- Home

- »

- Medical Devices

- »

-

Enteric Disease Testing Market Size, Industry Report, 2030GVR Report cover

![Enteric Disease Testing Market Size, Share, & Trends Report]()

Enteric Disease Testing Market (2025 - 2030) Size, Share, & Trends Analysis Report By Disease (Bacterial, Viral, Parasitic), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-1-68038-542-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Enteric Disease Testing Market Summary

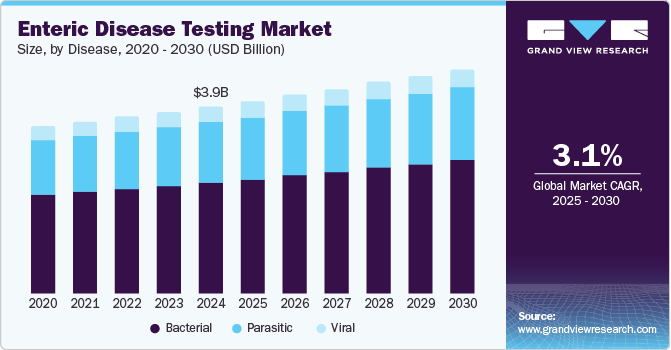

The global enteric disease testing market size was estimated at USD 3.96 billion in 2024 and is projected to reach USD 4.74 billion by 2030, growing at a CAGR of 3.1% from 2025 to 2030. Vital drivers of this market include technological advancements and supportive government initiatives in developed as well as emerging economies.

Key Market Trends & Insights

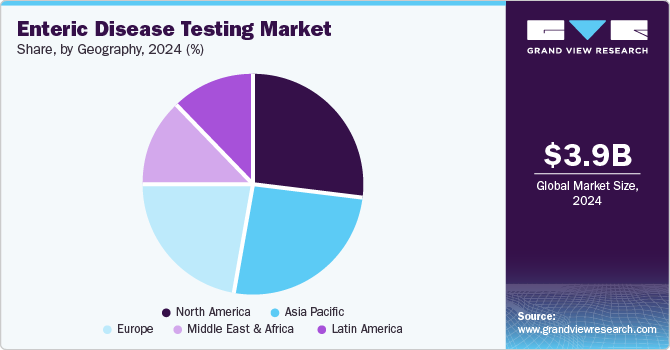

- In terms of region, North America was the largest revenue generating market in 2024.

- The U.S. enteric disease testing market dominated the regional market in 2024.

- By disease, the bacterial segment dominated the enteric disease testing industry, with a revenue share of 59.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.96 Billion

- 2030 Projected Market Size: USD 4.74 Billion

- CAGR (2025-2030): 3.1%

- North America: Largest market in 2024

Furthermore, growing awareness regarding early diagnosis is expected to enhance growth.

The rising prevalence of enteric diseases such as salmonellosis, shigellosis, and cholera primarily drives the growth of this market. For instance, according to the Centers for Disease Control and Prevention (CDC), nearly 1.35 million cases of salmonellosis are recorded each year in the U.S., leading to approximately 26,500 hospitalizations and the death of 420 patients. Growing awareness regarding the benefits of early diagnosis and timely intervention enabled by effective enteric disease testing is expected to create lucrative growth opportunities for this market.

In regions such as North America, Asia, and Africa, the prevalence of enteric infections caused by Salmonella, Campylobacter, Escherichia coli, and norovirus remains significantly high. According to NoroSTAT, a collaborative network of state health departments in the U.S. and the CDC, from August 2024 to March 2025, nearly 2,110 norovirus outbreaks were reported by NoroSTAT-participating states.

Consequently, there is an increasing demand for enteric disease testing to enable accurate and timely diagnoses. Growing awareness of early detection and effective management of enteric diseases among individuals, healthcare providers, and government entities drive market demand. Various organizations and government bodies are undertaking initiatives to enhance awareness, implement screening programs, and advocate for the utilization of diagnostic tests, thereby stimulating the growth of the enteric disease testing industry.

The traditional diagnostic process of enteric diseases is based on the culture method, which demands skilled staff and is time-consuming. The development of molecular diagnostics and other diagnostic technologies revolutionized the enteric disease testing market over the last decade. The increasing mortality rate due to these conditions and the cost efficiency of technologically advanced diagnostic systems are expected to drive the demand for early diagnosis of these conditions.

Initial symptoms associated with enteric diseases include abdominal cramps, vomiting, nausea, and anorexia, which can progress to severe conditions characterized by substantial fluid and nutrient loss from the body. The vulnerability of pediatric and geriatric age groups to these diseases is high due to their weak immune systems. According to the Bill and Melinda Gates Foundation, annually, approximately 500,000 young children under the age of 5 succumb to enteric and diarrheal diseases, predominantly in developing nations. Furthermore, an estimated 25,000 children annually lose their lives to enteric fever, primarily affecting regions that lack access to safe water and adequate sanitation facilities.

The mild initial symptoms of enteric diseases are sometimes overlooked, which impedes market growth. These diseases have emerged as a leading cause of morbidity and mortality globally, particularly in developing countries with inadequate drainage and sanitation infrastructure. Developing nations are estimated to contribute to more than 85% of the total incidence and epidemiology of enteric infections.

The growing incidence of enteric diseases in developing countries, insufficient laboratory facilities, and limited awareness present a significant untapped market opportunity. According to the World Health Organization, diarrheal disease is the third leading cause of death among children aged 1 to 59 months. Annually, diarrhea results in the deaths of approximately 443,832 children under the age of 5 and an additional 50,851 children aged 5 to 9 years. Globally, there are nearly 1.7 billion cases of childhood diarrheal disease each year.

Furthermore, an estimated 9.2 million cases of typhoid fever and 3.8 million cases of paratyphoid fever occur worldwide annually. These illnesses result in approximately 110,000 deaths from typhoid fever and 23,300 deaths from paratyphoid fever each year. A significant number of these deaths occur in South Asia, highlighting the critical impact of these diseases in the region. Thus, the increasing prevalence of enteric diseases and poor sanitation facilities in developing countries create a large untapped market.

Molecular diagnostics are used in various areas of microbiology, which include strain identification and isolation of enteric pathogens. Disease-causing microorganisms are also studied using different molecular diagnostic techniques. The application of molecular diagnostics in microbiology is expected to expand due to the introduction of technologically advanced instruments with improved accuracy levels. Clinical laboratories are adopting molecular diagnostics as a part of laboratory automation. Currently, Polymerase Chain Reaction (PCR), Implicit Association Test (IAT), and gene chips are the most widely used molecular diagnostic tests for infectious diseases. Thus, the rising adoption of molecular diagnostics in detecting enteric diseases is expected to drive the enteric disease testing market over the forecast period.

Technological advancement is another key factor in accelerating market growth. Technologies such as gastrointestinal panel tests are used to identify and qualitatively detect multiple parasitic, bacterial, and viral nucleic acids in individuals with signs and symptoms of gastroenteritis or infectious colitis. The tests are performed on saliva and stool samples to generate results for 15 pathogens in 6 hours.

They are also used to test inherited food sensitivities/allergies to organisms such as Toxoplasma gondii and Entamoeba histolytica. These tests are U.S. FDA approved. Market players are undertaking clinical studies to develop a new diagnostic test with high accuracy and performance. For instance, the XTAG Gastrointestinal (GPP) test was approved by the FDA. XTAG is a multiplexed nucleic acid test designed to simultaneously detect multiple viral, parasitic, and bacterial nuclei in stool samples.

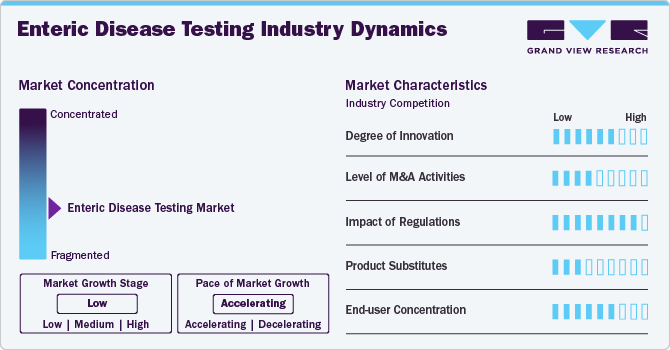

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The enteric disease testing industry is characterized by a medium degree of innovation. Advancements in diagnostic technology, improved access to patient data, and modern technology-driven solutions fuel innovation.

The enteric disease testing market has been experiencing moderate mergers and acquisitions. Strategic advancements by large enterprises and global companies operating in the healthcare technology industry drive these mergers and acquisitions. For instance, in June 2023, Merck & Co., Inc. acquired Prometheus Biosciences, Inc. Now a wholly owned subsidiary of Merck, Prometheus has a division called Prometheus Laboratories, which provides testing services associated with Inflammatory Bowel Disease (IBD) and other gastrointestinal diseases.

The enteric disease testing market is highly influenced by regulations implemented by different government authorities. For instance, the FDA regulates Nucleic Acid Amplification Tests (NAATs) used in the diagnosis of enteric diseases in the U.S. The threat of substitute products is low as advanced technologies have been significantly adopted in diagnostic testing.

Disease Insights

The bacterial segment dominated the enteric disease testing industry, with a revenue share of 59.5% in 2024. Various bacteria that cause these diseases are C. difficile, E. coli, Shigella, Salmonella, and Campylobacter. According to the National Institute of Health, C. difficile infections affect about half a million people in the U.S. annually.

The parasitic segment is expected to experience significant growth over the forecast period. According to the World Health Organization, as of February 2025, the total number of cholera cases recorded was 70,488 in 23 countries across three WHO regions. According to the Child Health Epidemiology Research Group (CHERG), enteric pathogens such as Salmonella spp., rotavirus, and V. cholera had a higher mortality rate than other enteric pathogens. Thus, the WHO committee prioritizes the development of new and improved vaccines against these pathogens. Even though some viruses are ubiquitous, such as rotavirus, which infects about 90% of individuals below 5 years of age, their activity is influenced by environmental factors based on seasonal and geographical patterns linked to hygiene, degree of sanitation, and access to clean drinking water.

Regional Insights

North America enteric disease testing market dominated the enteric disease testing industry, with the largest revenue share of 27.1% in 2024. The growing focus of public health organizations and government agencies on increased testing to reduce the overall influence of enteric diseases is a primary market driver. The presence of multiple diagnostic technology market players and manufacturers of medical devices and testing kits in the region also creates noteworthy growth opportunities.

U.S. Enteric Diseases Testing Market

The U.S. enteric disease testing market dominated the regional market in 2024. This share is attributable to the robust healthcare technology industry in the country, the sophisticated healthcare infrastructure, and the presence of multiple government programs that focus on protecting public health.

Asia Pacific Enteric Diseases Testing Market

Asia Pacific enteric disease testing market held a significant revenue share of the global market. The region's poor water distribution infrastructure, the presence of highly populated countries such as India and China, and the growing demand for advanced diagnostic technology solutions are likely to drive the growth of this market in the coming years.

MEA Enteric Diseases Testing Market

MEA enteric disease testing market is expected to grow at the fastest CAGR from 2025 to 2030. The rise in awareness regarding testing and timely interventions is primarily driving the growth of this market. The large number of foreign visitors entering the Middle East and Africa for business and leisure purposes also influences the growth experienced by this market.

Saudi Arabia enteric disease testing market dominated the MEA regional market in 2024. This growth is mainly driven by factors such as increasing urbanization, the large amount of food imported into the country, and growing investments in the healthcare industry. Growing concerns regarding food and waterborne enteric diseases are likely to drive demand for effective diagnostic technologies.

Key Enteric Disease Testing Company Insights

Some of the key market participants in the enteric disease testing industry include Abbott; BD; BIOMÉRIEUX; Bio-Rad Laboratories, Inc.; and Cepheid. Major companies in this industry focus on incorporating advanced technologies in testing solutions, developing innovation-based product ranges, and effective distribution to strengthen their market positions.

-

Abbott is one of the major market participants in medical technology, nutrition, and healthcare solutions. It offers a range of diagnostic products through its point-of-care business.

-

BIOMÉRIEUX is a global company operating in the diagnostic technology and solutions industry. It specializes in vitro diagnostics and focuses on microbiology, immunoassays, and molecular biology.

Key Enteric Disease Testing Companies:

The following are the leading companies in the enteric disease testing market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- BD

- Biomerica

- BIOMÉRIEUX

- Bio-Rad Laboratories, Inc.

- Cepheid

- Coris BioConcept

- DiaSorin S.p.A.

- Meridian Bioscience

- Quest Diagnostics Incorporated.

Recent Developments

-

In April 2024, a significant deployment of over 1.2 million cholera rapid diagnostic tests began, with the first batch arriving in Malawi. This effort was coordinated by Gavi, UNICEF, WHO, FIND, and other partners and is expected to enhance the timely detection and monitoring of cholera outbreaks, boosting the effectiveness of vaccination campaigns and strategic planning of future preventive vaccination efforts.

Enteric Disease Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.08 billion

Revenue forecast in 2030

USD 4.74 billion

Growth Rate

CAGR of 3.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Report updated

April 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disease and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE and Kuwait

Key companies profiled

Abbott; BD; Biomerica; BIOMÉRIEUX, Bio-Rad Laboratories, Inc.; Cepheid; Coris BioConcept; DiaSorin S.p.A.; Meridian Bioscience; Quest Diagnostics Incorporated.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enteric Disease Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the global enteric disease testing market report based on disease and region.

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Bacterial

-

C. Difficile

-

Campylobacteriosis

-

Cholera

-

E. Coli

-

H. Pylori

-

Salmonellosis

-

Shigellosis

-

-

Viral

-

Rotavirus

-

Norovirus

-

-

Parasitic

-

Amebiasis

-

Cryptosporidiosis

-

Giardiasis

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.