- Home

- »

- Next Generation Technologies

- »

-

Enterprise Information Archiving Market Size Report, 2030GVR Report cover

![Enterprise Information Archiving Market Size, Share & Trends Report]()

Enterprise Information Archiving Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Content Type, Services), By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-392-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Enterprise Information Archiving Market Summary

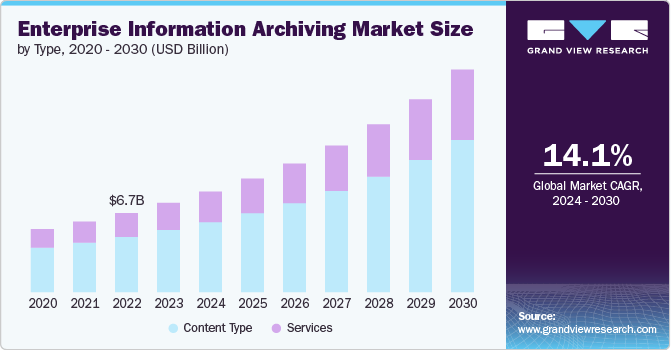

The global enterprise information archiving market size was estimated at USD 7.58 billion in 2023 and is projected to reach USD 18.89 billion, growing at a CAGR of 14.1% from 2024 to 2030. The enterprise information archiving (EIA) market is primarily driven by the increasing volume of digital data, stringent regulatory compliance requirements, and the need for improved data management and security.

Key Market Trends & Insights

- North America enterprise information archiving market held the major share of over 40% in 2023.

- The enterprise information archiving market in the U.S. is expected to grow significantly from 2024 to 2030.

- By type, the content type segment accounted for the largest market share, over 69%, in the market in 2023.

- By deployment, the cloud segment accounted for the largest market share in 2023.

- By enterprise size, the large enterprises segment accounted for the largest market share of over 67% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 7.58 Billion

- 2030 Projected Market Size: USD 18.89 Billion

- CAGR (2024-2030): 14.1%

- North America: Largest market in 2023

Organizations are compelled to adopt EIA solutions to manage vast amounts of data generated through emails, social media, and other communication channels. Additionally, regulatory frameworks such as GDPR, HIPAA, and SOX mandate data retention and protection, thereby necessitating robust archiving systems. Furthermore, the growing focus on data analytics and the integration of advanced technologies like artificial intelligence and machine learning enhance the value proposition of EIA solutions by enabling organizations to derive actionable insights from archived data, ensuring compliance and security, operational efficiency, and strategic decision-making.

The increasing volume of digital data drives the market by compelling organizations to adopt comprehensive archiving solutions to manage and preserve this data efficiently. As the proliferation of digital communication channels, such as emails, social media, and instant messaging, generates vast amounts of information, businesses need help with storage, retrieval, and compliance.

EIA solutions provide a systematic approach to capturing, indexing, and storing digital data, ensuring its availability for future reference and regulatory audits. The exponential growth of data necessitates scalable and secure archiving systems that can handle large volumes without compromising accessibility or integrity. This demand for effective data management strategies not only enhances operational efficiency but also mitigates risks associated with data loss, breaches, and non-compliance, fueling the EIA market's growth.

The need for improved data management and security is a pivotal driver of the enterprise information archiving market. Organizations increasingly recognize the importance of systematically managing digital information to ensure its accuracy, availability, and protection. EIA solutions facilitate the efficient organization and retrieval of data, enabling businesses to streamline their operations and enhance productivity. Moreover, the imperative for robust data security measures intensifies as cyber threats become more sophisticated.

EIA systems offer advanced security features such as encryption, access controls, and audit trails, which safeguard sensitive information from unauthorized access and breaches. These systems also ensure compliance with stringent regulatory requirements by providing comprehensive data retention and governance capabilities. Consequently, the critical need to balance effective data management with strict security protocols propels the adoption of EIA solutions, underscoring their value in maintaining organizational integrity and resilience.

Type Insights

The content type segment accounted for the largest market share, over 69%, in the market in 2023. The expansion of content types in EIA solutions is primarily influenced by the diversification of digital communication channels within organizations. As businesses increasingly utilize emails, social media platforms, instant messaging, collaboration tools, and cloud-based applications, the variety of data formats and sources proliferates. This necessitates EIA solutions that accommodate and manage various content types, ensuring comprehensive data capture, storage, and retrieval. The ability to archive diverse content types enhances organizational compliance and regulatory adherence and supports efficient knowledge management and data governance practices.

The services segment is anticipated to grow at the fastest CAGR over the forecast period. The growth in services offerings within EIA market is driven by the rising demand for specialized and value-added services that cater to the unique needs of different industries and organizations. Data migration, e-discovery, legal hold management, and advanced analytics enable businesses to leverage their archived data more effectively.

Moreover, integrating artificial intelligence and machine learning technologies within EIA services enhances capabilities such as automated data classification, sentiment analysis, and predictive analytics. These advanced services provide organizations with actionable insights, improve operational efficiency, and facilitate informed decision-making. The evolving landscape of regulatory requirements and the need for tailored solutions further propel the expansion of service offerings, making EIA solutions more versatile and comprehensive.

Deployment Insights

The cloud segment accounted for the largest market share in 2023. The increasing demand for scalability, flexibility, and cost-effectiveness drives the proliferation of cloud deployment for EIA solutions. Organizations are increasingly adopting cloud-based EIA solutions to leverage the benefits of reduced infrastructure costs, seamless scalability, and remote accessibility. The cloud offers the ability to quickly scale storage capacity and computing resources in response to growing data volumes without significant capital investments in hardware.

Additionally, cloud deployment facilitates more straightforward integration with other cloud-based applications and services, enhancing overall organizational agility. The rise of remote work and the need for secure, accessible data from any location further propels the adoption of cloud-based EIA solutions, as they provide reliable and safe access to archived data.

The on-premises segment is anticipated to expand at a compound annual growth rate of over 13% during the forecast period. The need for enhanced control, security, and compliance drives the growth of on-premises deployment of EIA solutions. Organizations with stringent regulatory requirements or sensitive data often prefer on-premises solutions to control their data infrastructure completely. On-premises deployment allows businesses to implement customized security protocols and direct oversight of data management processes, ensuring compliance with specific industry regulations and internal policies.

Additionally, organizations with robust IT infrastructure and data centers may find on-premises solutions more cost-effective in the long term. The preference for on-premises deployment is also influenced by concerns about data sovereignty and the desire to mitigate risks associated with third-party cloud providers. Consequently, businesses seeking heightened control and security of their archived data continue to drive the demand for on-premises EIA solutions.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share of over 67% in 2023. Large enterprises' primary drivers are regulatory compliance, data management efficiency, and risk mitigation. Large organizations operate under stringent regulatory frameworks such as GDPR, HIPAA, and SOX, which require meticulous data retention and protection practices. EIA solutions help these enterprises maintain compliance by providing comprehensive archiving capabilities, secure data storage, and robust audit trails.

Additionally, large enterprises' vast volumes of data necessitate sophisticated data management tools to ensure efficient retrieval, analysis, and utilization of information. EIA solutions enhance operational efficiency and decision-making by enabling seamless access to historical data. Furthermore, the potential risks associated with data breaches, legal disputes, and non-compliance drive large enterprises to adopt EIA solutions to safeguard their data and mitigate financial and reputational risks.

The small & medium enterprises segment is anticipated to expand at the fastest CAGR during the forecast period. SMEs are driven to adopt EIA solutions primarily due to the need for cost-effective data management, scalability, and competitive advantage. SMEs often face budget constraints and limited IT resources, making cost-effective and scalable solutions essential. Cloud-based EIA solutions offer SMEs the flexibility to scale their data management capabilities according to their growth and changing needs without significant capital investment.

Additionally, EIA solutions provide SMEs with advanced data management and analytics capabilities, enabling them to compete more effectively with larger enterprises by leveraging their archived data for strategic insights and decision-making. The need to adhere to industry-specific regulations and improve overall operational efficiency also compels SMEs to invest in EIA solutions, ensuring they can manage their data responsibly and remain competitive.

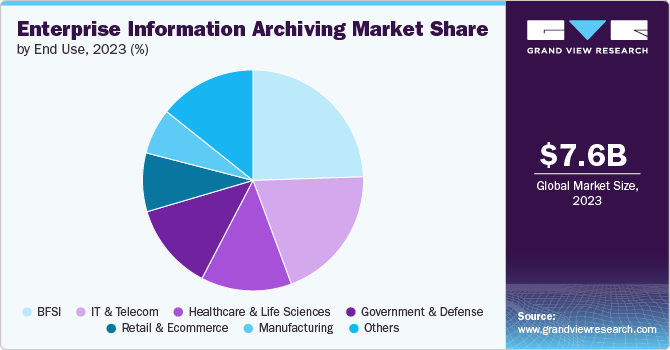

End-use Insights

The BFSI segment accounted for the largest market share of over 24% in 2023 in the enterprise information archiving market. In the BFSI sector, the primary drivers are stringent regulatory requirements, risk management, and data governance. The BFSI sector is heavily regulated, with mandates such as GDPR, Basel III, and Dodd-Frank requiring comprehensive data retention, protection, and auditability. EIA solutions help BFSI organizations ensure compliance by securely archiving vast amounts of transactional data, communications, and records, providing necessary audit trails, and facilitating regulatory reporting.

Additionally, EIA solutions assist in risk management by enabling financial institutions to quickly retrieve and analyze historical data to detect and mitigate fraud, conduct forensic investigations, and manage legal holds. The emphasis on data governance in the BFSI sector, driven by the need for transparency, accuracy, and accountability, further propels the adoption of robust EIA solutions to ensure the integrity and security of sensitive financial information.

The IT & telecom segment is anticipated to grow at the highest CAGR during the forecast period. The IT & telecom industry is driven to adopt EIA solutions primarily due to the need for efficient data management, operational continuity, and customer service enhancement. The rapid technological advancements and proliferation of digital communication channels in this industry generate vast amounts of data that need to be efficiently managed and stored. EIA solutions provide IT and telecom companies with the ability to archive and retrieve data seamlessly, ensuring operational continuity and minimizing downtime.

Furthermore, EIA solutions enhance customer service by enabling quick access to historical communications and interactions, facilitating faster and more accurate responses to customer inquiries and issues. The competitive nature of the IT & telecom industry, coupled with the need to maintain robust data security and compliance with industry regulations, drives the adoption of EIA solutions to ensure efficient data management, operational resilience, and superior customer service.

Regional Insights

North America enterprise information archiving market held the major share of over 40% in 2023. North America's market is characterized by a strong focus on regulatory compliance, particularly in sectors such as BFSI and healthcare. Organizations are increasingly adopting advanced EIA solutions to meet stringent data protection and privacy laws, including GDPR and HIPAA, driving market growth.

U.S. Enterprise Information Archiving Market Trends

The enterprise information archiving market in the U.S. is expected to grow significantly from 2024 to 2030. In the U.S., the EIA market is driven by the need for robust data management and security solutions across various industries. The emphasis on e-discovery, legal hold management, and regulatory compliance, especially within the financial and legal sectors, fuels the adoption of comprehensive EIA solutions.

Europe Enterprise Information Archiving Market Trends

Europe enterprise information archiving market is growing significantly at a CAGR of 13.0% from 2024 to 2030. In Europe, the EIA market is influenced by stringent data protection regulations such as GDPR. The focus on data privacy and the need for organizations to ensure compliance with these regulations drive the demand for EIA solutions. Additionally, growing data security and governance awareness further propels market growth.

Asia Pacific Enterprise Information Archiving Market Trends

The enterprise information archiving market in Asia Pacific is growing significantly at a CAGR of over 15% from 2024 to 2030. In the Asia Pacific region, the EIA market is experiencing rapid growth due to the increasing adoption of digital technologies and the expanding volume of digital data. Countries like China, Japan, and India are witnessing significant investments in IT infrastructure, driving the demand for scalable and efficient EIA solutions. The rising awareness of data management and regulatory compliance also contributes to market expansion in this region.

Key Enterprise Information Archiving Company Insights

Key players operating in the include Veritas Technologies LLC, Microsoft, International Business Machines Corporation, Dell Inc., Google LLC, Proofpoint, Mimecast Services Limited, Commvault, Barracuda Networks, Inc., and Smarsh Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Enterprise Information Archiving Companies:

The following are the leading companies in the enterprise information archiving market. These companies collectively hold the largest market share and dictate industry trends.

- Barracuda Networks, Inc.

- Commvault

- Dell Inc.

- Google LLC

- International Business Machines Corporation

- Microsoft

- Mimecast Services Limited

- Proofpoint

- Smarsh Inc.

- Veritas Technologies LLC

Recent Developments

-

In February 2024, Veritas, a global play in secure multicloud data resilience and Cohesity, a company in AI-powered data security and management, announced a definitive agreement under which Cohesity plans to merge with Veritas’ data protection business, which will be carved out of Veritas. This strategic combination will enable customers to benefit from accelerated innovations driven by the joint company’s scaled R&D investment, its steadfast commitment to customer success, and one of the industry’s most widespread partner ecosystems.

-

In July 2024, Barracuda Networks, Inc., a trusted partner and provider of cloud-first security solutions, announced the expansion of its email security products into the Indian market. This expansion aims to assist customers in complying with national regulations while deploying Barracuda’s advanced email protection, email archiving, and data classification solutions. Customer data can now be stored within Amazon Web Services (AWS) in India. The newly available data residency option addresses the evolving security and compliance requirements of India’s rapidly growing digital economy. This development is particularly significant for organizations in substantially regulated industry sectors such as finance, healthcare, and the public sector.

Enterprise Information Archiving Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.54 billion

Revenue forecast in 2030

USD 18.89 billion

Growth rate

CAGR of 14.1% from 2024 to 2030

Historical data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Veritas Technologies LLC; Microsoft; International Business Machines Corporation; Dell Inc.; Google LLC; Proofpoint; Mimecast Services Limited; Commvault; Barracuda Networks, Inc.; Smarsh Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enterprise Information Archiving Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the enterprise information archiving market report based on type, deployment, enterprise size, end-use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Content Type

-

Database

-

E-mail

-

Social Media

-

Web

-

Instant Messaging

-

Mobile Communication

-

File and Enterprise File Synchronization and Sharing

-

-

Services

-

Consulting

-

System Integration

-

Training, Support, and Maintenance

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government & Defense

-

IT & Telecom

-

Healthcare & Life Sciences

-

Retail & Ecommerce

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise information archiving market size was estimated at USD 7.58 billion in 2023 and is expected to reach USD 8.54 billion in 2024

b. The global enterprise information archiving market is expected to grow at a compound annual growth rate of 14.1% from 2024 to 2030 to reach USD 18.89 billion by 2030

b. North America dominated the enterprise information archiving market with a market share of 40.84% in 2023. North America's enterprise information archiving market is characterized by a strong focus on regulatory compliance, particularly in sectors such as BFSI and healthcare. Organizations are increasingly adopting advanced EIA solutions to meet stringent data protection and privacy laws, including GDPR and HIPAA, driving market growth.

b. Some key players operating in the enterprise information archiving market include Veritas Technologies LLC, Microsoft, International Business Machines Corporation, Dell Inc., Google LLC, Proofpoint, Mimecast Services Limited, Commvault, Barracuda Networks, Inc., and Smarsh Inc.

b. Several key factors are driving the growth of the enterprise information archiving market. The enterprise information archiving (EIA) market is primarily driven by the increasing volume of digital data, stringent regulatory compliance requirements, and the need for improved data management and security. Organizations are compelled to adopt EIA solutions to manage vast amounts of data generated through emails, social media, and other communication channels.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.