- Home

- »

- Medical Devices

- »

-

Endodontic Devices Market Size And Share Report, 2030GVR Report cover

![Endodontic Devices Market Size, Share & Trends Report]()

Endodontic Devices Market (2025 - 2030) Size, Share & Trends Analysis By Type (Instruments, Endodontic Consumables), By End Use (Dental Hospitals, Dental Clinics), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-049-1

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Endodontic Devices Market Summary

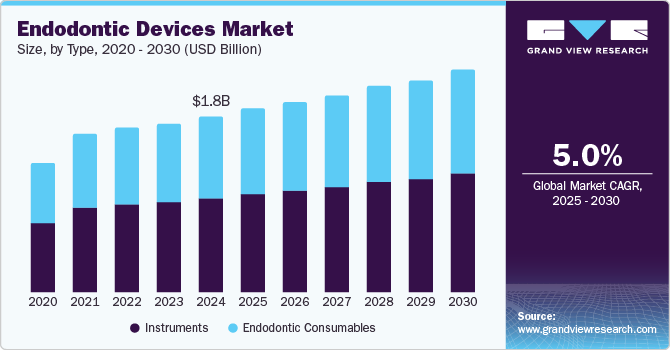

The global endodontic devices market size was estimated at USD 1.75 billion in 2024 and is projected to reach USD 2.35 billion by 2030, growing at a CAGR of 5.0% from 2025 to 2030. This growth can be attributed to the growing prevalence of dental infections, decay, and dental caries, which necessitate endodontic treatments. Moreover, the rise in dental tourism and technological advancements in endodontic devices further contribute to the market growth.

Key Market Trends & Insights

- North America endodontic devices market dominated the market with a share of over 39.13% in 2024.

- The endodontic devices market in the U.S. held the largest share in the North American market in 2024.

- Based on type, the consumables segment accounted for the largest revenue share of over 58.2% in 2024.

- Based on end use, the dental clinics segment is expected to grow at the highest CAGR of 5.3% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1.75 Billion

- 2030 Projected Market Size: USD 2.35 Billion

- CAGR (2025-2030): 5.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, the growing investments by key players, such as Danaher and Dentsply Sirona, for geographical expansion are expected to further boost the market. A rise in sugar and tobacco consumption has led to an increased prevalence of tooth decay and infection in children & adults. In the UK, oral health is improving; however, 24.7% of children aged 5 years & above have tooth decay, with an average of 3 to 4 teeth affected. Poor oral health leads to expensive treatments, resulting in a significant burden on the national government. Dental tourism involves patients seeking dental care outside their local healthcare systems.Dental Tourism is growing worldwide due to increased competition and technological advancements, enabling providers in developing countries to offer dental care at economical costs compared to their counterparts in developed countries. In destination countries, dental tourism gained popularity among Europeans and Americans owing to the cost savings associated with dental services, such as root canals, fillings, dental bridges, and orthodontic care. In Costa Rica, international tourists seeking dental care accounted for 40.0% of all medical tourist populations. According to Promed, people worldwide travel to developing countries for dental treatments primarily because it saves 60.0% to 70.0% of their overall treatment costs.

According to WHO, European and Asian countries have a high prevalence of dental diseases, with dental caries being the most frequent condition. Developing Asian countries such as India and China are witnessing an increase in dental diseases due to the growing consumption of sugary foods, poor tooth-brushing habits, and a low level of awareness about dental caries.

However, the advent of the COVID-19 pandemic affected the overall dental and oral hygiene market. Regular dental visits, appointments, and consultations ceased in many countries, and key manufacturers reported supply chain and operational constraints. However, the market is expected to recover, and according to the American Dental Association, 39.0% of practices in the U.S. are fully operational with the volume of patients they were treating before the pandemic.

Type Insights

Based on type, the consumables segment accounted for the largest revenue share of over 58.2% in 2024. Consumables are used for various applications in endodontic procedures, such as access preparation, shaping & cleaning, and obturation. The advancement in consumable products enhances their performance and effectiveness, contributing to their increasing demand. The rising preference for NiTi instruments that provide super-elasticity and help preserve the original anatomy of the apical foramen is anticipated to boost the motor-driven equipment segment. Handpieces are conventional yet emerging technology with various electric handpieces with different designs, applications, materials, and manufacturing methods.

In recent years, multiaxis grinding machinery has provided better cutting ability and flexibility when handling files. Electric motors are relatively inexpensive compared to air-driven units and are compact & mobile. The most used endodontic motors have a continuous and reciprocating motion function as they provide ease of use and save time. Dentsply Sirona offers an X-Smart IQ handpiece, a continuous and reciprocating cordless motor with an Apple iOS-controlled application, offering different torque settings and real-time torque monitoring. Within the consumable domain, the Dental Hospitals segment is driven by the growth in guided endodontics, which allows better predictability, safety, and clinical feasibility to locate canals and prevent root perforation. Navigation in dentistry is a significant example of technological advancement, as it has transformed surgical interventions to be safer, more reliable, and predictable. A computer-aided design-based methodology has spurred the demand for customized endodontics.

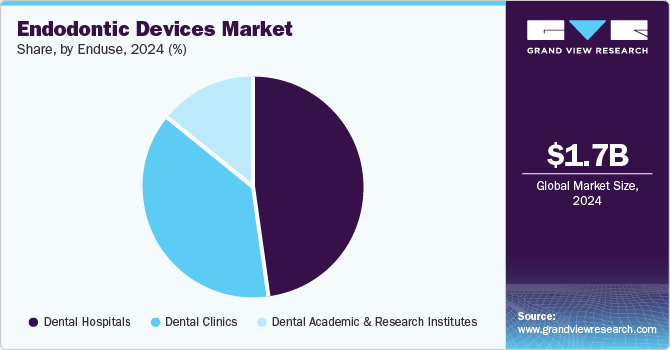

End Use Insights

The dental clinics segment is expected to grow at the highest CAGR of 5.3% over the forecast period. These healthcare facilities are witnessing demand due to their better operational efficiency, ability to offer specialized care, and improved patient outcomes. Moreover, the increasing number of dental clinics globally makes them more accessible and convenient for patients opting for endodontic procedures.

The presence of skilled and certified dental professionals, like dental surgeons, in such settings in hospital settings is also boosting growth. Hospital facilities are well equipped with advanced devices for effective diagnosis and quality treatment of dental conditions. Moreover, many patients prefer dental hospitals to undergo surgical dental treatments as the quality of dental care and service provided to the patients are high. However, the dental clinic segment is expected to witness high growth over the forecast period. Dental clinics are increasingly focusing on personalized attention, customized treatment plans, lower waiting times, specialist treatment, upgrading dental technology, and effective yet economical treatment, and these factors are driving the segment's market growth.

Regional Insights

North America endodontic devices market dominated the market with a share of over 39.13% in 2024. The market is driven by the rising prevalence of dental diseases and conditions in the region, such as dental pulp, tooth decay, and nerve infections, which has significantly increased the demand for endodontic procedures and treatments. This rise in treatments is further supported by the region's increasing awareness and emphasis on oral health and dental hygiene.

U.S. Endodontic Devices Market Trends

The endodontic devices market in the U.S. held the largest share in the North American market in 2024, owing to an increased prevalence of dental diseases and the rising demand for dental procedures among the aging population. Dental statistics by the Centers for Disease and Prevention (CDC) in June 2024 stated that one-quarter of the U.S. adults ages 20 to 64 suffer from at least one untreated cavity, and 42.0% of adults have periodontal (gum) disease. Technological advancements in endodontic devices, offering more efficient and less painful treatment options, also contribute to the market expansion.

Europe Endodontic Devices Market Trends

The endodontic devices market in Europe is experiencing significant growth driven by several key factors. First, the increasing prevalence of dental diseases, particularly in aging populations, prompts a higher demand for endodontic treatments. As patients become more aware of the importance of preserving their natural teeth, there is a notable rise in root canal procedures. Companies like Dentsply Sirona have a long-established presence in the European market, particularly in Germany, Sweden, France, and the UK.

The UK endodontic devices market is primarily driven by the increasing prevalence of dental conditions requiring root canal treatments. As more patients seek dental care and awareness of oral health grows, the demand for effective endodontic solutions is rising. For instance, in July 2024, Between January and March 2024, 2.56 million adults participated in the GP Patient Survey, sharing their perspectives on NHS dentistry.

The endodontic devices market in Germany is experiencing robust growth, primarily driven by an increasing prevalence of dental diseases and a growing aging population. As the demand for effective root canal treatments rises, more patients seek specialized endodontic care to preserve their natural teeth. This trend is further supported by heightened awareness of oral health and the critical role of endodontic procedures in maintaining dental aesthetics, prompting patients and practitioners to prioritize these treatments.

Asia Pacific Endodontic Devices Market Trends

The endodontic devices market in Asia Pacific is anticipated to experience the fastest growth over the forecast period due to the growing number of dental care centers, rising dental tourism, increasing R&D activities, and growing awareness about dental care. In developing economies, including India, there is limited or no access to oral health services, leading to a high incidence of dental diseases.

Japan endodontic devices market is experiencing significant growth, driven by technological advancements, an aging population, and increasing dental health awareness. Technological innovations in endodontic devices, including more efficient and patient-friendly solutions, make endodontic procedures more accessible and less intimidating for patients. This, coupled with Japan's demographic trend of an aging population, which typically shows a higher demand for dental care, including complex procedures such as root canal treatments, is propelling the market forward.

The endodontic devices market in China is primarily driven by the rapid expansion of the dental care sector, fueled by an increasing awareness of oral health and a growing middle class seeking advanced dental treatments. As urbanization progresses, more individuals access dental care services, leading to a higher demand for endodontic procedures.

South Korea endodontic devices market is expected to grow significantly over the forecast period due to the increasing prevalence of dental diseases, a growing elderly population more susceptible to tooth decay and gum diseases, and a rising emphasis on dental aesthetics. In addition, advancements in endodontic procedures and devices offer more efficient and less painful treatment options, encouraging more patients to opt for these treatments. The South Korean market also benefits from the growing disposable incomes, enabling individuals to invest more in their dental health.

Latin America Endodontic Devices Market Trends

The endodontic devices market in Latin America is experiencing significant growth, primarily driven by the increasing prevalence of dental diseases and a growing dental health awareness among the population. For instance, in 2022, as per a study on Global excellence in dental medicine in South America, 18,172 scientific articles in Dentistry were published globally, with Brazil contributing the highest number at 1,698, followed closely by the United States with 1,682.

Brazil endodontic devices market is expected to grow significantly over the forecast period.The rising prevalence of dental diseases and conditions, such as tooth decay and periodontal diseases, results in increased demand for endodontic treatments and procedures, driving the market forward. In addition, advancements in endodontic devices, incorporating cutting-edge technologies for more efficient and effective treatments, have significantly contributed to market growth. These advancements improve the success rates of endodontic procedures and enhance patient comfort, further boosting demand for such devices.

MEA Endodontic Devices Market Trends

The endodontic devices market in the Middle East & Africa is experiencing significant growth, driven by the increasing prevalence of dental diseases and conditions, such as tooth decay and periodontal diseases, which propels the demand for endodontic services and procedures. For instance, in March 2023, in Saudi Arabia, a high prevalence of dental caries affected 96 of 6-year-olds and 93.7% of 12-year-olds.

Saudi Arabia endodontic devices market dominated the MEA region in 2024. The rising awareness about oral hygiene and preventative dental care among the population has increased dental visits and treatments, fueling market growth. Furthermore, the Saudi government's supportive policies towards healthcare infrastructure, including substantial investments in the latest dental technologies and facilities, have created a conducive market expansion environment. For instance, in 2024, the Saudi Dental Society announced various activities during World Oral Health Day (WOHD) 2024 in Saudi Arabia to enhance the general public's understanding of oral health and promote the proactive management of chronic oral conditions and diseases.

Key Endodontic Devices Company Insights

Many major industry players are undertaking various strategies to strengthen their market presence. Some key strategies market players adopt include new product launches, mergers, acquisitions, partnerships, and geographical expansions.

Key Endodontic Devices Companies:

The following are the leading companies in the endodontic devices market. These companies collectively hold the largest market share and dictate industry trends.

- Danaher

- Dentsply Sirona

- FKG Dentaire

- Ultradent Products

- Ivoclar Vivadent

- Septodont

- COLTENE

- Micro-Mega

- Brasseler Holdings LLC

- DiaDent Group International

Recent Developments

-

In August 2024, Dentsply Sirona introduced the X-Smart Pro+ and Reciproc Blue in the U.S., offering a streamlined, one-file solution for endodontic procedures. This launch aims to simplify root canal treatments by providing a highly efficient and reliable system.

-

In November 2023, Kerr Dental launched ZenSeal, its first bioceramic endodontic sealer. Made from calcium silicate, ZenSeal offers excellent flowability and ensures a strong bond to dentin and gutta percha in simple and complex root canal cases. Its single-syringe delivery system reduces product waste by over 60% compared to a leading competitor, making it a cost-effective option for clinicians.

Endodontic Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.84 billion

Revenue forecast in 2030

USD 2.35 billion

Growth rate

CAGR of 5.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Danaher; Dentsply Sirona; FKG Dentaire; Ultradent Products; Ivoclar Vivadent; Septodont; COLTENE; Micro-Mega; Brasseler Holdings LLC; DiaDent Group International.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Endodontic Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and county levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global endodontic devices market based on type, end use, and regions:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Apex Locators

-

Endodontic Motors

-

Endodontic Scalers

-

Handpieces

-

Endodontic Lasers

-

Machine Assisted Obturation Systems

-

Others

-

-

Endodontic Consumables

-

Access Preparation

-

Shaping and Cleaning

-

Obturation

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Hospitals

-

Dental Clinics

-

Dental Academic and Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endodontic devices market size was estimated at USD 1.76 billion in 2024 and is expected to reach USD 1.86 billion in 2025.

b. The global endodontic devices market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2030 to reach USD 2.38 billion by 2030.

b. North America dominated the endodontic devices market with a share of over 39.5% in 2024. This is attributable to the introduction of innovative sources of ultrasound, the prevalence of dental caries among children, and the introduction of innovative sources of ultrasound.

b. Some key players operating in the endodontic devices market include Danaher, Dentsply Sirona, FKG Dentaire, Ultradent Products, Ivoclar Vivadent, Septodont, COLTENE, Micro-Mega, Brasseler Holdings, LLC and DiaDent Group International.

b. Key factors that are driving the endodontic devices market growth include the high prevalence of dental caries, growing expenditure on dental care, overall growth in consumer disposable income, and a rise in dental tourism.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.