- Home

- »

- Clinical Diagnostics

- »

-

Endocrine Function Diagnostics Market, Industry Report 2033GVR Report cover

![Endocrine Function Diagnostics Market Size, Share & Trends Report]()

Endocrine Function Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Test Type (TSH, hCG, Insulin), By Technology (Clinical Chemistry, Immunoassay), By Application, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-823-9

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Endocrine Function Diagnostics Market Summary

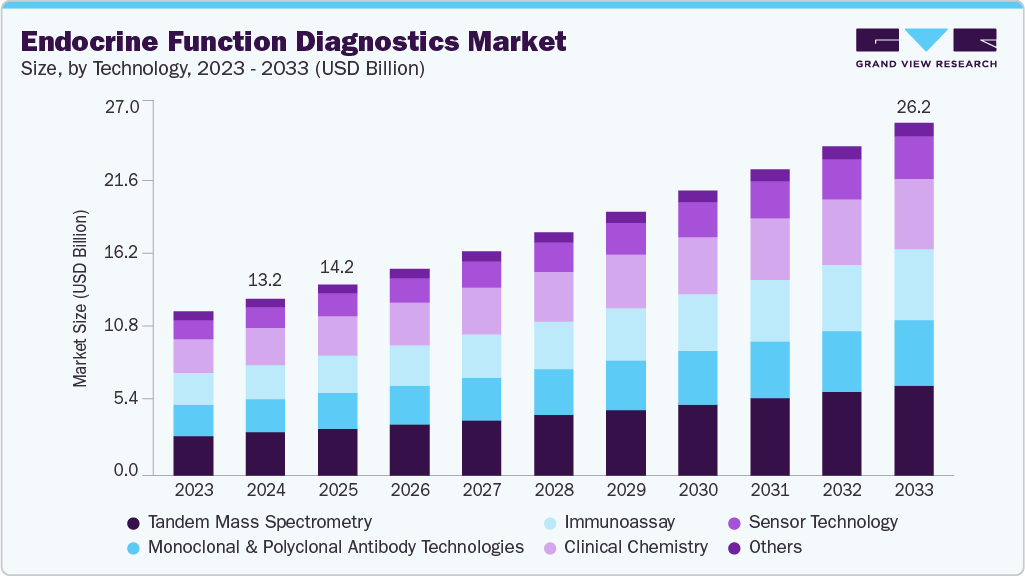

The global endocrine function diagnostics market size was estimated at USD 13.16 billion in 2024 and is projected to reach USD 26.23 billion by 2033, growing at a CAGR of 8.0% from 2025 to 2033. The growing prevalence of endocrine disorders, strong shift towards precision diagnostics, and technological innovations in assays and platforms are some of the major factors contributing to market growth.

Key Market Trends & Insights

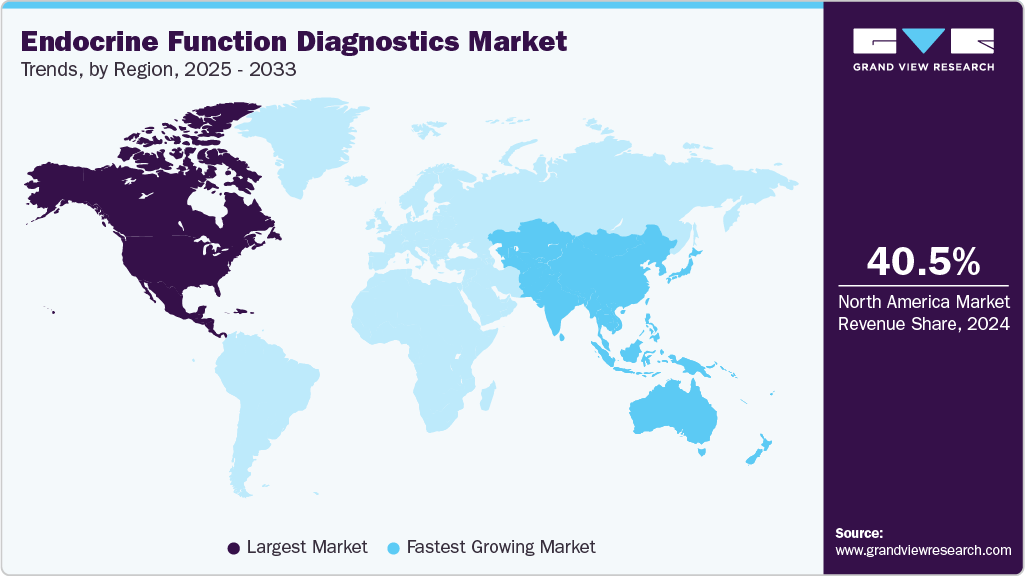

- North America market for endocrine function diagnostics dominated the global market and accounted for the largest revenue share of 40.48% in 2024.

- The U.S. led the North American market and held the largest revenue share in 2024.

- Based on test type, TSH dominated the global market and accounted for the largest revenue share of 27.99% in 2024.

- Based on technology, the tandem mass spectrometry segment held the largest revenue share of 24.46% in 2024.

- Based on application, the thyroid disorders segment held the largest revenue share of 30.18% in 2024. In terms of end use, the hospitals segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.16 Billion

- 2033 Projected Market Size: USD 26.23 Billion

- CAGR (2025-2033): 8.0%

- North America: Largest Market in 2024

According to statistics published by the American Cancer Society, 44,020 new cases of thyroid cancer were reported in the U.S. in 2025. The rate of new thyroid cancers was growing faster compared to other cancers in the U.S. This leads to consistent growth in demand for routine endocrine panel testing in hospitals, clinics, and diagnostic laboratories.

Advancements in product technologies fuel the market demand. According to the Cureus, part of the Springer Nature group, published an article in October 2023, in recent years, remarkable progress has been made in the treatment of endocrine system diseases and arrhythmia. Endocrine system disorders include a variety of diseases such as diabetes, thyroid dysfunction, and adrenal gland disease. Advances in biomarker identification and genomic profiling have made it possible to make more accurate diagnoses and develop individualized treatment plans. In addition, modern drugs and advanced delivery systems represent great progress in achieving improved glycemic control and minimizing the adverse effects of endocrine disorders in individuals characterized by improper heart rhythms. Arrhythmia poses a significant risk to cardiovascular health. Strategies to treat arrhythmia include wearable cardiac monitors, catheter-based ablation techniques, and artificial intelligence-based predictive algorithms. These advances facilitate early detection, risk stratification, and execution of targeted interventions, ultimately leading to improved patient outcomes.

The demand for endocrine function diagnostics is increasing as adults become more health-conscious and the number of lifestyle-related diseases increases. This increased awareness is contributing to the rise of home health care and point-of-care (POC) devices that deliver faster and more efficient results. Home care and POC devices are easy to use and provide a cost-effective alternative for adults and the growing elderly population. The WHO estimates that by 2025, about 167 million people, including adults and children, will be in poor health due to being overweight or obese. The prediction of these diseases is likely to impact the market and result in significant growth during the forecast period.

Increasing health complications in the elderly population are expected to drive the market growth during the forecast period. According to the National Council on Aging article in August 2023, 94.9% of adults aged 60 and older have at least one disease, and 78.7% have two or more. Obesity, which affects about 42% of adults over age 60, can also increase the risk of diseases such as heart disease, type 2 diabetes, and cancer. With the increase in the affected population, the number of tests used in endocrinology has increased substantially. These aspects are expected to boost market growth.

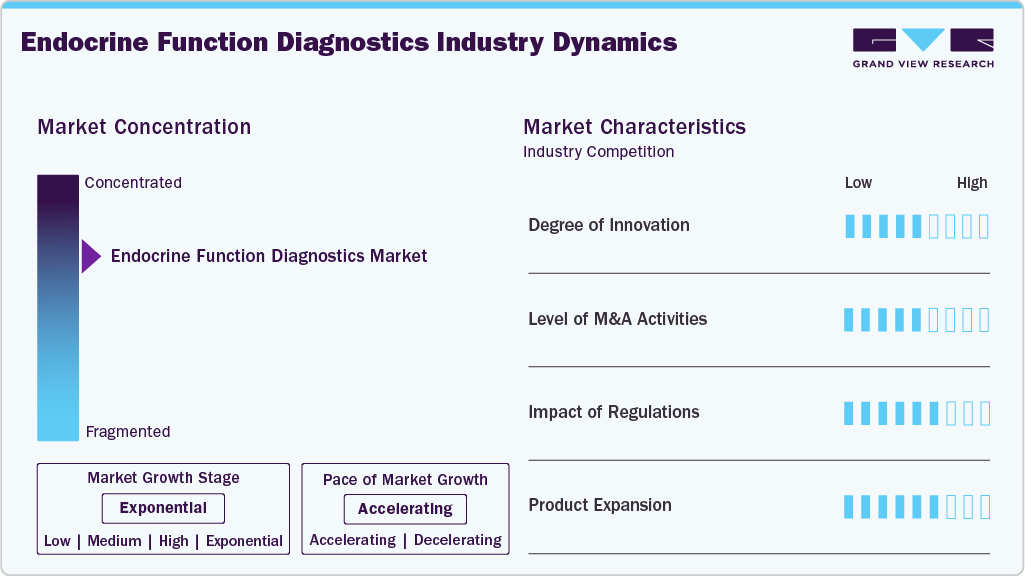

Market Concentration & Characteristics

The market has experienced a significant degree of innovation, with advanced technologies to enhance diagnostic accuracy and patient care. The landscape has evolved significantly from traditional hormone level assessments to innovative molecular and genetic analyses. Novel biomarkers, sophisticated imaging techniques, and integrated data analytics have revolutionized endocrine diagnostics, allowing for earlier detection and personalized treatment approaches. Integrating artificial intelligence and wearable devices further drives innovation, providing real-time insights into hormonal fluctuations.

Several market players, such as Abbott Laboratories, AB Sciex, and Agilent Technologies Inc., have not been extensively involved in mergers and acquisitions, indicating a relatively limited engagement in expanding their geographic presence for endocrine testing.

The impact of regulations on the market is high, as it drives demand for accurate and highly specific assays. Higher diagnostic accuracy and standardization, lower risk of false positives/negatives for hormone assays, increased industry consolidation (large players better equipped for compliance), facilitation of adoption of high-quality platforms (CLIA, chemiluminescence, LC-MS/MS) are some of the positive outcomes of the highly regulated environment.

Market leaders are diversifying their product portfolios to include innovative testing solutions, responding to the increasing demand for accurate and efficient diagnostics in endocrinology. This expansion encompasses a range of thyroid, adrenal, and reproductive hormone tests, addressing the growing need for endocrine health. Expanding the product line involves introducing complementary offerings that cater to evolving customer needs. This includes developing new features, variations, or accessories for existing products or venturing into related markets. Diversifying the product portfolio, a company can tap into different consumer segments and enhance its market presence.

Test Type Insights

The thyroid stimulating hormone (TSH) test segment led the market and accounted for the largest revenue share of 27.99% in 2024. The increasing prevalence of thyroid disorders and the rising awareness of early detection drive the demand for TSH tests. According to the NCBI article published in May 2023, TSH is an important regulator of the immune response and is also involved in maintaining the levels of several hormones, such as progesterone and human chorionic gonadotropin (hCG), in the human body. These tests assist in diagnosing thyroid dysfunction, a common endocrine issue. TSH tests play a pivotal role in assessing thyroid function by measuring the levels of thyroid-stimulating hormone. As thyroid disorders affect a significant global population, the TSH test becomes helpful in diagnosing and monitoring these conditions.

The human chorionic gonadotropin (hCG) hormone test is anticipated to witness significant market growth over the forecast period. The evolving landscape of reproductive health, coupled with advancements in fertility treatments, contributes to the expansion of hCG hormone tests. hCG remains the primary biomarker for pregnancy, and with the increasing number of pregnancies each year, the demand for hCG tests is expected to rise. A rapid rise in the use of at-home test kits in economies such as the U.S., Europe, China, and India is expected to impact market growth positively.

End Use Insights

Hospitals dominated the market in 2024. The increasing patient population and the demand for comprehensive healthcare services drive endocrine function diagnostics in hospitals. The trend towards integrated healthcare solutions reinforces the significance of hospitals as key contributors to this market. Hospitals serve as central hubs for endocrine testing, offering a diverse range of diagnostic services under one roof. The accessibility and promptness of testing in a hospital setting make it a preferred choice for individuals seeking comprehensive healthcare solutions.

Commercial laboratories is estimated to register the fastest CAGR over the forecast period. The outsourcing of diagnostic services, cost-effectiveness, and specialized testing capabilities contribute to the growth of endocrine function diagnostics in commercial laboratories. The emphasis on efficient and tailored testing solutions supports the expansion of this segment. Commercial laboratories specialize in providing a wide array of diagnostic testing services, including endocrine testing. Their ability to offer specialized and efficient testing, coupled with the flexibility of outsourcing, positions them as crucial players in the evolving landscape of endocrine diagnostics.

Application Insights

The thyroid disorders segment held the largest share of 30.18% in 2024, owing to the high and growing prevalence of hypothyroidism, hyperthyroidism, Hashimoto’s disease, and Graves’ disease, especially in women & aging populations, and growing pediatric thyroid dysfunction cases. These factors result in sustained, high-volume testing for TSH, Free T4, Free T3, anti-TPO, and anti-thyroglobulin antibodies. In addition, thyroid markers (especially TSH and FT4) are becoming mainstream in direct-to-consumer and at-home testing kits, making thyroid testing more accessible.

The diabetes & metabolic disorders segment is expected to exhibit the largest CAGR over the forecast period. Increasing prevalence of Type 1, Type 2, and gestational diabetes, driven by ageing populations, sedentary lifestyle, & obesity, escalation of pre-diabetes and insulin resistance, which expands screening volumes (HbA1c, fasting glucose, OGTT, insulin, C-peptide), growth of point-of-care (POC) HbA1c & glucose testing in clinics, pharmacies, & home settings, expansion of continuous glucose monitoring (CGM) and lab-based confirmatory tests are factors responsible for growth over the forecast period.

Technology Insights

Tandem mass spectrometry accounted for the largest revenue share in 2024, owing to factors such as high specificity & accuracy, ability to perform multiplex hormone panels, and recent technological advancements in LC-MS/MS platforms. According to the National MagLab article published in August 2023, the growing need for precision in hormone measurement drives the adoption of tandem mass spectrometry. Its ability to provide high sensitivity and specificity in analyzing multiple analytes simultaneously enhances the accuracy of endocrine testing. Tandem Mass Spectrometry stands out as a sophisticated technology that excels in measuring hormones with exceptional precision. Its applications extend to complex endocrine assessments, offering a valuable tool for clinicians seeking detailed insights into hormonal profiles.

The clinical chemistry segment is estimated to register a significant CAGR over the forecast period. The cost-effectiveness and versatility of clinical chemistry technologies make them attractive for routine endocrine testing. According to the AZoNetwork article published in July 2023, the continuous development of innovative assays within this technology further propels its adoption. Clinical chemistry encompasses various testing methods, including immunoassays and enzymatic assays, providing a broad range of biochemical analyses. Widely used in routine diagnostics, it offers a cost-effective and versatile approach to endocrine testing.

Regional Insights

North America dominated the market and accounted for a 40.48% share in 2024, driven by a rising patient awareness, high disease burden, technological advancements, proactive government measures, and improvements in healthcare infrastructure. The U.S. dominated the North America regional market due to a high number of thyroid cancer cases. According to the American Cancer Society article published in January 2023, about 43,720 new cases of thyroid cancer have been reported in the U.S., with 12,540 cases in men and 31,180 in women. Out of these cases, 4,444 have led to death. The deaths include 970 men and 1,150 women. Especially, thyroid cancer tends to be diagnosed at a relatively young age compared to other adult cancers, with an average age of 51 years at the time of diagnosis.

U.S. Endocrine Function Diagnostics Market Trends

The endocrine function diagnostics market in the U.S. is projected to grow significantly during the forecast period, driven by a combination of factors, including increasing awareness of the benefits of early disease detection, growing focus on tailored diagnostics & personalized medicine, and increasing development and adoption of POC endocrine tests that provide faster results, particularly in outpatient settings.

Europe Endocrine Function Diagnostics Market Trends

The endocrine function diagnostics market in Europe is likely to emerge as a lucrative region in the industry, strongly driven by universal public healthcare systems, high screening rates for thyroid and metabolic disorders, and growing preventive-health initiatives. Also, robust lab infrastructure and strong adoption of automated immunoassays and multiplex testing platforms help sustain growth.

The UK endocrine function diagnostics market is projected to grow during the forecast period. In the UK, the NHS’s emphasis on early detection and long-term management of endocrine conditions fuels routine thyroid, diabetes, and hormone panels. Regulatory stability and reimbursement for endocrine panels make the UK a key market within Europe.

The endocrine function diagnostics market in Germany is underpinned by its advanced healthcare infrastructure, strong hospital and reference lab networks, and high utilization of sophisticated assay technologies (e.g., LC-MS/MS).

Asia Pacific Endocrine Function Diagnostics Market Trends

The endocrine function diagnostics market in the Asia Pacific is anticipated to witness the fastest growth over the forecast period. One of the primary factors driving this growth is an increase in the geriatric population, a high number of patients with obesity cases, and the development of healthcare infrastructure. China dominated the Asia Pacific regional market due to a high number of obesity cases. According to the NCBI article published in July 2023, the proportion of overweight and obese adults in China reached 50.7% in the year 2022. Genetic inheritance is an important risk factor for childhood overweight and obesity. Children are two to three times more likely to be obese if one parent is obese, and 15 times more likely to be obese if both parents are obese. These aspects are boosting the market.

China endocrine function diagnostics market is projected to expand throughout the forecast period, driven by several key factors, including increasing prevalence of diabetes and obesity-related endocrine disorders, rising health awareness, and government investments in preventive healthcare. Expansion of diagnostic lab infrastructure, alongside adoption of automated platforms and multiplex hormone panels, is fueling growth in endocrine testing.

The endocrine function diagnostics market in Japanis expected to grow during the forecast period, driven by the increased incidence of thyroid dysfunction, metabolic syndrome, and adrenal disorders. High healthcare spending, strong reimbursement schemes, and adoption of high-precision diagnostics (including mass spectrometry) support the uptake of endocrine tests.

Latin America Endocrine Function Diagnostics Market Trends

The endocrine function diagnostics market in Latin America is expected to experience significant growth throughout the forecast period. Investments in laboratory modernization, increased access to diagnostic services, and awareness campaigns for metabolic and hormonal health are key growth levers.

MEA Endocrine Function Diagnostics Market Trends

The endocrine function diagnostics market in the MEA is being supported by rapid healthcare infrastructure development, rising burden of non-communicable diseases (like diabetes), and government-led chronic disease initiatives. The region is also witnessing increased deployment of point-of-care testing and advanced lab automation, improving endocrine test access in both urban and underserved areas.

Key Endocrine Function Diagnostics Company Insights

Abbott Laboratories, AB Sciex, and Agilent Technologies Inc. are some of the dominant players operating in the market. Laboratory Corporation of America Holdings, Quest Diagnostics Incorporated, and Ortho Clinical Diagnostics are some of the emerging market players. Major players are increasingly focusing on strategic initiatives, such as product launches & development, mergers & acquisitions, licensing partnerships, and co-development deals, making this market highly competitive.

Key Endocrine Function Diagnostics Companies:

The following are the leading companies in the endocrine function diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Laboratories

- AB Sciex

- Agilent Technologies Inc.

- bioMerieux SA

- Bio-Rad Laboratories Inc.

- DiaSorin S.p.A.

- F. Hoffmann-La Roche Ltd.

- Laboratory Corporation of America Holdings

- Quest Diagnostics Incorporated

- Ortho Clinical Diagnostics

Recent Developments

-

In January 2025, Eli Health launched Hormometer, a saliva-based hormone analysis device that uses smartphone analysis by turning smartphones into portable hormone analyzers.

-

In September 2024, Trinity Biotech acquired Metabolomics Diagnostics to expand its presence in maternal mental health. Metabolomics Diagnostics expertise would help Trinity Biotech to expand into advanced biomarker-based endocrine testing.

-

In April 2023, Eli Health raised USD 3.6 million to improve women's health with saliva-based continuous hormone monitoring technology. The initial business focus will be in the areas of menopause, fertility, and general health needs. In later stages, expansion into other areas such as contraception and endocrine diseases is planned, once the necessary additional regulatory and clinical work is completed.

-

In October 2023, Eli Lilly reported results from LIBRETTO-431 and LIBRETTO-531 Phase 3 trials at ESMO Congress 2023. Assessing Retevmo (selpercatinib), LIBRETTO-431 studied its efficacy in RET fusion-positive NSCLC, while LIBRETTO-531 focused on RET-mutant MTC. Compared to chemotherapy and MKIs, respectively, Retevmo showcased promising outcomes in these advanced cancers.

-

In November 2023, the FDA approved Eli Lilly and Company's Zepbound (tirzepatide) injection as the first obesity treatment activating both GIP and GLP-1 hormone receptors. It is indicated for adults with obesity or overweight individuals with related medical problems, aiding weight loss when used with a reduced-calorie diet and increased physical activity.

Endocrine Function Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.22 billion

Revenue forecast in 2033

USD 26.23 billion

Growth rate

CAGR of 8.0% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, technology, end use, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott Laboratories; AB Scie;, Agilent Technologies Inc.; bioMerieux SA; Bio-Rad Laboratories Inc.; DiaSorin S.p.A.; F. Hoffmann-La Roche Ltd.; Laboratory Corporation of America Holdings; Quest Diagnostics Incorporated; Ortho Clinical Diagnostics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endocrine Function Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global endocrine function diagnostics market report based on test type, technology, end use, application and region:

-

Test Type Outlook (Revenue in USD Million, 2021 - 2033)

-

Estradiol (E2) Test

-

Follicle Stimulating Hormone (FSH) Test

-

Human Chorionic Gonadotropin (hCG) Hormone Test

-

Luteinizing Hormone (LH) Test

-

Dehydroepiandrosterone Sulfate (DHEAS) Test

-

Progesterone Test

-

Testosterone Test

-

Thyroid Stimulating Hormone (TSH) Test

-

Prolactin Test

-

Cortisol Test

-

Insulin Test

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Tandem Mass Spectrometry

-

Immunoassay

-

Monoclonal & Polyclonal Antibody Technologies

-

Sensor Technology

-

Clinical Chemistry

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Thyroid Disorders

-

Diabetes & Metabolic Disorders

-

Adrenal Disorders

-

Pituitary Disorders

-

Reproductive & Fertility Disorders

-

Bone-Mineral Disorders

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Commercial Laboratories

-

Ambulatory Care Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endocrine function diagnostics market size was estimated at USD 13.16 billion in 2024 and is expected to reach USD 14.22 billion in 2025.

b. The global endocrine function diagnostics market size was valued at USD 13.16 billion in 2024 and is projected to reach USD 26.23 billion by 2033, growing at a compound annual growth rate (CAGR) of 8.0% from 2025 to 2033.

b. Based on test type, TSH segment dominated the global market and accounted for the largest revenue share of 27.99% in 2024.

b. Some key players operating in the endocrine function diagnostics market include Abbott Laboratories, AB Sciex, Agilent Technologies Inc., bioMerieux SA, Bio-Rad Laboratories Inc., DiaSorin S.p.A.,F. Hoffmann-La Roche Ltd., Laboratory Corporation of America Holdings, Quest Diagnostics Incorporated, Ortho Clinical Diagnostics

b. Key factors that are driving the endocrine function diagnostics market growth include growing prevalence of endocrine disorders, strong shift towards precision diagnostics, and technological innovations in assays and platforms

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.