- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Ferro Manganese Market Size, Share, Industry Report, 2030GVR Report cover

![Ferro Manganese Market Size, Share & Trends Report]()

Ferro Manganese Market (2025 - 2030) Size, Share & Trends Analysis Report By Grade (High Carbon, Refined), By Application (Carbon Steel, Stainless Steel, Alloy Steel, Cast Iron, Carbon & Low Alloy Steel), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68039-170-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ferro Manganese Market Summary

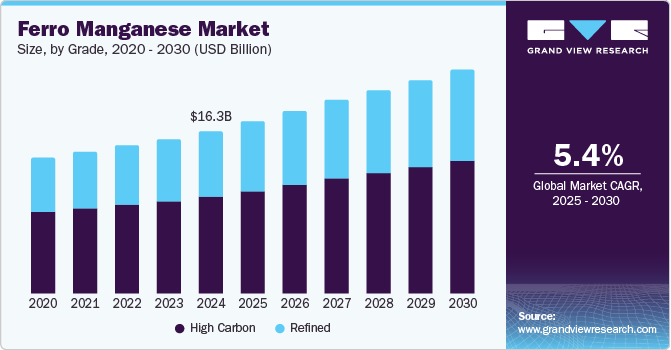

The global ferro manganese market size was estimated at USD 16.27 billion in 2024 and is projected to reach USD 22.48 billion by 2030, growing at a CAGR of 5.4% from 2025 to 2030. This growth can be attributed to the rising demand for steel, particularly in construction and automotive industries, which significantly boosts ferro manganese consumption as an essential alloying element.

Key Market Trends & Insights

- The Asia Pacific ferro manganese market dominated the global market and accounted for the largest revenue share of 50.8% in 2024.

- The ferro manganese market in China led the Asia Pacific market and accounted for the largest revenue share in 2024.

- By grade, the high-carbon ferro manganese led the market and accounted for the largest revenue share of 59.7% in 2024.

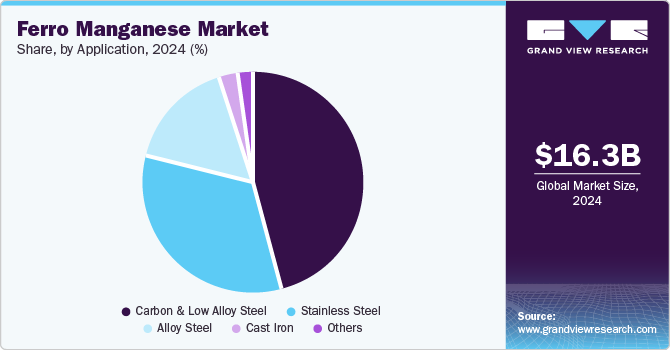

- By application, carbon and low-alloy steel segment dominated the market and accounted for the largest revenue share of 46.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.27 Billion

- 2030 Projected Market Size: USD 22.48 Billion

- CAGR (2025-2030): 5.4%

- Asia Pacific: Largest market in 2024

In addition, industrialization and urbanization in emerging markets further enhance this demand, alongside increased infrastructure investments. Furthermore, technological advancements in production methods and a shift towards sustainable practices contribute to market growth.

Ferro manganese is a ferroalloy composed primarily of manganese and iron, widely utilized in steelmaking to enhance strength and corrosion resistance. The increasing demand for stainless steel in the construction sector is significantly influencing market growth. Stainless steel is favored for its exceptional durability, corrosion resistance, and aesthetic qualities, making it ideal for various applications such as architectural cladding, handrails, and structural components such as beams and columns. Compared to concrete, its lightweight nature allows for less extensive foundations, reducing environmental impact.

In addition, as urbanization accelerates globally, the construction industry increasingly relies on stainless steel for bridges and other infrastructure projects. This trend is further supported by the automotive industry's rising demand for high-strength steel, which also utilizes ferro manganese as a key ingredient. Furthermore, the automotive sector's focus on safety and performance standards drives the need for durable materials, enhancing the overall demand for ferro manganese.

Moreover, advancements in production technologies and a growing emphasis on sustainability are propelling the use of stainless steel. Stainless steel's versatility in both structural integrity and design appeal makes it a preferred choice among architects and engineers. As these industries continue to expand, the reliance on ferro manganese in producing high-quality stainless steel will likely increase, further stimulating market growth.

Grade Insights

The high-carbon ferro manganese led the market and accounted for the largest revenue share of 59.7% in 2024. This growth can be attributed to its extensive application in steel manufacturing. High carbon ferro manganese is crucial for producing flat carbon steel products in high demand across various industries, including construction and automotive. In addition, the increasing need for high-strength steel, particularly with the rise of electric vehicles and infrastructure projects, further propels its consumption. Furthermore, technological advancements in production methods enhance manganese recovery, making high-carbon ferro manganese more efficient and cost-effective.

The refined ferro manganese is expected to grow at a CAGR of 5.7% over the forecast period, owing to its specific applications in producing stainless and alloy steels. As industries focus on sustainability and reducing environmental impact, refined ferro manganese offers lower carbon content, making it suitable for high-performance steel applications. In addition, the growing demand for lightweight and corrosion-resistant materials in sectors such as automotive and construction drives the need for refined ferro manganese. Furthermore, advancements in metallurgical processes that improve the quality and consistency of refined ferromanganese contribute to its increasing adoption in various applications.

Application Insights

Carbon and low-alloy steel segment dominated the market and accounted for the largest revenue share of 46.1% in 2024, primarily driven by the increasing demand for high-strength materials in various industries. In addition, carbon steel, known for its versatility and strength, is essential for the construction, automotive, and manufacturing sectors. Furthermore, as infrastructure projects expand and urbanization continues, the need for robust carbon steel products rises, directly boosting the consumption of ferro manganese as a critical alloying agent.

Cast iron is expected to grow at a CAGR of 6.3% from 2025 to 2030, owing to its applications in automotive components, machinery, and construction materials. Its durability and excellent casting properties make it a preferred choice in manufacturing heavy-duty products. In addition, the growing automotive industry, particularly with the shift towards electric vehicles, further enhances the need for cast iron components. Moreover, this increasing reliance on cast iron applications contributes to the overall growth of the ferro manganese market as it remains a vital ingredient in producing high-quality cast iron alloys.

Regional Insights

The Asia Pacific ferro manganese market dominated the global market and accounted for the largest revenue share of 50.8% in 2024. This growth can be attributed to rapid industrialization and urbanization. In addition, the region is the largest producer of steel, with increasing investments in infrastructure and construction projects. Furthermore, emerging economies such as India, Indonesia, and Vietnam are expanding their manufacturing capabilities, leading to higher demand for ferro manganese as a crucial alloying agent in steel production. This trend is expected to continue, further enhancing market growth.

China Ferro Manganese Market Trends

The ferro manganese market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, owing to its status as the world's largest steel producer and consumer. In addition, the country's ongoing infrastructure development and urbanization drive substantial demand for steel products, which directly increases the need for ferro manganese. Furthermore, government initiatives aimed at boosting domestic manufacturing capabilities further support this growth.

North America Ferro Manganese Market Trends

North America ferro manganese market growth is expected to be driven by robust demand from the construction and automotive industries. In addition, the ongoing recovery of infrastructure projects post-pandemic has increased the requirement for high-quality steel products. Furthermore, advancements in manufacturing technologies have enhanced the efficiency of ferro manganese production, making it more accessible to domestic industries. Moreover, as electric vehicle production ramps up, the need for high-strength alloys will further stimulate market growth in this region.

U.S. ferro manganese market dominated North America and accounted for the largest revenue share in 2024, which can be attributed to the expanding steel industry, which relies on ferro manganese as a crucial alloying element to enhance steel's strength and durability. In addition, increasing urbanization and infrastructure development projects are fueling demand for steel products. Furthermore, the automotive sector's growth, particularly in electric vehicles, also boosts ferro manganese consumption. Moreover, rising investments in renewable energy infrastructure are creating new opportunities for ferro manganese applications in specialized steel alloys used in wind turbine manufacturing.

Latin America Ferro Manganese Market Trends

The Latin America ferro manganese market is expected to grow at a CAGR of 7.6% over the forecast period, driven by increasing investments in mining and metallurgy. Countries such as Brazil are enhancing their steel production capabilities, driven by both domestic consumption and export opportunities. In addition, the region's rich mineral resources provide a solid foundation for ferro manganese production while growing construction and automotive sectors contribute to rising demand. Furthermore, as infrastructure projects expand across Latin America, the need for ferro manganese as an essential alloying element will continue to grow.

Europe Ferro Manganese Market Trends

The ferro manganese market in Europe is expected to grow significantly over the forecast period, primarily due to the rising demand for high-strength steel in various industries, including automotive and construction. In addition, the shift towards electric vehicles has intensified the need for lightweight materials, making ferro manganese increasingly important in steel production. Furthermore, European countries are investing in sustainable manufacturing practices, which further drives the demand for refined ferro manganese as industries aim to reduce their carbon footprints.

Germany ferro manganese market dominated the European market and accounted for the largest revenue share in 2024. The country's focus on innovation and sustainability has led to increased demand for high-performance steel products that require ferro manganese as a vital component. Furthermore, as Germany transitions towards more environmentally friendly technologies, the need for advanced materials will likely boost the consumption of ferro manganese in various applications.

Key Ferro Manganese Company Insights

Key players in the global ferro manganese industry include Monet Group, Tata Steel, Vale, and others. These players are adopting various strategies to enhance their competitive edge. These include investing in advanced production technologies to improve efficiency and reduce costs. In addition, companies are focusing on expanding their product portfolios to include specialty alloys that cater to specific industry needs. Furthermore, strengthening supply chain integration and forming strategic partnerships are crucial tactics employed to ensure a consistent supply of raw materials and effectively penetrate emerging markets.

-

Monnet Group manufactures essential alloys such as ferromanganese, silico-manganese, and ferrochrome, which are critical for steelmaking processes. The company operates within the ferroalloys segment, focusing on providing high-quality materials that serve as deoxidizing agents and alloying elements in steel production. Their diverse product portfolio caters to the demands of different industries, ensuring a robust presence in the global market.

-

Eramet Group produces high-quality ferro manganese and other alloys essential for steel manufacturing. The company operates primarily in the mining and metallurgical segments, leveraging its extensive expertise to supply critical materials used in various applications, including stainless steel and specialty alloys.

Key Ferro Manganese Companies:

The following are the leading companies in the ferro manganese market. These companies collectively hold the largest market share and dictate industry trends.

- Monet Group

- Tata Steel

- Gulf Manganese Corporation Limited

- Vale

- Eurasian Resources Group

- Ferroglobe

- China Minmetals Group Co., Ltd.

- Eramet Group

- South32

- OM Holdings Ltd.

Recent Developments

-

In December 2024, Eramet updated its 2024 targets for manganese activities in Gabon, focusing on increasing the production of ferromanganese. The company aims to enhance its operational efficiency and expand its market presence amid rising demand for manganese products. Furthermore, Eramet is adjusting its nickel activities in Indonesia to align with strategic goals. These revisions reflect the company's commitment to optimizing resource management while responding to evolving market conditions in the ferro manganese sector.

-

In October 2024, OM Holdings announced a collaboration with South32 to initiate a ferroalloy slag repurposing project. This initiative aimed to enhance sustainability in the ferro manganese industry by recycling waste materials from ferroalloy production. The partnership seeks to develop innovative methods for repurposing slag, thereby reducing environmental impact and promoting resource efficiency. This project highlights the commitment of both companies to advance sustainable practices within the ferro manganese sector while contributing to a circular economy.

Ferro Manganese Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.26 billion

Revenue forecast in 2030

USD 22.48 billion

Growth Rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, application, region

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East and Africa

Country scope

U.S., China, India, Japan, Germany, UK, France, and Brazil

Key companies profiled

Monet Group; Tata Steel; Gulf Manganese Corporation Limited; Vale; Eurasian Resources Group; Ferroglobe; China Minmetals Group Co., Ltd.; Eramet Group; South32; OM Holdings Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ferro Manganese Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global ferro manganese market report based on grade, application, and region.

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

High Carbon

-

Refined

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Carbon & Low Alloy steel

-

Stainless Steel

-

Alloy Steel

-

Cast Iron

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.