- Home

- »

- Consumer F&B

- »

-

Europe Wine Market Size & Trends, Industry Report, 2033GVR Report cover

![Europe Wine Market Size, Share & Trends Report]()

Europe Wine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Table Wine, Sparkling Wine, Dessert Wine), By Distribution Channel (Off-trade, On-trade), By Country (UK, Germany, France, Italy, Spain), And Segment Forecasts

- Report ID: GVR-4-68040-668-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Wine Market Summary

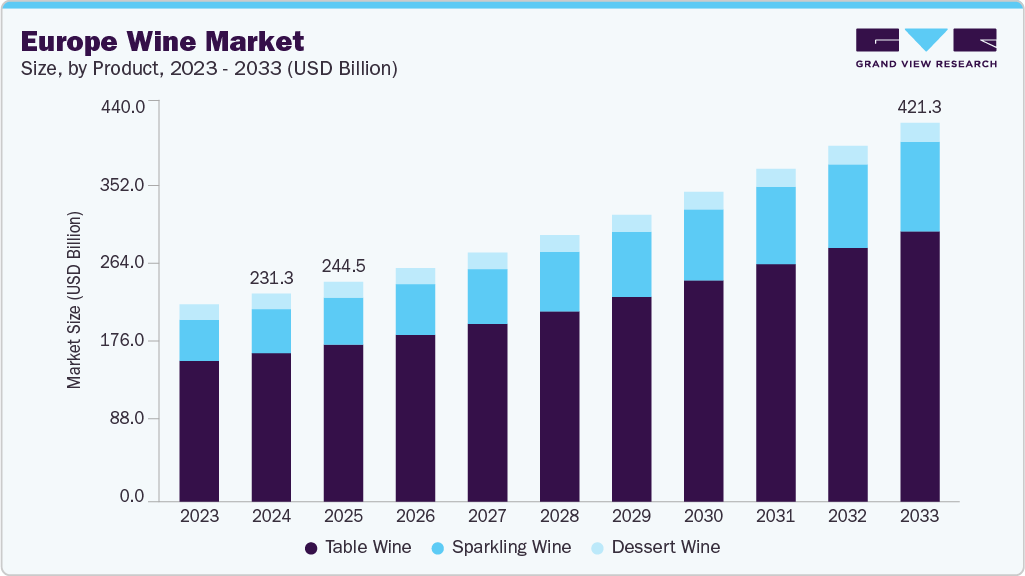

The Europe wine market size was estimated at USD 231.29 billion in 2024 and is expected to reach USD 421.26 billion by 2033, growing at a CAGR of 7.0% from 2025 to 2033. The Europe wine industry is growing steadily, driven by a combination of cultural heritage, evolving consumer preferences, and emerging lifestyle trends.

Key Market Trends & Insights

- By country, Germany accounted for the largest revenue share of 24.8% in 2024.

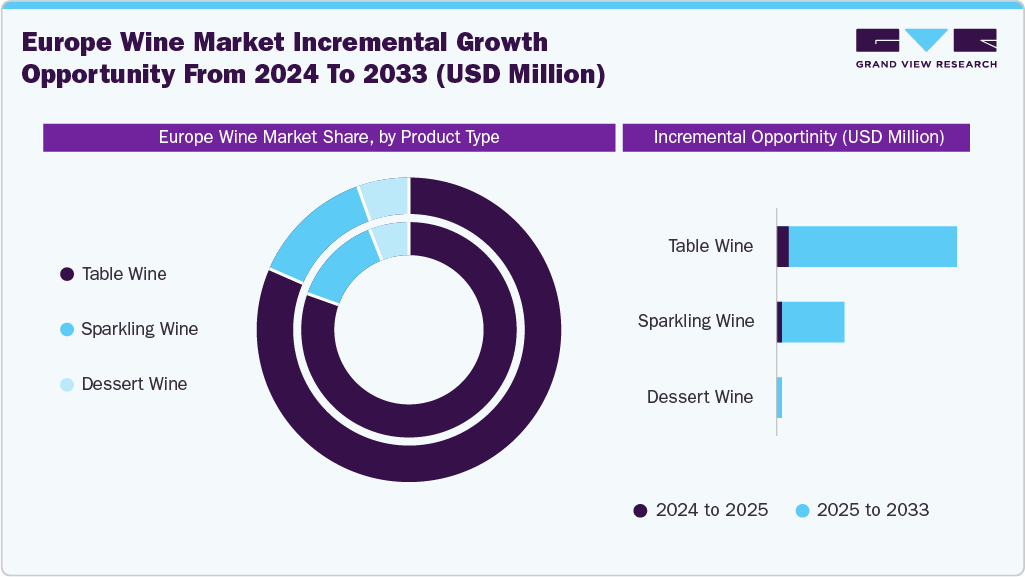

- By product, table wine led the market and accounted for a share of 71.4% in 2024.

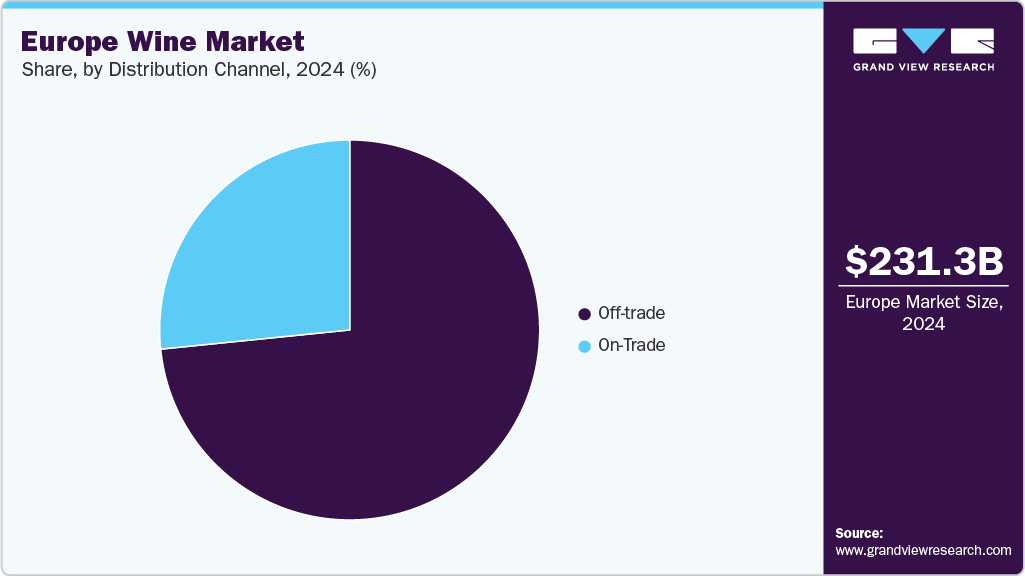

- By distribution channel, the off-trade sales held a share of 73.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 231.29 Billion

- 2033 Projected Market Size: USD 421.26 Billion

- CAGR (2025-2033): 7.0%

- Germany: Largest market in 2024

Wine has long been deeply embedded in European culture, particularly in countries like France, Italy, Spain, and Portugal, where it is traditionally consumed as part of daily meals. While overall per capita consumption has seen slight declines in some older markets due to aging populations and health consciousness, the broader wine market continues to expand due to diversification in product offerings and changing consumption habits.One key reason Europeans are increasingly interested in wine consumption is the rise of premiumization and experiential drinking. Consumers are shifting toward higher-quality wines, often opting for organic, biodynamic, and region-specific labels. This trend is particularly strong among younger and urban populations who value authenticity, sustainability, and craftsmanship. Wine tourism has also contributed to this interest, with regions like Bordeaux, Tuscany, and Rioja attracting visitors who develop a deeper appreciation for local wines and continue their consumption post-travel.

Moreover, the growth of e-commerce and direct-to-consumer platforms has made wine more accessible than ever before. Online wine clubs, subscription models, and digital wine education tools are helping consumers explore new varieties and regions. Retailers are also offering more diverse selections, including natural wines, vegan wines, and low-alcohol or alcohol-free options, catering to modern health and lifestyle trends.

Additionally, wine pairing with food and culinary integration is gaining traction. Europeans are increasingly exploring wine not just as a standalone drink but as a complementary element in gastronomy. This has led to rising consumption in both home settings and the food service industry, particularly in wine bars, fine-dining restaurants, and casual bistros.

Moreover, innovation in packaging, such as canned wine, small bottles, and eco-friendly containers, is attracting younger urban consumers who prioritize convenience and environmental responsibility. The rise of digital wine sales and subscription platforms has also expanded accessibility, especially post-COVID-19, as more consumers turn to online channels for discovering and purchasing wine. For instance, in March 2025, Aldi removed the protective aluminum and plastic sleeves from the corks of its own-label wines in the UK, making it the first supermarket in the country to do so. This change will be implemented across all 46 Aldi-branded corked wine lines, including popular varieties like Côtes du Rhone and Rioja Reserva, by the end of 2025. The initiative is expected to eliminate around 38 tonnes of unnecessary packaging annually, supporting Aldi’s broader commitment to sustainability and reducing waste while maintaining product quality.

Consumer Insights

The wine market and consumption in Europe continue to grow, driven by a mix of cultural traditions, evolving consumer preferences, and emerging lifestyle trends. Europe remains the global leader in wine consumption, accounting for over 50% of the world’s total.

This cultural foundation, combined with a strong focus on premiumization and quality, has sustained wine's popularity. Consumers are increasingly opting for high-quality, geographically indicated wines (such as AOC and DOCG), which account for over 60% of wine sales in France and Italy.

Similarly, in 2024, France led with 23.0 million hectoliters (mhl) despite a 3.6% year-on-year decline, while Italy followed closely with 22.3 mhl, remaining stable but 3.6% below its five-year average. Germany saw a 3.0% drop to 17.8 mhl, although interest among younger urban consumers is growing.

Spain and Portugal were notable exceptions to the overall downward trend. Spain’s consumption rose 1.2% to 9.9 mhl, driven by wine tourism and younger consumers. Portugal grew 0.5% to 5.6 mhl, 4.7% above the five-year average, and remains the only large EU market to exceed pre-pandemic levels (+10% vs. 2023). In contrast, the Netherlands saw a sharp 8.1% decline to 3.2 mhl, and Romania fell 11% to 3.0 mhl, though still above its five-year average. Austria remained stable at 2.2 mhl despite a slight drop, while Hungary rebounded 7.5% to 2.2 mhl, matching pre-pandemic figures.

Another key trend contributing to growth is the rise of sparkling wines, particularly in countries like Italy, France, Germany, and the UK Sparkling wine consumption in Europe increased by nearly 6% in 2023, with Prosecco leading the surge-Italy exported over 500 million bottles, a large share of which was consumed within Europe. The UK has emerged as the largest importer of Champagne, with over 21 million bottles imported in 2023. Meanwhile, still (table) wines remain the most widely consumed type across Europe, particularly in France, Italy, and Spain. Dessert wines like Port and Tokaji hold niche popularity in countries such as Portugal and Hungary.

Health-conscious consumption patterns are also reshaping the Europe wine industry. Moderate wine drinking, especially red wine, is often associated with the Mediterranean diet and heart health benefits, making it appealing to health-aware consumers. At the same time, the low- and no-alcohol wine category is gaining momentum, growing by 7% in 2023 in markets like Germany and the Netherlands. Sustainability is another major driver, with increasing demand for organic, biodynamic, and sustainably packaged wines. Innovations like lightweight bottles made from recycled glass, such as Ardagh Glass Packaging-Europe’s new 360g range, reflect this push toward reducing carbon footprints in wine production.

Despite overall growth, some countries are experiencing a decline in traditional wine consumption. In France, per capita wine intake has fallen from over 100 liters in the 1960s to around 40 liters in 2023. This decline is attributed to an aging population and shifting preferences among younger consumers, who are increasingly turning to craft beer, cocktails, and alcohol-free alternatives.

Product Insights

Table wine held the largest share of 71.4% of the overall Europe wine market revenue in 2024. As part of Europe’s long-standing culinary traditions, table wine is often viewed as a natural companion to food, making it a regular feature in home dining. Consumers, especially younger adults, are also showing growing interest in locally produced, sustainable, and organic table wines, which align with modern lifestyle values. The rise of casual, at-home socializing and accessible wine options in supermarkets and online channels has further contributed to the rising popularity of table wines across the region.

Sparkling wine is the fastest-growing segment, growing at a CAGR of 8.4% from 2025 to 2033. Sparkling wine consumption is increasing among people in Europe due to its association with celebration, sophistication, and evolving everyday enjoyment. Once reserved mainly for special occasions, sparkling wine is now being embraced for casual gatherings, brunches, and aperitifs, thanks to its refreshing taste and growing variety. The popularity of Prosecco, Cava, and other affordable options has made sparkling wine more accessible to a wider audience. Additionally, younger consumers are drawn to its festive appeal and lower alcohol content, while innovative packaging like single-serve bottles has boosted convenience and on-the-go consumption.

Distribution Channel Insights

The sales of wine through off-trade channels held the largest share of around 73.4% in 2024.Wine distribution sales are growing through off-trade channels in Europe due to increasing consumer preference for at-home consumption, affordability, and convenience. Supermarkets, liquor stores, and online platforms offer a wide variety of wines at competitive prices, making them attractive to both casual and regular wine drinkers. The rise of e-commerce, subscription boxes, and direct-to-consumer models has further expanded access to domestic and international wines. Additionally, post-pandemic habits have shifted many consumers toward enjoying wine in home settings, leading to steady growth in retail wine sales across the region.

Sales of wine through on-trade channels are expected to grow at a CAGR of 7.6% from 2025 to 2033. Wine distribution sales are growing through on-trade channels in Europe due to the rising popularity of wine in social and dining settings such as restaurants, bars, hotels, and wine lounges. Consumers increasingly seek curated wine experiences, food pairings, and premium selections that are often available only through these venues. On-trade channels also allow for personalized recommendations and enhanced tasting experiences, making them ideal for discovering new or regional wines. The resurgence of tourism, urban nightlife, and wine-focused events has further fueled demand, encouraging restaurants and hospitality businesses to expand their wine offerings and drive up on-trade sales.

Country Insights

Germany Wine Market Trends

Germany's wine industry accounted for the largest revenue share of 24.8% in 2024, driven by strong domestic consumption and a deep appreciation for local production, particularly its world-renowned Rieslings and increasingly impressive Spätburgunders (Pinot Noir). A significant driver is the growing consumer demand for sustainable, organic, and biodynamic wines, aligning with Germany's robust environmental consciousness. This focus on quality over quantity has led to a premiumization trend, with consumers willing to pay more for higher-tier German wines, recognizing the significant advancements in viticulture and winemaking in recent decades. The popularity of Sekt (German sparkling wine) also continues to be a key driver, catering to celebratory occasions and everyday enjoyment.

France Wine Market Trends

The France wine industry is anticipated to experience the fastest CAGR from 2025 to 2033. A primary driver is France's dominant position as a leading global exporter, with premium wines, particularly from Bordeaux, Burgundy, and Champagne, commanding high prices and driving significant revenue that sustains the domestic industry. Domestically, a deep-seated cultural appreciation for gastronomy ensures a continuous demand for wines that pair with traditional cuisine, reinforcing a focus on authenticity, appellation integrity, and the enduring value of regional specificities within the market. Moreover, the rise of low and no-alcohol alternatives, alongside efforts to engage younger consumers through approachable wines, innovative packaging (e.g., cans, bag-in-box for casual occasions), and digital marketing, are crucial for future growth.

Key Europe Wine Company Insights

The competitive landscape of the Europe wine market is shaped by the need for continuous investment in quality enhancement, efficient distribution, and brand differentiation to maintain market relevance and adaptability. Market dynamics are increasingly influenced by evolving consumer expectations for premium, convenient, and sustainable wine options. As awareness around wellness, lifestyle trends, and environmental impact grows, consumers are seeking wines that align with health-conscious choices, ethical sourcing, and everyday enjoyment. This shift is creating strong opportunities for wine producers and retailers who can deliver innovative, eco-friendly, and experience-driven offerings tailored to the preferences of modern American wine drinkers.

Key Europe Wine Companies:

- E. & J. Gallo Winery

- Constellation Brands, Inc.

- The Wine Group

- Treasury Wine Estates

- Concha Y Toro

- Castel Freres

- Accolade Wines

- Pernod Ricard

- Asahi Group Holdings, Ltd

- Beijing Yanjing Beer Group Co.

Recent Developments

-

In October 2024, Ardagh Glass Packaging-Europe launched a new lightweight range of 750ml Bordeaux and Schlegel wine bottles in Germany, reducing weight from 410g to 360g using up to 80% recycled glass. This results in a 12% cut in carbon emissions per bottle. Available in various colors and with screw caps or cork finishes, the range enhances sustainable packaging options in the European market.

-

In July 2024, Crurated, a digital platform specializing in rare and exceptional wines and spirits, entered into an exclusive partnership with Langosteria, a fine-dining Italian restaurant group. Through this collaboration, Langosteria will offer Crurated’s prestigious wine and spirit selections across its seven locations in Milan, Paris, Paraggi, and St. Moritz, with new venues planned in London and Miami. The partnership aims to elevate the fine dining experience by providing guests access to rare bottles, whose provenance and authenticity are guaranteed by Crurated’s blockchain technology.

Europe Wine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 244.48 billion

Revenue forecast in 2033

USD 421.26 billion

Growth rate

CAGR of 7.0% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in million liters, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, country

Country scope

UK; Germany; France; Italy; Spain

Key companies profiled

E. & J. Gallo Winery; Constellation Brands, Inc.; The Wine Group; Treasury Wine Estates; Concha Y Toro; Castel Freres; Accolade Wines; Pernod Ricard; Asahi Group Holdings, Ltd; Beijing Yanjing Beer Group Co.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Wine Market Report Segmentation

This report forecasts volume & revenue growth at regional and country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the Europe wine market report based on product, distribution channel, and country:

-

Product Outlook (Volume, Million Liters; Revenue, USD Million, 2021 - 2033)

-

Table Wine

-

Sparkling Wine

-

Dessert Wine

-

-

Distribution Channel Outlook (Volume, Million Liters; Revenue, USD Million, 2021 - 2033)

-

Off-trade

-

On-trade

-

-

Country Outlook (Volume, Million Liters; Revenue, USD Million, 2021 - 2033)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Frequently Asked Questions About This Report

b. The Europe wine market size was estimated at USD 231.29 billion in 2024 and is expected to reach USD 244.48 billion in 2025.

b. The Europe wine market is expected to grow at a CAGR of 7.0% from 2025 to 2030.

b. Table wine held the largest share of 71.4% of the overall Europe wine revenue in 2024. As part of Europe’s long-standing culinary traditions, table wine is often viewed as a natural companion to food, making it a regular feature in home dining. Consumers, especially younger adults, are also showing growing interest in locally produced, sustainable, and organic table wines, which align with modern lifestyle values.

b. Some of the key players operating in the Europe wine market include E. & J. Gallo Winery, Constellation Brands, Inc., The Wine Group, Treasury Wine Estates, Concha Y Toro, Castel Freres, Accolade Wines, Pernod Ricard, Asahi Group Holdings, Ltd, Beijing Yanjing Beer Group Co.

b. European wine market is growing steadily, driven by a combination of cultural heritage, evolving consumer preferences, and emerging lifestyle trends. Wine has long been deeply embedded in European culture, particularly in countries like France, Italy, Spain, and Portugal, where it is traditionally consumed as part of daily meals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.