- Home

- »

- Biotechnology

- »

-

Europe Gene Synthesis (Research Use) Market Report, 2030GVR Report cover

![Europe Gene Synthesis (Research Use) Market Size, Share & Trends Report]()

Europe Gene Synthesis (Research Use) Market Size, Share & Trends Analysis Report By Method (Solid-phase Synthesis, Chip-based Synthesis), By Service, By Application, By End-use, By Research Phase, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-108-0

- Number of Report Pages: 122

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The Europe gene synthesis (research use) market size was estimated at USD 310.6 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 15.8% from 2023 to 2030. The increasing applications of the technique in synthetic biology & genomic engineering along with technological advancements in gene synthesis methods are driving the expansion of this market. The rising adoption of gene synthesis in designing personalized medicines is projected to fuel the expansion of the regional market over the forecast period.

The COVID-19 pandemic severely impacted the gene synthesis (research use) market. Despite the economic recession due to the pandemic, the synthetic biology & gene synthesis markets have witnessed a significant increase in investments. Moreover, the market was impacted due to various research initiatives introduced based on DNA synthesis for developing treatments and vaccines for COVID-19. For instance, a study was published by the University of Oxford in which researchers evaluated the efficacy of existing synthetic plasmid DNA-based vaccines. The researchers also developed a synthetic DNA vaccine for the SARS-CoV2 virus.

The rising investments in the synthetic biology market are expected to propel the market growth over the forecast period. Due to the growing demand, investors have recently shifted their focus toward the synthesis biology industry. For instance, in 2020, eureKARE company was formed to focus on development and financing activities related to innovation in synthetic biology across Europe. Moreover, in May 2021, the company raised USD 60 million to develop microbiome and synthetic biology startups.

In addition, approximately USD 7.8 billion was invested in the synthetic biology field through public and private financing in 2020. This amount is nearly 2.5 times the funding received in 2019. The increased availability of public financing, along with the role of exchange-traded funds, has driven investments in this market. These increasing investments and funding activities can strengthen the growth over the coming years.

Over the projected period, the regional market’s growth is expected to be driven by technological advancements in DNA synthesis platforms. The launch of innovative DNA synthesis platforms with technologically cutting-edge specifications that address the increased demand of researchers is expected to support market growth. For instance, DNA Script launched the SYNTAX System in June 2021, the first benchtop nucleic acid printer based on EDS technology in the industry. The SYNTAX System is an integrated, automated printer that produces 96 DNA oligos simultaneously, each with a length of up to 60 nucleotides.

It produces it ready for use in molecular biology and genomics operations without extra processing. By enabling quick, on-site synthesis of DNA oligos for use in genomics processes such as qPCR, amplicon sequencing, endpoint PCR, and mutagenesis, DNA Script aims to speed up the development cycle for assay improvement. Such technological advancements in DNA synthesis systems can reduce the processing time and cost of DNA synthesis and sequencing, providing numerous synthesizing platforms.

Method Insights

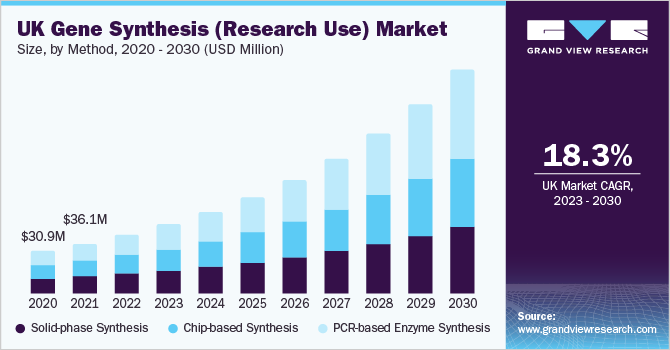

Based on method, the market is segmented into solid-phase, chip-based, and PCR-based enzyme synthesis. Solid-phase synthesis segment dominated the market in 2022 with a share of 38.3% due to the presence and widespread use of this technique, along with the increasing automation in solid-phase technology, which enhanced the efficiency of DNA synthesis. A rise in the adoption of solid-phase synthesis for biophysical studies also favors segment demand.

The PCR-based enzyme synthesis method is expected to witness the fastest CAGR of 17.9% over the forecast period. The growth of the segment can be attributed to the restraints of the chemical synthesis process, such as producing desired quality DNA for only up to a limited length and the environmental impact of the harsh chemicals used.

Services Insights

In the services segment, the antibody DNA synthesis segment held the largest market share of 61.6% in 2022, owing to an increase in the adoption of gene synthesis in the production of antibodies used for research and the availability of cutting-edge recombinant technology. Furthermore, the increased importance of personalized antibodies and related research for cancer or genetic disorders drives the segment.

The viral DNA synthesis segment is expected to grow at the fastest CAGR of 18.6% during 2023-2030. Gene synthesis enables the construction of viral DNA in the laboratory without needing an existent virus sample. Moreover, the synthesis of viral genomes also assists in recognizing the gene functions and pathogenicity of the organism, allowing for the development of better treatment or disorder prevention options. These applications of viral DNA synthesis services are anticipated to drive the segment.

Application Insights

Based on application, the gene synthesis market is segmented into gene & cell therapy development, vaccine development, and others. The gene & cell therapy development segment held a revenue share of 54.8% in 2022, and it is anticipated to showcase the fastest CAGR over the forecast period. The dominance and growth of the segment can be attributed to several factors, including increasing gene & cell therapy approvals and the growing use of gene synthesis methods for cloning synthetic therapeutic genes in viral vectors. Moreover, the growing adoption of gene & cell therapies and increasing government support are anticipated to drive the segment in the coming years.

Research Phase Insights

Based on research phase, the Europe gene synthesis (research use) market is segmented into preclinical and clinical. The clinical segment accounted for the largest regional market share of 72.7% in 2022. The segment is also projected to display lucrative growth over the forecast period with a CACR of 17.2%. The segment's growth is expected to be driven by the increase in the number of clinical trials for advanced therapy medicinal products. In addition, biomarker discovery and disease modeling are also anticipated to propel segment growth by 2030.

End-use Insights

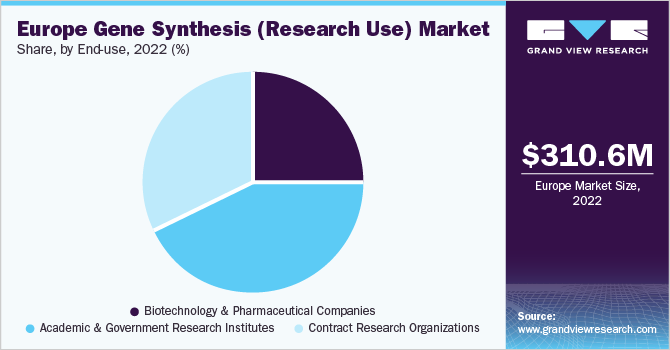

Based on end-use, the gene synthesis market is segmented into academic & government research institutes, biotechnology & pharmaceutical companies, and contract research organizations (CROs). The academic & government research institutions segment dominated the market with a revenue share of 42.9% in 2022. The segment's dominance is due to expanding research prospects aimed at exploring the use of gene synthesis for studying model organisms. Moreover, enhanced flexibility and automation in gene synthesis facilitated a growing penetration of the technique in research laboratories. Collaborations between industry and academia are expected to boost segment growth over the coming years.

The contract research organization end-use segment is expected to witness the fastest CAGR of 18.2% throughout the forecast period. The growing number of small biotechnology companies and increasing outsourcing trends are anticipated to impact segment growth in the forthcoming years.

Regional Insights

France dominated the Europe research use gene synthesis market with a revenue share of 16.34% in 2022. This dominance can be attributed to several factors, including the presence of key players and numerous initiatives they adopted to strengthen their product and service offerings and enhance their market presence. Moreover, government agencies are supporting the growth and innovation in the market.

For instance, in January 2021, DNA Script and the French Defense Innovation Agency collaborated on the development of new tools for disease diagnosis. The company received USD 1.6 million for this project as part of this collaboration. DNA Script’s novel enzymatic synthesis platform is employed in this project to generate high-fidelity nucleic acids rapidly. Collaborative efforts such as these are expected to fuel market growth over the forecast period.

On the other hand, the Netherlands gene synthesis research use market is projected to grow at the fastest CAGR of 21.0% from 2023 to 2030. The growth is mainly driven by factors such as the presence of a strong network of pharmaceutical and biotechnology companies, supportive government regulations for research, and the presence of various organizations that promote research through funding/grants. For instance, in November 2022, Cradle a Dutch-Swiss biotech startup received funding of USD 5.4 million to speed up its product development. Such investments by market players and government support are expected to drive the market growth over the coming years.

Key Companies & Market Share Insights

Several major players operating in the gene synthesis research use market include Thermo Fisher Scientific, Inc.; GenScript; Twist Bioscience; GENEWIZ; ProMab Biotechnologies, Inc.; and Integrated DNA Technologies, Inc. The market is witnessing growth owing to the numerous strategies key players employ to maintain their industry presence. For instance, in May 2023, GenScript announced the launch of GenTitan Gene Fragments synthesis service to perform gene synthesis at a relatively low cost. In addition, Twist Bioscience announced a collaboration with Astellas Pharma in April 2023 to support antibody discovery for immunotherapies. Some prominent players in the Europe gene synthesis (research use) market include:

-

GenScript

-

Azenta, Inc. (GENEWIZ)

-

Boster Biological Technology

-

Twist Bioscience

-

ProteoGenix, Inc

-

Biomatik

-

ProMab

-

Thermo Fisher Scientific, Inc.

-

Integrated DNA Technologies, Inc. (Danaher)

-

OriGene Technologies, Inc.

Europe Gene Synthesis (Research Use) Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 357.4 million

Revenue forecast in 2030

USD 998.9 million

Growth rate

CAGR of 15.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Method, service, application, research phase, end-use, region

Regional scope

Europe

Country scope

Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Netherland; Switzerland

Key companies profiled

GenScript; Azenta, Inc. (GENEWIZ); Boster Biological Technology; Twist Bioscience; ProteoGenix, Inc; Biomatik; ProMab; Thermo Fisher Scientific, Inc.; Integrated DNA Technologies, Inc. (Danaher); OriGene Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Europe Gene Synthesis (Research Use) Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe gene synthesis (research use) market report based on method, service, application, research phase, end-use, and region:

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Solid-phase Synthesis

-

Chip-based Synthesis

-

PCR-based Enzyme Synthesis

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Antibody DNA Synthesis

-

Viral DNA Synthesis

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Gene & Cell Therapy Development

-

Vaccine Development

-

Others

-

-

Research Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-clinical

-

Clinical

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology and Pharmaceutical Companies

-

Academic and Government Research Institutes

-

Contract Research Organizations

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Netherland

-

Switzerland

-

-

Frequently Asked Questions About This Report

b. The Europe gene synthesis (research use) market was valued at USD 310.6 million in 2022 and is expected to reach USD 357.4 million by the year 2023.

b. The Europe gene synthesis (research use) market is projected to register CAGR of 15.8% to reach market size of USD 998.9 million by 2030.

b. The Antibody DNA Synthesis segment accounted for the largest revenue share of 61.6% in 2022 owing to high demand for antibody synthesis services.

b. The key players operating in the Europe gene synthesis (research use) market include, ProteoGenix, Boster Biological Technology, GenScript, Integrated DNA Technologies, Inc., GENEWIZ, Twist Bioscience, Biomatik, ProMab Biotechnologies, Inc., Thermo Fisher Scientific, Inc., among others.

b. The key factors driving the market are, rising investment in synthetic biology, advent of enzymatic DNA synthesis process and technological advancements in DNA synthesis platforms.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."