- Home

- »

- Clinical Diagnostics

- »

-

Employer And Workplace Drug Testing Market Report, 2033GVR Report cover

![Employer And Workplace Drug Testing Market Size, Share & Trends Report]()

Employer And Workplace Drug Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Pre-employment drug screens, Post-employment), By Product (Consumables), By Mode, By Drug, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-463-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Employer And Workplace Drug Testing Market Summary

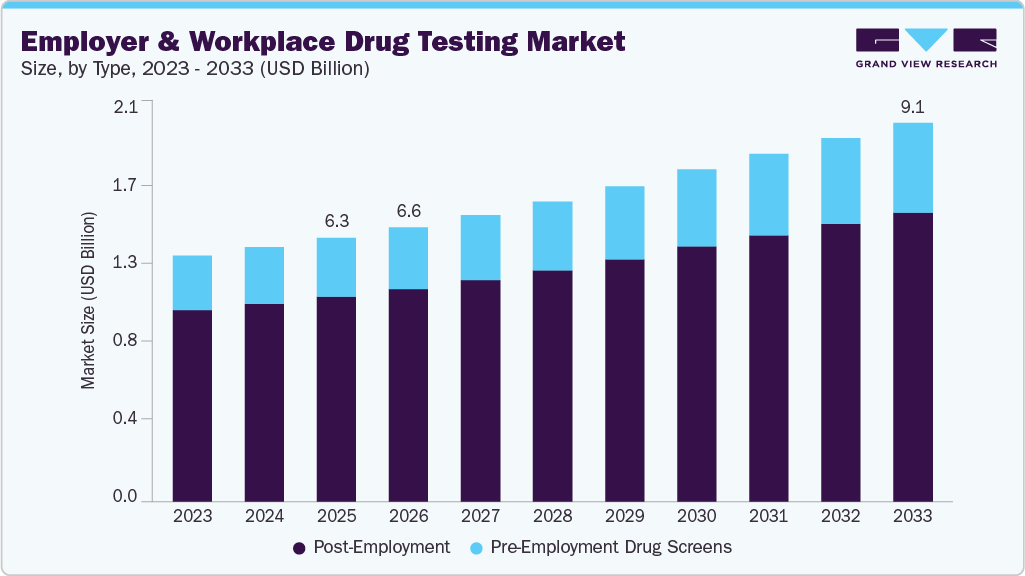

The global employer and workplace drug testing market size was estimated at USD 6,105.1 million in 2024 and is projected to reach USD 9,089.9 million by 2033, growing at a CAGR of 4.6% from 2025 to 2033. This market focuses on detecting the presence of illicit drugs and controlled substances in biological samples to support workplace safety, regulatory compliance, and productivity.

Key Market Trends & Insights

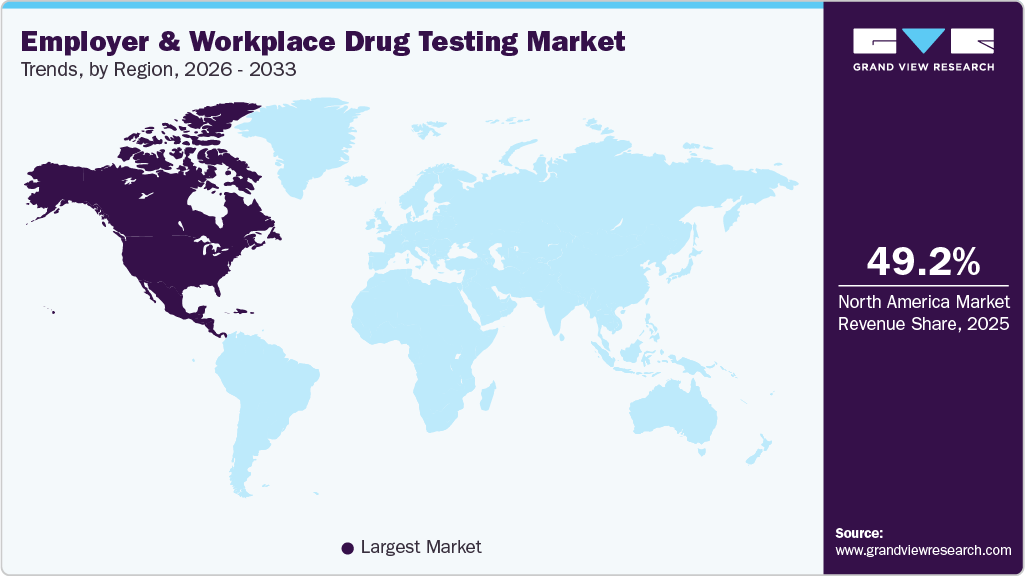

- North America dominated the global market with the largest revenue share of 48.99% in 2024.

- The U.S. led the North American market and held the largest revenue share in 2024.

- By type, the post-employment segment led the market with the largest revenue share of 77.8% in 2024.

- By product, the consumable segment led the market with the largest revenue share of 33.1% in 2024.

- By mode, the urine segment led the market with the largest revenue share of 40.9% in 2024.

- By drug, the cannabis/marijuana segment led the market with the largest revenue share of 58.3% in 2024.

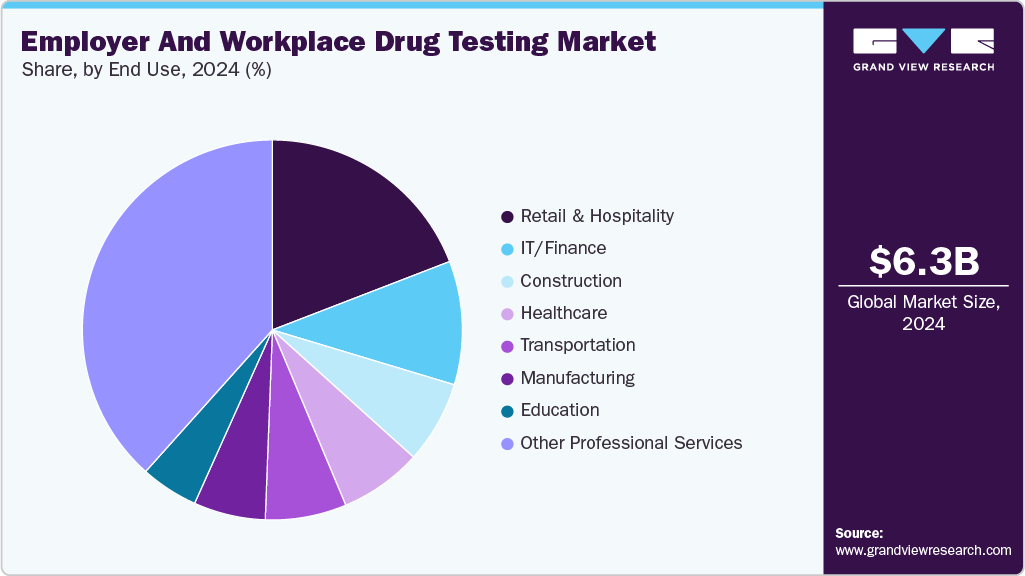

- By end use, the other professional services segment led the market with the largest revenue share of 38.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6,105.1 Million

- 2033 Projected Market Size: USD 9,089.9 Million

- CAGR (2025-2033): 4.6%

- North America: Largest market in 2024

Testing methods such as urine, oral fluid, hair, and blood analysis are widely used across industries, including transportation, manufacturing, construction, and energy, to reduce workplace accidents and absenteeism. Employer and workplace drug testing plays a significant role in pre-employment screening, random testing, and post-incident investigations, helping organizations maintain a safe and compliant workforce. The demand is driven by stricter government regulations, corporate policies promoting drug-free environments, and the availability of advanced rapid testing kits and laboratory-based confirmation methods. Growing awareness of substance abuse impacts on workforce performance and safety is further encouraging adoption across both developed and emerging markets.

According to a national survey by American Addiction Centers, 15.3% of U.S. workers reported working under the influence of alcohol, while 2.9% admitted to being under the influence of illicit drugs in 2024. These figures underscore a significant challenge for U.S. employers, highlighting the need for strong workplace drug testing policies. Furthermore, there is a growing emphasis on workplace safety and productivity, prompting organizations to adopt measures that ensure a drug-free environment. Rising awareness of the adverse effects of substance misuse in the workplace, including reduced productivity, increased absenteeism, workplace accidents, and legal liabilities, further drives demand for drug testing services.

Moreover, advancements in drug testing technologies have made testing more accurate, efficient, and cost-effective, encouraging more employers to incorporate these solutions into their human resource practices. As organizations increasingly recognize the value of maintaining a safe and productive work environment, the market for workplace drug testing continues to expand.

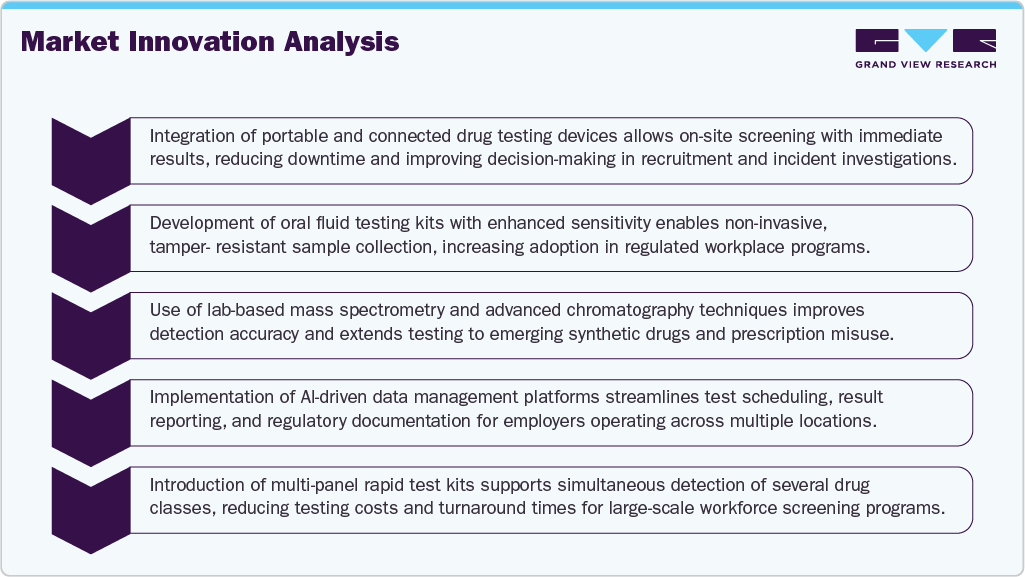

Overall, innovation in the employer and workplace drug testing industry is transforming the efficiency, accuracy, and scope of screening programs. Advances in portable devices and non-invasive sampling are making testing more convenient and less disruptive for both employers and employees, while sophisticated laboratory techniques are enhancing the ability to identify a broader range of substances with high precision. The integration of AI-driven data management and multi-panel rapid testing is streamlining operations, reducing costs, and supporting compliance with stringent regulatory requirements. These developments are enabling organizations to implement more proactive and reliable workplace drug testing strategies, strengthening safety and productivity across diverse industry sectors.

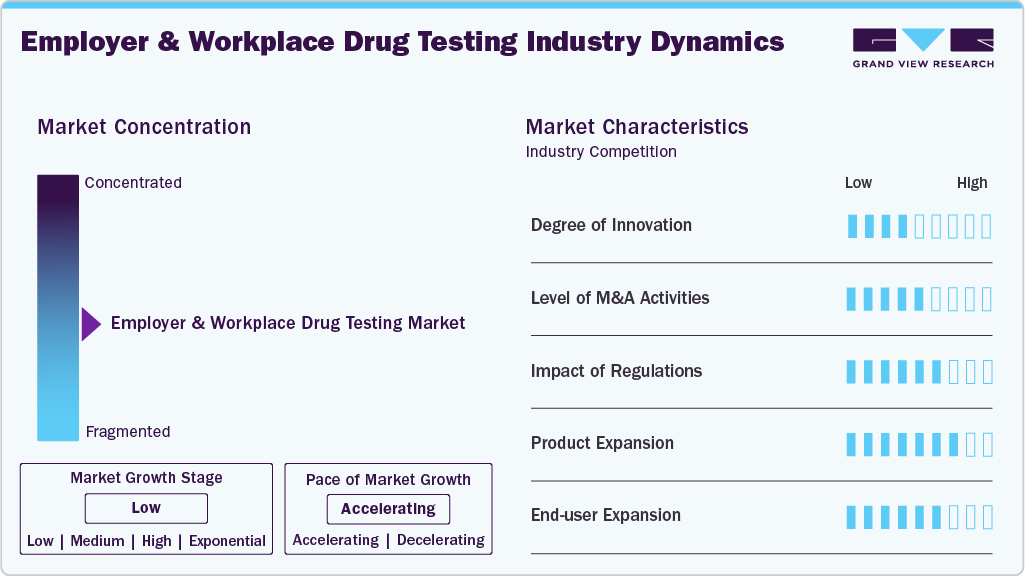

Market Concentration & Characteristics

The market is marked by a medium degree of innovation, driven by a medium degree of innovation, advancing through improvements in rapid testing technologies, non-invasive methods such as saliva and hair analysis, and the incorporation of artificial intelligence for enhanced accuracy and efficiency. Moreover, the emergence of remote testing solutions is effectively addressing the challenges associated with the growing prevalence of remote and hybrid work environments.

The market has experienced a moderate level of merger and acquisition activity, with companies aiming to broaden their product portfolios and strengthen technological capabilities. Such strategies are focused on improving service efficiency, expanding testing options, and enhancing overall market competitiveness, while also enabling firms to address evolving workplace safety requirements and regulatory standards.

Regulations significantly impact the market as regulations establish mandatory guidelines for drug testing procedures, which employers must adhere to. This ensures standardized practices across industries but also requires organizations to invest in compliant testing technologies and processes. Regulatory compliance led to increased costs for employers, as they must implement and maintain testing programs that meet legal standards. However, these costs are often offset by the potential savings from reduced absenteeism, increased productivity, and lower healthcare costs.

Product expansion in the market is robust, driven by the need to address emerging drug trends. In October 2023, Psychemedics Corporation launched its Advanced 5-Panel Drug Screen, an FDA-cleared test that replaces marijuana detection with fentanyl detection. This updated panel addresses the escalating fentanyl crisis and also screens for cocaine, opioids, PCP, and amphetamines. It delivers markedly improved accuracy, with detection capabilities that are 25 times more effective for opioids, 23 times more effective for cocaine, and 13 times more effective for amphetamines compared to conventional tests.

Regional expansion in the global market. There is increasing demand for drug testing services in various countries, particularly those with stringent regulatory requirements. Companies are expanding their geographic presence to enter markets characterized by high levels of industrial activity, such as the Midwest and South, where safety-sensitive sectors like manufacturing and transportation are prominent. Furthermore, regional expansion initiatives often aim at setting up local laboratories and service centers, improving accessibility, and reducing turnaround times for employers in different regions.

Type Insights

The post-employment segment led the market with the largest revenue share of 77.80% in 2024. This segment plays a vital role in safeguarding workplace safety and ensuring compliance by monitoring employees after hiring, especially in sectors such as transportation, energy, manufacturing, and healthcare. Through regular or unannounced testing, employers actively deter substance misuse, uphold regulatory standards, and mitigate risks of accidents and productivity declines. Rising emphasis on maintaining drug-free environments, reinforced by occupational health policies, continues to fuel demand for this segment. As an example of the broader urgency for ongoing monitoring: in 2023, alcohol-impaired driving fatalities in the U.S. dropped by approximately 8%, from 13,458 in 2022 to 12,429 in 2023, yet still accounted for 30% of all traffic fatalities-highlighting the persistent need for rigorous surveillance and prevention systems across all domains of safety, including the workplace.

The pre-employment drug screens segment is anticipated to grow at the fastest CAGR of 5.4% over the forecast period. Pre-employment drug testing is conducted before a candidate is officially hired, serving as a preventive measure to identify potential substance misuse among applicants. This practice is especially prevalent in safety-sensitive industries such as healthcare, transportation, construction, and manufacturing, where the risks associated with hiring individuals who use illicit drugs or misuse prescription medications have serious consequences, including workplace accidents, injuries, and legal liabilities. The demand for pre-employment drug screening is driven by several factors. Employers are becoming more aware of the financial and operational impacts of hiring individuals with substance use issues, such as increased absenteeism, reduced productivity, and higher turnover rates. By screening applicants before employment, organizations mitigate these risks, promote a safer work environment, and reduce long-term costs associated with employee healthcare, compensation claims, and liability insurance premiums. In addition, regulatory requirements and guidelines in many regions mandate pre-employment drug testing for specific sectors, further fueling market growth.

Product Insights

The consumable segment led the market with the largest revenue share of 33.16% in 2024. The consumables segment in the global market includes critical products such as urine collection cups, saliva swabs, test strips, reagents, and others. This segment is essential for ensuring the accuracy and reliability of drug tests, which is crucial for the effectiveness of drug screening programs. Further, to stay competitive, companies are increasingly focusing on developing more efficient and user-friendly consumables, such as rapid test kits and integrated collection devices. The regulatory environment plays a significant role in shaping this segment, with federal guidelines from the Department of Transportation (DOT) and the Substance Abuse and Mental Health Services Administration (SAMHSA) setting strict standards for drug testing procedures and related products. Compliance with these regulations is crucial for companies to maintain credibility and avoid legal risks. In addition, new state-level laws, such as Washington State's SB 5123, are influencing changes in the types of consumables needed, particularly for marijuana testing.

The services segment is anticipated to grow at the fastest CAGR of 5.4% from 2024 to 2033. The global market is highly competitive, with a diverse range of participants, from established diagnostic laboratories to specialized testing service providers. These companies maintain a strong market position due to their extensive laboratory networks and broad range of testing services, including urine, hair, saliva, and blood tests. They provide comprehensive drug testing solutions with quick turnaround times and nationwide reach, leveraging strong brand recognition and advanced technology to sustain their competitive advantage. Companies like First Advantage, Psychemedics, and Omega Laboratories concentrate on niche areas, such as hair drug testing or specialized employer screening services. Psychemedics, for instance, is well-known for its patented hair testing technology, which offers a longer detection window than other testing methods. This specialization enables these companies to establish unique positions within the competitive market landscape.

Mode Insights

The urine segment led the market with the largest revenue share of 40.86% in 2024. Urine tests are the most widely used type of pre-employment drug testing by employers, favored for their proven reliability and simplicity. This method is standard in both regulated and non-regulated industries, ensuring uniform application across different sectors. For employers required to conduct drug testing under federal mandates, urinalysis is the only approved method, reinforcing its status as the standard, particularly in industries with strict federal regulations.

The oral fluid segment is expected to grow at the fastest CAGR of 7.2% over the forecast period. Oral fluid testing provides a quick and noninvasive method for specimen collection. However, factors like inadequate fluid production due to physiological conditions or recent drug use, and potential interference from food or saliva-stimulating techniques affect the accuracy of drug concentration measurements. Currently, oral fluid testing is mainly used to detect drug abuse in safety-sensitive workplaces, roadside testing for drivers, and other situations where drug impairment is a concern. This method detects substances such as alcohol (ethanol), amphetamines, cocaine, opioids (including morphine, methadone, and heroin), and cannabis. The growing adoption of oral fluid testing is significantly impacting the global market by providing a less invasive alternative to traditional methods, thereby driving market growth.

Drug Insights

The cannabis/marijuana segment led the market with the largest revenue share of 58.30% in 2024 and is expected to grow at the fastest CAGR of 5.3% over the forecast period. The legalization and decriminalization of marijuana in many states has diminished the stigma surrounding its use, leading to increased consumption, including among employees. As per SAMHSA 2023 report, marijuana was the most commonly used illicit drug, with 21.8% of people aged 12 or older, or 61.8 million individuals, reporting its use in the past year. This trend is likely to drive demand for advanced drug testing solutions as employers work to maintain safe and productive workplaces amid shifting drug use patterns.

The amphetamine & methamphetamine segment is expected to grow at a significant CAGR during the forecast period. Advancements in drug testing technologies have improved the accuracy and efficiency of detecting amphetamines and methamphetamines. Methods such as urine tests, saliva tests, and hair follicle tests are commonly employed, each offering different detection windows and sensitivities. For example, urine tests are widely used due to their effectiveness in identifying recent drug use. In contrast, hair follicle tests provide a longer detection period, capturing substance use over several months.

End Use Insights

The other professional services segment led the market with the largest revenue share of 38.3% in 2024. The demand for employer and workplace drug testing spans various professional services sectors, including Professional, Scientific, and Technical Services, Wholesale Trade, and Public Administration. This demand is driven by the critical nature of their work and the need to uphold high standards of safety, compliance, and productivity within these industries.

The transportation segment is expected to grow at the fastest CAGR of 6.8% over the forecast period. The increasing number of commercial drivers and the necessity to comply with safety regulations are key factors driving the sector's growth. In addition, the rise in commercial vehicle registrations and the expansion of public transportation networks contribute to the growing demand for drug testing services. Further the U.S. Department of Transportation (DOT) mandates regular drug testing for safety-sensitive positions within the transportation sector. This includes testing for substances such as alcohol, amphetamines, cocaine, marijuana, and opioids. For instance, the Federal Motor Carrier Safety Administration (FMCSA) in the U.S. enforces rigorous drug testing requirements for commercial drivers, fueling market expansion. The adoption of advanced drug testing technologies, such as rapid testing kits and mobile testing units, is also contributing to the growth of the transportation segment.

Regional Insights

North America dominated the employer and workplace drug testing market with the largest revenue share of 48.99% in 2024. The region’s strong position is supported by well-established regulatory frameworks, stringent workplace safety requirements, and a high level of employer adoption across industries such as transportation, construction, energy, and healthcare. Federal and state mandates, combined with corporate policies promoting drug-free workplaces, have driven consistent demand for both laboratory-based and rapid drug testing solutions. The presence of key service providers, advanced laboratory infrastructure, and widespread availability of testing technologies further strengthens the regional market.

Ongoing concerns about substance misuse and its impact on workforce safety and productivity continue to influence employer testing strategies. Initiatives from agencies such as the U.S. Department of Transportation and the National Highway Traffic Safety Administration, alongside evolving state-level cannabis legislation, are shaping testing protocols and compliance requirements. The combination of regulatory enforcement, technological innovation, and a growing emphasis on occupational health is expected to sustain North America’s leading role in the global market.

U.S. Employer and Workplace Drug Testing Market Trends

The employer and workplace drug testing market in the U.S. accounted for the largest market revenue share in North America in 2024, fueled by the presence of the key player in the country. Major companies present in the drug testing market in the country include Bio-Rad Laboratories, Laboratory Corporation of America Holdings, and Quest Diagnostics. These organizations are enhancing their offerings through strategic initiatives such as new product launches, partnerships, and mergers to maintain competitive advantages. According to the 2024 Drug Testing Index, there was a 600% increase in attempts to tamper with drug tests, the highest rate in over 30 years, indicating a growing trend among workers to subvert testing processes. Overall post-accident positivity rates rose slightly to 10.4% in 2023. Post-accident marijuana positivity reached 7.5%, marking a consistent increase since 2012, correlating with marijuana legalization in various states.

The data highlights the need for ongoing evaluation of drug-free workplace programs in light of rising marijuana use and increased attempts to cheat drug tests. Furthermore, the introduction of rapid testing devices is gaining traction, allowing for quick results and increased efficiency in identifying substance use. For instance, new handheld devices could provide results in as little as five minutes, enhancing the speed of workplace drug testing processes.

Europe Employer and Workplace Drug Testing Market Trends

The employer and workplace drug testing market in Europe is experiencing significant growth. Regulations in Europe are not as stringent as in North America; however, there is growing pressure from employers and industry groups to implement more rigorous testing protocols, particularly in sectors such as transportation, energy, and public safety. The competitive scenario in Europe features both multinational corporations and regional players focusing on expanding their service portfolios and enhancing their technological capabilities.

The UK employer and workplace drug testing market is experiencing significant growth due to healthcare improvements and technological advancements. Recent developments include the introduction of digital platforms for managing drug testing programs and the use of non-invasive testing methods to ensure employee comfort and privacy.

The employer and workplace drug testing market in Germany is experiencing significant growth, driven by employers in Germany are adopting drug testing practices to minimize workplace accidents and enhance overall productivity. The competitive landscape is characterized by a mix of local and international companies offering diverse testing methodologies, with a strong emphasis on laboratory-based testing. Recent innovations in the German market include the use of advanced chromatographic techniques and mass spectrometry for more precise drug detection, as well as the development of mobile testing units that provide on-site testing services.

Asia Pacific Employer and Workplace Drug Testing Market Trends

The employer and workplace drug testing market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period, propelled by enhanced safety awareness, expanding industrial sectors, and evolving employer standards. Governments and organizations are increasingly deploying advanced testing methods to uphold workplace safety, particularly across industries like transportation, logistics, and public services. As an example of regional innovation, beginning January 2023, Singapore’s Central Narcotics Bureau (under MHA) rolled out saliva-based drug test kits at checkpoints and in joint roadblock operations to curb drug-impaired behaviors among drivers-demonstrating a broader shift toward non-invasive, rapid testing technologies applicable in workplace and public safety scenarios.

The Japan employer and workplace drug testing market is experiencing growth driven by there is growing recognition of the importance of drug testing in maintaining a safe and productive work environment. Japan has stringent regulations governing drug testing, overseen by the Ministry of Health, Labor, and Welfare (MHLW). This regulatory framework ensures that diagnostic devices used for drug testing comply with safety and quality standards, creating a conducive environment for companies offering toxicology screening solutions.

The employer and workplace drug testing market in China is growing, driven by a high level of fragmentation, with numerous local and regional players offering cost-effective solutions. Recent developments include the adoption of mobile testing units, digital platforms for managing testing programs, and the use of saliva-based testing methods, which offer a non-invasive alternative to traditional urine testing.

Latin America Employer and Workplace Drug Testing Market Trends

The employer and workplace drug testing market in Latin America is experiencing significant growth, due to rising alcohol consumption and the increasing prevalence of drug use across the region, particularly among young people and vulnerable populations. Workplace drug and alcohol testing is generally permitted without restrictions on test panels or specimen types. However, there are nuances in legislation across different countries. For instance, in Argentina, while drug testing is allowed, employees cannot be compelled to undergo testing, and results must be handled with confidentiality to avoid discrimination.

The Brazil employer and workplace drug testing market is anticipated to grow at the fastest CAGR during the forecast period. The regulatory landscape in employer and workplace drug testing in Brazil is evolving, with stricter laws being introduced to ensure workplace safety, thereby encouraging the adoption of drug testing practices among employers. The competitive environment is dominated by local players, but there is an increasing presence of multinational companies looking to expand their footprint in the region.

Middle East and Africa Employer and Workplace Drug Testing Market Trends

The employer and workplace drug testing market in the Middle East & Africa is expanding. In Saudi Arabia, recent government initiatives aimed at promoting a safer working environment, particularly in industries such as oil and gas, construction, and transportation, are spurring demand for drug testing services. The competitive scenario in this region is relatively nascent, with opportunities for growth being pursued by both regional and international companies.

The Saudi Arabia employer and workplace drug testing market is characterized by rapid innovation, growing competition, and a dynamic regulatory environment, which varies significantly across different regions. Manufacturers are continuously innovating to offer more accurate, cost-effective, and user-friendly testing solutions to meet the evolving needs of employers globally.

Employer and Workplace Drug Testing Company Insights

Key participants in the employer and workplace drug testing industry are focusing on developing innovative testing solutions and securing necessary certifications to broaden their offerings. In addition, companies are entering into partnerships, collaborations, mergers, and acquisitions to strengthen their presence in the sector. These initiatives aim to expand technological capabilities, increase regional coverage, and improve the accessibility of rapid, accurate, and non-invasive drug testing methods across diverse workplace environments.

Employer and Workplace Drug Testing Companies:

The following are the leading companies in the global employer and workplace drug testing market. These companies collectively hold the largest market share and dictate industry trends.

- First Advantage

- Laboratory Corporation of America Holdings (Labcorp)

- Drägerwerk AG & Co. KGaA

- Bio-Rad Laboratories, Inc.

- Abbott

- Clinical Reference Laboratory Inc.

- Quest Diagnostics

- Cordant Health Solutions

- DISA Global Solutions

- HireRight, LLC

- OraSure Technologies, Inc.

- Omega Laboratories

- Psychemedics Corporation

Recent Developments

-

In March 2025, Premier Biotech completed the acquisition of OraSure Technologies’ substance abuse testing business line (the OraSure Toxicology Line) and the Mexican subsidiary of Green Earth Biomedical LLC. This move strengthens Premier’s capabilities in oral fluid drug testing and supports the expansion of workplace testing solutions.

-

In May 2024, Omega Laboratories announced a partnership with Cannabix Technologies Inc. to integrate Cannabix’s advanced THC breathalyzer into Omega’s drug testing services. This collaboration made Omega the exclusive provider of laboratory services for Cannabix, enhancing its drug testing accuracy & efficiency.

-

In April 2024, Accurate Background, a provider of employment monitoring solutions, announced the launch of its next-generation drug and health screening services. The new offering integrates advanced technologies and enhanced data analytics to improve the accuracy and efficiency of drug testing and health screenings. This innovative service aims to streamline the screening process, provide faster results, and offer more comprehensive insights into employee health and substance use.

Employer And Workplace Drug Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,332.4 million

Revenue forecast in 2033

USD 9,089.9 million

Growth rate

CAGR of 4.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, mode, drug, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

First Advantage; Laboratory Corporation of America Holdings (Labcorp); Drägerwerk AG & Co. KGaA; Bio-Rad Laboratories, Inc.; Abbott; Clinical Reference Laboratory Inc.; Quest Diagnostics; Cordant Health Solutions; DISA Global Solutions; HireRight, LLC; OraSure Technologies, Inc.; Omega Laboratories; Psychemedics Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Employer And Workplace Drug Testing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global employer and workplace drug testing market on the basis of type, product, mode, drug, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Pre-employment drug screens

-

Post-employment

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumables

-

Instruments

-

Rapid Testing Devices

-

Services

-

-

Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Urine

-

Hair

-

Oral Fluid

-

Instant testing

-

-

Drug Outlook (Revenue, USD Million, 2021 - 2033)

-

Alcohol

-

Cannabis/Marijuana

-

Cocaine

-

Opioids

-

Amphetamine & Methamphetamine

-

LSD

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

IT/Finance

-

Manufacturing

-

Transportation

-

Construction

-

Retail and Hospitality

-

Healthcare

-

Education

-

Other Professional Services

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global employer and workplace drug testing market size was estimated at USD 6,105.1 million in 2024 and is expected to reach USD 6,332.4 million in 2025.

b. The global employer and workplace drug testing market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2033 and expected to reach USD 9,089.9 million by 2033.

b. North America dominated the employer and workplace drug testing market with a share of 48.9% in 2024. This is attributable to the presence of well-established regulations for workplace drug testing

b. Some key players operating in the employer and workplace drug testing market include First Advantage; Laboratory Corporation of America Holdings (Labcorp); Drägerwerk AG & Co. KGaA; Bio-Rad Laboratories, Inc.; Abbott; Clinical Reference Laboratory Inc.; Quest Diagnostics; Cordant Health Solutions; DISA Global Solutions; HireRight, LLC; OraSure Technologies, Inc.; Omega Laboratories; Psychemedics Corporation

b. Key factors that are driving the market growth include increasing reporting of substance abuse at the workplace and growing demand for pre-employment drug screening

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.