- Home

- »

- Consumer F&B

- »

-

Europe Premium Bottled Water Market, Industry Report 2030GVR Report cover

![Europe Premium Bottled Water Market Size, Share & Trends Report]()

Europe Premium Bottled Water Market Size, Share & Trends Analysis Report By Product (Spring Water, Mineral Water, Sparkling Water), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-220-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

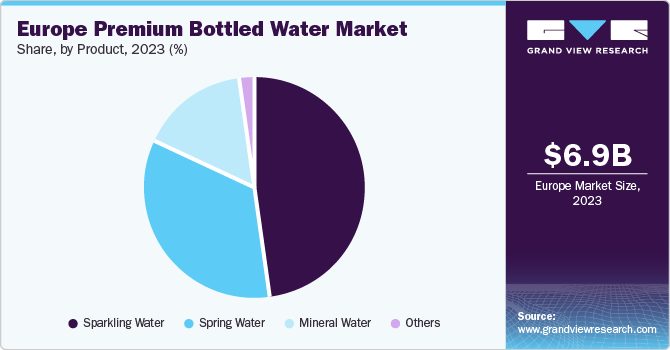

The Europe premium bottled water market size was estimated at USD 6.88 billion in 2023 and it is expected to grow at CAGR of 5.7% from 2024 to 2030. The unique selling point developed by the product generates demand from specific target group of customers. Perceived value possessed by the product and growing awareness about the benefits associated with consumption of premium quality bottled water are key driving factors behind anticipated growth of Europe premium bottled water market.

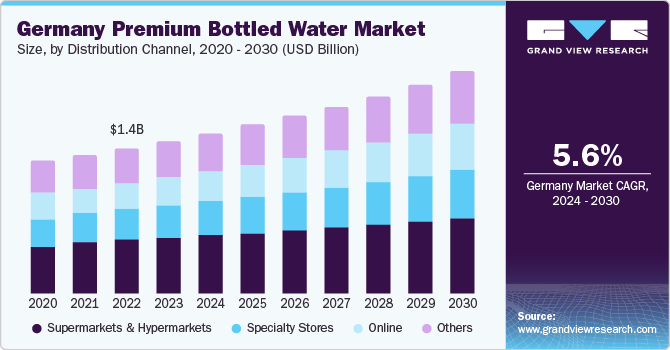

Germany premium bottled water market accounted for 7% of the global premium bottled water market revenue in 2023. Like every other industry in the world, especially those which are related with global hospitality and food service industry, the premium bottled water market was severely impacted by the pandemic. However, the changing industry scenario, encouraging patterns of the market and accelerating growth experienced by the global tourism and hospitality industry post pandemic times is expected to assist this market to grow at rapid pace.

Unparalleled rise in awareness regarding significance of health lifestyle has encouraged a group of customers to shift their routine water consumption from regular to premium-bottled water. Often, the product offered by this industry contain variety of minerals, including sodium, magnesium, and calcium as well. The water used in development of such products is generally glacier water or natural water.

In recent past, innovative and aggressive marketing strategies adopted by the premium-bottled water companies have played vital role in generating growing demand for the product. Companies have also been engaging influencers from different parts of the world to feature them in advertisements. The branding effort, followed by diligently executed strategies have resulted in developing competitive edge for many market participants. The advertisements broadcasted and distributed by key companies explain how their products are different from others while highlighting the quality aspect delivered by them in exchange of premium prices.

Market Concentration & Characteristics

The Europe premium bottled water market is growing at accelerating pace and growth stage is identified as high. This market is characterised presence of companies, which have been operating in the business for many decades. These companies have operations and distribution network across the globe. However, some of the new entrants of the market are also gaining attention from group of customers. The industry is fragmented in nature owing to presence of multiple players in different parts of the market. In addition, the backgrounds, and areas from where customers belong also has impact on company’s market share.

Many influencers from sports industry consume premium-bottled waters, however, clubs they play for or leagues they play in often tend to decide which company is appointed as beverage or hydration partners. For instance, In November 2023, Manchester United, one of the most popular Premier League clubs, announced three-year deal with Wow Hydrate and appointed them as new official sports hydration partner. Wow Hydrate’s plans to expand in Europe are effectively supported by this deal where some of world’s renowned sport celebrities can be seen in their advertisements, marketing campaigns, on television commercials and digital signage boards across Europe. “Hydrate like the reds” is one of their recent campaigns which already can be seen in parts of the region.

Degree of innovation is moderate in the market. Innovation is primarily adopted as a strategy to diversify the product portfolio and develop competitive edge over others. The innovation is often related to product features, product ingredients and marketing strategies executed by the companies.

The level of M&A (mergers & acquisitions) is moderate in the market. Generally, companies operating in the industry tend to form a collaboration or partnership with companies who have strong distribution network or presence in particular region to expand and strengthen their position in the market.

Threat of substitutes is at medium level. The premium-bottled water ranges are perceived as specially designed for group of customers. However, diverse marketing strategies adopted by the companies and product differentiation efforts have resulted into invention of products such as sports waters, protein waters, and electrolyte waters as well. End-user concentration is at moderate level as the product is often consumed by group of customers and not by masses.

Product Insights

The premium mineral water market in Europe accounted for revenue share of 41.65% in 2023. According to a report published by Natural Mineral Waters Europe in March 2021, the mineral content in bottled water available in the region is significantly higher than in any other tap water in the world. The bottled mineral waters often contain calcium, magnesium, sodium, and zinc. The rising demand for healthier alternatives to carbonated drinks, the mineral water has been gaining a lot of customer attention in the region.

Sparkling water market in Europe is expected to grow at CAGR of 6.3 % from 2024 to 2030. The expected growth can be attributed to consumer shifting their preferences from carbonated soft drinks or energy drink to sparkling waters, product’s characteristics such as presence of minerals including sodium, potassium and magnesium, and frothy, fizzy texture of the product. In recent past, sparkling water has become one of the most popular beverage choice in Europe region, including in Germany, France, and Spain.

Distribution Channel Insights

The sale generated through supermarket & hypermarkets in Europe premium bottled water market accounted for revenue share of 36.92% in 2023. Supermarkets and hypermarkets are considered as one of the most effective distribution channels owing to the efficient market penetration and brad visibility they can provide for companies. Using this channel, brands can easily reach the potential customers while conveying and providing detailed information about their products through marketing and clear labelling.

Easy accessibility through these stores is also contributing to high growth of the industry. This distribution channel also plays vital role in activities such as in-store testing, special offers, and customer loyalty programmes. In addition, premium bottled sales through online distribution channel is expected to grow at CAGR of 7.6% from 2024 to 2030.

Country Insights

France Premium Bottled Water Market Trends

The France premium bottled water market accounted for revenue share of 23.03 % in 2023. The market is poised to grow at rapid pace owing to lucrative opportunities such as increasing inflow of tourists post pandemic times, uninterrupted execution of planned sporting events in the country, growing inclination towards shifting choices from other carbonated drinks to premium bottled water in the region and more. Additionally, it has been said that premium bottled water which is originated from France and Germany holds the highest and purest amounts of essential calcium and daily magnesium as compared to other lands. France reports one of the highest consumptions of sparkling water in Europe and plays role of large exporter of bottled water within Europe.

Germany Premium Bottled Water Market Trends

The Premium bottled water market in Germany is expected to grow at CAGR of 5.4% from 2024 to 2030. The projected growth can be attributed to overall response to the culture of consumption of premium range waters. Restaurants and cafés in the Germany are known for offering separate water menus which entails wide range of sparkling and mineral bottled water sold by many brands.

Key Europe Premium Bottled Water Company Insights

The market is characterized by the presence of some exclusive companies with a strong presence across Europe. Several players have been introducing premium bottles to expand their consumer base in this market. These developments and innovation strategies have had a positive impact on the market. An increasing number of companies have also been introducing new products to gain a competitive edge.

-

Danone is one of leading premium bottled water providers of the world. It is well known for its sustainable packaging where it claims to use 84% of its packaging in reusable, recyclable, or compostable forms. It has distribution channels in more than 120 countries and employees working on ground in more than 55 countries.

-

FIJI Water sells water derived from tropical rainfalls, which is then purified by equatorial trade winds and filtered by volcanic rock. The minerals and electrolytes rich water is protected naturally from external elements during the process of collection and is stored in sustainable artesian aquifers. The company highlights the feature of their products being ‘Untouched’ and human contact free until consumers unscrew the cap.

Key Europe Premium Bottled Water Companies:

- Danone

- FIJI Water

- ROIwater

- NEVAS Water

- Lofoten Arctic Water

- Berg Water

- FineWaters

- Uisge Source

- MINUS 181 GmbH

- Vichy Catalan

Recent Developments

-

In April 2023, FIJI Water advanced further in its plan to commit to environmental sustainability by transitioning its best-selling products, 500 ml and 330 ml bottles into one hundred percent of rPET (recyclable plastic), whil excluding caps and labels for European market of premium bottled water.

-

In August 2022, PepsiCo, Inc., one of the leading companies from food & beverage industry, announced its partnership with AQUA Carpatica, premium spring water company from Romania, Europe.

Europe Premium Bottled Water Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.23 billion

Revenue Forecast in 2030

USD 10.09 billion

Growth Rate

CAGR of 5.5% from 2024 to 2030

Actuals

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Product, Distribution Channel, Country

Country scope

Germany, UK, Italy, Spain, France

Key companies profiled

Danone; FIJI Water; ROIwater; NEVAS Water; Lofoten Arctic Water; Berg Water; FineWaters; Uisge Source; MINUS 181 GmbH; Vichy Catalan

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Premium Bottled Water Market Report Segmentation

This report forecasts growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the report based on Europe premium bottled water market in product and distribution channel and country:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Spring Water

-

Sparkling Water

-

Mineral Water

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Frequently Asked Questions About This Report

b. The Europe premium bottled market was estimated at USD 6.88 billion in 2023 and is expected to reach USD 7.23 billion in 2024.

b. The Europe premium bottled market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 10.09 billion by 2030.

b. France dominated the Europe premium bottled market with a share of around 23% in 2023. The market is poised to grow at a rapid pace owing to lucrative opportunities such as increasing inflow of tourists post-pandemic times, uninterrupted execution of planned sporting events in the country, growing inclination towards shifting choices from other carbonated drinks to premium bottled water in the region, and more.

b. Some of the key players operating in the Europe premium bottled market include Danone; FIJI Water; ROIwater; NEVAS Water; Lofoten Arctic Water; Berg Water; FineWaters; Uisge Source; MINUS 181 GmbH; Vichy Catalan

b. Perceived value possessed by the product and growing awareness about the benefits associated with the consumption of premium quality bottled water are key driving factors behind the anticipated growth of the European premium bottled water market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."