- Home

- »

- Agrochemicals & Fertilizers

- »

-

Fertilizer Additives Market Size, Share & Trends Report, 2030GVR Report cover

![Fertilizer Additives Market Size, Share & Trends Report]()

Fertilizer Additives Market (2024 - 2030) Size, Share & Trends Analysis Report By Function (Corrosion Inhibitors, Hydrophobic Agents), By End-product (Urea, Ammonium Nitrate), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-845-9

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fertilizer Additives Market Size & Trends

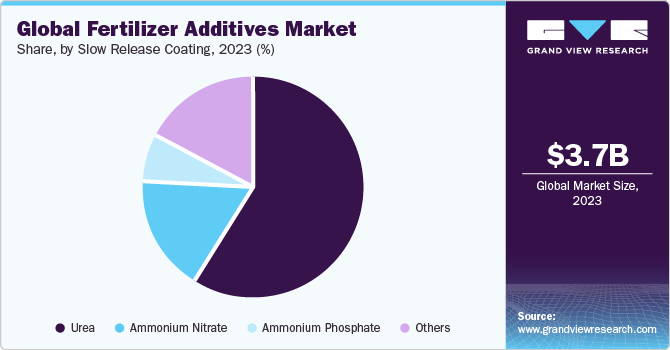

The global fertilizer additives market size was estimated at USD 3,729.39 million in 2023 and is projected to grow at a CAGR of 2.8% from 2024 to 2030. The market is driven by the growing demand for fertilizers. Shrinking arable land coupled with a rising global population has facilitated the adoption of practices that minimize waste and enhance agricultural productivity.

Fertilizer additives refer to chemicals that are added to fertilizers to improve their function or to make structural modifications. Changing agricultural practices and awareness regarding the quality & quantity of fertilizers are likely to fuel the utilization of additives in the coming years.

Fertilizer additives are witnessing high demand globally due to the adoption of sustainable agriculture practices across emerging economies and attempts to enhance crop yield per hectare. Companies operating in the ecosystem are investing heavily in research and development activities to enhance the quality of feed additives and make them suitable for changing agricultural practices.

The major distribution channels present in the market are direct supply agreements and third-party distribution channels. Direct supply agreements are gaining more importance owing to end-users entering into purchase agreements with manufacturers to ensure uninterrupted supply. The bulk quantity discounts, as well as some offsets on logistics costs, have led to end-users preferring to use the direct route.

Fertilizers improve soil yield. They can be classified into two types: organic and inorganic. Manure, fish meal, granite meal, and seaweed are organic fertilizers, while nitrogen, phosphorous, and potassium are inorganic fertilizers. The ability of inorganic fertilizers to act faster as compared to organic fertilizers is likely to fuel their growth.

Market Characteristics

The market is consolidated with the presence of major manufacturers with maximum market share. Fertilizer additives come in various products, such as toluene, xylene, ethylbenzene, and others.

The technology trends in the global market are influenced by the regulations and feedstock supply. A large number of players depend upon petroleum derivatives, they are expected to look out for new alternatives owing to supply-demand imbalance. The bio-based fertilizer trend is expected to impact process innovation and further manufacturing processes. The raw materials used in the manufacturing of fertilizer additives are inorganic chemicals. The popularity of these chemicals is expected to remain in the market owing to a lack of efficient alternatives. The stringent regulations imposed on organic chemicals have impacted their consumption in the manufacturing of fertilizer additives. Growing demand for fertilizers has increased the utilization of additives. Manufacturers are expanding the current capacities in order to cater to increasing demand by end user industries.

Function Insights

Based on function, the anti-caking segment led the market in terms of revenue share in 2023. Anti-caking, anti-dusting, corrosion inhibitors, and anti-coating are the primary functions of the product. The anti-caking function is the most significant among them. This is because during monsoon season, flakes form when fertilizers are stored. Therefore, additives are crucial to ensure fertilizers' safe storage and transportation. Anti-dusting is of utmost importance during the transportation and storage of fertilizers where there is a possibility of them getting exposed to dust.

The hydrophobic agents segment is also known as water repellents. They do not let moisture in the atmosphere affect the quality of fertilizers. Moisture is said to reduce the content of essential nutrients such as nitrogen, phosphorus, and potassium from fertilizers.

End-Product Insights

Based on end-product, the urea segment accounted for the largest revenue share in 2023. Urea, a nitrogenous fertilizer, is widely available and easily synthesized, making it a popular choice among farmers. The urea market is expected to grow significantly in emerging countries such as India and Brazil. It has a high nitrogen content, so it is used extensively by farmers, particularly in the Asia Pacific region. Urea is easily available in the market, and its popularity is expected to continue to rise due to its easy availability and cost-effectiveness.

The ammonium nitrate segment is a significant nitrogen source, containing both nitrate and ammonia. It has a high nutritional content and is cost-effective compared to other nitrogenous products, making it a popular choice among farmers. It is the second most commonly used nitrogenous product after urea. The popularity of ammonium nitrate has significantly increased in emerging economies of Asia Pacific and Latin America, known to be price-sensitive regions. The growing demand for ammonium nitrate can be attributed to its low price and high nitrogen and ammonium content.

Ammonium phosphate is a fertilizer that contains a high amount of phosphorus, one of the essential macronutrients. However, it is prone to absorbing moisture in the field and during storage. To avoid this, fertilizers with hydrophobic properties are used. There are two main grades of ammonium phosphate fertilizers available in the market: ammonium polyphosphates (APP) and diammonium phosphate (DAP), which are used based on the type of application.

Regional Insights

The fertilizer additives market in North America is projected to grow at a significant CAGR during the forecast period. The North America market is dominated by the U.S. Urea and ammonium nitrate were the most popular fertilizers in this region in 2023. Crop management planning has become a crucial part of the governments of countries across the region which in turn is likely to positively impact the market growth during the forecast period.

U.S. Fertilizer Additives Market Trends

The fertilizers additives market in U.S. is projected to grow at the fastest CAGR during the forecast period. The need for fertilizer additives may increase with the adoption of precision technologies in farming, as recommended fertilizers are applied modestly in precision farming. CRF and SRF are two types that can meet this need.

Asia Pacific Fertilizer Additives Market Trends

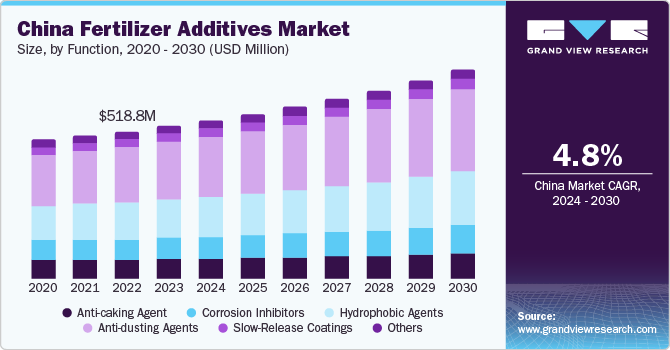

Asia Pacific dominated the fertilizer additives market with the revenue share of 60.05% in 2023. The demand for additives is expected to increase in emerging economies like China and India due to the growth of their agriculture sector. Agriculture is a crucial sector that significantly contributes to the GDP of these economies, including Bangladesh, India, China, and Sri Lanka.

The fertilizer additives market in China is projected to grow at the fastest CAGR during the forecast period. The market innovative nutrient sources used in specific soil and plant conditions to trigger special responses that improve plant growth and productivity. Due to repeated cropping without sufficient time for the soil to regain its fertility, Asia-Pacific soils are becoming unsuitable for cultivation. The market is expected to be driven by providing timely nutrition while having a low environmental impact.

Europe Fertilizer Additives Market Trends

The fertilizer additives market in Europe is projected to grow at the fastest CAGR during the forecast period. The market growth in Europe is primarily driven by factors such as the rising focus on sustainability, preference for organic and bio based agricultural produce, the presence of key chemical manufacturers and high emphasis on maintaining soil health in countries like Germany, France, and UK will lead to the market growth during the forecast period.

The Germany fertilizer additives market is anticipated to grow at the substantial CAGR during the forecast period. Repeated cropping without allowing the soil to regain fertility makes European soils unsuitable for cultivation. However, the product can help provide timely nutrition to the soil while impacting the environment less. These factors are expected to drive the market's growth, increasing the demand for product.

Central & South America Fertilizer Additives Market Trends

The fertilizer additives market in Central & South America is projected to grow at the fastest CAGR during the forecast period. This growth is attributed to expanding agricultural sector’s production in countries like Brazil, and Argentina. As the agricultural sector grows in this country demand for fertilizer additives to improve crop yields and quality also increases.

The Brazil fertilizer additives market is projected to grow at the significant CAGR during the forecast period. Brazil's agriculture industry is rapidly expanding, and it is a significant exporter of commodities, such as rice, maize, soybean, coffee, and more, to the global market. The demand for the market in the area is expected to rise because of the increasing land area used for cultivation and the growing risks to agriculture caused by changing climatic conditions such as droughts and heatwaves.

Middle East & Africa Fertilizer Additives Market Trends

The fertilizer additives market in Middle East & Africa is projected to grow at the fastest CAGR during the forecast period. This growth is attributed to increasing demand for sustainable agriculture practices, the need to increase crop yield and quality has led to rising demand for fertilizer additives in the region.

The Saudi Arabia fertilizer additives market is projected to grow at the fastest CAGR during the forecast period. Saudi Arabia demand for high yield in agriculture sector are met through subsequent demands for higher quality fertilizers and micro-nutrients, which in-turn has created positive influence for the market growth in the region.

Key Fertilizer Additives Company Insights

Some of the key players operating in the market include Clariant AG, and KAO Corporation among others.

-

Clariant AG, a Switzerland-based specialty chemical manufacturing company. It operates through four major business segments, namely care chemicals, catalysis, natural resources, and plastics & coatings. These segments cover various product categories such as additives, catalyst, functional minerals, industrial & consumer specialties, masterbatch, oil & mining service, and pigments, and cater to over 21 end-use industries all over the world

-

Kao Corporation is a Japan-based consumer goods and industrial product manufacturer and distributor. It operates through five major business segments, namely chemical, fabric & home care, cosmetics, skin & hair care, and human health care

ArrMaz, and Chemipol S.A. among others, are some of the emerging market participants in the global market.

-

ArrMaz is a manufacturer of specialty chemicals.The company offers its products and services to various end-use industries such as fertilizer and mining which includes industrial ammonium nitrate, phosphate, & asphalt, and oil & gas. It caters its products to customers from 70 countries across the globe

-

Chemipol S.A. is a manufacturer and supplier of biocides, additives, and process chemicals. The company offers its products to various end-use industries such as agrochemicals, emulsions & adhesives, fuel, household products, metalworking fluids, paints & coatings, paper, personal care, and water treatment

Key Fertilizer Additives Companies:

The following are the leading companies in the fertilizer additives market. These companies collectively hold the largest market share and dictate industry trends.

- Clariant AG

- KAO Corporation

- Dorf Ketal Chemicals (I) Pvt. Ltd.

- Solvay S.A.

- ArrMaz

- Chemipol S.A.

- Cameron Chemicals

- Michelman Inc.

- Tolsa SA

- ChemSol, LLC

Recent Developments

-

In May 2023, EuroChem Group AG launched a new line of slow-release fertilizers for sustainable agriculture. EuroChem-BMU has finished pilot testing to produce mineral NPS fertilizers with elemental sulfur. The Russian market will supply the first 4-kiloton batch of sulphur-containing fertilizers. NPS compounds, which include nitrogen (N), phosphorous (P), and potash (K), also contain elemental sulfur, which is one of the most significant nutrition supplements needed for plant growth. Oxidized sulfate sulfur allows plants to absorb nitrogen, phosphorus, and other essential minerals better. The release of sulfur improves the entire crop life cycle without needing reapplication, resulting in increased yields for soils with low sulfur concentrations

-

In April 2023, Nutrien acquired a controlling stake in Agrichem, a fertilizers and crop protection product provider. Agrichem is one of Brazil's largest liquids NPK fertilizer companies, as well as a producer and marketer of plant health products, including bio-stimulants and health inductors. As part of this acquisition, Nutrien expects to capture synergies through the distribution of a variety of Nutrien's existing crop input products and services in Brazil

Fertilizer Additives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3,854.95 million

Revenue forecast in 2030

USD 4,122.18 million

Growth rate

CAGR of 2.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Function, end-product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

KAO Corporation; Novochem Group; Clariant; Solvay Clariant AG; Dorf Ketal Chemicals (I) Pvt. Ltd.; ArrMaz; Chemipol S.A.; Cameron Chemicals; Michelman Inc.; Tolsa SA; ChemSol, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fertilizer Additives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the fertilizer additives market report based on, function, end-product, and region.

-

Function Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Corrosion Inhibitors

-

Hydrophobic Agents

-

Anti-dusting Agents

-

Anti-caking Agent

-

Slow-Release Coatings

-

Urea

-

Ammonium Nitrate

-

Ammonium Phosphate

-

Others

-

-

Others

-

-

End-Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Urea

-

Ammonium Nitrate

-

Ammonium Phosphate

-

Ammonium Sulphate

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fertilizer additives market size was estimated at USD 3,729.39 million in 2023.

b. The global fertilizer additives market is expected to grow at a compound annual growth rate (CAGR) of 2.8% from 2024 to 2030.

b. Asia Pacific dominated the fertilizer additives market with a share of more than half in 2023. This is attributable to robust growth of agriculture sector in emerging economies such as China and India.

b. Some key players operating in the fertilizer additives market include KAO Corporation, Novochem Group, Clariant, Solvay, and Filtra Catalysts & Chemicals Ltd.

b. Key factors that are driving the market growth include robust growth of fertilizer industry along with rising population & decreasing per capita arable land.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.