- Home

- »

- IT Services & Applications

- »

-

Exposure Management Market Size, Industry Report, 2030GVR Report cover

![Exposure Management Market Size, Share, & Trends Report]()

Exposure Management Market (2025 - 2030 ) Size, Share, & Trends Analysis Report By Component (Solution, Services), By Deployment (Cloud, On-Premise), By Application (Vulnerability Management, Threat Intelligence), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-502-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Exposure Management Market Summary

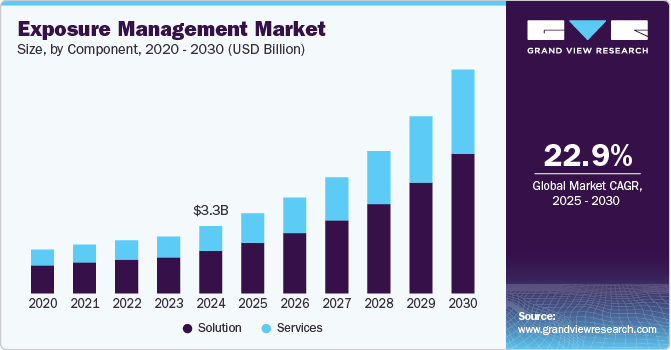

The global exposure management market size was estimated at USD 3.3 billion in 2024 and is projected to reach USD 10.91 billion by 2030, growing at a CAGR of 22.9% from 2025 to 2030. The exposure management market identifies, assesses, and manages potential security vulnerabilities, threats, and risks across an organization's IT infrastructure, digital assets, and business processes.

Key Market Trends & Insights

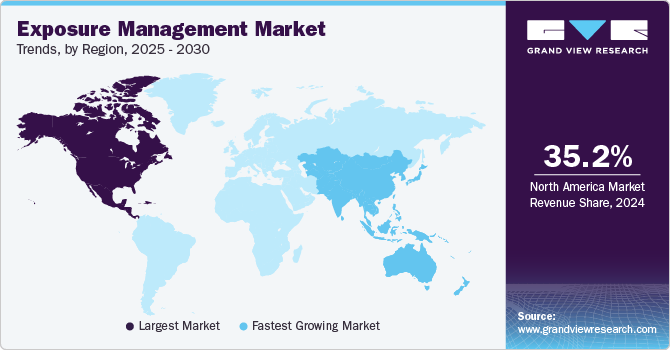

- North America held a significant share of over 35% of the exposure management industry in 2024.

- The exposure management industry in the U.S. is expected to grow significantly from 2025 to 2030.

- Based on component, the solution segment accounted for a market share of over 63% in 2024.

- Based on application, the vulnerability management segment accounted for the largest market share of over 29% in 2024.

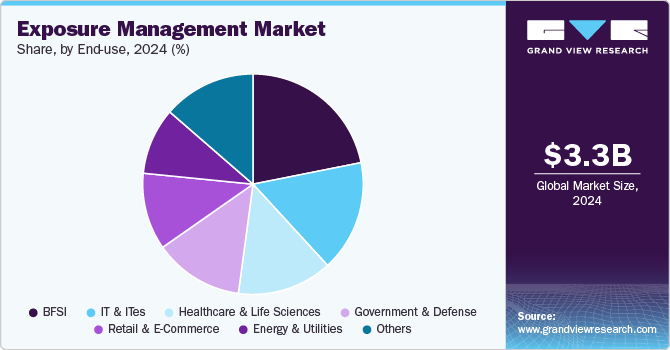

- Based on end-use, the BFSI segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.3 Billion

- 2030 Projected Market Size: USD 10.91 Billion

- CAGR (2025-2030): 22.9%

- North America: Largest market in 2024

Exposure management tools help enterprises improve their cybersecurity posture by proactively managing risks, detecting vulnerabilities, and mitigating cyber threats. As cyberattacks become more frequent and sophisticated, organizations across industries increasingly adopt advanced tools to detect and manage vulnerabilities in real time. Cybercriminals have evolved their strategies, using more targeted and complex methods, such as ransomware, advanced persistent threats (APTs), and zero-day exploits. These attacks are growing in number and sophistication, making it increasingly difficult for traditional security measures.

Critical sectors like BFSI (Banking, Financial Services, and Insurance), government, Attack Surface Management, and energy are prime targets due to the sensitive nature of the data they handle and their essential role in the economy and national security. This heightened threat landscape has driven the adoption of Exposure Management Solutions to address vulnerabilities before they are exploited. These tools allow organizations to continuously monitor their assets, assess risk, and apply proactive mitigation measures. Real-time threat detection systems are crucial to identify malicious activities early, reducing the potential impact.

The shift toward cloud computing and hybrid IT environments has revolutionized how organizations manage their infrastructure and data. Cloud adoption offers businesses flexibility, scalability, and cost-efficiency, enabling them to access resources on-demand and expand their operations without heavy investments in on-premises infrastructure. However, as companies increasingly migrate their data and applications to the cloud, they face new challenges in managing security risks. Unlike traditional on-premises systems, cloud environments are dynamic, decentralized, and often shared with third-party providers, expanding the potential attack surface.Exposure management solutions have become essential for securing both on-premises and cloud-based infrastructures, as they provide the necessary tools to manage and mitigate risks across hybrid environments. These solutions offer visibility into potential vulnerabilities and provide real-time threat detection, allowing organizations to identify and address security gaps in public and private cloud environments.

As emerging markets in Asia Pacific, Latin America, and the Middle East enhance their digital infrastructures, exposure management solutions will experience growing demand. Due to rapid digitalization and evolving attack tactics, cyber threats are increasingly targeting these regions. This has heightened the need for comprehensive cybersecurity solutions to safeguard critical data and systems. Exposure management tools will play a vital role in addressing vulnerabilities and mitigating risks in these developing economies.

The deployment of exposure management tools can present challenges for small and mid-sized businesses (SMBs) due to the high initial investment required for software, hardware, and employee training. These upfront costs may be a significant barrier for SMBs with limited cybersecurity budgets. In addition, the complexity of implementation can be a deterrent, as some solutions need to be deeply integrated with existing IT systems and infrastructures. This integration process can be time-consuming, requiring specialized expertise and potentially disrupting ongoing operations during setup.

Component Insights

The solution segment accounted for a market share of over 63% in 2024. As cyberattacks become more frequent and sophisticated, organizations increasingly rely on exposure management solutions to detect threats and manage vulnerabilities in real time. These tools help businesses proactively identify risks, allowing them to mitigate potential breaches and prevent operational disruptions. Furthermore, the rapid expansion of digital transformation initiatives and the proliferation of Internet of Things (IoT) devices have significantly increased attack surfaces, making organizations more vulnerable to cyber threats. Exposure management solutions are essential in securing these new digital assets, including IoT-connected devices, applications, and infrastructure. These solutions provide comprehensive protection across a broader attack surface by continuously monitoring these assets and addressing potential vulnerabilities.

The services segment is anticipated to grow at a significant CAGR of 23.5% during the forecast period. The complexity of integrating exposure management solutions with existing IT infrastructures often presents challenges for organizations lacking technical expertise. Professional services, including deployment, configuration, and customization, are essential to ensure smooth integration and effective implementation. Moreover, exposure management is an ongoing process requiring continuous monitoring and maintenance to stay ahead of evolving threats. Managed detection and response (MDR), incident response, and vulnerability management provide organizations with expert support to detect, address, and mitigate real-time risks, ensuring business continuity.

Deployment Insights

The cloud segment accounted for the largest market share in 2024. As organizations accelerate their migration to the cloud, securing cloud environments has become a top priority. Cloud exposure management solutions provide essential tools for monitoring, detecting, and mitigating vulnerabilities across various cloud infrastructures. These solutions ensure that businesses can safeguard their digital assets and data while benefiting from the flexibility and scalability of the cloud. In addition, many businesses are adopting hybrid and multi-cloud strategies to optimize performance, cost efficiency, and redundancy. This complexity requires unified exposure management solutions to secure assets across different cloud platforms. Such solutions enable consistent risk management and compliance, helping businesses navigate the challenges of a multi-cloud environment and enhance their security posture.

The on-premises segment is expected to grow significantly during the forecast period. On-premises exposure management solutions provide enhanced security control as all operations remain within the organization’s physical boundaries, reducing the risk of external breaches. This is especially important for businesses concerned about vulnerabilities in third-party cloud services, where data may be exposed to external risks. With on-premises solutions, organizations have direct oversight and control over their security infrastructure, enabling them to monitor, manage, and protect critical systems and data more effectively, ensuring higher security and compliance.

Application Insights

The vulnerability management segment accounted for the largest market share of over 29% in 2024. Organizations are increasingly adopting a proactive approach to cybersecurity, shifting away from reactive measures to prevent attacks before they occur. This focus on proactive security helps identify vulnerabilities early, reducing the risk of data breaches and minimizing the financial and reputational damage associated with cyberattacks. Vulnerability management plays a crucial role in this shift, enabling businesses to address weaknesses before attackers exploit them. Integrating automation and artificial intelligence (AI) into vulnerability management solutions significantly enhances efficiency. Automated scanning, prioritization, and remediation of vulnerabilities allow organizations to quickly identify critical security gaps and respond without manual intervention, streamlining operations and improving overall security.

The attack surface management segment is expected to grow significantly during the forecast period. As organizations increasingly adopt hybrid, multi-cloud, and remote work models, their attack surfaces grow more complex, requiring effective management. Attack Surface Management (ASM) solutions are vital in identifying and monitoring vulnerabilities across diverse IT environments, including networks, cloud platforms, and endpoints. Furthermore, the rising frequency of sophisticated cyberattacks, such as zero-day exploits and ransomware, emphasizes the need for continuous assessment. ASM solutions provide real-time visibility into potential entry points, enabling businesses to mitigate risks before malicious actors exploit them.

End-use Insights

The BFSI segment accounted for the largest market share in 2024. The ongoing digital transformation in the BFSI sector, including the widespread adoption of online banking, mobile apps, and digital payment systems, has expanded the attack surface, making it more vulnerable to cyber threats. Exposure management solutions are crucial in securing these new digital assets by proactively identifying and addressing vulnerabilities to prevent breaches that could expose sensitive customer data. Moreover, the BFSI sector requires continuous monitoring to detect and mitigate threats in real time. Exposure management solutions offer tools for real-time threat detection, vulnerability management, and risk mitigation, ensuring business continuity, minimizing downtime, and protecting both customer data and the integrity of financial systems from emerging cyber risks.

The IT and ITes segment is expected to grow significantly during the forecast period. As IT and ITeS companies embrace new technologies like cloud computing, AI, and IoT, their digital infrastructure becomes more complex, expanding the attack surface. Exposure management solutions are crucial in securing these interconnected environments, reducing the risk of cyberattacks on critical systems. In addition, the rise in cybersecurity threats targeting IT and ITeS companies—due to their handling of sensitive data and intellectual property—highlights the need for exposure management tools to protect against increasingly sophisticated cyber threats like ransomware and data breaches.

Regional Insights

North America held a significant share of over 35% of the exposure management industry in 2024. North American organizations emphasize advanced threat intelligence and real-time monitoring to stay ahead of evolving cyber threats. Exposure management solutions, which provide continuous monitoring, vulnerability assessments, and proactive threat detection, are increasingly adopted to ensure business continuity and security.

U.S. Exposure Management MarketTrends

The exposure management industry in the U.S. is expected to grow significantly from 2025 to 2030. Due to its status as a global hub for financial institutions, technology firms, and critical infrastructure, the U.S. has experienced a significant number of cyberattacks. The increasing sophistication of attacks, including ransomware and advanced persistent threats (APTs), is driving the adoption of exposure management solutions to secure sensitive data and systems.

Europe Exposure Management MarketTrends

The exposure management marketin Europe is growing significantly at a CAGR of over 22.0% from 2025 to 2030. European businesses and governments are advancing digital transformation, adopting cloud computing, IoT, and AI. These technologies increase the attack surface, necessitating robust exposure management solutions to secure evolving IT environments.

The UK exposure management industry is expected to grow rapidly in the coming years. The UK government’s National Cyber Security Strategy emphasizes enhancing the country’s cyber resilience. These efforts create opportunities for exposure management vendors to provide advanced solutions to the public and private sectors.Small and medium-sized enterprises (SMEs) in the U.K. increasingly recognize the need for exposure management solutions to secure their operations as they undergo digital transformation and face rising cyber threats.

The exposure management market in Germany held a substantial market share in 2024. With a strong focus on Industry 4.0, Germany is at the forefront of integrating IoT, cloud computing, and AI into industrial and business operations. These technologies expand the attack surface, necessitating exposure management solutions to secure complex environments.

Asia Pacific Exposure Management Market Trends

The exposure management marketin the Asia Pacific is growing significantly at a CAGR of over 24.7% from 2025 to 2030. The APAC region is undergoing significant digital transformation across industries, with widespread adoption of cloud computing, IoT, and AI. This creates a larger attack surface, driving demand for exposure management solutions to secure these expanding digital environments.The APAC region is home to a vast number of small and medium-sized enterprises (SMEs), which are increasingly recognizing the importance of exposure management to safeguard their operations amid rising cyber threats.

China exposure management industry held a substantial market share in 2024. China’s extensive adoption of technologies such as cloud computing, IoT, artificial intelligence, and big data has significantly expanded the digital landscape. Exposure management solutions are critical to securing these complex and interconnected environments.

The exposure management industry in Japan held a substantial market share in 2024. As Japanese companies digitize operations and adopt cloud-based services, exposure management solutions are essential to secure hybrid and multi-cloud environments effectively.The rise of IoT-connected devices and widespread cloud adoption in Japan create complex environments that require continuous monitoring and risk management through exposure management solutions.

India exposure management industry is growing rapidly. Initiatives like Digital India and cybersecurity policies such as the National Cyber Security Strategy have heightened the focus on securing IT environments, driving demand for exposure management solutions.India's small and medium-sized enterprises (SMEs) are becoming more aware of cybersecurity risks. Many SMEs invest in exposure management solutions to secure their operations and protect customer data.

Key Exposure Management Company Insights

The key market players in the global exposure management market include Tenable, Inc., CrowdStrike, Palo Alto Networks, Forescout Technologies, Inc., Ernst & Young Global Limited, VIAVI Solutions Inc., Verisk Analytics, Inc., International Business Machines Corporation, eSentire, Inc., Mandiant. The companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Exposure Management Companies:

The following are the leading companies in the exposure management market. These companies collectively hold the largest market share and dictate industry trends.

- CrowdStrike

- Ernst & Young Global Limited

- eSentire, Inc.

- Forescout Technologies, Inc.

- International Business Machines Corporation

- Mandiant

- Palo Alto Networks

- Tenable, Inc.

- Verisk Analytics, Inc

- VIAVI Solutions Inc.

Recent Developments

-

In December 2024, Tenable, Inc. added patch management capabilities to its platform, enabling organizations to rapidly address and close security exposures. This enhancement allows users to identify critical vulnerabilities and deploy patches efficiently, reducing the risk of cyberattacks. The integration streamlines vulnerability management, ensuring faster remediation of weaknesses across IT infrastructures and improving overall cybersecurity posture by proactively addressing potential threats before they can be exploited.

-

In May 2024, Forescout Technologies, Inc. announced the launch of its risk and exposure management solution, designed to provide real-time visibility into organizational risk and vulnerabilities. The platform enables proactive cybersecurity by identifying critical risks across IT, IoT, and OT environments, helping organizations reduce attack surfaces and ensure compliance with industry standards and regulations.

-

In February 2024, VIAVI Solutions Inc. introduced Observer Sentry, a traffic visibility solution for Threat exposure management. It provides critical insights into network traffic, enabling organizations to proactively identify vulnerabilities and detect threats. With advanced analytics and real-time monitoring, it enhances security posture and minimizes risks across enterprise IT environments.

Exposure Management Market Report Scope

Report Attribute

Details

Market size in 2025

USD 3.89 billion

Market Size forecast in 2030

USD 10.91 billion

Growth rate

CAGR of 22.9% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Market Size in USD million/billion and CAGR from 2025 to 2030

Report coverage

Market Size forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

CrowdStrike; Ernst & Young Global Limited; eSentire, Inc.; Forescout Technologies, Inc.; International Business Machines Corporation; Mandiant; Palo Alto Networks; Tenable, Inc.; Verisk Analytics, Inc.; VIAVI Solutions Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Exposure Management Market Report Segmentation

This report forecasts market Size growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the exposure management market report based on component, deployment, application, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Vulnerability Management

-

Threat Intelligence

-

Attack Surface Management

-

Assets Management

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Healthcare & Life Sciences

-

Retail & E-Commerce

-

Government & Defense

-

Energy and Utilities

-

IT and ITes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global exposure management market size was estimated at USD 3.27 billion in 2024 and is expected to reach USD 3.89 billion in 2025

b. The global exposure management market is expected to grow at a compound annual growth rate of 22.9% from 2025 to 2030 to reach USD 10.91 billion by 2030

b. The solution segment accounted for a market share of over 63% in 2024. As cyberattacks become more frequent and sophisticated, organizations are increasingly relying on exposure management solutions to detect threats and manage vulnerabilities in real time. These tools help businesses proactively identify risks, allowing them to mitigate potential breaches and prevent operational disruptions.

b. Some key players operating in the exposure management market include CrowdStrike, Ernst & Young Global Limited, eSentire, Inc., Forescout Technologies, Inc., International Business Machines Corporation, Mandiant, Palo Alto Networks, Tenable, Inc., Verisk Analytics, Inc., and VIAVI Solutions Inc.

b. The growth of the exposure management market is driven by the increasing need to identify, assess, and manage security vulnerabilities and risks across organizations' IT infrastructures and digital assets. As cyber threats evolve, businesses increasingly adopt exposure management tools to enhance their cybersecurity posture. These solutions proactively detect vulnerabilities, mitigate risks, and strengthen overall security defenses.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.