- Home

- »

- Next Generation Technologies

- »

-

Explainable AI Market Size & Share, Industry Report, 2030GVR Report cover

![Explainable AI Market Size, Share & Trends Report]()

Explainable AI Market (2025 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment, By Application (Fraud & Anomaly Detection, Drug Discovery & Diagnostics, Predictive Maintenance), By End Use, By Region, and Segment Forecasts

- Report ID: GVR-4-68040-074-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Explainable AI Market Summary

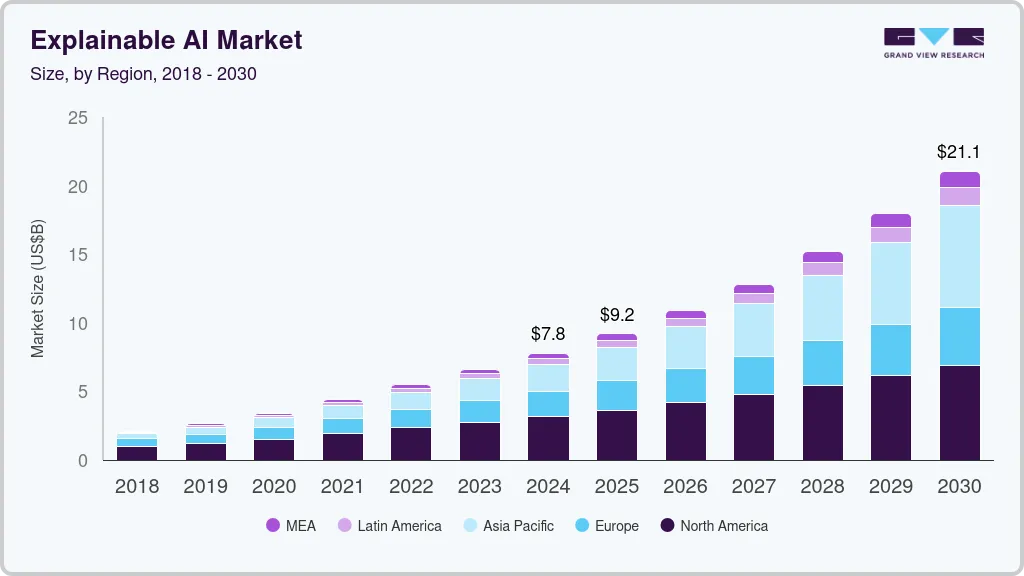

The global explainable ai market size was estimated at USD 7.79 billion in 2024 and is projected to reach USD 21.06 billion by 2030, growing at a CAGR of 18.0% from 2025 to 2030. There is a rising interest in AI solutions that can handle various data types, such as images, text, and numerical or genomic data.

Key Market Trends & Insights

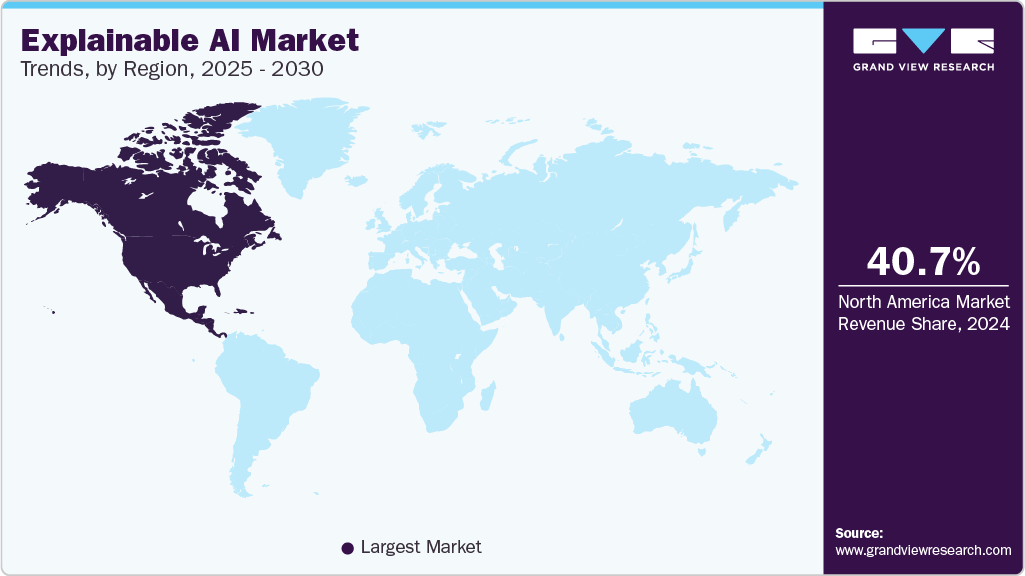

- North America dominated the explainable AI market with a share of 40.7% in 2024.

- The U.S. is a major driver of the explainable AI industry, supported by strong AI research and innovation hubs.

- By component, the solution segment accounted for the largest revenue share of 81.2 % in 2024.

- By deployment, the on-premises segment held the largest revenue share in 2024.

- By application, the fraud and anomaly detection segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.79 Billion

- 2030 Projected Market Size: USD 21.06 Billion

- CAGR (2025-2030): 18.0%

- North America: Largest market in 2024

Multimodal integration enables AI to synthesize these different inputs into a unified understanding, offering a more comprehensive view of complex problems. This approach supports more accurate, context-rich decision-making, especially in critical sectors such as healthcare, where decisions often depend on multiple data sources. This trend strongly supports the expansion of the explainable AI industry, as users require both transparency and integration in decision support tools. For instance, in May 2024, Fujitsu has developed explainable AI that integrates multimodal data-text, images, and numerical values-into knowledge graphs to support decisions in genomic medicine and cancer treatment.As deep learning models become more complex, it becomes harder to interpret how they reach decisions. This complexity creates a gap between model performance and user trust. Developers increasingly require tools that clarify the internal processes of these models. These tools help identify key features influencing predictions. Users also need transparency to ensure fairness, accountability, and compliance. This has led to a surge in demand for explainable AI frameworks. Explainability supports model debugging and validation in real-world deployments. Overall, it strengthens confidence in AI systems across sensitive and regulated industries.

Demand for explainable AI is increasing across sensitive sectors due to the high need for transparency and accountability. Healthcare organizations are using XAI to clarify diagnostic decisions, improve patient outcomes, and support medical professionals in making evidence-based choices. In finance, XAI helps ensure transparency in credit scoring, fraud detection, and algorithmic trading, aligning with regulatory expectations around fairness and bias mitigation. Defense agencies rely on explainable systems to validate mission-critical AI outputs, ensuring operational reliability and reducing risks in high-stakes environments. Legal professionals use XAI to understand, audit, and challenge algorithmic decisions, particularly in areas involving civil rights, sentencing, and compliance. These sectors often operate under strict regulatory scrutiny, which increases pressure to make AI models understandable and defensible.

Component Insights

The solution segment accounted for the largest revenue share of 81.2 % in 2024. This strong share is driven by increased demand for AI tools and platforms that help organizations make AI decisions more transparent and understandable. Companies across industries are prioritizing investment in explainable AI solutions to ensure compliance with emerging regulations and to build trust with end users. These solutions also address the complexity of deep learning models by providing clear insights into how AI reaches its conclusions. As a result, the solution segment has experienced rapid growth and continues to attract significant attention from businesses seeking to enhance AI accountability. This trend is expected to persist as organizations focus on deploying responsible AI technologies.

Explainable AI (XAI) consulting services specialize in helping organizations adopt and implement AI solutions that are transparent, interpretable, and accountable. These services focus on ensuring that AI models and systems can explain their decisions and behaviors, enhancing trust, understanding, and compliance, which is fueling the market growth. XAI consultants work with organizations to develop a strategy and roadmap for incorporating explainability into their AI initiatives. Innovative offerings by key players in the market, for instance, Google Cloud, which offers Explainable AI as a service, providing tools and frameworks to enhance the interpretability of AI models, is propelling the explainable AI market. It includes features such as integrated gradients and feature importance, which help users understand how to input features to contribute to model predictions.

Deployment Insights

The on-premises segment held the largest revenue share in 2024. Using on-premises explainable AI can provide several benefits, such as improved data security, reduced latency, and increased control over the AI system. Moreover, it may be preferable for organizations subject to regulatory requirements limiting the use of cloud-based services. Organizations use various techniques such as rule-based systems, decision trees, and model-based explanations to implement on-premises explainable AI. These techniques provide insights into how the AI system arrived at a particular decision or prediction, allowing users to verify the system's reasoning and identify potential biases or errors.

The cloud segment is growing in the explainable AI industry. Cloud platforms provide scalable infrastructure and accessibility that support the deployment of explainable AI solutions across industries. They enable easier integration of AI models with large datasets and facilitate collaboration among stakeholders. The flexibility and cost-efficiency of cloud services attract businesses to adopt explainable AI technologies hosted on the cloud. This growth is driven by the increasing demand for remote AI capabilities and the need for faster, more transparent AI decision-making processes. The cloud segment is expected to continue expanding as more organizations move their AI workloads to cloud environments.

Application Insights

The fraud and anomaly detection segment accounted for the largest revenue share in 2024, due to its critical role in enhancing security across various industries, especially in financial services. Organizations are increasingly adopting explainable AI to detect and prevent fraudulent activities while ensuring transparency in decision-making processes. This transparency is essential for regulatory compliance, as businesses must demonstrate how AI systems identify and respond to suspicious behaviors. Moreover, explainable AI improves the accuracy of fraud detection by providing clear insights into the patterns and anomalies flagged by the system, enabling faster and more effective responses.

Predictive maintenance is experiencing significant growth in the explainable AI market. This growth is driven by industries seeking to reduce downtime and maintenance costs by accurately predicting equipment failures before they occur. Explainable AI helps maintenance teams understand the reasoning behind predictions, increasing trust in AI-driven decisions. The transparency provided by explainable AI enables better planning and resource allocation, improving operational efficiency. As manufacturing and industrial sectors increasingly adopt IoT and AI technologies, the demand for explainable predictive maintenance solutions continues to rise. This trend supports safer, more reliable, and cost-effective asset management across various industries.

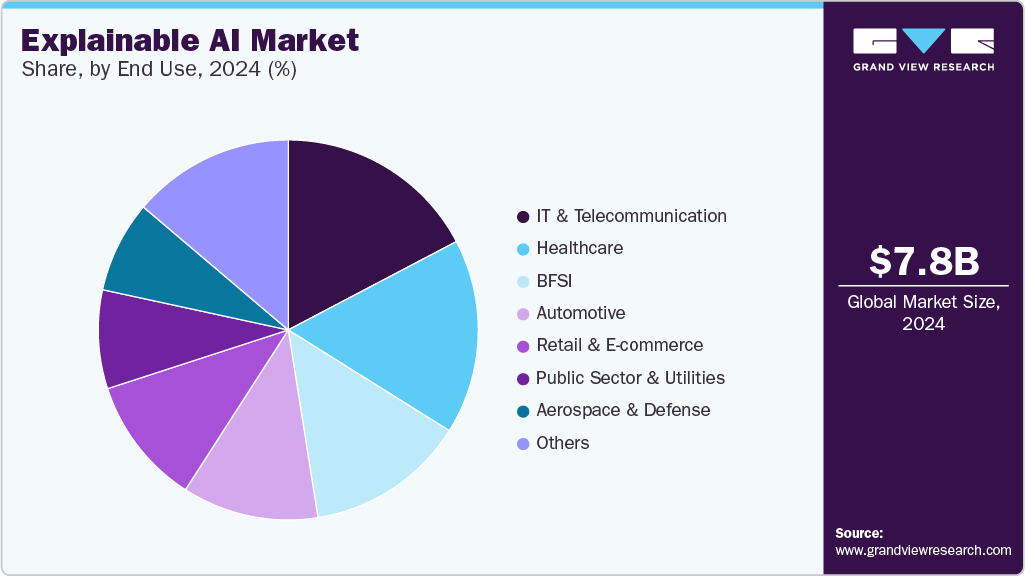

End Use Insights

The IT & telecommunication sector accounted for the highest revenue share in 2024. The rollout of 5G and the Internet of Things (IoT) is enabling organizations and individuals to collect more real-world data in real time. Artificial intelligence (AI) systems can use this data to become increasingly sophisticated and capable. Mobile carriers can enhance connectivity and their customers' experiences thanks to AI in the telecom sector. Mobile operators can offer better services and enable more people to connect by utilizing AI to optimize and automate networks. For instance, while AT&T anticipates and prevents network service interruptions by utilizing predictive models that use AI and statistical algorithms, Telenor uses advanced data analytics to lower energy usage and CO2 emissions in its radio networks.

Healthcare is rapidly growing within the explainable AI industry. The increasing use of AI for diagnostics, treatment planning, and patient monitoring demands transparency and trust in AI decisions. Explainable AI helps medical professionals understand the reasoning behind AI-generated insights, enhancing clinical acceptance and regulatory compliance. This transparency supports more accurate and personalized healthcare delivery, improving patient outcomes. Growing adoption of AI technologies in genomics, medical imaging, and drug discovery further fuels demand for explainable AI in healthcare. The sector’s focus on safety, ethics, and accountability makes explainability essential for wider AI integration.

Regional Insights

North America dominated the explainable AI market with a share of 40.7% in 2024. North America leads the market due to advanced technological infrastructure and strong AI research. The presence of major AI companies and healthcare institutions drives adoption. Strict regulatory requirements increase demand for transparent AI solutions. Growing investments in AI startups support market expansion. Awareness about AI ethics and accountability is high, boosting explainable AI use.

U.S. Explainable AI Market Trends

The U.S. is a major driver of the explainable AI industry, supported by strong AI research and innovation hubs. Leading technology companies and startups actively develop transparent AI solutions. Healthcare, finance, and defense sectors are early adopters due to regulatory and ethical concerns. Significant government funding and private investments accelerate growth. The focus on AI accountability and trust fuels demand across industries.

Europe Explainable AI Market Trends

Europe shows steady growth in the explainable AI industry, driven by data privacy laws such as GDPR. Governments and organizations focus on ethical AI deployment. The healthcare and automotive industries are key adopters. Collaborative AI research initiatives enhance technology development. Demand for AI transparency rises due to strict regulatory environments.

Asia Pacific Explainable AI Market Trends

Asia Pacific is rapidly emerging in the explainable AI industry with expanding digital transformation efforts. Countries such as China, Japan, and India invest heavily in AI technologies. The growing healthcare and manufacturing sectors fuel adoption. Increased focus on AI regulations encourages explainability. Rising awareness and government support drive market growth.

Key Explainable AI Company Insights

Some of the key companies in the market include Amelia US LLC, BuildGroup, Factmata, Google LLC, IBM Corporation, Kyndi, and Microsoft. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Google LLC has developed tools such as What-If Tool and TCAV (Testing with Concept Activation Vectors), which help users understand how AI models make decisions by visualizing data and explaining model predictions. Google also integrates explainability features in its AI platforms to enhance transparency and fairness. Their ongoing research aims to make AI systems more interpretable for a wide range of applications, from healthcare to finance.

-

IBM Corporation offers AI Explainability 360, an open-source toolkit that provides a variety of algorithms to interpret and explain AI models. IBM focuses on building trustworthy AI by enabling users to understand model behavior, detect biases, and comply with regulations through explainability. They continue to collaborate with academic and industry partners to advance standards and best practices in explainable AI.

Key Explainable AI Companies:

The following are the leading companies in the explainable AI market. These companies collectively hold the largest market share and dictate industry trends.

- Amelia US LLC

- BuildGroup

- DataRobot, Inc.

- Ditto.ai

- DarwinAI

- Factmata

- Google LLC

- IBM Corporation

- Kyndi

- Microsoft

Recent Developments

-

In May 2025, IBM Corporation and Amazon Web Services, Inc. are collaborating to advance agentic AI with new tools such as IBM watsonx Orchestrate integrated with Amazon Q index, enabling AI agents to access domain-specific data for personalized enterprise solutions. They are also enhancing AI governance with watsonx.governance to ensure responsible, transparent, and explainable AI throughout its lifecycle.

-

In January 2025, IBM Corporation partnered with e&, a telecommunications company in the UAE, to launch an advanced AI governance platform called watsonx governance, aimed at ensuring transparency, compliance, and ethical oversight across AI systems. This collaboration focuses on real-time risk management, bias detection, and full traceability to promote responsible and explainable AI operations at scale.

-

In July 2024, Teradata, a U.S.-based data analytics company, and DataRobot integrated their platforms to enable enterprises to build, scale, and deploy AI models with flexibility, security, and trust, supporting explainable and governed AI. This collaboration allows users to operationalize DataRobot models within Teradata VantageCloud using ClearScape Analytics’ Bring Your Own Model feature, accelerating AI innovation safely and cost-effectively.

Explainable AI Market Report Scope

Report Attribute

Details

Market Size value in 2025

USD 9.19 billion

Revenue forecast in 2030

USD 21.06 billion

Growth rate

CAGR of 18.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Component, deployment, application, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Amelia US LLC; BuildGroup; DataRobot, Inc.; Ditto.ai; DarwinAI; Factmata; Google LLC; IBM Corporation; Kyndi; Microsoft

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Explainable AI Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global explainable AI market report based on component, deployment, application, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Fraud and Anomaly Detection

-

Drug Discovery & Diagnostics

-

Predictive Maintenance

-

Supply Chain Management

-

Identity and Access Management

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

BFSI

-

Aerospace & Defense

-

Retail and E-commerce

-

Public Sector & Utilities

-

IT & Telecommunication

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global explainable AI market accounted for USD 7.79 billion in 2024 and is projected to reach USD 9.19 billion by 2025

b. The global explainable AI market is expected to grow at a compound annual growth rate of 18.0% from 2025 to 2030 to reach USD 21.06 billion by 2030.

b. North America dominated the explainable AI market with a share of 40.7% in 2024. This is attributable to rising healthcare awareness coupled with cloud-based technologies acceptance and constant research and development initiatives.

b. Key players covered in the report include Amelia US LLC, BuildGroup, DataRobot, Inc., Ditto.ai, DarwinAI, Factmata, Google LLC, IBM Corporation, Kyndi, Microsoft

b. The increase in technologically advanced solutions and the rising need for automation are prime factors boosting the demand for an explainable AI market. The transparency in the process offered by the explainable AI further boosts their adoption across multiple end-use sectors, globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.