Europe Polyurethane Market Size & Trends

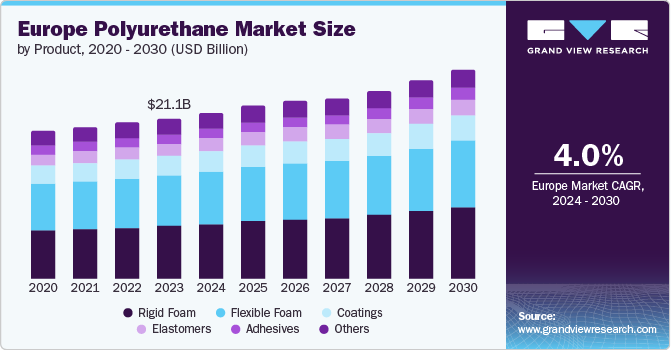

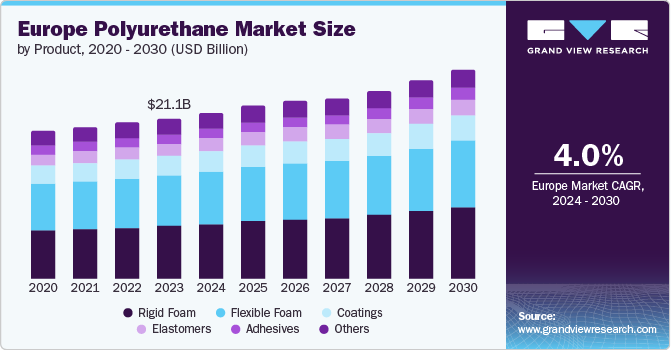

The Europe polyurethane market size was valued at USD 21.1 billion in 2023 and is expected to grow at a CAGR of 4.0% from 2024 to 2030. This is attributable to the robust expansion of the construction industry in the region which witnessed the growing demand for building insulation materials. Manufacturers increasingly sought PU for their excellent thermal insulation properties. Moreover, the region’s growing focus on energy-efficient buildings has led to the demand for PU insulation materials.

Another major market driver was the increasing demand for lightweight and high-performance materials in automobile manufacturing. Automakers alarmingly utilized these foams for durability and fuel efficiency. Furthermore, innovations in electric vehicles and hybrid cars have further boosted polyurethane (PU) adoption in vehicle interiors, exteriors, and under-the-hood applications.

Furthermore, Europe’s stringent environmental regulations have increasingly encouraged the use of eco-friendly materials including PU materials. In turn, PU manufacturers focused on developing bio-based and recyclable products to prioritize sustainability, catering to eco-conscious consumer preferences. Manufacturers have increasingly invested in research and technological innovations to improve PU formulations including new additives, flame retardants, and processing techniques.

Product Insights

The rigid PU market secured the dominant market share of 33.0% in 2023 owing to its excellent thermal insulation properties. The market was primarily driven by the growing demand for energy efficiency required in the construction industry. Rigid polyurethane (PU) was extensively utilized to enhance insulation, reduce energy consumption, and support the structure in buildings. Manufacturers also preferred this material for insulation in appliances including refrigerators and freezers. Additionally, rigid PU is also applied in various automotive components due to its favorable strength-to-weight ratio in fuel-efficient vehicles.

Flexible PU is expected to emerge as the fastest-growing segment during the forecast period. As the European automotive industry continues to innovate for comfort and safety, flexible PU foam is extensively applied in automotive seating, interiors, and cushioning. In addition, the market was augmented by furniture manufacturing which used PU in sofas, chairs, and mattresses for comfort and durability. Furthermore, ongoing research and development has led to innovative formulations to enhance foam density, resilience, and fire resistance, increasing material performance.

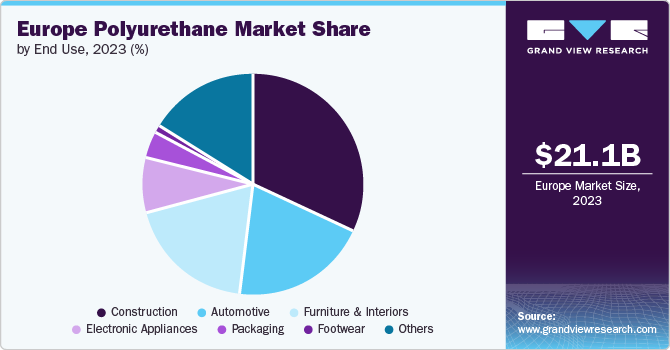

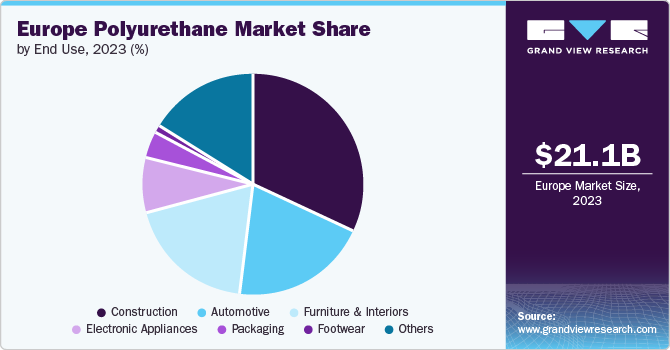

End-use Insights

The construction industry accounted for the largest market share in 2023. The market was driven by residential demand in metropolitan areas owing to urbanization, population growth, and migration. This has resulted in the growing demand for PU materials for insulation, flooring, and coatings to enhance energy efficiency in buildings. PU adhesives, sealants, and coatings were utilized for building renovation. These materials are used in hospital flooring, and wall panels. Furthermore, European governments invested in infrastructure development, including roads, bridges, and public facilities which led to the increasing demand for PU materials for road surfacing, sound barriers, and waterproofing.

The electronics & appliances sector is expected to emerge as the fastest-growing segment at a CAGR of 5.0% during the forecast period. This anticipated growth is attributable to the region’s growing population and rising disposable income. European consumers increasingly sought high-performing, convenient-to-use products, leading to increased adoption of PU materials. These materials were also used in wearable devices, fitness trackers, and smart health gadgets due to their lightweight nature, comfort, and durability.

Country Insights

Germany Polyurethane Market Trends

The PU market in Germany held the dominant share with 16.3% of the region owing to the sustainability concerns in the construction sector that augmented the demand for thermal insulation and energy efficiency. The demand for lightweight and high-performance materials, particularly in the electric vehicles and hybrid cars in the automobile manufacturing had also played a critical role in the market growth. PU materials were used in the automotive interior components, coatings, and adhesives. Furthermore, the booming e-commerce in Germany leading to the need for efficient packaging solutions, drove demand for protective cushioning properties offered by PU materials.

France Polyurethane Market Trends

The France PU market is projected to grow substantially at a CAGR of 4.6% during the forecast period. The market was propelled due to the thermal properties that PU offers to increase energy efficiency. In addition, the country’s stringent environmental regulations encouraged the use of eco-friendly materials including PU. This has led manufacturers to focus on developing bio-based and recyclable products and prioritize sustainability. They have increasingly invested in research and innovations to improve PU formulations including new additives, flame retardants, and processing techniques.

Key Europe Polyurethane Company Insights

The Europe PU market is characterized by the presence of a large number of manufacturers, and distributors which makes it a highly competitive market. Key players including BASF SE, Covestro AG, and Huntsman Corporation, have increasingly focused on innovation as the key to sustainability.

-

Covestro AG, based in Germany, specializes in producing high-tech polymer materials for various industries. Their product range includes isocyanates and polyols used in cellular foams, thermoplastic polyurethane, polycarbonate pellets, and additives for coatings and adhesives. Additionally, they focus on innovations including bio-based aniline and collaborate with partners to develop eco-friendly solutions.

-

Recticel NV/SA is an insulation company that concentrates on thermal and acoustic insulation, aligning with the energy transition, emphasizing sustainability, responsible solutions, and meeting customer needs while addressing environmental challenges.

Key Europe Polyurethane Companies:

- Covestro AG

- BASF SE

- Huntsman Corporation

- Dow Inc.

- Recticel NV/SA

- LANXESS AG

- Wanhua Chemical Group

- Interplasp

- Paul Bauder GmbH & Co. KG

- Evonik Industries AG

Recent Development

-

In May 2024, Covestro AG and Ecomaison collaboratively anonounced an innovative recycling approach for end-of-life polyurethane mattress foams. This concept integrates chemical and mechanical technologies, following meticulous foam type sorting at mattress cutting facilities

-

In May 2024, Dow Inc. announced the completion of the mechanical setup of its VORATRON Polyurethanes Systems adhesive and gap filler production line at its Polyurethanes Systems House in Ahlen, Germany. This expansion will increase the capacity of this product family, enabling the company to meet the growing demand for these materials in battery assembly solutions for the e-mobility sector.

Europe Polyurethane Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 21.8 billion

|

|

Revenue forecast in 2030

|

USD 27.5 billion

|

|

Growth Rate

|

CAGR of 4.0% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Report updated

|

September 2024

|

|

Quantitative units

|

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, end-use, country

|

|

Country scope

|

Germany; France; UK; Spain; Russia; Italy; Sweden; Norway; Denmark

|

|

Key companies profiled

|

Covestro AG; BASF SE; Huntsman Corporation; Dow Inc.; Recticel NV/SA; LANXESS AG; Wanhua Chemical Group; Interplasp; Paul Bauder GmbH & Co. KG; Evonik Industries AG

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Europe Polyurethane Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Europe polyurethane market report based on product, end-use, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

Rigid Foam

-

Flexible Foam

-

Coatings

-

Adhesives & Sealants

-

Elastomers

-

Others

-

End-use Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

Furniture and interiors

-

Construction

-

Electronic appliances

-

Automotive

-

Footwear

-

Packaging

-

Others

-

Country Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Sweden

-

Norway

-

Denmark