- Home

- »

- Advanced Interior Materials

- »

-

Elemental Sulfur Market Size & Share, Industry Report, 2030GVR Report cover

![Elemental Sulfur Market Size, Share & Trends Report]()

Elemental Sulfur Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Refineries, Gas Processing Plants), By End Use (Agriculture, Chemical, Rubber), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-121-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Elemental Sulfur Market Summary

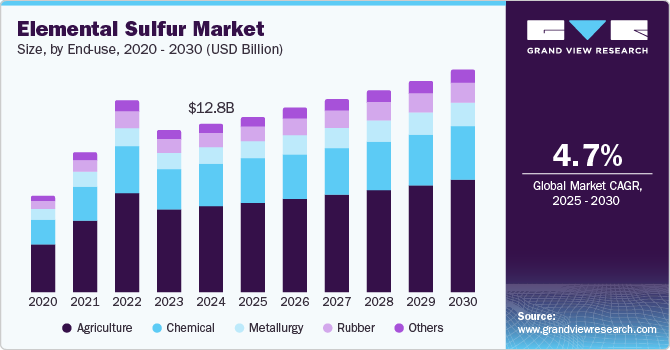

The global elemental sulfur market size was estimated at USD 12,808.7 million in 2024 and is projected to reach USD 16,779.7 million by 2030, growing at a CAGR of 4.7% from 2025 to 2030. The market growth is driven by increasing demand from the agricultural sector.

Key Market Trends & Insights

- Asia Pacific region dominates the global elemental sulfur with a revenue share of 42.3% in terms of revenue in 2024.

- The China elemental sulphur market is expected to grow during the forecast period.

- Based on end use, the metallurgy segment is expected to register the fastest growth in the said forecast period.

- Based on end source, the gas processing segment is expected to register the fastest CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 12,808.7 Million

- 2030 Projected Market Size: USD 16,779.7 Million

- CAGR (2025-2030): 4.7%

- Asia Pacific: Largest market in 2024

Sulfur is a key component in the production of fertilizers, specifically ammonium sulfate and phosphates, which are essential for crop growth and soil health. With the rising global population, the demand for food production has surged, necessitating higher agricultural output and subsequently boosting the demand for sulfur-based fertilizers. Additionally, the growing adoption of advanced agricultural techniques in developing countries further fuels market growth, as these methods often require higher-quality fertilizers to ensure productivity.

Regulatory pressures to minimize emissions of sulfur dioxide during refining and gas processing have led to advancements in sulfur recovery technologies, resulting in a steady supply of high-purity elemental sulfur. The shift towards cleaner energy sources and stricter environmental regulations has further highlighted the importance of sulfur recovery as part of sustainable industrial practices.

Drivers, Opportunities & Restraints

The global elemental sulfur industry’s growth is primarily driven by its extensive use in the chemical industry, particularly in the production of sulfuric acid, which is a key component in fertilizers. With the growing demand for agricultural products, the need for fertilizers has surged, thereby bolstering the demand for elemental sulfur. Additionally, the oil and gas industry is a significant contributor to the market, as sulfur is recovered as a by-product during refining processes.

Rising industrialization and infrastructure development globally have also spurred the demand for sulfur-based products, including in rubber vulcanization, detergent manufacturing, and mining processes. Furthermore, stringent environmental regulations mandating the desulfurization of fuels have increased sulfur recovery, positively impacting the market.

Advancements in sulfur recovery technologies present significant growth opportunities for the elemental sulfur market. Innovations such as the development of cleaner and more efficient recovery processes from sour gas and crude oil are likely to improve production efficiency and reduce environmental impact. The rise of renewable energy and green technologies also offers potential for sulfur use in emerging applications, such as in battery technologies and carbon capture systems. Growing investments in research and development for sulfur applications in specialty chemicals also promise to expand the scope of the market.

The market faces several restraints, including volatility in crude oil prices, which directly impacts sulfur production and availability, as it is largely derived as a by-product of oil and gas refining. Additionally, the market is susceptible to fluctuating demand in end use industries, particularly agriculture, which is influenced by seasonal and geopolitical factors. Environmental concerns related to sulfur emissions during production and use may also hinder market growth, as stricter regulations are imposed globally. Furthermore, the availability of substitutes such as urea-based fertilizers could pose a threat to the growth of the sulfur market in certain applications.

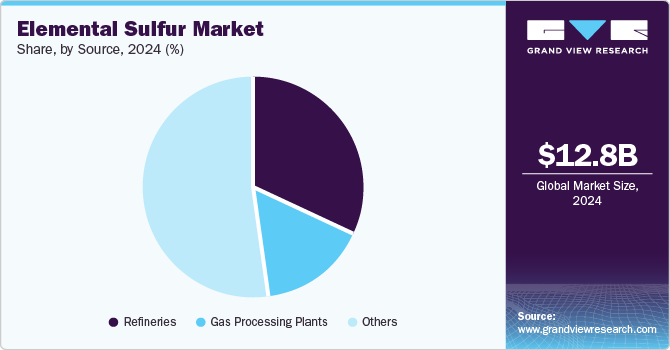

Source Insights

As global energy consumption continues to increase, particularly in emerging economies, refineries are expanding their capacities to meet the growing need. It is a by-product of refining processes for crude oil and natural gas, sees increased production as a result of heightened refining activities. This makes refineries a significant contributor to the overall sulfur supply chain. In December 2022, AccuStandard introduced a comprehensive new range of Certified Reference Materials to support the precise analysis of sulfur content in renewable diesel fuel. This launch represents a significant advancement in fuel analysis, aligning with the industry's transition toward more sustainable energy sources.

The gas processing segment is expected to register the fastest CAGR over the forecast period. The market is significantly driven by its role as a byproduct in gas processing activities, primarily due to the growing global demand for cleaner energy sources. Natural gas, considered a cleaner-burning alternative to coal and oil, often contains hydrogen sulfide as an impurity. Removing H2S through gas processing yields elemental sulfur as a valuable byproduct. With increased global energy demands and stricter environmental regulations to curb harmful emissions, gas processing facilities have been scaling up operations, thus enhancing sulfur recovery. This creates a robust supply of elemental sulfur, further fueling its market growth.

End Use Insights

Sulfur, an essential macronutrient, is a key component of amino acids and proteins that are vital for plant development. The increasing awareness among farmers about the importance of sulfur in mitigating nutrient deficiencies in crops has significantly bolstered the demand for elemental sulfur. Additionally, the rise in intensive farming practices and the depletion of natural sulfur levels in soils due to prolonged cultivation have further escalated the need for sulfur-based fertilizers.

The metallurgy segment is expected to register the fastest growth in the said forecast period. It is extensively used in the production of sulfuric acid, a vital reagent for extracting metals such as copper, nickel, and zinc through leaching processes. With the increasing global demand for these metals, particularly in industries like electronics, automotive, and renewable energy, the consumption of sulfuric acid and by extension, elemental sulfur has risen significantly.

The transition to greener energy sources, including electric vehicles and wind power, has fueled the demand for metals required in batteries and infrastructure, further supporting the growth of the metallurgy segment.

Regional Insights

Asia Pacific region dominates the global elemental sulfur with a revenue share of 42.3% in terms of revenue in 2024.The Asia Pacific elemental sulfur industry is experiencing robust growth, driven by the region's expanding industrial base and increasing demand for sulfur in key end use sectors. One of the primary drivers is the growing utilization of elemental sulfur in the production of sulfuric acid, which is a critical raw material for the fertilizers industry. With agriculture being a major economic sector in countries such as India, China, and Southeast Asian economies, the demand for fertilizers, particularly phosphate fertilizers, is on the rise. This trend significantly boosts the consumption of elemental sulfur, as sulfuric acid is essential for processing phosphate rock into fertilizers.

The China elemental sulphur market is expected to grow during the forecast period. The metallurgical industry in China is another critical driver of sulfur demand. China, being a global leader in steel production, relies heavily on sulfur compounds, including sulfuric acid, for metal extraction and refining processes. It is used in processes such as copper, zinc, and nickel extraction, which are essential for producing high-quality metals. As China’s industrial output continues to grow, especially with the strategic focus on infrastructure and renewable energy projects, the need for sulfur in metallurgy is expected to rise.

North America Elemental Sulfur Market Trends

North America's petrochemical and agricultural sectors, along with a strong focus on environmental regulations, drive regional growth. The petrochemical industry relies on sulfur as a key raw material for sulfuric acid production, essential for petroleum refining and fertilizer manufacturing. Rising demand for petroleum products further boosts elemental sulfur consumption, as sulfuric acid plays a critical role in refining crude oil and extracting valuable by-products.

U.S. Elemental Sulfur Market Trends

The U.S. elemental sulfur industry is driven by its industrial applications in chemicals, rubber, and pharmaceuticals. It is essential for producing detergents, pesticides, and vulcanized rubber, with demand rising alongside manufacturing and infrastructure growth. The automotive and construction sectors also rely on sulfur compounds for high-performance materials that meet strict quality standards.

Europe Elemental Sulfur Market Trends

Environmental regulations and initiatives aimed at reducing sulfur emissions have played a significant role in driving growth of the Europe sulfur industry. Europe has stringent environmental standards and emission reduction targets, particularly regarding sulfur dioxide emissions from industrial sources, power plants, and transportation. These regulations have encouraged the adoption of sulfur recovery technologies and processes, such as flue gas desulfurization, to comply with emissions standards. This regulatory pressure, combined with the European Union's commitment to reducing air pollution and achieving climate goals, has led to increased demand for sulfur and sulfur-based technologies.

Central & South America Elemental Sulfur Market Trends

The oil & gas sector in Central and South America is experiencing growth, particularly in countries such as Brazil, Argentina, and Colombia, which are investing heavily in oil exploration and production. As sulfur is a byproduct of crude oil refining, the increasing production of oil and natural gas directly correlates with a greater demand for sulfur recovery technologies. The continued growth of the oil & gas industry, including offshore and shale oil projects, ensures a steady supply of sulfur for various industrial applications, including in sulfuric acid production and desulfurization processes.

Middle East & Africa Elemental Sulfur Market Trends

The mining and metallurgy industries in the Middle East & Africa are also substantial contributors to the elemental sulfur industry. The region is home to significant mineral resources, including metals such as gold, copper, and iron ore, particularly in countries like South Africa, Morocco, and Zambia. It is used extensively in metal extraction and refining processes, particularly in hydrometallurgical techniques, such as sulfuric acid leaching, where sulfur plays a crucial role in extracting valuable metals from ores. As mining activities continue to increase to meet global demand for metals, sulfur remains integral to the metallurgical and extraction processes.

Key Elemental Sulfur Company Insights

Some of the key players operating in the market include ADNOC Group and China Petrochemical Corporation

-

ADNOC Group is a key player in the industry, producing sulfur as a byproduct of its natural gas and crude oil refining processes. The company’s sulfur production is integral to its refining operations, with sulfur being primarily used for sulfuric acid manufacturing, fertilizers, and various chemical applications.

-

China Petrochemical Corporation (Sinopec) offers elemental sulfur, sulfuric acid, and other sulfur-based chemicals that are used in a variety of industries, such as agriculture, petrochemicals as a raw material for various chemical processes, and metallurgy for ore processing.

Key Elemental Sulfur Companies:

The following are the leading companies in the elemental sulfur market. These companies collectively hold the largest market share and dictate industry trends.

- ADNOC Group

- China Petrochemical Corporation

- Georgia Gulf Sulfur Corporation

- Intrepid Potash

- JOHN H. CARTER COMPANY

- Motiva Enterprises LLC

- Saudi Arabian Oil Co.

- Shell plc

- Suncor Energy Inc.

- Valero

- Grupa Azoty

Recent Developments

-

In December 2023, LANXESS expanded its plant for sustainable sulfur carriers, marking a significant development in the market. The plant, located in the U.S., is now capable of producing more sulfur carriers, which are essential in converting elemental sulfur into a usable form for various industries, including agriculture and energy.

-

In July 2024, NASA's Curiosity rover uncovered a surprising sulfur-based discovery in a Martian rock, which could have implications for future space exploration and resource utilization. This finding opens new avenues for understanding Martian geology and the potential for in-situ resource utilization, particularly sulfur. While this discovery is not immediately tied to the terrestrial sulfur market, it may spur future developments in space mining and resource extraction technologies, potentially influencing industries involved in sulfur processing and supply in the longer term.

-

In November 2024, Abu Dhabi National Oil Company strengthened its position in the global sulfur market by fully integrating its sulfur operations. The company engages in sulfur mining while also producing elemental sulfur and sulfuric acid, reinforcing its role as a key player in the sulfur supply chain.

Elemental Sulfur Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.35 billion

Revenue forecast in 2030

USD 16.78 billion

Growth rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Source, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Poland; China; Japan; India; Singapore; Indonesia; Brazil; UAE; South Africa

Key companies profiled

ADNOC Group; China Petrochemical Corporation; Georgia Gulf Sulfur Corporation; Intrepid Potash; JOHN H. CARTER COMPANY; Motiva Enterprises LLC; Saudi Arabian Oil Co.; Shell plc; Suncor Energy Inc.; Valero; Grupa Azoty

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Elemental Sulfur Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global elemental sulfur market report based on source, end use, and region:

-

Source Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Refineries

-

Gas Processing Plants

-

Other

-

-

End Use Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Chemical

-

Rubber

-

Metallurgy

-

Others

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Singapore

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global elemental sulfur market size was estimated at USD 12.81 billion in 2024 and is expected to reach USD 13.35 billion in 2025.

b. The global elemental sulfur market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2030 to reach USD 16.78 billion by 2030.

b. Based on end-use segment, agriculture held the largest revenue share of more than 51.0% in 2024 owing to increasing demand for high-quality fertilizer across the world.

b. Based on end-use segment, agriculture held the largest revenue share of more than 51.0% in 2024 owing to increasing demand for high-quality fertilizer across the world Some of the key vendors of the global Elemental Sulfur market are ADNOC Group, China Petrochemical Corporation, Georgia Gulf Sulfur Corporation, Intrepid Potash, and JOHN H. CARTER COMPANY.

b. The key factor that is driving the growth of the global elemental sulfur market is the growing efforts towards food self-sufficiency across the globe, driving the demand for high quality fertilizer, is driving the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.