- Home

- »

- Medical Devices

- »

-

Europe Disposable Endoscopes Market Size, Report, 2030GVR Report cover

![Europe Disposable Endoscopes Market Size, Share & Trends Report]()

Europe Disposable Endoscopes Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Gastrointestinal Endoscopes, Laproscopes), By End-use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-919-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

EU Disposable Endoscopes Market Trends

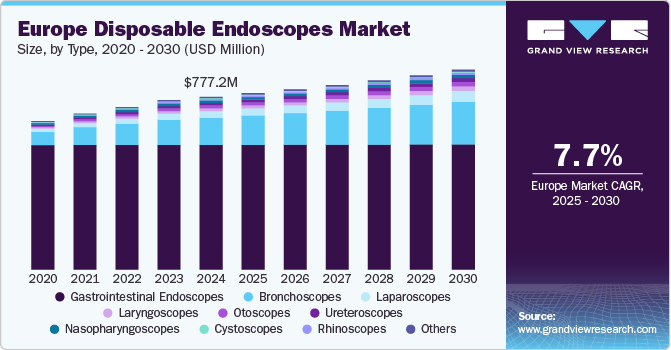

The Europe disposable endoscopes market size was estimated at USD 777.2 million in 2024 and is expected to grow at a CAGR of 7.73% from 2025 to 2030. Growing preference to minimize the risk of infection and maximize better clinical outcomes has increased the adoption of disposable endoscopes and their accessories in Europe. Furthermore, the growing incidence of functional gastrointestinal disorders and several other chronic diseases such as diabetes, cancer, and cardiovascular disorders has increased the diagnosis rate over the years, which, in turn, is anticipated to boost the market growth. For instance, according to an article published by the European Commission in January 2024, in 29 European countries, an estimated 23.7 million individuals faced a cancer diagnosis in their lifetime.

Minimally invasive surgeries (MISs), utilizing small incisions for diagnosing and treating various conditions, are gaining widespread acceptance in this region. Surgeons are increasingly favoring endoscopic surgeries over conventional open surgeries due to their numerous benefits. Following are some of the benefits of minimally invasive surgeries,

-

Reduced postoperative complications

-

Shorter hospital stays and recovery time

-

Decreased blood loss

-

Economic viability

Thus, such benefits offered by MISs boost the demand for disposable endoscopes.

Factors such as favorable reimbursement policies and commercialization of new products are anticipated to fuel market growth. Moreover, increasing CE mark approvals for disposable endoscopes and adopting various distribution strategies are major factors expected to boost the market. For instance, in November 2023, Ambu A/S received European regulatory clearance for its new ureteroscopy solution, such as Ambu aScope 5 Uretero, a flexible single-use ureteroscope.

The high prevalence of cancer & chronic diseases and the growing geriatric population are expected to drive the market growth in the country. According to Macmillan Cancer Support, in October 2022, there were approximately 3 million patients suffering from cancer in the UK, and 5.3 million patients are expected to be diagnosed with cancer in the country by 2040. The introduction of the National Awareness and Early Diagnosis Initiative has facilitated early diagnoses of cancer and increased access to optimal treatment, thereby playing a vital role in driving the market.

Recent technological advancements in disposable endoscopes have increased their demand in hospitals, diagnostic centers, and clinics, which is expected to drive the growth of the disposable endoscopes market. In addition, with various technological advancements, disposable endoscopy applications are widening at a rapid rate. For instance, different types of disposable endoscopes are available in the market and used in many specialties, including laparoscopy, ENT, arthroscopy, gynecology, urology, gastroenterology, and proctoscopy.

The adoption of disposable endoscopes increased due to their benefits, such as no maintenance costs, ready availability, no breakages, and no need for reprocessing between procedures. In addition, reprocessing reusable endoscopes is a challenge for many healthcare facilities. Multiple studies reported a high contamination rate after endoscope reprocessing, which further supports the adoption of disposable endoscopes. For instance, an article conducted study on duodenoscopes contamination published by The Journal of Hospital Infection in January 2023 reported that 27.5% of the reusable samples were positive for high-concern microorganisms.

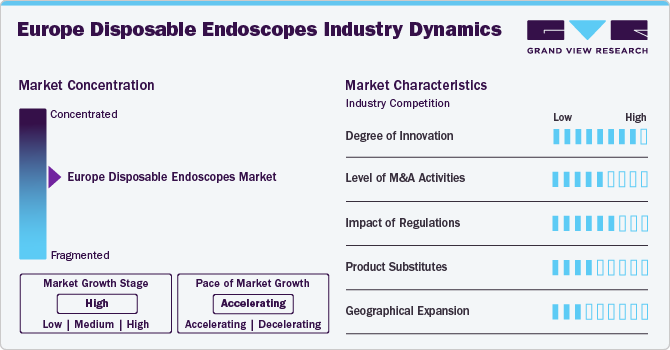

Market Concentration & Characteristics

The Europe market is characterized by a high degree of innovation, owing to approvals from governments and regulatory bodies, rising research activities, and growing investments to enhance healthcare infrastructure and advance research in the endoscopes field. For instance, in May 2021, Jiangsu Vedkang Medical Science and Technology and Pentax Medical entered a joint venture to develop disposable therapeutic products in the flexible endoscopy space. Under this collaboration, Jiangsu Vedkang would utilize Pentax Medical production and R&D capabilities.

The market is characterized by medium merger and acquisition activity. Market players are adopting this strategy to expand their product portfolio and distribution network. For instance, in June 2023, Olympus Corporation acquired Odin Vision, a London-based cloud-AI endoscopy startup, to enhance patient care by transforming procedural and clinical workflows.

Companies actively invest substantial resources in clinical trials and regulatory submissions to obtain regulatory approval for pipeline products. For instance, the European Union (EU) has introduced new regulations and guidelines impacting endoscopists and their patients. These changes increase the need for clinical trials and observational research to use endoscopic devices, for both new and existing endoscopic device use, to ensure they provide therapeutic benefits and reduce the risk of harm to patients.

Several market players are adopting this strategy to launch and receive approval from regulatory bodies. For instance, in October 2023, Ambu A/S, an endoscopy company in Denmark, received a CE mark approval for its Ambu aScope 5 Cysto HD, a single-use HD cystoscope.

Several market players are expanding their business by entering new geographical regions to strengthen their market position. For instance, in May 2021, PENTAX Medical Europe, a Japan-based endoscopic company, launched and received a CE mark for its PulmoONE, a single-use bronchoscope.

Type Insights

The gastrointestinal endoscopes segment dominated the market with a revenue share of 56.8% in 2024. Gastrointestinal endoscopes are classified as lower or upper endoscopy, depending on the area to be treated, such as the upper gastrointestinal tract (stomach, esophagus, jejunum, and duodenum) or lower gastrointestinal tract (colon, rectum, and terminal ileum). The market is driven by technological advancements, a rising prevalence of gastrointestinal disorders, and a shift towards minimally invasive surgeries, and governments and health organizations have been encouraging routine screenings for cancer, increasing the demand for diagnostic procedures. For instance, according to World Cancer Research Fund International, approximately 62,544 individuals in Germany had colorectal cancer in 2022.

The Laparoscopes segment is expected to witness the fastest CAGR growth from 2025 to 2030. The growing prevalence of chronic diseases and conditions that require surgical intervention, such as obesity, appendicitis, gallbladder diseases, pelvic inflammatory disease, and cancers (ovarian cancer and liver cancer), fueled the demand for laparoscopic procedures. Furthermore, market players adopt various strategies to strengthen their product portfolio. For instance, in June 2023, STERIS plc signed a definitive agreement to purchase the laparoscopic instrumentation, sterilization container assets, and surgical instrumentation from BD (Becton, Dickinson, and Company) for USD 540 million.

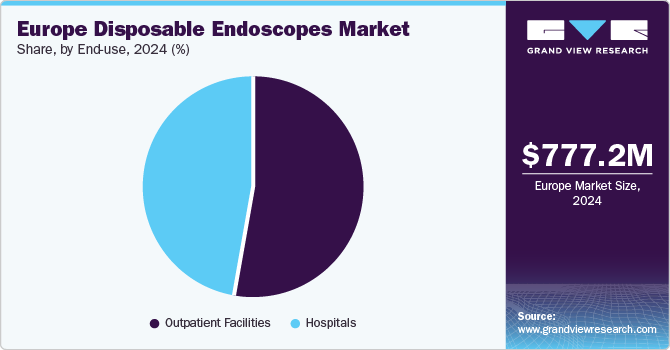

End-use Insights

The outpatient facilities segment dominated the market and accounted for the largest revenue share of 53.7% in 2024. This segment is anticipated to register the fastest growth over the forecast period. Outpatient facilities play an important role in the disposable endoscope market by offering efficient & convenient diagnostic and therapeutic procedures. The growing popularity of disposable endoscopes in outpatient settings is attributed to their multiple advantages. One of the major advantages of this endoscopes in outpatient facilities is their cost-effectiveness. These single-use endoscopes save time and resources for maintaining, sterilizing, and cleaning reusable endoscopes and eliminate the need for reprocessing. This streamlined approach reduces turnaround time, improves workflow efficiency, and enhances patient outcomes.

Hospital segment is anticipated to register a significant growth from 2025 to 2030. The rising number of healthcare centers, such as oncology specialty clinics, hospitals, and cancer centers, is growing the need for disposable endoscopes, which is anticipated to propel market growth. The number of endoscopies performed in hospitals is increasing with the rise in hospital facilities. For instance, the European Union has around 15,000 hospitals. Moreover, the UK has 1148 hospitals as of August 2023.

Regional Insights

Europe Disposable Endoscopes Market Trends

Ongoing technological advancements in the endoscope field and a rise in demand for minimally invasive procedures are among the factors driving the European disposable endoscope market. In addition, the increasing number of endoscopic device manufacturers present in this region, and the rise in disposable endoscopic devices product development activities are driving the market in the region.

Denmark Disposable Endoscopes Market Trends

The disposable endoscopes market in Denmark held a significant share in 2024. Key market players are undertaking various initiatives to strengthen their position, further propelling market growth. For instance, in January 2022, Ambu introduced the aCart platform to promote the adoption of single-use endoscopes. The platform comprises two launches-aCart Compact and aCart Plus-which provide convenient storage & transportation for displaying units, endoscopes, and additional accessories. These carts are designed to be compatible with Ambu’s complete range of endoscopy products, aiming to enhance workflows in various healthcare settings, including endoscopy suites, intensive care units, and operating rooms.

Key Europe Disposable Endoscopes Company Insights

Key participants in the market are focusing on devising innovative business growth strategies in the form of partnerships & collaborations, product portfolio expansions, mergers & acquisitions, and geographical expansions.

Key Europe Disposable Endoscopes Companies:

- Olympus Corporation

- Boston Scientific Corporation

- PENTAX Medical (Hoya Corporation)

- FUJIFILM Holdings Corporation

- Karl Storz GmbH & Co., KG

- Stryker

- Medtronic

- Ambu A/S

- STERIS plc.

Recent Developments

-

In August 2024, Ambu received CE mark approval for its new-generation duodenoscopy solutions, Ambu aBox 2 and Ambu aScope Duodeno 2, for ERCP procedures.

-

In March 2023, Ambu received CE mark approval for the two smaller sizes of its fifth-generation bronchoscope, the Ambu aScope 5 Bronch.

Europe Disposable Endoscopes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 834.6 million

Revenue forecast in 2030

USD 1.21 billion

Growth rate

CAGR of 7.73% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

Europe

Country scope

Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden,

Key companies profiled

Olympus Corporation; Boston Scientific Corporation; PENTAX Medical (Hoya Corporation); FUJIFILM Holdings Corporation, Karl Storz GmbH & Co., KG; Stryker; Medtronic; Ambu A/S; STERIS plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Disposable Endoscopes Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the Europe disposable endoscopes market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Otoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Gastrointestinal Endoscopes

-

Gastroscope (Upper GI Endoscope)

-

Enteroscope

-

Sigmoidoscope

-

Duodenoscope

-

Colonoscope

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Frequently Asked Questions About This Report

b. The Europe disposable endoscopes market size was valued at USD 777.2 million in 2024 and is expected to reach USD 834.6 million in 2025.

b. The Europe disposable endoscopes market is expected to grow at a compound annual growth rate of 7.73% from 2025 to 2030 to reach USD 1.21 billion by 2030.

b. Outpatient facilities dominated the Europe disposable endoscopes market with a share of 53.7% in 2024. This is attributable to the growing adoption across these facilities for various diagnostic and therapeutic procedures.

b. Some key players operating in the Europe disposable endoscopes market include Boston Scientific Corporation, Inc.; Flexicare Medical Ltd; Ambu A/S; Hill Rom Holdings.; and OBP Medical.

b. The gastrointestinal endosopy application segment dominated the Europe disposable endoscopes market and held the largest revenue share of 56.8% in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.