- Home

- »

- Plastics, Polymers & Resins

- »

-

Europe High Density Polyethylene Jerrycan Market, 2030GVR Report cover

![Europe High Density Polyethylene Jerrycan Market Size, Share & Trends Report]()

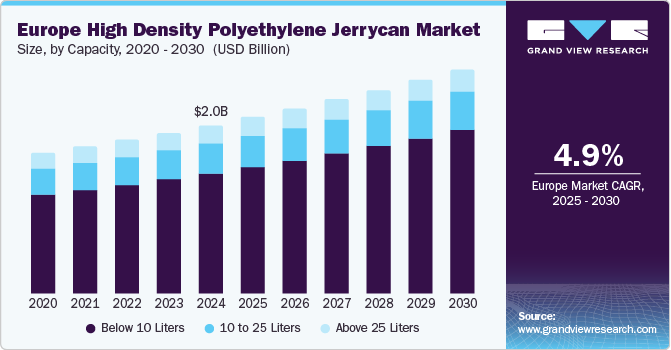

Europe High Density Polyethylene Jerrycan Market (2025 - 2030) Size, Share & Trends Analysis Report By Capacity (Below 10 Liters, 10 to 25 Liters, Above 25 Liters), By End-use (Chemicals & Agrochemicals, Food & Beverages), By Country, And Segment Forecasts

- Report ID: GVR-4-68038-991-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The Europe high density polyethylene jerrycan marketsize was valued at USD 2.03 billion in 2024 and is expected to grow at a CAGR of 4.9% from 2025 to 2030. This growth is attributed to the increasing demand for sustainable packaging solutions, particularly in the food and beverage sector. In addition, the rise of e-commerce has heightened the need for durable and recyclable packaging options. Furthermore, advancements in HDPE production technology and a favorable regulatory environment further support market expansion.

High density polyethylene (HDPE) jerrycans are robust containers made from a type of plastic known for its strength and durability. The increasing preference for convenient and resilient packaging solutions is significantly boosting the demand for HDPE jerrycans in Europe. These containers provide a cost-effective alternative to metal jerrycans, being lighter and rust-resistant, enhancing their appeal. Their durability and recyclability further position them as an eco-friendly option. Available in various sizes, HDPE jerrycans cater to diverse customer needs for storage and transportation, particularly beneficial in remote areas.

In addition, their stackable design optimizes space during storage and transit. The industrial sector's rising demand for packaging solutions also contributes to the growth of HDPE jerrycans, especially with the ongoing investments in oil and gas projects across Europe. Industrial activities and economic recovery largely fuel this demand.

Furthermore, rapid advancements in research and development, alongside the adoption of innovative technologies such as bioplastics, are expected to enhance the market landscape. Key players in the region focus on supplying HDPE jerrycans to industries such as chemicals, agrochemicals, pharmaceuticals, and food and beverages, thereby driving market expansion.

Capacity Insights

The below 10 liters segment dominated the market and accounted for the largest revenue share of 71.4% in 2024. This growth is attributed to the demand for portable and manageable packaging solutions. In addition, consumers, including small businesses and individuals, prefer this size for its convenience, allowing for easy handling and storage. Furthermore, the increasing trend of retailing liquids in smaller quantities caters to consumer preferences for practicality at home.

The 10 to 25-liter capacity segment is expected to grow at a CAGR of 4.3% over the forecast period, driven by industrial applications requiring larger volumes of liquid storage and transport. Industries such as chemicals, pharmaceuticals, and food and beverages benefit from HDPE jerrycans in this range due to their durability and resistance to impact. In addition, the need for efficient packaging solutions that can withstand rigorous handling and provide safety for hazardous materials also drives demand. Furthermore, the trend towards sustainable packaging solutions aligns with the characteristics of HDPE jerrycans, reinforcing their market presence in this capacity segment.

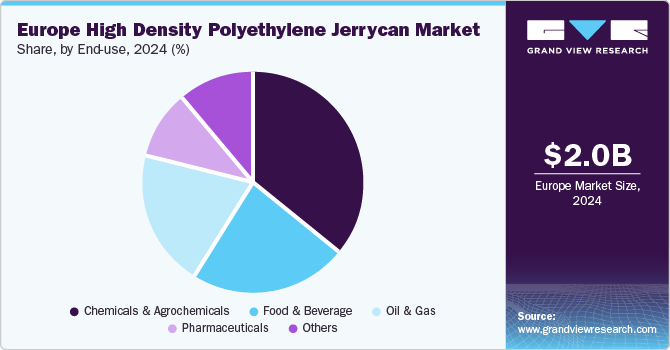

End-use Insights

The chemicals and agrochemicals segment led the market and accounted for the largest revenue share of 36.0% in 2024, primarily driven by the increasing demand for efficient and reliable packaging solutions. In addition, HDPE jerrycans are favored for their durability, resistance to impact, and ability to safely store hazardous materials. Furthermore, the rise in industrial activities and stringent regulations on chemical storage further enhance the need for secure and compliant packaging options, making HDPE jerrycans an ideal choice for this sector.

The food and beverage segment is expected to grow at a CAGR of 5.8% from 2025 to 2030, owing to the rising consumer preference for safe and hygienic packaging. These jerrycans provide excellent barrier properties, ensuring product integrity and freshness. In addition, the trend towards sustainable packaging solutions also plays a significant role, as HDPE is recyclable and lightweight. Moreover, the expanding food and beverage industry in Europe and increasing demand for convenient packaging for liquids drive the adoption of HDPE jerrycans in this end-use segment.

Country Insights

Germany high density polyethylene (HDPE) jerrycan market dominated the European market and accounted for the lowest revenue share of 25.9% in 2024. This growth is attributed to the increasing demand for efficient and sustainable packaging solutions across various industries. In addition, the country’s strong industrial base, particularly in chemicals and agrochemicals, necessitates reliable packaging for hazardous materials. Furthermore, Germany's commitment to environmental sustainability encourages the use of recyclable materials such as HDPE. Moreover, the ongoing advancements in production technology and a focus on reducing waste further enhance the appeal of HDPE jerrycans in the German market.

UK High Density Polyethylene Jerrycan Market Trends

The high density polyethylene (HDPE) jerrycan market in the UK is expected to grow at a CAGR of 6.8% over the forecast period, owing to the booming e-commerce sector, which demands lightweight and durable packaging solutions for shipping liquids. In addition, the growing consumer preference for eco-friendly products also propels the adoption of HDPE jerrycans, as they are recyclable and less environmentally harmful than traditional metal containers. Furthermore, stringent regulations regarding packaging waste are prompting manufacturers to seek sustainable alternatives, making HDPE jerrycans an attractive option for various applications in the food and beverage industry.

France High Density Polyethylene Jerrycan Market Trends

France high density polyethylene (HDPE) jerrycan market is expected to grow significantly over the forecast period, driven by a robust food and beverage sector that increasingly relies on safe and hygienic packaging. In addition, the rising consumer awareness regarding sustainability drives demand for recyclable packaging solutions, with HDPE jerrycans being a preferred choice. Furthermore, France's focus on reducing plastic waste through government initiatives encourages manufacturers to adopt eco-friendly practices.

Key Europe High Density Polyethylene Jerrycan Company Insights

Key companies in the Europe high density polyethylene jerrycan industry include Greif, Inc., Greiner Packaging, Nexus Packaging Ltd., and others. These players are adopting various strategies to enhance their market presence. Mergers and acquisitions are being pursued to consolidate resources and expand product portfolios. In addition, new product developments focus on innovative designs and enhanced functionalities to meet evolving consumer demands. Furthermore, strategic agreements and partnerships are established to leverage collaborations and improve distribution networks.

-

Greif, Inc. manufactures a wide array of packaging solutions, including jerrycans, bottles, and tight-head containers. The company serves multiple industries, such as chemicals, agrochemicals, food and beverages, and lubricants. The company focuses on providing durable and customizable HDPE products that meet stringent safety standards, including UN-certified packaging for hazardous materials.

-

RPC Group plc specializes in producing a variety of plastic packaging solutions. The company operates within segments such as food and beverage, personal care, and industrial applications. The company is known for its commitment to innovation, offering tailored HDPE jerrycans that meet specific customer requirements while ensuring compliance with industry regulations. Their extensive product range emphasizes lightweight and recyclable options, aligning with Europe's increasing demand for sustainable packaging solutions.

Key Europe High Density Polyethylene Jerrycan Companies:

The following are the leading companies in the europe high density polyethylene jerrycan market. These companies collectively hold the largest market share and dictate industry trends.

- SCHÜTZ GmbH & Co. KGaA

- Greif, Inc.

- UPM Raflatac

- Mauser Packaging Solutions

- WERIT Kunststoffwerke W. Schneider GmbH & Co. KG.

- Denios

- AST Kunststoffverarbeitung GmbH

- RPC Group plc

- Sirplaste

- Greiner Packaging

- Nexus Packaging Ltd.

- TubePlast

- Deren Ambalaj Sanayi ve Ticaret A.Åž.

- Kautex Textron GmbH & Co. KG.

Recent Developments

-

In May 2024, UPM Raflatac announced the launch of the world's first RecyClass-certified paper label designed specifically for rigid high-density polyethylene (HDPE) and polypropylene (PP) packaging. This innovative label aimed to enhance the recyclability of plastic packaging, including high-density polyethylene jerrycans, by providing a sustainable labeling solution. The certification underscores UPM Raflatac's commitment to supporting circular economy initiatives and reducing environmental impact in the packaging industry.

-

In September 2023, Sirplaste Portugal and SCG Chemicals announced significant investments in advanced recycling technology to enhance the production of high-density polyethylene (HDPE) plastic pellets. This collaboration aimed to meet the growing demand for sustainable packaging solutions, including applications for HDPE jerrycans. The new technology, known as SMX, was expected to improve the strength of the pellets while promoting circular economy principles.

Europe High Density Polyethylene Jerrycan Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.12 billion

Revenue forecast in 2030

USD 2.70 billion

Growth Rate

CAGR of 4.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Capacity, end-use, country

Regional scope

Europe

Country scope

Germany, UK, France, Italy, Spain, Russia, Central Europe, and Rest of Europe

Key companies profiled

SCHÜTZ GmbH & Co. KGaA; Greif, Inc.; UPM Raflatac; Mauser Packaging Solutions; WERIT Kunststoffwerke W. Schneider GmbH & Co. KG.; Denios; AST Kunststoffverarbeitung GmbH; RPC Group plc; Sirplaste; Greiner Packaging; Nexus Packaging Ltd.; TubePlast; Deren Ambalaj Sanayi ve Ticaret A.Åž.; Kautex Textron GmbH & Co. KG.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe High Density Polyethylene Jerrycan Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, View Research has segmented the Europe high density polyethylene jerrycan market report based on capacity, end-use, and country.

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 10 Liters

-

10 to 25 Liters

-

Above 25 Liters

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Chemicals & Agrochemicals

-

Food & Beverage

-

Pharmaceuticals

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Central Europe

-

Rest of Europe

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.