- Home

- »

- Homecare & Decor

- »

-

Event Management Market Size, Industry Report, 2033GVR Report cover

![Event Management Market Size, Share & Trends Report]()

Event Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Event Type (MICE, Weddings, Social, Sports, Music & Entertainment), By Service Type, By Delivery Mode, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-750-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Event Management Market Summary

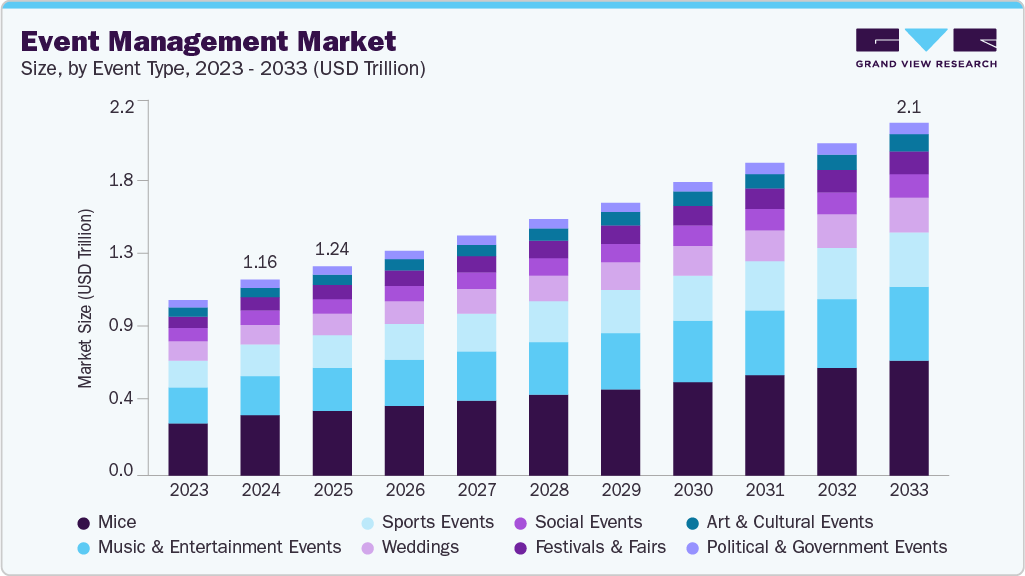

The global event management market size was estimated at USD 1,160.4 billion in 2024 and is projected to reach USD 2,089.6 billion by 2033, growing at a CAGR of 6.7% from 2025 to 2033. The rising demand for corporate gatherings and experiential events is a key factor driving the expansion of the global event management industry.

Key Market Trends & Insights

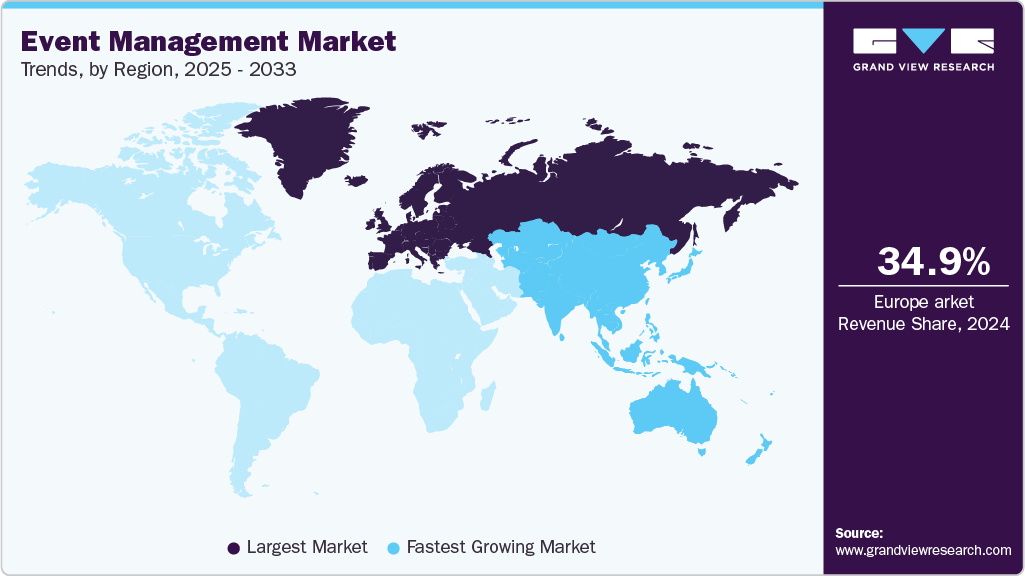

- Europe dominated the event management market with the largest revenue share of 34.86% in 2024.

- The event management software industry in Germany is expected to grow at a significant CAGR over the forecast period.

- By event type, the MICE segment led the market with the largest revenue share of 30.75% in 2024.

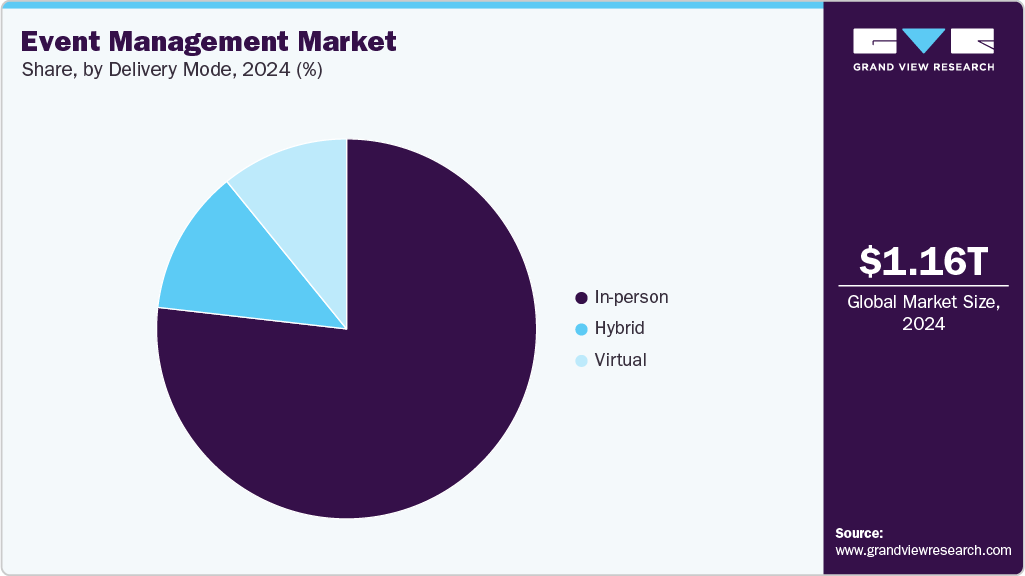

- Based on delivery mode, the in-person segment accounted for the largest market revenue share in 2024.

- By service type, the event production & technical services segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,160.4 Billion

- 2033 Projected Market Size: USD 2,089.6 Billion

- CAGR (2025-2033): 6.7%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

As enterprises increasingly seek to enhance their brand visibility, engage employees, launch products, and foster partnerships, professional event services are being increasingly contracted to handle logistics, production, and attendee experience. The rising corporate demand for virtual and hybrid events is driving the growth of the event management industry. Many organizations are inclined to host events combining in-person and online participation to reach broader audiences, reduce travel/logistical costs, and maintain continuity during disruptions. For instance, in North America, 15% of events are expected to take place in a hybrid format in 2025, reflecting the growing preference for flexibility. Furthermore, corporations have been investing in professional event management software to automate processes such as registration, attendee engagement, and post-event analytics, thereby increasing efficiency.

One leading trend in the event management industry has been the integration of artificial intelligence, augmented reality (AR), virtual reality (VR), and data analytics into event planning, operation, and attendee engagement. AI tools are being used to personalize experiences, predict attendance, manage content scheduling, automate customer interactions, and deliver real-time insights for improved decision-making.

For example, in 2024, Eventdex introduced an AI assistant across several modules of its platform (including the admin portal, badge printing, and matchmaking) to support event planners in resolving attendee queries and optimizing event flow. In addition, many event management software vendors are enhancing mobile and cloud-based platforms with predictive analytics and machine learning to offer tailored recommendations and improve engagement. Therefore, technological integration is one of the major drivers of the global event management industry.

Consumer Surveys & Insights

According to survey data from Bizzabo and Momencio (2025), events continue to play a pivotal role in fostering consumer engagement and connection, both in physical and virtual environments. A considerable proportion of consumers (55%) indicated that events made them feel more connected, while 65% believed that live events enhanced product understanding, emphasizing the importance of experiential and hands-on engagement.

However, virtual events were reported to face engagement challenges, with 67.7% of marketers highlighting difficulties in sustaining attendee interest during online sessions. This demonstrates that while digital formats expand accessibility, they require innovative strategies and tools to maintain audience attention and deliver value comparable to in-person experiences.

At the same time, a strong reliance on technology has been identified as a critical trend in shaping attendee satisfaction and operational efficiency. Nearly 89% of event professionals agreed that technology significantly improves experiences, and 63% of respondents emphasized the importance of engagement tools for future strategies. Despite this, hybrid event models have introduced complexities, with 50% of organizers reporting challenges in moderating Q&A sessions and 46% citing networking as a difficult aspect to manage.

These insights reveal that while digital integration and hybrid formats are advancing as industry standards, the focus must remain on enhancing interactivity, reducing friction in audience participation, and creating seamless networking opportunities to ensure sustainable event success.

Event Type Insights

The MICE segment led the market with the largest revenue share of 30.75% in 2024. Corporate firms and industry associations continued to allocate substantial budgets toward knowledge exchange, networking, and professional development activities. The accelerated globalization of businesses has created a consistent demand for platforms where strategic collaborations, product launches, and international trade showcases can be facilitated. The recurring need for structured and large-scale corporate gatherings positioned MICE as the most revenue-generating event type.

The music and entertainment events segment is expected to grow at the fastest CAGR of 7.1% from 2025 to 2033, due to the rising popularity of live concerts, cultural festivals, and large-scale entertainment experiences. The driver for this growth has been the increased consumer expenditure on leisure and lifestyle activities, fueled by younger demographics prioritizing experiential consumption over material goods. The rapid return of festivals and live entertainment after pandemic restrictions further accelerated investments in this segment, creating high growth momentum.

Service Type Insights

The event production and technical services segment led the market with the largest revenue share of 29.18% in 2024, as organizations prioritized high-quality audio-visual setups, stage design, and advanced lighting systems to ensure immersive experiences for both physical and hybrid audiences. The reliance on specialized technical infrastructure to deliver seamless event execution, which became essential in enhancing brand visibility and audience engagement, is driving the growth of the event management industry.

The registration, ticketing, and attendee management services segment is expected to grow at the fastest CAGR of 8.0% from 2025 to 2033. The driver for this rise has been the strong adoption of digital ticketing platforms and cloud-based attendee management systems, which streamline entry processes, provide real-time analytics, and improve security. This shift toward automation and convenience has driven higher demand from both event organizers and participants, further driving the growth of the event management industry.

Delivery Mode Insights

The in-person events segment led the market with the largest revenue share of 76.81% in 2024, as physical gatherings were viewed as more effective in building trust, generating leads, and facilitating spontaneous networking opportunities. The driver for this market share was the unique value of face-to-face interaction, which remained irreplaceable for stakeholders in sectors such as corporate business, exhibitions, and weddings.

The virtual events segment is expected to grow at the fastest CAGR of 9.8% from 2025 to 2033, driven by the cost-efficiency, scalability, and accessibility they offer. The driver for this growth has been the increasing use of digital platforms that allow global participation without geographical or logistical constraints, making them highly attractive for academic conferences, webinars, and multinational corporate meetings.

Regional Insights

The North America event management market is anticipated to grow at a significant CAGR during the forecast period, due to the region’s extensive corporate sector, high consumer spending on leisure, and widespread adoption of event technology solutions. The U.S. and Canada were recognized as primary hubs for international conferences, trade shows, and large-scale entertainment events. The presence of leading technology providers and event service operators enabled the seamless integration of advanced solutions such as data analytics, AI-powered attendee engagement, and virtual streaming platforms.

Strong demand from sectors such as IT, healthcare, and finance contributed to consistent activity in corporate meetings and exhibitions. Moreover, large-scale cultural events, including sports championships and film festivals, reinforced the region’s reputation as a leading event destination. The blend of technological innovation and high consumer engagement ensured North America’s continued relevance in shaping global event management industry standards.

U.S. Event Management Market Trends

The event management market in the U.S. is anticipated to grow at a significant CAGR during the forecast period, driven by the scale and diversity of events across corporate, cultural, and sports segments. A well-developed infrastructure of convention centers, stadiums, and entertainment venues allowed the U.S. to host global mega-events such as CES in Las Vegas and Super Bowl-related experiences. Corporations increasingly invest in conferences, brand activations, and incentive programs to strengthen customer and employee engagement.

In addition, the adoption of hybrid formats was accelerated, enabling both physical and virtual participation to maximize audience reach. A strong sponsorship ecosystem, coupled with high consumer interest in live entertainment and sports, further boosted event-related revenues. The U.S. market’s resilience was demonstrated by its rapid recovery from pandemic-related disruptions, with both corporate and cultural events experiencing strong demand, thereby reinforcing its role as a major contributor to the global event management industry expansion.

Europe Event Management Market Trends

Europe dominated the event management market with the largest revenue share of 34.86% in 2024, as the region benefited from a mature events ecosystem supported by advanced infrastructure and a high density of international exhibitions. Cities such as Frankfurt, Barcelona, and Paris have been positioned as global hubs for trade fairs, conferences, and cultural festivals, attracting multinational corporations and global audiences. This dominance was driven by strong government and private sector investments in tourism, convention centers, and hospitality, which enabled seamless hosting of mega-events.

In addition, sustainability initiatives mandated by European regulators influenced event planning practices, prompting organizers to adopt eco-friendly event production and resource-efficient logistics. As a result, Europe’s established reputation as a preferred destination for large-scale corporate gatherings and entertainment events is driving the growth of the global event management industry.

Asia Pacific Event Management Market Trends

The event management market in the Asia Pacific is anticipated to grow at the fastest CAGR of 8.3% from 2025 to 2033, driven by rapid urbanization, rising disposable incomes, and the growing appeal of entertainment and corporate events. Countries such as China, India, and Singapore increasingly hosted large-scale exhibitions, music festivals, and technology conferences that attracted international participation. Government policies promoting tourism and cultural exchange contributed to higher event inflows, while advancements in digital platforms encouraged hybrid and virtual participation.

Rising corporate investments in employee engagement, product launches, and regional conventions further accelerated the market expansion. The increasing popularity of large concerts, such as K-pop festivals in South Korea and electronic music events in Southeast Asia, highlighted the region’s shift toward entertainment-driven experiences. This momentum, supported by infrastructure development and younger population demographics, allowed the Asia-Pacific region to demonstrate unparalleled growth potential within the global event management industry.

Key Event Management Company Insights

In the global event management industry, the competitive landscape is characterized by a mix of large, vertically integrated firms, specialist software vendors, and niche technology providers, all vying for differentiation through feature depth, geographic reach, and flexibility. Key companies such as Cvent have been strongly positioned by offering full-stack SaaS solutions supporting in-person, virtual, and hybrid events, enhanced with AI-based insights and venue sourcing tools.

Meanwhile, platforms like Eventbrite, Bizzabo, Aventri, and RainFocus have competed by focusing on user experience, event analytics, marketing integrations, and superior support for hybrid and digital-first experiences. On the service side, large event production and management companies such as Freeman, GES, Informa, Vista Events, Creative Group, and others have remained important players, servicing large-scale corporations, entertainment, sports, and trade shows, leveraging their operations expertise, global footprint, and capacity to deliver complex, multi-venue events.

Key Event Management Companies:

The following are the leading companies in the event management market. These companies collectively hold the largest market share and dictate industry trends.

- Informa Group

- Live Nation Entertainment

- Cvent

- Eventbrite

- CTS Eventim

- QuintEvents

- SeatGeek

- Airmeet

- Bevy

- MKG

Recent Developments

-

In December 2024, Hubli announced an integration with Amadeus Cytric Easy, a travel and expense tool embedded in Microsoft Teams. The integration allows Cytric Easy users to book small meeting venues, group hotel stays, and internal office spaces.

-

In December 2024, Prismm (formerly Allseated), a provider of spatial design technology, partnered with HoneyBook, a client relationship management (CRM) platform, to integrate their services and streamline event planning for professionals.

Event Management Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 1,240.9 billion

Revenue forecast in 2033

USD 2,089.6 billion

Growth rate

CAGR of 6.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Event type, service type, delivery mode, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

Informa Group; Live Nation Entertainment; Cvent; Eventbrite; CTS Eventim; QuintEvents; SeatGeek; Airmeet; Bevy; MKG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Event Management Market Report Segmentation

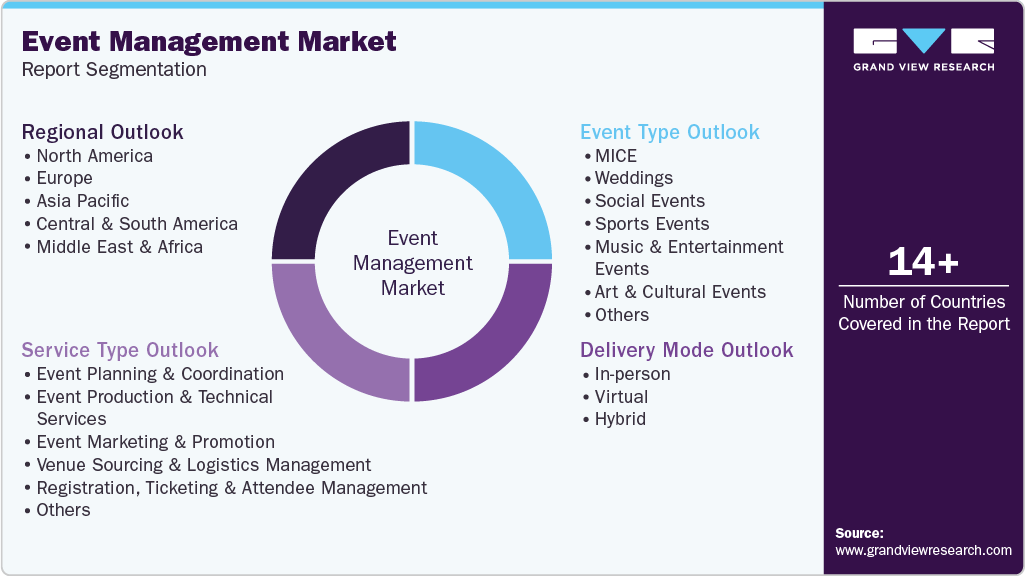

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global event management market report based on event type, service type, delivery mode, and region:

-

Event Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

MICE

-

Weddings

-

Social Events

-

Sports Events

-

Music and Entertainment Events

-

Art and Cultural Events

-

Political and Government Events

-

Festivals and Fairs

-

-

Service Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Event Planning & Coordination

-

Event Production & Technical Services

-

Event Marketing & Promotion

-

Venue Sourcing & Logistics Management

-

Registration, Ticketing & Attendee Management

-

Others

-

-

Delivery Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

In-person

-

Virtual

-

Hybrid

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global event management market was estimated at USD 1,160.4 billion in 2024 and is expected to reach USD 1,240.9 billion in 2025.

b. The global event management market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2033 to reach USD 2,089.6 billion by 2033.

b. The MICE event type accounted for the largest share of 30.75% of the event management market in 2024. Corporate firms and industry associations continued to allocate substantial budgets toward knowledge exchange, networking, and professional development activities.

b. Key players in the event management market are Informa Group, Live Nation Entertainment, Cvent, Eventbrite, CTS Eventim, QuintEvents, SeatGeek, Airmeet, Bevy, MKG, among others.

b. Key factors driving the event management market growth include the rising demand for corporate gatherings and experiential events, as well as the rising corporate demand for virtual and hybrid events, among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.