- Home

- »

- Advanced Interior Materials

- »

-

Europe Microencapsulation Market Size & Share Report 2030GVR Report cover

![Europe Microencapsulation Market Size, Share & Trends Report]()

Europe Microencapsulation Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Pharmaceutical & Healthcare Products), By Technology (Coating, Emulsion, Spray Technologies, Dripping, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-078-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The Europe microencapsulation market size was estimated at USD 3.67 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.9% from 2023 to 2030. The market growth is expected to be driven by the high penetration of technology in the pharmaceutical industry of developed regional economies, including Germany, the UK, France, and Italy.The research-based pharmaceutical industry is a key asset of the European economy and plays a critical role in restoring Europe on the growth trajectory, thereby driving demand for the technology from the pharma sector.Germany, France, the UK, and the Netherlands are considered the most prominent countries within the European functional food market, which is expected to drive the demand for microencapsulation across the food & beverages and nutritional supplements industries over the forecast period.

The presence of major pharmaceutical manufacturers, including Roche, Novartis, GlaxoSmithKline, Sanofi, Novo Nordisk, and Bayer, among several others, has a major impact on driving the demand for the microencapsulation technique in developing novel drug delivery systems. The industry players in the region are often engaged in strategic partnerships with microencapsulation technology users from the end-user industries.

The adoption of microencapsulation technology is anticipated to rise over the forecast period as a result of the increasing significance of organic synthesis in the pharmaceutical industry, which delivers a highly complex combination in contrast to the inorganic approach. By dividing supplied medication doses into smaller units that are distributed over a vast area of the gastrointestinal system, microencapsulation increases absorption by lowering localized drug concentration. These benefits are expected to drive the demand for microencapsulation in the pharmaceutical sector.

Europe has been a key region spearheading innovation in the microencapsulation market and is anticipated to grow at a significant pace in the next seven years. The increasing prominence of functional foods combined with the positive market growth for cutting-edge PCM in Europe is expected to spur the demand for microencapsulation. Cosmetotextile is an emerging application segment for the microencapsulation market across the globe and primarily in Europe.

The demand for microencapsulation technologies in Europe has increased significantly owing to the increasing demand for nutraceuticals and functional food products. Microencapsulation can be used to enhance the stability, shelf-life, and bioavailability of these products. Additionally, the use of microencapsulation to encapsulate drugs, which can improve their stability, reduce toxicity, and provide controlled release, is also anticipated to fuel market growth.

Application Insights

The pharmaceutical & healthcare products application segment led the market and accounted for 65.7% of the revenue share in 2022. Pharmaceutical manufacturers are competing to develop and commercialize more effective medicines with a high focus on the biotechnology industry. This is a source of many new medical treatments, as well as specialized and personalized treatments, which are expected to have a major impact on the growth of the pharmaceutical & healthcare products segment over the forecast period.

The home & personal care application segment is expected to expand at a CAGR of 12.0% over the forecast period. The region is witnessing extensive investments in the research & development of personal care products. The growing home & personal care industry in Europe, along with the utilization of microencapsulation technology to alter the quality of products such as fragrances & flavors used in perfumes, soaps, lotions, creams, and shampoos, is anticipated to propel the market growth over the forecast period.

The food & beverage application segment is likely to witness a growth rate of 11.4% over the forecast period. The growing trend toward leading a healthy lifestyle, the rising adoption of preventative health management through functional food diets, and improvements to the nutritional value of food products along with taste, color, texture, and aroma, have majorly impacted the demand for microencapsulation technology from the food & beverage industry.

Cosmetotextiles is a technology that combines cosmetics and fabrics via microencapsulation. These textiles perform cosmetic and biological activities such as energizing, slimming, refreshing, vitalizing, skin shining, anti-aging, body care, fitness, and health. Cosmetotextiles provide advantages to the skin, help fight the aging process, and provide a sense of wellness or well-being. Thus, the increasing use of cosmetotextiles is expected to have a major impact on the demand for microencapsulation technology over the forecast period.

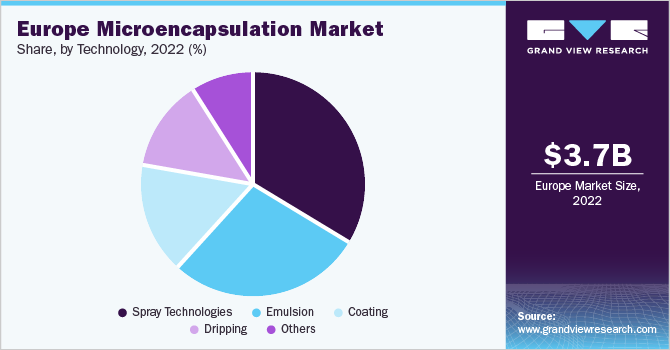

Technology Insights

The spray technology segment led the market and accounted for 33.7% of the revenue share in 2022. Spray technology offers high encapsulation efficiency along with good stability of the finished products. Encapsulation by spray drying and spray cooling technologies is a low-cost commercial process mainly used to encapsulate flavors, fragrances, and oils.

The emulsion segment is expected to witness a CAGR of 10.1% over the forecast period. Emulsion preparation plays a key role in ensuring the efficiency of microencapsulation, owing to the production of probiotic microcapsules. Microfluidic devices and membranes are potential microencapsulation techniques due to their ability to control particle size and work under mild conditions. Owing to the above-mentioned benefits, along with the potential of emulsion technology to ensure the safe delivery of next-generation probiotics, the segment growth is projected to remain strong.

Dripping technology produces microcapsules that are surrounded by wall materials and are produced by a relatively low-temperature entrapping method. The significant benefit of this technology is the extended shelf life of flavorings owing to the provision of an almost impermeable barrier against oxygen. Owing to these benefits, the dripping technology segment is expected to advance healthily over the forecast period.

Microencapsulation by coating technology includes different processes such as fluid bed coating, pan bed coating, and air suspension coating. Certain advantages of the microencapsulation coating technology, such as maximum protection of active materials, flavor, odor masking, and continued & controlled release, are anticipated to boost the segment growth.

Regional Insights

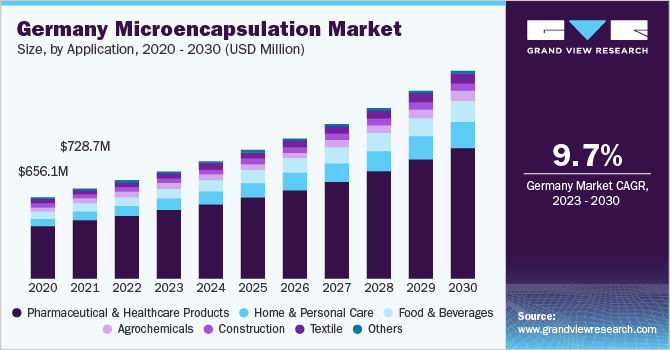

Germany accounted for the highest revenue share of 21.5% in the Europe microencapsulation market in 2022. The microencapsulation market in Germany is strongly influenced by the high production capacity of the pharmaceutical industry, owing to the presence of major pharmaceutical companies like Pfizer, Merck KGaA, Evonik, and many more.

Stringent European Union regulations and legislations specified by the European Food Safety Authority (EFSA) have a major impact on the selection of coating materials for the food and pharmaceutical industries. EFSA Panel on Flavorings, Food Additives, Processing Aids, and Materials in Contact with Food (AFC Panel) does the safety evaluation of additives in Europe. The authorization of matrix/coating material by the European Food Safety Authority would govern the choice of material for microencapsulation in the food industry, which has a major impact on market growth.

The UK is estimated to expand at the fastest growth rate of 10.8% over the forecast period from 2023 to 2030. The UK market for microencapsulation is driven by the rising demand from the pharmaceutical & healthcare, as well as food & beverage industries, primarily due to surging incidences of infectious diseases such as COVID-19 in the region. Growing health awareness among consumers, coupled with the rising medical tourism industry in the country, is expected to drive the demand for advanced drugs, which in turn, is expected to positively impact the microencapsulation industry growth.

The chemical industry is a key component of the French economy and ranks second in Europe. According to CEFIC, the turnover of approximately 3,500 companies was around USD 114.7 billion in 2021 in France. The output of these chemical companies ranges from basic chemicals to specialty and fine chemicals. The chemical industry is strong in consumer chemicals, including detergents, soaps, cosmetics, and perfumes, which sharply propels the use of microencapsulation techniques for the encapsulation of fragrance, flavor, essential oils, vitamins, and several other natural extracts.

Key Companies & Market Share Insights

Manufacturers adopt several strategies, including acquisitions geographical expansions, joint ventures, product developments, and mergers, to cater to the changing technological requirements and enhance market penetration across various applications such as home & personal care, food & beverages, agrochemicals, construction, textile, and others. For instance, in December 2022, SurTec International GmbH acquired omniTECHNIK Mikroverkapselungs GmbH, a family-owned company that offers microencapsulation reactive and non-reactive coating for fasteners.

Furthermore, stringent government regulations enforced on market players compel them to develop and launch new and innovative products. For instance, in April 2022, Sol-Gel Technologies Ltd., a clinical-stage specialty pharmaceutical company, announced that the Food and Drug Administration (FDA) had granted approval for EPSOLAY, a proprietary cream used for rosacea inflammatory lesions treatment in adults. EPSOLAY is patent protected until 2040 and uses Sol-Gel Technologies Ltd.'s proprietary microencapsulation technology to treat rosacea inflammatory lesions. Some of the prominent players in the Europe microencapsulation market include:

-

Capsulae

-

LycoRed Group

-

BASF SE

-

Balchem

-

AVEKA Group

-

Reed Pacific Pty Ltd.

-

GAT Microencapsulation GmbH

-

Ronald T. Dodge Co.

-

Evonik Industries AG

-

Bayer AG

Europe Microencapsulation Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.0 billion

Revenue forecast in 2030

USD 7.8 billion

Growth rate

CAGR of 9.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Application, technology, region

Regional scope

Europe

Country Scope

Germany; U.K.; France; Italy; Spain; Russia

Key companies profiled

Capsulae; LycoRed Group; BASF SE; Balchem; AVEKA Group; Reed Pacific Pty Ltd.; GAT Microencapsulation GmbH; Ronald T. Dodge Co.; Evonik Industries AG; Bayer AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Microencapsulation Market Report Segmentation

This report forecasts revenue growth at the regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Europe microencapsulation market report based on application, technology, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Healthcare Products

-

Home & Personal Care

-

Food & Beverages

-

Agrochemicals

-

Construction

-

Textile

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Coating

-

Emulsion

-

Spray Technologies

-

Dripping

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Frequently Asked Questions About This Report

b. Europe microencapsulation market size was estimated at USD 3.67 billion in 2022 and is expected to reach USD 4.0 billion in 2023.

b. Europe microencapsulation market, in terms of revenue, is expected to grow at a compound annual growth rate of 9.9% from 2023 to 2030 to reach USD 7.8 billion by 2030.

b. Germany held a dominant revenue share of 21.5% in Europe microencapsulation market in 2022. The microencapsulation market in Germany is highly influenced by high production capacity of the pharmaceutical industry.

b. Some of the key players operating in Europe microencapsulation market include Capsulae, LycoRed Group, BASF SE, Balchem, AVEKA Group, Reed Pacific Pty Ltd, and among others.

b. The key factors that are driving the Europe microencapsulation market include the growing demand for flavors, fragrances, essential oils, minerals, vitamins, enzymes and bioactive compounds in food and beverage products specifically in emerging economies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.