- Home

- »

- Sensors & Controls

- »

-

Emission Monitoring Systems Market Size Report, 2030GVR Report cover

![Emission Monitoring Systems Market Size, Share & Trends Report]()

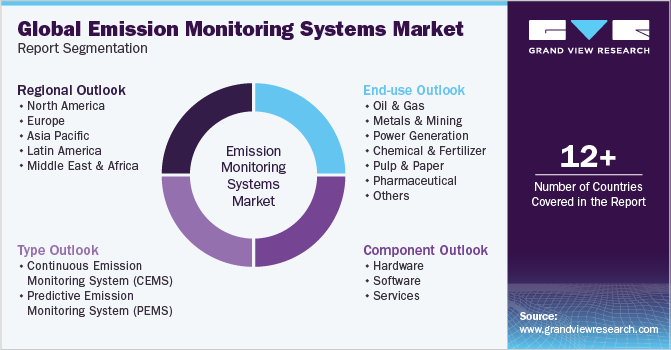

Emission Monitoring Systems Market Size, Share & Trends Analysis Report By Type (CEMS, PEMS), By Component (Hardware, Software), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-068-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

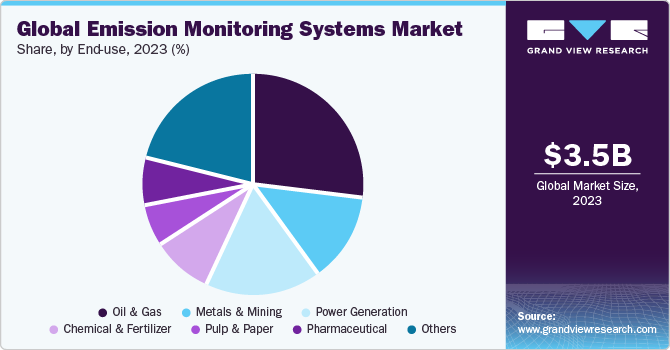

The global emission monitoring systems market size was valued at USD 3.50 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 10.3% from 2024 to 2030. The growth can be attributed to advancements in sensor technologies, data analytics, and remote monitoring capabilities that have significantly enhanced the functionality and efficiency of emission monitoring systems. Improved accuracy, reliability, and real-time data availability are driving the adoption of these systems. Emission monitoring systems (EMS) provide real-time data and analytics that enable organizations to identify areas of excessive emissions, energy waste, and process inefficiencies. Companies can enhance their overall operational efficiency and reduce costs by optimizing operations, reducing emissions, and minimizing energy consumption.

Moreover, the demand for these systems is significantly driven by stringent environmental regulations enforced by governments and regulatory bodies, including the United States Environmental Protection Agency (EPA), European Union Industrial Emissions Directive (IED), and National Environmental Laws and Regulations in Canada, among others. Industries are compelled by environmental regulatory authorities to implement EMS to track the release of pollutants.

These systems enable companies to measure various air pollutants' concentrations or emission levels. EMS is deployed to monitor and assess multiple environmental pollutants, including Mercury (Hg), Sulfur Dioxide (SO2), Hydrogen Chloride (HCI), Carbon Monoxide (CO), Nitrogen dioxide (NOx), Carbon Dioxide (CO2), Ammonia (NH3), Methane (CH4), Sulphur Hexafluoride (SF6), Hydrogen Fluoride (HF), and Total Organic Carbon (TOC), among others.

An EMS is designed to measure and monitor the release of pollutants and emissions into the environment. It tracks and analyzes the emissions generated by industrial processes, power plants, vehicles, and other sources. These systems ensure compliance with environmental regulations and standards. Through continuous monitoring of emissions, the system provides real-time data on the quantity and composition of released pollutants. This information is crucial for assessing the environmental impact, identifying sources of pollution, and implementing measures to mitigate and control emissions.

Various industries are subject to specific emission standards and guidelines they must adhere to. Sectors such as power generation, oil and gas, chemical manufacturing, and transportation have distinct emission requirements tailored to their operations. To meet these industry-specific regulations, companies rely on EMS designed to cater to their unique needs. The demand for these systems continues to grow as businesses strive to fulfill their regulatory obligations and ensure compliance with industry-specific emission standards.

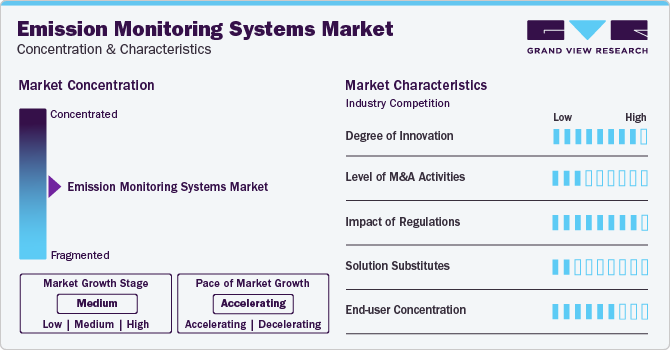

Market Concentration & Characteristics

The Emission Monitoring Systems market growth stage is medium. The Emission Monitoring Systems market demonstrates a high degree of innovation. Advancements in sensor technologies, data analytics, and integration with emerging technologies like Internet of Things (IoT) contribute to the continuous evolution of EMS solutions. Innovations enable more accurate, real-time monitoring and enhanced data analytics for better environmental insights.

The level of mergers and acquisitions in the Emission Monitoring Systems market is relatively low. The market is characterized by a mix of established players and innovative startups, with limited consolidation activities observed. Companies often focus on organic growth strategies and collaborations to enhance their technological capabilities.

The impact of regulations on the Emission Monitoring Systems market is significant. Stringent environmental regulations and emission standards imposed by governments and international bodies drive the demand for effective monitoring solutions. Industries, particularly those in sectors like manufacturing, energy, and transportation, must comply with these regulations, boosting the adoption of EMS.

The availability of substitutes for emission monitoring systems is low. Given the specialized nature of these systems in accurately measuring and reporting emissions, there are limited alternatives that can provide the same level of precision and compliance. This low substitutability reinforces the essential role of EMS in environmental management.

End-user concentration in the emission monitoring systems market is moderate. While a diverse range of industries, including power generation, chemical, petrochemical, and manufacturing, utilize EMS solutions, there is no extreme concentration within a specific sector. This diversity reflects the broad applicability of emission monitoring across various industries.

Type Insights

The CEMS segment led the market and held more than 79% share of the global revenue in 2023 and is projected to grow at the fastest CAGR of 10.3% during the forecast period. Based on type, the EMS market is bifurcated into continuous emission monitoring system (CEMS) and predictive emission monitoring system (PEMS). CEMS provides accurate and real-time data on emissions, enabling industries to monitor and track their pollutant levels continuously.CEMS encompasses a range of activities focused on identifying and reporting pollutant emissions from stationary sources to the atmosphere. Various industries, including coal-fired power plants, biomass power plants, oil-fired power plants, kraft pulp mills, waste incinerators, and cement plants, are required by regulatory authorities to continuously monitor their emissions, implement emission control measures, and provide ongoing documentation of their emissions to local environmental control agencies.

The Predictive Emission Monitoring Systems (PEMS) segment is anticipated to witness a CAGR of 9.4% throughout the forecast period. PEMS are software-based solutions that leverage advanced mathematical or statistical models to provide dependable real-time estimations of pollutant emissions. PEMS offers precise monitoring capabilities, significantly reducing capital investments and ongoing operational expenses associated with maintenance and spare parts. They also minimize disruptions to plant operations. By using PEMS, plant owners and operators gain better cost control and mitigate unforeseen expenses resulting from issues with traditional hardware analyzers. In addition, PEMS typically does not require the installation of additional hardware or equipment, minimizing interference with plant operations. This allows organizations to integrate emission monitoring seamlessly into their existing infrastructure without disruptions, reducing downtime and maximizing operational efficiency.

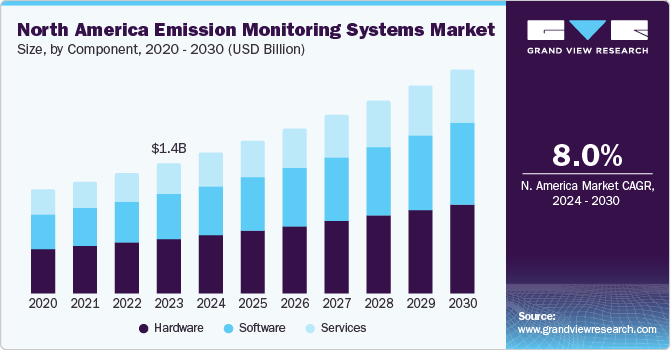

Component Insights

Based on component, the hardware segment led the market and held more than 56% share of the global revenue in 2023. The EMS market is bifurcated into hardware, software, and services. The hardware components work together to enable the continuous monitoring, measurement, and recording of emissions from stationary sources, providing accurate and reliable data for regulatory compliance and environmental management purposes. The hardware components in EMS include sensors, gas analyzers, opacity &, particulate matter monitors, sampling systems, control units, and data acquisition systems, among others. These devices are used to measure and quantify pollutant concentrations in the emissions.

The hardware components of EMS are often housed in protective enclosures or cabinets to safeguard them from environmental factors such as dust, moisture, and temperature variations. EMS often includes communication and networking devices to facilitate data transfer and integration with other systems. These devices can include modems, Ethernet interfaces, or wireless communication modules. They enable remote access to the data, data transmission to central databases, or integration with control systems or supervisory control and data acquisition (SCADA) systems.

The services segment is anticipated to witness the fastest growth, growing at a CAGR of 9.8% throughout the forecast period. The services segment is further categorized into installation & deployment, training, and support & maintenance. EMS services provide a comprehensive suite of solutions to assist industries in monitoring, managing, and reporting their pollutant emissions. These services provide comprehensive support to organizations in effectively managing their emissions, meeting regulatory obligations, ensuring compliance with environmental regulations, and driving continuous improvement in environmental performance.

These services help businesses enhance their sustainability efforts, minimize environmental impact, and maintain a strong reputation for environmental responsibility. In addition, EMS service providers offer assistance in the installation and configuration of emission monitoring hardware and software components. This involves setting up sensors, analyzers, data acquisition systems, and networking devices, ensuring proper calibration and integration with existing systems.

End-use Insights

In terms of end-use, the oil & gas segment led the market and held more than 26% share of the global revenue in 2023. Based on the end-use segment, the market is bifurcated into oil & gas, metals & mining, power generation, chemical & fertilizers, pulp & paper, pharmaceuticals, and others. Oil and gas companies utilize EMS to comply with regulations, demonstrate environmental responsibility, reduce costs, and optimize operations. Emission monitoring plays a crucial role in ensuring compliance with environmental regulations and minimizing the environmental impact of operations. Oil and gas companies utilize various technologies and strategies with EMS to achieve this. One primary application of these systems is the measurement and control of greenhouse gas emissions, including carbon dioxide (CO2), methane (CH4), and other volatile organic compounds (VOCs). These systems allow companies to accurately track and quantify their emissions, identifying sources of pollutants and implementing targeted emission reduction measures.

The power generation segment is anticipated to grow at a considerable CAGR of 11.4% throughout the forecast period. Power generation facilities, including thermal power plants, rely on these systems to monitor and manage the release of pollutants into the atmosphere. These systems play a vital role in the power generation sector by enabling accurate measurement and control of emissions to ensure regulatory compliance and reduce environmental impact. EMS is used in power generation to track and quantify emissions of various pollutants, such as sulfur dioxide (SO2), nitrogen oxides (NOx), particulate matter (PM), and carbon dioxide (CO2). These systems provide real-time data on pollutant levels, enabling power plants to assess their environmental performance and implement appropriate mitigation measures.

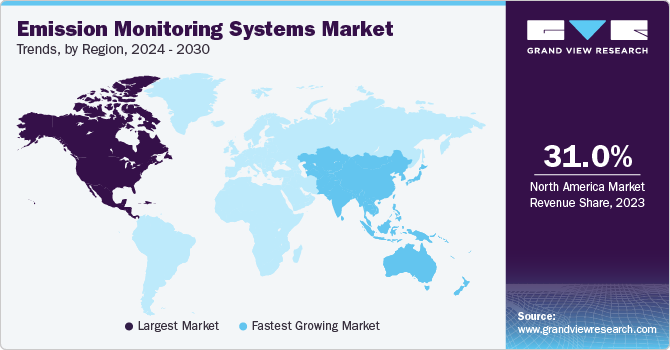

Regional Insights

North America led the overall market in 2023, with a share of more than 31.0% in terms of revenue. The growth is driven by a robust and dynamic economy, that is remarkable for its thriving industries such as manufacturing, technology, finance, and healthcare. The region's economic growth fuels demand for a wide range of products and services, fostering market expansion and driving innovation. Moreover, the region benefits from a thriving ecosystem that nurtures entrepreneurship, startups, and innovation. Moreover, government regulations and policies play a significant role in shaping the North American market. Regulatory frameworks prioritizing fair competition, consumer protection, and environmental sustainability create a favorable business environment. In addition, sector-specific regulations in energy, healthcare, and finance profoundly impact market dynamics and drive the demand for solutions that comply with these regulations. Clean Air Act, Clean Water Act, National Ambient Air Quality Standards, and National Pollutant Release Inventory are a few environmental regulations in the region.

The Asia Pacific region is expected to grow notably with the fastest CAGR of 13.0% during the forecast period. The Asia Pacific region is home to some of the fastest-growing economies globally, including China, India, Japan, and Southeast Asian countries. The region's expanding middle class, rising disposable incomes, and urbanization contribute to increased consumer spending, driving demand for various goods and services. Urbanization is rapidly transforming cities across the region, leading to increased infrastructure development and demand for construction-related products and services. The growth of smart cities, transportation networks, and sustainable infrastructure projects presents opportunities in sectors such as construction, real estate, and engineering, leading to increased adoption of EMS. Growing concerns about environmental sustainability and climate change have raised the focus on eco-friendly practices and renewable energy sources. The Asia Pacific region is investing in clean energy technologies, sustainable infrastructure, and green initiatives, driving market opportunities in renewable energy, energy-efficient solutions, and environmental services.

U.S. Emission Monitoring Systems Market Trends

The U.S. emission monitoring systems market has been influenced by increasingly stringent environmental regulations. The need to comply with emissions standards set by regulatory bodies drives the adoption of advanced monitoring technologies. The emphasis o monitoring air quality has been a significant trend. Industries and regulatory agencies are increasingly investing in monitoring systems that not only measure emissions but also assess their impact on air quality.

Germany Emission Monitoring Systems Market Trends

The emission monitoring systems market in Germany is projected to grow at a CAGR of 7.8% from 2024 to 2030. Germany, known for its commitment to environmental sustainability, has seen a focus on stringent environmental regulations. The emission monitoring systems market is influenced by regulations that require industries to monitor and report emissions to ensure compliance. There is a shift towards continuous emission monitoring systems (CEMS) in Germany. Continuous monitoring allows industries to actively track and manage emissions in real-time, aiding in meeting regulatory requirements.

India Emission Monitoring Systems Market Trends

The Indian government has implemented and strengthened environmental regulations, leading to a heightened demand for emission monitoring systems. Compliance with emissions standards is a key driver in the market. The growth of renewable energy projects in India, such as solar and wind installations, has contributed to the demand for emission monitoring systems. Monitoring emissions associated with clean energy production aligns with sustainability goals.

Saudi Arabia Emission Monitoring Systems Market Trends

The ongoing industrial expansion in Saudi Arabia, particularly in sectors such as petrochemicals and manufacturing, has led to an increased need for emission monitoring systems. Industries are adopting these systems to manage and control their emissions. Digitalization and the integration of IoT technologies have influenced the adoption of emission monitoring systems. These technologies enable efficient data collection, remote monitoring, and advanced analytics for better decision-making.

Key Emission Monitoring Systems Market Company Insights

Some of the key players operating in the market include ABB Ltd., Ametek, Inc., Emerson Electric Company, General Electric Company, Enviro Technology Services Plc, and Horiba Ltd., among others.

-

ABB provides a suite of advanced instrumentation and automation technologies designed for environmental monitoring and emission control. This includes gas analyzers, continuous emission monitoring systems (CEMS), and related solutions that help industries measure and manage their emissions effectively. ABB's solutions are designed to assist industries in meeting regulatory requirements related to emissions. The company's offerings often integrate cutting-edge technologies to ensure accurate measurement, data analysis, and reporting, helping businesses comply with environmental standards.

-

AMETEK manufactures and supplies gas analyzers and monitoring instruments that are relevant to emission monitoring. These products are designed to measure and analyze gases released during industrial processes, aiding in compliance with environmental regulations. AMETEK offers Continuous Emission Monitoring Systems (CEMS) designed to provide real-time monitoring of emissions from industrial sources. These systems assist industries in maintaining compliance with regulatory standards by continuously measuring pollutants and gases.

-

Greener Process Systems Inc and Net0 are some of the emerging companies in the global Emission Monitoring Systems market.

-

Greener Process Systems Inc. is a globally operating enterprise headquartered in South Florida. The company places great importance on fostering an inclusive culture, adopting a professional management approach, and maintaining an unwavering commitment to enhancing the Earth's environment through innovation and technology. With a firm belief that continual improvement is essential for the planet, the company expanded its operations worldwide in 2019, starting from its South Florida base. Greener Process Systems Inc. has experienced rapid growth, attributed to its patented technology designed to eliminate ship emissions in harbors. This innovation plays a crucial role in assisting port authorities and service providers in adhering to prevailing laws and regulations. Greener's SETH™ technology is instrumental in transforming the shipping and cruise industries, making them cleaner, more energy-efficient, and significantly more environmentally friendly.

-

leads the way in merging artificial intelligence with effective carbon emissions management, establishing a fresh benchmark for corporate environmental stewardship. Its platform enables businesses to steer towards carbon neutrality, unlocking both profitability and sustainable growth in a continually evolving global economy.

Key Emission Monitoring Systems Companies:

The following are the leading companies in the emission monitoring systems market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these emission monitoring systems companies are analyzed to map the supply network.

- ABB Ltd.

- Ametek, Inc.

- Emerson Electric Company

- General Electric Company

- Enviro Technology Services Plc.

- Horiba Ltd.

- Fuji Electric Co., Ltd.

- Rockwell Automation, Inc.

- Siemens AG

- Thermo Fisher Scientific Inc.

Recent Developments

-

In April 2023, the National Aeronautics and Space Administration (NASA) of the U.S. introduced a state-of-the-art device called Tropospheric Emissions: Monitoring of Pollution (TEMPO). This device aims to monitor air pollution in North America with unparalleled accuracy. This groundbreaking solution for air quality monitoring has the potential to unveil disparities in pollution exposure.

-

In January 2021, ABB has introduced a novel system for monitoring vessel emissions. ABB's CEMcaptain is specifically crafted to assist owners and operators in adhering to the latest regulations. Additionally, it offers enhanced measurement and digital capabilities that improve on-board safety, facilitate process optimization, and significantly decrease ownership costs.

Emission Monitoring Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.50 billion

Revenue forecast in 2030

USD 6.71 billion

Growth Rate

CAGR of 10.3% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

ABB Ltd., Ametek, Inc., Emerson Electric Company, General Electric Company, Enviro Technology Services Plc., Horiba Ltd., Fuji Electric Co., Ltd., Rockwell Automation, Inc., and Siemens AG among othersThermo Fisher Scientific Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Emission Monitoring Systems Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global emission monitoring systems market based on type, component, and region.

-

Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Continuous Emission Monitoring System (CEMS)

-

Predictive Emission Monitoring System (PEMS)

-

-

Component Outlook (Revenue, USD Million; 2017 - 2030)

-

Hardware

-

Software

-

Services

-

Installation & Deployment

-

Training

-

Support & Maintenance

-

-

-

End-Use Outlook (Revenue, USD Million; 2017 - 2030)

-

Oil & Gas

-

Metals & Mining

-

Power Generation

-

Chemical & Fertilizer

-

Pulp & Paper

-

Pharmaceutical

-

Others

-

- Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

U.A.E.

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the emission monitoring systems market include ABB Ltd.; Ametek, Inc.; Emerson Electric Company; General Electric Company; Enviro Technology Services Plc.; Horiba Ltd.; Fuji Electric Co., Ltd.; Rockwell Automation, Inc.; Siemens AG; and Thermo Fisher Scientific Inc.

b. Key factors that are driving the emission monitoring systems market growth can be attributed to advancements in sensor technologies, data analytics, and remote monitoring capabilities that have significantly enhanced the functionality and efficiency of emission monitoring systems.

b. The global emission monitoring systems market size was estimated at USD 3.31 billion in 2022 and is expected to reach USD 3.51 billion in 2023.

b. The global emission monitoring systems market is expected to grow at a compound annual growth rate of 9.7% from 2023 to 2030 to reach USD 6.71 billion by 2030.

b. North America dominated the emission monitoring systems market with a share of 31.6%. The market in North America is driven by a robust and dynamic economy, marked by thriving industries such as manufacturing, technology, finance, and healthcare.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."