- Home

- »

- Clinical Diagnostics

- »

-

Fecal Calprotectin Test Market Size, Industry Report, 2030GVR Report cover

![Fecal Calprotectin Test Market Size, Share & Trends Report]()

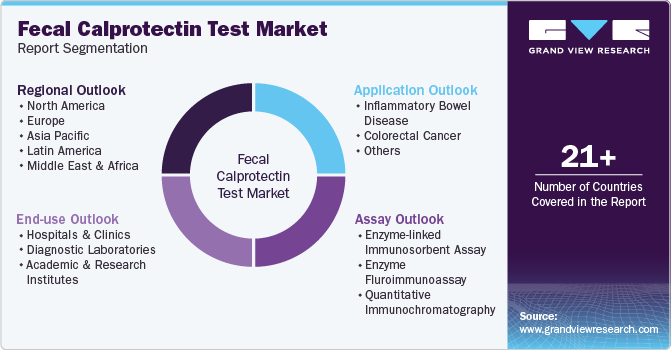

Fecal Calprotectin Test Market (2025 - 2030) Size, Share & Trends Analysis Report By Assay (Enzyme-linked Immunosorbent, Enzyme Fluroimmunoassay, Quantitative Immunochromatography), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-500-1

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fecal Calprotectin Test Market Size & Trends

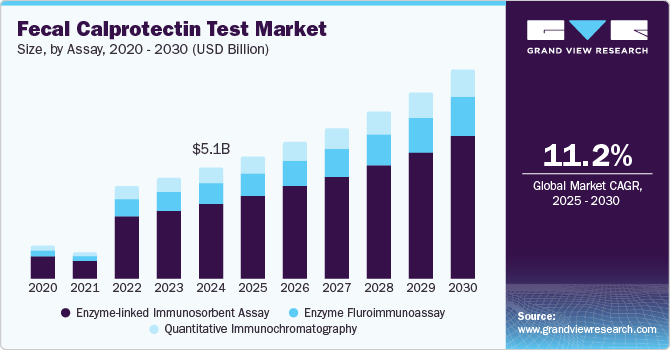

The global fecal calprotectin test market size was valued at USD 5.12 billion in 2024 and is expected to grow at a CAGR of 11.2% from 2025 to 2030. The growth is driven by the rising prevalence of gastrointestinal disorders, including inflammatory bowel disease (IBD), and the increasing demand for non-invasive diagnostic methods. Growing awareness, advancements in diagnostic technologies, and the test's utility in differentiating IBD from irritable bowel syndrome (IBS) further drive market expansion. Product innovation has been a key strategy by players in the market. For instance, in May 2024, BÜHLMANN upgraded its IBDoc software and application to make it more user-friendly.

The industry is experiencing significant growth, driven by the rising prevalence of gastrointestinal disorders such as inflammatory bowel disease (IBD) and irritable bowel syndrome (IBS). These conditions are becoming more common due to lifestyle changes, dietary habits, and environmental factors, creating a growing need for effective diagnostic tools. According to Johns Hopkins University, approximately 15% of the U.S. population suffers from IBS. fecal calprotectin tests has emerged as a preferred non-invasive diagnostic method, offering high sensitivity and specificity in detecting intestinal inflammation, which is crucial for distinguishing between IBD and IBS. This has reduced the reliance on invasive procedures like colonoscopies, making it a more patient-friendly option.

Technological advancements have further fueled market growth by improving test accuracy, reducing turnaround times, and enhancing accessibility. The development of point-of-care devices has enabled faster diagnosis, particularly in outpatient and primary care settings, expanding the test's applicability. Additionally, increasing awareness among healthcare professionals and patients about the benefits of early detection and management of gastrointestinal conditions has contributed to the market's expansion.

Supportive government initiatives and rising healthcare expenditure in developed and emerging economies have also played a pivotal role in driving the adoption of fecal calprotectin tests. Reimbursement policies in certain regions have made these tests more affordable, further boosting their demand. Moreover, the growing trend of home-based diagnostic kits has opened new avenues, catering to patients seeking convenient and private diagnostic solutions.

The market is also benefiting from the increasing focus on precision medicine, where fecal calprotectin levels serve as a key tool for monitoring treatment efficacy and disease progression in IBD patients. With continued advancements in diagnostic technologies and expanding applications in both clinical and research settings, the fecal calprotectin test market is poised for sustained growth in the coming years.

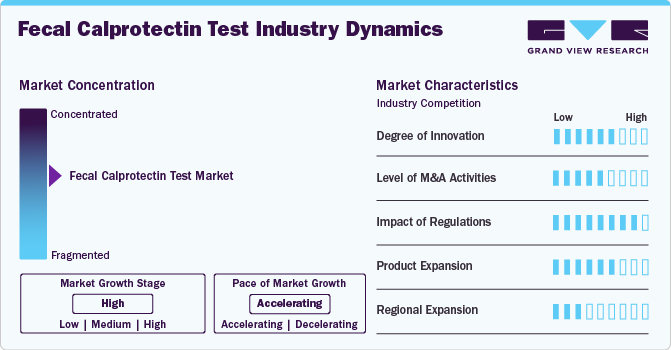

Market Concentration & Characteristics

The degree of innovation in the fecal calprotectin test industry focuses on enhancing diagnostic accuracy, speed, and accessibility. Advancements include high-sensitivity assays, point-of-care devices, and home-testing kits. Integration of AI for result interpretation and automation in laboratories further drives efficiency, supporting broader adoption and improved patient outcomes.

The industry demonstrates a high level of collaboration and partnership activities among diagnostic companies, healthcare providers, and research institutions. These partnerships aim to advance test development, improve accessibility, and enhance clinical applications. Collaborations often focus on co-developing innovative technologies, expanding distribution networks, and conducting clinical trials to validate diagnostic accuracy and efficacy.

Regulations significantly impact the market in shaping product development, market-entry, and adoption. Stringent regulatory frameworks, such as those set by the U.S. FDA, EMA, and other global agencies, ensure the safety, efficacy, and reliability of diagnostic tests. Compliance with these regulations can lengthen product development timelines and increase costs, but they also enhance market credibility and user trust.

Product expansion in the market is driven by increasing demand for innovative, patient-friendly solutions and advancements in diagnostic technologies. Companies are diversifying their product portfolios by introducing high-sensitivity assays, rapid point-of-care testing kits, and home-based diagnostic solutions.

Regional expansion in industry is fueled by rising awareness of gastrointestinal disorders, increasing healthcare infrastructure, and the growing prevalence of conditions like IBD and IBS in various regions. Companies are targeting emerging markets in Asia-Pacific, Latin America, and the Middle East & Africa, where healthcare access is improving, and demand for non-invasive diagnostic tools is rising.

Assay insights

The enzyme-linked immunosorbent assay segment accounted for the largest share of 66.4% in 2024. The segment’s dominance is owing to its high sensitivity, specificity, and reliability in detecting biomarkers. ELISA is a well-established technology with widespread acceptance in clinical and research settings, offering standardized protocols and robust results. Its scalability for high-throughput testing makes it ideal for laboratories handling large sample volumes. Additionally, ELISA kits are cost-effective, widely available, and supported by extensive validation studies, ensuring their credibility and ease of integration into diagnostic workflows.

The enzyme fluroimmunoassay segment is likely to grow at a CAGR of 10.5% over the forecast period. EFIA utilizes fluorescent labels, which provide more precise and quantifiable results, making it highly suitable for detecting low concentrations of calprotectin. Its ability to automate processes in modern laboratory settings further boosts efficiency and reduces human error, catering to the growing demand for high-throughput diagnostic solutions. Additionally, EFIA's compatibility with advanced diagnostic platforms and its potential for point-of-care applications position it as a competitive alternative in the market. Technology also offers rapid turnaround times, enabling quicker clinical decisions, and is often more cost-effective than traditional diagnostic methods, making it appealing in healthcare settings with budget constraints. As awareness of Fecal Calprotectin Test grows, EFIA is becoming more widely adopted in clinical practice, further fueled by advancements in assay precision and automation.

Application Insights

The inflammatory bowel disease segment captured the highest share of 66.0% in 2024. Inflammatory Bowel Disease (IBD) dominates the market due to its strong association with elevated calprotectin levels in stool. Fecal calprotectin is a biomarker of inflammation in the gastrointestinal tract, and its levels are significantly elevated in conditions like IBD, which includes Crohn's disease and ulcerative colitis. These diseases are chronic, often requiring long-term monitoring to assess disease activity, flare-ups, and the effectiveness of treatments.

Fecal calprotectin test provides a non-invasive, reliable, and cost-effective way to measure inflammation levels, making it an essential tool for managing IBD. The increasing prevalence of IBD globally, combined with the growing demand for non-invasive diagnostic and monitoring methods, has led to an expansion of the fecal calprotectin test market. According to a study published in the National Institutes of Health, in Canada, the prevalence of IBD was 29.9 per 100,000 in 2023, which is likely to grow to 31.2 per 100,000 by the year 2035.

Moreover, fecal calprotectin testsis increasingly being used not only for diagnosing IBD but also for differentiating it from other gastrointestinal conditions, further solidifying its role in IBD management. As healthcare providers seek more efficient ways to monitor and manage IBD, the demand for fecal calprotectin tests continues to grow, reinforcing its dominance in the market.

The colorectal cancer segment is expected to expand at a CAGR of 9.5% over the forecast period. As the global incidence of colorectal cancer rises, there is a greater emphasis on early detection methods. Fecal calprotectin tests offers a non-invasive alternative to traditional colonoscopy, making it a more attractive option for both patients and healthcare providers. The non-invasive nature of fecal calprotectin tests makes it a preferred choice for screening, particularly for individuals at average risk for colorectal cancer. This ease of use drives demand for such tests, especially in routine screening programs. According to the International Agency for Research on Cancer, in 2022, there were over 1.9 million cases of Colorectum cancer, which are likely to cross 2.3 million by 2030. With such lucrative growth in the number of cases, the demand for fecal calprotectin tests is predicted to show positive growth.

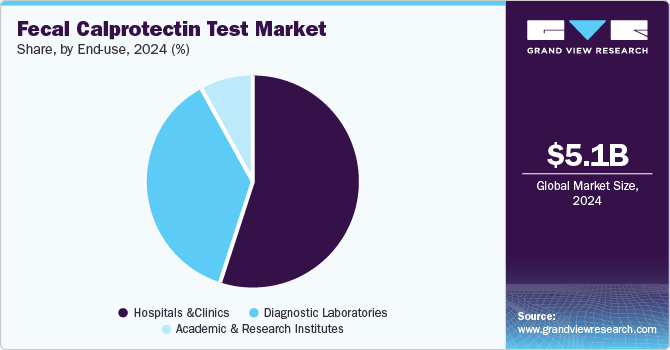

End-use Insights

Hospitals and clinics held the largest share of 54.7% in 2024. These settings serve a large patient base, including individuals with gastrointestinal symptoms or risk factors for colorectal cancer, making them the primary venues for diagnostic testing. Hospitals and clinics are equipped with advanced infrastructure, such as laboratory facilities and specialized healthcare professionals, which are essential for performing and interpreting fecal calprotectin tests. Furthermore, these settings integrate fecal calprotectin tests with other diagnostic procedures, such as colonoscopies and imaging, ensuring a holistic approach to patient care. Established referral networks with specialists, such as gastroenterologists and oncologists, further enhance the effectiveness of testing and treatment. Insurance coverage and reimbursement are often more accessible in hospitals and clinics, making testing more affordable for patients. Additionally, these institutions adhere to clinical guidelines and regulatory standards, ensuring the adoption of validated diagnostic methods.

The diagnostic laboratories segment is expected to expand at a CAGR of 10.6% by 2030. Diagnostic laboratories specialize in providing a wide range of testing services, including fecal calprotectin tests, which is crucial for detecting conditions like colorectal cancer and inflammatory bowel diseases. As demand for non-invasive and early diagnostic tools rises, laboratories are well-positioned to meet this need by offering specialized, accurate, and timely testing services. The rise in preventive healthcare and the growing awareness of the importance of early disease detection further contribute to the expansion of diagnostic laboratories.

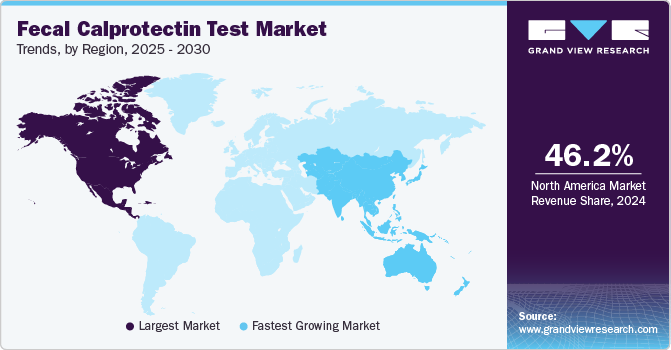

Regional Insights

North America fecal calprotectin test industry dominated and accounted for a 46.2% share in 2024. The increasing prevalence of colorectal cancer and other gastrointestinal disorders within the region is the major market driver. As awareness about the importance of early screening rises, more individuals are seeking non-invasive and accessible testing options like fecal calprotectin tests. North America, with its advanced healthcare infrastructure, is well-equipped to support the adoption of these diagnostic tools.

U.S. Fecal Calprotectin Test Market Trends

The fecal calprotectin test industry in the U.S. is projected to grow significantly during the forecast period. The U.S. healthcare system is highly developed, with a robust infrastructure for laboratory testing and diagnostic services. This allows for the widespread availability and accessibility of fecal calprotectin tests across various healthcare settings, from hospitals to diagnostic laboratories. The U.S. also has a well-established insurance system that often covers screening tests, making it easier for patients to access these services

Europe Fecal Calprotectin Test Market Trends

The fecal calprotectin test industry in Europe is driven by the rising incidence of colorectal cancer in Europe, which has led to greater emphasis on screening and early diagnosis. In 2022, over 500,000 cases of colorectal cancer were diagnosed across Europe, which is likely to cross 590,000 cases by 2030. Fecal Calprotectin Test, being a non-invasive and cost-effective option, is increasingly being used as a tool for early detection, especially in individuals at risk for colorectal cancer or inflammatory bowel diseases (IBD).

The UK fecal calprotectin test market is projected to grow during the forecast period. The National Health Service (NHS), which provides universal healthcare in the UK, has increasingly incorporated Fecal Calprotectin Test into its clinical guidelines for the diagnosis of IBD and as part of colorectal cancer screening programs. This integration within the NHS framework helps to ensure the widespread availability and accessibility of the test, driving demand across the country.

The fecal calprotectin test market in France is expected to show steady growth over the forecast period. France’s strong healthcare infrastructure, with advanced diagnostic laboratories and medical facilities, ensures the widespread availability of fecal calprotectin tests. There is also a growing awareness among the population about the importance of early disease detection, especially with colorectal cancer being one of the most common cancers in the country.

Germany fecal calprotectin test market is projected to expand during the forecast period. Germany has integrated fecal calprotectin tests into its clinical guidelines for the diagnosis of IBD and colorectal cancer screening, further driving its adoption in clinical practice. The German healthcare system also prioritizes preventive care, and fecal calprotectin tests offers an effective way to identify potential health issues early, potentially reducing the need for more invasive procedures like colonoscopies.

Asia Pacific Fecal Calprotectin Test Market Trends

The fecal calprotectin test industry in Asia Pacific is expected to experience the highest growth rate of 12.7% CAGR during the forecast period. In many countries, healthcare systems are undergoing rapid development with increasing access to advanced diagnostic technologies and healthcare services. This has contributed to the widespread availability of fecal calprotectin tests, particularly in countries like China, Japan, and India, where the healthcare infrastructure is improving, and diagnostic laboratories are expanding. The adoption is further supported by the growing focus on preventive healthcare and the desire to reduce healthcare costs by detecting diseases early, potentially avoiding the need for more invasive and expensive procedures such as colonoscopies.

China fecal calprotectin test market is projected to expand throughout the forecast period. China's healthcare system is undergoing significant reform and modernization, with improvements in infrastructure, access to advanced diagnostic technologies, and growing investment in medical research. This has led to the wider availability of fecal calprotectin tests, particularly in urban areas where diagnostic laboratories and healthcare facilities are more developed.

The fecal calprotectin test market in Japan is anticipated to grow during the forecast period. The aging population in Japan is a significant factor driving the demand for fecal calprotectin tests, as older individuals are at a higher risk for colorectal cancer and other gastrointestinal disorders. The focus on early detection in Japan is reflected in the growing number of health check-up programs and screenings that incorporate fecal calprotectin tests, particularly in urban areas where access to advanced diagnostic technologies is more widespread.

Latin America Fecal Calprotectin Test Market Trends

The fecal calprotectin test industry in Latin America is expected to experience significant growth throughout the forecast period. Public awareness of gastrointestinal health is rising in Latin America, as people become more aware of the risks associated with associated medical conditions such as IBD. As a result, more individuals are seeking out diagnostic tests, including fecal calprotectin, to monitor their health and detect potential issues early.

The fecal calprotectin test market in Brazil is likely to grow over the forecast period. National health campaigns and screening programs have contributed to the broader adoption of fecal calprotectin tests, especially as the country’s healthcare infrastructure continues to improve. The test is seen as a valuable tool for identifying potential gastrointestinal issues early, helping to reduce the need for more invasive procedures such as colonoscopies.

Middle East And Africa Fecal Calprotectin Test Market Trends

The fecal calprotectin test market in the Middle East and Africa is likely to grow over the forecast period. The regional market is likely to show growth due to the increasing prevalence of gastrointestinal disorders, such as inflammatory bowel disease (IBD), including Crohn’s disease and ulcerative colitis, in the region. These conditions are rising as awareness of gastrointestinal health is improving, and more patients seek diagnosis and management.

Saudi Arabia fecal calprotectin test industry is anticipated to experience lucrative growth during the forecast period. The country has been investing heavily in healthcare infrastructure as part of its Vision 2030 initiative, which aims to improve the quality of healthcare services and expand access to modern diagnostic tools. This has led to an increase in the availability of fecal calprotectin tests in both public and private healthcare facilities.

Key Fecal Calprotectin Test Company Insights

Key companies are making continuous efforts to fulfill the growing demand for tests owing to the increasing prevalence of IBD and cancer of the colorectum. For instance, in November 2022, Eiken Chemical Co., Ltd announced that they had launched OC-SENSOR Ceres, which is an automated faecal calprotectin analyzer. With the CE approval of the product, the company aims to market the product in Europe and other countries.

Key Fecal Calprotectin Test Companies:

The following are the leading companies in the fecal calprotectin test market. These companies collectively hold the largest market share and dictate industry trends.

- Epitope Diagnostics Inc.

- Hycult Biotech

- Actim

- Eagle Biosciences, Inc.

- OPERON

- Svar Life Science

- BÜHLMANN

- DRG International Inc.

- ALPCO

- Diazyme Laboratories

Recent Developments

-

In November 2022, EIKEN launched the OC-SENSOR Ceres, a fully automated fecal immunochemical test (FIT) and fecal calprotectin analyzer. This device offers high analytical performance in a compact design, facilitating efficient testing in clinical settings.

-

In November 2022, BIOHIT announced a partnership with Celltrion Healthcare UK Ltd wherein BIOHIT will supply Preventis SmarTest Calprotectin Home test to people at home. This service has been organized in response to the 360-degree care package of NHS for patients diagnosed with IBD.

-

In July 2022, DiaSorin obtained U.S. FDA approval for the LIAISON Q.S.E.T. Device Plus, a device designed to prepare human stool samples for testing with the LIAISON Calprotectin assay. This device enhances the efficiency of the sample preparation process, optimizing laboratory workflows.

Fecal Calprotectin Test Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.63 billion

Revenue forecast in 2030

USD 9.55 billion

Growth rate

CAGR of 11.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Assay, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK;, France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa

Key companies profiled

Epitope Diagnostics Inc.; Hycult Biotech; Actim; Eagle Biosciences, Inc.; OPERON; Svar Life Science; BÜHLMANN; DRG International Inc.; ALPCO; Diazyme Laboratories

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Fecal Calprotectin Test Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels, and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fecal calprotectin test market report on the basis of assay, application, end-use, and region.

-

Assay Outlook (Revenue, USD Million, 2018 - 2030)

-

Enzyme-linked Immunosorbent Assay

-

Enzyme Fluroimmunoassay

-

Quantitative Immunochromatography

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Inflammatory Bowel Disease

-

Colorectal Cancer

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals And Clinics

-

Diagnostic Laboratories

-

Academic And Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global fecal calprotectin testing market size was estimated at USD 5.12 billion in 2024 and is expected to reach USD 5.63 billion in 2025.

b. The global fecal calprotectin testing market is expected to grow at a compound annual growth rate of 11.2% from 2025 to 2030 to reach USD 9.55 billion by 2030.

b. North America dominated the fecal calprotectin testing market with a share of 46.2% in 2024. This is attributable to rising healthcare awareness along with high patient base within the region

b. Some key players operating in the fecal calprotectin testing market include Epitope Diagnostics Inc.; Hycult Biotech; Actim; Eagle Biosciences, Inc.; OPERON; Svar Life Science; BÜHLMANN; DRG International Inc.; ALPCO; Diazyme Laboratories

b. Key factors that are driving the market growth include the increasing prevalence of gastric disorders, such as colorectal cancer and IBD along with rising geriatric population susceptible to gastric disorders

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.