- Home

- »

- Pharmaceuticals

- »

-

Europe, Middle East And Africa Sports Nutrition Market Report, 2030GVR Report cover

![Europe, Middle East And Africa Sports Nutrition Market Size, Share, & Trends Report]()

Europe, Middle East And Africa Sports Nutrition Market Size, Share, & Trends Analysis Report By Product Type (Vitamins, Minerals), By Functionality, By Formulation, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-923-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The Europe, Middle East, and Africa sports nutrition market size was estimated at USD 3.1 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.9% from 2023 to 2030. As opposed to earlier, when sports nutrition was targeted only towards athletes, it has now become an everyday product for a wider consumer base across populations. Increasing awareness of overall health and well-being and an increase in diversification of products to cater to a wider consumer base by key players are key factors driving the market growth. The increasing prevalence of lifestyle diseases such as obesity and diabetes can be managed through health and nutrition products.

According to Our World in Data, in 2016, around 13.0% adults of 18 years & above age were obese. In addition, as per The World Health Organization, obesity in children & adolescents of age group 5-19 rose to approximately 18.0% in 2016 as compared to 4.0% in 1975. In Europe, cardiovascular diseases (CVD) continue to remain one of the leading causes of death, leading to 45% of all deaths. In Europe, Coronary Heart Disease (CHD) and stroke account for the majority of the more than 4 million annual CVD deaths.

In the post-pandemic period, the general awareness and concern toward health has increased. The market was affected adversely during the pandemic due to disruption in supply chain logistics globally, but the market is expected to pick up rapidly during the forecast years. As individuals have grown more concerned with their health and well-being, there has been an increase in the demand for products that aid with immunity and weight control. In addition, more individuals are exercising at home as a result of the transition to remote work, which has raised demand for sports nutrition products that are practical and simple to use. The population’s shift toward a more sedentary and unhealthier lifestyle has increased the susceptibility toward chronic diseases such as cardiovascular diseases, diabetes, obesity, and cancer. The awareness of the population about the need to stay healthy and maintain an overall sense of well-being has been on the rise since the pandemic.

Fitness has now become a major part of the population’s lifestyle; health and fitness products are not just for professional athletes but for the general population as well, as a measure to maintain health and prevent diseases. This has been a key factor responsible for the growth of this market. According to SNE, about 45% of Europeans indulge in intense sports activities, once a week.

A sense of physical and mental fitness has become more important than ever, considering the events faced by consumers during the pandemic. To achieve their fitness goals, consumers are continually looking for healthy and effective fitness products. Players in the market are continuing to meet demands by expanding their product portfolios as per the public’s tastes and preferences, which is resulting in the growth of the market.

Sports nutrition earlier was a niche market but has exploded in recent years, as fitness has become the focus for consumers. Products catering to vegan consumers have been increasing as there has been a paradigm shift in the demand for the same. As per a recent report of V-Label on 18 European nations, plant-based ingredients including potato, rice, or pea proteins were appealing to customers who were interested in sports & nutrition products. Consumers prefer halal-certified products, which have also been catered to, as a lot of current products in the sports nutrition market are certified as such. The number of halal-certified products in Europe is in the thousands, some of them are protein powder, vitamins, and minerals, sports supplements, energy bars, functional foods, and herbal teas. The vegetarian-friendly cellulose substance from pine trees used to make Capsugel's Veg Capsules is preferred by a wide range of consumers. They are gluten-free, preservative-free, Non-GMO Project Verified, Kosher and Halal certified, and they also hold accreditation from the Vegetarian and Vegan Action Society.

With the increase in the number of consumers adopting a healthy lifestyle, preferences have been varied; for example, many consumers prefer sports drinks and protein shakes with no added sugar, while some prefer natural sweeteners. According to a recent study by Mintel, the number of no-sugar nutrition products launched in Europe increased by 25% in 2021. Many sports nutrition companies collaborate with fitness enthusiasts and fitness influencers to increase their reach, which acts as a growth factor for the market.

Europe’s sports nutrition industry has been under the regulation of the European Specialist Sports Nutrition Alliance (ESSNA) since 2003, which acts as a conclave for law and enforcement agencies overseeing proper buying, selling, and ease of availability of products in the market.

Product Type Insights

According to product type, the market is segmented into vitamins, minerals, fatty acids, protein and amino acids, botanicals, nitrous oxide boosters, and others. The others segment held the largest revenue share of 51.8% in 2022. The growing demand for sports drinks, meal replacement smoothies, and energy bars is the key factor driving the segment growth. The market has an abundance of such products, catering to different tastes and preferences. According to FDT, flavors such as chocolate (77%), vanilla (73%), tropical fruit (57%), acai berry (56%), and lime (56%) were mostly preferred by the consumers, whereas, blackcurrant (26%), blueberries (25%), cola (25%), lemon (25%), and lemonade (25%) were least appealing flavors.

Accordingly, expansion in the product portfolios by companies has been a primary source of the growth of this market. The rising awareness of the need to supplement the diet with additional nutrients is also a key factor for growth in the segment. Products like energy bars and electrolytes are not limited to sports enthusiasts, as people are generally incorporating these products to attain a healthy lifestyle.

The protein and amino acids category is expected to grow at the fastest CAGR of 8.2% in the coming years. The companies in the market are also focusing on the protein and amino acids segment and have huge growth potential. Growing demand for alternate protein sources such as plant-based and vegan protein has catalyzed the growth of this segment. With a surge in the number of people adopting a healthy lifestyle, protein, and amino acid supplements for gym enthusiasts and people who are generally looking to adopt a form of diet have been key factors boosting growth for this product type.

Formulation Insights

With regard to formulations, the market is segmented into tablets and capsules, powders, gummies and soft chews, and other forms. The powders segment dominated the market with a revenue share of 41.0% in 2022. The majority of products such as proteins, meal replacement, and smoothie mixtures, are readily available in powder formulations. This is due to longer shelf-life and ease of consumption, ease of reconstitution, and easy transportation. Powdered protein is the most rapidly absorbed form of protein as it is already broken down into small molecules that can be easily digested. The absorption rate of powdered protein is 10gm/hr. A shift in focus towards physical fitness and strength has resulted in athletes and non-athletes alike opting for protein powder formulations to complete their nutritional requirements, as well as for muscle building and overall strength training.

The gummies and soft chews segment is anticipated to grow at the fastest CAGR of 8.2% over the forecast period due to the increasing young consumer base. The younger generation as well as adults prefer supplements with flavors that are easily available in the form of soft chews and gummies. The traditional supplement form, which tasted like medicine is not palatable to most of the population. They are convenient to eat compared to protein powder as they do not require water and taste well as they are mixed with artificial flavors and sweeteners.

Key industry players were driven to expand their product offerings with this in mind to incorporate different flavors and pack maximum nutrients in the form of gummies and soft chews. This has been one of the main factors driving the growth of this formulation type. The ease of use and higher nutrient availability have also been key driving factors for this segment’s growth.

Distribution Channel Insights

Based on distribution channel, the market is segmented into supermarkets/hypermarkets, drug stores/pharmacies, online retail, and other distribution channels. The others segment dominated the market with a share of 45.7% in 2022. The presence of specialty stores selling fitness products has increased in recent years. The preference for purchasing branded products from specialty stores rather than pharmacies or supermarkets has been a key factor driving the growth of this segment. Many consumers visiting gyms have loyalty programs and purchase their fitness products on the gym trainer’s recommendation. The presence of fake products being sold at grocery marts and supermarkets creates distrust in consumers and hence they prefer purchasing from specialty stores.

The online retail channel is expected to grow at the fastest CAGR of 8.4% during the forecast period. The pandemic forced fitness centers and gyms to close down along with retail shops, resulting in a drop in retail sales. The online sales however gained momentum as they remained operational during the pandemic, and this channel has now become a much easier way to purchase certified products directly from the company’s website. The shift in preferences and initiatives by companies for opening online retail stores have been key drivers for the fast growth in the segment.

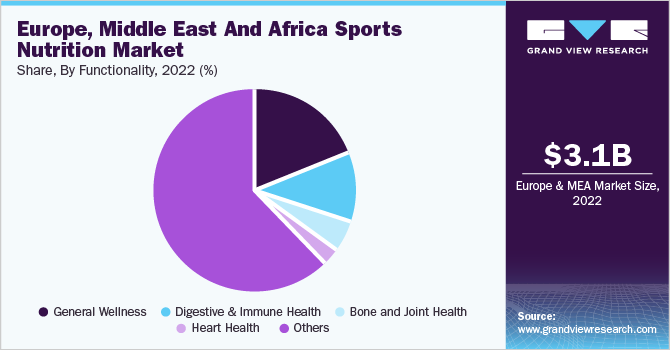

Functionality Insights

In terms of functionality, the market is segmented into digestive & immune health, bone & joint health, heart health, general wellness, and other functionalities. The others segment held the largest revenue share of 62.0% in 2022. The growth in this segment can be attributed to the skyrocketing demand for detox drinks, as well as pre- and post-recovery and workout drinks. Weight management has also been a major sector due to an overall increase in awareness around healthy lifestyles and fitness. People globally have been keen on adopting a healthy lifestyle. Therefore, the number of fitness centers and gyms has increased as well as their memberships, and people across the globe have tried adopting some form of a healthy lifestyle.

New dietary habits like veganism and flexitarians are becoming more popular in Europe. These diets emphasize the intake of fruits, vegetables, green tea, smoothies, and other healthy foods that are friendly to the environment and the body. Detox beverages readily fit into such regimens because they are made mostly of fresh fruits, vegetables, and tea extracts and contain little to no sugar.

The digestive and immune health sub-segment is poised to be the fastest-growing area with a CAGR of 7.9% over the forecast period. The current lifestyle practices and dietary habits have been a cause of major concern with respect to the increasing prevalence of chronic conditions such as diabetes and cardiovascular diseases. This has created a demand for products pertaining to digestive and immune health and is a key propellant for growth in this sub-segment. According to the World Health Organization (WHO), in the European region, there are around 60 million diabetics. The increase in demand for these supplement types has also been due to people adopting them in their daily lives as a prophylactic measure, rather than as a way to manage disease symptoms.

Regional Insights

In terms of region, Eastern Europe held the largest revenue share of 39.6% in 2022. An increase in awareness regarding health and overall well-being is driving regional growth. Due to rising middle-class consumer incomes, increasing number of gyms, and more health awareness, Eastern European nations are dominating the market. As per the 2022 European Health & Fitness Market Report (EHFMR) key findings, total number of fitness clubs increased by 0.2%, reaching 63,173 in 2021 in comparison to 63,059 in 2020. In April 2023, Nestlé Romania announced the acquisition of the SOLGAR nutrition and supplement segment, to commercialize its products directly in the Romanian market. In August 2021, Nestlé completed the acquisition of The Bountiful Company’s core brands including Sundown, Ester-C, Puritan’s Pride, Nature’s Bounty, Osteo Bi-Flex, and Solgar.

The Middle East is anticipated to grow at the fastest CAGR of 8.1% over the forecast period. The growth in the sports nutrition market in the region has been due to a paradigm shift in lifestyle and an increase in the disposable income of the population across the region. An increase in the number of fitness centers and gyms in the region is also boosting the overall market for sports nutrition. In July 2021, Khabib Nurmagomedov, a Mixed Martial Arts (MMA) legend, entered into a partnership with ENOC’s ZOOM stores, for distributing alkaline water and protein bars brands in the UAE. ENOC ZOOM is a convenience store operator in UAE and as per the ENOC Company website, in June 2023, ZOOM had over 245 stores across UAE.

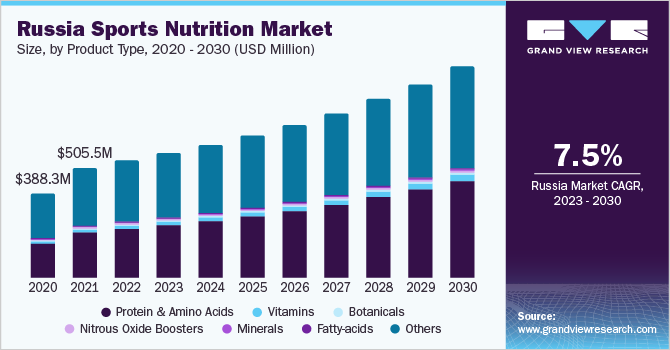

CIS held a substantial share in 2022. An increase in awareness regarding health and overall well-being is driving growth in this market. Growing GDP and advancements in the region have improved the decline of food supplies and nutritional supplements as per the Global Information and Early Warning System (GIEWS). The region is fast developing and emerging from the effects of the pandemic by adopting innovative strategies to manage the trade of food supplies and nutrition supplements.

Africa is expected to grow at a rapid rate in the coming years due to a paradigm shift in lifestyle and an increase in the disposable income of the population across the region. An increase in the number of fitness centers and gyms in the region is also boosting the overall market for sports nutrition.

Key Companies & Market Share Insights

The substantial growth in the sports nutrition industry has been due to key advancements in products, and developments like mergers and acquisitions, portfolio takeovers, expansion in existing portfolios, and others. In March 2022, Animal Booster Nutrition, India’s gym & health supplement brand, announced that it was set to introduce its brand, Anihac Pharma, in Gulf nations such as Kuwait, the UAE, Saudi Arabia, Bahrain, Qatar, and Oman. The range of products includes BCAA, weight gainer, amino acid, and pre-workout powder, which are available on its website. Some prominent players in the Europe, Middle East And Africa sports nutrition market include:

-

Herbalife International of America, Inc.

-

Biovea

-

Clif Bar

-

Glanbia PLC

-

Abbott Nutrition

-

GNC Holdings, Inc.

-

Ultimate Nutrition, Inc.

-

NOW Foods

-

Ascendis Health

-

SPORT MAX.

Europe, Middle East And Africa Sports Nutrition Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.4 billion

Revenue forecast in 2030

USD 2.7 billion

Growth rate

CAGR of 6.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, functionality, formulation, distribution channel, region

Regional scope

Europe; Middle East; Africa

Country scope

Russia; Kazakhstan; Uzbekistan; Belarus; Rest of CIS; UAE; Saudi Arabia; Qatar; Jordan; Rest of ME; Romania; Czech Republic; Poland; Hungary; Rest of Eastern Europe; Kenya; Uganda; Ethiopia; Senegal; Rest of Africa

Key companies profiled

Herbalife; Clif Bar; Glanbia PLC; Abbott Nutrition; GNC Holdings, Inc.; Ultimate Nutrition, Inc.; NOW Foods; BIOVEA; Ascendis Health; SPORT MAX;

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe, Middle East And Africa Sports Nutrition Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented Europe, Middle East And Africa sports nutrition market report based on product type, functionality, formulation, distribution channel, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamins

-

Vitamin E

-

Vitamin D

-

Vitamin B Complex

-

Vitamin C

-

Multivitamins

-

Other Vitamins

-

-

Minerals

-

Calcium

-

Zinc

-

Magnesium

-

Iron

-

Other Minerals

-

-

Enzymes

-

Coenzyme Q10

-

Other Enzymes

-

-

Fatty-acids

-

Omega 3

-

Other Fatty-acids

-

-

Protein & Amino Acids

-

BCAA

-

Whey Protein

-

Other Proteins and Amino-acids

-

-

Botanicals

-

Ashwagandha

-

Aloe Vera

-

Turmeric

-

Other botanicals

-

-

Nitrous Oxide Boosters

-

Other Sports Supplements

-

-

Functionality Outlook (Revenue, USD Million, 2018 - 2030)

-

Digestive & Immune Health

-

Bone and Joint Health

-

Heart Health

-

General Wellness

-

Others

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets & Capsules

-

Powders

-

Gummies and Soft Chews

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/ Hypermarkets

-

Drug Stores/ Pharmacies

-

Online Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Commonwealth of Independent States (CIS)

-

Russia

-

Kazakhstan

-

Uzbekistan

-

Belarus

-

ROCIS

-

-

Middle-East

-

United Arab Emirates

-

Saudi Arabia

-

Qatar

-

Jordan

-

RO Middle East

-

-

Eastern Europe

-

Romania

-

Czech Republic

-

Poland

-

Hungary

-

RO Eastern Europe

-

-

Africa

-

Kenya

-

Uganda

-

Ethiopia

-

Senegal

-

Rest of Africa

-

-

Frequently Asked Questions About This Report

b. The Europe, Middle East and Africa sports nutrition market size was estimated at USD 3.1 billion in 2022 and is expected to reach USD 1.4 billion in 2023

b. The Europe, Middle East and Africa sports nutrition market is expected to grow at a compound annual growth rate of 7.9% from 2023 to 2030 to reach USD 2.7 billion by 2030.

b. powder formulations dominated the Europe, Middle East & Africa sports nutrition market with a share of 412% in 2022. The majority of products such as protein powder, meal replacement, and smoothie mixtures, are readily available in powder formulations. This is due to longer shelf-life and ease of consumption, ease of reconstitution, and easy transportation. The large market share is representative of the increase in the number of people opting for supplements in powder form.

b. Some key players operating in Europe, Middle East and Africa sports nutrition market include Herbalife International of America, Inc., Biovea, Clif Bar, Glanbia PLC, Abbott Nutrition, GNC Holdings, Inc., Ultimate Nutrition, Inc., NOW Foods, Sporter.com, SPORT MAX.

b. Increasing awareness towards overall health and well-being and increase in diversification of products, to cater to a wider consumer base, by key players are both key factors driving growth in the market. The increasing prevalence of lifestyle diseases such as obesity and diabetes can be managed through health and nutrition products. Currently available products in the market cater to consumers with a myriad of health needs like for cardiovascular diseases.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."