- Home

- »

- Medical Devices

- »

-

Europe Wearable Medical Devices Market, Industry Report, 2030GVR Report cover

![Europe Wearable Medical Devices Market Size, Share & Trends Report]()

Europe Wearable Medical Devices Market Size, Share & Trends Analysis Report By Product (Diagnostic & Therapeutic), By Application, By Site, By Grade Type, By Distribution Channel, By Country, and Segment Forecasts 2024 - 2030

- Report ID: GVR-4-68040-301-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

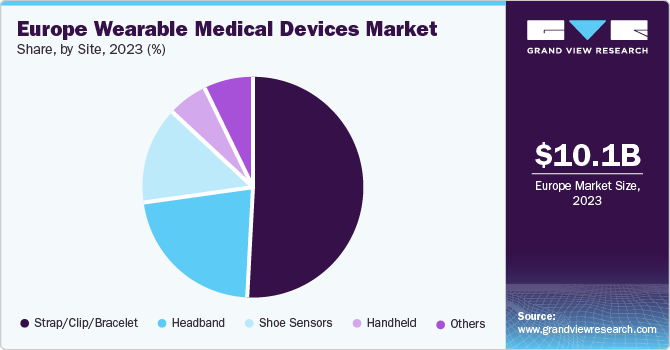

The Europe wearable medical devices market was estimated at USD 10.1 billion in 2023 and is expected to grow at a CAGR of 25.9% from 2024 to 2030. The surging demand for home care devices, central data management systems, and efficient wearable medical devices is expected to propel the market growth in the coming years. As consumers are growing more conscious about their health, there is a major increase in interest in keeping close tabs on their habits through remote patient monitoring systems. There is an increase in health quantification through mobile apps and a major concentration on healthy lifestyle orientation.

Several companies are launching remote patient monitoring devices and home healthcare products. This includes wearable medical devices that can navigate blood oxygen and respiration levels, heat and pulse rates, heat flux, galvanic skin responses, and skin temperature.

In 2023, the Europe region accounted for approximately 29.9% revenue share of the global wearable medical devices market. A major factor driving the market growth in Europe is the ongoing technological developments, the rising number of obese patients, increasing geriatric population, and rising healthcare expenditures. These have made companies launch health-related smart devices and apps, such as smart body analyzers and blood pressure monitors. These newly launched products designed with aesthetic appeal are likely to spur the rapid growth of wearable medical devices in Europe.

Product Insights

Diagnostic devices accounted for over 60.0% of the market share in 2023 and are expected to dominate the market over the forecast period. The growing number of neurological disorders is primarily driving the market growth. World Federation of Neurology reported that neurological disorders rank second in terms of death, and globally, it is the leading cause of disability. Consumers are progressively becoming aware of neurological wearables that ensure continuous assessment of cognitive capabilities.

Hence, they are transitioning to remote patient monitoring and home healthcare, which is creating a surging demand for diagnostic and monitoring devices. For instance, in April 2022, Eseye launched Telli Health's innovative range of remote patient monitoring (RPM) devices. These include a blood pressure monitor, blood glucometer, pulse oximeter, and thermometer. Moreover, they can easily enable connection to cellular phones to track their routine activities, such as step counts, calories, exercise habits, and sleep patterns. Excellent user experience and attractive designs have additionally been attributed to these devices gaining popularity.

The market is inclined towards wearable vital sign monitors that can be operated as surveillance systems as they can continuously record, monitor, and analyze critical clinical information, providing healthcare professionals with accurate data that helps them understand a patient’s condition and plan therapy accordingly. Wearable vital sign monitors comprise numerous devices that provide accurate patient data, such as Electrocardiograph (ECG), noninvasive blood pressure, body temperature, respiration rate, and brain activity.

Therapeutic products in the market are expected to grow rapidly at a CAGR of 26.9% over the forecast period. These devices include pain management devices, insulin-monitoring devices, rehabilitation devices, and respiratory devices. In May 2024. Dexcom launched Dexcom ONE+ to support type 2 diabetes patients in the UK. Growing R&D activities have resulted in the development of many technologically advanced products that are being used for various therapeutic purposes. Insulin monitoring devices have held the largest share in terms of revenue in this segment. Prevalence of diabetes has been a prime factor for this as these devices help in the continuous monitoring of blood insulin levels.

Application Insights

The home healthcare segment held the largest market share of 54.0% in 2023. As the European market is expanding, manufacturers are launching innovative products that mainly concentrate on home healthcare, remote patient monitoring, and sports & monitoring fitness. The market is rapidly driven because of easy user experience and the ability to synchronize with cellular phones and tablet devices. In March 2022, Infineon Technologies AG collaborated with Sleepiz AG to launch Infineon XENSIV 60 GHz radar technology, which can be integrated with wearable healthcare devices. It helps to accurately measure vital signs, including heartbeat and breathing rate. Home healthcare is specifically dominating the market because of the growing need to curb healthcare expenditure. In addition, since home healthcare helps reduce frequent hospital visits and detect early signs of diseases, there is a growing preference for its cost-effective measure from the consumers’ end.

Remote patient monitoring is projected to exhibit a CAGR of 28.4% during the forecast period. The rise of the geriatric population, along with an increasing need for continuous health monitoring, is likely to augment the growth. Remote patient monitoring provides consumers with various advantages, including early detection of illness, reduction of hospital bills, and getting precise understanding of patients’ health. These devices can accurately measure heart rate, blood pressure, body temperature, and oxygen levels in the body. Manufacturers have also introduced single-use portable devices that have progressively increased patient flexibility and helped save the cost of regular hospital visits.

Site Insights

Strap/clip/bracelet led the market share with more than 50.0% in 2023. Consumers’ interest in products such as smartwatches, smart badges, and bands is rapidly increasing as they ensure accurate data on pulse rate, respiratory rate, and physical activity and are easily accessible through Bluetooth and cloud connectivity. These accurate devices attract consumers with their appealing designs and water resistance power. Consumers are more likely to prefer advanced wrist-worn products with novel processors and enhanced solid-state battery life. A major market player, Apple, launched advanced yet compatible mobile tools equipped with a built-in electrocardiogram to warn a person in case of a heart complication, with automatic detection of a panic attack.

Shoe sensors are expected to boost as the fastest-growing site at a CAGR of 26.5% during the forecast period. These devices, which are primarily intended for athletes, are placed in the sole of a shoe. SurroSense Rx System is a wearable medical device, which helps to prevent foot ulcers by collecting blood pressure data.

Country Insights

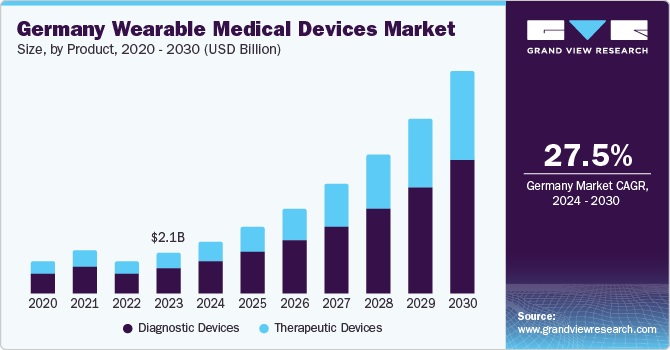

Germany Wearable Medical Devices Market Trends

Germany wearable medical devices market held more than 20.0% of the revenue share in the European region in 2023. It is expected to grow at a CAGR of 26.3% during the forecast period. The country is considering serious measures against the increasing prevalence of obese patients, and there has been an upsurge in technological developments. They have introduced Wandelbots, which is a wearable suit with sensors that allows users to demonstrate actions that a robot can replicate; the 8sense system is a cutting-edge back-coach and wearable device that provides continuous feedback on the user's posture, helping him in strengthening or relieving back muscles and in improving muscle memory. Such innovations are likely to increase the demand for wearable medical devices.

Sweden Wearable Medical Devices Market Trends

The wearable medical devices market in Sweden is expected to grow at a CAGR of 26.9% over the forecast period. The high standard of living and quality of the healthcare system in Sweden is anticipated to favor market growth.

Key Europe Wearable Medical Devices Company Insights

Companies are launching products designed to meet diverse consumer demands. Several leaders are dominating the market in different categories and are advancing with a wide range of products, including wearable medical devices such as monitors, telemetry systems, blood glucose monitoring systems, oximeters, fetal monitors, and others.

Key Europe Wearable Medical Devices Companies:

- Abbott Laboratories

- Medtronic

- Koninklijke Philips N.V

- Omron Corporation

- Samsung Electronics

- Stryker Corporation

- Sotera Digital Health

- Polar Electro

- Intelesense Ltd.

- Withings

Recent Developments

-

In December 2022, WISE received US Food and Drug Administration (FDA) approval for the WISE Cortical Strip. This is a single-use neuromonitoring device, developed using supersonic technology, that can be used for intraoperative monitoring and recording and as stimulation equipment to record the brain’s spontaneous electrical activity (ECoG) and somatosensory evoked potentials (SEPs).

Europe Wearable Medical Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.1 billion

Revenue forecast in 2030

USD 50.8 billion

Growth rate

CAGR of 25.9% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, site, grade type, distribution channel, country

Regional scope

Europe

Country scope

Germany; France; Italy; Spain; Netherlands; Russia; Sweden; UK

Key companies profiled

Abbott Laboratories; Medtronic; Koninklijke Philips N.V; Omron Corporation; Samsung Electronics; Stryker Corporation; Sotera Digital Health; Polar Electro; Intelesense Ltd.; Withings

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Wearable Medical Devices Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe wearable medical devices market report based on product, site, application, distribution channel, grade type, and country:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Diagnostic Devices

-

Vital Sign Monitoring Devices

-

Heart Rate Monitors

-

Activity Monitors

-

Electrocardiographs

-

Pulse Oximeters

-

Spirometers

-

Blood Pressure Monitors

-

Others

-

-

Sleep Monitoring Devices

-

Sleep trackers

-

Wrist Actigraphs

-

Polysomnographs

-

Others

-

-

Electrocardiographs Fetal And Obstetric Devices

-

Neuromonitoring Devices

-

Electroencephalographs

-

Electromyographs

-

Others

-

-

-

Therapeutic Devices

-

Pain Management Devices

-

Neurostimulation Devices

-

Others

-

-

Insulin/Glucose Monitoring Devices

-

Insulin Pumps

-

Others

-

-

Rehabilitation Devices

-

Accelerometers

-

Sensing Devices

-

Ultrasound Platform

-

Others

-

-

Respiratory Therapy Devices

-

Ventilators

-

Positive Airway Pressure (PAP) Devices

-

Portable Oxygen Concentrators

-

Others

-

-

-

-

Site Outlook (Revenue, USD Billion, 2018 - 2030)

-

Handheld

-

Headband

-

Strap/Clip/Bracelet

-

Shoe Sensors

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sports & Fitness

-

Remote Patient Monitoring

-

Home Healthcare

-

-

Grade Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer-Grade Wearable Medical Devices

-

Clinical Wearable Medical Devices

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmacies

-

Online Channel

-

Hypermarkets

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Russia

-

Sweden

-

UK

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."