- Home

- »

- Medical Devices

- »

-

Electroencephalography Devices Market Size Report, 2030GVR Report cover

![Electroencephalography Devices Market Size, Share & Trends Report]()

Electroencephalography Devices Market Size, Share & Trends Analysis Report By Product (32-Channel, Multichannel), By Type (Portable, Standalone), By Application (Trauma & Surgery, Disease Diagnosis), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-428-4

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Market Size & Trends

The global electroencephalography devices market size was estimated at USD 1.21 billion in 2023 and is projected to grow at a CAGR of 10.36% from 2024 to 2030. The Electroencephalography (EEG) devices market is witnessing substantial growth due increasing prevalence of neurological disorders, rising demand for non-invasive diagnostic techniques, and advancements in EEG technology.

In addition, the growing geriatric population and increasing awareness about the importance of early diagnosis of neurological conditions are likely to contribute to market growth. For instance, according to Western University, in March 2024, researchers developed a proficient, nonintrusive technique to enhance perfusion comprehension across hippocampus sections. This approach can assist in diagnosing neurological disorders, such as epilepsy, Alzheimer’s, and schizophrenia, contributing to the promotion of healthy aging. Overall, these factors indicate promising future growth for the EEG devices market.

The condition of the heart and blood vessels significantly impacts brain health. Despite comprising only 2% of body weight, the brain utilizes 20% of the body's oxygen and energy resources. A well-functioning heart ensures adequate blood flow to the brain, while healthy blood vessels facilitate the delivery of oxygen and nutrients, which are crucial for normal brain function.

Data provided by the Alzheimer's Association predicts that approximately 12.7 million individuals aged 65 years and above will have Alzheimer’s disease by 2050. Statistics from the National Vital Statistics Report, compiled by the Centers for Disease Control and Prevention (CDC), reveal that stroke was the fifth leading cause of death in the U.S. These facts are indicative of rising prevalence of disease requiring constant monitoring and treatment, propelling demand for EEG systems.

According to the National Center for Health Statistics, the death rate (per 100,000 population) for Alzheimer’s in the U.S. was reported as follows:

Age

(Years)

2018

(per 100,000 population)2019

(per 100,000 population)45-54

0.3

0.3

55-64

2.9

3.0

65-74

24.7

24.9

75-84

213.9

210.2

85+

1,225.3

1,191.3

According to the Alzheimer’s Association, in 2023, nearly 66% of individuals diagnosed with Alzheimer’s dementia in the U.S. were women. Of the 6.7 million people aged 65 years and above with Alzheimer’s dementia, 4.1 million were women and 2.6 million were men. This accounts for 12% of women and 9% of men aged 65 years and older in the U.S.

Ongoing advancements in understanding brain function and disorders are expected to drive innovation in EEG technology, enhancing diagnostic capabilities & expanding the applications of EEG devices in various neurological assessments & treatments. For instance, according to Yale Medicine, in July 2023, the U.S. FDA approved a novel Alzheimer's treatment- lecanemab-which demonstrated a moderate reduction in cognitive and functional decline in individuals with early-stage Alzheimer's disease.

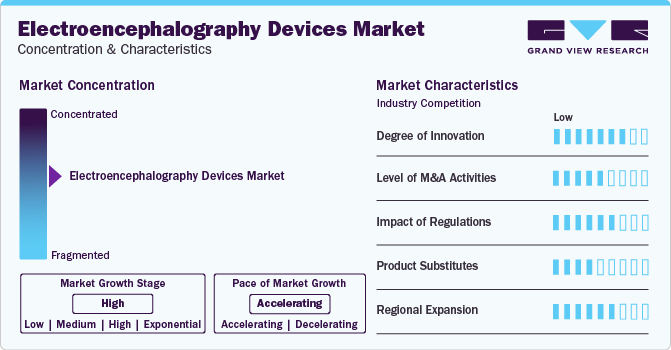

Market Concentration & Characteristics

The industry growth stage is high, and the pace of growth is accelerating, which can be attributed to the increasing prevalence of neurological disorders, such as epilepsy, Alzheimer's disease, and Parkinson's disease. In addition, the rising demand for noninvasive diagnostic techniques and continuous advancements in EEG technology can contribute to industry expansion. Favorable government regulations and reimbursement policies are expected to drive the industry further.

The EEG devices industry is characterized by a high degree of innovation, with companies consistently developing products that enhance efficiency and safety. For instance, according to humanbrainproject.eu, in September 2023, Marcello Massimini from the University of Milan devised an innovative method for assessing consciousness in coma patients. Combining Transcranial Stimulation (TMS) and EEG brain wave measurements, his team computed the Perturbational Complexity Index (PCI) to discern various consciousness levels. The team was trialing a TMS-EEG prototype in Milan and, with support from the Tiny Blue Dot Foundation, dispatched TMS-EEG devices to major US neurological hospitals. A spinoff was established to facilitate the method's integration into hospitals, and Massimini received an Innovation Award in 2022 for this endeavor, presented during the final HBP Summit 2023 in Marseille.

Stringent regulatory requirements imposed by agencies such as the U.S. FDA and the EU European Medicines Agency (EMA) contribute to establishing trust among consumers & healthcare professionals. Moreover, regulatory frameworks can influence industry entry barriers, competitive dynamics, and product pricing strategies, ultimately impacting the growth & evolution of the EEG devices market.

Mergers and acquisitions in the EEG devices market are rising due to the need for R&D, reflecting its dynamic nature. Companies are leveraging M&As to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in February 2024, Thyrocare, a diagnostic provider supported by Pharmeasy, was expected to purchase the ownership stake in Think Health Diagnostics based in Chennai. With this acquisition, Thyrocare aimed to expand its services by offering at-home ECG tests.

While EEG remains a widely used neurodiagnostic tool, advancements in neuroimaging techniques, such as functional magnetic resonance imaging (fMRI) and positron emission tomography (PET), offer alternative means of assessing brain activity. In addition, wearable devices with EEG-like functionalities are gaining popularity for monitoring brain health. For instance, in March 2022, Interaxon, Inc. (Muse) unveiled its VR Software Development Kit (SDK) with a new EEG headband compatible with leading VR Head-mounted Displays (HMDs) built on its Muse S EEG meditation & sleep headband technology. The company undertook strategic partnerships to advance brain health innovations, utilizing its acclaimed biosensing technology in AR and VR applications.

The EEG industry is experiencing robust global expansion due to the increasing prevalence of neurological disorders, rising healthcare expenditure, and growing awareness about early diagnosis & treatment of brain-related conditions. In addition, favorable government initiatives, supportive regulatory frameworks, and technological advancements can fuel regional expansion efforts in the EEG devices industry, catering to the diverse healthcare needs of different regions.

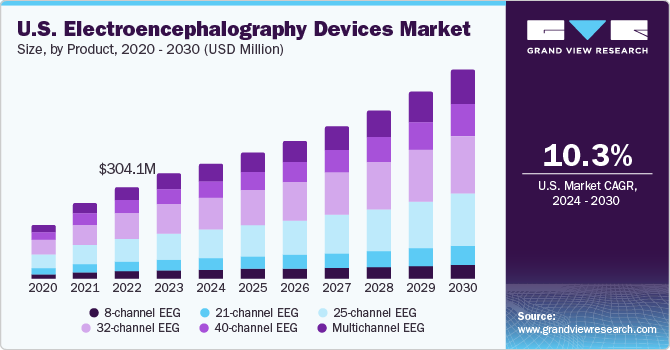

Product Insights

The 32-channel EEG segment accounted for the largest market share of 27.6% in 2023. Its growth can be attributed to the device’s enhanced diagnostic capabilities and higher spatial resolution. As healthcare providers seek more comprehensive insights into brain activity, the demand for EEG systems with increased channel capacity is rising. For instance, in February 2024, Neurotechnology's enhanced BrainAccess EEG solutions showcased upgraded headwear, expanded software functionalities, and the introduction of a novel 32-channel system. The 32-channel configuration allows simultaneous monitoring of multiple brain regions, enabling more accurate assessments of cognitive function and neurological disorders. In addition, technological advancements have made these systems more accessible and user-friendly, driving their adoption.

The multichannel EEG segment is likely to grow at the fastest CAGR over the forecast period. As more healthcare professionals recognize the importance of comprehensive brain monitoring, the demand for EEG systems with multiple channels is expected to increase. Multichannel EEG devices can simultaneously record electrical activity from various brain regions, providing detailed insights into neurological function and disorders. This enhanced diagnostic capability can drive adoption, particularly in research and clinical settings.

Type Insights

The standalone devices segment held the largest revenue share of 72.0% in 2023. These devices can operate independently without additional equipment or connections, offering convenience & portability, making them suitable for various settings, including clinics, hospitals, & research laboratories. The rising demand for point-of-care diagnostics and remote patient monitoring is driving the adoption of standalone EEG devices. In addition, technological advancements have improved their performance and reliability, fueling the market.

The portable devices segment is expected to grow at the fastest CAGR over the forecast period. These devices offer mobility and flexibility, enabling EEG recordings to be conducted outside traditional clinical settings. The increasing demand for ambulatory EEG monitoring is likely to drive the adoption of portable EEG devices, particularly for diagnosing epilepsy and monitoring sleep disorders. In addition, miniaturization and wireless technology advancements have improved their design and functionality, enhancing their usability & accuracy. For instance, according to AZoNetwork, in August 2023, researchers from the University of Houston validated & tested a wireless, low-cost, portable brain-computer interface that connects stroke patients' brains to powered exoskeletons for rehabilitation. This EEG-based system interprets brain activity, allowing the device to read the user's mind and initiate robotic movement, potentially improving motor recovery outcomes by promoting cortical plasticity following stroke.

Application Insights

The disease diagnosis segment accounted for the largest revenue share of 31.9% in 2023. EEG devices play a crucial role in diagnosing various neurological disorders, such as epilepsy, Alzheimer's disease, and Parkinson's disease. For instance, according to the University of Florida Health in February 2024, over the past 25 years, the population affected by Parkinson's disease has surged from 3 million to surpass 6 million individuals. It is projected to double once more by the year 2040. The rising prevalence of these conditions and the growing awareness about the importance of early diagnosis are likely to drive the demand for EEG devices for disease diagnosis. For instance, Prolira BV's DeltaScan Brain State Monitor is a worldwide bedside EEG device that offers clinicians a rapid and unbiased assessment of acute brain failure, even preempting symptoms. This capability empowers healthcare providers to promptly administer treatment, reinstating patients' cognitive wellness, as stated by Globetech Media in March 2023. In addition, advancements in EEG technology, including higher channel counts & improved signal processing algorithms, enhance the accuracy and reliability of EEG-based diagnostic tests. As a result, the disease diagnosis segment is expected to continue its upward trajectory in the EEG devices market.

The trauma and surgery segment is expected to grow at the fastest CAGR over the forecast period. EEG devices are crucial for monitoring brain activity during surgical procedures and managing Traumatic Brain Injury (TBI). For instance, in January 2022, Lawrence + Memorial (L+M) Hospital integrated an advanced brain monitoring device to detect silent seizures early in critically ill patients in their Intensive Care or Critical Care Unit. The Ceribell EEG Rapid Response monitor includes a headband, a small data recorder, and an online remote patient neurological activity monitoring platform. It helps promptly detect seizure activity and allows for immediate intervention when needed. The increasing prevalence of traumatic injuries and surgical interventions, coupled with the growing demand for real-time neurological monitoring, is expected to drive the adoption of EEG devices in this segment.

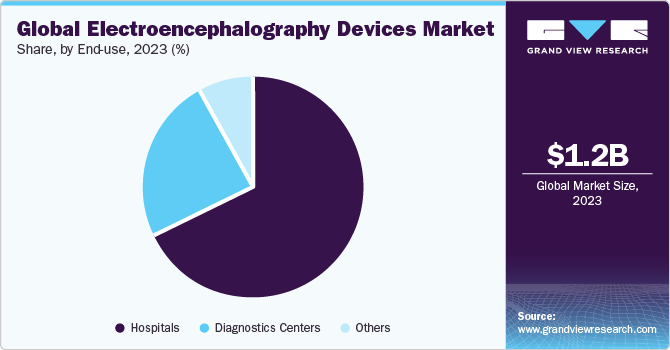

End-use Insights

The hospitals segment accounted for the largest revenue share of 67.7% in 2023. Hospitals are increasingly adopting EEG devices for neurological diagnostics & monitoring due to the rising prevalence of neurological disorders and the growing demand for advanced healthcare services. Hospitals primarily utilize ECG devices to record & analyze the rhythm and electrical activity necessitated for clinical & research objectives, making them the primary end-users. For instance, in July 2023, Nicklaus Children’s Hospital introduced a Transcranial Magnetic Stimulation (TMS) machine and a novel High-density Electroencephalogram (HD EEG) system, establishing itself as one of the pioneering institutions nationwide to provide such equipment for pediatric patient care. Furthermore, technological advancements, such as portable and wireless EEG devices, enhance hospital usability, further fueling market growth.

The diagnostic centers segment is likely to grow at the fastest CAGR over the forecast period. Diagnostic centers are crucial in providing specialized neurological diagnostic services to patients, driving the demand for EEG devices. With the increasing prevalence of neurological disorders and the growing emphasis on early diagnosis and treatment, diagnostic centers are expanding their capabilities to offer advanced EEG testing.

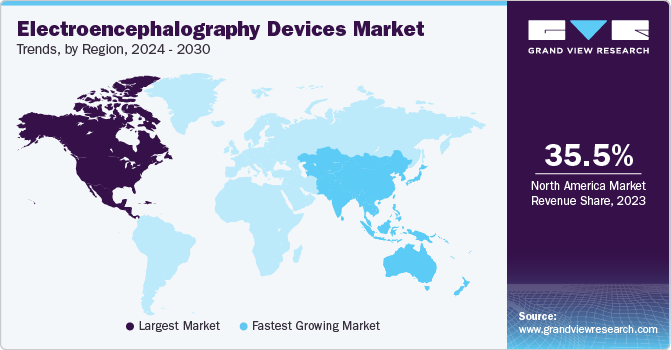

Regional Insights

TheNorth America electroencephalography devices market dominated the global market with a 35.5% revenue share in 2023. Increasing occurrences of sleep and neurodegenerative conditions, along with improved insurance coverage, are critical drivers of regional expansion. In addition, advanced healthcare infrastructure and robust distribution networks of leading vendors are expected to fuel growth. Favorable reimbursement policies in the U.S. have boosted the adoption of these systems for neurological disorder diagnosis. Furthermore, government bodies, such as the National Institute of Neurological Disorders and Stroke (NINDS), funding R&D in brain and nervous system disorders have further bolstered the regional market's dominance.

U.S. Electroencephalography Devices Market Trends

The electroencephalography devices market in the U.S. held a significant share of North America in 2023, driven by the increasing prevalence of neurological disorders such as epilepsy, Alzheimer's disease, & Parkinson's disease; rising demand for advanced diagnostic technologies; and favorable reimbursement policies. For instance, according to the CDC, in 2022, approximately 5.1 million U.S. individuals had a past medical record of epilepsy, and around 3.4 million citizens are currently affected by active epilepsy. Epilepsy is the fourth most prevalent brain disorder in the U.S., following Alzheimer's disease, migraine, and stroke. Moreover, the country’s well-established healthcare infrastructure and strong distribution networks, facilitating advanced product penetration, are likely to drive the U.S. EEG devices market.

Europe Electroencephalography Devices Market Trends

The electroencephalography devices market in Europe is expected toexhibit lucrative growth due to the rapidly aging population and rising EEG device approvals from European regulatory authorities. For instance, in August 2022, Brain Scientific announced that NeuroCap, its disposable headset, obtained CE mark approval in the EU. NeuroCap includes 22 pre-gelled electrodes and is available in various sizes. According to Brain Scientific, it can reduce EEG preparation time to approximately 5 minutes.

The electroencephalography devices market in the UK is anticipated to grow during the forecast period, primarily driven by the rising number of neurological procedures. In 2022, the total number of neurology procedures performed in the UK was 73,729. In July 2023, Cumulus Neuroscience, a digital health company, collaborated with two UK universities to enhance its at-home EEG headset, aiming to establish it as an early warning system for Alzheimer’s dementia.

The France electroencephalography devices market is expected to grow over the forecast period due to the increasing older population in the country. According to an article published by Le Monde in March 2023, around 26% of people living in France are aged over 60 years old.

The electroencephalography devices market in Germany is projected to expand over the forecast period owing to increased merger and acquisition activities undertaken by key players. For instance, in September 2022, the acquisition of Dr. Langer Medical GmbH by Brainlab, a digital medical technology company, highlights a strategic alignment for seamless integration. Dr. Langer Medical GmbH, headquartered in Waldkirch, Germany, specializes in developing intraoperative neuromonitoring solutions and related equipment for surgical procedures.

Asia Pacific Electroencephalography Devices Market Trends

The electroencephalography devices market in Asia Pacific region is expected to grow at the fastest rate during the forecast period. This can be attributed to the region's substantial population, increasing healthcare expenditure, and increasing demand for advanced medical treatments and technologies. In addition, the rising prevalence of neurological conditions and a growing need for specialized medical interventions positions the Asia Pacific region as a pivotal player in the anticipated economic and healthcare advancements.

The Japan electroencephalography devices market is expected to witness significant growth in the coming years. According to the World Bank data in July 2022, Japan has the highest proportion of the elderly population in the world. Thus, a growing geriatric population, which is more susceptible to neurological diseases, is expected to drive the demand for EEG devices.

The electroencephalography devices market in China is expected to grow at the fastest rate in Asia Pacific in 2023. Rapid urbanization and shift in lifestyle have led to elevated levels of stress, sleep deprivation, & other elements that raise the likelihood of neurological conditions. In China, numerous neurological disorders go unrecognized and untreated due to limited awareness, resources, and healthcare accessibility. According to the National Center for Biotechnology Information (NCBI), by 2050, an anticipated 4.07% of China's population will experience a stroke, marking a 101.49% rise from the 2.02% reported in 2019. The incidence of stroke is on the rise in China, owing to factors such as hypertension, diabetes, and unhealthy habits.

The India electroencephalography devices market is expected to grow over the forecast period due to increasing developments by established and emerging players in the country. For instance, in August 2020, scientists at the Indian Institute of Technology Madras demonstrated the utility of EEG in gauging the cognitive acuity of workers, particularly in critical situations. EEG entails the placement of sensors on the subject's scalp to monitor brainwave patterns.

Latin America Electroencephalography Devices Market Trends

The electroencephalography devices market in Latin America is expected to experience significant growth over the coming years due to increasing prevalence of neurological disorders, rising awareness about healthcare, and advancements in medical technology. In addition, favorable government initiatives, investments in healthcare infrastructure, and expanding healthcare expenditure are likely to drive market expansion. Argentina has established a regulatory framework for neurology devices overseen by the National Administration of Drugs, Food, and Medical Technology (ANMAT), the country's regulatory authority responsible for supervising these devices.

Saudi Arabia Electroencephalography Devices Market Trends

The electroencephalography devices market in Saudi Arabia is anticipated to expand over the forecast period due to various developments and projects. For instance, in February 2024, Saudi Health initiated a groundbreaking project on February 15th, aiming to offer tele-EEG services through the SEHA Virtual Hospital (SVH). This endeavor seeks to enhance healthcare provisions for individuals with neurological and brain conditions across Saudi Arabia by offering advanced diagnostic and treatment technologies. The network encompasses 24 hospitals across diverse regions, equipped with 42 advanced EEG devices directly linked to the SVH and supported by a team of specialized EEG technicians.

The electroencephalography devices market in Kuwait is expected to grow over the forecast period due to the increasing neurological treatments for epilepsy, Alzheimer's disease, and Parkinson's disease. For instance, as of July 2023, the neurosurgery clinic at Kuwait Hospital Sharjah managed around 200 cases each month, covering a range of conditions, including epilepsy, migraine, multiple sclerosis, nonepileptic attack disorders, and various movement disorders such as vibration syndrome & Parkinson’s disease. In addition, the clinic oversees follow-up appointments for stroke and congenital neurological defects, which can contribute to the growing need for EEG devices.

Key Electroencephalography Devices Company Insights

The competitive scenario in the electroencephalography devices market is highly competitive, with key players such as Electrical Geodesics, Inc.; Medtronic; and Cadwell Industries, Inc. holding significant positions. Major companies are undertaking various organic & inorganic strategies, such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of customers.

-

Electrical Geodesics, Inc. (EGI) is a neuroscience research and medical device company. It designs, manufactures, and markets clinical solutions for neuroscience research, clinical, and pharmaceutical markets. EGI’s products include systems for EEG, MEG, and other neuroimaging applications.

-

Medtronic is a global leader in medical technology, services, and solutions. The company operates in more than 150 countries and employs over 90,000 people worldwide. It provides innovative and life-saving medical devices, services, and software that help diagnose, treat, and manage conditions such as heart & vascular disease, neurological disorders, diabetes, obesity, and spinal disorders. Medtronic provides a range of brain monitoring products designed to help clinicians collect and interpret brain data in the diagnosis & treatment of neurological disorders, including brain diagnostic systems, intraoperative monitoring systems, neurostimulation systems, neurotherapy systems, and neurophysiological monitors.

Key Electroencephalography Devices Companies:

The following are the leading companies in the electroencephalography devices market. These companies collectively hold the largest market share and dictate industry trends.

- Natus Medical, Inc.

- Medtronic

- Nihon Kohden America, Inc.

- Brain Products GmbH

- Neurosoft

- Compumedics Ltd.

- Electrical Geodesics, Inc.

- ANT Neuro

- Lifelines neuro

- Mitsar

- Micromed

- Cadwell Laboratories, Inc.

- EBNeuro

- Magstim EGI

- Emotiv

Recent Developments

-

In January 2024, Gate entered into a collaboration with Beacon to employ EEG biomarkers in its Phase II trial for Major Depressive Disorder (MDD). The trial is expected to utilize Beacon's Dreem 3S headband device for exploratory EEG and sleep analyses in participants. Scheduled to commence in mid-2024, the Phase II investigation of Gate's zelquistine aims to advance understanding and potential treatments for MDD.

-

In January 2024, Aditxt, a biotechnology company headquartered in the U.S., collected EEG brain monitoring technologies and devices from Brain Scientific. The acquisition comprised a portfolio of 16 patents, which includes a disposable NeuroCap and a portable NeuroEEG.

-

In July 2023, a significant USD 1.5 million funding boost to the universities of Bath and Bristol was expected to help patients and & families with an easy-to-use Fastball EEG test to improve the early detection of dementia and Alzheimer's disease.

Electroencephalography Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.32 billion

Revenue forecast in 2030

USD 2.39 billion

Growth rate

CAGR of 10.36% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Natus Medical, Inc.; Medtronic; Nihon Kohden America, Inc.; Brain Products GmbH; Neurosoft; Compumedics Ltd.; Electrical Geodesics, Inc.; ANT Neuro; Lifelines neuro; Mitsar; Micromed; Cadwell Laboratories, Inc.; EBNeuro; Magstim EGI; Emotiv

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electroencephalography Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the electroencephalography devices market report based on product, type, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

8-channel EEG

-

21-channel EEG

-

25-channel EEG

-

32-channel EEG

-

40-channel EEG

-

Multichannel EEG

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Standalone Devices

-

Portable Devices

-

Wearable Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Trauma & Surgery

-

Disease Diagnosis

-

Anesthesia Monitoring

-

Sleep Monitoring

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostics Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global electroencephalography devices market size was estimated at USD 1.21 billion in 2023 and is expected to reach USD 1.32 billion in 2024.

b. The global electroencephalography devices market is expected to grow at a compound annual growth rate of 10.36% from 2024 to 2030 to reach USD 2.39 billion by 2030.

b. North America dominated the electroencephalography devices market with a share of 35.5% in 2023. This is attributable to the rising prevalence of various sleep and neurodegenerative disorders and accessibility to insurance.

b. Some key players operating in the electroencephalography devices market include Natus Medical, Inc.; Electrical Geodesics, Inc.; Medtronic; NeuroWave Systems, Inc.; Compumedics Ltd.; Noraxon U.S.A., Inc.; Cadwell Laboratories, Inc., and Nihon Kohden America, Inc.

b. Key factors that are driving the market growth include increasing prevalence of neurological disorders and rising awareness.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."