- Home

- »

- Power Generation & Storage

- »

-

Energy As A Service Market Size & Share Report, 2021-2028GVR Report cover

![Energy As A Service Market Size, Share & Trends Report]()

Energy As A Service Market Size, Share & Trends Analysis Report By Service (Supply, Demand, Energy Optimization), By End-use (Commercial, Industrial), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-3-68038-854-1

- Number of Report Pages: 79

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Energy & Power

Report Overview

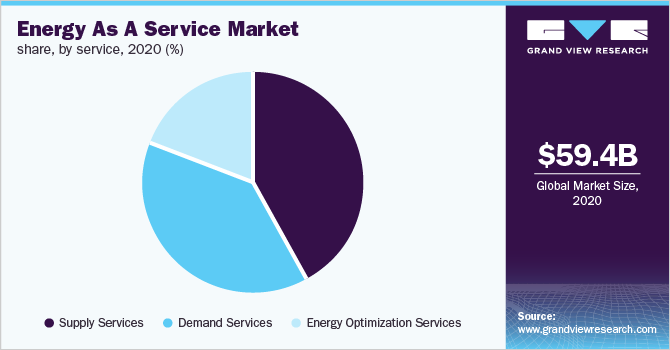

The global energy as a service market size was valued at USD 59.37 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 8.9% from 2021 to 2028. An increase in Distributed Energy Resources (DER), tax benefits for energy efficiency projects, new revenue generation streams for utilities, and a decrease in the cost of renewable power generation and storage solutions are some of the factors driving the growth. The market is driven by the rising potential of renewable energy, price volatility, and rising energy consumption are other significant factors driving growth. Organizations have gradually been looking for sustainable energy sources, which in turn is anticipated to positively influence the growth.

The Energy as a Service (EaaS) concept is still at its nascent stage, especially in developing economies. The market for EaaS is segmented on the basis of service type and end user. The services include management of usage, supply, and assessment. Most energy providers are opting for partnerships and business collaborations in order to attract more consumers. Developed countries, such as the U.S. and Canada have laid down policies and regulatory standards to promote the adoption of EaaS.

Increasing focus on renewable as well as non-renewable energy sources that mainly support renewable energy due to lowers costs, reduced carbon footprint, environment-friendly, and energy-efficient is projected to contribute to the market growth. Increasing government investments in sponsoring renewable sources are anticipated to drive the growth of the market over the forecast period.

Energy as a service also provides the customers with the flexibility of choice regarding pricing and ownership. It also helps the operators customize energy generation projects based on different power requirements of the customers in terms of both robust and modern. The service also enables easy and rapid assimilation of energy storage assets with a distributed generation system.

Energy As A Service Market Trends

Growing energy consumption across the globe is a major driver for the growth of the market. Energy as a service companies offers several software and technical solutions through which the companies understands the pattern of power consumption. Since energy consumption is growing at a rapid rate, energy is used across several sectors; the commercial sector is one of the noteworthy segments that use a higher capacity of energy to operate district heating services. Since many preexisting technologies used to generate power using renewable energy will increase usage of electricity consumption across the commercial sector.

A growing economy with increasing infrastructure requirements is driving energy demand and costs. When the economy malfunctions, demand and costs often fall. Most of our energy comes from fossil fuels such as coal and natural gas. This is usually the cheapest form of energy production. A shortage of these fossil fuels will require other, more expensive forms of energy production, ultimately leading to higher energy prices.

Energy pricing affects the cost-effectiveness of energy efficiency. Massachusetts included in New England has relatively high energy prices as compared to other states in the U.S. As of March 2016, the residential electricity prices were 19.84 cents per kilowatt hour, which were significantly higher than the U.S. average electricity prices. A similar trend is observed in all three sectors including commercial, industrial, and transportation. Natural gas prices are also higher than the U.S. average for the residential sector.

The high deployment costs of transforming the current utility infrastructure are expected to impede market growth during the forecast period. The energy business model as a service is based on real-time information and data analysis of consumer energy consumption and electricity market conditions. Therefore, collecting real-time information requires the deployment or maintenance of support infrastructure such as advanced measurement infrastructure, intelligent devices, and communications infrastructure. This will increase demand for utility infrastructure transformations and drive follow-up investments while curbing market growth during the forecast period.

End-user Insights

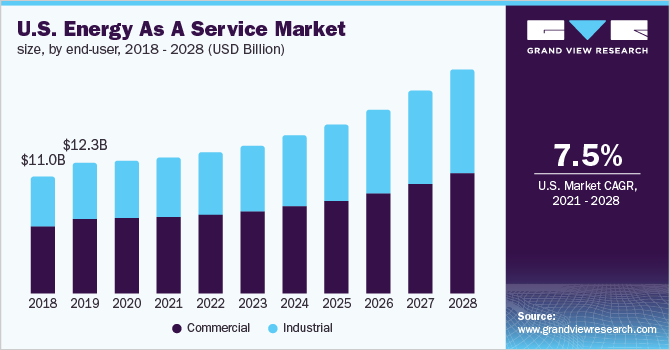

On the basis of end user, the energy as a service market is segmented into commercial and industrial users. The commercial segment is projected to register the fastest growth during the forecast period. The segment includes establishments, such as educational institutions, healthcare institutes, information centers, airports, and others. In the commercial sector, the buildings are solely responsible for more than 30% of overall consumption. As per the American Council for Energy-Efficient Economy (ACEEE), these institutions/establishments account for over 18% of the energy used by various sectors in the United States. Furthermore, half of the energy used by the commercial sector goes toward lighting and heating.

The growth in the segment can be attributed to various factors including an increase in occupancy, floor area, and admittance to services coupled with a surge in activities, including changes in climate and population. Different types of commercial buildings have exceptional energy needs and the EaaS market helps the commercial owner’s technical expertise and limited capital to instrument efficiency programs. Among several types of commercial buildings, service, and mercantile buildings consume most of the energy and are thus anticipated to contribute to the market growth.

The industrial segment is anticipated to hold the largest market share during the forecast period with energy service operations being mandated in the commercial segment. This is mainly because of significant structural impacts such as economic growth.

Service Insights

Based on service, the market for energy as a service is bifurcated into supply, demand, and optimization services. Supply service accounted for the largest market share in 2020 whereas, the demand services segment, on the other hand, is anticipated to register the fastest CAGR over the forecast period. Rising government efforts to encourage renewable energy coupled with the need for cost containment and energy conservation are anticipated to bode well for the growth of the segment in the forthcoming years.

The demand service segment held the leading market share in 2020 and is anticipated to continue leading the market during the forecast period. With the growing prices, the consumers are looking to procure robust energy supply in the absence of grid. This factor is anticipated to fuel the growth of the segment in near future.

The demand response management solution is expected to be vital in Energy as a service, which schedules the operation of appliances to save energy costs by considering the characteristics of electric equipment as well as customer convenience. Moreover, the solution advances the reliability of electrical grids and decreases the electricity cost of customers by shifting part of the demand from peak to off-peak demand periods. This has resulted in the increased adoption of demand services in industrial facilities.

The energy optimization services segment, on the other hand, is anticipated to register a healthy growth rate over the forecast period. Rising government efforts to encourage renewable energy coupled with the need for cost containment and energy conservation are anticipated to bode well for the growth of the segment in the forthcoming years.

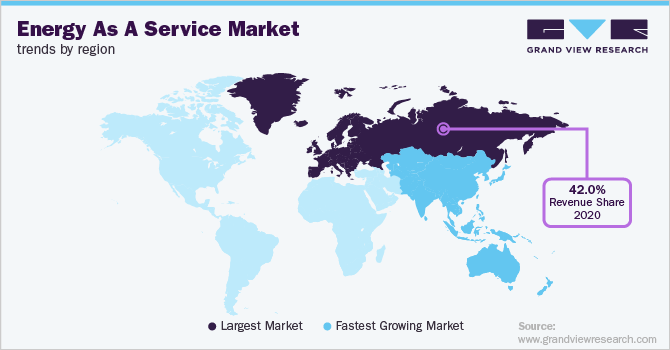

Regional Insights

Europe is projected to remain as the largest regional segment for energy as a service, at a market share of 41.85% in 2028, owing to the presence of intelligent building and building automation vendors in the utility and space. Key players in the region are inclined towards reducing costs for delivering services and enhancing the customer experience as per their needs.

Europe, led by Germany, Italy, and UK emerged as the largest regional market in 2020 of the global energy as a service market share. Various manufacturing enterprises have witnessed a rising trend of technology adoption in their operating facilities. IT-enabled high performance and intelligent manufacturing process is one of the key trends driving manufacturing industry in the region. In addition, revisions in European Commission legislative norms to incorporate energy efficiency in various industrial, commercial and residential sectors is expected to drive technological advancements in manufacturing and power & energy sectors over the next few years.

North America is projected to emerge as the second-largest regional segment. Key players are inclined toward reducing costs for delivering services and enhancing the customer experience.

The United States has a majority share of the North American energy market as a service, and this trend is expected to continue until 2028. North America is expected to be the largest regional segment due to the presence of smart building and building automation vendors. Key players tend to reduce the cost of providing services and improve the customer experience. Industry growth is expected to trigger a green building model, and also, support from their respective governments will lead to consumption-based energy measurements.

Asia Pacific is expected to witness the highest market growth due to the rise in large enterprises. For instance, in 2019, India had more than 300 proposed smart cities projects worth $2 billion. Although energy as a service is still in a nascent stage in the region, the exhaustion of fossil fuels for electricity generation is anticipated to create growth opportunities for the market in the forthcoming years. Moreover, the adoption of green building models and rising government support are some of the factors projected to fuel regional growth.

China will hold the largest market share in the Asia Pacific region in 2020 and will register a significant CAGR during the forecast period. The Chinese government has been actively investing in energy efficient power generation. They also opened a channel for foreign investment in the country. This is expected to boost the energy market as a service in the region.

Key Companies & Market Share Insights

The market looks promising as the large and small enterprises are looking for easy accessibility of energy sources from trading facilities. Hence, the governing bodies need to take major steps to strengthen the infrastructure for safeguarding quality and safety. The key players are also undertaking contracts for DER and energy efficiency solutions and audits and are thus contributing to the overall growth. However, deployment and integration challenges coupled with the governance of the centralized utility models may hamper the growth.

Nevertheless, the introduction of pay as you go and free for service models is expected to bode well for the key players. The companies are focusing on the successful deployment and distribution of energy to commercial and residential sectors. The ability to determine overhead intake helps them manage the energy portfolio to encounter their goals. The shift toward decentralized supplies is anticipated to help new players to enter the market. The providers are focusing on widening their geographical reach. The rising adoption of smart cities, energy storage systems, and electric vehicles is expected to positively influence their growth.

The key players include Schneider Electric; Engie; Siemens; Honeywell International Inc.; Veolia; Enel X S.r.l.; and EDF. Schneider Electric is a major player in automation and energy management. The company is inclined toward providing microgrids as services to commercial and governmental institutions. It has signed several agreements to enhance the EaaS business model driving the adoption of microgrids. Engie is another prominent player and is engaged in undertaking several novel and innovative initiatives to cater to the rising demand for sustainable and customized solutions.

Energy As A Service Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 61.4 billion

Revenue forecast in 2028

USD 111.8 billion

Growth rate

CAGR of 8.9 % from 2021 to 2028

Base year for estimation

2020

Actual estimates/Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in kilo tons, revenue in USD Million and CAGR from 2021 to 2028

Report coverage

Volume and revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Service, end user, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa’; Central & South America

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; South Korea; Brazil; Saudi Arabia

Key companies profiled

Schneider Electric; Siemens; Engie; Honeywell International Inc.; Veolia; EDF; Johnson Controls; Bernhard; General Electric; Entegrity; Enel SpA; Ørsted A/S; NORESCO, LLC; Centrica plc; Wendel

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Energy As A Service Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this report, Grand View Research has segmented the global energy as a service market report on the basis of service, end user, and region:

-

Service Outlook (Revenue, USD Billion, 2016 - 2028)

-

Supply

-

Demand

-

Energy Optimization

-

-

End-user Outlook (Revenue, USD Billion, 2016 - 2028)

-

Industrial

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2016 - 2028)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."