- Home

- »

- Homecare & Decor

- »

-

Europe Cat Litter Products Market, Industry Report, 2030GVR Report cover

![Europe Cat Litter Products Market Size, Share & Trends Report]()

Europe Cat Litter Products Market Size, Share & Trends Analysis Report By Product Type (Clumping, Conventional), By Raw Material (Clay, Wood/Bamboo/Sawdust), By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-229-2

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Europe Cat Litter Products Market Trends

The Europe cat litter products market size was estimated at USD 5.48 billion in 2023 and is expected to grow at a CAGR of 5.1% from 2024 to 2030. The growing pet adoption trend in the Europe region is driving the cat litter industry. The market is being significantly influenced by the recent trend of pet humanization, which involves giving pets more attention and cleanliness. In addition, rising cat owners' spending on pet supplies is another reason that is probably going to contribute to an increase in the market for cat litter.

Europe cat litter products market held 35% of the global cat litter products market revenue in 2023. In Europe, cats are the most common pets. In 2020, 88 million households in Europe had over 110 million pet cats, according to the European Pet Food Industry Federation (FEDIAF). Cats are preferred by many people over other pets because they are minimal maintenance and provide companionship. In the near future, these factors are expected to fuel the market demand for cat litter products.

Moreover, cat owners are looking for superior pet care options more and more. There is an increasing need for safety regulations and increased effectiveness when it comes to absorbing cat urine and excrement. In order to acquire momentum with customers and a sizable market share, several manufacturers in the region are concentrating on a variety of techniques, including diversifying their product portfolios, mergers and acquisitions, and partnerships.

UK-based Omlet, for example, introduced a new line of high-performance cat litters, in April 2021. The litters are Ultra Hygienic & Absorbent, Clumping & Compostable, Fresh Scent & 100% Biodegradable, Long Lasting & Low Waste, and Non-Clumping & Perfect for Kittens. Over the course of the forecast period, it is anticipated that these measures will increase the brands' sales of cat litter products in the area.

Market Concentration & Characteristics

Technology such as moisture-activated indications and dust-free formulae are being included into cat litter products to improve convenience and solve frequent problems with conventional litters. In response to customer concerns about sustainability and the environment, companies are investing in the development of cat litters made from alternative materials such paper, corn, walnut shells, and natural wood.

There have been a lot of merger and acquisition activities in the cat litter products industry, as leading firms look to grow their product lines and market share. Businesses have used strategic mergers and acquisitions to expand their distribution networks, have access to new technology, and take advantage of synergies.

The main areas of regulation in the cat litter product industry are labeling specifications, environmental effect, and product safety. With strict limits on potentially harmful compounds, regulatory organizations monitor the usage of ingredients in cat litters to guarantee that they are safe for pets and the environment. In addition, labeling laws require precise and unambiguous information on product composition, safety warnings, and usage guidelines.

The market for cat litter products is dominated by substitutes including wood pellets, corn, wheat, and walnut shells, as well as alternatives like paper-based litters. In addition, crystal- and silica-based litters are becoming more and more well-liked alternatives because of their superior absorbency and ability to manage odors.

Product Type Insights

The clumping cat litter products market in Europe accounted for 70.3% of the market share in 2023. It is easy to eliminate cat poop and urine without having to empty the litter box, clumping litter is becoming more and more popular among consumers. Moreover, clumping cat litter's growing popularity due to its many advantages and practicality would probably attract customers' attention and increase product sales during the projection period. Cat owners tend to choose cat litter that clumps hard. An increasing number of consumers want to eliminate the smell of cat poop and pee, which is driving demand for traditional litter products. Sales of traditional cat litter are increasing because of consumers' growing preference for inexpensive litter products due to their frequent use.

Europe conventional cat litter products market is projected to grow at a CAGR of 4.3% from 2024 to 2030. The demand for traditional litter products is driven by the increased consumer preference toward entirely removing the odor associated with cat urine and faeces. Conventional litter is made of wood chips and non-biodegradable clay matter, calcium silicate, and clay crystals. This product type helps absorb large volumes of urine and is characterized by better odor-removing properties. Blue Buffalo Naturally Fresh offers non-clumping cat litter made from walnut shells. The litter is environmentally friendly, biodegradable, and offers superior odor control. It is free from harmful chemicals and synthetic fragrances.

Raw Material Insights

Europe clay cat litter market held 81.5% of the market share in 2023. Clay cat litters are the oldest commercially available cat litter type and are preferred by several manufacturers owing to the highly absorbent and solid clump formation properties of clay. Clay expands when it comes in contact with liquid or moisture and immediately hardens. In relation to cat litter, this property makes it easily identifiable when it is time to dispose of the litter. Some prominent cat litter manufacturers-such as Bentonite Group, New Technologies LLC, The Siberian Cat businesses, and Leading LLC-prefer clay as a raw material owing to the aforementioned benefits. These companies have well-equipped production facilities to efficiently control the quality and production rate.

The demand for wood/bamboo/sawdust-based cat litter products is anticipated to grow at a CAGR of 8.1% from 2024 to 2030. There is a rising market for wood-based cat litter solutions as people prefer eco-friendly and sustainable options more and more. The environmentally friendly, adaptable, and highly effective pellets are made from recovered softwood waste. Clumping and non-clumping ökocat wood-based cat litter is available from the pet care product company Healthy Pet. Specially crafted micro wood pellets, renowned for their superior moisture absorption capabilities, are featured in the line of environmentally friendly and biodegradable cat litter.

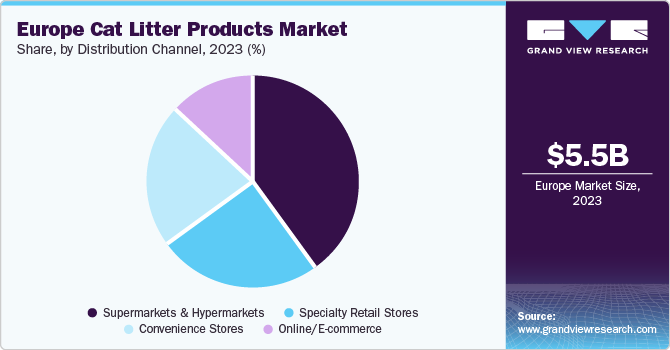

Distribution Channel Insights

Cat litter sales through supermarkets and hypermarkets channels accounted to the market share of 40.13% in 2023. Majority of the pet owners prefer purchasing pet care, pet food, and pet grooming products from hypermarkets and supermarkets as these products are less expensive than prescription-based products due to various discounts & sales offered at the retail stores. The availability of a variety of authentic brands, supported by expert assistance, is driving the sales of cat litter products through the offline channels. Moreover, major companies are investing in expanding their offline presence in the region to cater to the high demand for cat litter products.

The online sales of cat litter products is expected to grow at a CAGR of 6.2% from 2024 to 2030. The rising popularity of e-commerce has contributed to the growth of the online distribution segment. Online platforms have enabled manufacturers to gain potential customers, improve their communication, track finances, and cost-effectively boost brand awareness. Digitalization has offered the cat litter market several growth avenues and an active consumer base that prefers shopping online.

Country Insights

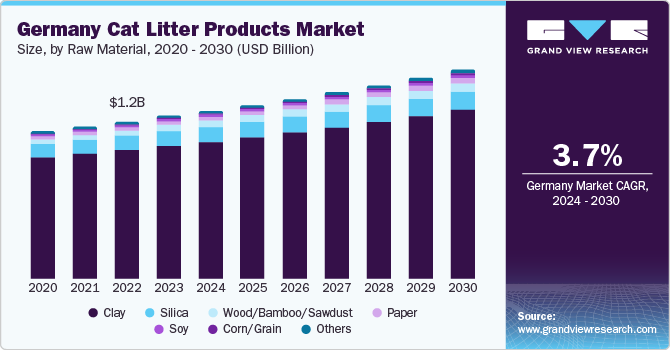

Germany Cat Litter Products Market Trends

Cat litter products market in Germany held 22.35% of the European market revenue in 2023.

The increasing number of cats as a pet is a major catalyst for market growth in Germany. According to the FEDIAF, in 2020, more than 15.7 million cats were adopted as a pet, and it increased by 6.4% to reach 16.7 million cats in 2021 in Germany. The rise in expenditure by cat owners on cat care products is expected to drive the demand for private label cat litter products in the German market. Customers are seeking products that prioritize effective odor control, easy cleaning, quick clumping properties, and extended shelf life.

UK Cat Litter Products Market Trends

Cat litter products market in the UK is projected to grow at a CAGR of 7% from 2024 to 2030. It is anticipated that the growing number of cat owners in the UK will favorably influence market Also, the country's cat litter industry is growing on accounts of the technological advancements and improvements. Over 12 million cats were adopted as pets in UK homes in April 2022, according to the Pet Food Manufacturers' Association (PFMA). Cat litter demand in the UK was further fueled by the fact that 28% of homes had at least one cat as a pet in April 2022.

Key Europe Cat Litter Products Company Insights

A small number of well-established companies and recent newcomers define the industry. Market participants are pursuing strategies such as new releases, diversification and expansion, and other tactics to hold onto their market share.

Key Europe Cat Litter Products Companies:

- Nestlé S.A.

- The Clorox Company

- Mars, Incorporated

- Oil-Dri Corporation of America

- Church & Dwight Co., Inc.

- Kent Corporation

- Intersand

- Dr. Elsey's

- Weihai Pearl Silica Gel Co., Ltd.

- Pettex Limited

Recent Developments

-

In December 2022,The Clinton, California, location of Nestlé Purina PetCare Company will soon expand thanks to the use of automated warehousing equipment. To handle this growth at the location, a new 90,000-square-foot structure will be built as part of the project.

-

In October 2022,The Clorox Company declared the grand opening of their cat litter plant in Martinsburg. This facility was built with the intention of making it easier to produce cat litter products, namely Scoop Away and Fresh Step. The business had made a major investment of USD 190 million in the Berkeley County site when it made public its plans to open the plant in January 2020.

Europe Cat Litter Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.74 billion

Revenue forecast in 2030

USD 7.76 billion

Growth rate

CAGR of 5.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, raw material, distribution channel, country

Regional scope

Europe

Country scope

France; Germany; UK; Spain; Italy

Key companies profiled

Nestlé S.A.; The Clorox Company; Mars, Incorporated; Oil-Dri Corporation of America; Church & Dwight Co., Inc.; Kent Corporation; Intersand; Dr. Elsey's; Weihai Pearl Silica Gel Co., Ltd.; Pettex Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Cat Litter Products Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Europe cat litter products market on the basis of product type, raw materials, distribution channel and country.

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clumping

-

Conventional

-

-

Raw Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clay

-

Silica

-

Wood/Bamboo/Sawdust

-

Paper

-

Soy

-

Corn/Grain

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets and Hypermarkets

-

Specialty Retail Stores

-

Convenience Stores

-

Online/E-commerce

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Frequently Asked Questions About This Report

b. The Europe cat litter products market was estimated at USD 5.48 billion in 2023 and is expected to reach USD 5.74 billion in 2024.

b. The Europe cat litter products market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 7.76 billion by 2030.

b. Germany dominated the Europe cat litter products market with a share of around 22.35% in 2023. The increasing number of cats as a pet is a major catalyst for market growth in Germany. According to the FEDIAF, in 2020, more than 15.7 million cats were adopted as pets, and it increased by 6.4% to reach 16.7 million cats in 2021 in Germany.

b. Some of the key players operating in the Europe cat litter products market include Nestlé S.A.; The Clorox Company; Mars, Incorporated; Oil-Dri Corporation of America; Church & Dwight Co., Inc.; Kent Corporation; Intersand; Dr. Elsey's; Weihai Pearl Silica Gel Co., Ltd.; Pettex Limited

b. The market growth is being significantly influenced by the recent trend of pet humanization, which involves giving pets more attention and cleanliness. In addition, rising cat owners' spending on pet supplies is another reason that is contributing to an increase in the market for cat litter.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."