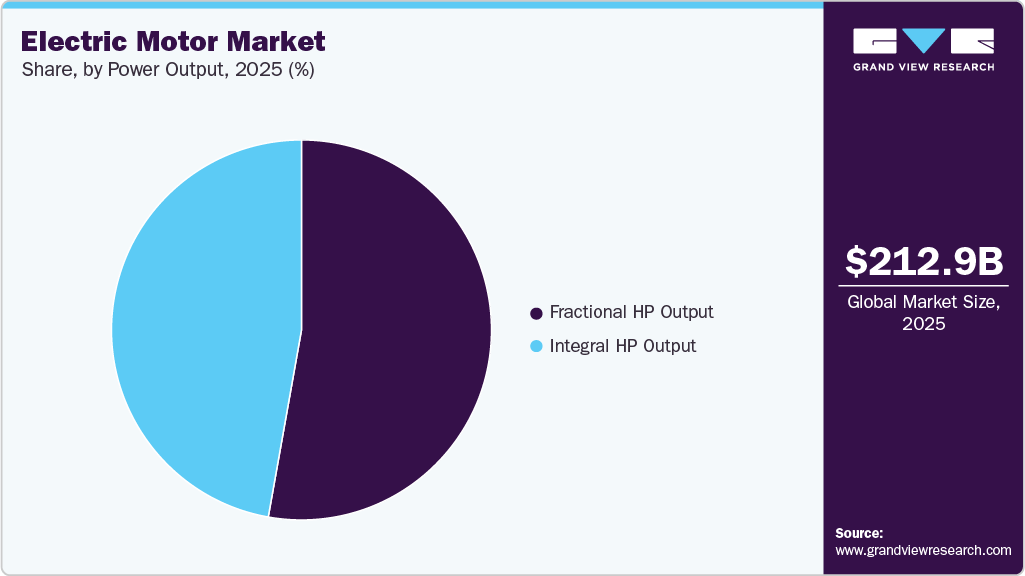

- By power output, the fractional HP output segment led the market and held the largest revenue share of over 52% in 2025.

- By application, the industrial machinery segment led the market, with the largest revenue share of over 40% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 212.96 Billion

- 2033 Projected Market Size: USD 405.67 Billion

- CAGR (2026-2033): 8.5%

- Asia Pacific: Largest market in 2025

The electric motor industry growth is driven by a convergence of advanced technologies, digital intelligence, and macroeconomic forces that are redefining how these foundational devices are designed, deployed, and managed across industries. Integration of edge computing, low-power microelectronics, and AI-based analytics is enhancing motor performance beyond traditional automation, enabling real-time condition monitoring, predictive maintenance, and adaptive control capabilities that maximize efficiency and uptime. Smart electric motors with IoT connectivity are increasingly context-aware and responsive, contributing to improved productivity, cost efficiency, and quality control across manufacturing, transportation, and infrastructure sectors.The accelerating global push toward electrification and decarbonization is significantly driving the growth of the electric motor industry. Governments and industries are increasingly replacing fossil-fuel-based mechanical systems with electric motor-driven solutions across transportation, manufacturing, and infrastructure. Large-scale investments in electric vehicles, renewable energy systems, and electrified industrial equipment are increasing demand for high-efficiency motors capable of delivering superior performance while reducing carbon emissions. This transition is positioning the electric motor industry as an enabler of sustainable industrial ecosystems.

In addition, rising emphasis on energy efficiency and lifecycle cost optimization is emerging as a critical growth driver for the electric motor industry. Enterprises are prioritizing motors with higher efficiency ratings, variable speed operation, and reduced maintenance requirements to lower the total cost of ownership. Advanced motor designs, coupled with intelligent drives and power electronics, allow precise control of torque and speed, enabling optimized energy consumption across diverse load conditions. These capabilities are becoming essential as energy prices rise and organizations focus on long-term operational resilience.

Furthermore, the growing adoption of automation, robotics, and digitally controlled production systems is creating strong demand for precision electric motors. As factories transition toward flexible manufacturing and mass customization, motors with high responsiveness, accurate motion control, and seamless integration with control systems become indispensable. Electric motors function as active components within digitally orchestrated production environments, supporting synchronized operations, reduced downtime, and higher throughput across the industrial value chain, thereby driving the market growth.

Motor Insights

The AC motors segment accounted for the largest market share of over 71% in 2025, driven by its widespread use in industrial, commercial, and infrastructure applications. These motors offer high reliability, compatibility with variable frequency drives (VFDs), and efficient performance in continuous-duty operations. Increasing adoption of energy-efficient and regulation-compliant motor systems further supports demand. Therefore, AC motors continue to dominate the market due to their scalability and cost-effective deployment across end use sectors.

The DC motors segment is expected to witness the fastest CAGR of over 9% from 2026 to 2033, supported by rising demand for precise speed control and high torque at low speeds. DC motors are increasingly used in electric vehicles, robotics, and battery-powered equipment due to their compatibility with electronic control systems. Ongoing advancements in brushless DC motor technology enhance efficiency and performance. Thus, DC motors are gaining accelerated adoption in applications requiring compact design and dynamic operational control.

Application Insights

The industrial machinery segment accounted for the largest market share in 2025, owing to increasing automation across manufacturing, mining, oil & gas, and processing industries. Electric motors are integral to pumps, compressors, conveyors, and material handling systems requiring continuous operation and precise control. Energy-efficiency regulations and replacement of legacy mechanical systems with electrified solutions are accelerating upgrades. Therefore, industrial machinery remains the primary demand driver for electric motors globally.

The motor vehicles segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the expanding use of electric motors in propulsion, braking, steering, and thermal management systems. Automakers are adopting high-efficiency motors to support electrification and comply with emission regulations. Rising EV production and advancements in motor control technologies are reinforcing demand. Thus, motor vehicles represent the fastest-growing application segment in the electric motor industry.

Power Output Insights

The fractional HP output segment accounted for the largest market share in 2025, owing to its widespread use in consumer appliances, HVAC systems, and commercial equipment. These motors are preferred for their compact size, cost efficiency, and suitability for continuous operation. Growing adoption of smart homes and demand for energy-efficient ventilation and cooling systems are reinforcing demand. Therefore, fractional HP motors remain the dominant choice for low-power, high-volume applications across end-use sectors.

The integral HP output segment is expected to witness a significant CAGR from 2026 to 2033, driven by increasing deployment in heavy industrial machinery, electric vehicles, and renewable energy systems. These applications require high power output, durability, and long operating cycles. Rising investments in industrial electrification and infrastructure modernization are further supporting adoption. Thus, integral HP motors are gaining traction in power-intensive and mission-critical applications globally.

Regional Insights

North America Electric Motor Market Trends

North America electric motor industry accounted for a share of over 18% in 2025, driven by the growing demand for the automotive industry, the increasing trend of automation in various manufacturing facilities, the rise in the inclusion of industrial and commercial HVAC systems, and the presence of various key companies in the region. The increasing awareness regarding the reduction of carbon footprint and enhanced efforts by organizations and governments to include energy-efficient solutions are driving the growth opportunities in the North America region.

U.S. Electric Motor Market Trends

The U.S. electric motor industry dominated with a share of over 78% in 2025, driven by strong investments in industrial automation, electrification of transportation, and large-scale infrastructure modernization. Federal incentives supporting domestic manufacturing and energy efficiency standards are encouraging companies to deploy advanced motor technologies. The growing shift toward smart factories and digitally enabled supply chains is reinforcing the need for reliable, high-performance motor systems, thereby sustaining the U.S. market’s position in the electric motor industry.

Europe Electric Motor Market Trends

Europe electric motor industry is expected to grow at a CAGR of over 7% from 2026 to 2033. The market growth is driven by accelerated industrial electrification, stringent energy efficiency regulations, and widespread adoption of smart manufacturing practices. European Union policies promoting Industry 4.0, carbon neutrality, and electrified mobility are pushing manufacturers to integrate high-efficiency motors, variable speed drives, and digitally connected motor systems. The region’s focus on sustainability, automation, and regulatory compliance continues to support the sustained growth of the electric motor industry.

The UK electric motor industry is expected to grow significantly in the coming years, driven by government-backed initiatives and increased investments in industrial digitization, automation, and electrification. The adoption of advanced manufacturing technologies, AI-driven process optimization, and robotics is accelerating demand for digitally controlled motors. The UK’s commitment to achieving net-zero emissions is pushing industries to upgrade HVAC systems, electrify transportation, and adopt energy-efficient motor solutions. These factors collectively support the growth of the electric motor industry.

The Germany electric motor industry is propelled by its strong industrial foundation and leadership in Industry 4.0-driven manufacturing transformation. German manufacturers are increasingly integrating smart motors with digital twins, advanced drive systems, and real-time monitoring to enhance productivity. Rising investments in electric mobility, factory automation, and renewable energy infrastructure, combined with strict efficiency and sustainability standards, are further boosting demand. Germany’s focus on high-performance engineering, digital manufacturing, and regulatory compliance continues to reinforce its pivotal role in the electric motor industry.

Asia Pacific Electric Motor Market Trends

Asia-Pacific electric motor industry dominated the global market with a share of over 47% in 2025, driven by rapid industrialization, large-scale infrastructure development, and accelerating electrification. Rising investments in smart factories, expansion of HVAC and commercial building projects, and increasing adoption of automation in emerging economies are boosting demand for efficient and reliable motor systems. Government initiatives supporting industrial modernization and energy efficiency are encouraging widespread deployment. These factors together position the Asia Pacific region as the growth driver for the electric motor industry.

The Japan electric motor industry is gaining traction owing to its focus on precision engineering, robotics, and high-performance industrial automation. Japanese industries are adopting advanced motor technologies to support factory automation, semiconductor manufacturing, and next-generation mobility solutions. Growing investments in energy-efficient equipment, compact motor designs, and electrification of transportation, combined with a strong emphasis on reliability and quality standards, are accelerating adoption within the electric motor industry.

The China electric motor industry is rapidly expanding. The market growth is supported by aggressive investments in electric vehicle production, renewable energy installations, and advanced manufacturing under national industrial modernization programs. Chinese manufacturers are increasingly adopting high-efficiency motors, integrated drives, and intelligent control systems to improve energy utilization and production scalability. Strong policy support for domestic manufacturing, grid upgrades, and industrial automation continues to reinforce China’s position in the market.

Key Electric Motor Company Insights

Some of the key players operating in the market are ABB and Siemens AG, among others.

-

ABB provides advanced electric motor and drive solutions that support digital transformation across manufacturing, utilities, transportation, and infrastructure sectors. The company focuses on high-efficiency motors, smart drives, and digitally enabled services that improve energy efficiency, reliability, and asset performance. ABB’s electric motor portfolio integrates automation, IoT connectivity, and predictive maintenance capabilities, allowing manufacturers to optimize operations, reduce downtime, and achieve sustainability targets, making it a leading player in the electric motor industry.

-

Siemens AG is a global technology leader offering a comprehensive range of electric motors and drive systems for industrial, energy, and mobility applications. The company emphasizes digitalization through its Industrial Edge, automation platforms, and energy-efficient motor solutions that support Industry 4.0 adoption. Siemens’ electric motors are widely used in smart factories, process industries, and infrastructure projects, helping customers enhance productivity, improve energy management, and support decarbonization initiatives within the electric motor industry.

Allied Motion, Inc. and ORIENTAL MOTOR USA CORP. are some of the emerging market participants in the electric motor industry.

-

Allied Motion, Inc. is an emerging player specializing in precision motion control products, including electric motors, drives, and integrated systems for industrial, medical, and aerospace applications. The company focuses on customized motor solutions with high efficiency, compact designs, and advanced control capabilities. Allied Motion is expanding its presence by addressing niche, high-performance applications and supporting customers transitioning toward automation and electrification.

-

ORIENTAL MOTOR USA CORP. is an emerging participant in the market, known for its focus on small and medium-sized motors used in automation, robotics, and precision machinery. The company offers stepper motors, servo motors, and brushless DC motors designed for reliability and ease of integration. ORIENTAL MOTOR is strengthening its market position by supporting growing demand for compact, energy-efficient motors in factory automation and smart equipment applications.

Key Electric Motor Companies:

The following are the leading companies in the electric motor market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Allied Motion, Inc.

- AMETEK, Inc.

- Johnson Electric Holdings Limited

- Nidec Motor Corporation

- Franklin Electric

- Regal Rexnord Corporation

- Schneider Electric

- Siemens AG

- ORIENTAL MOTOR USA CORP.

Recent Developments

-

In June 2025, Allied Motion, Inc. expanded its SA Series Axial Flux Motor lineup with a new 63.5 mm variant optimized for compact, high-precision motion applications such as camera systems and imaging equipment, enhancing its specialty motor offerings for automation and precision industries. This product expansion reinforces Allient’s role in the precision motor market and supports growth in automation-driven sectors.

-

In May 2025, Schneider Electric advanced energy technology and AI-powered electrification solutions at its Innovation Summit North America 2025, showcasing its EcoStruxure platform designed to integrate electrification, automation, and intelligence across industrial, infrastructure, and building systems to improve resilience, efficiency, and real-time energy management. These innovations are expected to strengthen Schneider Electric’s leadership and accelerate the adoption of smart motor solutions in industrial applications.

-

In January 2025, Nidec Motor Corporation launched its PrecisionFlow electronically commutated motor (ECM) at the International Production & Processing Expo (IPPE) in Atlanta, aimed at boosting energy-efficient performance in HVAC and industrial applications. The launch is anticipated to expand Nidec’s presence in high-efficiency motor segments and emerging industrial applications.

Electric Motor Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 229.18 billion

Revenue forecast in 2033

USD 405.67 billion

Growth rate

CAGR of 8.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Motor, power output, application, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

ABB; Allied Motion, Inc.; AMETEK, Inc.; Johnson Electric Holdings Limited; Nidec Motor Corporation; Franklin Electric; Regal Rexnord Corporation; Schneider Electric; Siemens AG; ORIENTAL MOTOR USA CORP.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Electric Motor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the electric motor market report based on motor, power output, application, and region:

-

Electric Motor Outlook (Revenue, USD Billion, 2021 - 2033)

-

AC Motor

-

Synchronous AC Motor

-

Induction AC Motor

-

-

DC Motor

-

Brushed DC Motor

-

Brushless DC Motor

-

-

Hermetic Motor

-

-

Power Output Outlook (Revenue, USD Billion, 2021 - 2033)

-

Integral HP Output

-

Fractional HP Output

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Industrial Machinery

-

Motor Vehicles

-

HVAC Equipment

-

Aerospace & Transportation

-

Household Appliances

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric motor sales market size was estimated at USD 212.96 billion in 2025 and is expected to reach USD 229.18 billion in 2026.

b. The global electric motor sales market is expected to grow at a compound annual growth rate of 8.5% from 2026 to 2033 to reach USD 405.67 billion by 2033.

b. Asia-Pacific electric motor dominated the market with a share of over 47% in 2025, driven by rapid industrialization, large-scale infrastructure development, and accelerating electrification. Rising investments in smart factories, expansion of HVAC and commercial building projects, and increasing adoption of automation in emerging economies are boosting demand for efficient and reliable motor systems. Government initiatives supporting industrial modernization and energy efficiency are encouraging widespread deployment. These factors together position the Asia Pacific region as the growth driver for the electric motor industry.

b. Some key players operating in the electric motor sales market include ABB, Allied Motion, Inc., AMETEK.Inc., Johnson Electric Holdings Limited, Nidec Motor Corporation, Franklin Electric, Regal Rexnord Corporation, Schneider Electric, Siemens AG, ORIENTAL MOTOR USA CORP.

b. Key factors that are driving the growing adoption of electric vehicles, increasing automation across industrial manufacturing, rising demand for energy-efficient motors in HVAC and appliances, and expanding investments in renewable energy and infrastructure projects.

b. The AC motor segment led the electric motor sales market, accounting for the largest revenue share of over 70% % in 2025 and is attributable to AC motors' extensive applications ranging from irrigation pumps to modern-day robotics.

b. The DC motor segment is projected to witness the highest CAGR of over 9% from 2026 to 2033 and is supported by rising demand for precise speed control and high torque at low speeds. DC motors are increasingly used in electric vehicles, robotics, and battery-powered equipment due to their compatibility with electronic control systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.