- Home

- »

- IT Services & Applications

- »

-

Enterprise Mobility Management Market Size Report, 2030GVR Report cover

![Enterprise Mobility Management Market Size, Share, & Trends Report]()

Enterprise Mobility Management Market (2025 - 2030) Size, Share, & Trends Analysis Report By Solution (Software, Services), By Deployment (Cloud-based, On-premises), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-075-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Enterprise Mobility Management Market Summary

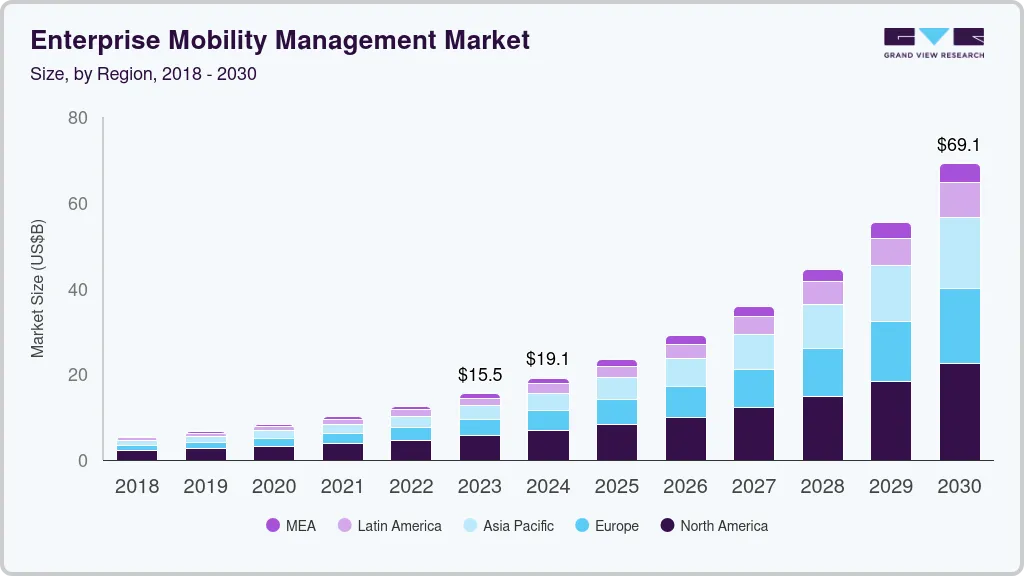

The global enterprise mobility management market size was estimated at USD 19.05 billion in 2024 and is projected to reach USD 69.12 billion by 2030, growing at a CAGR of 24.1% from 2025 to 2030. Owing to significant increase in mobile devices and a shift in various end use companies' focus on protecting their digital infrastructure, thereby propelling market growth.

Key Market Trends & Insights

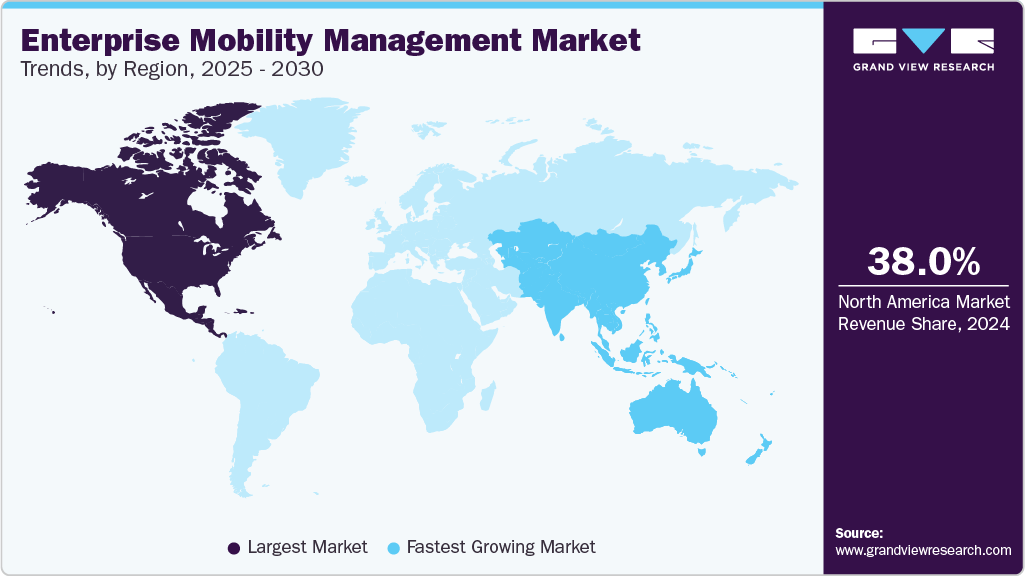

- The North America enterprise mobility management industry held a major global share of over 38.0% in 2024.

- The U.S. enterprise mobility management industry is projected to grow during the forecast period.

- By solution, the software segment held the largest market share of over 63.0% in 2024.

- By deployment, the cloud-based segment dominated the market with a revenue share of over 56.0% in 2024.

- By enterprise size, the large enterprises segment dominated the market with a revenue share of over 52.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.05 Billion

- 2030 Projected Market Size: USD 69.12 Billion

- CAGR (2025-2030): 24.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, advancements in cloud-based EMM solutions are creating a positive outlook for the market. The rising adoption of Bring Your Own Device (BYOD) policies and the growing mobile workforce by various enterprises to enhance employee productivity are expected to drive market growth in the forecast period.EMM involves various enterprise sizes such as Mobile Device Management (MDM), Mobile Device Provisioning, and Mobile Enterprise Size Management (MAM), Mobile security, enterprise mobility solutions, and Mobile Content Management (MCM). EMM helps organizations maximize employee productivity, control operating costs, and reduce device downtime. EMM enables IT administrators to distribute enterprise sizes to end user devices remotely, allowing them to access all essential data. Furthermore, it provides powerful security capabilities, such as remote data wiping and encryption, to protect corporate data.

The governments of various countries, such as India, the UK, Saudi Arabia, Brazil, and Canada, are significantly investing in cybersecurity solutions to safeguard sensitive information. These governments are funding various research projects on cybersecurity to enhance their digital infrastructure data security. For instance, in February 2023, the government of Canada announced federal funding of USD 1.9 million as a part of the Cyber Security Cooperation Program for cybersecurity projects at Université de Sherbrooke. The research projects focus on improving cybersecurity in Industry 4.0, 5G connectivity, and other wireless environments. Such initiatives by the government are expected to boost the growth of the market.

The expansion of cloud services and SaaS-based productivity tools further propels the EMM market. As more enterprise sizes migrate to the cloud, employees increasingly access corporate systems from mobile devices. EMM platforms help organizations ensure that only authorized devices and users can access cloud enterprise sizes, often through single sign-on (SSO), identity federation, and access control policies. Integration with unified endpoint management (UEM) and mobile enterprise size management (MAM) capabilities also enables IT teams to maintain oversight of how apps and data are used on mobile devices.

Solution Insights

The software segment held the largest market share of over 63.0% in 2024. The enterprise mobility software strengthens the security of employees’ mobile devices to protect the company’s sensitive data. This software also offers various benefits, such as controlling content access, updating content with just one click on bulk devices, and providing security against data breaches, creating positive market trends. Moreover, the advancements in EMM software and the availability of diverse EMM software portfolios are expected to drive the growth of the market.

The services segment is anticipated to grow at the fastest CAGR during the forecast period. Enterprise mobility management services allow organizations to keep customer personally identifiable information (PII) and intellectual property secure and safe. These services protect mobile devices from malware attacks while providing flexibility and convenience to users when using mobile devices. Furthermore, EMM services offer various solutions, such as mobile device provisioning, enterprise mobility solutions, mobile threat defense, and mobile security, supporting the segment growth.

Deployment Insights

The cloud-based segment dominated the market with a revenue share of over 56.0% in 2024. The cloud segment is witnessing significant growth owing to its various benefits, such as centralized data security and enhanced flexibility in various EMM operations, such as mobile device security, mobile device provisioning, and mobile application management. Cloud deployment helps end use companies eliminate the expenses incurred on dedicated hardware and software. Moreover, cloud-based enterprise mobility management solutions can equally facilitate automatic data backups and secure data storage. As a result, data is never compromised, even if there is any issue on the user side, and the system can resume operations automatically.

The on-premises segment is expected to register a CAGR of 22.2% from 2025 to 2030. The on-premises segment provides business owners a total control over the system, including security, upgrades, and maintenance, supporting the industry trend. Further, on-premise deployments are equipped with advanced security features that assist organizations in complying with various government regulations. It gives organizations more control over sensitive data and assists with compliance. However, the proliferation of cloud-based EMM solutions and their low operating costs is expected to hamper the growth of the on-premise segment in the forecast period.

Enterprise Size Insights

The large enterprises segment dominated the market with a revenue share of over 52.0% in 2024. Large enterprises face various risks, such as hacking and data breaches, that come with the increasing use of advanced technologies. Large enterprises must strengthen the security of their mobile devices to avoid any significant data and financial losses due to cyberattacks. With the increase in work-from-home policy adoption, the use of personal devices and anonymous networks poses a security threat to large enterprises. Due to this, the demand for EMM solutions is expected to increase in large enterprises over the forecast period.

The small and medium-sized enterprises (SMEs) segment is expected to register the fastest CAGR from 2025 to 2030. The small & medium enterprises are vulnerable to cyber-attacks due to low levels of security, due to budget constraints. However, the availability of low-cost enterprise mobility management solutions and significant penetration by market players are anticipated to accelerate the adoption of EMM solutions in SMEs over the forecast period.

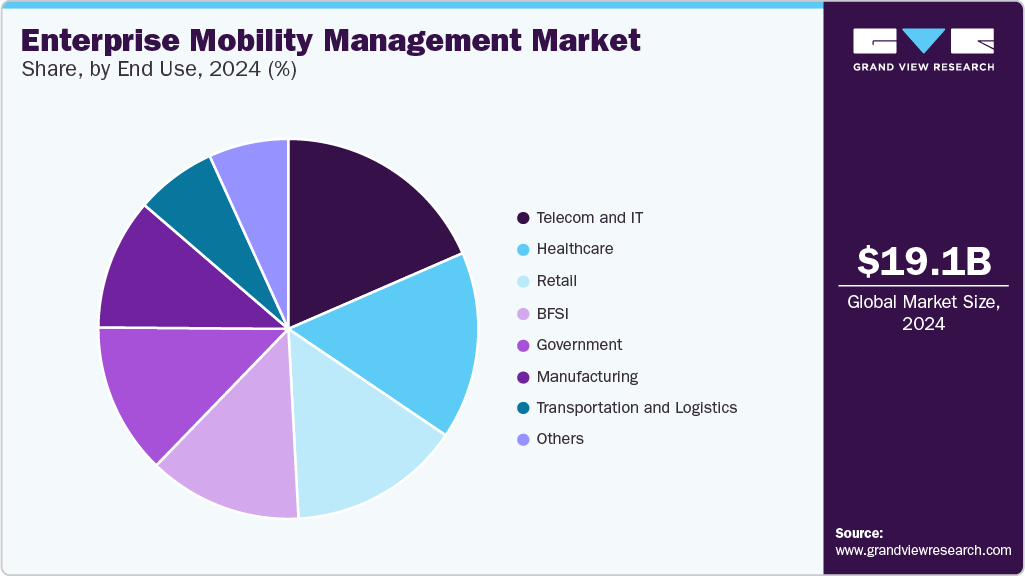

End Use Insights

The IT & telecom segment held the largest market share of over 18.0% in 2024 in the enterprise mobility management industry. The significant advancements in wireless infrastructure and IT modernization are boosting the enterprise mobility management solutions in the IT & telecom industry. The increasing usage of endpoint devices, coupled with the rising number of private unsecured network connections, is creating a potential environment for cyberattacks. As such, IT & telecom companies focus on implementing EMM solutions, and therefore are contributing to the market growth.

The retail segment is anticipated to register the fastest CAGR during the forecast period. The penetration of e-commerce companies and the significant rise in online shopping activities are propelling the demand for enterprise mobility management solutions in the retail industry. The growth in retail mobile devices, such as kiosks and POS terminals, is forcing retailers to improve the digital security of these devices to protect critical business data, supporting segment growth.

Regional Insights

The North America enterprise mobility management industry held a major global share of over 38.0% in 2024. The availability of key market players such as Cisco Systems, Inc., IBM Corporation, & Microsoft Corporation, and increasing public and private investments in cybersecurity solutions are driving the growth of the North America EMM market. The supportive government initiatives to strengthen digital security and protect sensitive data are creating robust market opportunities for the EMM market. For instance, in March 2023, the Government of the U.S. announced a new cybersecurity strategy to strengthen its cyber defenses to control the rising digital crimes and hacking in the U.S. With this program, the government will improve its collaboration with market players and invest in cybersecurity projects across the country.

U.S. Enterprise Mobility Management Market Trends

The U.S. enterprise mobility management industry is projected to grow during the forecast period. The adoption of bring-your-own-device (BYOD) policies across a wide range of U.S. organizations is a significant driver in the EMM market. While BYOD offers flexibility and cost advantages, it also presents security challenges, such as the risk of data leaks or unauthorized access to sensitive information. EMM solutions address these concerns through features such as app containerization, data encryption, remote wipe capabilities, and policy enforcement. These tools help companies maintain control over corporate data without infringing on employee privacy, making them essential for balancing security and usability in BYOD environments.

Europe Enterprise Mobility Management Market Trends

The enterprise mobility management industry in Europe is expected to grow at a CAGR of 25.1% from 2025 to 2030. Europe’s push toward digital transformation and smart enterprise solutions is boosting the use of mobile-first platforms across industries such as healthcare, logistics, manufacturing, and retail. EMM plays a vital role in supporting these changes by enabling secure mobility, remote troubleshooting, application management, and real-time data access from the field. In industries where mobile devices are critical for frontline operations or customer service, EMM ensures that performance and security standards are upheld without disruption.

The enterprise mobility management industry in Germany is expected to grow during the forecast period. Germany’s strong emphasis on Industry 4.0 and digital transformation is also accelerating the need for EMM solutions. As manufacturers and logistics companies integrate smart technologies and connected devices into their operations, managing mobile assets becomes essential for workforce enablement and operational continuity. Field workers, technicians, and sales teams are increasingly equipped with mobile devices to streamline tasks and improve responsiveness. EMM platforms allow centralized control of these devices, ensuring they are secure, up to date, and functioning optimally in demanding industrial environments.

Asia Pacific Enterprise Mobility Management Market Trends

The enterprise mobility management industry in Asia Pacific is expected to register the fastest CAGR of 26.3% from 2025 to 2030. The growing demand for smart devices and systems in the consumer electronics and automotive sectors, particularly in countries like Japan and South Korea, is driving market growth. Both these nations are heavily investing in autonomous technologies to improve the functionality and safety of consumer electronics and vehicles. The automotive industry, for example, is focused on the development of autonomous vehicles, including self-driving cars and trucks, with substantial investments in AI, sensors, and machine learning algorithms to drive vehicle automation. As consumer demand for smart, connected, and autonomous products rises, manufacturers in the region are adopting enterprise mobility management technologies to meet these needs, ensuring they stay competitive in the rapidly evolving marketplace.

The enterprise mobility management industry in China is projected to grow during the forecast period. Investments in 5G and smart infrastructure projects are poised to boost EMM demand even further. With faster connectivity and a surge in mobile and IoT devices, organizations need sophisticated tools to manage, monitor, and secure these endpoints in real time. EMM platforms will play a key role in ensuring operational efficiency and security as APAC economies continue their transition to digitally connected ecosystems.

Key Enterprise Mobility Management Company Insights

SAP SE and Broadcom, Inc., among others, are some of the leading participants in the enterprise mobility management industry.

-

SAP SE, a German multinational software corporation, specializes in enterprise software solutions that facilitate business operations and customer relations. SAP introduced the SAP Mobile Platform, a robust solution designed to enable organizations to develop, deploy, and manage mobile applications across diverse devices and platforms. This platform supports both native and hybrid app development, offering tools such as drag-and-drop designers and pre-built templates to expedite the development process. Moreover, it ensures consistent user experiences and supports offline functionality, allowing users to operate without internet connectivity and synchronize data once reconnected.

-

Broadcom Inc., a global technology company, has significantly expanded its enterprise software portfolio through strategic acquisitions, notably the acquisition of VMware in November 2023. This acquisition brought VMware's robust enterprise mobility management (EMM) solutions, particularly the Workspace ONE platform, under Broadcom's umbrella. Workspace ONE, powered by AirWatch technology, offers a comprehensive suite for unified endpoint management (UEM), integrating device management, application management, and identity management to provide secure and seamless access to applications across various devices.

Matrix42 and Ivanti, Inc. are some of the emerging market participants in the enterprise mobility management industry.

-

Matrix42 is a provider of workplace management solutions. The company specializes in enabling seamless management of physical, virtual, and mobile environments, integrating client lifecycle, cloud, SaaS, virtualization, and service management into a holistic solution. Matrix42 offers a comprehensive solution known as Silverback. Silverback provides simple, secure, and scalable management of mobile devices and workspaces through a single interface. It encompasses features such as device management, security and compliance, over-the-air configuration, mobile application management, mobile content management, user self-service, and integration with leading deployment programs and IT service management systems.

-

Ivanti is a prominent IT software company specializing in IT security, systems management, and enterprise mobility solutions. Ivanti's Endpoint Manager Mobile (EPMM) provides comprehensive mobile device management (MDM), mobile application management (MAM), and mobile content management (MCM) functionalities. It enables organizations to securely manage the lifecycle of mobile devices and applications, from registration to retirement, ensuring secure access to corporate data, email, and apps.

Key Enterprise Mobility Management Companies:

The following are the leading companies in the enterprise mobility management (EMM) market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- SAP SE

- Broadcom, Inc.

- AppTec GmbH

- VMware, Inc.

- Citrix Systems

- Ivanti

- IBM Corporation

- Microsoft Corporation

- Micro Focus

- Zoho Corporation Pvt. Ltd.

- Matrix42

- Sophos

- BlackBerry Limited

- Esper

Recent Developments

-

In May 2025, SAP SE announced that VFS Global will utilize its software to develop advanced AI-powered digital solutions aimed at enhancing cross-border mobility and citizen services. As these areas become increasingly digitized, governments are turning to cutting-edge technologies like artificial intelligence to boost efficiency and strengthen sovereign security. VFS Global is implementing SAP S/4HANA Cloud Public Edition along with other SAP solutions.

-

In October 2023, BlackBerry Limited launched two major innovations in Unified Endpoint Management (UEM). BlackBerry UEM software is designed to oversee, monitor, and secure all end-user devices across an organization. By extending BlackBerry UEM to the edge, the company aims to enhance enterprise productivity and improve the employee experience. This approach brings workloads closer to the user and their devices, ensuring ultra-low latency connectivity while maintaining the high security standards that customers rely on from BlackBerry.

-

In October 2023, BlackBerry Limited partnered with ServiceNow to streamline device management for organizations. This solution, which integrates ServiceNow's Flow Designer with BlackBerry UEM, aims to minimize the administrative load on IT teams for common device management tasks, all while ensuring top-notch security. ServiceNow's Flow Designer allows businesses to build comprehensive digital workflows, automating operations to boost efficiency and enhance the overall experience.

Enterprise Mobility Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.48 billion

Revenue forecast in 2030

USD 69.12 billion

Growth rate

CAGR of 24.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, enterprise size, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Cisco Systems, Inc.; SAP SE; Broadcom, Inc.; AppTec GmbH; VMware, Inc.; Citrix Systems; Ivanti; IBM Corporation; Microsoft Corporation; Micro Focus; Zoho Corporation Pvt. Ltd.; Matrix42; Sophos; BlackBerry Limited; Esper

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enterprise Mobility Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global enterprise mobility management market report based on solution, deployment, enterprise size, end use, and region.

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Mobile Device Management

-

Mobile Identity Management

-

Mobile Content Management

-

Mobile Application Management

-

-

Services

-

Professional Services

-

Consulting

-

Integration

-

Support and Maintenance

-

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premises

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small and Medium-sized Enterprises

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Healthcare

-

IT & Telecom

-

BFSI

-

Manufacturing

-

Transportation and Logistics

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise mobility management market size was estimated at USD 19.05 billion in 2024 and is expected to reach USD 23.48 billion by 2025.

b. The global enterprise mobility management market is expected to grow at a compound annual growth rate of 24.1% from 2025 to 2030 to reach USD 69.12 billion by 2030.

b. The key players operating in the enterprise mobility management market include Cisco Systems, Inc., SAP SE, Broadcom, Inc., AppTec GmbH, VMware, Inc., Citrix Systems, Ivanti, IBM Corporation, Microsoft Corporation, Micro Focus, Zoho Corporation Pvt Ltd., Matrix42, Sophos, Blackberry, and Esper.

b. The rising adoption of Bring Your Own Device (BYOD) policies and the rising mobile workforce by various enterprises to enhance employees' productivity are expected to drive market growth in the forecast period.

b. Software dominated the enterprise mobility management market with a share of over 63.0% in 2024. This is attributable to various benefits offered by software such as controlling content access, updating content in just one click on bulk devices, and providing security against data breaches, creating positive market trends.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.