- Home

- »

- Plastics, Polymers & Resins

- »

-

Europe Medical Polyethylene Market Report, 2022-2030GVR Report cover

![Europe Medical Polyethylene Market Size, Share & Trends Report]()

Europe Medical Polyethylene Market Size, Share & Trends Analysis Report By Application (Medical Tubing, Disposables, Medical Bags, Medical Implants, Containers, Drug Testing Equipment), By Country, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-918-3

- Number of Report Pages: 86

- Format: PDF, Horizon Databook

- Historical Range: 2019 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

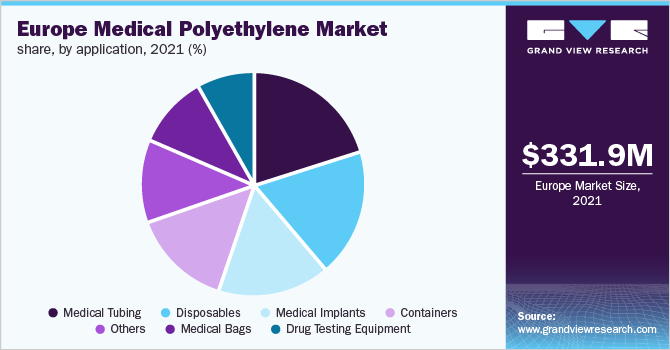

The Europe medical polyethylene market size was valued at USD 331.95 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.9% from 2022 to 2030. Factors such as increasing demand from the medical industry are anticipated to fuel the demand for medical-grade polyethylene. Polyethylene is widely utilized in the manufacturing of medical device components such as medical tubing, disposables, medical implants, medical bags, containers, and others owing to its properties such as low coefficient of friction, excellent chemical resistance, and good impact resistance.

To cater to the increasing demand from the medical industry, polyethylene in medical applications is being utilized for providing higher durability, chemical resistance, corrosion resistance, and enhanced protection. Different grades of polyethylene including high-density polyethylene (HDPE), low-density polyethylene (LDPE), linear low-density polyethylene (LLDPE), and ultra-high molecular weight polyethylene (UHMWPE) are used in medical applications, including disposables, medical implants, containers, and medical tubing.

Due to the COVID-19 pandemic, the use of disposables such as PPE kits and disposable gloves has increased significantly. High-density Polyethylene (HDPE) and Low-density Polyethylene (LDPE) are types of polyethylene that are majorly used for the manufacturing of medical disposables, which include gloves, syringes, PPE kits, masks, face shields, and others, due to their lightweight characteristics, higher flexibility at lower temperatures, and resistance towards corrosion.

Increasing demand for polyethylene-based instruments in surgical procedures to maintain hygiene and safety is expected to drive the demand for polyethylene in surgical gloves and medical tubing applications. In addition, the increasing occurrence of urinary disorders is expected to drive the demand for urinary catheters, which, in turn, is expected to drive the demand for polyethylene for the manufacturing of medical tubing in the region.

Application Insights

The medical tubing application segment dominated the European market and accounted for more than 20.0% share, in terms of revenue, in 2021. Increasing demand from the medical industry has driven the market for polyethylene across the region owing to its properties such as low coefficient of friction, excellent chemical resistance, and good impact resistance.

Low-density polyethylene (LDPE) provides excellent durability, non-toxicity, and easy processing, therefore used in the manufacturing of urinary catheter tubing. Furthermore, LLDPE is highly flexible, provides high impact strength, enhanced water vapor, and alcohol barrier properties, and possesses stress crack and impact resistance, making it ideal for medical waste disposal applications. UHMWPE is non-toxic, odorless, tasteless, and extremely tough & durable; it is known for its high abrasion, wear resistance, and chemical resistance properties. HDPE is used by plastic surgeons in facial augmentation for cosmetic or reconstructive purposes as it offers an excellent alternative to autogenous and alloplastic materials.

Country Insights

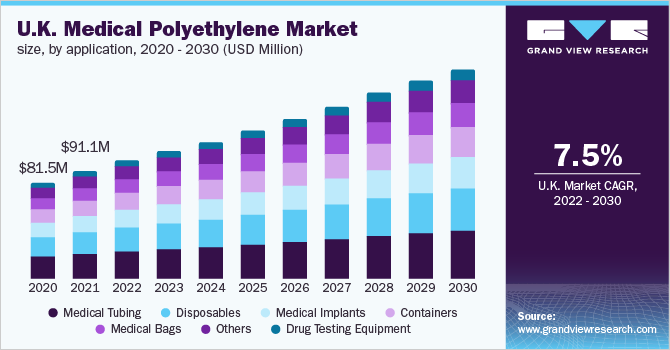

The U.K. led the European market in 2021 and accounted for a revenue share of more than 25.0%. In the U.K., medical tubing along with disposables held a considerable share in 2021, in terms of both volume and revenue. Changing medical needs in the U.K., coupled with the increased spending capacities of consumers, are expected to drive the demand for polyethylene in the country over the forecast period.

The medical device industry in Spain has witnessed growth on account of the burgeoning aging population and increasing life expectancy. This has driven medical application manufacturers to set up manufacturing facilities in the country. Portugal is an important market for medical applications, and a considerable portion of the market is dominated by medical device imports from the U.S. According to the International Trade Administration, Portugal is considered one of the strictest countries in terms of regulations in the European Union and requires a CE mark for the devices to be marketed in the country.

Key Companies & Market Share Insights

The European market has been characterized by the presence of key players, along with the presence of a few medium and small regional players. The rising population, the impact of the pandemic, improving living standards, and rising disposable income are factors contributing to the growth of the medical industry in the European region. Major players are continuously working on expanding manufacturing capabilities with the rise in demand from the medical industry.

For instance, in March 2021, Celanese Corporation planned to build a new ultra-high-molecular-weight polyethylene (UHMWPE) facility in Europe. This facility was expected to support growth in its high-value GUR engineered materials portfolio. The expansion is expected to begin in 2024 with an annual production capacity of approximately 34,000 metric tons/year. Some prominent players in the Europe medical polyethylene market include:

-

Celanese Corporation

-

SABIC

-

Dow Inc.

-

Tekni-Plex Inc.

-

Exxon Mobil Corporation

-

LyondellBasell Industries Holdings B.V.

-

Orthoplastics Ltd.

-

Biesterfeld AG

Europe Medical Polyethylene Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 365.17 million

Revenue forecast in 2030

USD 624.27 million

Growth Rate

CAGR of 6.9% from 2022 to 2030

Base year for estimation

2021

Historical data

2019 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, country

Regional scope

Europe

Country scope

Germany; U.K.; France; Italy; Spain; Portugal

Key companies profiled

Celanese Corporation; SABIC; Dow Inc.; Tekni-Plex Inc.; Orthoplastics Ltd.; Biesterfeld AG; Exxon Mobil Corporation; LyondellBasell Industries Holdings B.V.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the Europe medical polyethylene market report based on application and country:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Medical Tubing

-

Disposables

-

Medical Bags

-

Medical Implants

-

Containers

-

Drug Testing Equipment

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Portugal

-

Frequently Asked Questions About This Report

b. The Europe medical polyethylene market size was estimated at USD 331.95 million in 2021 and is expected to reach USD 365.17 million in 2022.

b. The Europe medical polyethylene market is expected to grow at a compound annual growth rate of 6.9% from 2022 to 2030 to reach USD 624.27 million by 2030.

b. The UK dominated the Europe medical polyethylene market with a share of 27.45% in 2021. This is attributable to the rising number of hip replacement surgeries in Europe.

b. Some key players operating in the Europe medical polyethylene market include Tekni-Plex, Inc.; Dow, Inc.; SABIC; Celanese Corporation; Orthoplastics Ltd.; LyondellBasell Industries Holdings B.V.; Biesterfeld AG; and Exxon Mobil Corporation.

b. Key factors that are driving the Europe medical polyethylene market growth include growing healthcare expenditures across Europe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."