- Home

- »

- Next Generation Technologies

- »

-

Europe Transportation Management Systems Market Report 2030GVR Report cover

![Europe Transportation Management Systems Market Size, Share & Trends Report]()

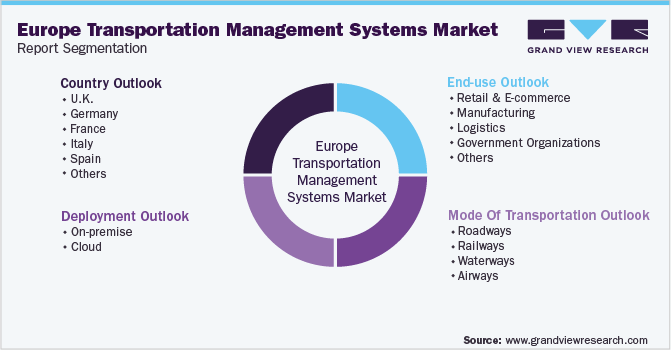

Europe Transportation Management Systems Market Size, Share & Trends Analysis Report By Mode Of Transportation (Roadways, Railways, Waterways, Airways), By Deployment (On-premise, Cloud), By End-Use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-011-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

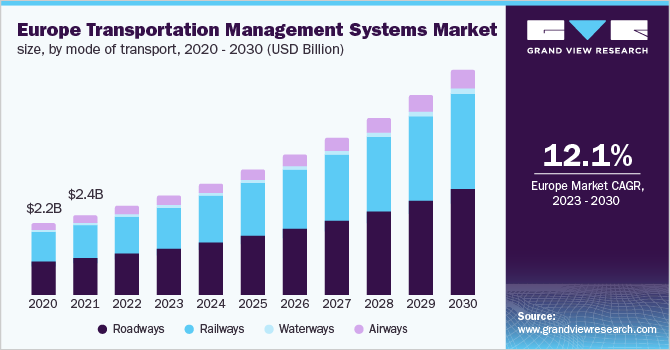

The Europe transportation management systems market size was valued at USD 2.70 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 12.1% from 2023 to 2030. The growth of the market is owing to increased return on investment (ROI) and the advent of digital transformation in the transportation sector. Therefore, the introduction of digital from linked warehouses to new mileage delivery services increases TMS's value and presence in the market, reshaping the sector into a dynamic setting for fostering social change. Most cloud-based transportation management solutions are offered for rent as software (SaaS). This indicates that rather than paying for the technology outright, customers subscribe to it on a monthly or yearly basis. Users are constantly using the most recent software version because this is more cost-effective. The development of technologies such as IoT and cloud-based services also provides prospects for the market's overall growth.

The rise of e-commerce and the significant return on investment provided using transportation management systems (TMS) are projected to be the primary drivers of industry expansion. The improved commerce between developed and emerging economies, which has resulted in higher imports and exports, impacts demand for this market segment. Innovative and efficient transportation management solutions are required because the raw materials must come from various locations worldwide. The market for the logistics sector is also aided by emerging economies' rising demand for luxury automobiles. Most high-end vehicles are produced in Europe before being transferred to other nations. Automotive sectors now employ TMS because of the necessity to track these shipments and ensure that they arrive on time. Additionally, the global supply of auto parts modifies the industry's need for TMS.

Supply chain visibility, TMS, commodity trading, transaction, and risk management (CTRM) software, and demand planning are essential in during the Ukraine-Russia War in Europe to better manage transportation and continue the supply chain. Demand planning and TMS experienced the most significant traffic spikes in the country, possibly indicating that customers are most concerned about demand variations and the ability to track shipments, choose the best routes, and keep operating fleets in war zones. The key trend impacting the growth of the traffic management systems market is an increase in the number of strategic alliances.

A wide range of industries, including industrial manufacturing, pharmaceutical, automotive, aerospace and defense, and oil and gas, is where vendors create strategic alliances with market participants, including software developers and technology platform suppliers. Vendors in the market are therefore upgrading their mode of transport to meet the demands of travel and tourist businesses. As numerous nations are ready to break the lockdowns gradually in the following months, the need for this software will increase. The governments of several countries have permitted most firms to resume operations following safety regulations. In the long term, it is projected that there will be a significant increase in demand for transportation management systems.

Mode Of Transportation Insights

The roadways segment dominated the market in 2022 with a market share of over 45%. Road transportation is not only one of the most popular but also one of the least expensive methods for moving cargo. It can be loaded and unloaded anywhere because of its flexibility. However, there are several drawbacks to using the road, such as its limited capacity, the frequent placement of police checkpoints at strategic locations, the fact that the streets are only sometimes in great condition, and the fact that there are numerous other issues. However, the demand for logistics via roads is set to increase if governments in emerging nations maintain pushing to improve transportation infrastructure, thus, impacting the need for TMS in the roadways market.

Deployment Insights

The on-premise segment dominated the market in 2022 with a market share of over 60%. The user sets up and operates on-site transportation management systems on their server. Most established manufacturing and distribution businesses still favor the on-premise deployment of transportation management system solutions. This is due to the strict safety criteria, the simplicity of accessing the server, and the organization's substantial control over system customization. In the upcoming years, end-use sectors are anticipated to use cloud TMS solutions as more people become aware of the advantages of the cloud and how inexpensively it can be set up compared to on-premise deployment.

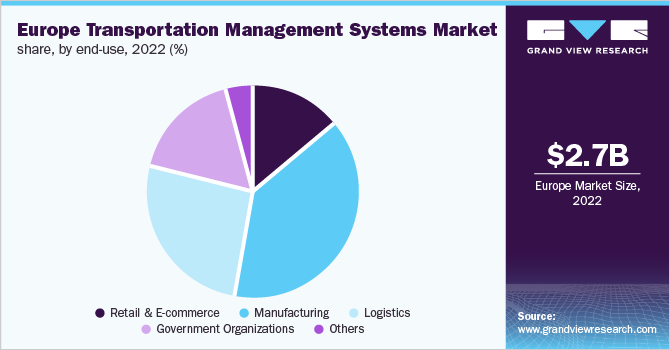

End-use Insights

The manufacturing segment dominated the market in 2022 with a market share of over 35%. TMS provides logistical needs to the manufacturing supply chain. Transportation management systems help deliver raw materials to manufacturing facilities and finished goods to distribution centers and end consumers by offering fast and economical logistics solutions. Regardless of market situations, TMS has been offering manufacturing organizations affordable, dependable logistics systems to handle their freight.

The transportation sector is facing many difficulties, including a shortage of drivers, rules from the government, and increased operating expenses. The remaining drivers are requesting a pay increase as the number of drivers is rapidly declining. We anticipate greater shipping expenses because of these difficulties. Manufacturers are increasingly looking to transportation management systems (TMS) for real-time performance data to gauge the effectiveness of transportation modifications. A TMS aids manufacturing in achieving end-to-end visibility, which opens the door to lean operations and lower operating expenses.

Country Insights

The U.K. dominated the Europe transportation management system market in 2021 and accounted for a market share of over 20%. The transportation system in the U.K. has been improved in several ways by the government. For instance, in November 2020, the government of the U.K. launched the Future of Transport program to encourage transportation industry innovation and develop a new transportation market, secure a modern transportation system, and maintain the U.K. at the forefront of innovation by decarbonizing the transportation sector for the welfare of all of humanity. Such initiatives contribute to the growth of the market in the region.

Germany is anticipated to witness a considerable growth rate during the forecast period. The authorities in the country are establishing, strengthening, and upholding progressive laws, norms, and institutional policies to support the logistics sector's efficient operation and foster a vibrant, competitive environment. For instance, Germany's freight transportation and logistics planning policies assist the country in redefining the logistics sector. With this initiative, they are laying the groundwork for a reliable and effective logistics and freight transportation system in Germany. The primary goal is to ensure that commodities are transported without incident, fostering economic development and job creation while remaining vigilant on climate change and environmental protection issues.

Key Companies & Market Share Insights

The industry is characterized by few entry barriers for new players as new players can establish their businesses with minimal investments. Competition among the players is high. Large companies are pursuing various inorganic growth strategies such as partnerships, acquisitions, collaborations, and strategic agreements to increase their customer base and geographical reach. In April 2022, 3Gtms, partnered with Greenscreens.ai, a provider of pricing infrastructure for the truckload spot rate. Through this partnership, Greenscreens.ai integrated intelligent spot market pricing. Through this connectivity, brokers and 3PLs may confidently quote spot market loads and take advantage of new opportunities with faster, smarter pricing. Some of the prominent players operating in the Europe transportation management systems market are:

-

3GTMS

-

BluJay Solutions Ltd.

-

C.H. Robinson Worldwide, Inc.

-

Cerasis, Inc.

-

inet-logistics GmbH

-

Infor Inc.

-

International Business Machines Corporation

-

JDA Software Group, Inc.

-

Manhattan Associates

-

MercuryGate International Inc.

-

Oracle Corporation

-

SAP SE

-

The Descartes Systems Group Inc.

-

Trimble Transportation Enterprise Solutions, Inc.

Europe Transportation Management Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.01 billion

Revenue forecast in 2030

USD 6.69 billion

Growth rate

CAGR of 12.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mode of transport, deployment, end-use, country

Country scope

U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway

Key companies profiled

3GTMS; BluJay Solutions Ltd.; C.H. Robinson Worldwide, Inc.; Cerasis, Inc.; inet-logistics GmbH; Infor Inc.; International Business Machines Corporation; JDA Software Group, Inc.; Manhattan Associates; MercuryGate International Inc.; Oracle Corporation; SAP SE; The Descartes Systems Group Inc.; Trimble Transportation Enterprise Solutions, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Transportation Management Systems Market Segmentation

This report forecasts revenue and volume growth at the regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe transportation management systems market report based on the mode of transport, deployment, and country:

-

Mode Of Transportation Outlook (Revenue, USD Million, 2018 - 2030)

-

Roadways

-

Railways

-

Waterways

-

Airways

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail & E-commerce

-

Manufacturing

-

Logistics

-

Government Organizations

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

France

-

Frequently Asked Questions About This Report

b. The Europe transportation management systems market size was estimated at USD 2.70 billion in 2022 and is expected to reach USD 3.01 billion in 2023.

b. The Europe transportation management systems market is expected to witness a compound annual growth rate of 12.1% from 2023 to 2030 to reach USD 6.69 billion by 2030.

b. The U.K. held the largest share of over 20% in 2022. The transportation system in the U.K. has been improved in several ways by the government. For instance, in November 2020, the government of the U.K. launched the Future of Transport program to encourage transportation industry innovation and develop a new transportation market, secure a modern transportation system, and maintain the U.K. at the forefront of innovation by decarbonizing the transportation sector for the welfare of all of humanity. Such initiatives contribute to the growth of the market in the region.

b. Key industry players operating in the Europe transportation management systems market include 3GTMS; BluJay Solutions Ltd.; C.H. Robinson Worldwide, Inc.; Cerasis, Inc.; inet-logistics GmbH; Infor Inc.; International Business Machines Corporation; JDA Software Group, Inc.; Manhattan Associates; MercuryGate International Inc.; Oracle Corporation; SAP SE; The Descartes Systems Group Inc.; and Trimble Transportation Enterprise Solutions, Inc.

b. The rise of e-commerce and the significant return on investment provided using transportation management systems are projected to be the primary drivers of industry expansion.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."