- Home

- »

- Communications Infrastructure

- »

-

eDiscovery Market Size, Share And Growth Report, 2030GVR Report cover

![eDiscovery Market Size, Share & Trends Report]()

eDiscovery Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Organization Size, By Deployment Model (On Premise, Cloud), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-412-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

eDiscovery Market Summary

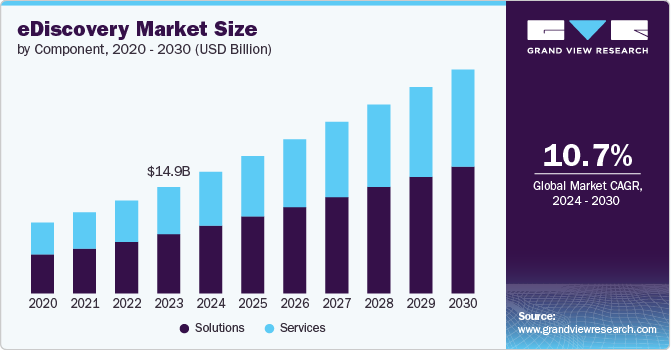

The global eDiscovery market size was estimated at USD 14.99 billion in 2023 and is projected to reach USD 31.51 billion by 2030, growing at a CAGR of 10.7% from 2024 to 2030. The increasing need for organizations to preserve metadata from electronic documents is significantly driving market growth.

Key Market Trends & Insights

- The North America eDiscovery market accounted for the largest revenue share of over 47% in 2023.

- The Asia Pacific E-discovery market is expected to grow at the fastest CAGR of over 13% from 2024 to 2030.

- By component, the solutions segment in the market registered the largest share of over 55% in 2023.

- By organization size, the small and medium enterprises segment is expected to witness the highest CAGR from 2024 to 2030.

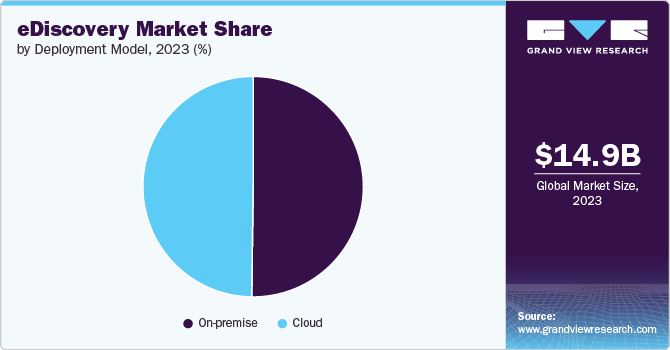

- By deployment model, the on-premise segment registered the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 14.99 Billion

- 2030 Projected Market Size: USD 31.51 Billion

- CAGR (2024-2030): 10.7%

- North America: Largest market in 2023

Moreover, stringent regulatory requirements are rising constantly, and the preservation of metadata ensures that digital information remains authentic and accessible over time. This trend of data transitions from analog to digital formats, which necessitates robust eDiscovery solutions, is expected to fuel market growth in the coming years.

The shift towards cloud-based services has transformed how organizations manage their data. Cloud-based E-discovery solutions offer scalability, cost-effectiveness, and ease of access compared to traditional on-premises systems. This trend is further accelerated by the growing remote work culture post-COVID-19, as companies are seeking flexible solutions that can support distributed teams while ensuring compliance with legal standards.

Organizations are prioritizing cybersecurity measures that include effective eDiscovery practices, owing to the rise in cyberattacks and data breaches. The need to respond to security incidents often requires comprehensive data management strategies that encompass eDiscovery capabilities, which is responsible for the market growth. As businesses recognize the importance of safeguarding sensitive information while complying with legal obligations, this trend is expected to continue to fuel demand for advanced eDiscovery solutions.

Furthermore, the number of litigations worldwide has been on the rise, driven by heightened regulatory scrutiny across sectors, including finance, healthcare, and technology. Organizations are increasingly required to produce electronic evidence during legal proceedings, which boosts the demand for efficient eDiscovery tools that can streamline the process of identifying, collecting, and reviewing electronically stored information (ESI). This trend is expected to fuel market growth in the coming years.

Moreover, the integration of artificial intelligence (AI) and machine learning (ML) into eDiscovery processes is revolutionizing how organizations handle large volumes of data. These technologies enhance data analysis capabilities by automating document review processes and improving accuracy in identifying relevant information. As AI-driven analytics become more prevalent, these trends are expected to drive significant growth in the E-discovery market.

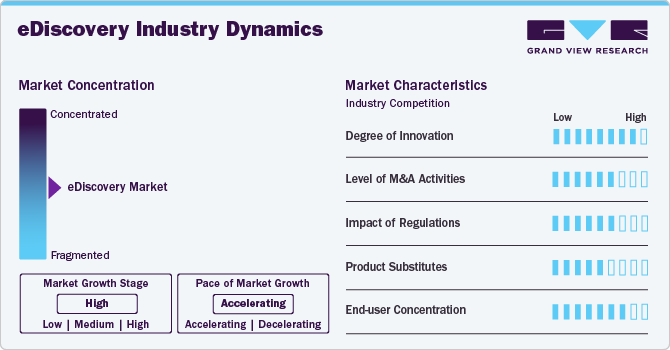

Market Concentration & Characteristics

The market is characterized by a high degree of innovation, driven primarily by advancements in technology and the increasing complexity of data management. Innovations such as artificial intelligence (AI), machine learning (ML), and advanced analytics are transforming how eDiscovery processes are conducted. These technologies enable faster data processing, improved accuracy in document review, and enhanced predictive coding capabilities. The continuous evolution of these technologies ensures that companies remain competitive while also meeting regulatory requirements.

The level of mergers & acquisition activities in the market is expected to be moderate, as companies seek to enhance their service offerings and expand their market reach. This trend is fueled by the need for comprehensive solutions that integrate various aspects of legal technology, including data collection, processing, review, and production. Larger firms often acquire smaller niche players with specialized technologies or expertise to bolster their capabilities.

The impact of regulations on the market is expected to be moderate. Compliance with laws such as the General Data Protection Regulation (GDPR) in Europe and various industry-specific regulations in sectors like finance and healthcare necessitates stringent data management practices. Many eDiscovery providers are investing heavily in compliance-related features within their software solutions. Additionally, ongoing changes in legislation regarding data privacy continue to influence how companies approach eDiscovery, prompting them to adopt more proactive strategies for managing electronic information.

The competition from product substitutes in the market is expected to be moderate. General-purpose document management systems or collaboration platforms equipped with search capabilities can serve as substitutes for traditional eDiscovery software in certain contexts. Moreover, some organizations may opt for internal teams utilizing existing IT infrastructure rather than outsourcing their eDiscovery needs to specialized vendors.

The end-user concentration in the market is moderate to high. Large corporations-particularly those in highly regulated industries such as finance, healthcare, and telecommunications-constitute a substantial portion of demand due to their extensive legal obligations regarding data retention and discovery processes. However, small - to medium-sized enterprises (SMEs) are increasingly recognizing the importance of effective eDiscovery practices as they navigate litigation risks or regulatory scrutiny. This shift has led many vendors to tailor their offerings specifically for SMEs by providing scalable solutions that cater to varying budgets and resource constraints.

Component Insights

The solutions segment in the market registered the largest share of over 55% in 2023, owing to the increasing reliance on advanced technologies and software solutions that streamline the process of electronic data discovery. Organizations are increasingly facing regulatory pressures and legal challenges that necessitate efficient management of large volumes of data. As a result, they are investing heavily in comprehensive eDiscovery solutions that offer features such as data processing, analytics, and review capabilities. The integration of artificial intelligence and machine learning into these solutions has further enhanced their effectiveness, allowing for faster and more accurate identification of relevant information, thereby driving segmental growth.

The services segment is anticipated to record significant growth of over 10% from 2024 to 2030. This growth can be attributed to several factors, including the increasing complexity of legal cases and the growing volume of electronically stored information (ESI) that organizations must manage. As companies navigate this evolving landscape, there is a rising demand for specialized services such as consulting, managed services, and support for data collection and processing.

Organization Size Insights

The large enterprises segment accounted for the largest market share in 2023. Large enterprises typically have extensive data management needs, driven by their vast amounts of digital information generated from various sources such as emails, documents, and databases. These organizations often face complex legal and regulatory requirements that necessitate robust eDiscovery solutions to ensure compliance and mitigate risks associated with litigation and investigations. Additionally, larger firms usually possess greater financial resources to invest in advanced eDiscovery technologies and services, enabling them to implement comprehensive strategies for data collection, processing, and analysis.

The small and medium enterprises segment is expected to witness the highest CAGR from 2024 to 2030, driven by a combination of increasing awareness about data security and compliance among smaller businesses, along with the growing accessibility of affordable eDiscovery solutions tailored for their specific needs. As SMEs continue to digitize their operations, they generate significant amounts of data that require effective management during legal proceedings or audits. The rise of cloud-based eDiscovery platforms has made it easier for SMEs to adopt these technologies without incurring prohibitive costs associated with traditional systems. These factors are expected to contribute to segmental growth in the coming years.

End-use Insights

The legal sector segment in the market registered the largest share in 2023. This growth can be attributed to the increasing complexity of legal regulations across various industries, which has necessitated a higher demand for legal services, particularly in areas such as compliance, intellectual property, and corporate governance. Additionally, the rise of digital transformation has led to new legal challenges related to data privacy, cybersecurity, and e-commerce, further driving the need for specialized legal expertise. This combination of regulatory demands and the necessity for strategic legal counsel is expected to contribute to the rapid growth of the segment.

The manufacturing segment is anticipated to record the fastest growth from 2024 to 2030. The ongoing advancements in automation and smart manufacturing technologies are revolutionizing production processes, leading to increased efficiency and reduced operational costs. Additionally, there is a growing emphasis on sustainability and eco-friendly practices within manufacturing operations, prompting companies to innovate their processes and product offerings. Moreover, government initiatives aimed at revitalizing manufacturing sectors through incentives and support programs are likely to further accelerate the segmental growth in coming years.

Deployment Model Insights

The on-premise segment registered the largest revenue share in 2023. This growth can be attributed to its established presence and the preference of many organizations for maintaining control over their data. Companies often opt for on-premise solutions to ensure compliance with stringent regulatory requirements, particularly in industries such as finance, healthcare, and legal services, where data sensitivity is paramount. Additionally, on-premise systems allow organizations to customize their eDiscovery processes according to specific needs and workflows, which can enhance efficiency and effectiveness, thereby driving segmental growth.

The cloud segment is expected to grow at highest CAGR from 2024 to 2030. The increasing shift towards digital transformation has led organizations to adopt cloud-based solutions for their scalability, flexibility, and cost-effectiveness. Cloud eDiscovery platforms offer significant advantages such as reduced IT overhead costs, ease of access from remote locations, and rapid deployment capabilities that align well with modern business operations. Furthermore, advancements in cloud security measures are alleviating concerns regarding data breaches and compliance issues; thereby, the demand for these solutions is expected to surge in the coming years.

Regional Insights

The North America eDiscovery market accounted for the highest revenue share of over 47% in 2023. In North America, the E-discovery market is driven by stringent regulatory compliance requirements such as GDPR and CCPA, high volumes of litigation, technological advancements in AI and machine learning, and the exponential growth of data from diverse sources. Furthermore, a strong shift towards cloud-based solutions for scalability, integration of AI for predictive coding and automated review, heightened data privacy concerns, and the impact of remote work increasing the need for decentralized data handling capabilities.

U.S. eDiscovery Market Trends

The E-discovery market in the U.S. is projected to grow at a CAGR of over 9% from 2024 to 2030. The U.S. E-discovery market is witnessing a significant shift towards increased automation and data-driven decision-making, driven by the adoption of advanced technologies such as Building Information Modeling (BIM) and real-time monitoring systems. This trend is characterized by the integration of IoT devices that enhance operational efficiency, improve safety protocols, and facilitate remote management of construction sites.

Europe eDiscovery Market Trends

Europe E-discovery market is anticipated to grow at a CAGR of over 10% from 2024 to 2030. This growth is propelled by strict GDPR enforcement, increasing cross-border litigation, the rise in corporate investigations, and the adoption of advanced technologies. Key trends in the region include a regulatory compliance focus, advanced analytics integration, growing cloud solution adoption, and significant emphasis on cybersecurity to protect sensitive information.

The E-discovery market in the UK is anticipated to grow at a CAGR from 2024 to 2030. In the U.K., the eDiscovery market is driven by stringent regulatory requirements like GDPR, a high volume of litigation, and increasing corporate investigations. Trends include the growing adoption of cloud-based eDiscovery solutions for scalability and cost-effectiveness, the integration of AI and machine learning for improved data processing and analysis, and a strong focus on data privacy and security to comply with regulatory standards.

Germany E-discovery market is expected to grow at a CAGR from 2024 to 2030. Germany's eDiscovery market is influenced by strict data protection laws, including GDPR, and the increasing need for compliance in cross-border litigation cases. In addition, a growing preference for cloud-based eDiscovery solutions, and heightened awareness of data privacy and cybersecurity measures to protect sensitive information is driving the market expansion in Germany.

The E-discovery market in France is projected to grow at a CAGR from 2024 to 2030. The adoption of advanced analytics and AI for efficient data processing, a strong move towards cloud-based solutions for better scalability and cost management, and an increasing emphasis on data privacy and security to ensure compliance with stringent regulatory requirements.

Asia-Pacific eDiscovery Market Trends

The Asia Pacific E-discovery market is expected to grow at the fastest CAGR of over 13% from 2024 to 2030. The emerging data protection regulations heightened corporate governance standards, rapid economic growth, and extensive digital transformation in the region is significantly propelling the market growth in the region.

The E-discovery market in China is projected to grow at a CAGR from 2024 to 2030. Chinese market is shaped by new data protection regulations like the Personal Information Protection Law (PIPL), rapid digitalization across industries, and a growing implementation of AI and machine learning technologies to enhance data processing. There is also a notable shift towards cloud-based eDiscovery solutions for scalability and cost efficiency, coupled with a heightened focus on data security and privacy.

The E-discovery market in Japan is expected to grow at a CAGR from 2024 to 2030. The market is driven by regulatory pressures from laws such as the Act on the Protection of Personal Information (APPI), increased integration of advanced technologies such as AI and machine learning, and a strong emphasis on corporate governance and internal investigations.

The India E-discovery market is expected to grow at a CAGR from 2024 to 2030. In India, emerging data privacy regulations, such as the Personal Data Protection Bill, and rapid digital transformation are driving the eDiscovery market. Furthermore, there is an increasing use of AI and automation to improve efficiency, alongside a growing need for robust eDiscovery tools due to the rise in litigation and corporate investigations. These trends are expected to fuel market growth in the coming years.

Middle East And Africa eDiscovery Market Trends

The E-discovery market in the Middle East and Africa is expected to grow at a significant CAGR of over 11% from 2024 to 2030. The market is driven by new data protection regulations in countries such as the UAE and South Africa, economic diversification efforts, investment in advanced technologies, and the growth of multinational business operations requiring cross-border compliance.

Saudi Arabia E-discovery market is anticipated to grow at a CAGR from 2024 to 2030. The push towards digitization is increasing the volume of electronically stored information (ESI), which necessitates robust eDiscovery solutions in the country, which is expected to drive market growth in the coming years.

Key eDiscovery Company Insights

Some key players operating in the market include Microsoft Corporation, Lighthouse, and IBM Corporation, among others.

-

Microsoft Corporation is a multinational technology company actively engaging in the eDiscovery market through its comprehensive eDiscovery solution, Microsoft Purview, designed to assist organizations in managing legal and compliance-related data. It enables businesses to efficiently identify, hold, and analyze data across various Microsoft services such as Exchange Online, SharePoint Online, and OneDrive for Business. The platform is part of Microsoft’s broader commitment to providing robust security and compliance tools that help organizations navigate the complexities of regulatory requirements and legal obligations.

-

Lighthouse is a provider of eDiscovery solutions, specializing in the management and analysis of electronic data for legal and compliance purposes. Founded with a mission to streamline the complexities associated with electronic discovery, Lighthouse offers a comprehensive suite of services that encompass data collection, processing, review, and production. Their innovative platform leverages advanced technologies such as artificial intelligence and machine learning to enhance the efficiency and accuracy of data handling. The company caters to various sectors, including law firms, corporations, and government entities, ensuring that clients can navigate the intricacies of litigation and regulatory investigations.

Conduent, and Exterro, Inc. are some emerging participants in the market.

-

Conduent is a provider of business process services, specializing in legal compliance and eDiscovery solutions. The company leverages advanced technology and analytics to assist organizations in managing complex legal processes, ensuring compliance with regulatory requirements, and optimizing operational efficiency.

-

Exterro, Inc. is a provider of e-discovery software solutions that cater to the needs of legal and compliance professionals. The company focuses on streamlining the e-discovery process through its comprehensive suite of tools designed for data management, legal hold, and investigation workflows. The company’s platform integrates various functionalities, allowing organizations to efficiently manage their electronic data during litigation and regulatory inquiries.

Key E-discovery Companies:

The following are the leading companies in the E-discovery market. These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- Microsoft Corporation

- Open Text Corporation

- Exterro, Inc.

- Lighthouse

- Nuix Limited

- Conduent

- Veritas Technologies LLC

- One Discovery

- FTI Consulting, Inc.

Recent Developments

-

In April 2024, Lighthouse launched its new antitrust practice, which aims to provide comprehensive legal and consulting services to clients navigating complex antitrust issues. This initiative is complemented by innovative technology offerings designed to enhance the efficiency and effectiveness of antitrust investigations and compliance efforts. The firm emphasizes a multidisciplinary approach, combining legal expertise with advanced technology to address the evolving challenges in antitrust law.

-

In January 2024, Lighthouse launched the industry's first AI-powered privilege review tool, Lighthouse AI Privilege Review, which enhances the identification and management of privileged information. This innovative tool offers up to 6.6 times greater accuracy than traditional methods and has successfully generated a 200,000-entry privilege log accepted by the Federal Trade Commission, showcasing its effectiveness in large-scale legal matters.

-

In January 2024, Exterro launched Exterro Assist, a generative AI-powered assistant designed to enhance e-discovery processes. This advanced tool enables users to automate complex workflows, generate data insights, and conduct precise searches using natural language, potentially increasing productivity by up to 75%. Exterro Assist will first be available as an add-on for Exterro Legal Hold customers and will soon be integrated across the entire Exterro Data Risk Management Platform.

eDiscovery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.11 billion

Revenue forecast in 2030

USD 31.51 billion

Growth rate

CAGR of 10.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2024 to 2030

Report Component

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, organization size, deployment model, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

IBM Corporation; Microsoft Corporation; Open text Corporation; Lighthouse; Exterrro, Inc.; Nuix Limited; Conduent; Veritas Technologies LLC; One Discovery; FTI Consulting, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global eDiscovery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global eDiscovery market report based on component, organization size, deployment model, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solutions

-

Services

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises

-

-

Deployment Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Legal Sector

-

Government and Regulatory Agencies

-

BFSI

-

Healthcare

-

Retail and Consumer Goods

-

Energy and Utilities

-

IT and Telecommunications

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global eDiscovery market size was estimated at USD 14.99 billion in 2023 and is expected to reach USD 17.11 billion in 2024.

b. The global eDiscovery market is expected to grow at a compound annual growth rate of 10.7% from 2024 to 2030 to reach USD 31.51 billion by 2030.

b. The eDiscovery market in North America accounted for a significant revenue share of over 47% in 2023, driven by stringent regulatory compliance requirements such as GDPR and CCPA, high volumes of litigation, technological advancements in AI and machine learning, and the exponential growth of data from diverse sources.

b. Some key players operating in the eDiscovery market include IBM Corporation, Microsoft Corporation, Open Text Corporation, Exterro, Inc., Lighthouse, Nuix Limited, Conduent, Veritas Technologies LLC, One Discovery, FTI Consulting, Inc.

b. Key factors that are driving the eDiscovery market growth include the increasing need for organizations to preserve metadata from electronic documents, shift towards cloud-based services, and the integration of artificial intelligence (AI) and machine learning (ML) into eDiscovery.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.