- Home

- »

- Next Generation Technologies

- »

-

Factory Automation Market Size, Share, Industry Report 2030GVR Report cover

![Factory Automation Market Size, Share & Trends Report]()

Factory Automation Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Technology (DCS, PLC, SCADA), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-582-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Factory Automation Market Size & Trends

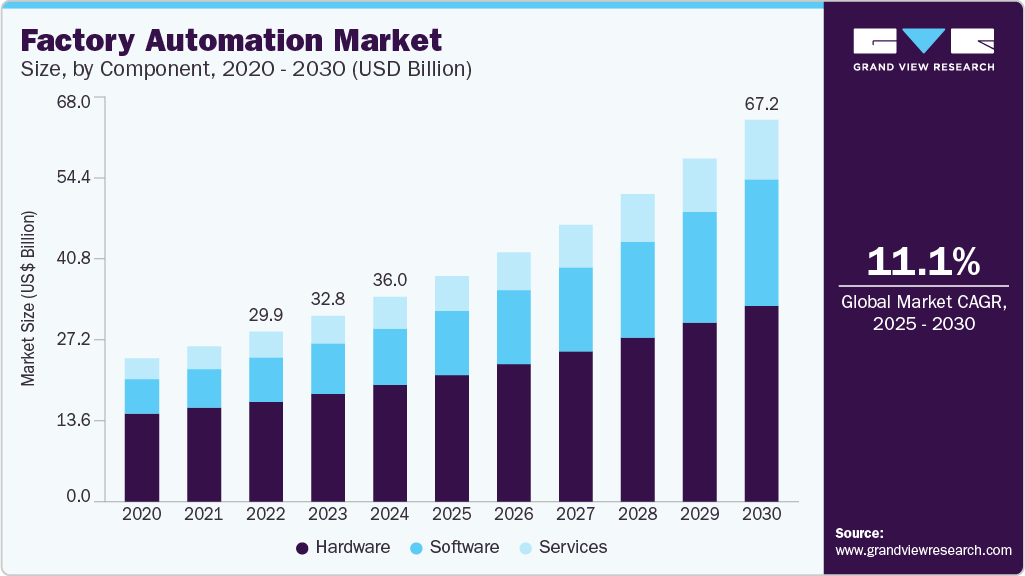

The global factory automation market size was estimated at USD 36.01 billion in 2024 and is expected to grow at a CAGR of 11.1% from 2025 to 2030. The industry is primarily driven by the rising demand for operational efficiency, the growth of manufacturing and industrial sectors, and the increasing implementation of autonomous plants and remote operations aimed at reducing costs and boosting productivity.

Key Highlights:

- North America factory automation market accounted for a significant share of over 27% in 2024

- The factory automation market in the U.S. dominated with a share of over 81% in 2024

- By component, software segment is expected to witness the fastest CAGR of over 14% from 2025 to 2030

- By component, hardware segment dominated the market with a revenue share of over 57% in 2024

- By end use. the manufacturing segment accounted for the largest revenue share in 2024

Additionally, the growing adoption of artificial intelligence (AI) and machine learning (ML) in factory automation systems is revolutionizing manufacturing processes, enabling predictive maintenance, real-time data analysis, and autonomous decision-making, and reducing downtime, which is further fueling the factory automation industry expansion. The growing integration of collaborative robots, or cobots, is another major driver in the factory automation industry. This reflects a shift toward flexible automation where cobots are increasingly used for dynamic, short-run, or high-mix manufacturing tasks. Companies are leveraging cobots' ease of programming and adaptability to respond quickly to changing production demands. Moreover, there's a rising emphasis on safety-certified robotics that supports worker wellbeing while improving operational output, making cobots a central feature of next-generation smart factories.

Additionally, edge computing is emerging as a critical trend in the factory automation industry, enabling faster data processing directly or near the source, such as sensors, machines, or robots, instead of relying solely on cloud infrastructure. This approach significantly reduces latency, enhances real-time control, and increases system reliability in time-sensitive industrial environments. Additionally, it supports localized AI inference, empowering automation systems to make intelligent, autonomous decisions without constant cloud connectivity.

Furthermore, the adoption of digital twin technology is rapidly transforming the factory automation industry. These virtual replicas of physical assets allow manufacturers to simulate operations, test changes, and diagnose issues in real time without disrupting actual production. By enabling predictive maintenance and performance optimization, digital twins help reduce downtime and enhance system efficiency. This trend is especially impactful in complex industries such as aerospace, automotive, and energy, where precision and reliability are critical.

Moreover, factories are increasingly turning to cloud-based platforms to manage automation systems, enabling centralized control, remote monitoring, and data-driven insights across multiple sites. Cloud solutions support faster software updates, real-time analytics, and seamless integration with enterprise IT systems. This shift is also paving the way for new business models such as Automation-as-a-Service, allowing manufacturers to scale operations efficiently with lower capital investment, which is expected to further fuel the factory automation industry in the coming years.

Component Insights

The hardware segment dominated the market with a revenue share of over 57% in 2024, driven by the growing deployment of robotics, sensors, PLCs, HMIs, and industrial PCs to automate tasks and streamline production processes. As manufacturers aim to reduce labor dependency, improve accuracy, and enhance productivity, demand for high-performance, durable, and intelligent hardware components is rising. This shift toward smart factories and real-time process control is encouraging investment in advanced hardware capable of handling complex operations with minimal human intervention, which is expected to drive segmental growth in the coming years.

The software segment is expected to witness the fastest CAGR of over 14% from 2025 to 2030. The need for real-time monitoring, predictive maintenance, and production optimization is pushing manufacturers to adopt sophisticated automation software such as MES, HMI, simulation tools, and AI-driven analytics platforms. As factories become more connected, the demand for cloud-based solutions, digital twins, and cybersecure industrial software is surging. Additionally, software is central to implementing Industry 4.0, allowing seamless integration of hardware, data, and enterprise systems.

End Use Insights

The manufacturing segment accounted for the largest revenue share in 2024, driven by the rising demand for fast, hygienic, and efficient production processes. Manufacturers are increasingly adopting automated material handling, packaging, and quality control systems to maintain product consistency and meet strict safety standards. The integration of temperature-controlled and sensor-based technologies ensures the freshness and compliance of perishable items. Moreover, automation solutions are helping companies scale operations, reduce manual labor, and comply with evolving health regulations, solidifying this segment’s dominance in the market.

The healthcare segment is expected to witness the fastest CAGR from 2025 to 2030. Retailers are embracing automation to optimize warehouse operations, streamline supply chains, and enhance last-mile delivery efficiency. The deployment of automated storage and retrieval systems (ASRS), robotic picking, and smart sorting technologies in fulfillment centers is on the rise. Additionally, innovations such as automated lockers, contactless packaging, and real-time inventory management are improving operational agility and customer experience. These trends are fueling substantial growth in automation adoption across the retail sector.

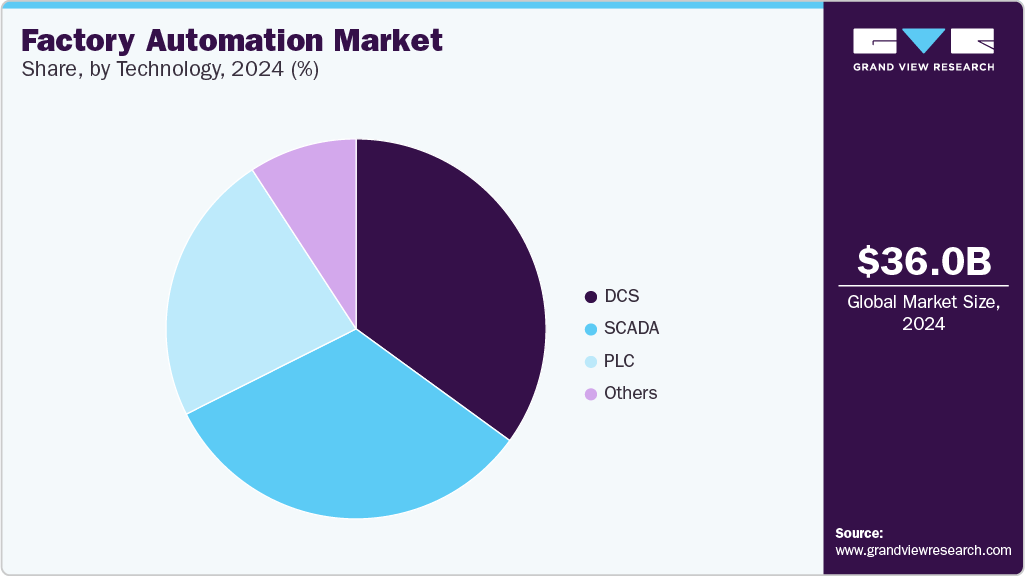

Technology Insights

The DCS segment accounted for the largest market share in 2024, driven by the increasing need for centralized and precise control of complex, continuous processes, particularly in industries such as oil & gas, chemicals, power generation, and pharmaceuticals. DCS offers high reliability, scalability, and safety, making it ideal for managing large-scale industrial operations with minimal downtime. The growing emphasis on energy efficiency, regulatory compliance, and real-time data integration is further boosting adoption. Additionally, the integration of DCS with Industrial IoT (IIoT) and advanced analytics is enabling predictive control, remote monitoring, and improved operational efficiency.

The SCADA segment is expected to witness the fastest CAGR from 2025 to 2030, owing to its ability to provide real-time visibility and control over factory operations, which is crucial for decision-making and performance optimization. The increasing demand for remote monitoring, especially in utilities, water treatment, and energy sectors, is a major driver. With the rise of smart factories and connected infrastructure, SCADA's role in enabling centralized data collection, fault detection, and alarm handling is becoming indispensable. Furthermore, the integration of SCADA with cloud platforms, AI, and edge computing is enhancing its capabilities, making it more adaptive and efficient for modern industrial environments.

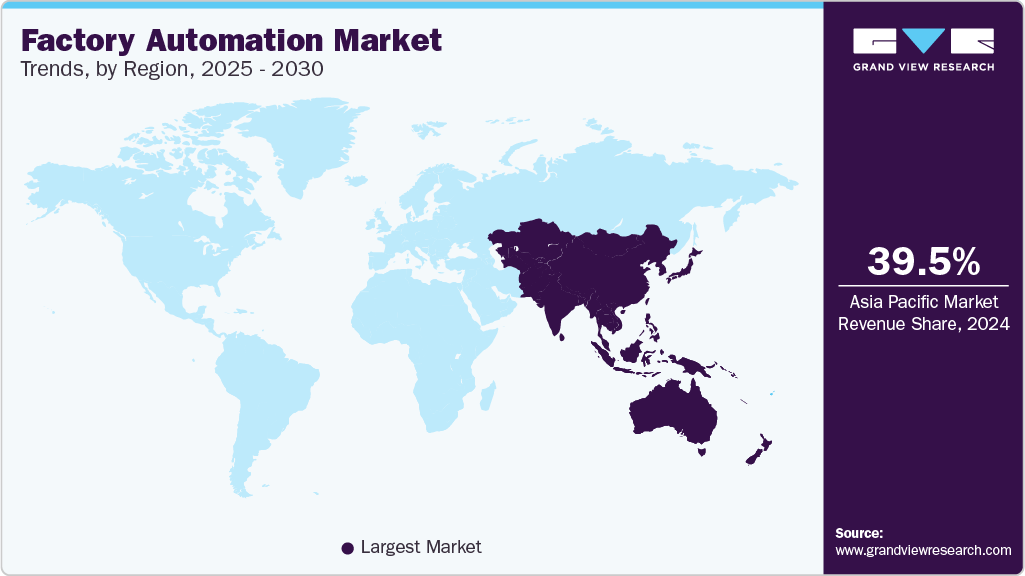

Regional Insights

North America factory automation market accounted for a significant share of over 27% in 2024, driven by a strong focus on smart manufacturing, AI integration, and digital transformation. The region is seeing rapid adoption of IIoT platforms, edge computing, and real-time analytics to boost operational efficiency and product quality. Sectors such as automotive, electronics, pharmaceuticals, and aerospace are leading in automation investments. Government incentives for green technologies and the rising demand for mass customization are further shaping automation strategies across North American factories.

U.S. Factory Automation Market Trends

The factory automation market in the U.S. dominated with a share of over 81% in 2024, driven by the country’s need to remain globally competitive, modernize aging industrial infrastructure, and address labor cost and skill gaps. The Inflation Reduction Act and other federal programs are incentivizing digital manufacturing upgrades, especially in semiconductors, clean energy, and automotive (EVs). U.S. manufacturers are also prioritizing cybersecurity, flexibility, and scalable automation solutions to handle market volatility and meet evolving consumer demands.

Europe Factory Automation Market Trends

The factory automation market in Europe is expected to grow at a CAGR of over 6% from 2025 to 2030, supported by strong regulatory frameworks, sustainability goals, and government funding for Industry 4.0 initiatives. The region's push toward carbon neutrality and energy-efficient production is accelerating the adoption of smart automation, AI, and digital twins. Advanced economies are modernizing legacy infrastructure with cloud-based platforms, robotics, and cyber-physical systems to enhance productivity and competitiveness. Industries such as automotive, pharmaceuticals, and aerospace are at the forefront, with a growing focus on interoperability and industrial cybersecurity across supply chains.

The UK factory automation market is expected to grow at a significant rate in the coming years, driven by the need to boost industrial productivity and adapt to labor shortages and rising input costs. The government’s support for digital transformation through initiatives is encouraging SMEs to adopt automation technologies such as robotics, cloud-based MES, and predictive maintenance systems.

The factory automation market in Germany is driven by its deep-rooted engineering expertise, dominance in automotive manufacturing, and its leadership in the Industry 4.0 movement. German factories are heavily investing in advanced robotics, PLCs, and IoT-enabled machinery, backed by public-private partnerships. The country is pioneering in integrated cyber-physical systems, digital twin technologies, and real-time production analytics. Germany’s strong export-oriented manufacturing sector continues to demand high-performance and scalable automation solutions.

Asia Pacific Factory Automation Market Trends

The factory automation market in Asia Pacific is expected to grow at the fastest CAGR of over 13% from 2025 to 2030, driven by rapid industrialization, government initiatives, and growing demand for smart manufacturing. Countries in the region are significantly investing in automation technologies, aiming to enhance productivity and reduce labor costs. The adoption of Industry 4.0 technologies, such as robotics, AI, and IoT, is expanding, alongside the push for sustainable manufacturing practices. Moreover, the strong presence of major automation solution providers and a growing manufacturing base in automotive, electronics, and textiles are fueling market growth in the region.

The Japan factory automation market is gaining traction, driven by the growing focus on precision manufacturing and advanced robotics solutions. The aging workforce and labor shortages are key drivers, prompting industries to automate to maintain efficiency and productivity. Japan also has a strong R&D ecosystem for robotics, which leads to continuous advancements in AI-driven automation and collaborative robots.

The factory automation market in China is rapidly expanding, driven by the shift towards high-tech manufacturing in industries such as automotive, electronics, and consumer goods is pushing the demand for robots, IoT solutions, and artificial intelligence. China’s labor cost advantage is narrowing, leading to a higher adoption of automated production systems to increase efficiency and quality control. Additionally, the growth of smart factories and industrial AI is transforming traditional manufacturing processes.

Key Factory Automation Companies Insights

Key players operating in the factory automation market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Factory Automation Companies:

The following are the leading companies in the factory automations market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Emerson Electric Co.

- Fuji Electric Co., Ltd.

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Omron Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corporation

Recent Developments

-

In March 2025, Siemens AG completed its acquisition of Altair Engineering Inc. for approximately USD 10 billion, marking a significant expansion of its industrial software capabilities. This strategic move enhances Siemens AG's leadership in simulation and industrial artificial intelligence (AI) by integrating Altair's strengths in mechanical and electromagnetic simulation, high-performance computing (HPC), data science, and AI.

-

In December 2024, Fuji Electric Co., Ltd. announced plans to augment its switchboard and uninterruptible power supply (UPS) production facilities at the Kobe Factory. The expansion includes installing skid system production equipment, which allows for consolidated wiring, testing, and inspections, reducing on-site installation time by 40%. This investment is expected to increase production capacity by 50%, addressing labor shortages and enhancing efficiency for internet data center projects.

-

In April 2024, Omron Corporation introduced the VT-X850, a next-generation 3D Computed Tomography (CT) Automatic X-ray Inspection (AXI) system tailored for electric vehicle (EV) Surface Mount Technology (SMT) manufacturing lines. This advanced inspection solution addresses the complexities of inspecting large, intricate, and dense materials, integrating a high-voltage X-ray tube and Artificial Intelligence (AI) to deliver speed, accuracy, and ease of use.

Factory Automation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 39.69 billion

Revenue forecast in 2030

USD 67.17 billion

Growth rate

CAGR of 11.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; U.A.E.

Key companies profiled

ABB Ltd.; Emerson Electric Co.; Fuji Electric Co., Ltd.; Honeywell International Inc.; Mitsubishi Electric Corporation; Omron Corporation; Rockwell Automation, Inc.; Schneider Electric SE; Siemens AG; Yokogawa Electric Corporation.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Factory Automation Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global factory automation market report based on component, technology, end use, and region:

-

Component (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology (Revenue, USD Billion, 2018 - 2030)

-

DCS

-

PLC

-

SCADA

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Chemical

-

Energy & Utilities

-

Food & Beverage

-

Healthcare

-

Manufacturing

-

Mining & Metal

-

Oil & Gas

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global factory automation market size was estimated at USD 36.01 billion in 2024 and is expected to reach USD 39.69 billion in 2025.

b. The global factory automation market is expected to grow at a compound annual growth rate of 11.1% from 2025 to 2030 to reach USD 67.17 billion by 2030.

b. The Asia Pacific factory automation market accounted for the largest market share of over 41% in 2024, driven by rapid industrialization, government initiatives, and growing demand for smart manufacturing.

b. Some key players operating in the factory automation market include ABB Ltd., Emerson Electric Co., Fuji Electric Co., Ltd., Honeywell International Inc., Mitsubishi Electric Corporation, Omron Corporation, Rockwell Automation, Inc., Schneider Electric SE, Siemens AG, and Yokogawa Electric Corporation.

b. Key factors driving the factory automation market include the rising demand for operational efficiency, the growth of manufacturing and industrial sectors, and the increasing implementation of autonomous plants and remote operations aimed at reducing costs and boosting productivity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.