- Home

- »

- Advanced Interior Materials

- »

-

Environmental Test Chamber Market Size, Share Report 2030GVR Report cover

![Environmental Test Chamber Market Size, Share & Trends Report]()

Environmental Test Chamber Market (2023 - 2030) Size, Share & Trends Analysis Report By Product, By Business Model, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-098-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global environmental test chamber market size was estimated at USD 946.6 million in 2022 and is projected to grow at a compounded annual growth rate (CAGR) of 3.0% from 2023 to 2030. The increasing number of regulations in end-use industries such as aerospace & defense and automotive coupled with the growing requirement of monitoring the effects of various stress factors are expected to drive the demand for the market for environmental testing chambers over the forecast period. An environmental chamber is used in a variety of sectors to assess the effects of a product or substance under certain environmental conditions. It is also referred to as an environmental test room or a climatic chamber. Environmental test chambers are used to evaluate the performance of items and materials in several settings such as temperature, humidity, altitude, vibration, and light.

The aerospace sector in the U.S. continues to have the greatest trade balance (USD 77.6 billion in 2019) and the second-highest volume of exports (USD 148 billion) of any manufacturing industry. This leading position has been maintained for decades, with aerospace exports expanding at an average rate of 5.3% over the last decade and the aerospace trade balance increasing at an average rate of 4.6% since 2010. Therefore, the increasing aerospace industry in the U.S. will result in increased demand for environmental test chambers in the future years.

Environmental test chambers are used in the aerospace industry to evaluate atmospheric conditions to guarantee that they meet the regulations of the Society of Automotive Engineers (SAE). The aerospace sector is primarily concerned with safety, dependability, and efficiency. To verify a product's viability, the product is tested in an environmental chamber for a thermal shock as well as a simulation of various air conditions.

The aerospace business is ever-changing, as each aircraft is expected to be capable of operating at high altitudes while remaining safe, efficient, and dependable. For instance, Tenney Environmental has contributed to the aerospace sector with a diverse range of thermal testing chambers and atmospheric simulators. Furthermore, Tenney Environmental's superior altitude and vacuum chambers can simulate circumstances as high as 200,000 feet.

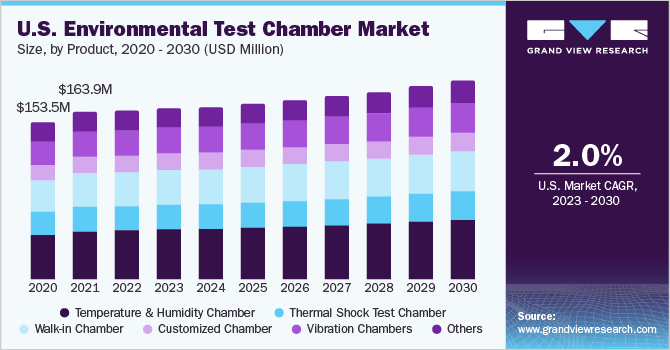

Product Insights

Temperature & humidity chamber dominated the market in 2022 with a revenue share of 29.6%. Temperature and humidity chambers give the same accurate and high-quality data as bigger chamber; however, with a smaller footprint, flexibility, and cost-effectiveness. Despite their modest size, they can contain the same data-gathering computational units seen in more expensive equipment. These are perfect for university labs, small businesses, and testing minor components and parts. These aforementioned factors are expected to propel the demand for the environmental test chamber industry in the coming years.

The thermal shock test chamber segment is anticipated to grow at a CAGR of 3.0% from 2023 to 2030. Thermal shock chambers also called climatic chambers are utilized for thermal shock testing in which the material is subjected to severe vibration. This is performed by repetitive abrupt transitioning from high to low temperatures for the detection of damaged parts. Furthermore, they are used for items to study their characteristics and failures caused by numerous materials and their thermal expansion coefficients. These factors fuel the adoption of thermal shock test chambers in the upcoming years.

Vibration testing chambers are used to assess a component or piece of equipment through its resistance to combined mechanical and environmental stresses that could impair performance under normal use settings. To assure user dependability and safety, the two main product categories that must undergo these testing are automotive and aeronautical components.

Application Insights

The research and development (R&D) segment was estimated to hold a 70.2% share of the environmental test chamber market in 2022. Research is critical for the technological and engineering tasks required to advance product design and development. R&D is used by businesses in practically every industry to plan, build, and deliver new and innovative goods. Moreover, environmental test chambers are used for numerous R&D purposes. Some are intended for laboratory study, testing in the search for or evaluation of product alternatives, pre-production prototype construction, and testing.

The most common tests performed are those for product shelf-life. Companies use HALT (highly accelerated life testing) to simulate a product's lifespan. The purpose is to discover a product's 'failure point' so that companies may set standards or, if necessary, focus on a different design that is more durable.

Business Model Insights

The product segment dominated the market in 2022 with a revenue share of 83.3% owing to increasing new automotive manufacturing facilities, for instance, Maruti Suzuki, Hyundai Motor Company, Kia Motors, SAIC, Changan, and Beiqi Foton, and Fiat are expected to invest approximately USD 8 to 10 billion in India to set up their automotive factories and expand their production in India, which will drive the demand for environmental test chambers over the forecast period.

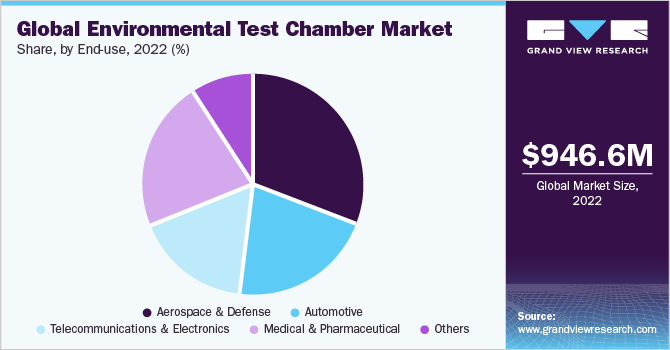

End-use Insights

The defense and aerospace segment dominated the market in 2022 with a revenue share of 30.7%. Environmental test chambers are used in the defense and aerospace industries to test components and products to enhance their durability and reliability. Furthermore, most environmental test chambers are built to meet a wide range of Mil-Std test regulations, including Mil-Std 810, Mil-Std 883, and other military testing requirements. These aforementioned factors are expected to propel the demand in the aerospace & defense end-use segment.

Chambers that can withstand extreme cold and heat as well as low and high humidity, help evaluate how cars and associated components will work under the most extreme conditions. These aforementioned factors are anticipated to propel the demand in the automotive end-use segment over the forecast period.

The medical & pharmaceutical segment is projected to grow at a CAGR of 2.8% from 2023 to 2030. Environmental test chambers are commonly employed in the pharmaceutical industry to simulate the vast range of temperature fluctuations and humidity levels, to which the products may be subjected. Tests in this field extend beyond product testing that includes examining the endurance of pharmaceutical container materials crucial for the protection of medicine efficiency. Compliance with various standards and regulations enforced on the business is an integral aspect of pharmaceutical testing. These have aided in product development by determining their longevity, shelf life, and conditions resulting in their decay.

Environmental variables, particularly moisture, humidity, and temperature changes make electronic devices extremely prone to failure. These variables are used to evaluate the stability of electrical equipment in relation to its surroundings during use. ICs, switches, touch panels, surge protectors, transducers, semiconductors circuit boards, and different assemblies are among the components examined.

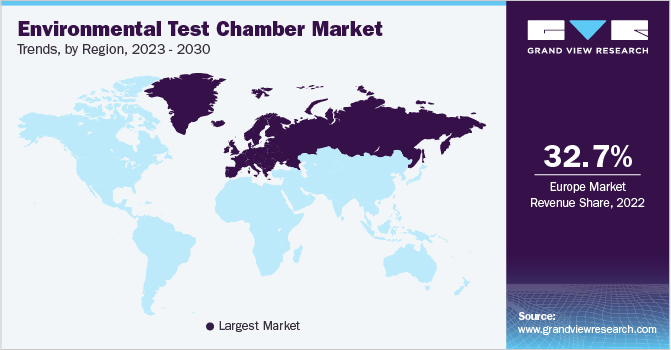

Regional Insights

Europe held a 32.7% share of the environmental test chambers market in 2022, owing to significant investment in R&D of various end-use industries including medical & pharmaceutical and automotive. Moreover, the rising use of tailored drugs is also driving the demand for environmental test chambers. The tailored drug involves the storage and testing of lesser batches of medicine, which can be done more proficiently using stability test chambers. The above-mentioned factors will positively affect the environmental test chamber industry growth.

Asia Pacific is projected to grow at a CAGR of 3.6% over the forecast period. The expansion of the new electric vehicle manufacturing facility, along with the new reforms in the regulatory framework in the region, is likely to augment the demand for environmental test chambers over the forecast period. For instance, in February 2023, Volvo CEO Jim Rowan announced the possibility of setting up a new global electric vehicle plant in India. Lithium-ion batteries are broadly utilized in electric and hybrid vehicles, where they have to withstand extreme humidity, temperatures, and other environmental conditions during their operational life. Environmental test chamber s assist in identifying potential concerns and safeguards, so they can meet safety standards and regulations.

Key Companies & Market Share Insights

The key players adopt various strategies such as the novel expansion of production facilities, additional investments in manufacturing facilities, product launches, and collaboration to maintain a competitive edge in the market. Furthermore, the companies are also engaged in market acquisitions, mergers, expansion, and product modification approaches to ensure market domination. For instance, In April 2022, ESPEC CORP launched a new Environmental Stress Chamber AR Series. The new equipment can achieve the global warming potential (GWP) value and consume lower power during operation (maximum 21% reduction). Some prominent players in the global environmental test chamber market include:

-

KOMEG Technology Ind Co., Ltd

-

ACMAS Technologies Pvt. Ltd.

-

Weiss Technik North America, Inc.

-

Russells Technical Products

-

Thermotron Industries

-

TA Instruments

-

Memmert GmbH + Co. KG

-

BINDER GmbH

-

Envisys Technologies

-

ESPEC CORP

-

Angelantoni Test Technologies

-

Climatic Testing Systems, Inc. (CTS)

-

Hastest Solutions Inc.

-

CM Envirosystems

Environmental Test Chamber Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 964.4 million

Revenue forecast in 2030

USD 1,197.9 million

Growth rate

CAGR of 3.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, business model, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; UAE; South Africa; Saudi Arabia

Key companies profiled

KOMEG Technology Ind Co., Ltd; ACMAS Technologies Pvt. Ltd.; Weiss Technik North America, Inc.; Russells Technical Products; Thermotron Industries; TA Instruments; Memmert GmbH + Co. KG; BINDER GmbH; Envisys Technologies; ESPEC CORP; Angelantoni Test Technologies; Climatic Testing Systems, Inc. (CTS); Hastest Solutions Inc.; CM Envirosystems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Environmental Test Chamber Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global environmental test chamber market report based on product, application, end-use, business model, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Temperature & Humidity Chamber

-

Thermal Shock Test Chamber

-

Walk-in Chamber

-

Customized Chamber

-

Vibration Chambers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research and Development (R&D)

-

Production & Inspection

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Telecommunications & Electronics

-

Medical & Pharmaceutical

-

Others

-

-

Business Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Product

-

Service

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global environmental testing chamber market size was estimated at USD 946.6 million in 2022 and is expected to be USD 964.4 million in 2023.

b. The environmental testing chamber market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.0% from 2023 to 2030 to reach USD 1,197.9 million by 2030

b. Asia Pacific dominated the environmental testing chamber market with a revenue share of 39.9% in 2022. The expansion of new electric vehicle manufacturing facility, along with the new reforms in the regulatory framework in the region, is likely to augment the demand for environmental testing chambers over the forecast period.

b. Some of the key players operating in the environmental testing chamber market include: KOMEG Technology Ind Co.,Ltd, ACMAS Technologies Pvt. Ltd., Weiss Technik North America, Inc., Russells Technical Products, Thermotron Industries, TA Instruments, Memmert GmbH + Co. KG, BINDER GmbH, Envisys Technologies, ESPEC CORP, Angelantoni Test Technologies, Climatic Testing Systems, Inc. (CTS), Hastest Solutions Inc., CM Envirosystems.

b. Key factors that are driving the environmental testing chamber market growth include the rising research and development (R&D) investment in emerging countries including China and India.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.