- Home

- »

- Pharmaceuticals

- »

-

Europe Active Pharmaceutical Ingredients Market Report 2033GVR Report cover

![Europe Active Pharmaceutical Ingredients Market Size, Share & Trends Report]()

Europe Active Pharmaceutical Ingredients Market (2025 - 2033) Size, Share & Trends Analysis Report By Synthesis, By Manufacturer, By Type (Generic APIs, Innovative APIs), By Application (Cardiovascular Diseases, Endocrinology), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-064-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe API Market Size & Trends

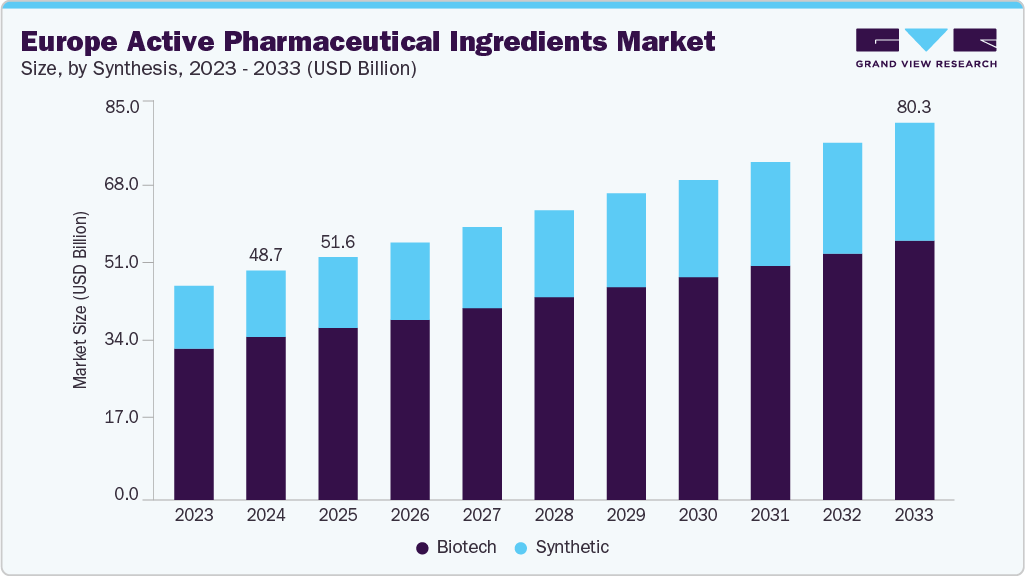

The Europe active pharmaceutical ingredients market size was estimated at USD 48.69 billion in 2024 and is projected to reach USD 80.16 billion by 2033, growing at a CAGR of 5.67% from 2025 to 2033. The increasing demand for generic and specialty medicines, driven by widespread patent expirations of blockbuster drugs and growing healthcare cost-containment policies, is a key factor fueling the Europe active pharmaceutical ingredients (API) market. National health systems across the EU are actively promoting generic substitution to improve patient access while reducing expenditure, which directly boosts the need for cost-effective, high-quality APIs. Specialty medicines, particularly those targeting oncology, rare diseases, and autoimmune disorders, are also gaining momentum, driving requirements for both complex synthetic APIs and high-potency active pharmaceutical ingredients (HPAPIs).

The rapid expansion of biologics and biosimilars production across Europe is significantly boosting demand for complex APIs, particularly large molecules and high-purity ingredients. Countries such as Germany, Switzerland, and Ireland are major centers for biologics manufacturing, hosting state-of-the-art facilities for monoclonal antibodies, recombinant proteins, and vaccines. The expiration of patents for several leading biologics has accelerated the launch of biosimilars, especially in oncology, immunology, and endocrinology segments, creating a surge in biologics API production. For instance, in 2024, the European Medicines Agency (EMA) reported that it had approved a record 28 biosimilars, and oncology remained the dominant therapeutic area during this period.

EU regulatory incentives, such as streamlined biosimilar approval pathways by the European Medicines Agency (EMA), further support this growth. In early 2025, EMA’s CHMP issued positive opinions for three biosimilars: Dyrupeg (pegfilgrastim) and the aflibercept biosimilars Pavblu and Skojoy, further confirming sustained momentum in biosimilar launches. Manufacturers are increasingly investing in advanced bioprocessing technologies, including single-use systems and continuous biomanufacturing, to meet stringent quality requirements and improve efficiency. This trend is also leading to a rise in contract manufacturing partnerships, where API producers collaborate with pharmaceutical companies to scale up biologics and biosimilars production for domestic use and export markets.

Advancements in pharmaceutical manufacturing technologies are transforming the Europe API market, enabling higher efficiency, better quality control, and more sustainable production processes. Continuous manufacturing, process analytical technology (PAT), and green chemistry are increasingly being adopted by leading API producers to optimize operations and reduce environmental impact. These innovations help meet stringent EU regulatory standards while lowering production costs and improving yield. Countries such as Belgium, the Netherlands, and the UK are investing in digitalized and automated production lines, which enhance traceability and minimize human error. Furthermore, Industry 4.0 integration allows for real-time monitoring of API quality parameters, ensuring compliance with Good Manufacturing Practices (GMP). Sustainable manufacturing practices are gaining regulatory and consumer support, driving the shift toward eco-friendly solvents, waste minimization, and renewable energy use in API production. As competition intensifies, technological leadership is becoming a critical differentiator for API manufacturers in Europe’s highly regulated pharmaceutical landscape.

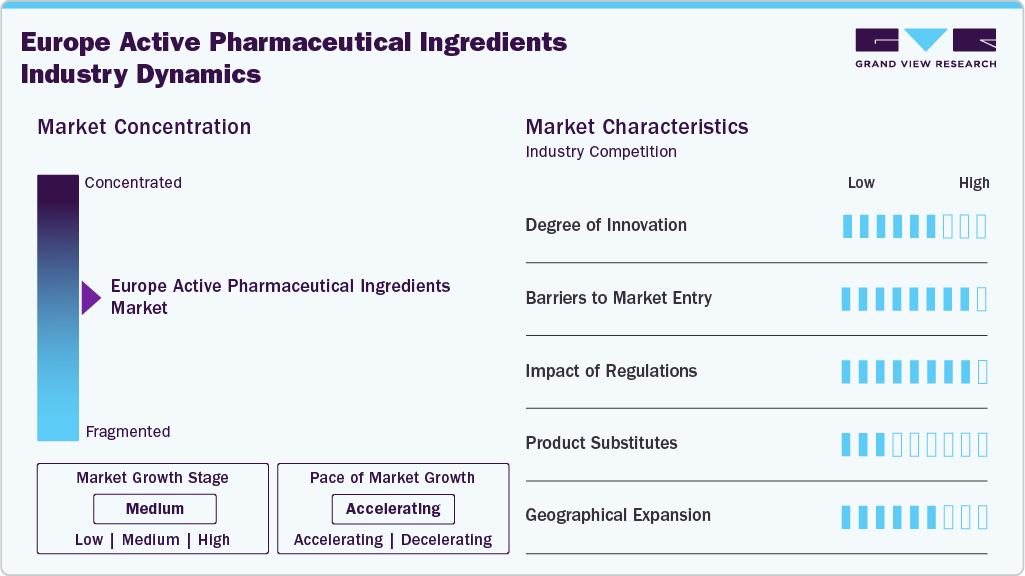

Market Concentration & Characteristics

The API industry in Europe exhibits a moderate-to-high degree of innovation, particularly in therapeutic areas such as oncology, cardiovascular diseases, and CNS disorders. Continuous advancements in biotech synthesis, including monoclonal antibodies, recombinant proteins, and therapeutic enzymes, are enabling more targeted and effective treatments. Leading pharmaceutical manufacturers are integrating green chemistry and continuous manufacturing to enhance quality and reduce environmental impact. Innovation is also driven by the rising development of high-potency APIs for cancer and rare disease treatments. This focus on advanced therapies is strengthening Europe’s position as a global hub for high-value API production.

The European API market presents high entry barriers due to stringent regulatory requirements, substantial capital investment needs, and established competition from global leaders. Compliance with EMA guidelines and Good Manufacturing Practices (GMP) is mandatory, requiring significant investment in advanced production facilities. Established players such as Merck & Co., Boehringer Ingelheim, and Teva have long-standing relationships with pharmaceutical companies, making it challenging for newcomers to secure contracts. In addition, the complex manufacturing of biotech APIs for oncology and chronic disease treatments demands specialized technical expertise. These factors collectively limit the ability of new entrants to compete on quality, scale, and regulatory compliance.

Regulatory frameworks in Europe have a strong influence on API manufacturing, ensuring high standards for safety, efficacy, and quality. The EMA’s rigorous approval processes and periodic inspections help maintain the integrity of APIs used in critical treatments such as cardiovascular, oncology, and neurological therapies. Regulations also encourage sustainable and ethical manufacturing practices, prompting companies to adopt cleaner production technologies. Harmonized EU-wide standards simplify cross-border trade within the region, benefiting large-scale producers. However, strict compliance requirements can increase operational costs, particularly for smaller manufacturers targeting niche treatment markets.

In the treatment-focused API segment, product substitutes are relatively limited due to the specificity of active ingredients for certain therapeutic classes. For example, monoclonal antibodies used in oncology or biologic hormones for endocrinology cannot be easily replaced without compromising treatment efficacy. While some generic small-molecule APIs may serve as cost-effective alternatives, their interchangeability depends on therapeutic equivalence and regulatory approval. Biologics and high-potency APIs for specialized treatments face minimal substitution risk due to their complex production and clinical value. As a result, most therapeutic APIs enjoy a stable demand base with low vulnerability to substitution threats.

Geographical expansion is a strategic priority for API manufacturers targeting Europe’s growing therapeutic markets. Western Europe, led by Germany, France, and the UK, remains a hub for high-quality, regulated API production, particularly for oncology and chronic disease treatments. Eastern European countries such as Poland and Hungary are emerging as competitive manufacturing locations due to lower costs and favorable investment policies. Many global players, including Cipla, Aurobindo Pharma, and Viatris, are expanding their European operations to strengthen supply chains and meet rising local demand. This regional diversification ensures better access to key markets and supports the delivery of APIs for a wide range of therapeutic applications.

Synthesis Insights

The synthetic segment dominated the market with the largest revenue share of 71.1% in 2024, driven by established manufacturing processes and cost efficiency in producing a wide range of APIs. These APIs are essential for high-volume production in therapeutic areas such as cardiovascular, CNS, and gastrointestinal disorders. The scalability of chemical synthesis enables rapid output to meet demand in Europe’s mature pharmaceutical markets. In January 2025, Touchlight received Good Manufacturing Practice (GMP) certification for its synthetic DNA manufacturing facility in Hampton, UK, marking a significant milestone in synthetic API production and showcasing advancements in manufacturing capabilities. Lower production costs and easier raw material sourcing enhance the segment’s competitive edge. Strong expertise in synthetic chemistry ensures consistent quality, regulatory compliance, and adaptability for diverse formulations, sustaining its market leadership.

The biotech segment is projected to grow at the fastest CAGR of 6.50% over the forecast period, fueled by rising demand for biologics in oncology, immunology, and rare disease treatment. Advances in recombinant DNA technology and cell culture systems enable efficient large-scale production of complex molecules. Biotech APIs, including monoclonal antibodies, therapeutic enzymes, and vaccines, are gaining market share as personalized medicine adoption increases. In May 2024, Eli Lilly & Company announced a USD 9 billion investment to expand synthetic API manufacturing capabilities in Lebanon, Indiana, USA, to meet the rising demand for biologics and biosimilars in Europe. The high treatment efficacy and targeted nature of biologics appeal to prescribers and patients seeking improved outcomes. Europe’s strong clinical research infrastructure and growing biosimilar production capacity continue to accelerate this segment’s shift toward advanced, targeted therapeutic solutions.

Manufacturer Insights

The captive APIs segment dominated the market with the largest revenue share of 50.40% in 2024, driven by the ability of in-house manufacturing to ensure supply security and quality control. Large pharmaceutical companies integrate API production within their operations to maintain consistency for branded and generic drugs. This model supports faster product development timelines by streamlining manufacturing and formulation processes. In-house production allows better alignment of capacity with clinical and commercial needs. Captive API manufacturing also minimizes dependency on external suppliers, reducing the risk of supply disruptions. The approach supports proprietary technology retention, which is critical in competitive therapeutic areas. These advantages sustain the dominance of captive APIs in the regional market.

The merchant APIs segment is projected to grow at the fastest CAGR of 7.00% over the forecast period, driven by increasing outsourcing trends among pharmaceutical companies. Smaller and mid-sized firms rely on merchant suppliers for specialized APIs to avoid substantial capital investments. Merchant manufacturers offer flexible capacity and a diverse product range across multiple therapeutic areas. In May 2024, AGC Biologics, a global Contract Development and Manufacturing Organization (CDMO), partnered with BioConnection, a specialized Contract Manufacturing Organization (CMO), to provide aseptic filling of vials and syringes for clinical and commercial production in Europe, enhancing regional service capabilities. With growing expertise in synthetic and biotech APIs, along with strategic alliances, merchant suppliers are well-positioned to meet evolving market demands and sustain strong growth.

Type Insights

The innovative API segment dominated the market with the largest revenue share of 52.46% in 2024, as pharmaceutical companies' focus on developing novel treatments for complex diseases. These APIs are integral to next-generation therapies in oncology, neurology, and immunology. High clinical value and targeted action drive their uptake in specialized care settings. Many innovative APIs require advanced manufacturing processes, supporting premium pricing. Continuous R&D investment by leading manufacturers strengthens the innovation pipeline. The demand for differentiated therapies is increasing as patient populations seek improved treatment outcomes. This trend positions innovative APIs for sustained high growth.

The generic API segment is projected to grow at the fastest CAGR of 6.90% over the forecast period, fueled by strong demand for cost-effective treatments across Europe. Patent expirations for major drugs have opened opportunities for generic manufacturing. The segment benefits from high prescription volumes in chronic conditions such as hypertension, diabetes, and cardiovascular diseases. Established supply chains enable efficient distribution to meet widespread demand. Generic APIs offer therapeutic equivalence to branded products, supporting their high adoption rate. High manufacturing efficiency and competitive pricing further reinforce their market position. The segment’s scale advantage ensures continued dominance in the regional market.

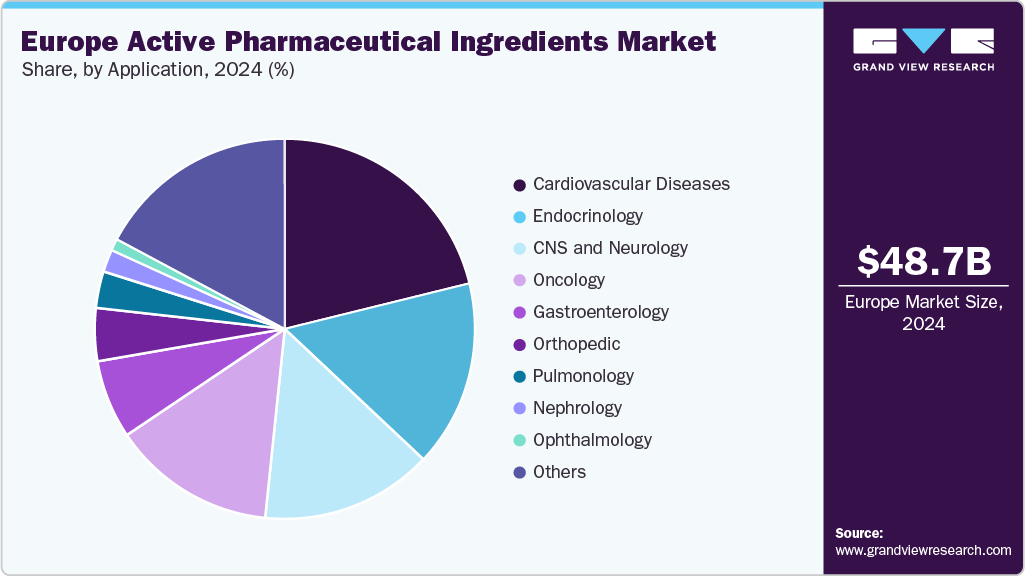

Application Insights

The cardiovascular diseases segment dominated the market with the largest revenue share of 21.15% in 2024, driven by the high prevalence of heart-related conditions in Europe. Aging populations and sedentary lifestyles contribute to rising demand for antihypertensives, statins, and anticoagulants. The segment benefits from long-term treatment regimens, ensuring consistent API consumption. Established manufacturing capabilities support large-scale production of cardiovascular drugs. Clinical guidelines emphasize ongoing medication for risk reduction, driving sustained demand. Cardiovascular APIs have a strong presence across hospital and retail pharmacy channels. These factors collectively maintain the segment’s leading position.

The oncology segment is projected to grow at the fastest CAGR of 7.34% over the forecast period, fueled by rising cancer incidence and demand for targeted therapies. The shift toward personalized medicine has increased the need for high-potency APIs. Biotech innovations, such as monoclonal antibodies and therapeutic vaccines, are expanding the oncology API pipeline. Many treatments require complex manufacturing and strict quality control, supporting premium market positioning. Clinical adoption of novel oncology drugs is accelerating across Europe’s healthcare systems. API suppliers are expanding capacity to meet growing demand in both innovative and biosimilar oncology products. This sustained demand supports the segment’s high growth outlook.

Country Insights

UK Active Pharmaceutical Ingredients Market Trends

The UK active pharmaceutical ingredients industry is expected to register the fastest CAGR of 8.09% over the forecast period, driven by its strong pharmaceutical manufacturing base and advanced R&D capabilities. Demand is supported by high production of APIs for oncology, cardiovascular, and central nervous system therapies. The presence of global pharmaceutical companies and specialized biotech firms enhances domestic capacity. Growing use of biosimilars and complex generics is stimulating demand for both synthetic and biotech APIs. The UK also benefits from a robust clinical trial ecosystem, supporting innovation in treatment-oriented APIs. This combination of manufacturing strength and therapeutic diversity sustains the country’s market position.

Germany Active Pharmaceutical Ingredients Market Trends

Germany active pharmaceutical ingredients (API) industry held a significant revenue share of 24.55% in 2024, driven by its position as a leading hub for high-quality API production. The country is a key supplier of APIs for oncology, cardiology, and diabetes treatments. Strong industrial infrastructure supports large-scale production and advanced synthesis technologies. Leading global API manufacturers have major facilities in Germany, enabling efficient supply to domestic and export markets. Demand growth is further fueled by an increasing focus on biologics and high-potency APIs. These strengths solidify Germany’s role as a central player in the European API landscape.

France Active Pharmaceutical Ingredients Market Trends

France active pharmaceutical ingredients (API) industry held a substantial market share in 2024, driven by its diverse pharmaceutical sector and expertise in both synthetic and biotech API production. The market benefits from high demand for APIs in oncology, respiratory care, and infectious disease treatments. France’s manufacturing facilities are recognized for their ability to produce complex molecules at a commercial scale. The country is also active in developing biosimilars, contributing to the growth of biotech APIs. Partnerships between domestic and multinational firms enhance the supply of innovative therapies. This balanced production and therapeutic focus support France’s market performance.

Spain Active Pharmaceutical Ingredients Market Trends

Spain active pharmaceutical ingredients (API) industry held a substantial market share in 2024, attributed to expanding manufacturing capacity and rising demand for generics. The country is increasing the production of APIs for cardiovascular, gastrointestinal, and musculoskeletal treatments. Competitive production costs and a skilled workforce attract international API partnerships. Spanish manufacturers are investing in high-volume synthetic API production to serve both local and global markets. Growing domestic pharmaceutical consumption is adding momentum to market growth. These factors position Spain as a fast-growing player in Europe’s API industry.

Italy Active Pharmaceutical Ingredients Market Trends

Italy active pharmaceutical ingredients (API) industry held a substantial market share in 2024, driven by its established role in supplying APIs for antibiotics, cardiovascular, and oncology treatments. The country’s manufacturing base supports both bulk API production and specialized high-potency molecules. Italian firms are known for flexibility in scaling production to meet diverse market demands. The domestic pharmaceutical industry’s integration with API manufacturing ensures efficient supply chains. Export strength, particularly to European and global markets, enhances revenue potential. This mix of specialization and production capacity secures Italy’s position in the regional market.

Denmark Active Pharmaceutical Ingredients Market Trends

Denmark active pharmaceutical ingredients (API) industry held a substantial market share in 2024, driven by its expertise in biotech API production, particularly for diabetes and hormonal therapies. The country hosts advanced facilities for recombinant proteins and monoclonal antibodies. Strong integration between pharmaceutical manufacturing and research institutions supports the rapid development of complex molecules. Denmark’s focus on high-value therapeutic areas ensures consistent demand for innovative APIs. API exports form a major component of its pharmaceutical sector revenue. This specialization in biotech products underpins Denmark’s competitive edge in Europe.

Sweden Active Pharmaceutical Ingredients Market Trends

Sweden active pharmaceutical ingredients (API) market held a substantial market share in 2024, driven by its focus on sustainable manufacturing and advanced drug development. The market benefits from demand for APIs in oncology, CNS disorders, and rare disease treatments. Swedish manufacturers prioritize environmentally responsible production methods without compromising quality. Collaboration with academic research centers accelerates the commercialization of novel APIs. The country’s pharmaceutical exports contribute significantly to API market growth. This combination of innovation and responsible manufacturing strengthens Sweden’s role in the European market.

Norway Active Pharmaceutical Ingredients Market Trends

Norway active pharmaceutical ingredients (API) market held a substantial market share in 2024, driven by specialization in niche APIs for oncology, immunology, and specialty care. The country’s API production emphasizes high-purity biotech molecules for advanced therapies. Local manufacturers leverage strong technical expertise to serve both domestic and export markets. Demand is supported by the ongoing development of targeted treatments requiring complex synthesis. Collaborative projects between pharmaceutical companies and research institutions enhance product pipelines. These factors help Norway retain a competitive position in the European API industry.

Key Europe Active Pharmaceutical Ingredients Company Insights

The Europe active pharmaceutical ingredients (API) industry is highly competitive, led by Cipla, Inc., with a strong presence in generic APIs and a wide therapeutic portfolio. Merck & Co., Inc. and Boehringer Ingelheim International GmbH focus on innovative APIs for complex diseases, supported by advanced manufacturing capabilities. Sun Pharmaceutical Industries Ltd. and Aurobindo Pharma maintain a strong position in high-volume API supply for global and regional markets. AbbVie, Inc. and Bristol-Myers Squibb Company drive growth through proprietary molecules in oncology, immunology, and specialty care. Teva Pharmaceutical Industries Ltd. and Viatris Inc. leverage extensive generic API portfolios with robust distribution networks. Albemarle Corporation specializes in high-purity and specialty APIs, catering to critical treatment segments. Competition centers on product quality, manufacturing scalability, therapeutic diversification, and long-term supply partnerships across Europe.

Key Europe Active Pharmaceutical Ingredients Companies:

- Cipla, Inc.

- Merck & Co., Inc.

- Boehringer Ingelheim International GmbH

- Sun Pharmaceutical Industries Ltd.

- AbbVie, Inc.

- Bristol-Myers Squibb Company

- Teva Pharmaceutical Industries Ltd.

- Albemarle Corporation

- Aurobindo Pharma

- Viatris Inc.

Recent Developments

-

In January 2025, Pharmaceutical Technology reported that the European Union sought to reduce its reliance on imported APIs and finished medicines, as its share of global Drug Master Files (DMFs) dropped from 42% in 2000 to 10% in 2023. The European Commission proposed the Critical Medicines Act in March 2025 to strengthen domestic production. The move aims to improve the EU’s pharmaceutical manufacturing and mitigate the risk of drug shortages.

-

In February 2024, Teva Pharmaceutical Industries reaffirmed its decision to remain a unified company for both its generic and branded drug operations, dismissing earlier speculation about a potential split. The CEO highlighted the strong demand for the company’s API business. As part of its strategy to improve operational efficiency and focus on its core business areas, Teva plans to divest its API division by 2025.

-

In July 2023, EUROAPI, a prominent European API manufacturer, reported a 2.6% increase in net sales for the first half of the year, reaching approximately USD 537 million. The company added 35 new clients across both small and large molecules and resumed its prostaglandin production in Budapest, which contributed to its strong performance.

-

In May 2023, Boehringer Ingelheim and German Chancellor Olaf Scholz announced the construction of a new Chemical Innovation Plant at the company’s headquarters in Ingelheim, Germany. This facility was planned to develop and produce active pharmaceutical ingredients.

Europe Active Pharmaceutical Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 51.57 billion

Revenue forecast in 2033

USD 80.16 billion

Growth rate

CAGR of 5.67% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Synthesis, manufacturer, type, application, country

Country Scope

UK; Germany; France; Spain; Italy; Denmark; Sweden; Norway; Rest of Europe

Key company profiled

Cipla, Inc.; Merck & Co., Inc.; Boehringer Ingelheim International GmbH; Sun Pharmaceutical Industries Ltd.; AbbVie, Inc.; Bristol-Myers Squibb Company; Teva Pharmaceutical Industries Ltd.; Albemarle Corporation; Aurobindo Pharma; Viatris Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Active Pharmaceutical Ingredients Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Europe active pharmaceutical ingredients (API) market report based on synthesis, manufacturer, type, application, and country:

-

Synthesis Outlook (Revenue, USD Billion, 2021 - 2033)

-

Biotech

-

Biotech APIs Market, By Type

-

Generic API

-

Innovative API

-

-

Biotech APIs Market, By Product

-

Monoclonal Antibodies

-

Hormones

-

Cytokines

-

Recombinant Proteins

-

Therapeutic Enzymes

-

Vaccines

-

Blood Factors

-

-

-

Synthetic

-

Synthetic APIs Market, By Type

-

Generic API

-

Innovative API

-

-

-

-

Manufacturer Outlook (Revenue, USD Billion, 2021 - 2033)

-

Captive APIs

-

Merchant APIs

-

Merchant APIs Market, By Type

-

Generic API

-

Innovative API

-

-

Merchant APIs Market, By Synthesis

-

Biotech

-

Synthetic

-

-

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Generic API

-

Innovative API

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cardiovascular Diseases

-

Oncology

-

CNS and Neurology

-

Orthopedic

-

Endocrinology

-

Pulmonology

-

Gastroenterology

-

Nephrology

-

Ophthalmology

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2021 - 2033)

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

Frequently Asked Questions About This Report

b. The Europe active pharmaceutical ingredients market size was estimated at USD 48.69 billion in 2024 and is projected to reach USD 51.57 billion in 2025.

b. The Europe active pharmaceutical ingredients market is projected to grow at a CAGR of 5.67% from 2025 to 2033 to reach USD 80.16 billion by 2033.

b. Based on type of synthesis, synthetic segment dominated the market with the largest revenue share of 71.1% in 2024, driven by established manufacturing processes and cost efficiency in producing a wide range of APIs.

b. Some of the key players operating in the Europe API market include Cipla, Inc., Merck & Co., Inc., Boehringer Ingelheim International GmbH, Sun Pharmaceutical Industries Ltd., AbbVie, Inc., Bristol-Myers Squibb Company, Teva Pharmaceutical Industries Ltd., Albemarle Corporation, Aurobindo Pharma, Viatris Inc.

b. Key factors that are driving the market growth include advancements in developing active pharmaceutical ingredients (API), expansion in the biopharmaceutical industry, and the establishment of new advanced manufacturing facilities that support the production of complex products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.