- Home

- »

- Medical Imaging

- »

-

Europe Medical Imaging Market Size, Industry Report, 2030GVR Report cover

![Europe Medical Imaging Market Size, Share & Trends Report]()

Europe Medical Imaging Market Size, Share & Trends Analysis Report By Technology (X-ray, Computed Tomography, Ultrasound, MRI, Nuclear Imaging), By End-use (Hospitals), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-208-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Europe Medical Imaging Market Trends

The Europe medical imaging market size was estimated at USD 12.0 billion in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030. An increasing awareness about the benefits of early disease detection, growing aging population, technological advancements in healthcare, improved investment & reimbursement initiatives undertaken by the governments, and developments of new facilities by market players in Europe are propelling the market growth. The rise in lifestyle-related diseases, such as diabetes, cardiovascular diseases, and obesity, due to unhealthy dietary habits, sedentary lifestyles, and high stress levels, has also led to a higher demand for healthcare services & early detection tools, thereby driving market growth.

According to the National Health Service England, 43.4 million medical imaging tests were reported in England from February 2022 to January 2023. Medical imaging plays a crucial role in the early detection, diagnosis, treatment planning, and monitoring of various diseases. As the burden of chronic illnesses continues to grow, the need for advanced imaging technologies is expected to increase. Technological advancements in healthcare have significantly improved turnaround time, making diagnosis and treatment more efficient. The development of advanced imaging modalities, such as MRI, CT scans, ultrasound, and PET scans, has significantly improved diagnostic capabilities, leading to better patient outcomes.

Technological innovations, such as 3D and 4D imaging, artificial intelligence (AI) integration, and digital imaging have enhanced medical imaging procedures' accuracy, speed, and efficiency. The COVID-19 pandemic has significantly impacted the global medical imaging market growth. During the peak of the pandemic, many non-essential medical imaging procedures were postponed or canceled to prioritize resources for COVID-19 patients. This led to a decline in the overall volume of imaging procedures performed in Europe. To minimize the risk of exposure to the virus, healthcare providers in Europe increasingly adopted remote imaging services, such as telemedicine and tele-radiology. This shift towards remote services has accelerated the adoption of digital imaging technologies but has impacted the medical imaging market growth in Europe.

According to the National Health Service England, in January 2023, 1.65 million people underwent plain radiography (X-ray), and around 0.31 million people were examined with magnetic resonance imaging. The introduction of CT scans and 3D MRIs assists radiologists in examining scans, reducing analysis time and improving efficacy. Moreover, computer vision systems can detect conditions that are not visible to the human eye. For instance, Moorfields Eye Hospital in the UK and Google Health collaborated to curate a dataset of images of eye retinas to understand all eye scans performed using an optical CT scanner to ensure early detection of age-related macular degeneration.

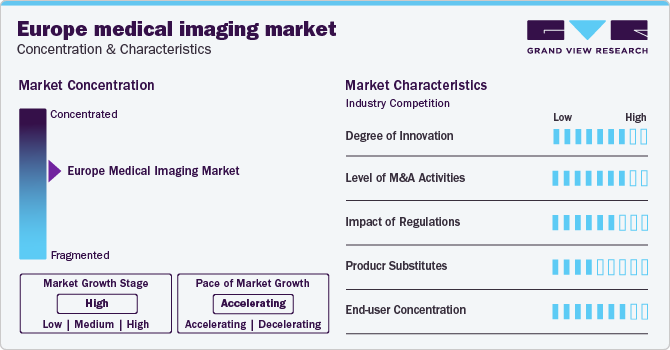

Market Concentration & Characteristics

The market growth stage is high, and the pace of its growth is accelerating. Innovation in medical imaging, including new procedures, is driven by ongoing research & collaboration between various organizations, regulatory frameworks, and rising need for early disease detection. Technological advancements in the medical imaging sector are anticipated to propel market growth. For instance, in September 2023,Koning Health and Healthyr partnered to provide non-surgical breast health solutions for women. Vera Breast CT solution is designed to deliver 3D-guided imaging. This partnership aims to integrate the imaging technology of Koning and Healthyr’s at-home testing solutions to identify breast health issues at their earliest stages.

M&A activities are often introduced by market players driven by the desire to expand operational efficiency and to achieve economies of scale or to gain access to new markets and reinforce market presence. M&A activities are accelerating, which is contributing to market growth. For instance, in February 2024, French medical imaging group IMDEV welcomed Bpifrance and CAPZA as minority shareholders. With 90 CT scanners and MRI, 6 Gamma cameras, and 3 PET scanners, IMDEV covers over 200 radiologists and 120 centers ensuring access to medical services and quality care.

Regulations significantly impact the market by shaping equipment approval processes, safety standards, and reimbursement policies, thereby influencing the purchasing decisions of end-users and manufacturers. Driving factors behind these regulations include concerns for patient safety and quality of care, technological advancements necessitating updated standards, and economic considerations driving reimbursement policies. According to the European Medical Device Regulation (MDR), under the Medical Device Regulation (MDR) enacted in 2017 with a transition period until December 31, 2027, or 2028, manufacturers must adhere to stricter classification rules, enhanced post-market surveillance, and increased transparency, with a focus on robust AI/ML measures for connected devices. The authorities released marketing submission recommendations for AI/ML-enabled device software functions, while the International Medical Device Regulators Forum (IMDRF) emphasized cybersecurity measures, such as risk assessments and incident response plans to safeguard patient data and device functionality, ensuring harmonization of international standards.

Product substitutes encompass alternative diagnostic technologies or methods that serve similar purposes to traditional imaging modalities. The growth is attributed to the technological advancements leading to the development of non-invasive or less expensive diagnostic tools, preferences for radiation-free imaging options, and growing availability and adoption of point-of-care diagnostic devices. In addition, factors, such as regulatory changes promoting the use of alternative diagnostic methods, cost-effectiveness, and patient preferences for specific imaging modalities, further contribute to the demand for product substitutes. For instance, in February 2024, Koninklijke Philips N.V. introduced a new light-based catheter guidance system for cath labs, focusing on advancing radiation-free interventional imaging, particularly for endovascular aortic procedures. Initially released in specialized hospitals in Europe and the U.S., the LumiGuide system utilizes Fiber Optic RealShape (FORS) technology to generate real-time, high-resolution 3D images without the need for X-ray angiography or fluoroscopy, marking a significant milestone in Philips' ongoing development of FORS technology.

End-user concentration in the market is influenced by factors, such as the prevalence of well-equipped hospitals, technological advancements driving end-user preferences, governmental regulations shaping investment decisions, demographic shifts towards aging populations, and competitive dynamics favoring vendors offering innovative solutions, all of which collectively determine the distribution of medical imaging equipment across hospitals, diagnostic centers, and research institutions in the region.

Technology Insights

The magnetic resonance imaging segment dominated the market with a revenue share of 33.7% in 2023. The segment growth can be attributed to technological advancements, increasing demand for early and accurate diagnosis, rising incidence of chronic diseases, expanding applications of medical imaging in various medical specialties, and growing investments in healthcare infrastructure. For instance, in March 2023, Guerbet, a contrast products company for medical imaging, got approval from the European Commission to market Elucirem. This macrocyclic gadolinium-based contrast agent is used in magnetic resonance imaging to improve visualization and detect pathologies with disruption of the blood-brain barrier.

MRI technology offers advanced imaging capabilities that allow for detailed visualization of soft tissues, organs, and structures within the body. This high level of detail is crucial for accurate diagnosis and treatment planning in a wide range of medical conditions. MRI’s ability to provide detailed anatomical information has positioned it as a preferred choice for many healthcare providers. The computed tomography segment is expected to grow with the fastest CAGR of 11.2% during the forecast period. The integration of artificial intelligence (AI) and machine learning algorithms into CT imaging systems has enhanced diagnostic accuracy, workflow efficiency, and automation of image analysis tasks. These technological integrations have further propelled the adoption of CT imaging in clinical practice.

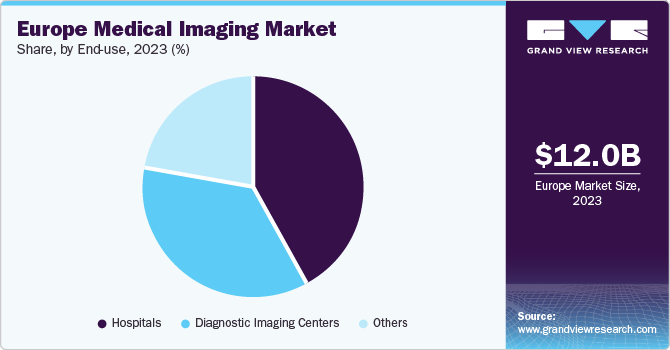

End-use Insights

The hospitals end-use segment accounted for the largest revenue share in 2023. The increasing number of patients, advancements in medical imaging technologies, and growing demand for accurate and timely diagnosis have fueled the segment growth. Hospitals are the primary providers of healthcare services, catering to a diverse range of patients with different health requirements. As the population ages, the need for medical imaging services to diagnose and treat various health conditions also increases. For instance, in November 2023, HoloCare, a Norwegian health tech startup, expanded its commercial presence in the UK and Europe by launching an Artificial Intelligence and mixed reality -powered platform in 5 hospitals to aid pre-surgical planning and enable interactive engagement with medical images for radiologists and technologists.

The diagnostics imaging centers segment is expected to grow at the fastest CAGR during the forecast period. Diagnostic imaging centers play a vital role in preventive healthcare by offering screening services that help identify potential health issues before they progress, contributing to increased market growth. The introduction of cutting-edge imaging modalities, such as MRI, CT scans, ultrasound, and PET scans, has revolutionized the field of medical imaging, allowing for more accurate diagnoses and improved patient outcomes. For instance, in October 2023, GE HealthCare announced constructing a new CT production line in France with the Revolution Maxima CT machine set to be assembled for European users. French staff will manage the facility for testing, configuration, accessorizing, and deliveries.

Country Insights

UK Medical Imaging Market Trends

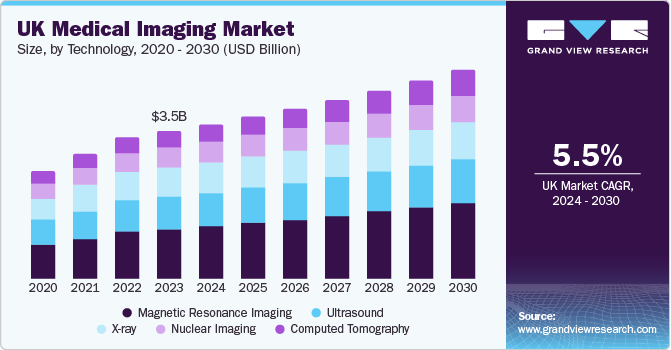

The UK medical imaging market accounted for a dominant share of 30.7% in 2023. It is also anticipated to witness significant growth owing to the advanced healthcare infrastructure, including state-of-the-art medical imaging facilities, highly skilled healthcare professionals, radiologists, technicians, and a well-established regulatory framework governing medical imaging practices. These facilities are equipped with cutting-edge technology, such as MRI machines, CT scanners, and ultrasound equipment, allowing for high-quality diagnostic imaging services.

Increasing awareness about the benefits of early detection tools will support market growth. Moreover, rising cases of lifestyle-related diseases, such as diabetes, cardiovascular diseases, and obesity, due to unhealthy dietary habits, sedentary lifestyles, and increasing stress levels, have led to a higher demand for healthcare services and early detection tools, thereby driving market growth. In February 2024, the European Society of Radiology announced the "ESR Essentials" series, a collaboration with 14 European subspecialty medical imaging societies, marking a significant advancement in clinical research in imaging, moving beyond small observational studies to expansive, multi-center medical imaging trials.

Germany Medical Imaging Market Trends

The medical imaging market in Germany will witness significant growth owing to a high prevalence of chronic diseases, favorable government initiatives, and the market players' activities are the main factors that propel market growth. For instance, in October 2023, PIUR IMAGING and Curium partnered to develop tomographic 3D ultrasound solutions for thyroid imaging in Germany, a significant advancement in medical imaging that could improve cancer patient care and treatment outcomes.

France Medical Imaging Market Trends

The France medical imaging market growth is driven by a growing aging population, increasing medical expenditures, a shift toward value-based care, and technological advancements. For instance, in June 2023, Gleaner, a France-based European manufacturer of medical imaging solutions powered by AI, raised USD 29.4 million in funding. The suite of AI-powered products from Gleaner helps physicians and radiologists diagnose patients, increasing accuracy and reducing the time needed to read and analyze exams.

Italy Medical Imaging Market Trends

The medical imaging market in Italy is driven by high awareness of the advantages of virtual healthcare, a growing aging population, and a rise in the cases of chronic illnesses. For instance, in February 2024, United Imaging Healthcare Europe collaborated with Fora Spa and AUSLP Hospital to introduce a Mobile Digital PET/CT system in Italy. The system is now fully operational in the Piacenza province.

Key Europe Medical Imaging Company Insights

The competitive market of Europe medical imaging is dominated by numerous small- and large-scale companies offering a diverse range of products with enhanced technology across various segments. These players are implementing initiatives, such as R&D, mergers, collaborations, and partnerships. Some key players operating in the market include GE Healthcare, Koninklijke Philips N.V., Siemens Healthineers, and PIUR IMAGING.

-

PIUR IMAGING is a medical device company, which provides access to high-quality healthcare through AI-driven tomographic 3D ultrasound solutions with the help of proprietary sensor technology and is specialized in the acquisition and visualization of 3D ultrasound images. It also offers integration of software into freshly built hardware from medical device manufacturers.

-

Esaote is an Italian biomedical and imaging company that deals with the design, production, sale, and maintenance of equipment for medical diagnostics and focuses on software solutions in healthcare settings.

Key Europe Medical Imaging Companies:

- GE Healthcare

- Koninklijke Philips N.V.

- Siemens Healthineers

- Canon Medical Systems Corporation

- Mindray Medical International

- Esaote

- Hologic, Inc.

- Samsung Medison Co., Ltd.

- Koning Corporation

- PerkinElmer Inc.

- FUJIFILM VisualSonics Inc.

- PIUR IMAGING

Recent Developments

-

In February 2024, Fujifilm Healthcare Europe announced the launch of its new 1.5 Tesla superconductive MRI scanner, Echelon Synergy, at the European Congress of Radiology 2024. It features AI-powered deep learning for enhanced image sharpness and scanning speed

-

In May 2023, GE HealthCare received a USD 30 million order from St. Luke's University Health Network to install more than 20 AI-powered computerized tomography systems. This Smart Subscription will enable seamless integration with the existing network, providing regular AI and software updates

-

In February 2022, FUJIFILM VisualSonics and PIUR IMAGING partnered to bring Ultra High Frequency 3D ultrasound imaging technology to Vevo MD. These technological advancements support clinical research in the evaluation of anomalies in several applications, including vascular, dermatology, and neurology

Europe Medical Imaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.6 billion

Revenue forecast in 2030

USD 17.0 billion

Growth rate

CAGR of 5.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use, country

Region scope

Europe

Country scope

UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway

Key companies profiled

GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Canon Medical Systems Cor.; Mindray Medical International; Esaote; Hologic, Inc.; Samsung Medison Co., Ltd.; Koning Corp.; PerkinElmer Inc.; FUJIFILM VisualSonics Inc.; PIUR IMAGING

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Medical Imaging Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe medical imaging market report based on technology, end-use, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

X-ray

-

By Modality

-

Radiography

-

Fluoroscopy

-

Mammography

-

-

-

Magnetic Resonance Imaging

-

By Architecture

-

Closed System

-

Open System

-

-

-

Ultrasound

-

By Portability

-

Handheld

-

Compact

-

Cart/Trolley-based

-

-

-

Computed Tomography

-

By Technology

-

High-end Slice

-

Mid-end Slice

-

Low-end Slice

-

Cone beam CT

-

-

-

Nuclear Imaging

-

By Product

-

SPECT

-

PET

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Frequently Asked Questions About This Report

b. The Europe medical imaging market size was estimated at USD 12.00 billion in 2023 and is expected to reach USD 12.6 billion in 2024.

b. The Europe medical imaging market is expected to grow at a compound annual growth rate of 5.12% from 2024 to 2030 to reach USD 16.96 billion by 2030.

b. United Kingdom dominated the Europe medical imaging market with a share of over 30% in 2023. This is attributable to presence of key market players, strong healthcare infrastructure, rising preference for the early disease diagnosis, and growing prevalence of chronic disorders.

b. Some key players operating in the Europe medical imaging market include GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Koninklijke Philips N.V., Canon Medical Systems Corporation, Mindray Medical International, Esaote, Hologic, Inc., Samsung Medison Co., Ltd., Koning Corporation, PerkinElmer Inc., FUJIFILM VisualSonics Inc., Cubresa Inc.

b. Key factors that are driving the market growth include high adoption of advanced, high-end medical imaging equipment due to favorable reimbursement scenario and fundings from market players.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."