- Home

- »

- IT Services & Applications

- »

-

Energy Cloud Market Size & Share, Industry Report, 2033GVR Report cover

![Energy Cloud Market Size, Share & Trends Report]()

Energy Cloud Market (2025 - 2033) Size, Share & Trends Analysis Report By Component, By Deployment Mode, By Service Model, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-788-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Energy Cloud Market Summary

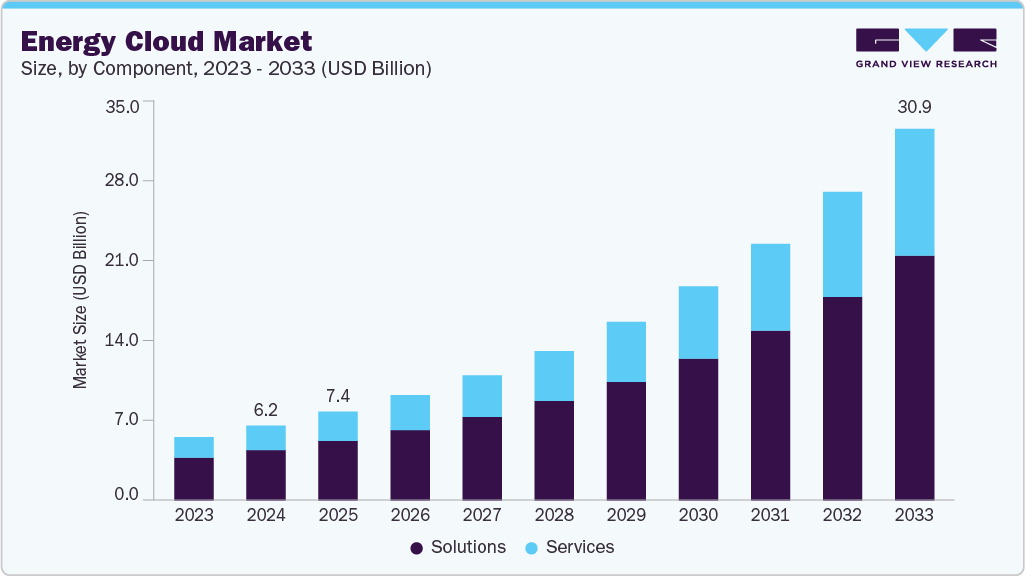

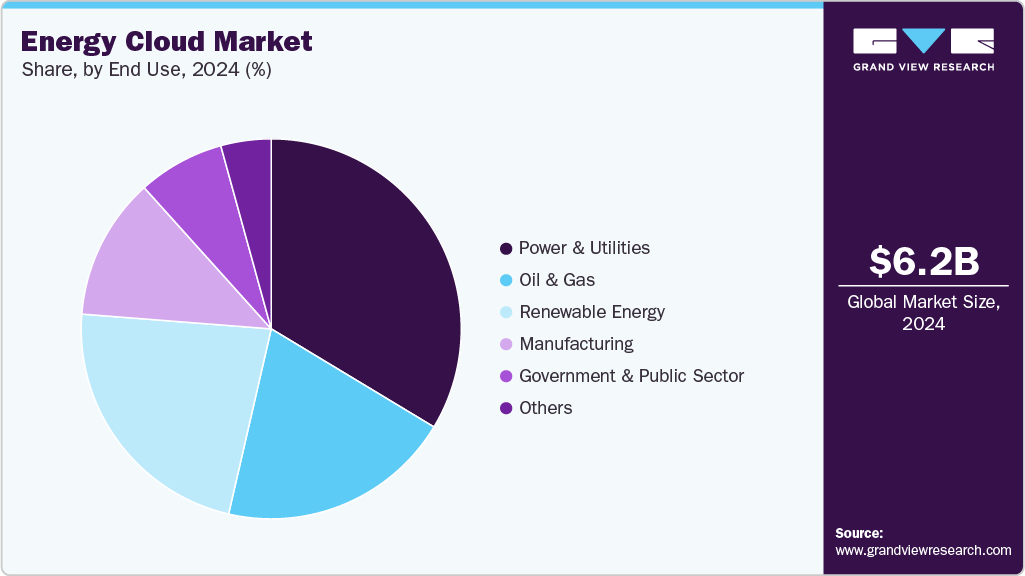

The global energy cloud market size was estimated at USD 6.24 billion in 2024 and is projected to reach USD 30.93 billion by 2033, growing at a CAGR of 19.6% from 2025 to 2033. The growth of the global energy cloud market is driven by the convergence of cloud-native technologies, IoT-enabled energy infrastructure, and AI-powered analytics that are transforming the way energy is generated, managed, and consumed.

Key Market Trends & Insights

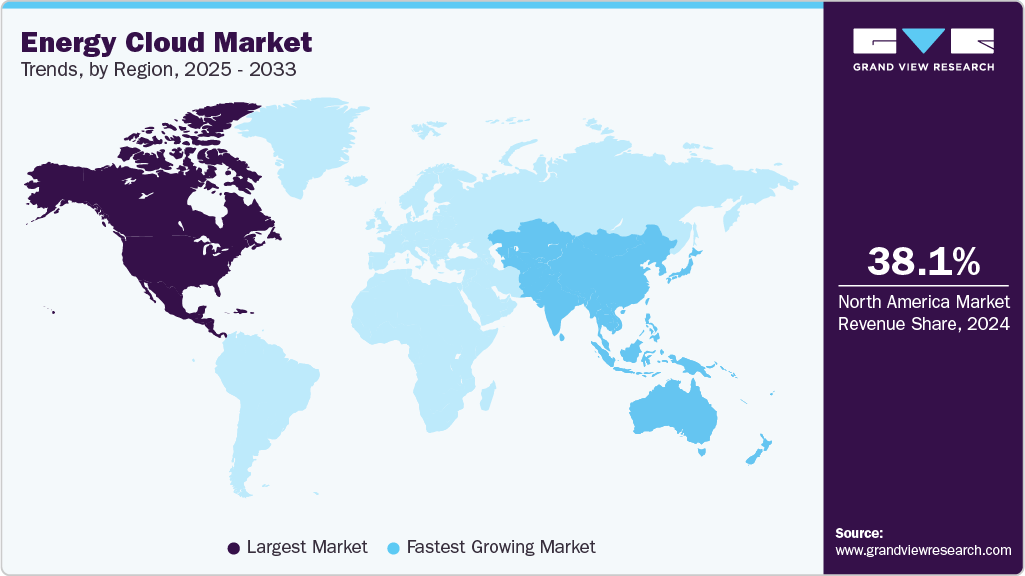

- North America held a 38.10% revenue share of the global energy cloud market in 2024.

- In the U.S., the market is driven by the rapid deployment of smart grid initiatives, advanced metering infrastructure (AMI), and large-scale renewable integration.

- By component, the solutions segment held the largest revenue share of 67.25% in 2024.

- By deployment mode, the public cloud segment held the largest revenue share in 2024.

- By service, the Software as a Service (SaaS) segment accounted for the largest revenue share of 39.92% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.24 Billion

- 2033 Projected Market Size: USD 30.93 Billion

- CAGR (2025-2033): 19.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Enterprises across the energy value chain including utilities, independent power producers (IPPs), grid operators, and renewable developers are increasingly adopting Energy Cloud solutions to modernize their operations and transition toward a more digital, resilient, and sustainable energy ecosystem. These cloud-based platforms enable real-time visibility across generation, transmission, and distribution networks, allowing operators to monitor grid health, forecast demand, and manage distributed assets more efficiently. Through advanced analytics and AI-driven insights, organizations can optimize asset utilization, reduce unplanned downtime, and extend the lifespan of critical infrastructure such as turbines, transformers, and substations. Moreover, cloud-based automation supports predictive maintenance and dynamic load balancing, improving grid reliability while minimizing operational costs.

The growth of the global energy cloud market is being propelled by the convergence of cloud-native architectures, IoT-enabled infrastructure, and AI-driven analytics, which are redefining how energy is produced, distributed, and managed. Energy enterprises including utilities, grid operators, and renewable developers are increasingly transitioning from legacy on-premises systems to intelligent, cloud-based platforms that provide real-time visibility, predictive insights, and automated control across distributed assets. These platforms enable predictive maintenance, demand forecasting, and dynamic load balancing, helping organizations improve operational efficiency and grid reliability while reducing downtime. The rising integration of renewable energy resources such as solar and wind, combined with regulatory emphasis on decarbonization and grid modernization, further accelerates cloud adoption. By unifying data from generation, transmission, and consumption points, the energy cloud empowers energy providers to achieve greater sustainability, transparency, and agility.

For instance, in July 2022, Siemens Energy launched an AI-driven Managed Detection & Response (MDR) platform in collaboration with Amazon Web Services (AWS). The platform, available through AWS Marketplace, integrates industrial cybersecurity monitoring with cloud-based analytics to protect generation, transmission, and distribution assets from evolving cyber threats. This development underscores how security, resilience, and digitalization are becoming inseparable pillars of the modern energy ecosystem. As cloud-native solutions, edge computing, and AI continue to converge, energy cloud is emerging as a strategic foundation for next-generation energy systems enabling decentralized power generation, automated grid orchestration, and a data-centric approach to sustainability.

Component Insights

The solutions segment accounted for the largest revenue share of 67.25% in 2024, owing to the strong demand for integrated, cloud-native energy management tools that handle complex grid operations and distributed energy assets. Utilities and energy providers increasingly prioritize modular solutions such as Enterprise Asset Management (EAM), Supply Chain Management (SCM), Customer Relationship Management (CRM), Risk & Compliance Management, Workforce Management, and Reporting & Analytics to optimize operations across generation, transmission, distribution, and interfaces. These solutions deliver functionalities such as predictive maintenance, real-time monitoring, demand forecasting, asset health analytics, regulatory reporting, and outage management, which are critical for managing a dynamic, decarbonizing energy network with high resilience and efficiency. For instance, in March 2025, Hitachi Energy announced a strategic collaboration with Amazon Web Services (AWS) to deliver cloud-based energy solutions, including AI-driven vegetation management and asset/work management software, to help utilities enhance grid reliability and reduce outages. This kind of alliance underscores that energy companies are turning to cloud solutions to integrate operational intelligence, analytics, and control across their infrastructures. As cloud-native architectures, AI/ML models, and edge-to-cloud orchestration converge with regulatory pressures for sustainability and resilience, the solutions sub-segment is expected to continue to be a key driver of market growth and differentiation in the energy cloud market.

The services segment is projected to grow at the fastest CAGR during the forecast period, driven by the increasing demand for specialized support in deploying, managing, and optimizing cloud-based energy solutions. Services include professional services such as consulting, system integration, and implementation, as well as managed services covering monitoring, maintenance, and continuous optimization of energy cloud platforms. Organizations are increasingly relying on service providers to streamline cloud adoption, ensure regulatory compliance, and implement AI-powered analytics without the need for heavy upfront infrastructure investments. For instance, in April 2024, Siemens Energy partnered with AWS to offer managed cloud services for utilities, combining AI-driven asset management, predictive maintenance, and real-time grid monitoring capabilities. This demonstrates that service offerings are evolving to deliver end-to-end operational efficiency, cybersecurity, and compliance support. With the growing complexity of distributed energy resources, hybrid grids, and renewable integration, the services segment is expected to see robust adoption, a key driver of energy cloud market growth.

Deployment Mode Insights

The public cloud segment accounted for the largest revenue share of 61.10% in 2024 due to its cost-effectiveness, scalability, and rapid deployment capabilities. Energy enterprises, including utilities, grid operators, and renewable energy providers, are increasingly leveraging public cloud platforms to host energy management solutions, integrate distributed energy resources (DERs), and implement AI-driven analytics without the need for extensive on-premises infrastructure. Public cloud platforms enable real-time monitoring, predictive maintenance, and centralized control across geographically distributed assets, allowing organizations to optimize operations while reducing capital expenditures. For instance, in March 2025, GE Vernova signed an agreement with Amazon Web Services (AWS) to support the expansion of Amazon's data centers worldwide. This collaboration aims to address increased energy demands, improve grid security, and reduce carbon emissions by providing sustainable electricity solutions. In return, AWS likely to assist GE Vernova in advancing its cloud migration and digital innovation efforts. This partnership underscores the growing reliance on public cloud infrastructure to meet the evolving needs of the energy sector.

The hybrid cloud segment is projected to grow at a significant CAGR over the forecast period due to the increasing need for flexibility, data sovereignty, and security in managing complex energy infrastructures. Energy enterprises are adopting hybrid models to leverage the scalability of public cloud environments while maintaining sensitive operational data and mission-critical workloads within private cloud or on-premises systems. This dual approach allows organizations to balance performance, compliance, and cost efficiency, which is especially crucial in the highly regulated energy sector. In addition, the growth of distributed energy resources (DERs), smart grids, and IoT-enabled energy networks is further accelerating hybrid cloud adoption, as these systems generate vast volumes of data that must be processed both locally (for real-time control) and in the cloud (for analytics and long-term optimization). Moreover, the increasing integration of AI, edge computing, and predictive analytics within hybrid frameworks enables faster decision-making and enhances grid resilience. For instance, in February 2025, ABB partnered with IBM to expand its hybrid cloud offerings for utilities, providing an AI-powered energy management platform that enables real-time asset monitoring and carbon footprint optimization across distributed energy systems. This reflects a growing industry trend where hybrid cloud deployments serve as the foundation for secure, intelligent, and interoperable energy ecosystems, empowering providers to modernize operations while ensuring compliance with evolving regulatory frameworks.

Service Model Insights

The Software as a Service (SaaS) segment accounted for the largest revenue share of 39.92% in 2024, owing to its ease of deployment, lower upfront costs, and scalability that align well with the digital transformation needs of energy enterprises. SaaS-based platforms enable utilities, oil & gas operators, and renewable energy providers to access advanced analytics, grid management, and customer engagement tools through subscription-based models, reducing dependence on costly on-premises infrastructure. These solutions offer real-time data visualization, predictive maintenance, energy forecasting, and asset optimization capabilities that are critical for improving operational efficiency and sustainability outcomes across complex, distributed energy systems. The segment’s dominance is also driven by the rising adoption of AI- and IoT-integrated SaaS solutions, which support automation, grid reliability, and demand-response optimization. Moreover, SaaS facilitates interoperability with existing IT and OT systems, enabling energy organizations to scale seamlessly across regions and regulatory frameworks. For instance, in April 2025, Oracle Energy and Water announced the expansion of its SaaS-based utility management suite to help utilities enhance grid flexibility and customer engagement through data-driven insights and AI-powered automation. The platform allows utilities to forecast energy demand, optimize distributed generation, and manage outages efficiently through a unified cloud interface. Such innovations underscore the pivotal role of SaaS in enabling end-to-end digital transformation, positioning it as the most widely adopted and revenue-generating service model in the Energy Cloud Market.

The Infrastructure as a Service (IaaS) segment is forecast to experience a substantial CAGR over the forecast period. The growth is attributed to the growing need for high-performance computing, scalable storage, and real-time data processing across the energy ecosystem. As utilities, oil & gas companies, and renewable energy providers increasingly rely on cloud infrastructure to manage massive data volumes from smart grids, IoT sensors, and distributed energy resources (DERs), IaaS offers flexibility and scalability to support dynamic workloads and AI-driven analytics. The shift toward cloud-native infrastructure is also enabling faster deployment of digital twins, predictive maintenance applications, and grid modernization initiatives. Moreover, increasing investments in edge-to-cloud integration and sovereign cloud infrastructure are enhancing data security and regulatory compliance in critical energy operations. For instance, in May 2025, Microsoft Azure partnered with Schneider Electric to expand sustainable cloud infrastructure solutions for the energy sector, enabling utilities to optimize data center energy efficiency and integrate renewable energy sources more effectively. As the energy sector accelerates digital transformation and decentralization, IaaS is becoming a cornerstone for scalable, resilient, and sustainable infrastructure modernization, positioning it as one of the fastest-growing segments in the Energy Cloud Market.

Application Insights

The smart grid segment accounted for the largest share of 27.88% in 2024 driven by the rapid modernization of grid infrastructure and increasing integration of renewable and distributed energy resources (DERs). Energy providers are leveraging cloud-based platforms to enable real-time grid monitoring, predictive maintenance, and demand-response management, enhancing both reliability and efficiency. The adoption of smart grids is further supported by the proliferation of IoT devices, edge analytics, and AI-powered forecasting tools, which facilitate dynamic load balancing and fault detection across complex energy networks. Governments and utilities worldwide are investing heavily in smart grid digitalization to meet decarbonization goals and ensure grid resilience amid growing electricity demand. For instance, in February 2025, Siemens Energy and Google Cloud announced a collaboration to develop AI-enabled grid management solutions that use cloud-based analytics to optimize power flow, integrate renewable sources, and predict equipment failures in advance. This growing convergence of cloud computing and grid intelligence underscores the pivotal role of the smart grid segment in driving the digital transformation of the global energy ecosystem, positioning it as the leading application area within the energy cloud market.

The Distributed Energy Resources (DER) segment is expected to grow at the fastest CAGR during the forecast period, driven by the increasing adoption of renewable energy sources such as solar, wind, and battery storage, coupled with the growing need for decentralized, resilient, and flexible energy systems. Energy Cloud platforms enable real-time monitoring, predictive maintenance, and optimized dispatch of DERs, allowing utilities and independent power producers to balance intermittent supply, manage peak demand, and integrate multiple generation sources efficiently. The rise of microgrids, prosumer participation, and energy trading platforms is further accelerating DER adoption, as stakeholders seek to maximize energy efficiency and reduce carbon footprints. For instance, in March 2025, Hitachi Energy collaborated with AWS to launch a cloud-based DER management platform that leverages AI and machine learning to optimize distributed generation and storage across utility and commercial grids. This demonstrates that cloud-enabled solutions are becoming essential for managing complex, decentralized energy networks. The combination of regulatory support for renewable integration, technological advancements in cloud analytics, and the increasing need for operational agility positions DERs as the fastest-growing application segment within the energy cloud market.

End Use Insights

The power & utilities segment accounted for the largest revenue share of 33.64% in 2024 due to the increasing adoption of cloud-based solutions to modernize grid infrastructure, integrate renewable energy, and optimize operational efficiency. Utilities are leveraging Energy Cloud platforms to enable real-time monitoring, predictive maintenance, demand forecasting, and automated load balancing, all of which are essential for maintaining grid reliability amid rising electricity demand and the increasing presence of distributed energy resources (DERs). The growing focus on decarbonization, regulatory compliance, and smart grid initiatives is further accelerating cloud adoption in this sector, as providers seek scalable and cost-effective solutions to enhance resilience and sustainability. For instance, in June 2025, RWE, a leading German utility, announced a strategic partnership with Amazon Web Services (AWS) to exchange renewable energy and cloud-based technological services. Under the agreement, RWE likely to supply clean energy from its wind and solar facilities in exchange for AWS cloud services, particularly in the areas of artificial intelligence and data analytics. This collaboration aims to strengthen RWE's renewable energy development and support Amazon’s sustainability goals for its data centers. RWE has already contracted 1.1 gigawatts of renewable energy with Amazon through seven power purchase agreements in the U.S., and both companies expect the partnership to grow, aligning with increasing electricity demands driven by digitalization and electrification.

The renewable energy segment is projected to grow at the fastest CAGR during the forecast period driven by the rapid expansion of solar, wind, and battery storage projects worldwide and the increasing need for cloud-based management of distributed energy resources (DERs). Energy Cloud platforms enable renewable energy providers to monitor generation, forecast output, optimize storage utilization, and integrate seamlessly with smart grids, ensuring reliability despite the intermittent nature of renewable sources. In addition, rising regulatory mandates for decarbonization, sustainability reporting, and carbon neutrality are pushing organizations to adopt cloud solutions that provide real-time analytics, performance optimization, and compliance capabilities.For instance, in May 2025, Enel Green Power partnered with Microsoft Azure to deploy a cloud-based platform for monitoring and managing its global renewable energy assets. The platform leverages AI and IoT-enabled analytics to optimize energy production, predict equipment maintenance needs, and improve grid integration, supporting Enel’s commitment to sustainability and operational efficiency. Such initiatives highlight that cloud adoption is becoming crucial for scaling renewable energy operations, making the renewable energy segment the fastest-growing end use category in the energy cloud market.

Regional Insights

North America energy cloud market accounted for the largest market share of 38.10% in 2024 in the energy cloud market, fueled by the rapid modernization of aging grid infrastructure, the high penetration of renewable energy sources, and widespread adoption of smart grid technologies. Utilities are increasingly implementing AI-powered predictive maintenance, real-time load balancing, and advanced energy management platforms to optimize operations across highly interconnected and digitized grids. The region is witnessing growing integration of distributed energy resources (DERs), microgrids, and energy storage systems, supported by cloud-based orchestration for improved grid resiliency. Moreover, North American energy providers are prioritizing cybersecurity and compliance-driven cloud architectures due to stringent federal and state regulations, while leveraging IoT and edge-to-cloud solutions to enable granular monitoring, dynamic demand response, and decarbonization initiatives. The market is also shaped by industry collaborations and cloud partnerships that accelerate innovation in AI analytics, asset management, and predictive operational efficiency, positioning the region as a global leader in advanced Energy Cloud deployment.

U.S. Energy Cloud Market Trends

In the United States, the energy cloud market is experiencing rapid growth driven by the rapid deployment of smart grid initiatives, advanced metering infrastructure (AMI), and large-scale renewable integration. U.S. utilities are increasingly leveraging cloud-based platforms for real-time grid monitoring, predictive maintenance, and energy storage optimization, particularly to manage distributed energy resources (DERs) and microgrid operations. There is a strong emphasis on regulatory compliance and cybersecurity, driving the adoption of hybrid and multi-cloud architectures that ensure secure data handling and resilience across critical infrastructure. The market is further shaped by AI-driven analytics and IoT-enabled edge computing, enabling utilities to optimize load forecasting, reduce downtime, and enhance operational efficiency. Moreover, the U.S. energy sector is witnessing growing industry collaborations and cloud technology partnerships, aimed at accelerating digital transformation, decarbonization, and modernization of the national grid.

Europe Energy Cloud Market Trends

Energy cloud market in Europe is anticipated to register considerable growth from 2025 to 2033, driven by the accelerated adoption of renewable energy, grid digitization, and cross-border electricity trading initiatives. Utilities and energy providers are increasingly implementing cloud-based smart grid platforms, predictive maintenance solutions, and energy management systems to integrate intermittent renewable sources such as wind and solar, while maintaining grid stability. The region’s market is strongly influenced by stringent regulatory frameworks such as the EU Green Deal and renewable energy directives, which mandate enhanced reporting, carbon tracking, and compliance, thereby encouraging adoption of cloud-enabled analytics and monitoring tools. In addition, European energy operators are investing in distributed energy resource (DER) management, microgrid orchestration, and AI-powered demand response, leveraging cloud platforms to enhance operational efficiency and resiliency.

The energy cloud market in the UK is witnessing strong momentum, driven by the rapid transition to renewable energy, smart grid modernization, and government-led decarbonization initiatives. Utilities and energy providers are increasingly leveraging cloud-based platforms for real-time grid monitoring, predictive maintenance, and distributed energy resource (DER) management, enabling better integration of wind, solar, and energy storage systems. The market is strongly shaped by regulatory requirements, including grid resilience, carbon reporting, and data security mandates, which are accelerating the adoption of secure, hybrid cloud architectures. Moreover, UK energy operators are deploying AI-powered analytics and IoT-enabled edge solutions to optimize demand response, enhance operational efficiency, and reduce outages. Collaborative efforts between energy companies and technology providers are also fostering innovation in digital twin modeling, smart metering, and cloud orchestration, positioning the UK as a leader in efficient and digitally optimized energy networks.

Germany energy cloud market is gaining traction owing to the nation’s strong commitment to the Energiewende (energy transition), renewable energy integration, and smart grid deployment. Utilities and energy providers are increasingly adopting cloud-based energy management platforms to optimize wind, solar, and battery storage assets, improve grid reliability, and manage distributed energy resources (DERs) efficiently. The market is heavily influenced by strict regulatory frameworks, including grid stability mandates, carbon reduction targets, and data protection requirements, which are accelerating adoption of secure hybrid and multi-cloud architectures. Additionally, German energy operators are deploying AI-powered predictive analytics, IoT-enabled edge devices, and digital twins to forecast demand, detect faults, and optimize maintenance schedules.

Asia Pacific Energy Cloud Market Trends

Asia Pacific is expected to register the fastest CAGR of 20.7% from 2025 to 2033, driven by the rapid industrialization, urbanization, and increasing electricity demand across the region. Countries such as China, India, Japan, and South Korea are heavily investing in smart grid deployment, renewable energy integration, and energy storage solutions, creating strong demand for cloud-based energy management platforms. The market is also shaped by government initiatives promoting decarbonization, carbon trading, and renewable adoption, which accelerate cloud adoption for real-time monitoring, predictive maintenance, and grid optimization. In addition, the proliferation of distributed energy resources (DERs), microgrids, and IoT-enabled energy networks is driving the need for hybrid and multi-cloud architectures to manage large volumes of data efficiently. Cloud-enabled AI analytics, digital twins, and edge computing are increasingly being implemented to enhance operational efficiency, reliability, and resilience in rapidly expanding and digitizing energy systems across Asia Pacific.

Japan energy cloud market is experiencing strong growth driven by the nation’s commitment to renewable energy expansion, energy efficiency, and grid modernization, particularly in the wake of challenges from natural disasters and aging infrastructure. Japanese utilities are increasingly adopting cloud-based energy management platforms to integrate solar, wind, and battery storage systems, optimize distributed energy resources (DERs), and enhance grid resilience. The market is strongly influenced by government policies promoting decarbonization, smart grid deployment, and carbon reduction targets, which encourage cloud-enabled solutions for real-time monitoring, predictive maintenance, and energy optimization. Additionally, Japanese energy providers are leveraging AI-driven analytics, IoT-enabled edge devices, and digital twin technologies to forecast demand, detect faults, and improve operational efficiency. Collaborations between energy companies and technology providers are fostering innovation in microgrid orchestration, renewable integration, and cloud-based analytics, positioning Japan as a leading adopter of digitalized and sustainable energy systems in Asia Pacific.

Energy cloud market in China held a substantial market share in 2024, driven by rapid expansion of renewable energy, grid modernization initiatives, and large-scale industrial electrification. Chinese utilities and energy providers are increasingly adopting cloud-based energy management platforms to optimize solar, wind, and hydro assets, manage distributed energy resources (DERs), and enhance grid reliability and flexibility. The market is shaped by government policies promoting carbon neutrality, smart grid deployment, and energy efficiency, which are accelerating adoption of cloud-enabled solutions for real-time monitoring, predictive maintenance, and demand forecasting. Additionally, the proliferation of IoT sensors, AI-driven analytics, and digital twins allows operators to improve operational efficiency, detect faults proactively, and integrate decentralized generation efficiently.

India energy cloud market is witnessing rapid growth due to the government’s push for renewable energy expansion, rural electrification, and smart city initiatives. Cloud-based platforms are being adopted to manage the increasing penetration of solar farms, wind energy projects, and decentralized microgrids, particularly in regions with constrained infrastructure and variable grid stability. The market is also influenced by the perform, achieve, and trade (PAT) schemes, renewable energy certificates (REC), and other regulatory incentives, which encourage utilities to deploy cloud-enabled solutions for energy monitoring, predictive analytics, and operational optimization. Moreover, emerging digital technologies such as AI-based load forecasting, IoT-enabled demand response, and edge-to-cloud orchestration are helping Indian energy providers optimize resource allocation, reduce losses, and improve energy access in both urban and rural areas. Strategic collaborations between energy firms, technology vendors, and government-backed programs are further driving innovation in distributed energy management and smart grid deployments, positioning India as one of the fastest-growing energy cloud markets in Asia Pacific.

Key Energy Cloud Company Insights

Key players operating in the energy cloud industry are Amazon Web Services (AWS), Bloom Energy, CyrusOne, DigitalOcean and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In October 2025, Bloom Energy has partnered with Brookfield Asset Management to deploy its fuel cell technology across AI data centers, including a new European site expected by year-end.

-

In October 2025, Google announced a USD 24 billion investment in AI infrastructure across the U.S. and India, including a new data center campus in Visakhapatnam, Andhra Pradesh.

-

In July 2025, CyrusOne signed a deal with Calpine Energy to power a new data center in Bosque County, Texas, expected to be operational by Q4 2026.

-

In March 2025, GE Vernova and AWS expanded their partnership to electrify and decarbonize data centers across North America, Europe, and Asia, integrating AI and data analytics capabilities.

Key Energy Cloud Companies:

The following are the leading companies in the energy cloud market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services (AWS)

- Bloom Energy

- CyrusOne

- DigitalOcean

- Enel

- GE Vernova

- Google Cloud

- Honeywell

- IBM

- Microsoft

- NTT Global

- Oracle

- RWE

- Schneider Electric

- Siemens

Energy Cloud Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.39 billion

Revenue forecast in 2033

USD 30.93 billion

Growth rate

CAGR of 19.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Scope

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, service model, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Amazon Web Services (AWS); Bloom Energy; CyrusOne; DigitalOcean; Enel; GE Vernova; Google Cloud; Honeywell; IBM; Microsoft; NTT Global; Oracle; RWE; Schneider Electric; Siemens

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Energy Cloud Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global energy cloudmarket report based on component, deployment mode, service model, application, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solutions

-

Supply Chain Management

-

Customer Relationship Management (CRM)

-

Enterprise Asset Management (EAM)

-

Risk and Compliance Management

-

Workforce Management

-

Reporting and Analytics

-

-

Services

-

Managed Services

-

Professional Services

-

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Service Model Outlook (Revenue, USD Billion, 2021 - 2033)

-

Infrastructure as a Service (IaaS)

-

Platform as a Service (PaaS)

-

Software as a Service (SaaS)

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Smart Grid

-

Energy Management

-

Energy Storage

-

Distributed Energy Resources (DER)

-

Grid Automation

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Power & Utilities

-

Oil & Gas

-

Renewable Energy

-

Manufacturing

-

Government & Public Sector

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global energy cloud market size was estimated at USD 6.24 billion in 2024 and is expected to reach USD 7.39 billion in 2025.

b. The global energy cloud market is expected to grow at a compound annual growth rate of 19.6% from 2025 to 2033 to reach USD 30.93 million by 2033.

b. The power & utilities segment dominated the energy cloud market in 2024 due to the increasing adoption of cloud-based solutions to modernize grid infrastructure, integrate renewable energy, and optimize operational efficiency.

b. Some key players operating in the market include Amazon Web Services (AWS), Bloom Energy, CyrusOne, DigitalOcean, Enel, GE Vernova, Google Cloud, Honeywell, IBM, Microsoft, NTT Global, Oracle, RWE, Schneider Electric, Siemens and Others.

b. Factors such as the convergence of cloud-native technologies, IoT-enabled energy infrastructure, and AI-powered analytics that are transforming the way energy is generated, managed, and consumed plays a key role in accelerating the energy cloud market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.