- Home

- »

- Clinical Diagnostics

- »

-

Ferritin Testing Market Size & Share, Industry Report, 2033GVR Report cover

![Ferritin Testing Market Size, Share & Trends Report]()

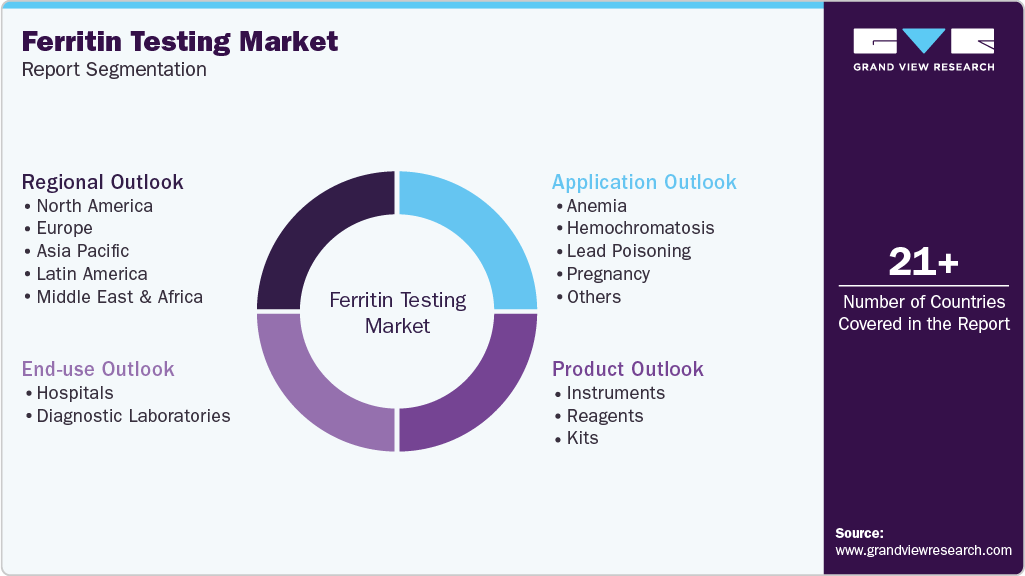

Ferritin Testing Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Instrument, Reagent, Kits), By Application (Anemia, Hemochromatosis, Lead Poisoning, Pregnancy), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-496-3

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ferritin Testing Market Summary

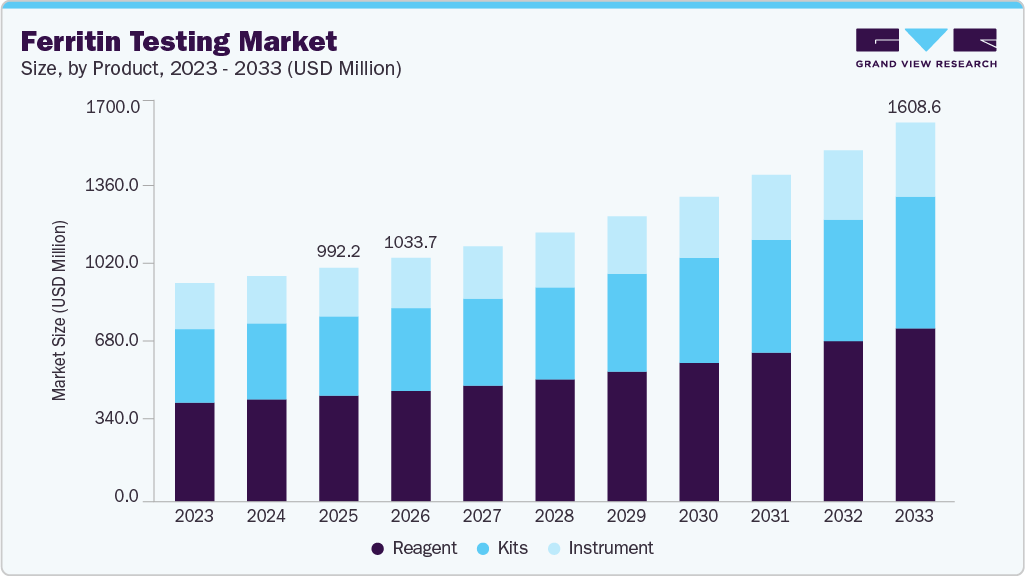

The global ferritin testing market size was estimated at USD 992.19 million in 2025 and is projected to reach USD 1,608.59 million by 2033, growing at a CAGR of 6.52% from 2026 to 2033. The rising prevalence of iron deficiency anemia and iron overload disorders such as hemochromatosis has driven the demand for ferritin testing.

Key Market Trends & Insights

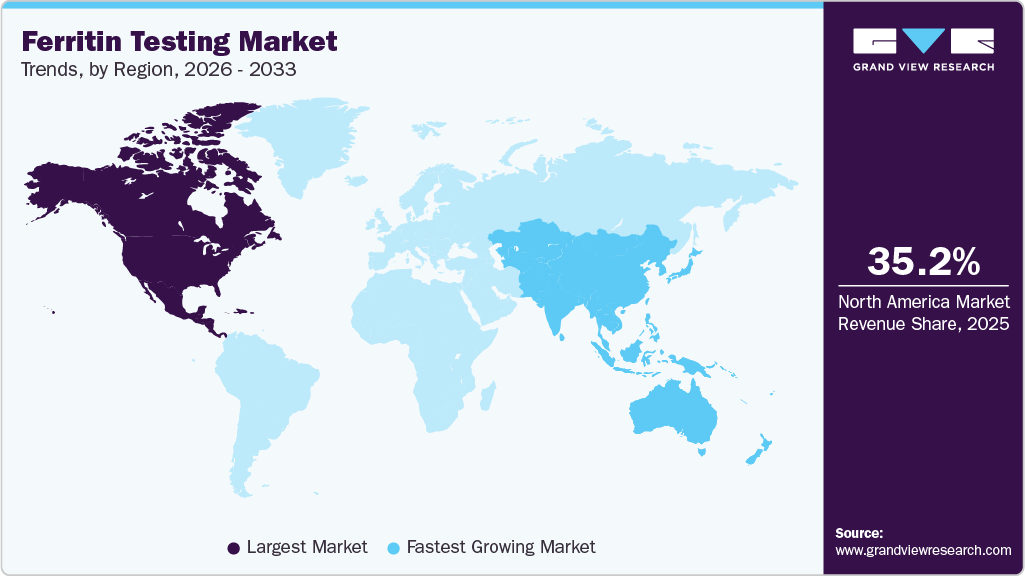

- North America dominated the global ferritin testing market with the largest revenue share of 35.20% in 2025.

- The ferritin testing industry in the U.S. accounted for the largest market revenue share in North America in 2025.

- By product, the reagent segment led the market with the largest revenue share of 45.32% in 2025.

- By application, the anemia segment led the market with the largest revenue share of 44.20% in 2025.

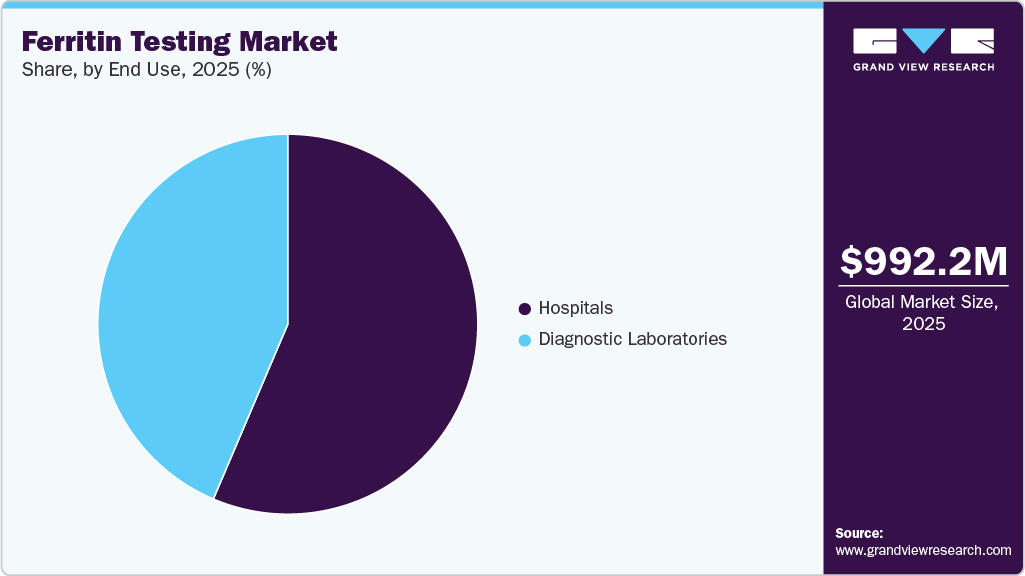

- Based on end-use, the hospitals segment led the market with the largest revenue share of 56.41% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 992.19 Million

- 2033 Projected Market Size: USD 1,608.59 Million

- CAGR (2026-2033): 6.52%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Increased awareness of the importance of iron monitoring in maternal health, chronic diseases, and pediatric populations has boosted demand. Advancements in diagnostic technologies, such as automated analyzers and point-of-care testing kits, have enhanced accessibility and accuracy, further driving market growth. In addition, the growing focus on preventive healthcare, coupled with expanding healthcare infrastructure in emerging markets, supports the adoption of ferritin tests for early diagnosis and effective treatment management.Technological advancements have revolutionized ferritin testing by introducing innovative point-of-care (POC) diagnostic devices. Microfluidic paper analytical devices (µPADs) and paper-based electrochemical immunosensors are examples of groundbreaking tools that offer portable, cost-effective, and reliable solutions for ferritin measurement. These devices are particularly beneficial in resource-limited settings, where traditional laboratory infrastructure may be unavailable. For instance, µPADs can use capillary whole blood samples to measure ferritin levels, enabling rapid screening and diagnosis in remote areas. This innovation not only addresses the challenges of accessibility but also facilitates public health interventions by providing actionable data for healthcare providers. Products like QDx Instacheck exemplify this trend, offering a powerful POC diagnostic system that extends ferritin testing beyond hospitals and laboratories to clinics and even near patient care sites.

Another driving factor in the ferritin testing industry is the increasing focus on maternal and child health. Iron deficiency anemia is a leading cause of morbidity among pregnant women and children, particularly in low- and middle-income countries. Early detection of ferritin levels in these populations is critical for preventing complications such as preterm birth, low birth weight, and developmental delays in children. The availability of portable ferritin testing devices allows healthcare providers to integrate iron status monitoring into routine antenatal and pediatric care, thereby improving health outcomes. For example, community health programs in rural areas can leverage portable diagnostic tools to identify at-risk individuals and implement targeted interventions, such as iron supplementation or dietary modifications.

In addition to addressing iron deficiency, ferritin testing plays a crucial role in managing chronic diseases and conditions associated with iron overload. Patients with hemochromatosis, liver disorders, or chronic kidney disease often require regular monitoring of ferritin levels to prevent complications. The adoption of advanced diagnostic technologies, such as automated analyzers and immunoassays, has enhanced the accuracy and efficiency of ferritin testing in clinical settings. Furthermore, the integration of artificial intelligence (AI) and machine learning algorithms into diagnostic systems has the potential to improve data interpretation and enable personalized treatment plans. For instance, AI-driven platforms can analyze ferritin test results in conjunction with other biomarkers to provide a comprehensive assessment of a patient’s iron status and overall health.

The rising demand for preventive healthcare and wellness initiatives has also created opportunities in the ferritin testing industry. As individuals become more proactive about their health, there is a growing interest in routine screening for iron levels as part of general health check-ups. This trend is particularly evident in developed markets, where consumers can access home-based testing kits and telemedicine services. Companies are capitalizing on this demand by developing user-friendly diagnostic solutions that empower individuals to monitor their health from the comfort of their homes. For example, home-based ferritin testing kits that use capillary blood samples and provide results through smartphone apps are gaining popularity, offering convenience and real-time insights.

Despite these advancements, challenges remain in ensuring the widespread adoption of ferritin testing, particularly in underserved regions. The high cost of advanced diagnostic systems and limited awareness about the importance of ferritin measurement are barriers to market growth. However, initiatives by governments and non-governmental organizations (NGOs) to promote iron deficiency screening and treatment are helping to bridge this gap. Public health campaigns, such as those focused on anemia prevention, are creating awareness and driving demand for ferritin testing in both urban and rural areas. Additionally, partnerships between diagnostic companies and healthcare providers are facilitating the distribution of affordable testing solutions to resource-constrained settings.

The growing emphasis on research and development (R&D) in diagnostic technologies is expected to expand the ferritin testing industry further. Companies are investing in the development of next-generation diagnostic tools that combine portability, accuracy, and ease of use. For instance, advancements in biosensor technology and nanomaterials are paving the way for highly sensitive and specific ferritin testing devices. These innovations have the potential to transform the diagnostic landscape by enabling early detection of iron-related disorders and improving patient outcomes. Moreover, the integration of cloud-based platforms with diagnostic devices is enhancing data management and enabling remote monitoring, which is particularly valuable in the context of telemedicine and digital health.

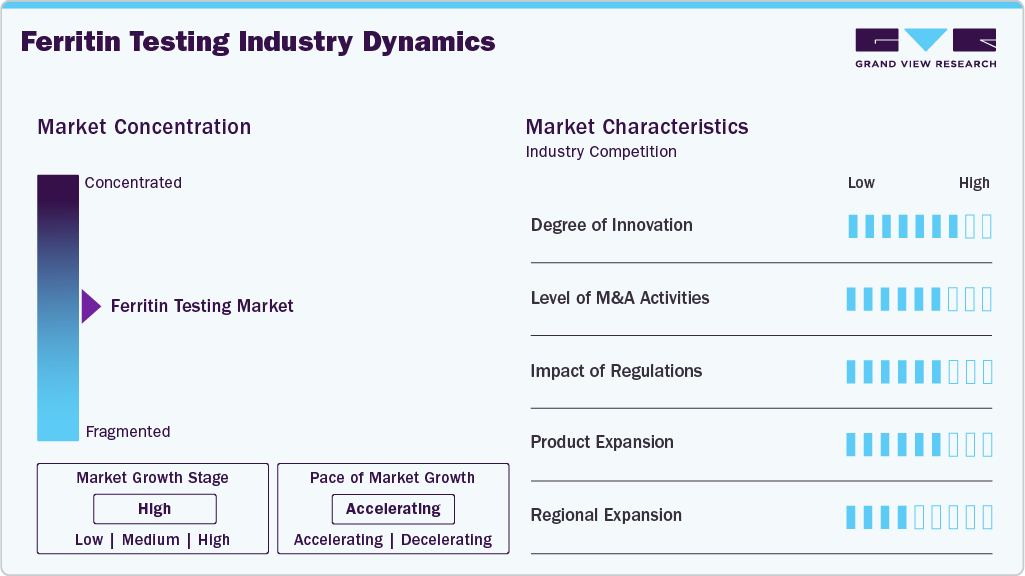

Market Concentration & Characteristics

The market is characterized by moderate to high levels of innovation, including the frequent development and introduction of novel techniques and diagnostic technologies, such as point-of-care diagnostics kits, which define the global ferritin testing industry. Key players are investing in innovative methods and technologies to meet the global demand of the market.

The ferritin testing industry is also characterized by the leading players with moderate levels of product launches and merger and acquisition (M&A) activity. Market players, including bioMérieux, CTK Biotech, Inc., and Thermo Fisher Scientific Inc.,are involved in new product launches and mergers and acquisitions. Strategic activities, such as mergers and acquisitions (M&A), partnerships, and collaborations, serve to increase the company’s competitiveness, expand its geographic reach, and help it enter new territories.

The ferritin testing industry is witnessing a high degree of innovation, driven by advancements in diagnostic technologies and point-of-care solutions. Innovative devices such as microfluidic paper analytical devices (µPADs) and electrochemical immunosensors are making ferritin testing more accessible, portable, and cost-effective. Automated analyzers and AI-integrated platforms enhance accuracy and efficiency, enabling the development of personalized treatment plans. Home-based testing kits with smartphone integration are transforming consumer-driven healthcare. These innovations address unmet needs in resource-limited settings, fostering early diagnosis and paving the way for improved clinical outcomes and expanded market adoption globally.

The ferritin testing industry has witnessed moderate levels of mergers and acquisitions (M&A) activities in recent years. Key drivers include the consolidation of diagnostic companies to expand product portfolios and improve technological capabilities, particularly in point-of-care testing and automated solutions. Companies are acquiring innovative startups specializing in biosensors, microfluidic devices, and portable diagnostic tools to strengthen their market position. For example, major players are targeting firms with expertise in paper-based immunosensors and advanced ferritin testing kits. These M&A activities aim to enhance global reach, improve accessibility, and address the growing demand for ferritin testing solutions.

Regulations significantly impact the ferritin testing industry by ensuring the accuracy, reliability, and safety of diagnostic tools. Stringent guidelines from agencies like the FDA, CE, and ISO standards drive the development of high-quality testing devices. Compliance with these regulations is crucial for market entry, particularly in regions such as the U.S. and Europe. In addition, government policies promoting anemia screening and public health initiatives boost demand for ferritin tests. In emerging markets, relaxed regulatory frameworks can accelerate adoption, while harmonized global standards support international trade and innovation in ferritin testing technologies.

In the ferritin testing industry, product substitutes include alternative diagnostic methods for assessing iron levels and related conditions. These substitutes include serum iron tests, total iron-binding capacity (TIBC) tests, and transferrin saturation measurements, which are commonly used to evaluate iron metabolism. In addition, advanced imaging techniques, such as MRI for liver iron concentration, and genetic testing for conditions like hemochromatosis, may serve as indirect substitutes. While these methods provide complementary or alternative insights, ferritin testing remains the gold standard due to its cost-effectiveness, ease of use, and reliability in diagnosing iron deficiency and overload conditions.

The ferritin testing industry is experiencing significant geographical expansion, driven by increasing healthcare awareness and enhanced diagnostic infrastructure in emerging markets. Regions such as the Asia-Pacific and Latin America are experiencing rapid growth due to the increasing prevalence of iron-deficiency anemia and government initiatives promoting early diagnosis. Countries such as India and China are investing in healthcare access, boosting demand for ferritin testing devices. In developed regions such as North America and Europe, advancements in point-of-care testing and home-based diagnostic kits are further expanding the market reach. Global collaborations and technology transfers also facilitate the global penetration of ferritin testing solutions.

Product Insights

The reagent segment led the market with the largest revenue share of 45.32% in 2025, driven by the increasing adoption of immunoassay-based diagnostic methods such as ELISA and chemiluminescent immunoassays. These methods rely on high-quality reagents for accurate and sensitive quantification of ferritin. For instance, the rising demand for monoclonal antibodies in reagent formulations enhances test specificity and reliability. Companies like Thermo Fisher Scientific and Roche Diagnostics are innovating reagents tailored for automated platforms, further fueling market growth. Additionally, recurring reagent consumption supports revenue stability, particularly in large diagnostic laboratories and hospitals.

The kits segment is anticipated to grow at the fastest CAGR during the forecast period, due to the rising demand for ready-to-use diagnostic solutions. Kits designed for ELISA and chemiluminescent assays are gaining popularity due to their ease of use and compatibility with automated systems. For example, Abbott’s Architect Ferritin Assay Kits are widely adopted in clinical laboratories for high-throughput testing. In addition, the increasing availability of point-of-care kits, such as QDx Instacheck Ferritin, supports decentralized testing in clinics and resource-limited settings. The growing emphasis on rapid and accurate ferritin measurement for anemia management drives the expansion of this segment.

Application Insights

The anemia segment led the market with the largest revenue share of 44.20% in 2025 and is expected to grow at the fastest CAGR over the forecast period. Anemia, a condition affecting one-fourth of the global population, is increasingly prevalent among women, expectant mothers, young girls, and children under 5. According to the statistics published by the WHO in February 2025, it is estimated that globally 40% of all the children (aged 6-59 months), 30% of women (aged 15-49 years), and 37% of pregnant women are affected by anemia. This growing prevalence is driven by factors such as poor nutrition, chronic diseases, and inadequate healthcare access, especially in developing regions. The rising demand for anemia diagnostics and treatment is fueling the growth of the anemia segment market. In addition, the rapid expansion of the global testing market, particularly in point-of-care and home-testing devices, is expected to further accelerate this growth, providing accessible solutions for anemia detection and management.

The pregnancy segment is experiencing significant growth due to the routine use of ferritin assays to monitor maternal iron status and manage gestational anemia. Factors such as increasing birth rates, greater access to healthcare, and the growing focus on maternal and fetal well-being are driving this trend. Expectant mothers are increasingly seeking early and accurate detection of pregnancy-related conditions, including anemia, gestational diabetes, and preeclampsia, which is fueling the demand for specialized testing services. The market for pregnancy-related testing, particularly for conditions like anemia and gestational diabetes, is expanding with innovations in home testing and point-of-care devices. These advancements are making pregnancy-related health monitoring more accessible, convenient, and affordable, further driving the growth of the pregnancy testing market.

End Use Insights

The hospitals segment led the market with the largest revenue share of 56.41% in 2025 and is also expected to grow at the fastest CAGR over the forecast period, driven by factors such as increasing patient volumes, advancements in medical technology, and rising demand for specialized treatments. The expansion of healthcare infrastructure, particularly in emerging economies, is also contributing to this growth. Hospitals are increasingly adopting advanced diagnostic tools, including rapid testing devices, to enhance patient outcomes and optimize operational efficiency.

The growing prevalence of chronic diseases, coupled with the need for timely and accurate diagnosis, is fueling the demand for efficient testing solutions. As a result, the testing market within hospitals is expanding, with innovations in point-of-care and lab-on-a-chip technologies playing a key role in enhancing diagnostic accuracy and accessibility, thus driving further market growth.

Regional Insights

North America dominated the global ferritin testing market with the largest revenue share of 35.20% in 2025. The North American market is experiencing steady growth, driven by the rising prevalence of iron deficiency anemia and other related conditions. Increasing awareness about the importance of early diagnosis and monitoring of iron levels is contributing to this trend. The demand for ferritin tests is also growing due to the aging population and the higher incidence of chronic diseases, such as kidney disease and cancer, which can affect iron metabolism. In addition, advancements in diagnostic technologies, including point-of-care testing and lab-based solutions, are enhancing the accessibility and efficiency of ferritin testing, further driving market expansion in the region.

U.S. Ferritin Testing Market Trends

The ferritin testing market in U.S. is experiencing robust growth, fueled by a rising awareness of iron deficiency and related health conditions such as anemia, chronic kidney disease, and cancer. The increasing prevalence of these conditions, especially among the aging population, is driving demand for accurate and efficient diagnostic tests. Moreover, advancements in testing technologies, such as point-of-care devices and automated lab systems, are enhancing testing speed and accessibility. Healthcare professionals are also emphasizing the importance of early detection and personalized treatment, contributing to the growing adoption of ferritin tests. In addition, rising healthcare expenditures and improved insurance coverage are further boosting market growth in the U.S.

Europe Ferritin Testing Market Trends

The ferritin testing market in Europe is expanding due to the rising incidence of iron deficiency anemia, particularly among women, children, and the elderly. Increased healthcare awareness, along with advancements in diagnostic technologies, is driving demand for ferritin testing. The market is also benefiting from government initiatives that promote early disease detection and the growing adoption of point-of-care and automated testing solutions, thereby improving accessibility and efficiency across healthcare settings.

The UK ferritin testing market is growing, driven by the increasing prevalence of iron deficiency anemia and related health issues, including chronic kidney disease and cancer. The aging population and increased awareness about the importance of iron level monitoring are key factors contributing to this growth. For example, the National Health Service (NHS) has been focusing on improving anemia diagnosis through blood tests, including ferritin levels, as part of routine health screenings. Additionally, companies like Abbott and Roche are offering advanced diagnostic solutions, including automated ferritin testing systems, to enhance accuracy and reduce testing times in healthcare facilities. The demand for point-of-care testing devices is also increasing, enabling quicker and more accessible testing outside traditional lab settings.

The ferritin testing market in France is growing steadily, driven by an increasing focus on early diagnosis and management of iron deficiency anemia, particularly among vulnerable populations, such as women, children, and the elderly. As the prevalence of chronic diseases, including cancer and kidney disorders, rises, there is a growing demand for ferritin testing to monitor iron levels and detect potential deficiencies. The French healthcare system, which emphasizes preventive care, supports the adoption of ferritin testing as part of routine check-ups. Additionally, advancements in diagnostic technologies, including point-of-care testing devices and automated laboratory systems, are enhancing accessibility and efficiency. Companies like bioMérieux and Siemens Healthineers are leading the market with innovative testing solutions, contributing to the sector’s growth.

The Germany ferritin testing market is experiencing significant growth, fueled by increasing awareness of iron deficiency anemia and its impact on health, particularly among women, children, and the elderly. The rising prevalence of chronic diseases, such as kidney disease and cancer, which affect iron metabolism, is driving demand for accurate ferritin tests. Germany's advanced healthcare infrastructure and focus on preventive care further support the adoption of ferritin testing. The market is also benefiting from innovations in diagnostic technologies, including point-of-care testing and lab-based solutions, which enhance accessibility and reduce testing time. Companies like Roche and Siemens Healthineers are key players in offering cutting-edge ferritin testing solutions, driving market expansion in the region.

Asia Pacific Ferritin Testing Market Trends

The ferritin testing market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period, driven by the increasing prevalence of iron deficiency anemia, particularly in countries with large populations such as India and China. Rising awareness of the importance of iron health, coupled with a growing emphasis on early diagnosis and disease prevention, is fueling market demand. In addition, the region's expanding healthcare infrastructure, along with increasing access to diagnostic services, is contributing to the growth of ferritin testing. Innovations in point-of-care testing and affordable diagnostic solutions are improving accessibility, especially in rural areas. Major players, including Abbott and Roche, are capitalizing on this trend by offering advanced ferritin testing technologies, further boosting market expansion in the region.

The China ferritin testing market is expanding rapidly due to the rising prevalence of iron deficiency anemia, particularly among women, children, and the elderly. As chronic conditions like kidney disease, cancer, and gastrointestinal disorders become more common, the demand for ferritin testing is increasing. In addition, the Chinese government’s focus on improving healthcare access and early diagnosis is driving the adoption of diagnostic tests, including ferritin tests. The market is also benefiting from advancements in diagnostic technologies, such as point-of-care testing devices and automated systems, which are making ferritin testing more accessible and efficient. Companies like Abbott and Siemens Healthineers are leading the market with innovative solutions, helping to improve the accuracy and speed of ferritin testing in both urban and rural healthcare settings.

The ferritin testing market in Japan is growing due to the increasing awareness of iron deficiency anemia and the rising prevalence of chronic diseases such as kidney disorders, cancer, and gastrointestinal issues. Japan's aging population is a key driver, as elderly individuals are more prone to iron imbalances, which fuels demand for regular monitoring through ferritin tests. In addition, Japan’s advanced healthcare system supports the adoption of cutting-edge diagnostic technologies, including automated ferritin testing systems and point-of-care devices. These innovations help improve testing accuracy and reduce turnaround times. Major players, such as Roche and Abbott, are providing state-of-the-art ferritin testing solutions, thereby contributing to the market’s growth. Furthermore, Japan's emphasis on preventive healthcare and early diagnosis further supports the increasing use of ferritin tests in clinical settings.

Latin America Ferritin Testing Market Trends

The ferritin testing market in Latin America is experiencing growth, driven by increasing awareness of iron deficiency anemia and the rising prevalence of related conditions such as chronic kidney disease, cancer, and malnutrition. Countries such as Brazil, Mexico, and Argentina are experiencing increased demand for ferritin tests due to expanding healthcare access and enhanced public health initiatives focused on early diagnosis. The market is also benefiting from advancements in diagnostic technologies, such as point-of-care testing devices, which are improving accessibility in both urban and rural areas. As healthcare systems in Latin America continue to modernize, the adoption of automated and efficient ferritin testing solutions is expected to increase. Key players, including Abbott and Roche, are expanding their presence in the region, offering advanced ferritin testing solutions that cater to the growing demand.

The Brazil ferritin testing market is growing, driven by an increasing prevalence of iron deficiency anemia, particularly among women, children, and the elderly. As Brazil's healthcare system continues to improve and expand, there is a rising demand for accurate diagnostic tests, including ferritin testing, to monitor and manage iron levels. The market is also supported by the growing focus on preventive healthcare, with an emphasis on early diagnosis of anemia and related conditions such as chronic kidney disease and gastrointestinal disorders. Advancements in diagnostic technologies, including point-of-care testing and automated systems, are making ferritin testing more accessible and efficient. Key players, such as Abbott and Roche, are expanding their offerings in Brazil, providing innovative ferritin testing solutions to meet the growing demand in both urban and rural healthcare settings.

Middle East & Africa Ferritin Testing Market Trends

The ferritin testing market in the Middle East & Africa is experiencing gradual growth, driven by an increasing focus on healthcare improvement and rising awareness of iron deficiency anemia, particularly in countries with high malnutrition rates and vulnerable populations, such as women and children. The prevalence of chronic diseases like cancer, kidney disease, and gastrointestinal disorders is also contributing to the growing demand for ferritin testing to monitor iron levels. The market is benefiting from advancements in diagnostic technologies, such as point-of-care testing and portable devices, which are improving accessibility in remote and underserved areas. The growing healthcare infrastructure in countries such as the UAE, Saudi Arabia, and South Africa is also driving the adoption of ferritin testing. International players such as Abbott and Roche are expanding their presence in the region, providing innovative solutions to meet the growing demand for accurate and efficient ferritin testing.

The Saudi Arabia ferritin testing market is expanding due to the rising prevalence of iron deficiency anemia and related conditions, such as chronic kidney disease, cancer, and malnutrition. As the country focuses on improving healthcare services through Vision 2030, there is a growing emphasis on early diagnosis and preventive care, which is driving demand for ferritin testing. The market is also benefiting from the increasing adoption of advanced diagnostic technologies, including point-of-care testing devices and automated lab systems, which improve the speed and accuracy of ferritin tests. In addition, the growing number of healthcare facilities and expanding insurance coverage in Saudi Arabia are making ferritin testing more accessible to a wider population. International companies like Abbott and Roche are enhancing their presence in the country, offering innovative ferritin testing solutions to meet the rising demand.

Key Ferritin Testing Company Insights

Some of the key market players include Eurolyser Diagnostica GmbH, Cortez Diagnostics Inc, Pointe Scientific, Inc, bioMrieux, Humankind Ventures Ltd, Aviva Systems Biology Corporation, Abnova Corporation, Cosmic Scientific Technologies, CTK Biotech, Inc, Thermo Fisher Scientific Inc. These players are undertaking various strategic initiatives to increase their share in the market. New product development, collaborations, and partnerships are some such endeavors.

Key Ferritin Testing Companies:

The following are the leading companies in the ferritin testing market. These companies collectively hold the largest market share and dictate industry trends.

- EUROLyser Diagnostica GmbH

- Cortez Diagnostics Inc

- Pointe Scientific, Inc

- bioMérieux

- Humankind Ventures Ltd

- Aviva Systems Biology Corporation

- Abnova Corporation

- Cosmic Scientific Technologies

- CTK Biotech, Inc

- Thermo Fisher Scientific Inc.

Ferritin Testing Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1,033.74 million

Revenue Forecast in 2033

USD 1,608.59 million

Growth rate

CAGR of 6.52% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

EUROLyser Diagnostica GmbH; Cortez Diagnostics Inc.; Pointe Scientific, Inc.; bioMérieux; Humankind Ventures Ltd; Aviva Systems Biology Corporation; Abnova Corporation; Cosmic Scientific Technologies; CTK Biotech, Inc.; Thermo Fisher Scientific Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ferritin Testing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global ferritin testing market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instrument

-

Reagent

-

Kits

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Anemia

-

Hemochromatosis

-

Lead Poisoning

-

Pregnancy

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Diagnostic Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ferritin testing market size was estimated at USD 992.19 million in 2025 and is expected to reach USD 1,033.74 million in 2026.

b. The global ferritin testing market is expected to grow at a compound annual growth rate of 6.52% from 2026 to 2033 to reach USD 1,608.59 million by 2033.

b. North America dominated the ferritin testing market with a share of 35.20% in 2025, driven by the rising prevalence of iron deficiency anemia and other related conditions. Increasing awareness about the importance of early diagnosis and monitoring of iron levels is contributing to this trend

b. Some key players operating in the ferritin testing market include Eurolyser Diagnostica GmbH, Cortez Diagnostics Inc, Pointe Scientific, Inc, bioMrieux, Humankind Ventures Ltd, Aviva Systems Biology Corporation, Abnova Corporation, Cosmic Scientific Technologies, CTK Biotech, Inc, Thermo Fisher Scientific Inc

b. Key factors that are driving the market growth include rising prevalence of iron-deficiency anemia and iron-overload disorders such as hemochromatosis has driven the demand for ferritin testing. Increased awareness of the importance of iron monitoring in maternal health, chronic diseases, and pediatric populations has boosted demand. Advancements in diagnostic technologies, such as automated analyzers and point-of-care testing kits, have enhanced accessibility and accuracy, further driving market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.