- Home

- »

- Plastics, Polymers & Resins

- »

-

Medical Tubing Market Size, Share & Growth Report, 2030GVR Report cover

![Medical Tubing Market Size, Share & Trends Report]()

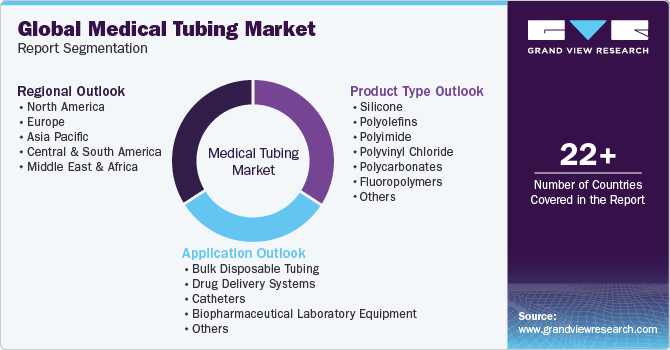

Medical Tubing Market Size, Share & Trends Analysis Report By Product Type (Silicone, Polyolefins, Polyimide, Polycarbonates), By Application (Bulk Disposable Tubing, Catheters, Drug Delivery Systems), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-600-4

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Medical Tubing Market Size & Trends

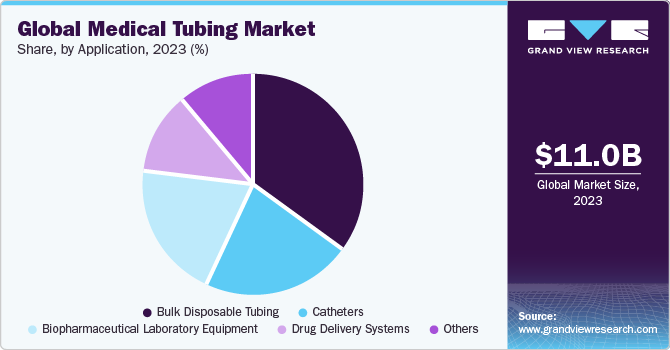

The global medical tubing market size was estimated at USD 11 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.5% from 2024 to 2030. Easy consumer access to healthcare products and surged global demand for medical devices that are equipped with effective tubing are factors projected to drive market growth during the forecast period. Continuous innovations in drug delivery systems by medical device manufacturers have resulted in the requirement for customizable medical tubes, which is projected to drive the demand for medical tubes in drug delivery systems. Also, a growing number of collaborations and joint ventures between various companies in the medical device sector is expected to expand the global reach of disposable medical devices, consequently boosting market growth.

The growing geriatric population worldwide has significantly driven the requirement for medical devices equipped with tubes, thereby fueling market growth. Moreover, the increasing prevalence of cardiovascular diseases, cancer, arthritis, and other disorders that necessitate complex surgical procedures has surged the demand for minimally invasive treatment methods. This has boosted the consumption of nylon, plastic polymers, silicone, and other materials, which are ideal for developing catheters and medical tubing, thus driving global medical tubing demand.

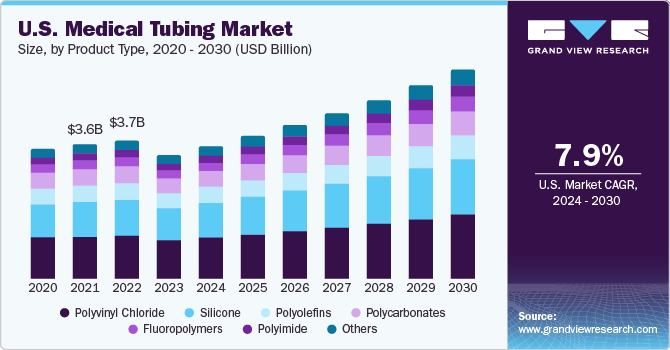

The presence of a substantial geriatric population & advanced healthcare infrastructure, as well as relatively high patient disposable incomes, are some vital drivers of the healthcare sector in the United States. As per the Population Reference Bureau, the number of people aged 65 and older in the country is poised to nearly double from 52 million in 2018 to 95 million by 2060. These mentioned factors are expected to positively impact the demand for medical tubing in applications such as catheters and drug delivery systems, among others.

In terms of revenue, polyvinyl chloride (PVC) was estimated to be the largest segment. However, its demand is expected to decline on account of presence of toxic bis (2-ethylhexyl) phthalate (DEHP) content in PVC tubes. Manufacturers are rapidly switching to the production of DEHP-free PVC medical tubes in order to comply with regulations which are anticipated to further facilitate the growth of polyvinyl chloride tubing over the coming years.

Improving healthcare systems, life expectancy is also anticipated to increase in developing regions of the world. This demographic trend will surge the demand for medical equipment incorporated with lightweight, portable medical tubing. The use of devices such as eternal tube feeding equipment and patient monitoring equipment is expected to witness a rapid rise during the forecast period, thereby acting as an opportunity for the growth of the market.

Application Insights

Based on application, the bulk disposable tubing segment led the market and accounted for a revenue share of 34.5% in 2023. Bulk disposable devices include urological products, surgical instruments, syringes, and needles. Growing emphasis on preventing the spread of infection from one patient to another is anticipated to drive segment growth over the forecast period.

Major materials used for developing bulk disposable tubing is silicone and polyvinyl chloride (PVC). Silicone bulk disposable medical tubing are widely used in medical implants, as well as in draining and feeding medical applications, as they are resistant to extreme temperature variations and possess high strength and flexibility.

Catheters are narrow tubes composed of medical-grade materials that serve a variety of roles in medical applications. They are introduced into the bodies of patients to treat diseases or perform surgeries. Demand for catheters has been encouraged by increasing cases of chronic conditions in the global population that require hospitalization.

Major materials used for developing catheters are silicone and polyvinyl chloride (PVC). As silicone catheters are latex-free, they are appropriate for individuals who are allergic or sensitive to latex. In addition, silicone is one of the preferred materials over latex, as it is highly tested and widely used over time. Certain advantages of silicone catheters are their smoothness and flexibility. Moreover, they have less encrustation.

Regional Insights

North America led the market and accounted for a revenue share of 35.5% in 2023. Factors such as technological advancements, and increasing healthcare spending, coupled with government policies are likely to propel the market demand. For instance, in 2021, according to NHE (National Health Expenditure Data), U.S. medicare spending increased by 8.4% USD 900 billion, and Medicaid increased by 9.2% USD 734 billion compared to 2020. Some of the major manufacturers in North America are Bentec Medical, Spectrum Plastics Group, Hitachi Cable America, Inc., and NewAge Industries, Inc.

Well-established medical infrastructure and increasing healthcare expenditures are expected to drive product demand in Europe. Steady demand for minimally invasive and diagnostic equipment, which use medical tubes, is also anticipated to boost the market growth.

Asia Pacific is estimated to be the fastest-growing regional due to the rising demand for better healthcare products which has pushed medical equipment manufacturers to emphasize on the development of innovative ways to reach a wide range of people. Moreover, rising demand for minimally invasive surgeries, and upsurge in geriatric population are factors that will boost the demand for healthcare services.

The demand for healthcare services in Central & South America, owing to several factors, including an aging population on account of longer life expectancy and lower birth rates coupled with rising instances of chronic diseases. Also, public-private partnerships are increasing in the sector. Thus, improving healthcare infrastructure, coupled with expanding healthcare industry.

Market Dynamics

Plastics play an important role in the manufacturing of medical tubes such as conduits for acquiring biopsy samples, vascular catheters, and stent holders owing to their inertness to body fluids & tissues, resistance to sterilization conditions, low cost for high volume applications, and higher optical properties. Thus, medical tubes made of plastics are witnessing increased adoption in medical devices.

Medical tubing solutions, such as braided tubing, tapered tubing, and para tubing, produced through advanced extrusion technologies are developed to eliminate the assembling of two or more tubes, thus resulting in cost reduction by eliminating secondary steps such as the joining of tubes. Latest developments in extrusion technologies offer plastic tubes with a combination of desired properties such as flexibility, high tensile strength, lightweight, and non-ferrous properties are also augmenting the evolution of the market.

Product Type Insights

In terms of product, the polyvinyl chloride (PVC) segment held the largest revenue share of 30.7% in 2023 in the market. An increasing use of single-use pre-sterilized medical devices has resulted in a strong demand for PVC-based medical devices. PVC can also be sterilized using methods such as irradiation and ethylene oxide sterilization.

Demand for silicone in medical applications is increasing as it is not toxic to living tissues and is unlikely to yield an allergic response. Further, silicon tubing used in medical devices is usually of higher grade and is manufactured using a continuous vulcanization and extrusion process.

The demand for polycarbonates in the medical tubing space is increasing as they can be sterilized using various effective methods such as ethylene oxide, irradiation (gamma and electron-beam), and steam autoclaving, which offers device manufacturers broader flexibility to determine the most economical way for building a product.

Fluoropolymers are inert, non-toxic, and bio-compatible, and further can be sterilized. These unique properties have made fluoropolymers an optimum choice for medical devices. Fluoropolymers are preferred for use in next-generation medical devices such as sutures, bio-containment vessels, syringes, and catheters.

Key Companies & Market Share Insights

The manufacturers adopt several strategies, including acquisitions, mergers, joint ventures, new product developments, and geographical expansions, to enhance market penetration and cater to the changing technological requirements of various end-use industries.

The outbreak of COVID-19 pandemic prompted medical tubing manufacturers to strengthen online marketplaces for services and spare part availability. For instance, in February 2023, Freudenberg expanded its medical tubing production to Massachusetts. Aim of this initiative is to serve its Eastern U.S. customers by providing them with custom solutions.

Key Medical Tubing Companies:

- Asahi Tec Corp.

- MDC Industries

- Nordson Corp.

- ZARYS International Group

- Hitachi Cable America Inc.

- NewAge Industries, Inc.

- TE Connectivity

- Freudenberg & Co. KG

- Spectrum Plastics Group

- ATAG SpA

Medical Tubing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.9 billion

Revenue forecast in 2030

USD 19.5 billion

Growth rate

CAGR of 8.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; France; Germany; Italy; Netherlands; Russia; Spain; UK; China; India; Japan; Australia; Singapore; South Korea; Brazil; South Africa

Key companies profiled

Asahi Tec Corp.; MDC Industries; Nordson Corp.; ZARYS International Group; Hitachi Cable America, Inc.; NewAge Industries, Inc.; TE Connectivity; Freudenberg & Co. KG; Spectrum Plastics Group; ATAG SpA; Saint-Gobain; Bentec Medical; Trelleborg AB; MicroLumen, Inc.; Optinova; Vanguard Products Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Tubing Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical tubing market report based on product type, application, and region:

-

Product Outlook (Revenue, USD Billion; 2018 - 2030)

-

Silicone

-

Polyolefins

-

Polyimide

-

Polyvinyl Chloride

-

Polycarbonates

-

Fluoropolymers

-

Polytetrafluoroethylene (PTFE)

-

Fluorinated ethylene propylene (FEP)

-

-

Others

-

-

Application Outlook (Revenue, USD Billion; 2018 - 2030)

-

Bulk disposable tubing

-

Silicone

-

Polyolefins

-

Polyimide

-

Polyvinyl Chloride

-

Polycarbonates

-

Fluoropolymers

-

Polytetrafluoroethylene (PTFE)

-

Fluorinated ethylene propylene (FEP)

-

-

Others

-

-

Drug delivery systems

-

Silicone

-

Polyolefins

-

Polyimide

-

Polyvinyl Chloride

-

Polycarbonates

-

Fluoropolymers

-

Polytetrafluoroethylene (PTFE)

-

Fluorinated ethylene propylene (FEP)

-

-

Others

-

-

Catheters

-

Silicone

-

Polyolefins

-

Polyimide

-

Polyvinyl Chloride

-

Polycarbonates

-

Fluoropolymers

-

Polytetrafluoroethylene (PTFE)

-

Fluorinated ethylene propylene (FEP)

-

-

Others

-

-

Biopharmaceutical laboratory equipment

-

Silicone

-

Polyolefins

-

Polyimide

-

Polyvinyl Chloride

-

Polycarbonates

-

Fluoropolymers

-

Polytetrafluoroethylene (PTFE)

-

Fluorinated ethylene propylene (FEP)

-

-

Others

-

-

Others

-

Silicone

-

Polyolefins

-

Polyimide

-

Polyvinyl Chloride

-

Polycarbonates

-

Fluoropolymers

-

Polytetrafluoroethylene (PTFE)

-

Fluorinated ethylene propylene (FEP)

-

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Netherlands

-

Russia

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Singapore

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global medical tubing market size was estimated at USD 11 billion in 2023 and is expected to be USD 11.9 billion in 2024.

b. The global medical tubing market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.5% from 2024 to 2030 to reach USD 19.5 billion by 2030.

b. North America dominated the medical tubing market in 2023, as various small and large companies are driving innovation in the healthcare sector in order to provide healthy lifestyles and provide innovative treatments and devices.

b. Some of the key players operating in the medical tubing market include ASAHI TEC CORPORATION, MDC Industries, Nordson Corporation, ZARYS International Group, Hitachi Cable America Inc., NewAge Industries, Inc., TE Connectivity, Freudenberg & Co. KG, Spectrum Plastics Group, ATAG SpA, Saint-Gobain.

b. The market for medical tubing is primarily being driven by increased accessibility to healthcare supplies on a global scale, simple access to medical-grade polymers at reasonable prices, and rising demand for medical devices that incorporate tubing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."