- Home

- »

- Medical Devices

- »

-

Eye Care Services Market Size, Share, Industry Report 2033GVR Report cover

![Eye Care Services Market Size, Share & Trends Report]()

Eye Care Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Service Type (Vision Testing & Eye Exams, Surgical Interventions), By Indication (Dry Eye Syndrome), By Provider Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-625-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Eye Care Services Market Summary

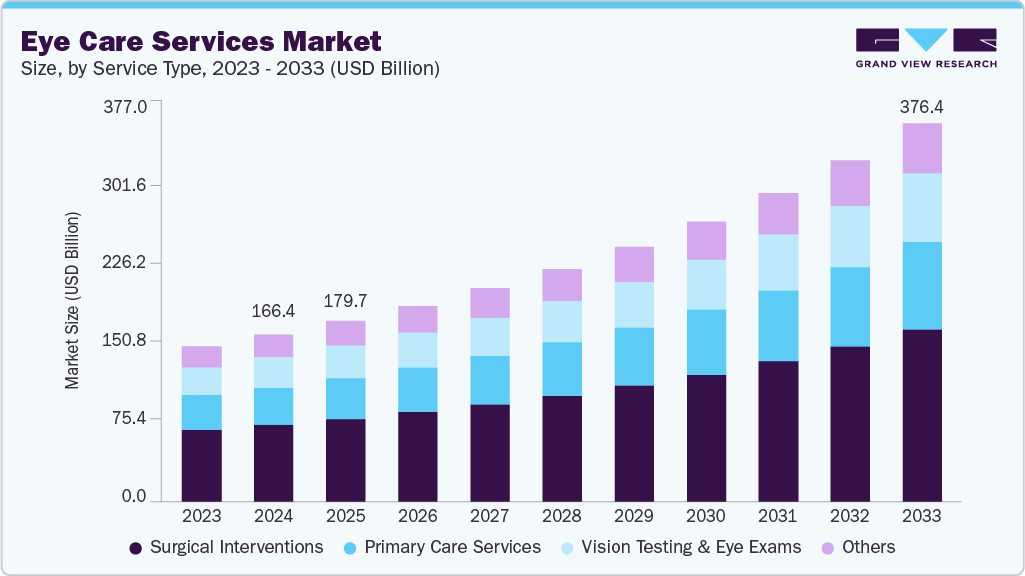

The global eye care services market size was estimated at USD 166.38 billion in 2024 and is projected to reach USD 376.37 billion by 2033, growing at a CAGR of 9.68% from 2025 to 2033. The growth is attributed to the increasing number of individuals experiencing vision-related issues, a quickly aging population, advancements in technology, and heightened awareness regarding eye care.

Key Market Trends & Insights

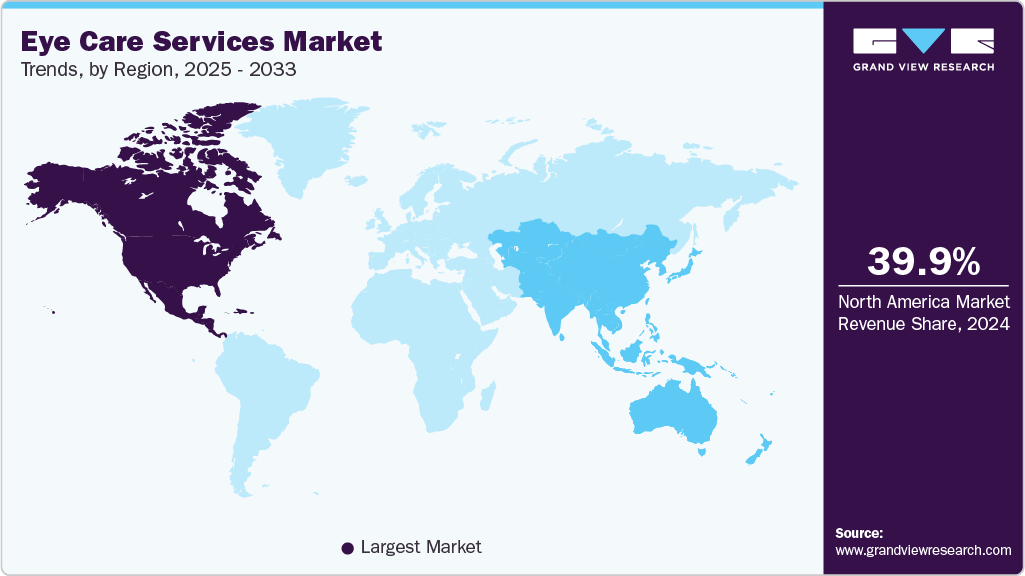

- North America eye care services market held the largest share of 39.90% of the global market in 2024.

- The eye care services market in the U.S. is expected to grow significantly over the forecast period.

- By service type, the surgical interventions segment held the highest market share of 45.92% in 2024.

- By indication, the refractive errors segment held the highest market share in 2024.

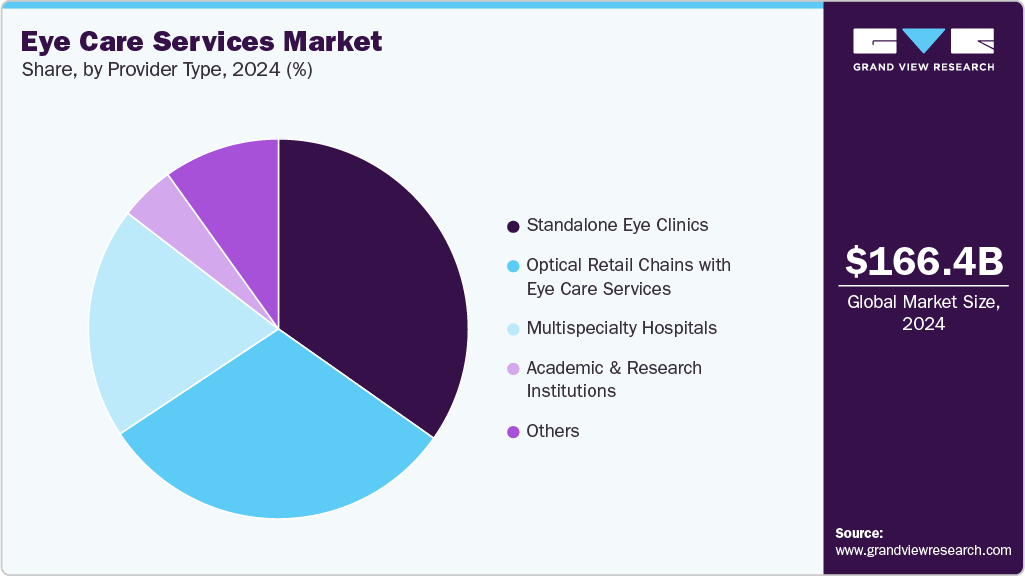

- Based on provider type, the standalone eye clinics segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 166.38 Billion

- 2033 Projected Market Size: USD 376.37 Billion

- CAGR (2025-2033): 9.68%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rising occurrence of vision problems, particularly vision impairment and presbyopia, offers substantial opportunities for industry. According to the World Health Organization (WHO) report published in August 2023, approximately 2.2 billion people suffer from vision impairment globally. In addition, there are an estimated 1.09 billion cases of presbyopia in the middle-aged elderly population propelling the demand for vision care services.Technological advancements in diagnostic and surgical procedures, such as minimally invasive laser surgeries and AI-driven diagnostic tools, have enhanced treatment outcomes and patient experience, further stimulating demand. In addition, greater awareness of vision health aided by public health campaigns and routine vision screening programs has increased early diagnosis rates and the uptake of preventive care services.

Moreover, the market is also being driven by increased access to care in emerging economies, supported by both public sector initiatives and private investments in tele-optometry and mobile eye clinics. In developed regions, higher spending capacity and the expansion of insurance coverage for vision care contribute to consistent market growth.

Technological & Awareness Trend in Market:

Category

Technologies/Initiatives

Impact on Market

Diagnostic Technologies

AI-based retinal imaging, Optical Coherence Tomography (OCT)

Faster, earlier, and more accurate diagnosis

Surgical Advancements

LASIK, femtosecond laser-assisted cataract surgery, SMILE

Minimally invasive, faster recovery, improved outcomes

Digital Tools

Tele-optometry, smartphone-based vision testing apps

Expanded access to remote/rural populations

Public Awareness Programs

School vision screening, World Sight Day campaigns

Increased early detection and demand for preventive care

Wearable Tech & Monitoring

Smart contact lenses, continuous IOP monitors for glaucoma

Real-time monitoring improves management of chronic cases

Integration with EHR

AI-assisted EHR analytics in ophthalmology

Streamlined care coordination and personalized treatments

Technological Innovations & Applications in Industry:

Technology/Initiative

Example

Description & Impact

AI-Based Retinal Imaging

Google’s DeepMind & Moorfields Eye Hospital

AI algorithms analyze retinal scans to detect diabetic retinopathy with high accuracy, enabling early treatment and reducing blindness risk.

Tele-optometry Platforms

Opternative (now Visibly)

Online vision tests allow patients to renew prescriptions remotely, increasing convenience and access, especially during COVID-19.

Femtosecond Laser Surgery

Alcon’s LenSx Laser System

Widely adopted in cataract surgery, improves precision and reduces recovery time compared to traditional methods.

Smart Contact Lenses

Google/Verily’s Smart Lens (under development)

Designed to monitor glucose levels in tears for diabetic patients, promising non-invasive real-time health tracking.

Public Awareness Campaigns

World Sight Day & Prevent Blindness Campaigns

Global and national efforts are increasing public knowledge on eye health, resulting in higher screening rates and preventive care uptake.

Mobile Eye Clinics

Aravind Eye Care System (India)

Provides high-volume, low-cost eye exams and surgeries in rural regions, leveraging portable diagnostic tools and telemedicine for follow-up.

Furthermore, increasing public health initiatives and a focus on preventive care are raising awareness about the necessity of regular eye exams. In May 2024, the Canadian Association of Optometrists (CAO) initiated a nationwide digital campaign to highlight the significance of eye health. This campaign, backed by provincial optometry associations, encourages Canadians to book regular eye exams with their optometrists.

Initiatives Enhancing Access to Eye Care:

Region

Initiative

Description & Impact

Emerging Economies

Public Sector Vision Programs

Governments launch national blindness prevention programs (e.g., India’s NPCBVI, China’s Vision 2020) to improve screening and treatment accessibility.

Mobile Eye Clinics

Portable diagnostic and surgical units deliver care to remote/rural populations, reducing travel barriers (e.g., Aravind Eye Care System in India).

Tele-optometry Platforms

Remote vision testing and consultations expand services to underserved areas, especially where specialists are scarce.

NGO and Non-Profit Partnerships

Organizations such as Orbis International provide funding, training, and infrastructure support to improve care delivery

Developed Regions

Insurance Expansion for Vision Care

Broader coverage of eye exams, corrective lenses, and surgeries under public (Medicare, NHS) and private insurance plans increases patient uptake.

Corporate Wellness & Screening Programs

Employers integrate routine vision screening and care into employee health plans, boosting preventive care participation.

Investment in Advanced Clinics & Technologies

The private sector invests in state-of-the-art diagnostic and surgical centers, enhancing treatment quality and patient experience.

Digital Health Integration

Adoption of telehealth, AI diagnostics, and electronic records improves care coordination and access, especially post-COVID-19.

In addition, policy frameworks and government initiatives play a pivotal role in shaping the accessibility, quality, and delivery of eye care services worldwide. By establishing national programs, expanding insurance coverage, and reforming regulations, countries can address key challenges such as limited access in rural areas, increasing prevalence of vision disorders, and rising healthcare costs.

Policy Impact on Eye Care Services:

Country/Region

Policy Initiative

Impact on Market

India

National Programme for Control of Blindness & Visual Impairment (NPCBVI)

Massive scale-up of cataract surgeries and vision screening; improved access in rural areas; reduced blindness rates.

China

National Myopia Control Plan

Introduction of school-based vision screenings and public awareness campaigns; early detection and management of myopia in children.

U.S.

Medicare Coverage Expansion for Eye Care

Increased access to glaucoma and diabetic retinopathy screenings among seniors; growth in outpatient eye care services.

UK

NHS Vision Screening Programs

Preventive care focus led to higher early diagnosis rates and reduced long-term treatment costs; integrated digital health tools usage.

Brazil

Public-Private Partnerships in Eye Care

Enhanced reach of mobile eye clinics in underserved rural areas; improved affordability and access for low-income populations.

South Africa

Telehealth Regulatory Reforms

Enabled growth of tele-optometry services, improving access in remote regions; stimulated private sector investment in digital eye care.

Access to comprehensive vision care remains a significant challenge for many underserved and remote populations, particularly in rapidly growing urban areas. To address these gaps and improve early diagnosis and treatment of vision impairments, innovative outreach programs have become increasingly vital. For instance, in August 2024, Sightsavers introduced a Mobile Eye Health Van in Bangalore aimed at expanding access to quality eye care services, especially for underserved and remote communities. The mobile unit is equipped with advanced diagnostic tools and staffed by trained eye care professionals, enabling on-site vision screenings, cataract detection, and referrals for treatment. This initiative supports early diagnosis and timely intervention, reducing barriers such as travel distance and cost, and contributes to the broader goal of eliminating avoidable blindness in the region.

Market Concentration & Characteristics

The chart below represents the relationship between industry concentration, industry characteristics, and industry participants. The industry displays a moderate level of concentration, with several key players dominating the market. There are stringent regulatory standards ensuring service quality and safety. Moreover, the industry benefits from increasing demand for ocular healthcare globally.

The industry is experiencing a high degree of innovation. The use of the eye as a diagnostic window into overall health known as oculomics combined with AI, is emerging as a powerful approach to identify diseases earlier and more accurately. For instance, in May 2025, the Alliance for Healthcare from the Eye was launched to revolutionize disease detection and coordinated care delivery by leveraging cutting-edge technologies such as oculomics and artificial intelligence AI. By integrating advanced data insights with clinical practice, the alliance seeks to transform how healthcare providers detect and manage diseases, positioning eye care as a pivotal gateway to overall health.

are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in May 2024, Visibly acquired Lensabl to enhance its platform with optical e-commerce, aiming to make vision care more accessible. Lensabl's expertise includes direct-to-consumer sales and a growing B2B sector, offering white-label e-commerce solutions and modernized vision plans. This merger combines Lensabl's retail offerings with Visibly's telehealth services, promising broader access to affordable vision care.

The regulatory framework for the industry involves compliance with industry-specific guidelines and standards to ensure accuracy and consistency. In May 2022, WHO introduced Eye Care in Health Systems; Guide for Action during the 75th World Health Assembly in Geneva. The guide presents a practical four-step process: conducting a situation analysis; developing an eye care strategic plan with a monitoring framework; formulating and implementing an operational plan; and establishing ongoing review mechanisms. To support these steps, WHO has developed four key tools: the Eye Care Situation Analysis Tool (ECSAT), Eye Care Indicator Menu (ECIM), Package of Eye Care Interventions (PECI), and Eye Care Competency Framework (ECCF).

The market is experiencing a significant degree of service expansion as the demand for home-based care services continues to increase. Companies are expanding their services to include a broader range of healthcare services. For instance, in February 2025, Maxivision Super Specialty Eye Hospitals entered a strategic partnership with Mumbai-based Ojas Group to form a joint venture named Ojas Maxivision Eye Hospitals. This collaboration aims to invest USD 58.41 million to expand eye care services across Maharashtra. The initiative plans to open five new centers in Mumbai within the next 24 months and gradually extend operations to other parts of the state.

Service Type Insights

Based on service type, the surgical interventions segment dominated the market with the largest revenue share of 45.92% in 2024. The aging global population, especially in developed and middle-income countries, is driving the demand for advanced ophthalmic surgical procedures. Technological advancements such as femtosecond lasers, minimally invasive glaucoma surgeries (MIGS), and robotic-assisted surgeries are making procedures safer, faster, and more effective, thereby increasing patient acceptance.

In addition, increased healthcare spending and the expansion of ambulatory surgical centers specializing in ophthalmology are also contributing to the rising number of surgical procedures worldwide. For instance, in June 2024, AMSURG and Comprehensive EyeCare Partners (CompEye) jointly acquired Alta Rose Surgery Center in Las Vegas, Nevada, marking the fourth outpatient surgery center under their expanding partnership. This acquisition aligned with AMSURG's strategic focus on expanding its network of ambulatory surgery centers (ASCs) following its emergence as an independent entity after separating from Envision Healthcare.

The primary care services segment is anticipated to grow at the fastest CAGR over the forecast period, attributed to the rising awareness of preventive eye health, increasing prevalence of chronic conditions such as diabetes and hypertension that affect vision, and an aging global population prone to age-related diseases such as cataracts, macular degeneration, and glaucoma. Technological advancements in diagnostic tools and tele-optometry are expanding access to eye exams, especially in underserved or rural areas. For instance, in March 2023, Orbis International, in collaboration with PBMA's H.V. Desai Eye Hospital, inaugurated a Green Vision Center (GVC) in Satara, Maharashtra, with the aim of delivering sustainable and accessible primary care services to the local community. This initiative is part of Orbis's broader strategy to establish environmentally responsible facilities across India.

In addition, the growing integration of vision care into general healthcare frameworks, especially in countries with universal health systems or expanding insurance coverage, is boosting demand for routine eye checkups, refractive error correction, and chronic disease monitoring.

Indication Insights

Based on indication, the refractive errors segment including myopia, hyperopia, astigmatism, and presbyopia dominated the market with the largest revenue share of 38.95% in 2024. The growth in the demand for vision correction is due to aging populations experiencing more vision issues such as presbyopia and cataracts. In addition, there is a rise in myopia among children and teens, attributed to increased screen time and reduced outdoor activities. Advances in technology, such as the emergence of minimally invasive surgical methods such as SMILE and the incorporation of AI in diagnostic tools, have improved the accuracy and safety of refractive surgeries. In May 2024, WHO launched the SPECS 2030 initiative to address uncorrected refractive errors, the leading cause of vision impairment globally. This initiative aims to increase the effective coverage of refractive error correction by 40% by 2030, ensuring that more individuals have access to appropriate spectacles. SPECS 2030 focuses on five strategic pillars: improving access to refractive services, building the capacity of personnel, enhancing population education, reducing the cost of refractive error services, and strengthening surveillance and research.

The glaucoma segment is expected to grow at the fastest CAGR during the forecast period. Glaucoma is a group of conditions that damage the optic nerve, and is increasingly affecting aging populations worldwide, particularly among individuals over 60. The rising geriatric population, along with increasing rates of diabetes and hypertension both risk factors for glaucoma have led to higher demand for early screening, diagnosis, and treatment. Advancements in diagnostic technologies, such as Optical Coherence Tomography (OCT) and AI-assisted imaging, have made detection more accurate and accessible, encouraging routine eye exams. In January 2025, Optegra introduced a new NHS glaucoma service at its Eye Hospital in Manchester, aiming to alleviate long waiting times at local NHS trusts. This free service is designed for glaucoma patients whose condition has progressed beyond the capabilities of their local optician practice, offering timely monitoring and specialist interventions.

Provider Type Insights

Based on provider type, the standalone clinics segment dominated the market with the largest revenue share of 34.76% in 2024 owing to increasing technological advancements in diagnostic and surgical equipment have enabled standalone clinics to offer high-quality, cost-effective, and convenient services. Furthermore, the rising preference for outpatient care and shorter waiting times compared to hospitals supports the growth of these clinics. Urbanization and increasing disposable incomes also empower more people to invest in specialized services. In October 2023, Dr. Agarwal’s Eye Hospitals announced plans to expand its footprint in the market, with plans to invest up to USD 150 million over the next 2–3 years. The company aims to nearly double its network to 300 eye hospitals across India and Africa, focusing on regions such as Maharashtra, Delhi, Uttar Pradesh, and central India. The company is also establishing over 100 primary eye clinics in tier 2 and tier 3 towns to enhance accessibility.

The academic & research institution segment is expected to grow at the fastest CAGR during the forecast period. This is driven by increasing investments in ophthalmic research, and the growing demand for advanced diagnostic and treatment technologies. These institutions play a crucial role in pioneering innovative therapies, such as gene therapy, retinal implants, and minimally invasive surgical techniques, which enhance patient outcomes and expand treatment options. Moreover, government funding, public-private partnerships, and collaborations with pharmaceutical and medical device companies further stimulate academic research growth. For instance, in December 2024, The Advanced Research Projects Agency for Health (ARPA-H) announced a groundbreaking initiative aimed at developing the first-ever complete eye transplantation procedure to restore vision for individuals who are blind or visually impaired. This initiative, known as the Transplantation of Human Eye Allografts (THEA) program, represents a significant investment in medical innovation, with ARPA-H committing up to USD 125 million to support this ambitious project.

Regional Insights

The North America region dominated the eye care services market with the largest revenue share of over 39.90% in 2024, driven by a high prevalence of vision-related disorders, a well-established healthcare infrastructure, widespread insurance coverage, and early adoption of advanced eye care technologies. Technological advancements have also played a pivotal role, with innovations such as LASIK procedures, teleophthalmology, and AI-driven diagnostics enhancing the efficiency and accessibility of eye care. The widespread use of digital devices has led to a rise in digital eye strain and related issues, prompting greater awareness and demand for corrective eyewear and treatments.

U.S. Eye Care Services Market Trends

The eye care services market in the U.S. held the largest share in 2024 due to a strong emphasis on innovation, and growing strategic alliances & partnerships. In November 2024, Eye Health America (EHA) announced a strategic partnership with Bowden Eye & Associates, marking its 25th collaboration and expanding its presence into Eastern Florida. This partnership enables continuity of cutting-edge specialty eye care services to the Northeast Florida community with the compassion and expertise cultivated over the past 24 years. Moreover, the collaboration underscores EHA's momentum in nurturing meaningful affiliations across Florida, marking its second partnership in the state over the last 12 months. John Swencki, Co-CEO of EHA, emphasized the opportunity to bring innovative, patient-centered care to more communities across the Southeast, highlighting the importance of this partnership in delivering top-tier eye care services throughout the region.

Europe Eye Care Services Market Trends

The eye care services market in Europe is anticipated to grow significantly due to a rapidly aging population, technological innovations in diagnostic & treatment modalities, rising prevalence of vision impairment due to lifestyle changes, increasing awareness of eye health, and improving healthcare accessibility and insurance coverage for vision-related services. Moreover, private clinics are increasingly partnering with public health systems to address surgical backlogs, particularly in cataract surgeries. For instance, as per the report published by The Guardian in June 2024, nearly 60% of cataract surgeries are now performed in England by private providers, up from 24% five years ago. Moreover, in May 2025, EssilorLuxottica, announced its acquisition of Optegra, a prominent European ophthalmology network, in a strategic move to enhance its medical technology portfolio. This acquisition aligns with EssilorLuxottica's broader strategy to transition from a traditional eyewear company to a comprehensive med-tech entity. The integration of Optegra's clinical expertise complements EssilorLuxottica's existing capabilities in smart eyewear, diagnostic tools, and AI-powered health technologies.

The UK eye care services market is expected to grow significantly over the forecast period as the NHS provides free eye exams for certain groups, supporting preventive care. In addition, there is a growing push for digital solutions to reduce strain on the public system, with opticians offering integrated services and e-health tools. Moreover, the launch of the new Optometry First services by NHS Shropshire, Telford and Wrekin in July 2025 is expected to improve access to eye care for residents. By enabling people to get eye care services closer to home, it should reduce pressure on hospitals and help catch eye problems earlier through more convenient optometry consultations. This aims to achieve faster treatment, better outcomes, and overall improved community eye health.

Asia Pacific Eye Care Services Market Trends

The eye care services market in Asia Pacific has been estimated to be the fastest-growing region propelled by large and aging populations in countries such as China, India, and Japan. Increasing disposable income, expanding healthcare access, and a surge in awareness campaigns for vision health are accelerating market growth. Rapid urbanization and digital device overuse are also raising demand for services.

The eye care services market in India is driven by rising awareness, a high burden of cataracts and refractive errors, and a dual model of affordable and premium services. Non-profit organizations such as Aravind Eye Care are leading the way in providing scalable, cost-effective service delivery. Moreover, Centre for Sight has unveiled a compelling new brand campaign featuring fitness icon and endurance athlete Milind Soman. Launched in April 2025, the campaign challenges prevailing perceptions about aging and eye health, urging individuals to prioritize their vision care as they age. The initiative highlights often-overlooked risks such as cataracts, glaucoma, diabetic retinopathy, and gradual vision loss. It underscores the importance of regular eye check-ups, especially after the age of 40, aligning eye health with overall fitness.

Latin America Eye Care Services Market Trends

The eye care services market in Latin America is anticipated to grow significantly over the forecast period, primarily driven by the increasing demand for prescribed products among the elderly population due to the rising prevalence of eye disorders. Major players are enhancing their market presence through collaborations and acquisitions. The market is also influenced by the increasing usage of digital devices, surging demand for prescribed spectacles, and the rising prevalence of vision impairment.

Brazil eye care services market held the largest market share in 2024 due to the public health campaigns educating the population about the importance of regular eye examinations and early detection of eye conditions, leading to increased utilization of eye care services. In May 2024, the "April Brown" campaign known in Brazil as "Abril Marrom" was launched to raise awareness about eye health and preventable vision loss. Initiated in São Paulo, this nationwide initiative has become a cornerstone in promoting eye health across Brazil. The campaign aligned with the International Agency for the Prevention of Blindness's (IAPB) "2030 In Sight" strategy, emphasizing behavioral changes and universal access to eye care services. Through public awareness efforts, the campaign encouraged regular eye examinations, early detection of eye conditions, and advocated for equitable access to eye care services.

Middle East and Africa Eye Care Services Market Trends

The eye care services market in MEA is anticipated to grow significantly during the forecast period driven by the increasing prevalence of Age-related Macular Degeneration (AMD) and amblyopia, especially in the geriatric population, and rising disposable income leading to better access to healthcare services. Government initiatives focusing on health awareness and investment in innovative services, and well-equipped facilities are also significant drivers. In addition, the market benefits from the entry of international brands offering innovative solutions, including contact lenses and prescription glasses, catering to the unique needs of the region.

South Africa eye care services market is expected to grow significantly over the forecast period due to shifting consumer behavior and a growing demand for fashionable eyewear and contact lenses that serve both functional and aesthetic purposes. The rise in screen time has led to increased cases of digital eye strain, prompting demand for products such as light-blocking blue glasses. Moreover, policy initiatives, such as the National Health Insurance Act of 2023, aim to improve access to quality health care services, including eye care, by establishing a National Health Insurance Fund.

Key Eye Care Services Companies Insights

Key players operating in the eye care services market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Eye Care Services Companies:

The following are the leading companies in the eye care services market. These companies collectively hold the largest market share and dictate industry trends.

- Aravind Eye Care System

- Alcon

- Asia Pacific Eye Centre

- Topcon Corporation

- iCARE HEALTH SOLUTIONS

- US Eye

- Pamlico Capital

- Vision Service Plan

- Opty (HOBRASIL OPHTHALMOLOGICAL HOSPITALS)

- Eye Associates of New Mexico

- Providence Health Care

- ASG Hospital Pvt. Ltd.

- Centurion Eye Hospital

- Al Saudi Hospital

Recent Developments

-

In May 2025, UCL and Moorfields Eye Hospital launched a new medical technology company, Cascader Limited, aiming to transform the detection and management of eye diseases through AI. This venture is a collaboration between the UCL Institute of Ophthalmology, Moorfields Eye Hospital NHS Foundation Trust, and Topcon Healthcare, combining academic research, clinical expertise, and technological capabilities.

-

In April 2025, VSP Vision, in collaboration with the healthcare innovation hub MATTER, launched the second annual VSP Vision Innovation Challenge, aiming to discover and support groundbreaking solutions that enhance eye care experience. This global competition invites both early-stage and growth-stage startups to present innovations that empower patients, expand access to care, and elevate provider capabilities.

-

In March 2025, HelpMeSee expanded its simulation-based cataract surgery training program in Latin America through new partnerships in Guatemala and Colombia. This initiative aims to address the significant shortage of trained cataract surgeons in the region by providing accessible, high-fidelity surgical training. The training program utilizes a virtual reality Eye Surgery Simulator, modeled after aviation simulation methods, to teach Manual Small Incision Cataract Surgery (MSICS).

-

In June 2024, Sankara Eye Foundation inaugurated the nation's first-of-its-kind Innovation Lab for eye care, with the aim to revolutionize ophthalmic care through advanced research, development, and training, with a particular focus on serving underserved and rural communities across India. The Innovation Lab is dedicated to developing need-based solutions that go beyond existing options, ensuring world-class eye care access for all, including the most remote villages in the country.

Eye Care Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 179.70 billion

Revenue forecast in 2033

USD 376.37 billion

Growth rate

CAGR of 9.68% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, indication, provider type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Aravind Eye Care System; Alcon; Asia Pacific Eye Centre; Topcon Corporation; iCARE HEALTH SOLUTIONS; US Eye; Pamlico Capital; Vision Service Plan; Opty (HOBRASIL OPHTHALMOLOGICAL HOSPITALS); Eye Associates of New Mexico; Providence Health Care; ASG Hospital Pvt. Ltd.; Centurion Eye Hospital; Al Saudi Hospital

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Eye Care Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global eye care services market report based on service type, indication, provider type, and regions.

-

Service Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Vision Testing & Eye Exams

-

Surgical Interventions

-

Cataract Surgery

-

Refractive Surgery

-

Glaucoma Surgery

-

Retinal Surgery

-

Corneal Surgery

-

Others

-

-

Primary care services

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Refractive Errors

-

Cataracts

-

Glaucoma

-

Age-related Macular Degeneration (AMD)

-

Diabetic Retinopathy

-

Dry Eye Syndrome

-

Others

-

-

Provider Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Standalone Eye Clinics

-

Multispecialty Hospitals

-

Optical Retail Chains with Eye Care Services

-

Academic & Research Institutions

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global eye care services market size was estimated at USD 166.38 billion in 2024 and is expected to reach USD 179.70 billion in 2025.

b. The global eye care services market is expected to grow at a compound annual growth rate of 9.7% from 2025 to 2033 to reach USD 376.37 billion by 2033.

b. North America dominated the eye care services market with a share of 39.90% in 2024 driven by a high prevalence of vision-related disorders, a well-established healthcare infrastructure, widespread insurance coverage, and early adoption of advanced eye care technologies.

b. Some key players operating in the eye care services market include Aravind Eye Care System, Alcon, Asia Pacific Eye Centre, Topcon Corporation, iCARE HEALTH SOLUTIONS, US Eye, Pamlico Capital, Vision Service Plan, Opty (HOBRASIL OPHTHALMOLOGICAL HOSPITALS), Eye Associates of New Mexico, Providence Health Care, ASG Hospital Pvt. Ltd., Centurion Eye Hospital, Al Saudi Hospital

b. The market growth is attributed to the increasing number of individuals experiencing vision-related issues, a quickly aging population, advancements in technology, and heightened awareness regarding eye care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.