- Home

- »

- Pharmaceuticals

- »

-

Epinephrine Market Size And Share, Industry Report, 2033GVR Report cover

![Epinephrine Market Size, Share & Trends Report]()

Epinephrine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Auto-Injectors, Prefilled Syringes & Disposable Injectors), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-773-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Epinephrine Market Summary

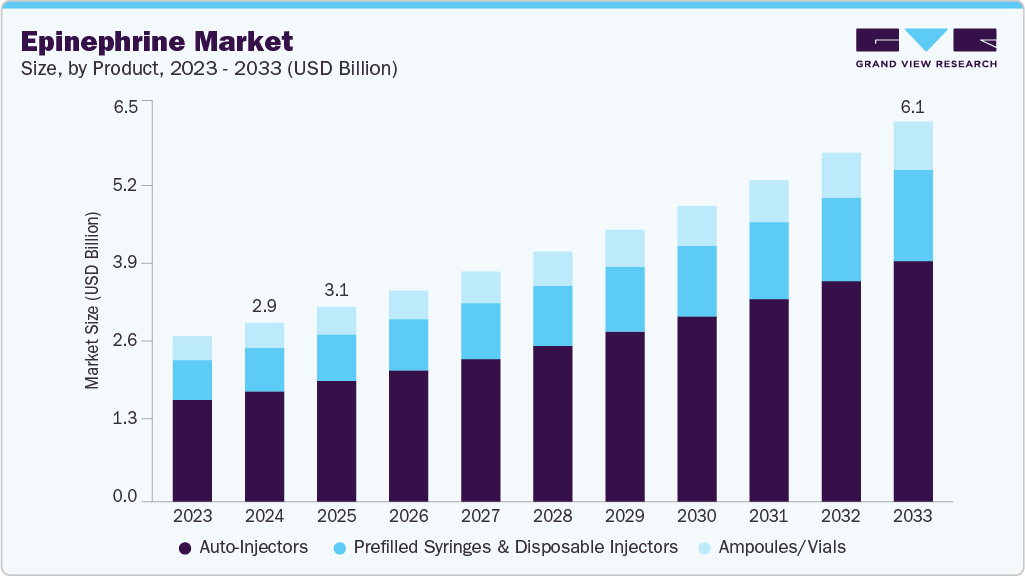

The global epinephrine market size was valued at USD 2.87 billion in 2024 and is projected to reach USD 6.08 billion by 2033, growing at a CAGR of 8.71% from 2025 to 2033. The growth is attributed to rising allergy prevalence, greater public awareness of anaphylaxis, and expanding “stock epinephrine” policies in schools and public venues drive demand.

Key Market Trends & Insights

- North America dominated the market with the largest revenue share of 42.73 % in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 10.0 % over the forecast period.

- By product, the auto-injectors (Epinephrine Auto-Injectors - EAIs) segment accounted for the largest revenue share of 61.76 % in 2024.

- By distribution channel, the retail pharmacies segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.87 Billion

- 2033 Projected Market Size: USD 6.08 Billion

- CAGR (2025-2033): 8.71 %

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market trends point toward diversification beyond traditional injectable forms, with strong momentum for needle-free and alternative delivery systems such as intranasal sprays and oral films that promise greater convenience and compliance. Growing awareness of life-threatening anaphylaxis and improvements in healthcare infrastructure are fueling market expansion. In June 2025, a joint report by WHO Europe and the European Respiratory Society estimated that 81.7 million people in the WHO European Region are living with chronic respiratory diseases (CRDs), including asthma and COPD, with many additional cases remaining undiagnosed. This highlights the significant patient population requiring timely intervention.The entry of generics and biosimilar equivalents is intensifying price competition while improving accessibility, prompting branded players to differentiate through smart, connected devices and patient-support programs. Additionally, regional market expansion in emerging economies, strategic partnerships, and supply-chain localization are becoming key focus areas, reflecting an overall trend toward innovation, affordability, and broader public access within the epinephrine segment.

Increasing awareness of severe allergic reactions and the rising global prevalence of anaphylaxis are driving demand for epinephrine as a critical emergency treatment. Enhanced education initiatives focusing on recognizing and managing life-threatening allergic episodes have supported this trend.

Market Concentration & Characteristics

The industry is characterized by moderate innovation due to research and development activities. Manufacturers are moving beyond traditional auto-injectors to develop needle-free options such as intranasal sprays and sublingual or dissolving film formulations that simplify administration during emergencies and address needle anxiety, particularly in children. Additionally, companies are exploring miniaturized, temperature-stable devices that extend shelf life and enable easier public stocking in schools, workplaces, and transportation hubs. These innovations are collectively reshaping the competitive landscape, aiming to expand patient access, reduce administration errors, and provide differentiated value in a maturing yet high-impact therapeutic segment.

Epinephrine is a critical, life-saving drug, so regulations around approval, safety, storage, and prescription are stringent. Regulatory compliance is time-consuming, restricting new players and reinforcing existing firms' dominance.

While alternatives such as other emergency treatments or generic forms exist, epinephrine remains the treatment choice for anaphylaxis. The limited availability of effective substitutes slightly reduces competitive pressure, but it is not the primary driver of concentration compared to barriers and regulation.

Regional market expansion in emerging economies, strategic partnerships, and supply-chain localization are becoming key focus areas, reflecting an overall trend toward innovation, affordability, and broader public access within the epinephrine segment. In December 2024, Fresenius Kabi expanded its U.S. epinephrine injectable portfolio by launching Epinephrine Injection, USP, 30 mg/30 mL multi-dose vials.

Product Insights

The auto-injectors (Epinephrine Auto-Injectors - EAIs) segment accounted for the largest revenue share of 61.76% in 2024, driven by the increasing focus on convenient and effective drug delivery solutions. In recent years, advancements in syringes and injectors have improved usability, making disposable auto-injectors a preferred choice for patients and caregivers. Epinephrine auto-injectors are essential for treating anaphylaxis, enabling timely administration by non-medical individuals, which can be life-saving by reversing allergic reactions, opening airways, and maintaining blood pressure.

The ampoules/vials (hospital injectables) segment is anticipated to experience significant growth over the forecast period, due to increasing demand for hospital-based treatments and emergency care. Hospitals and healthcare facilities rely on injectable epinephrine in ampoules or vials for precise dosing in acute situations, such as severe allergic reactions, cardiac arrest, and anaphylaxis. This growth is further supported by product advancements, such as the launch of American Regent’s FDA-approved sulfite-free Epinephrine Injection, USP, in March 2023, designed for emergency treatment of allergic reactions, including anaphylaxis, resulting from insect bites/stings, sera, drugs, foods, other allergens, and diagnostic testing substances, and exercise-induced anaphylaxis or idiopathic anaphylaxis.

Distribution Channel Insights

The retail pharmacies distribution channel segment accounted for the largest revenue share of 58.70% in 2024. Retail pharmacies allow patients to easily obtain epinephrine for personal use, particularly for individuals with chronic conditions such as asthma or severe allergies who require immediate access to the drug. The rise in awareness about anaphylaxis and self-administration and the growing adoption of epinephrine auto-injectors for home use drive demand through this channel. In addition, expanding pharmacy networks and supportive government policies promoting accessibility of essential medications further boost growth in the retail pharmacy segment.

The online pharmacies segment is estimated to grow at the fastest CAGR over the forecast period. Consumer preference for convenient and contactless access to medications is steadily increasing. The growth of e-commerce platforms, enhanced digital healthcare infrastructure, and greater awareness of emergency treatments like epinephrine encourage more patients to purchase medicines online. In addition, online pharmacies offer competitive pricing, home delivery, and discreet service, making them a preferred choice for patients managing chronic conditions or at risk of severe allergic reactions.

Regional Insights

North America epinephrine market dominated with the largest revenue share of 42.73% in 2024. Strong awareness among patients and healthcare professionals about the timely use of epinephrine auto-injectors continues to drive market growth. In addition, a well-established healthcare infrastructure, favorable reimbursement policies, and the presence of major pharmaceutical players such as Viatris, Glenmark, and Teva Pharmaceuticals improve product availability and accessibility. For instance, in February 2025, Glenmark launched a generic epinephrine injection (10 mg/10 mL, multiple-dose vial) in the U.S., receiving 180 days of exclusivity under the Competitive Generic Therapy (CGT) pathway, further expanding treatment options.

U.S. Epinephrine Market Trends

The epinephrine market in the U.S. dominated the regional market in 2024. The high prevalence of anaphylaxis and allergic conditions in the U.S., including asthma and food allergies, is driving strong demand for epinephrine as an emergency treatment. Asthma alone affects approximately 24.9 million Americans, including 20.2 million adults and 4.6 million children, and results in over 94,000 hospital stays and 900,000 emergency visits annually, highlighting the critical need for rapid intervention: well-established healthcare infrastructure, favorable government reimbursement policies, and extensive awareness programs further support market growth.

Europe Epinephrine Market Trends

The epinephrine market in Europe is expected to experience strong growth over the forecast period. The growing number of patients with chronic conditions such as asthma and cardiac arrest is driving demand for epinephrine in Europe, with innovations like nasal sprays complementing traditional injections and supporting wider adoption. Strong government support, rising healthcare expenditure, technological advances in drug delivery, and active R&D initiatives further fuel market growth.

Asia-Pacific Epinephrine Market Trends

The epinephrine market in Asia Pacific is expected to grow at the fastest CAGR of 10.0 % over the forecast period. Urbanization, pollution, and changing dietary habits increase the incidence of allergic and respiratory conditions, amplifying the need for emergency therapeutics. Local manufacturing of low-cost generic epinephrine injectors and advances in delivery systems like nasal sprays and needle-free devices are making emergency treatment safer and more accessible, especially in rural and developing areas.

Middle East & Africa Epinephrine Market Trends

The epinephrine market in the Middle East and Africa is expected to experience growth in the coming years, driven by ongoing improvements in healthcare infrastructure and greater access to essential medicines. Governments, particularly in Gulf Cooperation Council (GCC) countries, are investing heavily in modernizing healthcare facilities, which is increasing the availability and use of emergency treatments like epinephrine.

Key Epinephrine Company Insights

Key players operating in the epinephrine market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key companies in the epinephrine market include Viatris Inc., Kaleo, Inc., Amneal Pharmaceuticals, Inc., Teva Pharmaceutical Industries Ltd., Pfizer Inc., Fresenius Kabi AG, Baxter International Inc., and BPI Labs / Generic Injectables Manufacturers.

-

Viatris Inc. is a global healthcare company that offers a broad portfolio of over 1,400 approved therapeutic molecules, including branded medicines, generics, biosimilars, over-the-counter (OTC) products, and active pharmaceutical ingredients (APIs). In addition, Viatris manufactures and markets a wide range of injectable medications, including emergency-use drugs such as epinephrine.

Key Epinephrine Companies:

The following are the leading companies in the epinephrine market. These companies collectively hold the largest market share and dictate industry trends.

- Viatris Inc.

- Kaleo, Inc.

- Amneal Pharmaceuticals, Inc.

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Fresenius Kabi AG

- Baxter International Inc.

- BPI Labs / Generic Injectables Manufacturers

- Kindeva Drug Delivery

- Sandoz (a Novartis Division)

Recent Developments

-

In July 2025, Kaléo’s AUVI-Q (epinephrine injection, USP) was cleared by Axiom Space for use during its Ax-4 mission to safeguard the crew against allergic emergencies. The device was included in the mission’s medical kit and flight surgeons’ launch and landing kits, reflecting its reliability in critical situations.

-

In February 2025, Glenmark Pharmaceuticals Inc., USA, launched its Epinephrine Injection USP, 10 mg/10 mL (1 mg/mL) Multiple-Dose Vial, a product that is both bioequivalent and therapeutically equivalent to BPI Labs’ reference-listed drug.

Epinephrine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.12 billion

Revenue forecast in 2033

USD 6.08 billion

Growth rate

CAGR 8.71% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key company profiled

Viatris Inc.; Kaleo, Inc.; Amneal Pharmaceuticals, Inc.; Teva Pharmaceutical Industries Ltd.; Pfizer Inc.; Fresenius Kabi AG; Baxter International Inc.; BPI Labs / Generic Injectables Manufacturers; Kindeva Drug Delivery; Sandoz (a Novartis Division)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Epinephrine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global epinephrine market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Auto-Injectors (Epinephrine Auto-Injectors - EAIs)

-

Prefilled Syringes & Disposable Injectors

-

Ampoules / Vials (Hospital Injectables)

-

- Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.