Europe Eyewear Market Size & Trends

The Europe eyewear market size was anticipated at USD 67.09 billion in 2023 and is expected to grow at a CAGR of 7.3% from 2024 to 2030. The increasing prevalence of ophthalmic disorders, such as presbyopia, myopia, astigmatism, and hyperopia, and growing awareness regarding the significance of regular eye health checkups and eye examinations are driving the market growth. In addition, the rising adoption of eyewear as a fashion accessory among youngsters is further boosting the industry growth. The Europe market held a 36.6% share of global eyewear market revenue in 2023. Impactful changes in lifestyles driven by rapid urbanization, an increasing number of innovations launched in the form of products by healthcare and technology industries, and a large geriatric population are some of the other factors driving the industry demand.

According to the Population Reference Bureau (PRB), Europe has the world’s oldest population, with people aged 65 years and older accounting for approximately 19% of the total population, which is almost one in five. The percentage of geriatrics in the overall population significantly influences this market. In addition, eyewear is primarily perceived as a fashion trend worldwide. It encourages eyewear brands to launch new products regularly equipped with the latest technologies and fashion preferences identified by studying customer behavior data.

Furthermore, an increase in brand awareness has also driven the growth of this industry. Customer choices are highly influenced by multiple aspects, such as social media platforms, technological advancements, such as virtual try-ons, the emergence of eyewear e-commerce platforms, and more. These factors have attracted new customers from a pool of millennials and Gen Z buyers who prefer online shopping experiences over offline and tend to consider eyewear as part of their appearances and fashion choices.

Products Insights

The spectacles segment dominated the market and accounted for a share of 71.4% in 2023. One of the key factors responsible for this growth is the growing occurrence of computer vision syndrome (CVS) in the region. An increase in the use of smartphones and digital screens has resulted in a rising number of CVS cases worldwide. In addition, the increasing number of individuals opting for online learning and remote education has led to a growing number of children with CVS.

The sunglasses segment is expected to register a CAGR of 10.3% from 2024 to 2030. Key market participants in the region offer diverse product portfolios. The products mainly vary based on price, quality, product features, and brand value. Increasing acceptance of sunglasses as part of fashion accessories and product positioning initiated by luxury brands have driven demand for sunglasses.

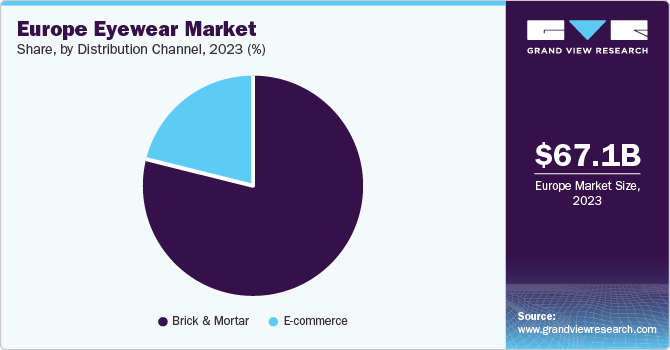

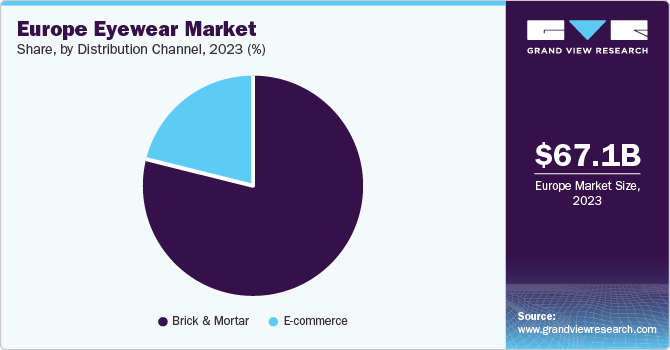

Distribution Channel Insights

The brick-and-mortar segment dominated the industry and accounted for a share of 79.1% in 2023. This can be attributed to the increased awareness about regular eye examinations and the need for eyewear, which has led to a rise in eyewear sales from brick-and-mortar stores. Though the eyewear market is growing on e-commerce platforms, factors like immediate possession, personal assistance provided by store associates, and the opportunity to examine the quality of offering through buying eyewear from brick-and-mortar stores have driven the growth of this segment in the region.

The e-commerce platforms segment is expected to grow at the fastest CAGR of 8.6% from 2024 to 2030. It is mainly due to the growing adoption of smartphone technology and increasing inclination toward online shopping owing to associated services, such as doorstep delivery, return & refund, enhanced customer assistance, and multiple payment alternatives, coupled with exciting offers for frequent customers and subscribers of e-commerce platforms. The increasing inclusion of cutting-edge technologies, such as virtual try-ons, has also been attracting a considerable number of new customers to e-commerce platforms for eyewear purchases.

Country Insights

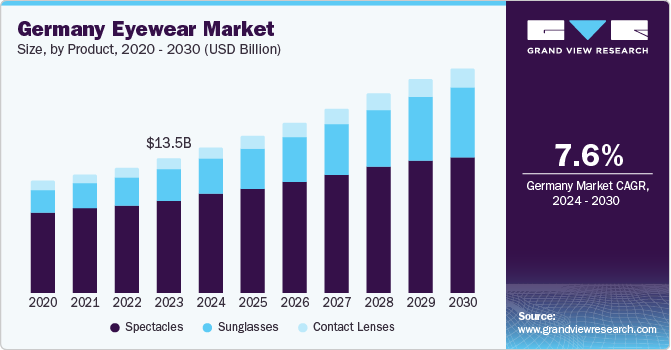

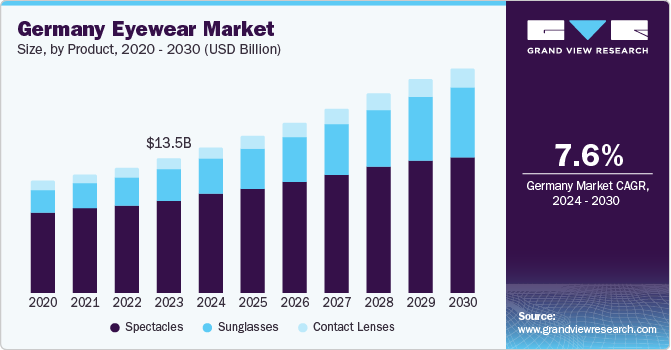

Germany Eyewear Market Trends

Germany accounted for the highest revenue share of 20.1% in 2023. The presence of a large millennial population and the existence of multiple fashion brands have contributed to the growth of the eyewear industry in Germany. The impact of social media, growing disposable income levels, and increasing demand for products, such as sunglasses, smart eyewear, colored contact lenses, and fashionable spectacle frames, have also played a significant role in this growth.

Russia Eyewear Market Trends

Russia is expected to grow at the fastest CAGR of 10.8% during the forecast period. This is primarily due to the growing demand for eyewear in the country as a fashion accessory. Furthermore, factors, such as increasing expenditure on eye care, availability of multiple offerings in the eyewear market, and inclusion of the latest technology in eyewear development & delivery, are expected to fuel market growth.

Key Europe Eyewear Company Insights

Some of the key and emerging companies in the Europe eyewear market include Alcon, De Rigo S.p.A., EssilorLuxottica, Fielmann AG, MARCOLIN SPA, PRADA S.P.A. Rodenstock GmbH and others. To develop a competitive advantage over other market players, companies undertake multiple strategies, such as innovation, collaboration, expansion, product diversification, post-purchase assistance, and others.

-

PRADA S.P.A., headquartered in Milan, Italy, is one of the key brands in the fashion industry. The company also manufactures and offers high-end, premium-range eyewear. Some of the eyewear products offered by the company include high-vision lenses, single-vision, anti-reflective, polar lenses, fashion lenses, progressive lenses, and photochromic lenses

-

Established in 1877, Rodenstock GmbH is one of the major German manufacturers of spectacle frames and ophthalmic lenses. It offers products, such as progressive lenses for the workplace, sports activities, and single-vision lenses. Rodenstock GmbH has manufacturing sites in 13 different countries, including Sweden, Denmark, Norway, Brazil, Chile, Italy, Australia, Uruguay, the United Kingdom, and Bangkok. In addition, it has distribution partners and sales subsidiaries in more than 85 countries across the globe

Key Europe Eyewear Companies:

- Alcon

- De Rigo S.p.A.

- EssilorLuxottica

- Fielmann AG

- MARCOLIN SPA

- PRADA S.P.A.

- Rodenstock GmbH

- SAFILO GROUP S.P.A.

- Zeiss International

- Silhouette International Schmied AG

Recent Developments

-

In April 2024, one of the leading multinational companies in the medical technology industry, Carl Zeiss Meditec AG, announced the acquisition of Dutch Ophthalmic Research Center (International) B.V. (D.O.R.C.). The other entity involved in the deal was Eurazeo SE, a Paris, France-based investment firm formerly owned by D.O.R.C. The acquisition process was initiated in December 2023; however, in April 2024, ZEISS secured regulatory approvals and can now lead to integration implementation to attain top-quality innovation for the ophthalmic devices and eyewear market

-

In April 2024, EssilorLuxottica SA completed the acquisition of Washin Optical Co., Ltd., a leading optical industry retailer with a network of more than 70 stores across Japan

Europe Eyewear Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2030

|

USD 110.08 billion

|

|

Growth rate

|

CAGR of 7.3% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, distribution channel, country

|

|

Country scope

|

Germany; Italy; Spain; The Netherlands; Russia; Sweden; UK

|

|

Key companies profiled

|

Alcon; De Rigo S.p.A.; EssilorLuxottica; Fielmann AG; MARCOLIN SPA; PRADA S.P.A.; Rodenstock GmbH; SAFILO GROUP S.P.A.; Zeiss International; Silhouette International Schmied AG

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Europe Eyewear Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe eyewear market report based on product, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Contact Lenses

-

Premium Contact Lenses

-

Mass Contact Lenses

-

Spectacles

-

Spectacle Frames

-

Spectacle Frames, by Type

-

Premium Spectacle Frames

-

Mass Spectacle Frames

-

Spectacle Frames, by Style

-

Round

-

Square

-

Rectangle

-

Oval

-

Others

-

Spectacle Lenses

-

Sunglasses

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Brick & Mortar

-

E-commerce

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

Italy

-

Spain

-

The Netherlands

-

Russia

-

Sweden

-

UK