- Home

- »

- Plastics, Polymers & Resins

- »

-

Europe Aerosol Market Size & Share, Industry Report, 2030GVR Report cover

![Europe Aerosol Market Size, Share & Trends Report]()

Europe Aerosol Market (2024 - 2030) Size, Share & Trends Analysis Report Material (Steel, Aluminum), By Type (Bag-in-Valve, Standard), By Application (Personal Care, Household), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-323-2

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Aerosol Market Size & Trends

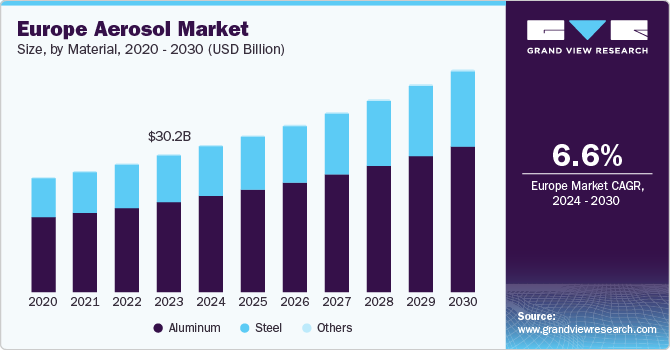

The Europe aerosol market size was estimated at USD 30.2 billion in 2023 and is expected to expand at a CAGR of 7.1% from 2024 to 2030. This growth is attributed to the increasing need for beauty and personal care items, especially in countries like Spain, Italy, Germany, France, and the UK. Moreover, consumers' growing focus on health and inclination towards grooming items like shaving creams, hair styling foams, deodorants, and fragrances are propelling the market's growth. Furthermore, the increasing popularity of physical activities is anticipated to drive the demand for topical aerosol solutions like pain relief sprays, thereby driving market growth.

The Europe aerosol market accounted for a share of 36.2% of the global aerosol market revenue in 2023. The market growth is driven by various factors and is positioned for significant expansion. Europe, with its recognized consumer base and stringent environmental regulations, leads in aerosol packaging innovation and sustainability efforts. Key countries, such as Germany, France, and the UK, play a vital role in evolving the industry. Furthermore, ongoing innovations are concentrated on refining valve effectiveness, using environmentally friendly fuels, and designing compact aerosol cans for on-the-go convenience. Customized labeling, digital integration, and diversification of product lines are tailored to evolving consumer preferences.

Sustainability efforts, product innovations, and eco-friendly solutions present a tremendous growth opportunity for the market in Europe. Manufacturers are focused on sustainable practices, such as the use of recyclable materials and reduced VOC emissions, to meet environmental rules and customer preferences. Innovations in product designs, fragrance, and functional features are expected to meet evolving consumer demands, improving market competitiveness.

Material Insights

The aluminum segment dominated the market and accounted for the largest share of 64.4%. This growth is attributed to the strong performance of end-use industries, mainly personal care, household products, and manufacturing sectors. The region's focus on sustainability and eco-friendly packaging solutions, such as recyclable aluminum cans, also drives market growth. Furthermore, innovations in valve efficacy, compact designs, and customization options to meet growing consumer preferences are further driving growth.

The steel material segment is expected to grow rapidly in the coming years owing to the wide utilization of steel in industrial and automotive applications. Although steel is heavier than aluminum, it is still preferred for its durability and strength.

Type Insights

The standard valve type segment led the market and held the largest market share of 78.7% in 2023. This growth is attributed to the rising demand for aerosol valves in industries, such as healthcare, personal care, and automotive. Furthermore, strict government rules on the disposal and reuse of old vehicles have obligated the industry to adopt effective procedures to meet the requirements, leading to increased recycling of aerosol valves and fostering sustainable market expansion.

The bag-on-valve segment witnessed substantial growth in 2023 owing to factors, such as increased product purity without propellants and rising consumer preferences for this packaging method over conventional aerosol containers, mainly in sectors, such as food and beverages.

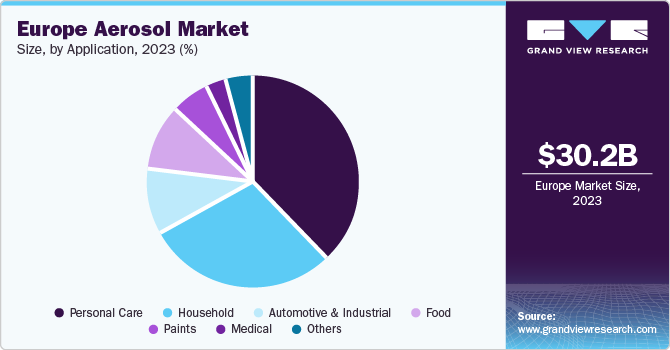

Application Insights

The personal care segment dominated the market and accounted for the largest share of 37.9% in 2023. This growth is attributed to the increasing need for aerosol packaging in the cosmetics, skincare, and hair care industries. Furthermore, consumers are placing greater importance on personal grooming and prefer packaging options that provide suitability, efficiency, and precise dispensing. This ensures easy application for users and keeps the products fresh for longer periods.

The household segment held a significant market share in 2023 owing to the increasing demand for aerosol products like air fresheners, cleaning agents, and lubricants. In addition, consumers value the ease and accuracy provided by aerosol packaging, encouraging manufacturers to invest in eco-friendly materials and propellants to address environmental concerns and provide user-friendly household cleaning solutions.

Country Insights

The aerosol market in Germany dominated the market and accounted for the largest revenue share of 16.2% in 2023. This growth is attributed to the strict environmental rules that have promoted the advancement and acceptance of environmentally friendly aerosol technologies, which align with the increasing focus on sustainability. In addition, German consumers and leading companies favor sustainable aerosol solutions to provide eco-friendly products packaged in recyclable materials and with a reduced carbon footprint.

The France aerosol market witnessed significant growth in 2023 owing to the country's reputation for high-quality beauty and hygiene items, which resulted in a strong desire for top-notch aerosol products. Furthermore, the increasing use of aerosol paint sprays in street art has also contributed to the market's growth, as they are appreciated for their quick and even paint distribution, in line with the increasing popularity of graffiti in the country.

Key Europe Aerosol Company Insights

The aerosol market in Europe is fragmented due to the presence of various established companies and opportunities.

-

Lindal Group manufactures and distributes aerosol valves, actuators, and spray caps in various sectors, including cosmetics, household, pharmaceuticals, food, and technical industries. The company is renowned for its innovative designs, which provide excellent functionality and return on investment.

Key Europe Aerosol Companies:

- Lindal Group

- Atlantic Zeiser

- Cerulean

- Citus Kalix

- Leonhard Fischer GmbH

- Act Aerosol Chemie Technik GmbH

- Fenoplast Fügetechnik GmbH

- Technima France

- BM Aerosol

Recent Developments

-

In February 2024, Lindal Group partnered with the UK Aerosol Recycling Initiative led by Alupro to boost aerosol recycling awareness and achieve a 50% recycling rate by 2030. Their funding accelerates feasibility studies, data gathering, pilot projects, and customer engagement efforts. Lindal Group's involvement reflects its commitment to addressing aerosol recycling encounters and encouraging sustainability in the industry

-

In October 2023, LINDAL Group expanded its Bag-on-valve manufacturing lines in Europe and North America to meet increasing customer demand. This investment increases lead time flexibility, vital for securing new business. The company's commitment to barrier pack technology is evident through its BOV Application Lab, offering expertise, R&D services, and product testing

Europe Aerosol Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 32.2 billion

Revenue forecast in 2030

USD 48.8 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, material, application, country

Regional Coverage

Europe

Country Coverage

Germany; France; Italy; UK

Key companies profiled

Lindal Group; Atlantic Zeiser; Cerulean; Citus Kalix; Leonhard Fischer GmbH; Act Aerosol Chemie Technik GmbH; Fenoplast Fügetechnik GmbH; Technima France; BM Aerosol.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Aerosol Market Report Segmentation

This report forecasts revenue growth at a country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe aerosol market report based on type, material, and application.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bag-In-Valve

-

Standard Valve

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Steel

-

Aluminum

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Care

-

Household

-

Automotive & Industrial

-

Food

-

Paints

-

Medical

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

France

-

Italy

-

UK

-

Frequently Asked Questions About This Report

b. The Europe aerosol market was estimated at USD 30.2 billion in 2023 and is expected to reach USD 32.2 billion in 2024.

b. The Europe aerosol market is expected to grow at a compound annual growth rate of 7.1% from 2024 to 2030, reaching USD 48.8 billion by 2030.

b. Aluminum led the market and accounted for the largest share, 58.6%, in 2023. This growth is attributed to its strength, low weight, corrosion resistance, and recycling capacity.

b. The key players in the aerosol market include Henkel AG & Co., KGaA; S. C. Johnson & Son, Inc.; Procter & Gamble; Unilever; Honeywell International Inc.; Akzo Nobel N.V.; Beiersdorf AG; Estée Lauder Inc.; and Oriflame Cosmetics Global SA.

b. The European aerosol market is anticipated to be driven by the increasing need for beauty and personal care items, especially in countries like Spain, Italy, Germany, France, and the UK.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.