- Home

- »

- Animal Feed and Feed Additives

- »

-

Feed Palatability Enhancers And Modifiers Market Report, 2030GVR Report cover

![Feed Palatability Enhancers And Modifiers Market Size, Share & Trends Report]()

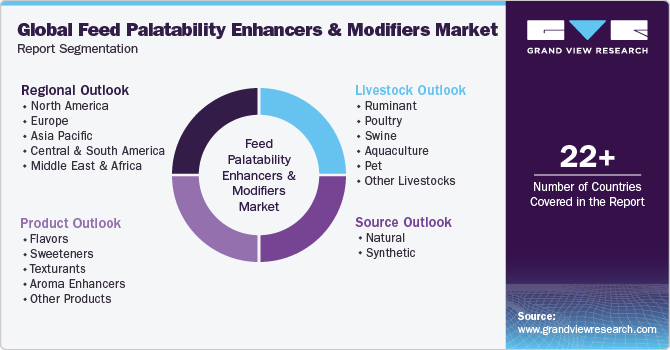

Feed Palatability Enhancers And Modifiers Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Natural, Synthetic), By Product (Flavors, Sweeteners), By Livestock, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-253-6

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global feed palatability enhancers and modifiers market size was estimated at USD 3,250.52 million in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030. This is attributable to the increasing demand for livestock products, the need to enhance livestock productivity, the rise in meat consumption, and the adoption of modern practices in animal husbandry.

These factors collectively stimulate the demand for the product, as they play a crucial role in improving the taste, smell, and texture of animal food, ultimately leading to better intake, enhanced growth, and increased overall feed efficiency.

Feed palatability enhancers and modifiers constitute additives employed in animal food to augment its gustatory, olfactory, visual, and textural properties. These additives primarily serve to ameliorate feed consumption, foster enhanced growth, and elevate overall efficacy. Their principal objective lies in mitigating the bitter taste and odor inherent in other additives such as vitamins, minerals, and medications present in the product. Through the enhancement of taste, scent, and texture, these products heighten the general appeal of the product, thereby playing a pivotal role in the advancement of the animal food sector. Their prominence within the realm of feed supplements is attributable to their capacity to boost intake and enhance the palatability of animal food. Moreover, they contribute to the enhancement of livestock health.

The escalating demand for animal-derived goods, particularly amid the backdrop of burgeoning meat consumption worldwide, stands as a pivotal catalyst propelling the product market. With the global populace on a continual upsurge, the call for meat and assorted livestock commodities escalates in parallel, necessitating heightened livestock productivity and an augmentation of the overall allure of animal food. This trajectory has garnered specific attention from product manufacturers, precipitating a surge in the requisition for palatability enhancers and modifiers to align with the evolving requisites of the livestock sector. Furthermore, the adoption of pioneering and contemporary methodologies in animal husbandry has engendered an amplified demand for the product.

The market encounters various constraints that impede its expansion and potential. A notable restraint is the escalation in the cost of raw materials, presenting a formidable challenge for market participants. The upward trajectory in raw material costs employed in product manufacturing exerts pressure on overall production expenses, thereby influencing the pricing and profitability of these goods. This constraint accentuates the imperative for market participants to confront challenges related to costs and delve into sustainable sourcing methodologies to alleviate the repercussions of escalating raw material expenses on the market.

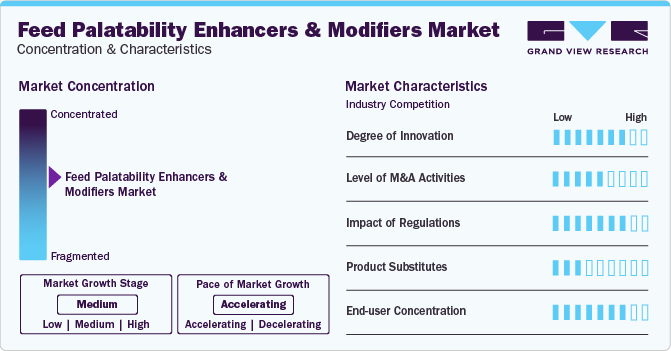

Market Concentration & Characteristics

The market demonstrates characteristics akin to a fragmented landscape, typified by the participation of numerous small and medium-sized enterprises in conjunction with prominent multinational corporations. This fragmentation manifests within the market framework, wherein a diverse array of entities competes to cater to the dynamic requisites of the animal nutrition and production sector. Illustratively, significant stakeholders encompass DuPont de Nemours, Inc., Associated British Foods plc, Kerry Inc., Symrise, Adisseo, Elanco, Ensign-Bickford Industries Inc., and Kent Nutrition Group, among others. The coexistence of these notable international entities alongside smaller rivals mirrors the segmented nature of the market, wherein multiple contenders vie for market penetration and sway.

Market growth stage is medium, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation. Ongoing research and development activities in the field of automation & manufacturing efficiency, quality control & testing, and aroma & flavor enhancement, among others, drive innovations in production.

The manufacturing and utilization of feed palatability enhancers and modifiers are subject to a myriad of regulations and standards aimed at safeguarding the safety and quality of animal food. These regulations are designed to uphold animal welfare, ensure food safety, and preserve environmental sustainability. While regulatory specifics may diverge contingent on country or region, there exist overarching regulatory frameworks governing the industry. Key regulatory bodies and organizations overseeing the market include the US Food and Drug Administration (FDA), the European Food Safety Authority (EFSA), Codex Alimentarius, and National Regulatory Authorities, among others.

Regulations are instrumental in ensuring that animal food additives, including palatability enhancers and modifiers, adhere to stringent safety criteria. This serves to uphold the integrity of animal food and mitigate the potential for adverse effects on animal well-being and food safety. However, while regulatory compliance is crucial for maintaining industry standards, it can pose challenges for prospective entrants into the market. The necessity to conform to rigorous safety and efficacy benchmarks often demands substantial investments in research, development, and testing processes. Consequently, these requirements may act as deterrents for new companies seeking to establish a presence in the market, thus potentially limiting the number of entities operating within it.

End-user concentration plays a pivotal role in shaping the dynamics of the global feed palatability enhancers and modifiers market. With a multitude of product manufacturers increasingly incorporating these products into their formulations, there's a tendency towards larger volume purchases. This trend can engender economies of scale for suppliers of the product, potentially yielding cost efficiencies in both production and distribution processes. Moreover, heightened end-user concentration often fosters enduring relationships between suppliers of the product and major players in the end-use industries. This stability lays the groundwork for collaborative ventures, mutual comprehension, and the establishment of enduring business partnerships.

Source Insights

Based on source, the synthetic products segment led the market with the largest revenue share of approximately 60.91% in 2023. These products are artificially derived compounds synthesized through chemical processes, designed to replicate natural flavors, or enhance the appeal of animal food. These additives provide a diverse array of flavors and taste profiles, tailored to meet specific demands within the animal nutrition and production sector. Consequently, the anticipated surge in demand for these products is expected to persist over the forecast period.

Natural feed palatability enhancers and modifiers originate from plant or animal sources, encompassing elements such as herbs, spices, and meat extracts. These natural constituents impart a genuine and organic flavor to animal food, resonating with the escalating consumer inclination towards natural and organic goods. Consequently, in tandem with the burgeoning global demand for natural and eco-friendly products, driven by evolving consumer preferences, a rapid escalation in demand for natural products is anticipated.

Product Insights

The flavors segment dominated the market with the revenue share in 2023. As a pivotal product segment, flavors significantly contribute to augmenting the taste and aroma of animal food. These flavors may originate from natural sources such as herbs, spices, and meat extracts, or they can be artificially synthesized to replicate distinct taste profiles. For instance, natural flavors like meat extracts can enrich the palatability of pet food, whereas synthetic flavors offer a diverse array of taste options tailored to accommodate specific animal preferences.

Sweeteners constitute another significant product category within the feed palatability enhancers and modifiers market. These sweetening agents encompass both natural variants, such as sucrose and fructose, and synthetic alternatives, including high-intensity sweeteners like saccharin and aspartame. The incorporation of sweeteners into animal food serves the purpose of elevating its palatability and accommodating the taste inclinations of animals.

Texturants, as a product category, hold considerable importance within the product market. These additives serve to alter the texture and tactile sensation of animal food, thereby enhancing its overall palatability and acceptance among animals. For instance, high-ester pectin, which has previously been utilized to augment viscosity and enhance mouthfeel in beverages and soft drinks, addresses the requirement for improved texture in animal food.

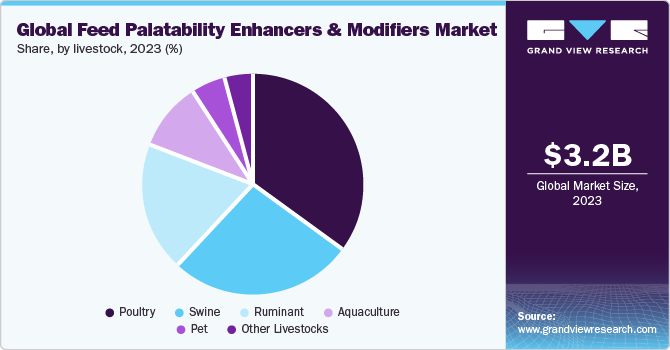

Livestock Insights

Based on livestock, the poultry segment led the market with the largest revenue share of 35.33% in 2023. Poultry species exhibit discernible taste preferences and nutritional necessities, prompting the demand for tailored solutions. For instance, integrating sweeteners and texturants into poultry food can amplify palatability and cater to particular dietary requisites, thereby bolstering overall growth and performance among poultry. The market presents a plethora of products meticulously crafted to fulfill the distinctive needs of poultry species, underscoring the dynamic and specialized character of this segment within the market.

Swine, commonly known as pigs, exert considerable influence on the product market. With distinct taste preferences and dietary needs, these animals propel the requirement for customized solutions. The escalating worldwide demand for pork and other meat derivatives underscores the necessity for augmented livestock production. In response to this demand surge, farmers and producers seek avenues to optimize efficiency and enhance the palatability of animal food. In this pursuit, feed palatability enhancers and modifiers emerge as pivotal tools in accomplishing these objectives.

Feed palatability enhancers and modifiers are incorporated into cattle food to elevate its taste, aroma, and texture, thereby rendering it more enticing to the animals. Through the enhancement of feed palatability, these additives have the potential to bolster intake, ensuring cattle receive essential nutrients crucial for growth and productivity. Furthermore, the burgeoning demand for premium beef products and the heightened emphasis on animal welfare have significantly impacted the utilization of the product. In response to consumer preferences, producers endeavor to meet expectations by augmenting the taste and caliber of beef by utilizing these additives.

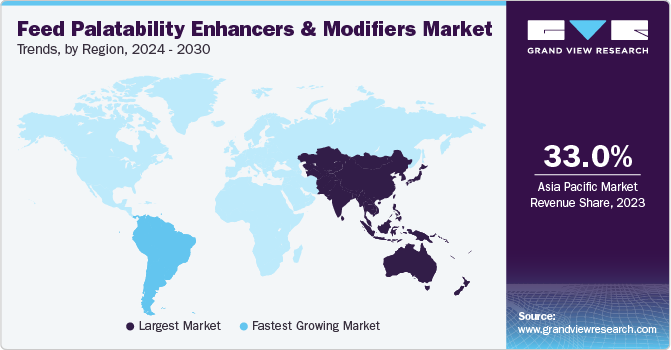

Regional Insights

The feed palatability enhancers & modifiers market in North America was the second largest market in terms of consumption of the product. Factors driving this consumption include consumer awareness about meat quality, increased demand for high-quality animal products, and the rising trend of pet ownership.

U.S. Feed Palatability Enhancers And Modifiers Market Trends

The feed palatability enhancers & modifiers market in U.S. was one of the leading consumers of the product on account of advances in animal nutrition and food technology, focusing on reducing waste and improving, and increasing meat consumption in the country.

The Canada feed palatability enhancers and modifiers market emerged as the fastest growing market in terms of consumption of the product. Rapid industrialization coupled with a rise in global trade related to the product impacts the consumption trends in the country.

Asia Pacific Feed Palatability Enhancers And Modifiers Market Trends

Asia Pacific dominated the feed palatability enhancers & modifiers market with the revenue share of 33% in 2023. This high share is attributable to expanding animal food industry, growing animal health concerns, rising demand for animal food, and market awareness and adoption. In addition, the region is home to numerous animal food manufacturing companies, both domestic and international, thereby fueling the demand for the product exponentially.

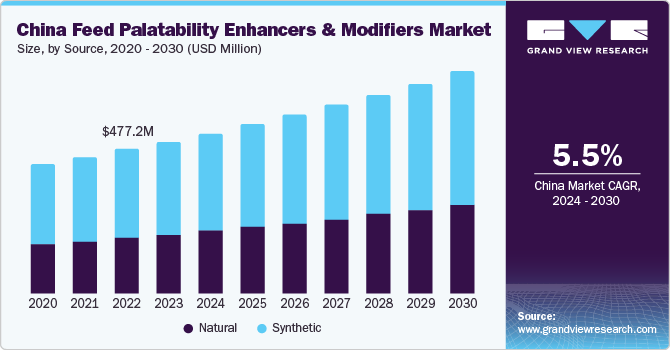

The feed palatability enhancers & modifiers market in China held a significant revenue share of 46% in terms of product consumption in 2023. China has a significant livestock industry, particularly in the production of swine/pork and cattle. The increasing demand for meat products in the country has led to a greater focus on improving animal food quality and palatability. Feed palatability enhancers and modifiers play a crucial role in enhancing the taste, aroma, and texture of animal food, making it more appealing to livestock and improving intake.

Europe Feed Palatability Enhancers And Modifiers Market Trends

The feed palatability enhancers & modifiers market in Europe is anticipated to grow at the fastest CAGR during the forecast period. The product demand is set to increase due to rise in demand for animal-based products for consumption coupled with increasing production of animal food. According to Alltech Agri Report, Europe witnessed significant animal food production for pets, equine, and aquaculture with an increase of 1.65%, 1.78%, and 1.09% respectively.

The Spain feed palatability enhancers and modifiers market emerged as the largest consumer in European region with a revenue share of approximately 16% in 2023. This is attributable to rising meat consumption in the country. As of 2023, according to FAO stats, Spain was the 6th largest meat consumer with 100.26 kgs of meat consumed per person. Such factors are expected to have a positive impact on the product market.

The feed palatability enhancers and modifiers market in Italy held a prominent position in the consumption of the product, due to rising animal food production in the country. According to FEFAC, in 2023, Italy’s compound animal feed production rose 2.4% compared to the previous year. Such factors are responsible for the growth of the product in the country.

Central & South America Feed Palatability Enhancers And Modifiers Market Trends

The feed palatability enhancers & modifiers market in Central & South America is anticipated to grow at the fastest CAGR over the fastest period. The region witnessed a significant increase in animal food production in the year 2023. According to an Alltech report, animal food production in CSA increased 1.6% with an increase of 3.006 million metric tons in terms of volume. This increase in the production of animal feed is anticipated to have a positive impact on the demand for the product.

The Brazil feed palatability enhancers and modifiers market is anticipated to grow at the fastest CAGR over the forecasted period, on the account of rising disposable income of the overall population coupled with rising concerns regarding quality of animal food that influence the demand for the product.

Middle East & Africa Feed Palatability Enhancers And Modifiers Market Trends

The feed palatability enhancers & modifiers market in Middle East & Africa is anticipated to grow at the fastest CAGR over the forecast period. According to Alltech Agri-Food Outlook 2023, Middle East witnessed exponential growth in terms of tonnage of animal food production of 24.73%. Beef was the most consumed meat type with a YoY of 6.89% in 2023. This trend is expected to grow further and positively influence the demand for the product over the forecast period.

The Saudi Arabia feed palatability enhancers and modifiers market is set to dominate the regional market due to expansion in animal food production. Various manufacturers such as Tanmiah Food Company have secured credit to support their expansion plans regarding production of poultry food. Such strategic initiatives undertaken by companies are anticipated to have a positive impact on market growth.

Key Feed Palatability Enhancers And Modifiers Company Insights

Some of the key players operating in the market include DuPont, Associated British Foods Plc, Kerry Group Plc, and Symrise AG, among others.

-

Kerry Group is a multinational manufacturing organization which serves various end-use industries such as Food & Beverages, Pharmaceutical & Biotechnology, Animal feed, etc. Their vast portfolio of products is divided into 5 division namely Taste Ingredients, Nutrition Ingredients, Food Solutions, Beverage Solutions, Foodservice, and Pharma & Biotechnology

-

Symrise is one of the leading manufacturing companies in the world engaged in production of fragrances, flavors, natural nutrition & cometic ingredients. The company has more than 35000 products in their vast product portfolio, serving to more than 6000 customers in over 150 countries

Elanco Animal Health, Kent Nutrition Group, are some of the emerging market participants in the global market.

-

Elanco is engaged in proving solutions to animal health & nutrition industry via their products, which are segmented into 3 business categories: farm animals, pets, and services. The company is also engaged in R&D and have numerous patents to its name

-

Kent Nutrition Group, a part of Kent Corporation, is home to Kent and Blue Seal animal nutrition brands. The company is engaged in livestock feeding industry and uses quality ingredients to develop their products

Key Feed Palatability Enhancers And Modifiers Companies:

The following are the leading companies in the feed palatability enhancers and modifiers market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont

- Associated British Foods Plc

- Kerry Group Plc

- Symrise AG

- Adisseo France SAS

- Elanco Animal Health

- Kent Nutrition Group

- Kemin Industries, Inc.

- Diana Foods

Recent Developments

-

In February 2023, Adisseo announced acquisition of Nor-Food, a France based company, that produces plant-based specialty ingredients and plant extracts for animal nutrition industry

-

In September 2022, BASF SE and Evonik Industries AG partnered to curb and reduce environmental footprint of animal feed manufacturing and animal protein industries. Cooperation combines BASF’s deep value chain sustainability experience in animal nutrition and Evonik’s extensive knowledge of feed formulation and customer insights

-

In June 2023, Evonik Industries AG launched its Biolys product line for animal feeds. The new Biolys provides higher concentration of L-lysine. The product also contains valuable components resulting from its fermentation process, additional nutrients and energy that further benefit livestock such as swine or poultry

Feed Palatability Enhancers & Modifiers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3,414.02 million

Revenue forecast in 2030

USD 4,803.87 million

Growth rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product, livestock, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; China; India; Japan; South Korea; Vietnam; Thailand; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

DuPont; Associated British Foods Plc; Kerry Group Plc; Symrise AG; Adisseo France SAS; Elanco Animal Health; Kent Nutrition Group; Kemin Industries, Inc.; Diana Foods

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Feed Palatability Enhancers And Modifiers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the feed palatability enhancers and modifiers market report based on source, product, livestock, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flavors

-

Sweeteners

-

Texturants

-

Aroma Enhancers

-

Other Products

-

-

Livestock Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Ruminant

-

Poultry

-

Swine

-

Aquaculture

-

Pet

-

Other Livestocks

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global feed palatability enhancers and modifiers market was estimated at USD 3,250.32 million in 2023 and is expected to reach USD 3,414.02 million in 2024.

b. The global feed palatability enhancers and modifiers market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 4,803.87 million by 2030.

b. Asia Pacific dominated the global feed palatability enhancers and modifiers market with a share of 33.5% in 2023. This high share is attributable to the expanding animal food industry, growing animal health concerns, rising demand for animal food, and market awareness and adoption.

b. Some of the key players operating in the market include DuPont, Associated British Foods Plc, Kerry Group Plc, and Symrise AG, among others.

b. Increasing demand for livestock products, the need to enhance livestock productivity, the rise in meat consumption, and the adoption of modern practices in animal husbandry. These factors collectively stimulate the demand for the product, as they play a crucial role in improving the taste, smell, and texture of animal food, ultimately leading to better intake, enhanced growth, and increased overall feed efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.