- Home

- »

- Animal Health

- »

-

Europe Pet Insurance Market Size, Industry Report, 2030GVR Report cover

![Europe Pet Insurance Market Size, Share & Trends Report]()

Europe Pet Insurance Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal (Dogs, Cats), By Coverage (Accidents & Illness), By Sales Channel (Agency, Broker), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-446-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Pet Insurance Market Size & Trends

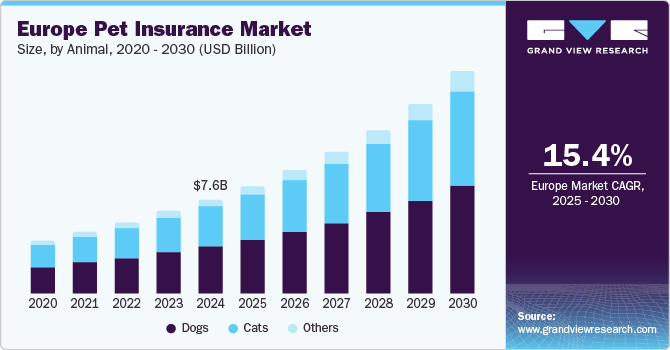

The Europe pet insurance market size was valued at USD 7.62 billion in 2024 and is anticipated to grow at a CAGR of 15.45% from 2025 to 2030. This growth is primarily fueled by the increasing number of pets, growing adoption of pet insurance in European countries, increasing initiatives by major players, and growing humanization of pets. According to the European Pet Food Industry Federation (FEDIAF), in 2022, 129.0 million cats, 106.0 million dogs, and 30.0 million small mammals were recorded in Europe.

Furthermore, there were 166.0 million pet-owning homes in Europe, with at least one dog or cat owned by 25% and 27% of families, respectively. This growth in pet ownership directly correlates with an increase in the demand for pet-related products and services, including veterinary care & pet insurance. A larger pet population provides a larger pool of potential customers for pet insurance companies, thereby driving market growth.

Pet care costs have been steadily increasing over the years due to various factors, including advancements in medical technology, higher demand for specialized treatments, and increasing overhead costs for veterinary practices. As a result, pet owners are faced with escalating bills for routine check-ups, vaccinations, surgeries, medications, and emergency treatments. The affordability of these veterinary services becomes a concern for many pet owners, especially when faced with unexpected medical emergencies or chronic conditions. The study found that the human-animal link is strong, that pets benefit their owners' health, and that greater bonds are associated with better medical treatment. According to the survey, 93% of pet owners in Germany and 84% of pet owners in the UK claim to have benefited from the human-animal link in terms of their mental and physical health.

Government regulatory bodies can influence the pet insurance market in Europe by establishing favorable regulatory frameworks that encourage industry growth. For instance, in Germany, dog parents must register their dogs with the government and pay a dog tax. Dog liability insurance is mandatory in certain German states including Berlin, Hamburg, Thuringia, Saxony-Anhalt, and Lower Saxony. Pet insurance providers such as Lassie AB offer two variants of dog liability insurance policies- either with no deductible or with a deductible of EUR 150 (USD 164) per claim. Private stakeholders, including pet insurance companies, veterinarians, pet product manufacturers, and retail outlets, are increasingly collaborating to drive innovation and expand the reach of pet insurance products and services. Such supportive initiatives are expected to fuel the adoption of pet insurance in Europe.

The market presents several opportunities for growth and innovation, especially considering the increasing importance of pets in people's lives and the evolving expectations of pet owners. One of these opportunities is identifying and targeting niche segments within the pet insurance market, such as exotic pet owners, senior pet owners, or owners of specific breeds, can be a lucrative strategy. Developing specialized insurance products tailored to the unique needs of these segments can help differentiate offerings and attract loyal customers. Fetch, Inc. offers custom dog insurance plans based on breed. Its policy for Labrador Retriever, for instance, provides cover for breed-specific issues such as hip dysplasia, ACL tear, and swallowed objects. Another crucial opportunity which can provide lucrative market growth is educating pet owners about the importance of pet insurance, preventive care, and responsible pet ownership can help increase awareness & adoption of insurance products. Investing in educational initiatives through online resources, workshops, and community outreach programs can position insurance companies as trusted advisors in the pet healthcare space

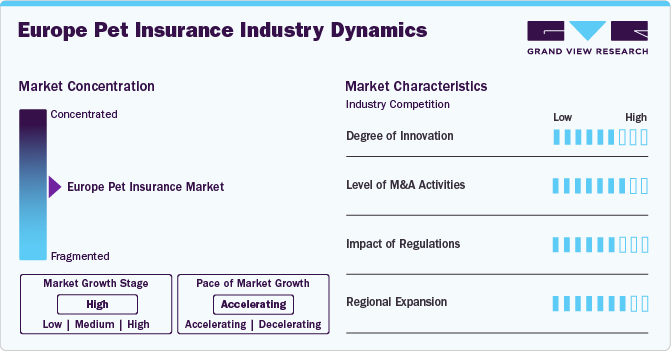

Market Concentration & Characteristics

The European pet insurance market is rapidly innovating due to technological advancements and changing consumer demands. Companies are adopting digital tools like AI-powered claims processing, telemedicine, and mobile apps to improve customer experience and streamline operations. For instance, in May 2024, JAB Holding Company launched a global insurance platform and asset management company, with Anant Bhalla as Senior Partner and CIO. JAB, a major player in pet insurance, insures over 5 million pets and expects to generate USD 3 billion in revenue by 2024.

The European pet insurance market has seen significant M&A activity as companies aim to expand their market presence and diversify offerings. In June 2024, Trupanion, Inc. and Boehringer Ingelheim formed a strategic partnership to enhance access to quality pet healthcare, support veterinary and consumer education, and provide innovative disease prevention and treatment solutions. This collaboration reflects a broader trend of consolidation in the industry, driven by the need to leverage established distribution networks, broaden geographic reach, and advance technological capabilities.

Regulation plays a crucial role in shaping the European pet insurance market. The European Insurance and Occupational Pensions Authority (EIOPA) and national regulatory bodies like the Financial Conduct Authority (FCA) in the UK set stringent standards for transparency, consumer protection, and solvency. Recent regulations such as the Insurance Distribution Directive (IDD) have mandated clearer disclosure of policy terms and conditions, enhancing consumer trust. Additionally, the EU’s General Data Protection Regulation (GDPR) imposes strict rules on data handling, affecting how insurers manage and protect pet health data. Compliance with these regulations is critical for insurers operating in Europe, influencing their operational practices and shaping the competitive environment.

The European pet insurance market is expanding regionally, with established markets in Northern and Western Europe (e.g., the UK, Germany, Sweden) seeing growth, while Eastern and Southern Europe (e.g., Spain, Italy) are experiencing accelerated expansion. This growth is fueled by rising disposable incomes and increasing pet ownership, with around 80 million households in Europe owning pets, according to the European Pet Food Industry Federation (FEDIAF). In June 2023, the Association of British Insurers reported a 28% rise in claims from 2021 to 2022, though average premiums increased by only 1%. This discrepancy between rising claims and steady premiums could affect the profitability of insurers and their bargaining power. As awareness of pet insurance benefits spreads, further market growth and diversification are expected across Europe.

Animal Insights

Based on animal, the market is segmented into dogs, cats, and others. In 2024, the dogs segment dominated the market with a substantial share of 50.35% due to the growing pet adoption, expansion of service offerings by insurance companies, and growing disposable income. Pet insurance plans for dogs cover a wide range of conditions, such as outpatient and inpatient treatment, health checks, preventive measures such as vaccinations, dental prophylaxis, flea & tick prevention, costs of medication, bandages, castration & sterilization, and operations. Moreover, in Germany, pets are treated as beloved family members. The growing need to lower financial risks and safeguard pet health is expected to drive the market.

The other animals segment such as horses, small mammals, reptiles, and others are expected grow at the fastest CAGR 17.04% during the forecast period. This growth is driven by the evolving pet ownership patterns, increasing demand for specialized coverage, advancements in veterinary care, and favorable economic conditions. As pet owners become more aware of the unique health risks and care requirements associated with different animals, the demand for specialized insurance products has surged. Horse insurance by Petplan, for instance, covers vet fees, personal accidents, permanent loss of use, and third-party liability, insuring horses up to 25 years old. The company provides three plans: horse insurance plan for first-time owners or serious competitors, veteran plan for horses aged 17 to 40 years, and essential insurance policy for riders aged 5 to 75 years who do not own a horse.

Coverage Insights

In 2024, the accident and illness segment dominated the European pet insurance market, accounting for over 84.07% of the total share. This dominance is driven by the high costs of veterinary treatments, the rising number of companion animals, and increasing awareness of the benefits of pet insurance. These policies offer extensive coverage, including for medications, chronic and acute diseases, and diagnostic tests. This comprehensive protection appeals to pet owners, contributing to the segment's rapid growth. For instance, PetGuard, a UK-based insurer, provides accident and illness coverage with annual payouts up to USD 3,848.84, USD 7,697.67, or USD 15,395.34 to cover treatment costs for pets. This trend of growth in the accident and illness segment is expected to continue as more pet owners recognize the value of such comprehensive coverage.

The other insurance type such as liability insurance policies, lifetime insurance, and surgery are expected grow at the fastest CAGR of 16.84% during the forecast period. This growth is attributed to the need for coverage against potential damage and legal costs, particularly for dogs and horses. Companies like BavariaDirekt and Barmenia Insurance in Germany provide various liability policies, including those for horse owners that cover extensive damages and costs. Renters insurance often includes minimal liability coverage for dogs, with typical legal costs for dog bites ranging from USD 100,000 to USD 300,000. The average cost of dog bite claims has surged, reaching around USD 50,245 in 2020, highlighting the increasing importance of such insurance coverage.

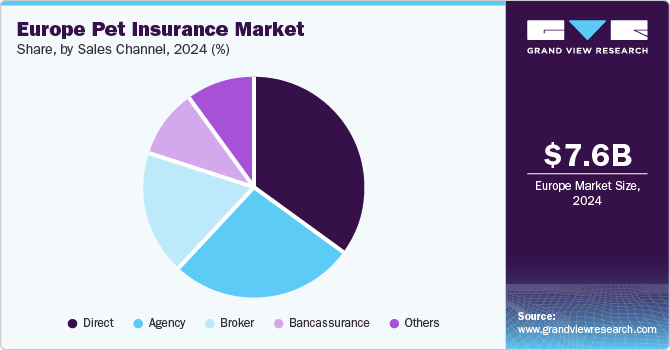

Sales Channel Insights

Based on sales channel, the direct channel segment held the largest share of 34.88% in 2024. This can be attributed to the high usage of direct sales strategies by key pet insurance providers. DFV Deutsche Familienversicherung AG, for instance, reported that direct sales contributed to 87.3% of the company’s new business during 2020. Similarly, Petplan, reported that direct sales accounted for about 61% of its personal lines insurance revenue in 2020. Moreover, direct sales channels possess multiple benefits over others, which promotes segment growth. This channel often allows for more personalized customer service and policy customization. Pet owners can tailor their coverage to meet the specific needs of their pets, which is a strong incentive for choosing direct sales.

The others segment comprises employers, pet stores, animal care centers, vets, and is anticipated to register the fastest growth over the forecast period. This can be attributed to the increasing number of companies onboarding veterinary care providers and pet stores as a means to reach consumers or pet parents. Petplan-a leading company in the Europe pet insurance market, for instance, attributed 4.5% of its revenue in 2020 to vets. Similar partnerships between insurance providers and other industry stakeholders are anticipated to contribute to the segment growth over the forecast period. Moreover, veterinary clinics often promote preventive care, which can be more affordable and effective when covered by insurance. This encourages pet owners to invest in insurance plans that cover such services.

Regional Insights

UK Pet Insurance Market Trends

The UK pet insurance market dominated in the region with a share of over 26.44%. The dominance is bolstered by rising pet ownership and increasing awareness of pet health risks. The Association of British Insurers (ABI) reported that pet insurance payouts in 2022 exceeded GBP 1 billion (USD 1.28 Bn), the highest on record since data collection began in 2007. This averages GBP 2.8 million (USD 3.57 Mn) paid out daily for veterinary treatments and diagnoses. This surge reflects rising pet ownership costs and the growing number of insured pets. In 2022, 1.3 million claims were made, a 28% increase from the previous year, with payouts rising by 17%. Dogs accounted for 75% of claims, cats 20%, and other pets 5%. The most common claims involved spinal surgery, costing between USD 10,201.74 and USD 12,752.17, while ongoing claims were often for skin conditions and diabetes.

Germany Pet Insurance Market Trends

The pet insurance market in Germany is thriving due to a combination of high pet ownership rates and a strong emphasis on pet health. The German pet insurance market benefits from a robust regulatory environment and increased consumer awareness of the financial benefits of pet insurance. According to FEDIAF estimates, 25% of German households owned at least one dog in 2023, while 26% owned at least one cat. According to a 2020 survey by Coya, an insurance provider for pets in Germany, the country had some of the best cities in the world to own and raise a pet. In addition, in its Best Cities for Dogs Index, Munich, Cologne, Hamburg, Berlin, and Frankfurt ranked in the top 30.

Spain Pet Insurance Market Trends

The pet insurance market in Spain is expanding significantly due to increasing pet ownership and rising disposable incomes. As Spanish households spend more on pets, there is a growing recognition of the financial benefits of insurance. As per the recent animal welfare law in the country, which was enacted in September 2023, pet owners would be forced to purchase liability insurance for their pets under the new regulations. The annual payment is likely around USD 27.2 to USD 32 and approximately USD 54.5 for dogs assessed to be of a dangerous breed. Dog owners who do not have this insurance as of September 29, 2023, are subject to fines from USD 545.07 to USD 1,090.1. Pet owners are opting for insurance policies to save extra expenses, which is expected to fuel the market growth over the forecast period.

Sweden Pet Insurance Market Trends

The pet insurance market in Sweden is expanding rapidly due to a high rate of pet ownership and increasing public awareness of the benefits of pet insurance. It is set to showcase the highest growth of over 17.74% in Europe throughout the forecast period of 2025-2030. Sweden has one of the highest pet ownership rates in Europe, and with this comes a growing demand for insurance to cover the costs of veterinary care. According to the National Association of Insurance Commissioners, over a million dogs were kept as pets in Sweden in 2021, and 90% had insurance. Dog insurance is voluntarily purchased by many pet owners in Sweden, with annual premiums averaging USD 536. In addition, the expansion of key insurance companies into the Sweden pet insurance market is fueling market growth. For instance, in May 2023, Hedvig, a Swedish full-stack insurer, entered the pet insurance market. The company’s coverage includes compensation for time spent at home caring for pets and offers a SEK 1,000 deductible discount if policyholders use FirstVet. Claims can be reported through Hedvig's app. Such expansions strengthen competition, diversify coverage options, and boost consumer interest, driving the overall growth of the pet insurance market in Sweden.

Key Europe Pet Insurance Company Insights

The market is characterized by the presence of several key players who dominate the landscape with substantial market share. These companies are leading the industry through extensive distribution networks, and a broad portfolio.

Key Europe Pet Insurance Companies:

- Trupanion, Inc.

- Deutsche Familienversicherung AG (DFV)

- Petplan (Allianz)

- Getsafe GmbH

- Jab Holding Company

- Direct Line (U K Insurance Limited)

- EQT Group

- Waggel Limited

- ProtectaPet

- Perfect Pet Insurance

- Feather Insurance (Popsure Deutschland GmbH)

- Agria Pet Insurance Ltd.

Recent Developments

-

In October 2024, Agria Pet Insurance Ltd has launched Ireland's first horse insurance policy, offering lifetime cover for veterinary fees, with features such as chronic condition coverage, up to €10,000 (USD 10,955) of veterinary fee cover per year, and affordable monthly premiums.

-

In October 2024, Quantee, a financial solutions provider and Agria Pet Insurance limited partnered in Sweden to achieve optimized pricing of pet insurance for the pet owners. Agria's strategic objectives will be complemented by the latter’s end-to-end pricing platform and enhance its offerings in the market.

-

In September 2024, Trupanion launched pet medical insurance in Germany and Switzerland, offering coverage for cats and dogs without restrictions based on breed or age. The company's patented technology facilitates direct payments to veterinarians, simplifying the claims process and enhancing transparency, with plans to expand its high-value product in Europe.

-

In October 2023, DFV Deutsche Familienversicherung AG introduced the BiPRO interface to optimize digital collaboration with brokers to provide high-quality, direct insurance products that facilitate brokers' focus on customer needs.

-

In October 2023, Getsafe acquired Luko Insurance's entire German customer base, adding 50,000 policies to its portfolio. With over 550,000 customers across Europe, Getsafe continues its profitable growth by focusing on a fully digital D2C model targeting young, tech-savvy Europeans. The acquisition aligns with Getsafe's strategy to become a leading platform for digital insurance, achieving higher margins & customer satisfaction.

-

In February 2023, Waggel Limited partnered with Vet-AI to provide its pet insurance customers with unlimited access to Joii Pet Care's 24/7 digital vet consultations, vet nurse consultations, and a symptom checker. This collaboration aims to simplify pet insurance and enhance pet health through innovative, convenient online veterinary care.

-

In June 2022, JAB Holding Company entered into a strategic partnership with Fairfax Financial Holdings by acquiring Fairfax's interests in Crum & Forster Pet Insurance Group and Pethealth Inc. This acquisition is expected to create a combined global pet insurance platform with estimated revenues exceeding USD 1.2 billion by 2023, insuring over 2.1 million pets.

Europe Pet Insurance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.69 billion

Revenue forecast in 2030

USD 17.84 billion

Growth Rate

CAGR of 15.45% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, coverage, sales channel, country

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Austria; Hungary; Poland; Romania; Czech Republic; Switzerland; Luxembourg; Portugal; Belgium; Rest of Europe

Key companies profiled

Trupanion; DFV; Petplan (Allianz); PetPartners, Inc.; GETSAFE; Direct Line (UK Insurance Limited); Embrace Pet Insurance Agency; LLC (JAB Holding Company); Waggel Limited; Perfect Pet Insurance; Deutsche Familienversicherung AG (DFV);Petplan (Allianz); EQT AB; ProtectaPet; Perfect Pet Insurance; Feather Insurance (Popsure Deutschland GmbH); Agria Pet Insurance Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Pet Insurance Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe pet insurance market report based on animal, coverage, sales channel, and country.

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Coverage Outlook (Revenue, USD Million, 2018 - 2030)

-

Accident & Illness

-

Accident only

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Agency

-

Broker

-

Direct

-

Bancassurance

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Austria

-

Hungary

-

Poland

-

Romania

-

Czech Republic

-

Switzerland

-

Luxembourg

-

Portugal

-

Belgium

-

Rest of Europe

-

-

Frequently Asked Questions About This Report

b. The Europe pet insurance market was valued at USD 7.62 billion in 2024 and is anticipated to reach USD 8.69 billion in 2025.

b. The Europe pet insurance market is anticipated to grow at a compound annual growth rate (CAGR) of 15.45% from 2025 to 2030 to reach USD 17.84 billion by 2030.

b. By coverage type, accident and illness segment dominated the European pet insurance market in 2024, accounting for over 84.07% of the total share. This dominance is driven by the high costs of veterinary treatments, the rising number of companion animals, and increasing awareness of the benefits of pet insurance. These policies offer extensive coverage, including for medications, chronic and acute diseases, and diagnostic tests. This comprehensive protection appeals to pet owners, contributing to the segment's rapid growth

b. Some of the prominent players operating in this market include Trupanion; DFV; Petplan (Allianz); PetPartners, Inc.; GETSAFE; Direct Line (UK Insurance Limited); Embrace Pet Insurance Agency; LLC (JAB Holding Company); Waggel Limited; Perfect Pet Insurance; Deutsche Familienversicherung AG (DFV); Petplan (Allianz); EQT AB; ProtectaPet; Perfect Pet Insurance; Feather Insurance (Popsure Deutschland GmbH); Agria Pet Insurance Ltd.

b. The market growth is primarily fueled by the increasing number of pets, growing adoption of pet insurance in European countries, increasing initiatives by major players, and growing humanization of pets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.