- Home

- »

- Next Generation Technologies

- »

-

Europe Generative AI Market Size And Share, Report, 2030GVR Report cover

![Europe Generative AI Market Size, Share & Trends Report]()

Europe Generative AI Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Technology, By End-use, By Application (Computer Vision, NLP, Robotics & Automation), By Model, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-195-4

- Number of Report Pages: 77

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Generative AI Market Size & Trends

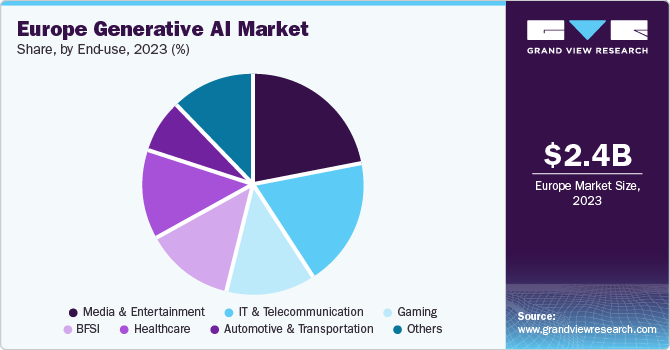

The Europe generative AI market size was estimated at USD 2.42 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 35.8% from 2024 to 2030. Generative AI is a subset of artificial intelligence that focuses on creating new content, such as images, music, or text and has been experiencing significant growth in Europe owing to the increasing availability of large datasets. Europe has seen a proliferation of data across various domains, including finance, healthcare, and entertainment. This abundance of data provides significant resources for training generative AI models, enabling them to produce more accurate and diverse outputs.

Moreover, advancements in deep learning techniques have played a pivotal role in driving the growth of generative AI in Europe. Deep learning algorithms, particularly those based on neural networks such as Variational Autoencoders (VAEs) and Generative Adversarial Networks (GANs), have shown notable capabilities in generating realistic and high-quality content. These advancements have fueled innovation in generative AI research and applications across the region.

Access to extensive datasets is essential for enhancing and refining generative AI models. Countries like the UK, Germany, France, and Italy with advanced technological infrastructures possess abundant data resources, particularly in fields like computer vision and language processing, fostering the growth of a generative AI market. Additionally, cloud storage solutions offer significant benefits for the generative AI market. They simplify data access and collaboration, allowing teams across the region to store and share diverse datasets effortlessly. Furthermore, cloud storage operates on a pay-as-you-go model, easing financial burdens and ensuring secure management of sensitive projects.

The Europe generative AI market trends include using AI, statistics, and probability to create computer-based representations of targeted variables based on observations, previous input, or datasets. Moreover, generative AI tools have experienced significant growth in Europe owing to advancements and the increasing integration of these technologies across diverse sectors. Industries such as healthcare, automotive, finance, academia, and creative arts are leveraging generative AI for tasks ranging from medical image analysis and drug discovery to autonomous vehicle development and enhancing learning experience. For instance, in February 2024, Multiversity, an Italian company, collaborated with a consulting company, Bain & Company, to develop an AI tool using OpenAI generative AI (GenAI) technology. The new GenAI University Assistant tool has been designed to enrich the educational journey of students enrolled at Multiversity's digital universities. It provides students with instant study assistance, valuable insights, and additional resources in real time, enhancing their overall learning experience.

The Europe generative AI gaming market is witnessing growth due to an increasing player base and diversification, which has created a demand for immersive and personalized gaming experiences. Integrating generative AI technologies, such as procedural content generation and neural network-based algorithms, enables game developers to create more lifelike and intelligent virtual characters. These AI-driven characters can exhibit complex behaviors, emotions, and personalities, improving the immersion and realism of gaming environments. Generative AI creates more engaging and believable gaming experiences by simulating human-like interactions and responses, fostering deeper player engagement and emotional connection.

Generative artificial intelligence (AI), vital in managing IT operations and services, is rapidly gaining popularity in European regions. European businesses and research institutions increasingly recognize the transformative potential of generative AI technologies in various industries. With a strong emphasis on ethical AI development and responsible deployment, European companies leverage generative AI to enhance product innovation, streamline operations, and improve customer experiences.

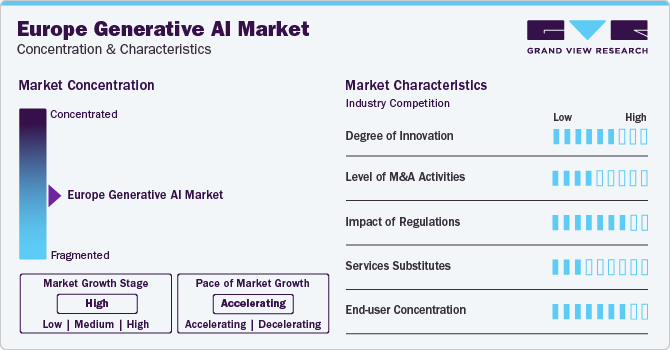

Market Concentration & Characteristics

Europe generative AI market growth stage is high, and the pace is accelerating. The generative AI market in the region is characterized by an active and rapidly evolving landscape driven by technological advancements, diverse applications, and a supportive ecosystem. One prominent feature is the increasing adoption of generative AI across various industries, including healthcare, finance, entertainment, and more. The demand for innovative solutions in healthcare, such as medical image synthesis and drug discovery, boosted significant growth in the region.

Government initiatives and policies supporting AI development influence the growth of the generative artificial intelligence market in the region. Europe has implemented strategies to promote research, innovation, and the responsible use of AI technologies. These initiatives often include funding, collaborations, and regulatory frameworks between government bodies, industry, and academia. As governments actively engage in shaping the AI landscape, it contributes to a favorable environment for the growth of the generative AI market in the region, fostering innovation and cross-industry collaborations. Many companies are introducing generative AI tools in the European market to leverage and enhance product innovation, streamline operations, and gain a competitive edge in an increasingly digital and data-driven economy. For instance, in July 2023, Google launched the generative AI model Bard in Europe. The Bard is available in forty languages, including Spanish, German, and Chinese.

The Europe generative AI market is developing and has a slightly concentrated nature, featuring several regional and global players. The market players are investing in research & development to create advanced solutions and gain a competitive edge. Moreover, they are entering into mergers & acquisitions and partnerships as the market is characterized by rapid change, innovation, and disruption. Moreover, according to a survey by Strand Partners of over 14,000 businesses and 16,000 citizens, 38% of European companies were experimenting with AI, which would have a positive economic impact.

Component Insights

Based on components, the market is further bifurcated into software and services. The software segment accounted for the largest revenue share of 64.6% in 2023 and is expected to continue to dominate the industry over the forecast period. The growth of the software industry can be attributed to various factors, including the adoption of cutting-edge technologies, increased investment in artificial intelligence, the rising need for automation, and favorable regulatory environments in the region. Moreover, the Generative AI software is expected to significantly impact many sectors and industries, including manufacturing, gaming, and design.

The service segment is expected to witness the fastest growth during the forecast period. The segment growth can be attributed to the increasing concerns over fraud detection, data protection, risk factor modeling, and trading prediction. Cloud-based generative AI services are expected to gain popularity as they provide scalability, flexibility, and cost-effectiveness, fueling the segment's growth. For instance, in December 2023, Mistral AI, an artificial intelligence solutions provider, partnered with Google Cloud, optimized proprietary language models, and distributed both its open weights on Google Cloud's AI-optimized infrastructure.

Technology Insights

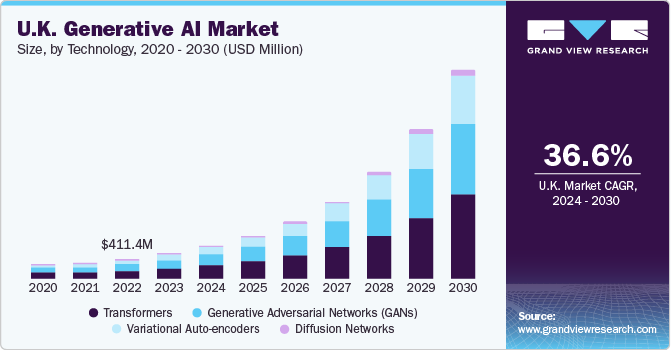

Based on technology, the market is segmented into variational auto-encoders, Generative Adversarial Networks (GANs), transformers, and diffusion networks. The transformers segment held the largest revenue share in 2023. The growing use of transformer applications, such as text-to-image AI, which transforms textual input into visual output, contributes to this trend. Numerous companies are integrating text-to-image AI capabilities into their platforms, aiming to transform the process of visual content creation for projects, campaigns, and brands.

Moreover, the segment of diffusion networks is anticipated to grow at the highest CAGR during the forecast period. Image synthesis has become indispensable across various sectors, including healthcare, automotive, transportation, defense, media, entertainment, banking, financial services, and insurance (BFSI). This advancement has empowered these sectors to meet escalating requirements for image generation and deliver valuable services to enterprises, governmental entities, and the general populace.

Application Insights

The Natural Language Processing (NLP) segment dominated the market in 2023 and is projected to grow at a significant CAGR during the forecast period. Integrating generative AI into existing NLP frameworks and platforms has made it easier to use in real-world applications. Companies and developers can now access pre-trained generative AI models and APIs from leading tech companies and research institutions, enabling them to prototype and deploy NLP-powered applications quickly and with minimal effort.

The computer vision segment is anticipated to grow at the fastest CAGR during the forecast period. The demand for personalized and immersive user experiences drives the integration of generative AI techniques in computer vision applications. From customized product recommendations to virtual try-on experiences, generative models are revolutionizing how businesses engage with customers. By leveraging generative AI, companies can create highly customized and interactive visual experiences catering to individual preferences and behaviors, enhancing customer satisfaction and loyalty.

Model Insights

One of the significant factors driving the growth is the increasing demand for AI-driven solutions for natural language understanding and generation in various applications and industries, which is driving the adoption of large language models. From virtual assistants and chatbots to content generation and sentiment analysis, large language models power various NLP applications that enhance user experiences, automate tasks, and derive valuable insights from text data.

The multimodal generative model is expected to grow fastest during the forecast period. There is an increasing demand for AI models capable of processing and generating content across multiple modalities, such as text, images, and audio. Multimodal generative models enable machines to understand and develop content more representative of human experiences. It leads to more immersive and contextually rich interactions in applications such as virtual assistants, chatbots, and content creation tools.

End-use Insights

Based on end-use, the market is segmented into media & entertainment, BFSI, IT & telecommunications, healthcare, automotive & transportation, and others. Other sub-segment further comprises security and aerospace & defense. The media & entertainment segment accounted for the largest revenue share in 2023 and is projected to grow at a significant CAGR over the forecast period. The growing utilization of generative AI to enhance advertising and campaign journalism is expected to fuel the demand for this technology within the media and entertainment sectors.

The BFSI segment is expected to witness the fastest growth rate during the forecast period. The market growth in this segment is attributed to enhancing customer experiences and simplifying complex data analysis and risk management. The banking and finance industry is rapidly undergoing digital transformation, with countries such as the UK, Spain, and Italy leading in AI innovation. Moreover, the need to simplify complex data analysis, enhance customer experiences, and manage risk is expected to drive the growth of generative AI in the market.

Regional Insights

Germany dominated the industry with a share of 23.0% in 2023 due to accelerating adoption across traditional sectors such as manufacturing, retail, telecoms, and healthcare and the development of artificial intelligence (AI) computing power. Many companies are launching generative AI tools and chatbots to enhance customer interactions, automate repetitive tasks, and provide personalized experiences across various industries and applications. For instance, in September 2023, a German technology company, SAP, launched a generative AI assistant, Joule, to transform business operations. It is integrated across its enterprise cloud portfolio, providing proactive and contextualized insights from a combination of SAP solutions and third-party sources.

The generative AI market in the UK is expected to grow significantly during the forecast period. The UK's strong digital infrastructure and thriving tech ecosystem create a conducive environment for the growth of generative AI. The presence of leading tech companies, startups, and innovation hubs in cities like London, Cambridge, and Edinburgh fosters collaboration and knowledge exchange, enabling the rapid development and adoption of AI technologies.

Moreover, many European countries, such as Spain, Italy, Sweden, and others, are establishing associations for the ethical and innovative use of generative AI. For instance, in November 2023, Spain launched GenAiA, a generative AI association based in Madrid. GenAiA is a point of contact for experts and companies to share their knowledge and experience in utilizing technology most efficiently and innovatively. Such initiatives are expected to drive the growth of the generative AI market across the region.

Key Europe Generative AI Company Insights

Some key players operating in the market includeAleph Alpha; Mistral AI; and Helsing.

-

Aleph Alpha is an AI application and research company focusing on developing and operationalizing large-scale AI models for language, strategy, and image data, aiming to empower enterprises and governments with AI technology. Aleph Alpha's offerings include a platform that ensures operations are aligned with the latest requirements and risks are mitigated, as well as trustworthiness features that provide explainability and control over AI-driven processes and decisions.

-

Mistral AI is a French AI company that produces large open-language models. Mistral AI's latest model, Mixtral 8x7B, has 46.7 billion parameters and outperforms other models in five languages. The company aims to develop open-weight models that are on par with proprietary models and to serve the open community and enterprise customers.

Pixis, Everseen, and DeepL are some of the other market participants in the Europe generative AI market.

-

Pixis is a technology company that develops codeless AI infrastructure to help brands scale their marketing efforts. The company offers proprietary artificial intelligence models deployed across various products and plugins, enabling businesses to scale their marketing, creative, and performance efforts.

-

DeepL is a leading AI communication company known for its advanced neural machine translation service, DeepL Translator. The platform utilizes AI to deliver high-quality translations for diverse languages and communication needs.

Europe Generative AI Companies:

The following are the leading companies in the Europe generative AI market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these Europe generative AI companies are analyzed to map the supply network.

- Aleph Alpha

- Mistral AI

- Helsing

- Pixis

- Everseen

- DeepL

- Creative Fabrica

- PolyAI

- Humanloop

- Conjecture

Recent Developments

-

In February 2024, Capgemini partnered with Mistral AI, an artificial intelligence company, to focus on accelerating the evolution towards more versatile, accessible, and cost-effective generative AI implementation at scale. Capgemini aims to support its numerous global clients in maximizing long-term value and expediting the implementation of their generative AI initiatives by integrating Mistral AI's exceptionally efficient foundational models into their comprehensive generative AI framework.

-

In February 2024, IBM and Natwest announced upgrades to the bank's virtual assistant, Cora, leveraging generative AI technology to offer customers access to a broader spectrum of information through conversational interactions. This initiative positions the bank as one of the adopters of generative AI within the UK, enhancing the safety, intuitiveness, and accessibility of its digital services through the virtual assistant.

-

In July 2023, OYO launched ChatGPT-powered self-check-in in the UK. The virtual solution powered by ChatGPT aims to minimize wait times for customers of partner hotels by providing a streamlined check-in process that takes just five minutes.

Europe Generative AI Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.13 billion

Revenue forecast in 2030

USD 19.63 billion

Growth rate

CAGR of 35.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, end-use, application, model, region

Regional scope

Europe

Country scope

U.K.; Germany; France; Italy; Spain; Netherlands

Key companies profiled

Aleph Alpha; Mistral AI; Helsing; Pixis; Everseen; DeepL

Creative Fabrica; PolyAI; Humanloop; Conjecture

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Generative AI Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the Europe generative AI marketreport based on component, technology, end-use, application, model, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Generative Adversarial Networks (GANs)

-

Transformers

-

Variational Auto-encoders

-

Diffusion Networks

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Media & Entertainment

-

BFSI

-

IT & Telecommunication

-

Healthcare

-

Automotive & Transportation

-

Gaming

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Computer Vision

-

NLP

-

Robotics and Automation

-

Content Generation

-

Chatbots and Intelligent Virtual Assistants

-

Predictive Analytics

-

Others

-

-

Model Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Language Models

-

Image & Video Generative Models

-

Multi-modal Generative Models

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Frequently Asked Questions About This Report

b. The Europe generative AI market size was estimated at USD 2.42 billion in 2023 and is expected to reach USD 3.13 billion in 2024.

b. The Europe generative AI market is expected to grow at a compound annual growth rate of 35.8% from 2024 to 2030 to reach USD 19.63 billion by 2030

b. Germany dominated the Europe generative AI market with a market share of 23.0% in 2022 owing to accelerating adoption across traditional industries such as manufacturing, retail, telecoms, and healthcare and the development of artificial intelligence (AI) computing power.

b. Some key players operating in the Europe generative AI market include Amazon.com Inc., Alibaba Group, Meta Model, Inc., Tencent Holdings Ltd., Nvidia Corporation, Epic Games, Inc., Roblox Corporation, Unity Technologies, Inc., Nextech AR Solutions Corp., The Sandbox, Decentraland, Microsoft Corporation, Antier Solutions Pvt. Ltd., Innowise Group, Aetsoft Inc.

b. Factors such as advancements in deep learning techniques are expected to drive market growth. Moreover, increasing concerns over fraud detection, data protection, risk factor modeling, and trading prediction drives the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.