- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Fertility Supplements Market Size And Share Report, 2030GVR Report cover

![Fertility Supplements Market Size, Share & Trends Report]()

Fertility Supplements Market (2024 - 2030) Size, Share & Trends Analysis Report By Ingredient Type, Product Type, By End-user, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-136-8

- Number of Report Pages: 159

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fertility Supplements Market Summary

The global fertility supplements market size was estimated at USD 2,049.0 million in 2023 and is projected to reach USD 3,517.0 million by 2030, growing at a CAGR of 8.1% from 2024 to 2030. The market is driven by factors such as rising healthcare costs, changing lifestyles, and medical advancements.

Key Market Trends & Insights

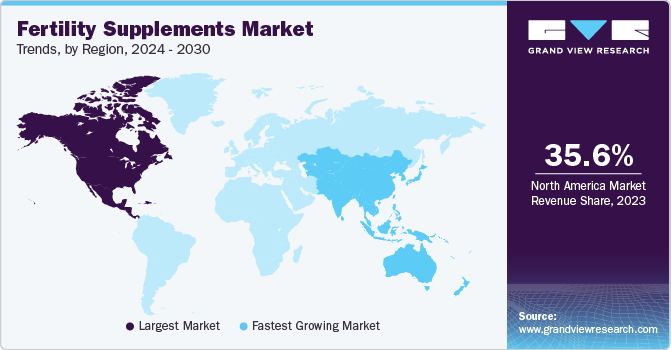

- In terms of region, North America was the largest revenue generating market in 2023.

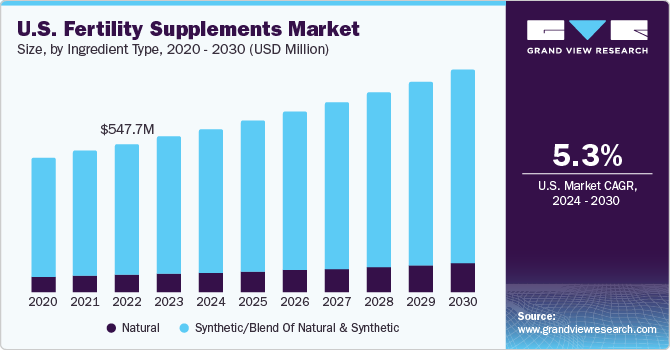

- Country-wise, U.S. is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, synthetic/ blend of natural & synthetic accounted for a revenue of USD 1,824.7 million in 2023.

- Natural is the most lucrative ingredient type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 2,049.0 Million

- 2030 Projected Market Size: USD 3,517.0 Million

- CAGR (2024-2030): 8.1%

- North America: Largest market in 2023

Furthermore, the rising trend of women delaying pregnancies and increasing concerns over the ongoing decline in fertility rates will boost market growth.

Various lifestyle habits such as smoking, alcohol consumption, poor diet, and mental stress are attributable to increasing infertility. Women experiencing a more significant amount of stress are more likely to produce high levels of alpha-amylase and, in turn, face difficulty in getting pregnant. These factors are expected to increase the infertility rate globally over the forecast period, thereby increasing the demand for fertility supplements.

The World Health Organization claims that several factors, including rising rates of smoking and alcohol use, an increase in the obese population, and elevated stress levels leading to hormonal imbalances, are responsible for the widespread issue of infertility. Factors contributing to infertility include age, gaining weight, polycystic ovarian syndrome (PCOS), or repeated miscarriages, which consequently affect their families and the community.

According to OECD data released in 2023, Korea, France, Sweden, and Switzerland’s total fertility rates (TFR) in 2021 were 0.81, 1.80, 1.67, and 1.51, respectively, lower than the average TFR of 2.1. Over one in four adults is obese in Chile, Australia, South Africa, Canada, and the UK. Over the past decade, the prevalence of obesity has increased in Switzerland, France, the U.S., Canada, and Mexico; on the contrary, it has stabilized in Spain, Italy, England, and Korea.

Various lifestyle habits such as smoking, alcohol consumption, poor diet, and mental stress are attributable to increasing infertility. Women experiencing a more significant amount of stress are more likely to produce high levels of alpha-amylase and, in turn, face difficulty in getting pregnant. All these factors are expected to increase the infertility rate globally over the forecast period, thereby increasing the demand for fertility supplements.

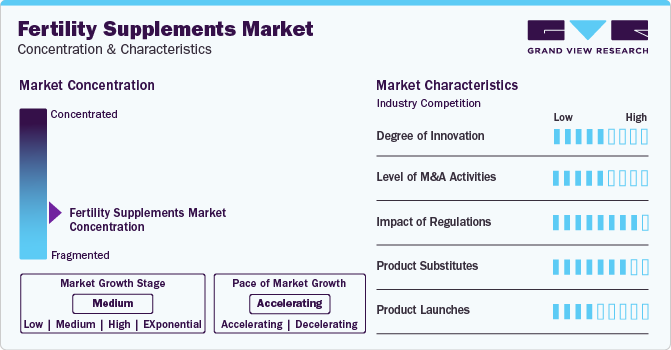

Market Concentration & Characteristics

Manufacturers are highly focused on providing supplements that are easy to swallow and can keep up with the changing market dynamics. For instance, Easy2Swallow designed tablets and capsules that were 40%-70% smaller by weight and coated for easier swallowing.

In addition, Capsugel provides products with coni-snap hard gelatin capsules, which are considered easy to swallow. The company also provides vegetarian gel caps that appeal to consumers with special health, religious, lifestyle, and dietary requirements. The increasing investment and emergence of new players in the market are also expected to foster innovation in fertility supplements.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market share and expand their geographical reach. Companies are also focusing on raising awareness among consumers regarding the ambiguity concerning the ingredients used, while strictly adhering to international regulatory standards.

The regulations play a critical role in shaping the fertility supplements market by ensuring product safety, transparency, and compliance with health and environmental standards. As consumer demands and regulatory landscapes continue to evolve, the impact of regulations on the fertility supplements market is likely to remain a focal point for industry stakeholders and consumers alike. Substitutes in the fertility supplements market primarily include other functional food options that offer similar health benefits, convenience, and nutritional value.

Ingredient Type Insights

The synthetic/blend of natural and synthetic fertility supplements segment dominated the market, having accounted for a revenue share of 89.1% in 2023. These supplements contain a mix of vitamins and natural ingredients to assist in boosting fertility. Selenium, zinc, folic acid, vitamin C, vitamin B6, CoQ1, and Myo-Inositol are among the major synthetic ingredients that are in demand and are easily available.

The demand for natural fertility supplements is expected to grow significantly over the forecast period. The introduction of innovative products and technological advancements in the health and wellness industry is anticipated to boost the growth of this segment. For instance, in April 2019, the National Institutes of Health (NIH) stated that natural health products with medicinal value are becoming more and more important in clinical research as they are less expensive and have fewer side effects than conventional synthetic nutraceuticals. Chyawanprash (CP) is extremely valuable for international trade and therapeutic purposes. Its numerous preventive, promotive, and curative health benefits are supported by reported evidence, demonstrating that it is an age-old remedy. Widespread utilization of plant-derived products for a healthier lifestyle and minimizing potential side effects is expected to promote the use of natural ingredients over the forecast period.

Product Type Insights

Capsule-based fertility supplements dominated the market, having accounted for a revenue share of 39.9% in 2023. The rising importance of microencapsulation in the health and wellness industry to ensure the controlled release of finished products and maintain the color characteristics is expected to prompt manufacturers to opt for capsule dosage forms over the forecast period. However, high prices associated with the packaging method are projected to prevent manufacturers from using capsule formulation over the forecast period. Rising concern related to the harmful effects of traditional pharma drugs has prompted an increased adoption of herbal medicines. This is anticipated to create growth opportunities for product manufacturers in the forecast period.

Liquid-based fertility supplement demand is expected to grow at a CAGR of 13.1% from 2024 to 2030. Vitamins in liquid form are suitable for both children and older adults because of their flexible dosage options. Unlike other types, liquid supplement formulations usually have a shorter shelf life and must be refrigerated. For individuals struggling with pill ingestion or esophageal challenges, opting for liquid vitamins serves to be a more favorable choice. The fertility supplements in this form can be easily used in water or smoothies and are quickly assimilated by the body, resulting in increasing demand.

End-user Insights

Sales of fertility supplements for women dominated the market in 2023, accounting for a revenue share of 54.6%. Infertility in the female reproductive system can result from various irregularities affecting the ovaries, uterus, fallopian tubes, and the endocrine system, among other factors. Infertility affects an estimated 15% of couples globally, amounting to 48.5 million couples. According to NIH in March 2023, about 20% of cases involve the male alone, and another 30%-40% involve the male as a contributing factor.

The men’s segment is anticipated to be the fastest-growing segment over the forecast period. The most common causes of infertility in the male reproductive system are abnormal sperm shape and motility, low or absent sperm counts, and issues with semen ejection. Around 1 in 6 adults worldwide, or 17.5% of the population, suffer from infertility, according to a 2023 WHO report. This highlights the critical need to expand access to high-quality, reasonably priced reproductive care for those in need. According to NIH in March 2023, approximately 20% of cases involve the male alone, and another 30% to 40% involve the male as a contributing factor.

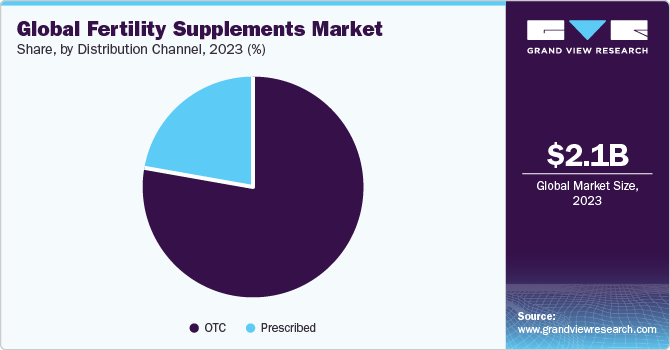

Distribution Channel Insights

Sales of OTC fertility supplements dominated the market and accounted for a 77.6% share of the global revenue in 2023. Sales of OTC fertility supplements are anticipated to witness steady growth in emerging economies owing to rising consumer awareness regarding these products’ nutritional value and health benefits. According to the School of Public Health in March 2023, for males and females ages 14 and up, the Recommended Dietary Allowance (RDA) for vitamin E is 15 mg daily, with pregnant women included. Nursing women require a little extra 19 mg daily.Furthermore, the convenience of direct purchase and cost-effectiveness drive the growth of the segment.

The prescribed fertility supplements are expected to witness the fastest growth over the forecast period. Strict government regulations by the governing bodies and limited awareness among individuals are expected to create opportunities for prescribed fertility supplements. For instance, searching for reliable lab verification can be a fast and efficient method to focus on supplement options that have gone above and beyond, such as finding the logos of Underwriters Laboratories (UL), Consumer Labs (CL), National Sanitation Foundation (NSF), United States Pharmacopeia (USP), and Consumer Labs (CL) to guarantee they contain no hazardous ingredients.

Regional Insights

North America dominated the market for fertility supplements and accounted for a 35.6% share of the global revenue in 2023. Due to the rising rate of infertility and increased public awareness of general health, North America is predicted to experience significant growth over the forecast period. Given that these variables are linked to both male and female infertility, the majority of people in the area tend to use fertility supplements because they are an excellent source of micronutrients and support fertility.

The Asia Pacific segment is projected to grow at the fastest rate over the forecast period. Various other initiatives are being conducted by public and private entities to raise awareness about infertility, efforts that are likely to bode well for the fertility supplements market in the Asia Pacific. The Asia Pacific Initiative on Reproduction (ASPIRE) comprises clinicians and scientists dedicated to fertility and assisted reproductive technology (ART). The organization's mission is to raise awareness about infertility and ART, enhancing related services in the Asia Pacific region.

Key Fertility Supplements Company Insights

Fairhaven Health; Active Bio Life Science GmbH; LENUS Pharma GesmbH; and Coast Science are some of the dominant players operating in the fertility supplements market.

-

Coast Science the company is recommended across the globe by over 1400 physicians in 49 countries. The company is an affiliated member and copartner of the European Society for Human Reproduction, Endocrinology, the American Society for Reproductive Medicine, the American Urological Association, the Middle Eastern Fertility Society, and the Canadian Fertility and Andrology Society.

-

Fairhaven Health is a designer, manufacturer, and supplier of products for promoting male and female fertility, breastfeeding, and pregnancy wellness. It also offers natural fertility products to help conceive. The company’s fertility supplements products also aim to promote reproductive health in women and men; ovulation predictors, such as fertile focus ovulation microscopes, OvaCue fertility monitors; basal thermometers, ovulation tests; prenatal vitamins, BFP pregnancy, and breastfeeding support products.

Crown Nutraceuticals (Crown Fertility); extreme V, Inc.; and Babystart are some of the emerging market players functioning in fertility supplements market.

- RBK Nutraceuticals Pty Ltd. specializes in dietary supplement products and focuses on bringing natural products manufactured at a pharmaceutical grade quality standard affordably. Various products manufactured by the company are Gluzin- Zinc Gluconate, Citrumelon- Citrulline, Citruaid- Citrulline, Heartflo- CoQ10, Toco VE- Vitamin E, and Heartflo Plus- CoQ10 + VE.

Key Fertility Supplements Companies:

The following are the leading companies in the fertility supplements market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these fertility supplements companies are analyzed to map the supply network.

- Fairhaven Health

- Coast Science

- Lenus Pharma GesmbH

- Active Bio Life Science GmbH

- Orthomol

- Exeltis USA, Inc.

- Bionova

- Fertility Nutraceuticals LLC

- Vitabiotics Ltd.

- extreme V, Inc.

- Xena Bio Herbals Pvt. Ltd.

- Gonadosan Distribution GmbH (Fertilovit)

- InnovaMed Ltd. (Amino Expert)

- Babystart Ltd

- Crown Nutraceuticals

- Sal Nature LLC

- Yadtech

- Prega News

- PlusPlus Lifesciences LLP

- Eu Natural

Recent Developments

-

In April 2023, Indian pharma company Mankind Pharma set up a dedicated factory in Udaipur, Rajasthan, for the comprehensive manufacturing of Duphaston (dydrogesterone), a synthetic hormone widely utilized for preventing miscarriage and treating infertility.

-

In December 2022, TRIFERTY-ATM, a food supplement developed by Laboratorio Reig Jofre in collaboration with the Barcelona Center for Male Infertility and Analysis (CIMAB), contributes to fertility and reproduction by promoting normal sperm formation, supporting energy metabolism, and reducing cellular oxidative stress.

-

In April 2022, Fertility Nutraceuticals, LLC unveiled two novel prenatal vitamin supplements: Advanced Prenatal and Advanced Prep 35-39. These capsules, containing the full recommended daily choline value for pregnant and nursing women, are individually packaged for on-the-go use. Advanced Prep 35-39, designed for women aged 35-39, incorporates 25mg of patented FERTINATAL, a micronized DHEA, to address the specific needs of the advanced reproductive age range.

Fertility Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.20 billion

Revenue forecast in 2030

USD 3.52 billion

Growth rate

CAGR of 8.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredient type, product type, end-user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; China; Japan; India; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Fairhaven Health; Coast Science; Lenus Pharma GesmbH; Active Bio Life Science GmbH; Orthomol; Exeltis USA, Inc.; Bionova; Fertility Nutraceuticals LLC; Vitabiotics Ltd.; extreme V, Inc.; Xena Bio Herbals Pvt. Ltd.; Gonadosan Distribution GmbH (Fertilovit); InnovaMed Ltd. (Amino Expert); Babystart Ltd.; Crown Nutraceuticals; Sal Nature LLC; Yadtech; Prega News; PlusPlus Lifesciences LLP; Eu Natural

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Fertility Supplements Market Report Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global fertility supplements market report based on ingredient type, product type, end-user, distribution channel, and region:

-

Ingredient Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Natural

-

Synthetic/ Blend of Natural & Synthetic

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Capsules

-

Tablets

-

Soft Gels

-

Powders

-

Liquids

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

OTC

-

Prescribed

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global fertility supplements market size was estimated at USD 2.05 billion in 2023 and is expected to reach USD 2.20 billion in 2024

b. The global fertility supplements market is expected to grow at a compound annual growth rate of 8.1% from 2024 to 2030 to reach USD 3.52 billion by 2030.

b. North America dominated the market for fertility supplements and accounted for 35.6% share of the global revenue in 2023. Due to the rising rate of infertility and increased public awareness of general health, North America is predicted to experience significant growth over the forecast period.

b. Some of the key market players in the fertility supplements market are Fairhaven Health, Coast Science, Lenus Pharma GesmbH, Active Bio Life Science GmbH, Orthomol, Exeltis USA, Inc., Bionova, Fertility Nutraceuticals LLC, Vitabiotics Ltd., extreme V, Inc., Xena Bio Herbals Pvt. Ltd., Gonadosan Distribution GmbH (Fertilovit), Amino Expert (Innovamed Ltd.), Babystart Ltd., Crown Nutraceuticals, Sal Nature, Yad-Tech, Prega News, PlusPlus Lifesciences LLP, Eu Natural.

b. The fertility supplements market has experienced significant growth in recent years, factors such as rising healthcare costs, changing lifestyles, and medical advancements. Furthermore, the rising trend of women delaying pregnancies and rising concerns over the ongoing decline in fertility rates will boost market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.