- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Energy Gels Market Size And Share, Industry Report, 2033GVR Report cover

![Energy Gels Market Size, Share & Trends Report]()

Energy Gels Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Carbohydrate, Isotonic/Electrolyte, Caffeinated), By Flavor, By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-829-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Energy Gels Market Summary

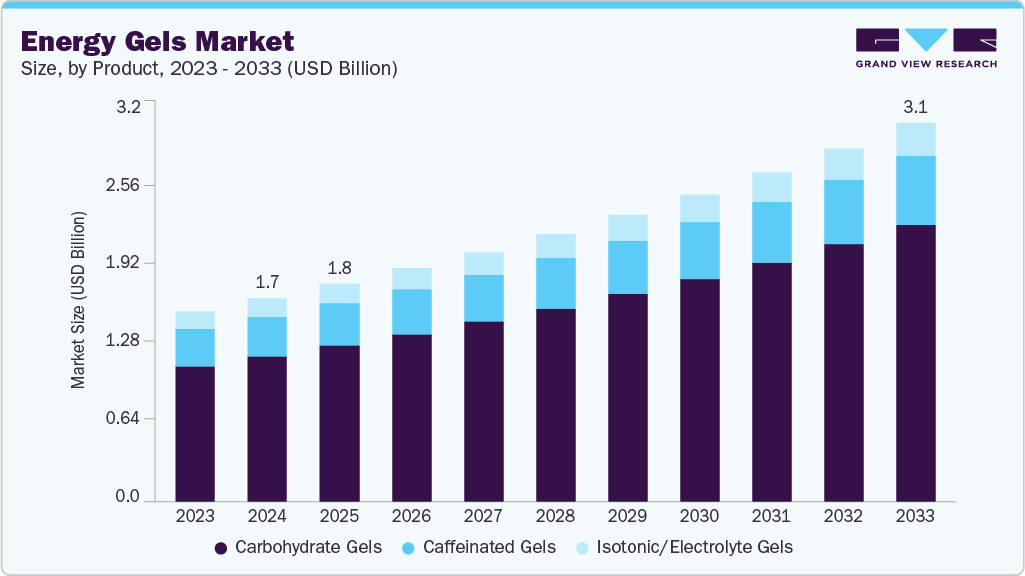

The global energy gels market size was valued at USD 1.66 billion in 2024 and is projected to reach USD 3.09 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033. The growth of the market is primarily driven by the consumer’s rising participation in endurance sports such as running, cycling, triathlons, and adventure racing.

Key Market Trends & Insights

- The North America energy gels market held the largest revenue share of 48.5% in 2024.

- U.S. dominated the North America energy gels market with a revenue share of 85.5% in 2024.

- By product, the carbohydrate gels segment held the largest market share of 71.6% in 2024.

- By flavor, the flavored segment held the largest market share of 85.9% in 2024.

- By application, the endurance sports and activities segment dominated the market with a revenue share of 88.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.66 Billion

- 2033 Projected Market Size: USD 3.09 Billion

- CAGR (2025-2033): 7.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, the consumer shift towards the convenient nutrition formats is also expected to drive the overall energy gels market growth. The market is also being propelled by the advancements in the product formulations, which have led to introduction of isotonic and electrolyte energy gels.The global energy gels market is growing steadily as nutrition and sports have become a regular and important part of the training schedules across the world. Energy gels are mainly preferred as they are convenient to carry and help maintain energy levels during sports or training. The market has a significant presence of companies, such as GU Energy Labs, Powerbar, and Veloforte that focus on taste in addition to quick energy and provide these energy gels with clean labels and various specializations worldwide.

The growth in the global energy gels industry is also supported by the rising interest of people in fitness, the visibility of the product through retail stores, and collaborations of the brands with sports events such as cycling, marathons, and other athlete communities. Producers globally are adding new flavors and widening their energy gel offerings by including coffee flavors, dessert-inspired flavors, and tangy flavors to attract more consumers. In addition, the market growth is also driven by the consumer's strong digital engagement globally, where energy gel brands use training apps to promote their products online. Furthermore, as familiarity among the consumers keeps rising, energy gels are becoming common and a convenient choice for instant energy during endurance and sports activities, which is further accelerating the market growth.

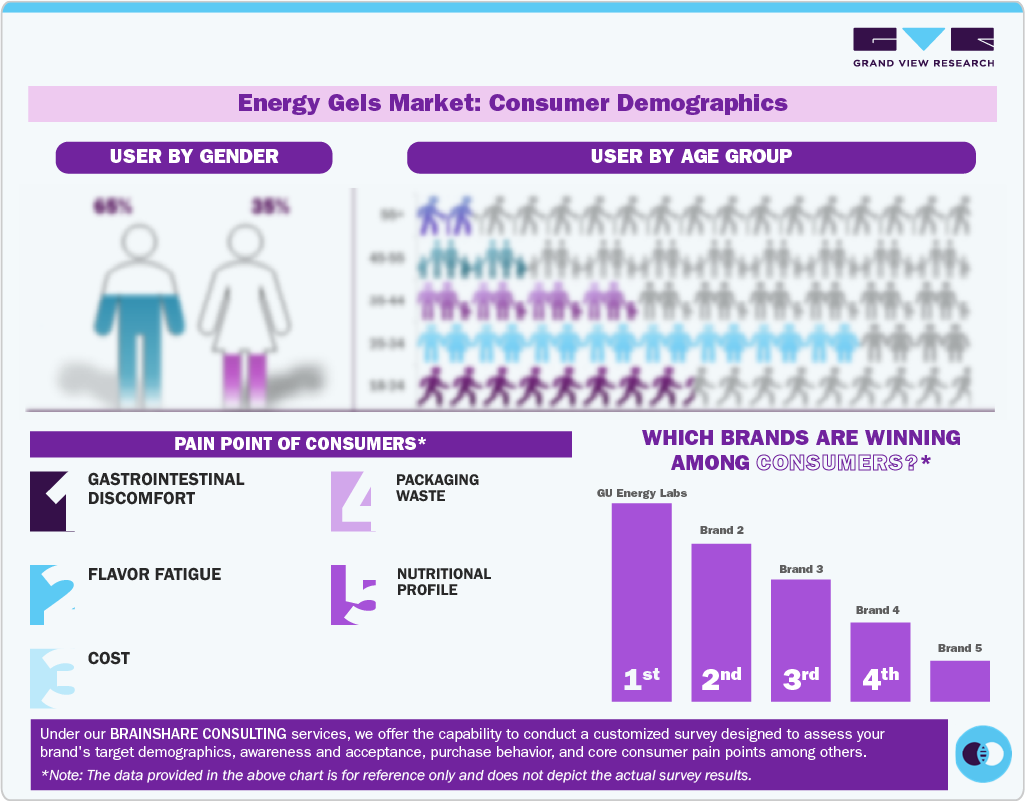

Consumer Insights

Consumers across the global energy gels market are becoming more selective when it comes to fitness. They not only look for products that are nutritious but also good in taste and better to digest. In addition, consumers prefer energy gels that come with proper labeling and have a balanced blend of carbohydrates, which won't cause digestive discomfort. There is also a growing interest in brands that are offering various flavors with added benefits such as electrolytes, caffeine, or natural flavors. Convenience is an important factor as consumers prefer single-serve packets while running or on long rides. Overall, the market experiences consumer behavior shifting to more trusted brands and products that blend easily into their endurance activities.

Consumer demographics in the global energy gels market show that the usage is more common among males as they are more involved in the physical activities as compared to females. But, at the same time, female participation is also growing as they are getting involved in running, exercising, and fitness training sessions. The market is mainly shaped by young and middle-aged athletes followed by the younger age groups who follow regular training sessions or participate frequently in endurance activities. The usage among the old age group is low as endurance activity levels are low.

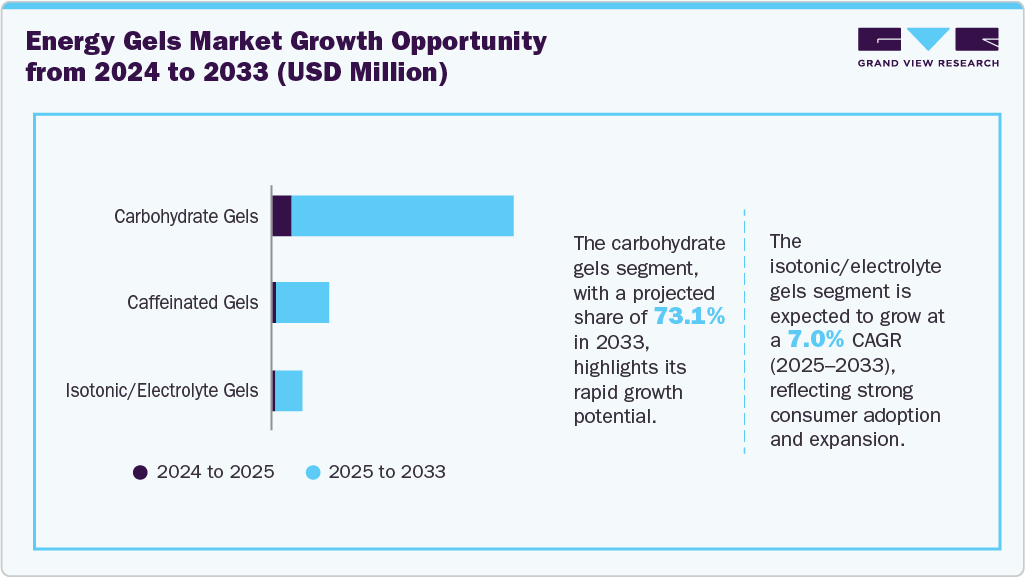

Product Insights

The carbohydrate gels segment held the largest market revenue share of 71.6% in 2024 and is expected to grow at the fastest CAGR over the forecast period.The segment is driven by the role of carbohydrates in energy gels to provide quick energy during long-distance endurance activities, as carbohydrate intake is important to prevent fatigue and support endurance routine. These energy gels are made to be rapidly absorbed, making them a preferred choice among athletes, runners, and cyclists who require continuous energy without any interruption. The carbohydrate energy gel has a simple and portable format with endurance performance benefits, which makes it a preferred product in the sports nutrition market. As more consumers are adopting easy energy options, carbohydrate energy gels continue to experience the fastest growth in the energy gels market.

The isotonic/electrolyte gels segment is projected to grow over the forecast period, owing to its effortless consumption without water during endurance activities. Moreover, it is supported by the consumers who look for products that not only provide quick energy/carbohydrate but also help to provide hydration during intense workouts. These energy gels are a game changer as they provide electrolytes in addition to carbohydrates, allowing consumers to maintain their performance, mainly in hot weather when fluid and minerals can easily be lost. Moreover, energy gels are a better option for those who prefer liquid/gel formats. As consumers around the world are becoming more aware of the importance of hydration and balanced electrolyte content in the body while performing endurance activities, which is expected to drive the market segment continues to grow in the energy gels industry in the upcoming forecast period.

Flavor Insights

The flavored segment held the largest market revenue share of 85.9% in 2024, driven by the consumer’s preference for better taste and sensory appeal, mainly during the intense sessions where flavor fatigue can set in. Flavored energy gels enhance the consumer’s overall experience and keep motivating them to fuel up, making energy gels a key choice. The energy gels market offers various flavors of energy gels, such as citrus and tangy flavors, coffee flavors, berry and tropical fruit options, to attract more consumers. There are coffee-flavored energy gels that appeal to consumers who prefer a flavor with a caffeine boost. And a dessert-inspired collection for consumers, for those who prefer a richer taste. The market also offers classic and neutral flavors for those who like simple energy gel options. In January 2023, the brand TORQ expanded its flavored energy gel options by launching its “NEW Cola Caffeine Energy Gel”, which contains 89mg of caffeine sourced from natural guarana. This wide range of flavors strengthens consumer acceptance and keeps the flavored energy gels leading category in the market.

The unflavored segment is expected to grow at the fastest CAGR over the forecast periodThe segment growth is driven by the consumers who prefer simpler energy gels that help to avoid taste fatigue and reduce digestive discomfort during endurance activities. Many athletes choose neutral gels when they need multiple servings during one single session, as the lack of strong flavors makes it easier to fuel over long periods. This choice is also driven by consumers who prefer clean labeling with fewer additives or artificial ingredients. As consumers become aware of the ingredient lists and overall gut comfort, the unflavored category continues to grow rapidly. This trend is highlighted by product introductions like TORQ's 'Naked Flavorless Energy Gel', which was launched in response to athlete demand for a neutral option that would help refresh the mouth and give energy without being too noticeable.

Application Insights

The endurance sports and activities segment dominated the market with a revenue share of 88.2% in 2024 and is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is driven by the rising demand for endurance sports such as running, cycling, triathlons, and others, where quick energy is important for them to keep going. Energy gels can easily fulfil this need by providing quick carbohydrates without any interruption or preparation. As consumer participation in sports, races, and marathons around the world is growing, endurance athletes remain the key consumers of energy gels. This connection between the product offerings and the consumer needs keeps endurance sports and activities a dominant segment in the market.

The military and defense segment is expected to grow at the fastest CAGR over the forecast period. The segment's growth is fueled by the rising adoption of high-performance nutrition solutions by the armed forces that support sustained physical activity in challenging environments. Energy gels are used by the defense and military forces as they are light in weight, easy to carry, and provide quick energy during missions or training, mainly at times when traditional food is not practical. With a growing emphasis on keeping soldiers ready with better operational efficiency, there has been higher adoption of energy gels. As defense and military forces have started using new energy-boosting methods in their training and operations, the market segment is expected to grow during the forecast period.

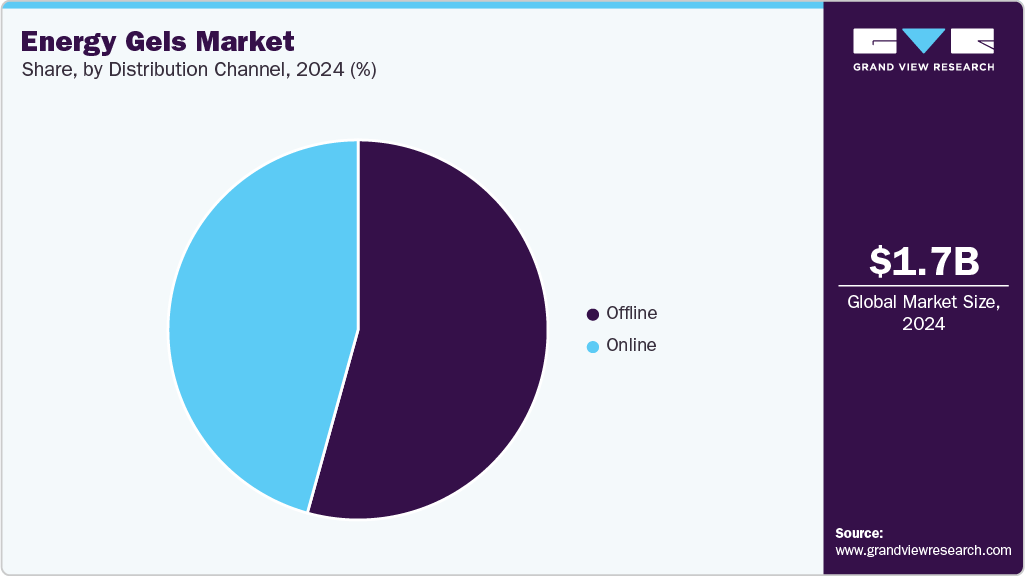

Distribution Channel Insights

The offline segment accounted for the largest revenue share of 54.3% in 2024. The growth is driven by the athletes and sports participants who prefer buying energy gels from the physical stores, as they can compare products and get guidance from the staff. This makes the store’s experience valuable. Sporting goods stores, specialty nutrition shops, pharmacies, and supermarkets not only offer immediate availability of the products but also a trusted environment for product selection. These offline distribution channels benefit from increased brand visibility, in-store promotions, and the advantages of collaboration with the local sports communities.

The online segment is projected to grow at the fastest CAGR over the forecast period.The convenient access to a wider variety of energy gel products drives this growth. Consumers enjoy buying from an e-commerce platform as they provide flexibility in purchasing and doorstep delivery for busy athletes, as well as regular users. In addition, digital platforms offer promotions, athlete endorsements, and educational content that help consumers to make smart choices. As these benefits continue to shape the buying behavior of consumers, the online distribution channel continues to grow.

Regional Insights

The North America energy gels market accounted for the largest revenue share of 48.5% in 2024, supported by many runners, cyclists, and athletes in the region. People in this area are well-informed about sports nutrition, they participate in many races, and often use structured fueling strategies, whether they are casual or competitive athletes. There is a wide range of products available with major sports nutrition brands, shops, and retail options offering a lot of choices in flavors. A notable trend in the region is the rising preference for clean labeling and stomach-friendly gels, as consumers look for options that support performance as well as digestive comfort.

U.S. Energy Gels Market Trends

The U.S. dominated the North America energy gels market region with a share of 85.5% in 2024, due to its strong engagement in endurance activities. The country has a huge population of runners, cyclists, triathletes, and fitness enthusiasts who regularly use such products during training sessions and competitive events. This demand is further supported by the presence of major sports nutrition brands, retail stores and a developed distribution network.

Europe Energy Gels Market Trends

The Europe energy gels market is expected to grow over the forecast period, driven by the strong tradition in sports activities and the demand for natural and convenient ingredients. The region hosts many multisport events, which attract more participants and increase the demand for products such as energy gels. Consumers in Europe are choosing gels made from clean, natural ingredients, as well as specialized formats. In addition, the availability of energy gels in physical stores and online platforms is improving, which supports the ongoing market growth.

Asia Pacific Energy Gels Market Trends

The Asia Pacific energy gels market is expected to grow at the fastest CAGR of 8.5% over the forecast period. This is mainly because of the increasing participation in marathons, cycling events, and organized fitness activities from major countries such as China, Japan, South Korea, and Australia. As urban regions expand and more people become interested in endurance training, there’s a rising demand for energy gel products. The region is also being fueled by the increasing e-commerce platforms, which give easier access to the global as well as domestic brands.

China dominated the Asia-Pacific energy gels market in 2024. This growth is due to the fitness and sports initiatives adopted by the government and private sectors in the country. The increasing development of running clubs, cycling groups, and community fitness programs has created a large base of consumers who are eager for performance-driven nutrition options. As awareness about health increases with rising disposable incomes, the market continues to grow.

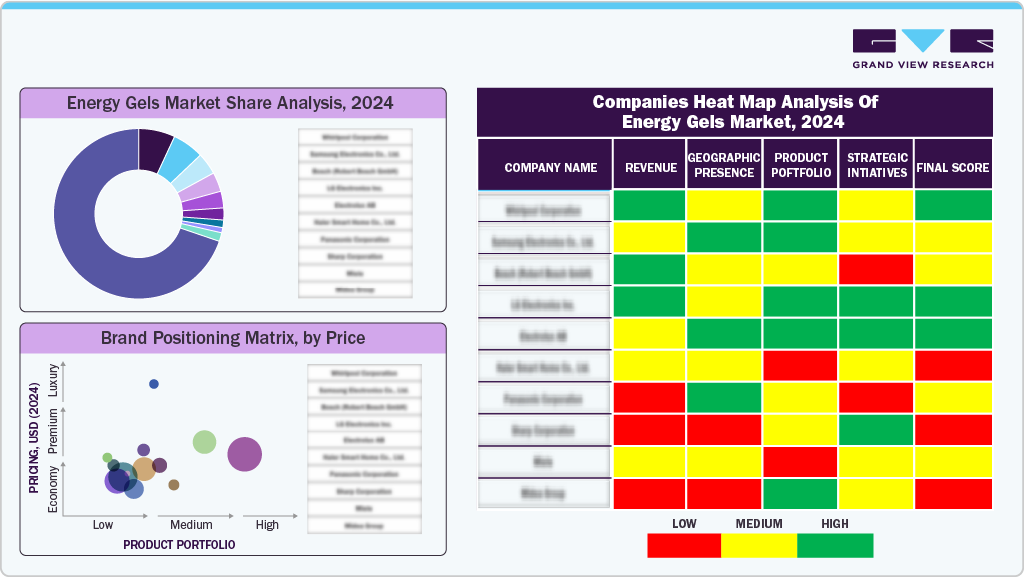

Key Energy Gels Company Insights

Some key players in the global energy gels market include GU Energy Labs, Mellifera JSC, Boom Nutrition Inc., and others. Major players embrace strategies such as innovation, new product development, distribution, and partnerships to address changing consumer preferences and growing demand for extensive product portfolios by diverse consumer groups.

-

GU Energy Labs was founded in 1993 when its founder created the first energy gel to solve the challenge of eating key nutrients while ultra-running. The company offers various nutrition options, including energy gels for immediate energy and hydration.

Key Energy Gels Companies:

The following are the leading companies in the energy gels market. These companies collectively hold the largest market share and dictate industry trends.

- GU Energy Labs

- Mellifera JSC

- Boom Nutrition Inc.

- Hammer Nutrition

- Powerbar

- Science In Sport

- Amacx B.V.

- Bare Performance Nutrition, LLC

- Veloforte

- Tā Energy

- Styrkr

- Carbs Fuel

- High Five by Associated British Foods PLC

- PepsiCo, Inc.

- Honey Stinger

- Huma Gel

- The UCAN Company

- Neversecond Nutrition, Inc.

- Puresport

Recent Developments

-

In October 2025, Puresport announced the launch of a new energy gel that delivers 30 grams of carbohydrates in each serving. The company recommends one gel every 30 minutes to help runners maintain optimal energy levels.

-

In January 2023, Protein Rebel launched the first maple syrup energy gel, named Maple Ignite, in the UK. This energy gel provides a sustained energy boost to support endurance activities. Each 36g tube of Maple Ignite delivers potassium, carbohydrates, calcium, sodium, as well as manganese, iron, and antioxidants.

Energy Gels Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.78 billion

Revenue forecast in 2033

USD 3.09 billion

Growth rate

CAGR of 7.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, flavor, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, India, Japan, South Korea, Australia & New Zealand, Brazil, Argentina, Saudi Arabia, South Africa, UAE

Key company profiled

GU Energy Labs; Mellifera JSC; Boom Nutrition Inc.; Hammer Nutrition; Powerbar; Science In Sport; Amacx B.V.; Bare Performance Nutrition, LLC; Veloforte; Tā Energy; Styrkr; Carbs Fuel; High Five by Associated British Foods PLC; PepsiCo, Inc.; Honey Stringer; Huma Gel; The UCAN Company; Neversecond Nutrition, Inc.; Puresport;

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Energy Gels Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global energy gels market report on the basis of product, flavor, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Carbohydrate Gels

-

Isotonic/Electrolyte Gels

-

Caffeinated Gels

-

-

Flavor Outlook (Revenue, USD Million, 2021 - 2033)

-

Flavored

-

Citrus & Tangy Flavors

-

Berry & Tropical Fruit Flavors

-

Coffee Flavors

-

Dessert-Inspired (Vanilla, Chocolate, Salted Caramel Flavors, etc.)

-

Others (Neutral/Classic Flavors, etc.)

-

-

Unflavored

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Endurance Sports and Activities

-

Military and Defense

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Company-Owned Websites

-

Third-Party Aggregators

-

-

Offline

-

Hypermarket/Supermarket

-

Sports & Fitness Stores

-

Others (Retail Pharmacy Stores, etc.)

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.