Market Size & Trends

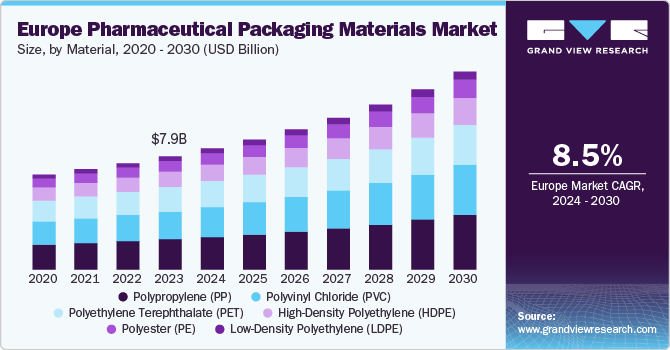

The Europe pharmaceutical packaging materials marketsize was valued at USD 7.92 billion in 2023 and is projected to grow at a CAGR of 8.5% from 2024 to 2030. This growth is attributed to the increasing demand for prescription drugs. With an aging population and the rising prevalence of chronic diseases such as diabetes, cardiovascular diseases, and cancer, the market witnessed a growing need for effective and safe medication. This surge in demand necessitates robust packaging solutions that ensure the integrity and safety of pharmaceutical products throughout their shelf life.

Furthermore, innovations in drug delivery systems, such as pre-filled syringes, inhalers, and transdermal patches, require specialized packaging materials that can maintain the stability and efficacy of drugs. These advanced delivery systems have become popular due to their convenience and improved patient compliance, driving the demand for high-quality packaging materials. Furthermore, major companies have heavily invested in research and development to enhance the packaging quality of the products and improve the safety of drugs and medicines. Proper packaging helps avoid any physical damage or contamination.

Moreover, technological advancements in packaging materials and processes have been significant market drivers. Innovations such as smart packaging, including tamper-evident seals, track-and-trace capabilities, and temperature indicators, have gained considerable traction in the market. These technologies enhance the safety and security of pharmaceutical products, providing added value to both manufacturers and consumers. Integrating such advanced technologies in packaging materials is expected to boost market growth.

In addition, regulatory requirements and standards have played a crucial role in the pharmaceutical packaging market. The European Union has stringent regulations to ensure the safety and efficacy of pharmaceutical products. Compliance with these regulations requires pharmaceutical companies to invest in high-quality packaging materials that meet the necessary standards. This regulatory landscape ensures that packaging materials are safe, non-reactive, and capable of protecting the drug from environmental factors such as moisture, light, and oxygen.

Material Insights

Polypropylene (PP) dominated the market with the largest revenue share of 26.8% in 2023. The material is known for its high tensile strength, low moisture absorption, sterilization, and reusability. These properties make it ideal for pharmaceutical packaging applications where product integrity and protection from environmental factors are crucial, leading to the extensive usage of PP in manufacturing packaging materials. Furthermore, the material is relatively inexpensive compared to other packaging materials, which makes it an attractive option for pharmaceutical companies looking to manage costs without compromising quality.

The Polyvinyl Chloride (PVC) segment is expected to grow substantially during the forecast period owing to the material’s excellent chemical resistance, durability, and flexibility. These properties make it suitable for various pharmaceutical packaging applications such as blister packs, bottles, and medical devices. PVC provides barrier properties as it aids in protection against moisture, bacteria, and contamination and meets high safety and quality standards per European stringent regulations.

Application Insights

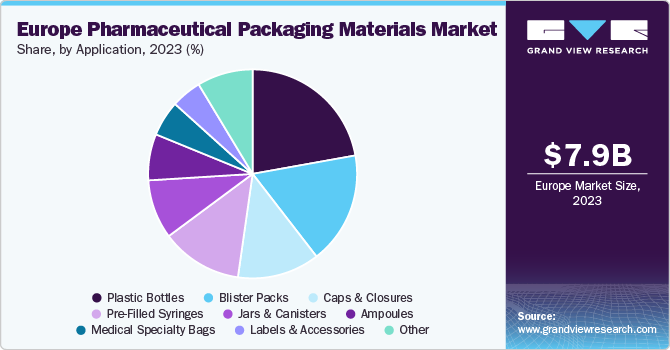

Plastic bottles accounted for the dominant market share in 2023 owing to versatility and durability. They are widely used for packaging liquid medications such as syrups, nasal sprays, ophthalmic solutions, and lotions due to their excellent barrier properties, which protect the contents from moisture, light, and contamination. In addition, plastic bottles, particularly those made from high-density polyethylene (HDPE) and polyethylene terephthalate (PET), provide high temperature and impact resistance and are relatively inexpensive to produce compared to glass and other materials.

Blister packs are projected to grow at a CAGR of 9.3% during the forecast period with the increasing demand for secure and tamper-evident packaging. These packs provide a high level of protection against tampering, which is crucial for maintaining the integrity and safety of pharmaceutical products. This feature is particularly important in the context of European stringent regulatory requirements, which mandate robust packaging solutions to prevent contamination and ensure patient safety. Moreover, blister packs allow for precise control over individual doses, making it easier for patients to adhere to their medication regimens.

Country Insights

The Germany pharmaceutical packaging materials market led the European market, holding the largest revenue share of 22.4% in 2023. The stringent regulatory requirements primarily drove the market. Germany has rigorous standards for pharmaceutical packaging to ensure the safety and efficacy of medications. Compliance with these regulations necessitates using high-quality, non-toxic packaging materials that protect drugs from environmental factors such as moisture, light, and oxygen. In addition, Germany is one of the leading pharmaceutical markets in Europe, with a strong presence of major pharmaceutical companies and a robust research and development infrastructure. The increasing production of pharmaceuticals necessitates reliable and efficient packaging solutions to ensure the safe distribution and storage of medications.

France Pharmaceutical Packaging Materials Market Trends

The pharmaceutical packaging market in France is expected to grow at a CAGR of 9.4% over the forecast period. With a growing emphasis on environmental sustainability, the market saw a significant shift towards eco-friendly and reusable packaging materials. This trend is further supported by stringent regulatory policies that encourage using sustainable materials in pharmaceutical packaging. The rise in healthcare spending and therapeutic development has also fueled the market’s growth. The French government’s initiatives to restore the production of essential medicines and ensure a steady supply chain have also positively impacted the market.

Key Europe Pharmaceutical Packaging Materials Company Insights

Some major European pharmaceutical packaging materials market companies are Sumitomo Chemical Co., Ltd., Arkema, Eastman Chemical Company, and others. These companies have focused on managing raw material procurement and maintaining product quality. They have also aimed at product development by investing in research and development, collaboration, mergers and acquisitions, and more.

-

Arkema is a multinational manufacturer of specialty materials. It designs materials to address global challenges such as new energies, resource depletion, and urbanization. Its segments include adhesives, advanced materials, coatings, and chemical intermediates. Arkema emphasizes sustainability, bio-based ingredients, and circular solutions.

-

Dow, a materials science company, offers a wide range of products and services globally. Its portfolio spans agricultural films, construction materials, medical packaging, and more. Dow specializes in producing plastics such as polyurethane, polyethylene, polypropylene, and synthetic rubber. It focuses on sustainability, circular economy, and innovation.

Key Europe Pharmaceutical Packaging Materials Companies:

- Sumitomo Chemical Co., Ltd.

- Arkema

- MOL GROUP

- Eastman Chemical Company

- Dow

- Exxon Mobil Corporation

- Formosa Plastics Corporation, U.S.A.

- Covestro AG

- Toray Industries, Inc.

- Mitsubishi Chemical Europe GmbH

- LyondellBasell Industries Holdings B.V.

- Solvay

Recent Developments

Europe Pharmaceutical Packaging Materials Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 8.47 billion

|

|

Revenue forecast in 2030

|

USD 13.83 billion

|

|

Growth rate

|

CAGR of 8.5% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Material, application, country

|

|

Country scope

|

Germany, UK, France, Italy, Russia.

|

|

Key companies profiled

|

Sumitomo Chemical Co., Ltd.; Arkema; MOL GROUP; Eastman Chemical Company; Dow; Exxon Mobil Corporation; Formosa Plastics Corporation, U.S.A.; Covestro AG; Toray Industries, Inc.; Mitsubishi Chemical Europe GmbH; LyondellBasell Industries Holdings B.V.; Solvay

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Europe Pharmaceutical Packaging Materials Market Report Segmentation

This report forecasts revenue growth at regional and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe pharmaceutical packaging materials market report based on material, application, and country.

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

High-Density Polyethylene (HDPE)

-

Low-Density Polyethylene (LDPE)

-

Polyester (PE)

-

Polypropylene (PP)

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate (PET)

-

Application Outlook (Revenue, Kilotons, USD Million, 2018 - 2030)

-

Plastic Bottles

-

Blister Packs

-

Labels & Accessories

-

Caps & Closures

-

Medical Specialty Bags

-

Pre-Filled Syringes

-

Ampoules

-

Jars & Canisters

-

Other

-

Country Outlook (Revenue, Kilotons, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Russia